Golconda Gold Ltd. (“Golconda Gold” or the “Company”) (TSXV: GG;

OTCQB: GGGOF) today announces that it has entered into a US$5

million stream transaction relating to its Galaxy project in South

Africa with Empress Royalty Holding Corp. (“Empress”), a

wholly-owned subsidiary of Empress Royalty Corp. (“Empress

Royalty”) (TSXV: EMPR | OTCQX:EMPYF).

Golconda Gold, its subsidiary Galaxy Gold Reefs

(Pty) Ltd., and certain of its affiliates, have entered into a

metal purchase and sale agreement dated November 21, 2023 (the

“Agreement”) with Empress for payable gold production from the

Galaxy mine in South Africa. Pursuant to the terms of the

Agreement, Empress will make an up-front cash payment totalling

US$5 million (the “Investment”) for payable gold produced from the

Galaxy mine. The Investment is based on 3.5% of the payable gold

production from the Galaxy mine for an initial 8,000 payable

ounces; thereafter, the percentage will reduce to 2.0% of the

payable gold production until the earlier of: (i) 20,000 ounces

having been paid to Empress; or (ii) 20 years after the first

payment was made. The purchase price for the payable gold delivered

pursuant to the Agreement is 20% of the gold spot price. The

closing of the transaction and the funding of the Investment is

subject to typical conditions precedent.

“We are excited to partner with Empress who,

through their due diligence, have understood the true potential of

Galaxy. With the proceeds generated from the Investment, we will be

fully funded to implement and execute our Phase 1 and 2 expansion

plans at the Galaxy mine.

We have faced challenges at Galaxy over the last

few years including the effects of COVID-19 in slowing our

expansion plans, flooding both at the mine and at our concentrate

warehouse in Durban, and production challenges due to a lack of

investment in the mining fleet required to meet our production

targets. We currently have over 35,000 tonnes per month (“tpm”) of

spare capacity in the processing plant. Therefore, the Investment

will primarily be used to acquire new underground equipment and

cover the working capital costs of underground development to

increase underground production and fill the processing plant,”

said Nick Brodie, Chief Executive Officer of the Company.(1)

The Galaxy Gold

Mine(2)

Golconda Gold acquired the Galaxy mine in

November 2015. Galaxy is situated 8 km west of the town of

Barberton and 45 km west of the provincial capital of Nelspruit in

the Mpumalanga Province of South Africa. The property covers 58.6

km2 and is part of the prolific Barberton Greenstone Belt.

Galaxy consists of 22 ore bodies, all of which

can be accessed via adits at level 17 and level 22. Galaxy is

currently mining at the following two main ore bodies:

- Galaxy ore body – a massive pipe

shaped ore body with a thickness of 35m and a strike of around 100m

(the “Galaxy Ore Body”); and

- Princeton ore body – a steeply

dipping ore body with a thickness of 5m and a strike of 300m (the

“Princeton Ore Body”).

The current mine plan includes the mining of the

Galaxy Ore Body and the Princeton Ore Body using a mechanised cut

and fill mining method. There are also extensive tailings around

the Galaxy mine site which Golconda Gold intends to use to

supplement production.(1) Golconda Gold has already upgraded the

crushing circuit, float plant and filtration plant to 50,000 tpm,

from the original 15,000 tpm plant, which produces a gold

concentrate.

Galaxy is currently in Phase 1 of its expansion

program taking production to 15,000 tpm and 1,100 recovered gold

ounces per month. The proceeds from the Agreement will be used to

fund the expansion required in Phase 2 to take production to 48,000

tpm and 2,800 recovered gold ounces per month.(1)

Golconda Gold has completed the Galaxy Technical

Report and the PEA (as such terms are defined below) for the Galaxy

mine, which supports the expansion plans already undertaken and the

future plans for expansion. In addition, Golconda Gold has a drill

ready plan to expand the resource to over 4 million ounces, which

encompasses the other 20 identified ore bodies. Work is already

underway to determine how this can support future expansion of

Galaxy.

Empress has completed a site visit, and a

third-party engineering firm has satisfactorily completed a

technical analysis of the Galaxy mine. The use of proceeds from the

transactions contemplated by the Agreement will enhance and expand

the production profile at Galaxy moving forward.(1)

About Golconda Gold

Golconda Gold is an un-hedged gold producer and

explorer with mining operations and exploration tenements in South

Africa and New Mexico. Golconda Gold is a public company and its

shares are quoted on the TSX Venture Exchange (“TSXV”) under the

symbol “GG” and the OTCQB under the symbol “GGGOF”. Golconda Gold’s

management team is comprised of senior mining professionals with

extensive experience in managing mining and processing operations

and large-scale exploration programmes. It is committed to

operating at world-class standards, focused on the safety of its

employees, respecting the environment, and contributing to the

communities in which it operates. Golconda Gold’s primary objective

is to be reshaped into a long-life and low-cost operation that can

produce positive returns for investors across commodity cycles

by:

- Optimising current mining,

processing and administrative operations to reduce costs and

maximize profits; and

- Grow through opportunistic

acquisition and development opportunities.

About Empress Royalty Corp.

Empress Royalty is a global royalty and

streaming creation company providing investors with a diversified

portfolio of gold and silver investments. Since listing in December

2020, Empress Royalty has built a portfolio of precious metal

investments and is actively investing in mining companies with

development and production stage projects who require additional

non-dilutive capital. Empress Royalty has strategic partnerships

with Endeavour Financial and Terra Capital which allow Empress

Royalty to not only access global investment opportunities but also

bring unique mining finance expertise, deal structuring and access

to capital markets. Empress Royalty is looking forward to

continuously creating value for its shareholders through the proven

royalty and streaming models.

Notes:

(1) This is forward-looking information and is

based on a number of assumptions. See “Cautionary Notes”.

(2) The deposits at the Galaxy mine are

supported by a technical report entitled “NI 43-101 Technical

Report on the Galaxy Gold Mine, South Africa” which was issued on

July 3, 2020 (the “Galaxy Technical Report”), with an effective

date of June 29, 2020, a copy of which is available under the

Company’s profile on www.sedar.com. The Galaxy Technical Report was

prepared by Minxcon (Pty) Ltd and approved by Mr. Uwe Engelmann,

BSc (Zoo. & Bot.), BSc Hons (Geol.) Pr.Sci.Nat., MGSSA, and Mr.

Daniel (Daan) van Heerden, B Eng (Min.), MCom (Bus. Admin.), MMC,

Pr.Eng., FSAIMM, AMMSA, both “qualified persons” as defined by

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), and independent of the Company for the

purposes of NI 43-101. The preliminary economic assessment (“PEA”)

supported by the Galaxy Technical Report is preliminary in nature

as the resources included in the PEA are comprised 54% of inferred

mineral resources. Inferred mineral resources are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves. There is no certainty that the PEA will be realized.

Cautionary Notes

Certain statements contained in this press

release constitute “forward-looking statements”. All statements

other than statements of historical fact contained in this press

release, including, without limitation, those regarding completion

of the transactions contemplated by the Agreement, timing of

receipt of the Investment if at all, the Company’s projected plans

for expansion and production at the Galaxy mine, the Company’s use

of proceeds from the transactions contemplated by the Agreement,

any future financings or transactions contemplated by the Company,

the impact of the transactions contemplated by the Agreement on the

Company and its expansion plans, creation of long term value for

stakeholders, future financial position and results of operations,

strategy, proposed acquisitions, plans, objectives, goals and

targets, and any statements preceded by, followed by or that

include the words “believe”, “expect”, “aim”, “intend”, “plan”,

“continue”, “will”, “may”, “would”, “anticipate”, “estimate”,

“forecast”, “predict”, “project”, “seek”, “should” or similar

expressions or the negative thereof, are forward-looking

statements. These statements are not historical facts but instead

represent only the Company’s expectations, estimates and

projections regarding future events. These statements are not

guarantees of future performance and involve assumptions, risks and

uncertainties that are difficult to predict. Therefore, actual

results may differ materially from what is expressed, implied or

forecasted in such forward-looking statements.

Additional factors that could cause actual

results, performance or achievements to differ materially include,

but are not limited to: the Company’s dependence on two mineral

projects; gold price volatility; risks associated with the conduct

of the Company’s mining activities in South Africa and New Mexico;

regulatory, consent or permitting delays; risks relating to the

Company’s exploration, development and mining activities being

situated in South Africa and New Mexico; risks relating to reliance

on the Company’s management team and outside contractors; risks

regarding mineral resources and reserves; the Company’s inability

to obtain insurance to cover all risks, on a commercially

reasonable basis or at all; currency fluctuations; risks regarding

the failure to generate sufficient cash flow from operations; risks

relating to project financing and equity issuances; risks arising

from the Company’s fair value estimates with respect to the

carrying amount of mineral interests; mining tax regimes; risks

arising from holding derivative instruments; the Company’s need to

replace reserves depleted by production; risks and unknowns

inherent in all mining projects, including the inaccuracy of

reserves and resources, metallurgical recoveries and capital and

operating costs of such projects; contests over title to

properties, particularly title to undeveloped properties; laws and

regulations governing the environment, health and safety; the

ability of the communities in which the Company operates to manage

and cope with the implications of any local, regional, national or

international outbreak of a contagious disease; operating or

technical difficulties in connection with mining or development

activities; lack of infrastructure; employee relations, labour

unrest or unavailability; health risks in Africa; the Company’s

interactions with surrounding communities and artisanal miners; the

Company’s ability to successfully integrate acquired assets; risks

related to restarting production; the speculative nature of

exploration and development, including the risks of diminishing

quantities or grades of reserves; development of the Company’s

exploration properties into commercially viable mines; stock market

volatility; conflicts of interest among certain directors and

officers; lack of liquidity for shareholders of the Company; risks

related to the market perception of junior gold companies; and

litigation risk. Management provides forward-looking statements

because it believes they provide useful information to investors

when considering their investment objectives and cautions investors

not to place undue reliance on forward-looking information.

Consequently, all of the forward-looking statements made in this

press release are qualified by these cautionary statements and

other cautionary statements or factors contained herein, and there

can be no assurance that the actual results or developments will be

realized or, even if substantially realized, that they will have

the expected consequences to, or effects on, the Company. These

forward-looking statements are made as of the date of this press

release and the Company assumes no obligation to update or revise

them to reflect subsequent information, events or circumstances or

otherwise, except as required by law.

Information of a technical and scientific nature

that forms the basis of the disclosure in the press release has

been prepared and approved by Kevin Crossling Pr. Sci. Nat.,

MAusIMM. and former Business Development Manager for Golconda Gold,

and a “qualified person” as defined by NI 43-101. Mr. Crossling has

verified the technical and scientific data disclosed herein and has

conducted appropriate verification on the underlying data.

Neither the TSXV nor its regulation services

provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

For further information please

contact:Nick BrodieCEO, Golconda Gold Ltd.+ 44 7905

089878Nick.Brodie@GolcondaGold.comwww.golcondagold.com

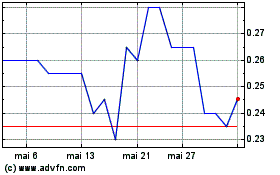

Golconda Gold (TSXV:GG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Golconda Gold (TSXV:GG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024