false

0001852353

0001852353

2025-02-03

2025-02-03

0001852353

us-gaap:CommonStockMember

2025-02-03

2025-02-03

0001852353

DC:WarrantsEachWholeWarrantExercisableForOneShareOfRegistrantsCommonStockAtExercisePriceOf2.08PerShareMember

2025-02-03

2025-02-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 6, 2025 (February 3, 2025)

DAKOTA

GOLD CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

001-41349 |

85-3475290 |

(State or other jurisdiction of

incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

106 Glendale Drive, Suite A,

Lead, South Dakota, United States 57754

(Address of principal executive offices) (Zip Code) |

| |

(605) 906-8363

(Registrant's telephone number,

including area code)

|

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

DC |

|

NYSE

American LLC |

| Warrants, each warrant exercisable for one share of the Registrant's common stock at an exercise price of $2.08 |

|

DC.WS |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. | Entry into a Material Definitive Agreement. |

Second Amendment Agreement

On February 3, 2025, Dakota Gold Corp. (the

“Company”) and DTRC LLC, a wholly owned subsidiary of the Company (“DTRC”), entered into a second amendment (the

“Second Amendment Agreement”) to the option agreement for the purchase and sale of real property dated October 14, 2021,

as amended on September 8, 2022 (the “Richmond Hill Option Agreement”), to acquire LAC Minerals (USA) LLC and Homestake Mining

Company of California’s (“HMCC”) Richmond Hill Property in the Homestake District, South Dakota.

Under the terms of the Second Amendment Agreement,

the term of the LAC Option Agreement was extended from March 7, 2026 to December 31, 2028. As consideration for the Second Amendment

Agreement, DTRC will provide a cash payment of $170,000 to HMCC on each of March 1, 2026, March 1, 2027 and March 1, 2028.

The foregoing description of the Second Amendment

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amendment Agreement,

a copy of which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

Third Amendment Agreement

On February 3, 2025, DTRC entered into a

third amendment (the “Third Amendment Agreement”) to the option agreement for the purchase and sale of real property dated

September 7, 2021, as amended on September 30, 2021 and November 20, 2023 (the “Homestake Option Agreement”),

to acquire certain of Homestake Mining Company of California’s surface rights and residual facilities in the Homestake District

in South Dakota.

Under the terms of the Third Amendment Agreement,

the term of the Homestake Option Agreement was extended from March 7, 2026 to December 31, 2028. As consideration for the Third

Amendment Agreement, DTRC will provide a cash payment of $340,000 to HMCC on each of March 1, 2026, March 1, 2027 and March 1,

2028.

The foregoing description of the Third Amendment

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Third Amendment Agreement,

a copy of which is filed herewith as Exhibit 10.2 and incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure. |

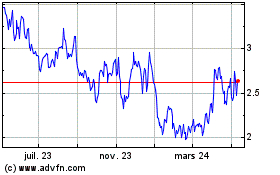

On February 6, 2025, the Company issued a

press release announcing (i) the Second Amendment Agreement, (ii) the Third Amendment Agreement and (iii) the results and

publication of an updated and revised S-K 1300 Initial Assessment and Technical Report Summary for the Company’s Richmond Hill Gold

Project (the “2025 Initial Assessment”). The 2025 Initial Assessment, dated February 3, 2025 was prepared in accordance

with Subpart 1300 of Regulation S-K. A copy of the press release is furnished with this Current Report on Form 8-K

as Exhibit 99.1.

In accordance with General Instruction B.2 of

Form 8-K, the information set forth in this Item 7.01 and in the press release is deemed to be “furnished” and shall

not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as

amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

A copy of the Initial Assessment is attached as

Exhibit 96.1 to this Current Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

| |

|

| |

(d) Exhibits |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

DAKOTA GOLD CORP. |

| |

|

| |

/s/ Shawn Campbell |

| |

Name: Shawn Campbell |

| |

Title: Chief Financial Officer |

Date: February 6, 2025

Exhibit 10.1

SECOND AMENDMENT TO

OPTION AGREEMENT FOR PURCHASE AND SALE OF REAL PROPERTY

THIS SECOND AMENDMENT

(the “Amendment”) to the Option Agreement for Purchase and Sale of Real Property dated as of October 14, 2021

(the “Richmond Hill Option Agreement”), is entered into as of February 3, 2025 (the “Amendment Effective

Date”), by and among Homestake Mining Company of California, a California corporation (“Homestake” or

“Owner”) and LAC Minerals (USA) LLC, a Delaware limited liability company (“LAC Minerals”),

DTRC LLC (formerly known as Dakota Territory Resource Corp.), a Nevada limited liability company (the “Option

Holder”), and Dakota Gold Corp., a Nevada corporation (“Dakota Gold”). Homestake shall act as the

“Administrative Agent”) of Owners under this Amendment. Homestake, LAC Minerals, Option Holder and Dakota Gold

sometimes may be referred to in this Amendment individually as a “Party”, and collectively as the

“Parties”.

RECITALS

| A. | Owner, LAC Minerals, and Option Holder entered into the Richmond Hill Option Agreement. |

| B. | The Richmond Hill Option Agreement was amended on September 8, 2022, to, among other

things, extend the option period until March 7, 2026. |

| C. | By Agreement and Plan of Merger dated effective as of September 30, 2023, Homestake and LAC Minerals merged,

with Homestake continuing as the surviving entity assuming all rights and obligations of LAC Minerals. |

| D. | The Parties desire to further extend the option period as set forth in this Amendment. |

| E. | Option Holder is the successor entity to Dakota Territory Resource Corp. pursuant to that certain Amended

and Restated Agreement and Plan of Merger, dated as of September 10, 2021, between Dakota Gold Corp. (formerly known as JR Resources Corp.),

Dakota Territory Resource Corp., DGC Merger Sub I Corp. and DGC Merger Sub II LLC. |

| F. | Option Holder is a wholly-owned subsidiary of Dakota Gold, which is made a Party for the purpose of the

share issuance contemplated under Richmond Hill Option Agreement as amended. |

AGREEMENT

NOW, THEREFORE, in consideration

of the premises and the mutual agreements, representations and warranties herein set forth and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Parties agree as follows:

1. Extension of Option

Period. The definition of Option Period in Section 1.38 of the Option Agreement hereby is deleted in its entirety and replaced with

the following:

“The period that begins on the Effective Date and

ends on the earlier of (a) December 31, 2028, and (b) the date the Option Holder delivers to the Administrative Agent the Option

Exercise Notice.”

2.

Consideration. In consideration for this Amendment, on the Amendment Effective Date, Option Holder shall provide a payment of $170,000

to Owner on each of the following dates: March 1, 2026, March 1, 2027, and March 1, 2028. Notwithstanding the foregoing, no payments under

this provision shall be required after the date upon which the Option Holder delivers to the Administrative Agent the Option Exercise

Notice.

3. Miscellaneous Provisions.

(a) The Parties agree that,

except as specifically modified by this Amendment, the Option Agreement as amended remains in full force and effect in accordance with

its terms. This Amendment shall not be construed as a waiver or amendment of any other provision of the Option Agreement or for any purpose,

except as expressly set forth herein.

(b) This Amendment shall be

governed by and construed in accordance with the laws of the State of South Dakota without reference to the conflict of law provisions

thereof.

(c) This Amendment may be executed

in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed

to be an original and all of which taken together shall constitute one and the same agreement. This Amendment may be validly executed

and delivered by facsimile, portable document format (.pdf) or other electronic transmission, and a signature by facsimile, portable document

format (.pdf) or other electronic transmission shall be as effective and binding as delivery of a manually executed original signature.

(d) This Amendment shall be

binding upon and inure to the benefit of the Parties and their respective successors and assigns permitted by the Option Agreement.

[REMAINDER OF PAGE LEFT BLANK]

IN WITNESS WHEREOF, the Parties hereto

have caused this Amendment to be executed by their respective officers thereunto duly authorized as of the Effective Date.

| HOMESTAKE MINING COMPANY OF CALIFORNIA |

|

|

| |

|

|

| By: |

/s/

Michael McCarthy |

|

|

| Name: |

Michael McCarthy |

|

|

| Title: |

Director |

|

|

| DTRC LLC |

|

DAKOTA GOLD CORP. |

| |

|

|

| By: |

/s/

Patrick Malone |

|

By: |

/s/ Patrick

Malone |

| Name: |

Patrick Malone |

|

Name: |

Patrick Malone |

| Title: |

Senior Vice President of

Dakota Gold Corp., its manager |

|

Titile: |

Senior Vice President |

Exhibit 10.2

THIRD AMENDMENT TO OPTION AGREEMENT

FOR PURCHASE AND SALE OF REAL PROPERTY

This Third Amendment to Option

Agreement for Purchase and Sale of Real Property (“Second Amendment”) is made and entered into as of February 3, 2025

(the “Effective Date”), by and between Homestake Mining Company of California, a California corporation (“Owner”),

and DTRC LLC, a Nevada limited liability company (“Option Holder”). Owner and Option Holder sometimes may be referred

to in this Contract individually as a “Party”, and collectively as the “Parties.”

RECITALS

A.

Owner and Dakota Territory Resource Corp, a Nevada corporation entered into that certain Option Agreement for Purchase and Sale of

Real Property, dated September 7, 2021, (the “Homestake Option Agreement”) as amended on September 30, 2021, and November

20, 2023, to, among other things, extend the option period until March 7, 2026.

B.

Option Holder is the successor entity to Dakota Territory Resource Corp. pursuant to that certain Amended and Restated Agreement and

Plan of Merger, dated as of September 10, 2021, between Dakota Gold Corp. (formerly known as JR Resources Corp.), Dakota Territory Resource

Corp., DGC Merger Sub I Corp. and DGC Merger Sub II LLC.

C.

Owner and Option Holder wish to amend the Homestake Option Agreement to extend the Option Period.

AGREEMENT

NOW THEREFORE, in consideration

of the foregoing and of the mutual promises and covenants contained in this Second Amendment, the receipt and sufficiency of which are

hereby acknowledged, and intending to be legally bound hereby, the Parties, hereby covenant and agree as to the following:

1. Extension of the Option

Period. The definition of Option Period in Section 1.37 of the Option Agreement as amended is hereby deleted in its entirety and replaced

with the following:

“The period that begins on the Effective Date and

ends on the earlier of (a) December 31, 2028, and (b) the date the Option Holder delivers to the Owner the Option Exercise

Notice.”

2.

Consideration. In consideration for this Amendment, on the Amendment Effective Date, Option Holder shall provide a payment of $340,000

to Owner on each of the following dates: March 1, 2026, March 1, 2027, and March 1, 2028. Notwithstanding the foregoing, no payments under

this provision shall be required after the date upon which the Option Holder delivers to the Administrative Agent the Option Exercise

Notice.

3. Miscellaneous Provisions.

(a) The Parties agree that,

except as specifically modified by this Amendment, the Option Agreement as amended remains in full force and effect in accordance with

its terms. This Amendment shall not be construed as a waiver or amendment of any other provision of the Option Agreement or for any purpose,

except as expressly set forth herein.

(b) This Amendment shall be

governed by and construed in accordance with the laws of the State of South Dakota without reference to the conflict of law provisions

thereof.

(c) This Amendment may be executed

in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed

to be an original and all of which taken together shall constitute one and the same agreement. This Amendment may be validly executed

and delivered by facsimile, portable document format (.pdf) or other electronic transmission, and a signature by facsimile, portable document

format (.pdf) or other electronic transmission shall be as effective and binding as delivery of a manually executed original signature.

(d) This Amendment shall be

binding upon and inure to the benefit of the Parties and their respective successors and assigns permitted by the Option Agreement..

[SIGNATURE PAGE TO FOLLOW]

IN WITNESS WHEREOF, the Parties have executed this

Contract as of the Effective Date.

| |

OWNER: |

| |

|

| |

HOMESTAKE MINING COMPANY OF CALIFORNIA,

a California corporation |

| |

|

| |

By: |

/s/ Michael McCarthy |

| |

Name: |

Michael McCarthy |

| |

Title: |

Director |

| |

|

| |

OPTION HOLDER |

| |

|

| |

DTRC LLC, a Nevada limited liability company |

| |

|

| |

By: |

/s/ Patrick Malone |

| |

Name: |

Patrick Malone |

| |

Title: |

On behalf of Dakota Gold Corp., its manager |

Exhibit 23.1

CONSENT OF QUALIFIED PERSON

In connection with the Company’s Current

Report on Form 8-K dated February 6, 2025 and any amendments or supplements and/or exhibits thereto (the “Form 8-K”),

the undersigned consents to:

| · | the filing and use of the technical report summary titled “S-K 1300 Initial Assessment and Technical

Report Summary – Richmond Hill Gold Project, South Dakota, U.S.A.” (the “TRS”) dated Feb 3, 2025 as an exhibit

and referenced in the Form 8-K; |

| · | the incorporation by reference of the TRS in the Registration Statements on Form S-3 (File Nos. 333-263883

and 333-266155) and Form S-8 (File Nos. 333-265399 and 333-267210) (collectively, the “Registration Statements”); |

| · | the use of and references to the undersigned’s name, including the undersigned’s status as

an expert or “qualified person” (as defined in Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange

Commission) in connection with the TRS, the Form 8-K and the Registration Statements; and |

| · | Any extracts or summaries of the TRS included or incorporated by reference in the Form 8-K and the

Registration Statements, and the use of any information derived, summarized, quoted or referenced from the TRS, or portions thereof, that

was prepared by the undersigned, that the undersigned supervised the preparation of and/or that was reviewed and approved by the undersigned,

that is included or incorporated by reference in the Form 8-K and the Registration Statements. |

The undersigned is the qualified person responsible

for authoring, and this consent pertains to, Sections of the TRS: Section 1 except 1.5, 2-8, 9.1, 11-21, 22 except 22.2, 23 except

23.2 and 23.6, 24-26

Dated February 3, 2025

For Independent Mining Consultants, Inc.

Exhibit 23.2

CONSENT OF QUALIFIED PERSON

In connection with the Company’s Current

Report on Form 8-K dated February 6, 2025 and any amendments or supplements and/or exhibits thereto (the “Form 8-K”),

the undersigned consents to:

| · | the filing and use of the technical report summary titled “S-K 1300 Initial Assessment and Technical

Report Summary – Richmond Hill Gold Project, South Dakota, U.S.A.” (the “TRS”) dated Feb 3, 2025 as an exhibit

and referenced in the Form 8-K; |

| · | the incorporation by reference of the TRS in the Registration Statements on Form S-3 (File Nos. 333-263883

and 333-266155) and Form S-8 (File Nos. 333-265399 and 333-267210) (collectively, the “Registration Statements”); |

| · | the use of and references to the undersigned’s name, including the undersigned’s status as

an expert or “qualified person” (as defined in Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange

Commission) in connection with the TRS, the Form 8-K and the Registration Statements; and |

| · | Any extracts or summaries of the TRS included or incorporated by reference in the Form 8-K and the

Registration Statements, and the use of any information derived, summarized, quoted or referenced from the TRS, or portions thereof, that

was prepared by the undersigned, that the undersigned supervised the preparation of and/or that was reviewed and approved by the undersigned,

that is included or incorporated by reference in the Form 8-K and the Registration Statements. |

The undersigned is the qualified person responsible

for authoring, and this consent pertains to, Sections of the TRS: 1.5, 9.2, 10, 22.2, 23.2, 23.6

Dated February 3, 2025

For Woods Process Service, LLC.

Exhibit 96.1

Richmond

Hill Project

Mineral

Resource Estimate

RICHMOND HILL PROJECT

Mineral

REsource Estimate

Table

of Contents

| SECTION |

PAGE |

| |

|

| Table of Contents |

ii |

| List of Figures and Illustrations |

vii |

| List of Tables |

x |

| 1.1 | Property

Description |

1 |

| 1.2 | Geology

and Mineralization |

1 |

| 1.3 | Exploration,

Development, and Operations |

2 |

| 1.4 | Sample

Preparation, Analysis, Security, and Data Verification |

2 |

| 1.5 | Mineral

Processing and Metallurgy |

2 |

| 1.6 | Mineral

Resource Estimate |

3 |

| 1.7 | Environmental |

5 |

| 1.8 | Conclusion

and Recommendations |

5 |

| 2.1 | Registrant |

7 |

| 2.2 | Terms

of Reference |

7 |

| 2.3 | Qualified

Persons |

9 |

| 2.4 | Date |

9 |

| 2.5 | Sources

of Information |

9 |

| 2.6 | Previous

Technical Report Summaries |

9 |

| 2.7 | Acronyms

and Abbreviations |

9 |

| 2.8 | Units

of Measure and Metric Equivalents |

13 |

| 3.1 | Project

Location |

14 |

| 3.2 | Ownership |

14 |

| 3.3 | Mineral

Tenure Holdings |

14 |

| 3.4 | Richmond

Hill Option Agreement |

22 |

| 3.5 | Surface

Rights |

23 |

| 3.6 | Water

Rights |

23 |

| 3.7 | Royalties |

23 |

| 3.8 | Permitting |

32 |

| M3-PN240322

3 February 2025

Revision 0 |

ii |

Richmond

Hill Project

Mineral

Resource Estimate

| 3.8.1 | Existing

Permitting |

32 |

| 3.8.2 | Future

Permitting |

33 |

| 3.9 | Potential

Significant Encumbrances |

35 |

| 3.10 | Violation

and Fines |

35 |

| 3.11 | Significant

Factors and Risks That May Affect Access, Title or Work Programs |

35 |

| 4 | Accesibility,

Climate, Local Resources, Infrastructure and Physiography |

36 |

| 4.1 | Topography,

Elevation, and Vegetation |

36 |

| 4.2 | Property

Access |

37 |

| 4.3 | Climate |

37 |

| 4.4 | Local

Resources and Infrastructure |

37 |

| 5.1 | Explorations |

39 |

| 5.2 | Mining |

42 |

| 5.3 | Dakota

Gold Corp |

43 |

| 6 | Geological

Setting, Mineralization and Deposit |

44 |

| 6.1 | Local

Geology |

44 |

| 6.2 | Regional

Geology |

51 |

| 6.3 | Lithology |

53 |

| 6.4 | Landforms

and Structures |

58 |

| 6.5 | Deposit

Type |

58 |

| 6.6 | Mineralization |

59 |

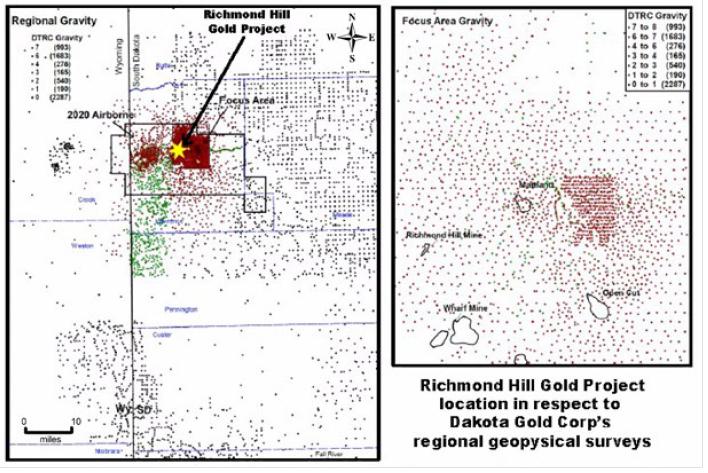

| 7.1 | Airborne

Geophysics |

61 |

| 7.2 | Gravity

Compilation and Survey |

62 |

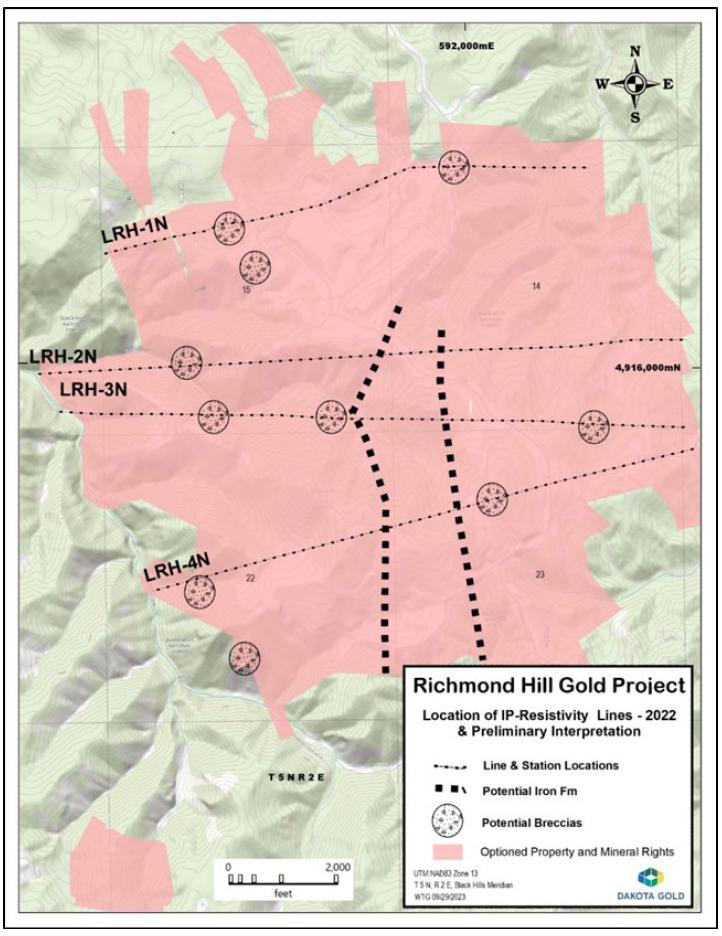

| 7.3 | Induced

Polarization Survey |

63 |

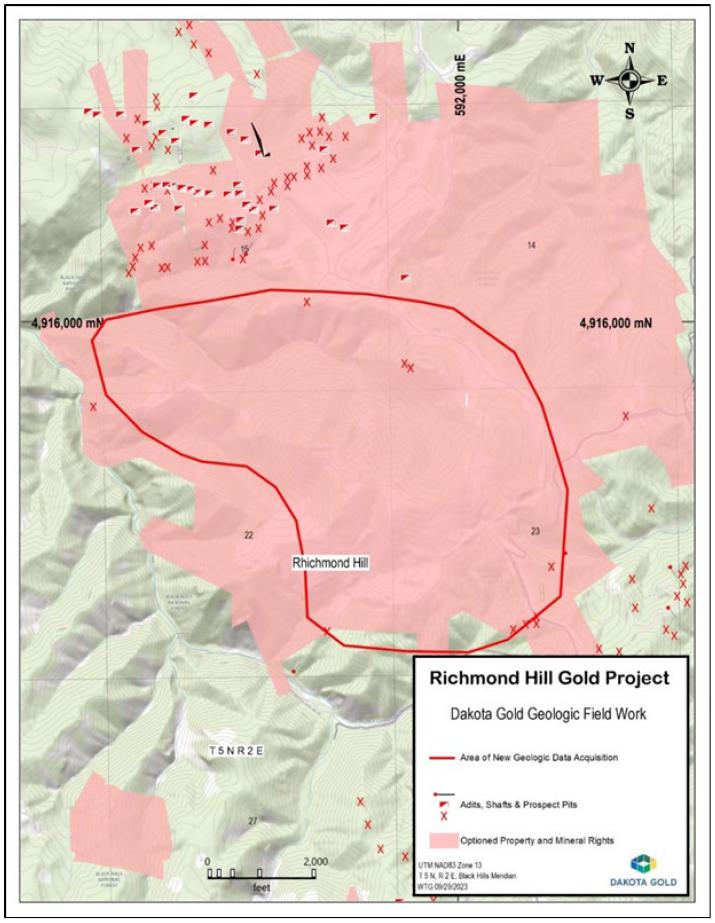

| 7.4 | Geological

Mapping |

65 |

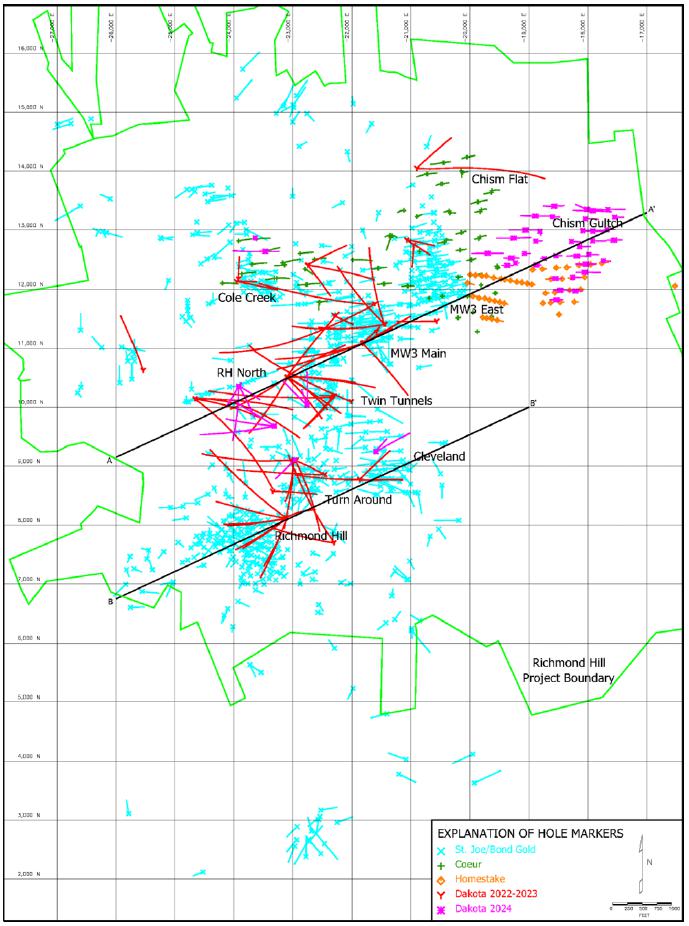

| 7.5 | Drilling |

67 |

| 7.5.1 | Summary |

67 |

| 7.5.2 | Freeport

(1981 – 1983) |

69 |

| 7.5.3 | St.

Joe, Bond Gold, and Homestake (1984 – 1994) |

69 |

| 7.5.4 | Coeur

(2019 – 2020) |

69 |

| 7.5.5 | Dakota

Gold (2022 – 2024) |

70 |

| 7.5.6 | Opinion |

72 |

| 7.6 | Hydrogeology

and Geotechnical |

72 |

| 8 | Sample

Preparation, Analyses, and Security |

73 |

| M3-PN240322

3 February 2025

Revision 0 |

iii |

Richmond

Hill Project

Mineral

Resource Estimate

| 8.2 | Procedures

for Historical Drilling Programs from 1981 to 1994 |

74 |

| 8.2.1 | Freeport

(1981-1983) |

74 |

| 8.2.2 | St.

Joe, Bond Gold, and Homestake (1984-1994) |

74 |

| 8.3 | Procedures

for Drilling Programs from 2019 to 2020 |

76 |

| 8.3.1 | Drilling

Programs |

76 |

| 8.3.2 | Sampling,

Sample Preparation, Analysis, and Security |

76 |

| 8.3.3 | Quality

Assurance and Quality Control Procedures |

77 |

| 8.4 | Procedures

for Drilling Programs from 2022 to 2024 |

77 |

| 8.4.1 | Drilling

Programs |

77 |

| 8.4.2 | Sampling,

Sample Preparation, Analysis, and Security |

77 |

| 8.4.3 | Quality

Assurance and Quality Control Procedures |

78 |

| 9.1 | Drillhole

Sampling Data |

91 |

| 9.1.1 | Dakota

Gold Drilling |

91 |

| 9.1.2 | Coeur

Drilling |

91 |

| 9.1.3 | St.

Joe/Bond Gold, LAC and Homestake Drilling |

91 |

| 9.1.4 | Other

Reviews |

92 |

| 10 | Mineral

Processing and Metallurgical |

96 |

| 10.1 | Preliminary

Geometallurgical Data Model Development |

96 |

| 10.2 | Oxide

and Mixed Metallurgical Testing |

97 |

| 10.2.1 | Historical

Bottle Roll Tests |

98 |

| 10.2.2 | Historical

Metallurgical testing: Oxide & Transition Heap Leach |

100 |

| 10.3 | Sulfide

and Transition Metallurgical Testing |

103 |

| 10.3.1 | Historical

Metallurgical Reports: Sulfide & Transition Flotation |

104 |

| 10.3.2 | Metallurgical

Report – BL1244 |

104 |

| 10.3.3 | Metallurgical

Report – BL1346 |

107 |

| 10.4 | Richmond

Hill Historical Operating Data |

110 |

| 10.5 | Recovery

Estimates |

111 |

| 10.6 | Summary

and Recommendations |

111 |

| 11 | Mineral

Resource Estimate |

112 |

| 11.1 | Mineral

Resource |

112 |

| 11.2 | Price

Sensitivity |

114 |

| 11.3 | Mineral

Resource Parameters |

116 |

| 11.4 | Additional

Information |

118 |

| 11.5 | Description

of the Block Model |

118 |

| M3-PN240322

3 February 2025

Revision 0 |

iv |

Richmond

Hill Project

Mineral

Resource Estimate

| 11.5.1 | General |

118 |

| 11.5.2 | Drilling

Data |

119 |

| 11.5.3 | Geologic

Controls |

121 |

| 11.5.4 | Cap

Grades and Compositing |

126 |

| 11.5.5 | Summary

Statistics |

127 |

| 11.5.6 | Variogram

Analysis |

131 |

| 11.5.7 | Block

Grade Estimation |

140 |

| 11.5.8 | Resource

Classification |

145 |

| 11.5.9 | Bulk

Density |

150 |

| 11.6 | Reconciliation

of January 2025 and October 2023 Mineral Resources |

151 |

| 11.6.1 | Leach

Mineral Resource |

151 |

| 11.6.2 | Mill

Resource |

152 |

| 11.6.3 | Reconciliation

Summary |

158 |

| 12 | Mineral

Reserve Estimates |

159 |

| 13 | Mining

Methods |

160 |

| 14 | Process

and Recovery Methods |

161 |

| 15 | Infrastructure |

162 |

| 16 | Market

Studies |

163 |

| 17 | Environmental

Studies, Permitting and Plans, Negotiations, or Agreements with Local Individuals or Groups |

164 |

| 17.1 | Results

of Environmental Studies |

164 |

| 17.2 | Requirements

and Plans for Waste and Tailings Disposal, Site Monitoring, and Water Management During Operations

and After Mine Closures |

164 |

| 17.3 | Project

Permitting Requirements, Permit Application Status, and Requirements to Post Performance

or Reclamation Bonds |

165 |

| 17.4 | Requirements

and Plans for Waste and Tailings Disposal, Site Monitoring, and Water Management During Operations

and After Mine Closure |

165 |

| 17.5 | Mine

Closure, Remediation, and Reclamation Plans, and Associated Costs |

166 |

| 17.6 | Qualified

Person’s Opinion on the Adequacy of Current Plans to Address Any issues Related to

Environmental Compliance, Permitting, and Local Individuals or Groups |

168 |

| 17.7 | Descriptions

of Any Commitments to Ensure Local Procurement and Hiring |

168 |

| 18 | Capital

and Operating Costs |

169 |

| 19 | Economic

Analysis |

170 |

| 20 | Adjacent

Properties |

171 |

| 21 | Other

Relevant Data and Information |

172 |

| 21.1 | Homestake

Mine Facilities |

172 |

| 21.2 | Sanford

Underground Research Facility |

172 |

| 22 | Interpretation

and Conclusions |

173 |

| 22.1 | Mineral

Resources |

173 |

| M3-PN240322

3 February 2025

Revision 0 |

v |

Richmond

Hill Project

Mineral

Resource Estimate

| 22.2 | Processing |

174 |

| 22.3 | Mineral

Tenure |

174 |

| 22.4 | Summary

Conclusion |

175 |

| 23.1 | Initial

Assessment with Economic Analysis |

176 |

| 23.2 | Metallurgical

Testing and Process Design |

176 |

| 23.3 | Additional

Drilling |

177 |

| 23.4 | Environmental

Data Collection |

179 |

| 23.5 | Resource

Estimation |

179 |

| 23.6 | Mineral

Processing and Metallurgical Testing |

179 |

| 25 | Reliance

on Information Provided by the Registrant |

185 |

| 25.1 | Legal

Matters |

185 |

| 25.2 | Tenure |

185 |

| 25.3 | Significant

Encumbrances and Permitting |

185 |

| 25.4 | History |

185 |

| 25.5 | Exploration |

185 |

| 25.6 | Environment |

185 |

| 26 | Date

and Signature Page |

186 |

| M3-PN240322

3 February 2025

Revision 0 |

vi |

Richmond

Hill Project

Mineral

Resource Estimate

List

of Figures and Illustrations

| FIGURE |

DESCRIPTION |

PAGE |

| |

|

|

| Figure 2-1: |

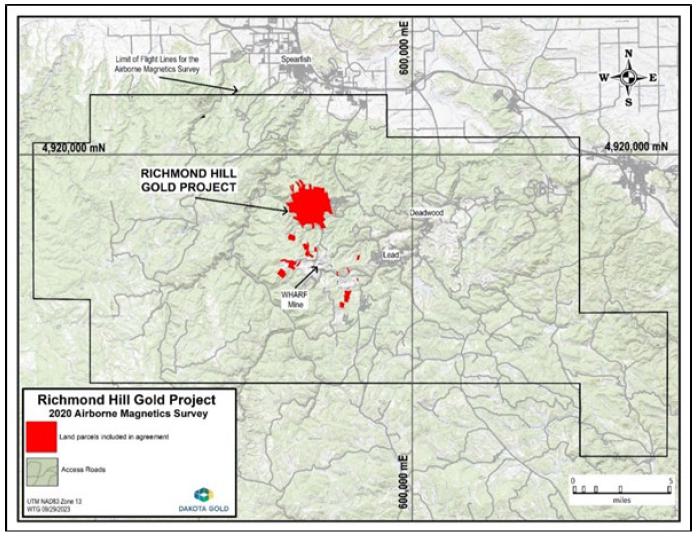

Property Location |

8 |

| Figure 3-1: |

Richmond Hill Project Location and Ownership |

16 |

| Figure 3-2: |

Richmond Hill Project Royalties |

31 |

| Figure 4-1: |

Richmond Hill Gold Property Location |

36 |

| Figure 4-2: |

Richmond Hill Gold Project Access |

38 |

| Figure 6-1: |

Exploration Zones |

45 |

| Figure 6-2: |

Geology of Richmond Hill |

46 |

| Figure 6-3: |

Richmond Hill Gold Project Target Zones on 0.01 oz/ton Grade Shell Plot |

47 |

| Figure 6-4: |

Regional Geologic map of the Black Hills Uplift (from Lufking et. Al,

2009) |

52 |

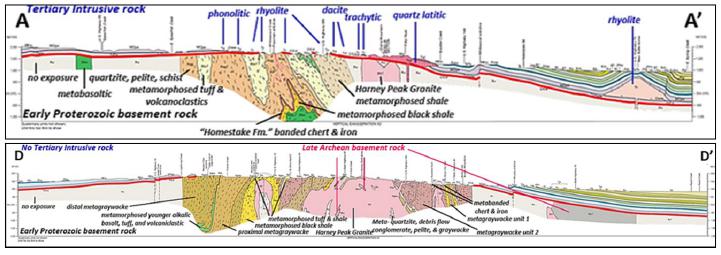

| Figure 6-5: |

Southwest to Northeast Structural Cross-Sections (modified from Redden and DeWitt 2008) |

53 |

| Figure 6-6: |

Precambrian Stratigraphic Section of the Northern Black Hills |

55 |

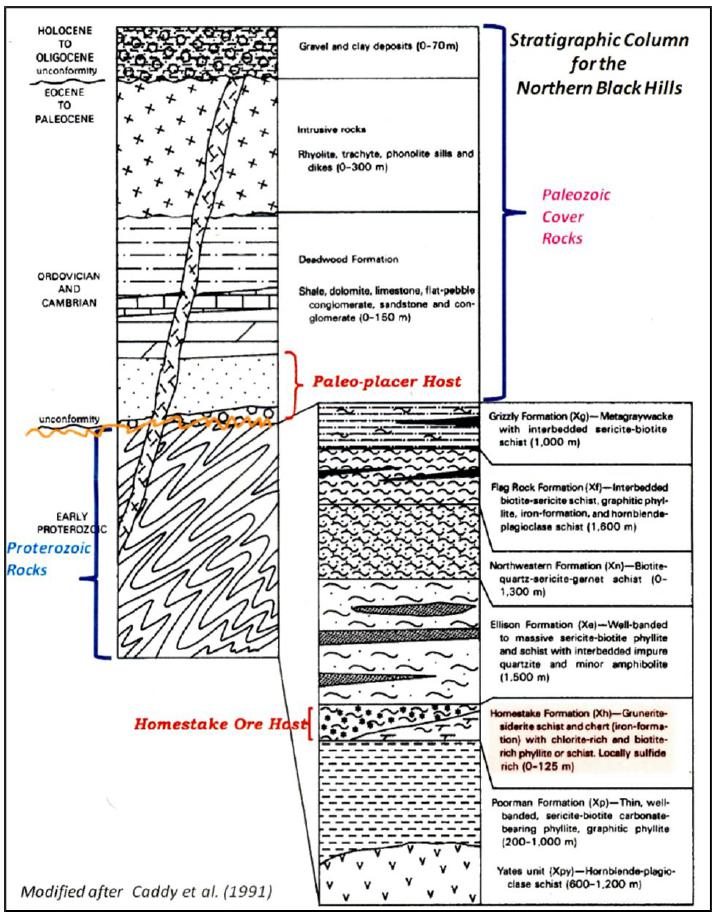

| Figure 6-7: |

Black Hills General Stratigraphic Section |

56 |

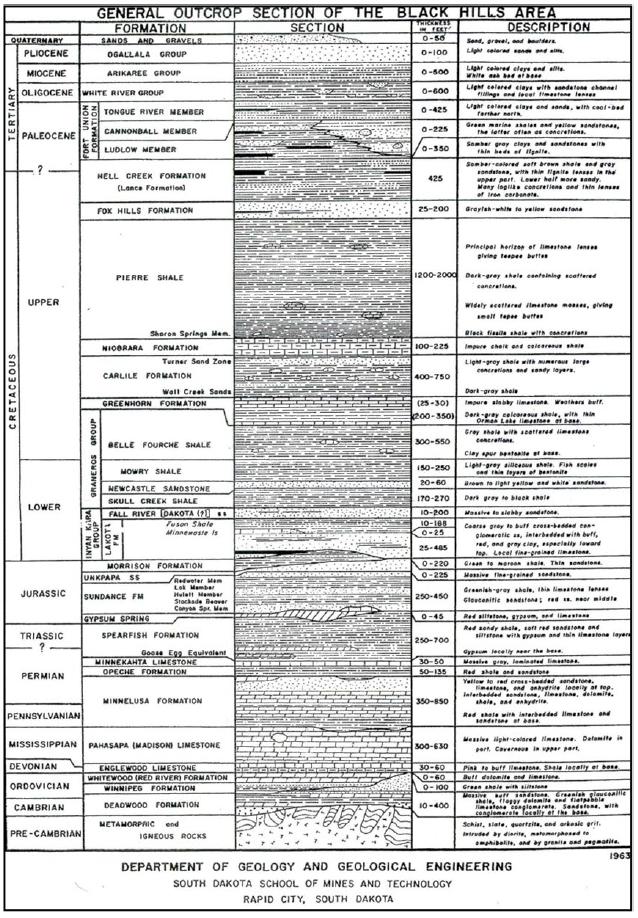

| Figure 7-1: |

Airborne Magnetics Survey Flightline Limits |

61 |

| Figure 7-2: |

Gravity Survey Station Locations |

63 |

| Figure 7-3: |

Geophysical IP – Resistivity Survey Line Locations |

64 |

| Figure 7-4: |

Dakota Gold Geologic Field Work |

66 |

| Figure 7-5: |

Richmond Hill Gold Project Drillholes by Company |

68 |

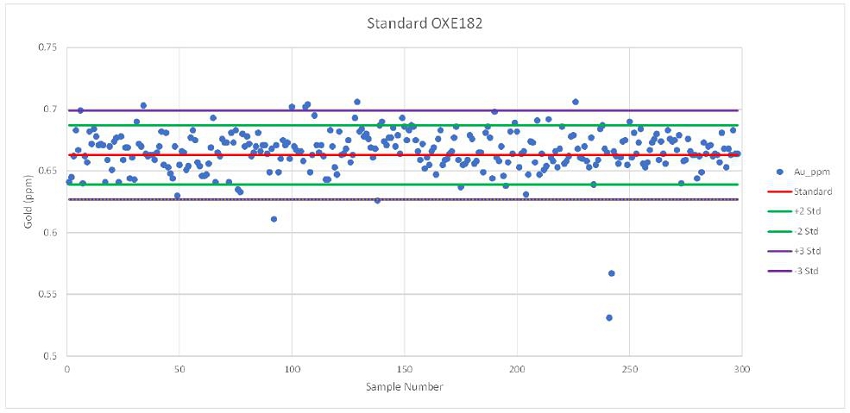

| Figure 8-1: |

Control Chart for CRM OXE182 Gold Assays |

81 |

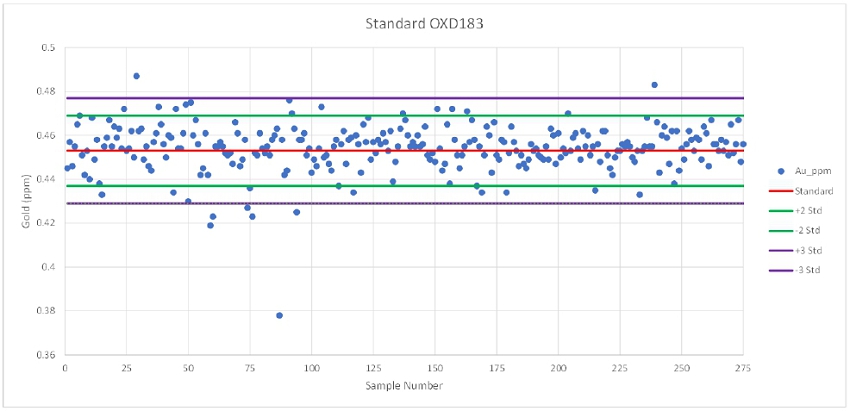

| Figure 8-2: |

Control Chart for CRM OXD183 Gold Assays |

82 |

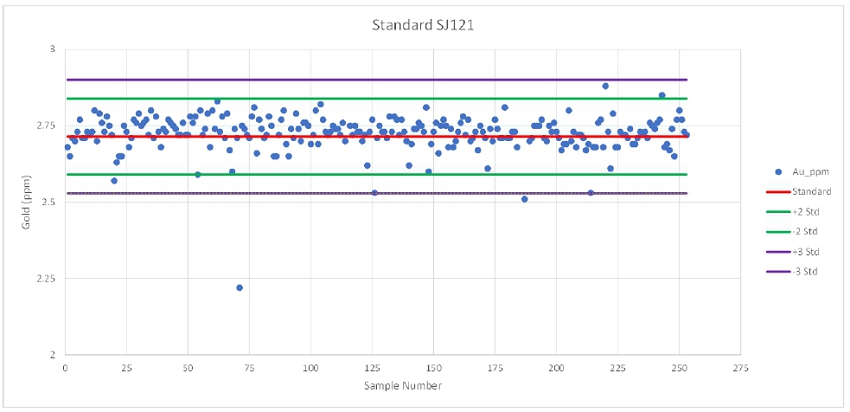

| Figure 8-3: |

Control Chart for CRM SJ121 Gold Assays |

83 |

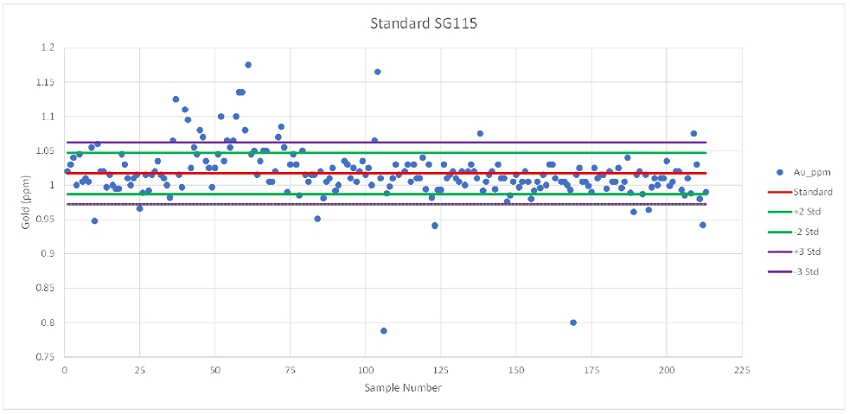

| Figure 8-4: |

Control Chart for CRM SG115 Gold Assays |

84 |

| Figure 8-5: |

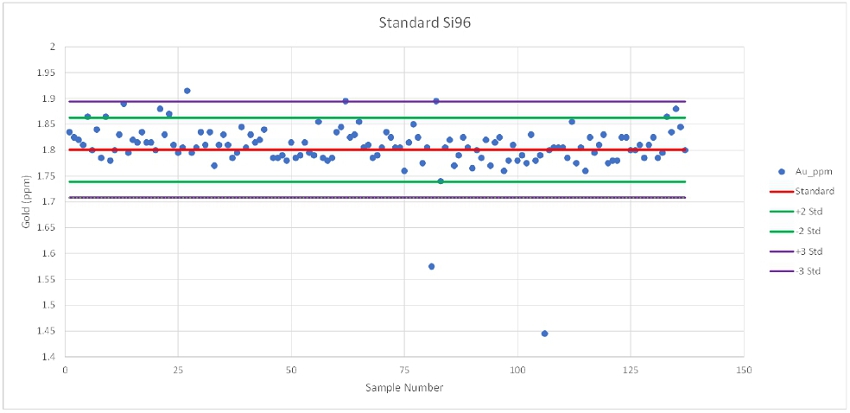

Control Chart for CRM Si96 Gold Assays |

85 |

| Figure 8-6: |

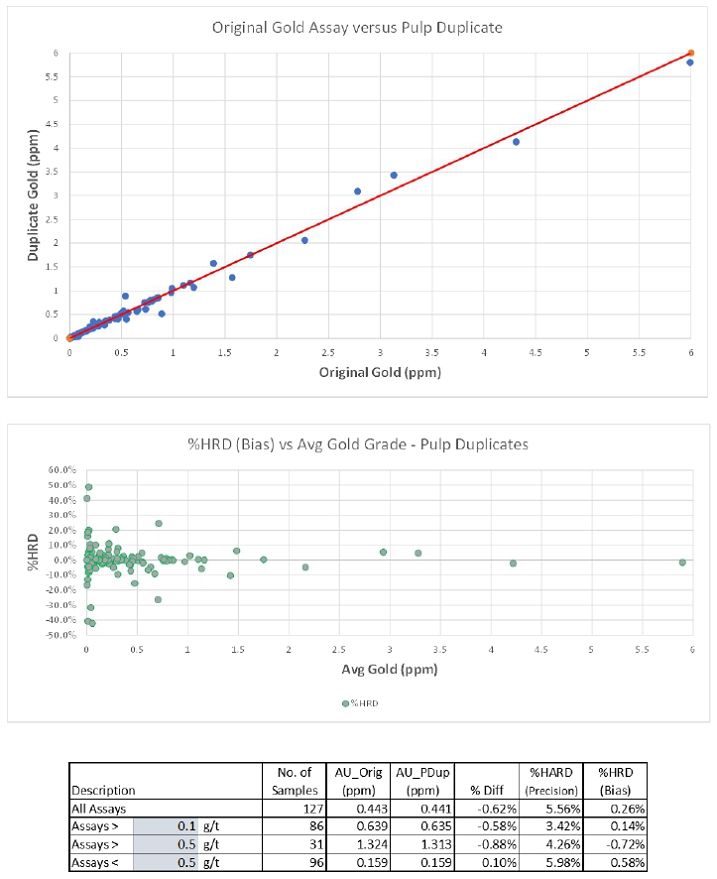

Original Gold Assay versus Pulp Duplicate |

88 |

| Figure 8-7: |

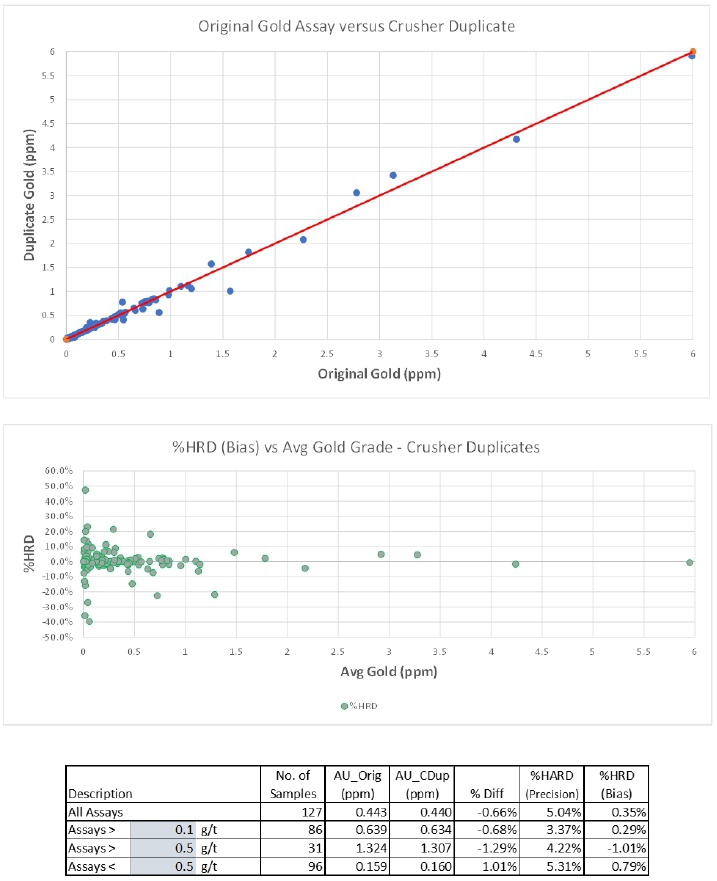

Original Gold Assay versus Crusher Duplicate |

89 |

| Figure 8-8: |

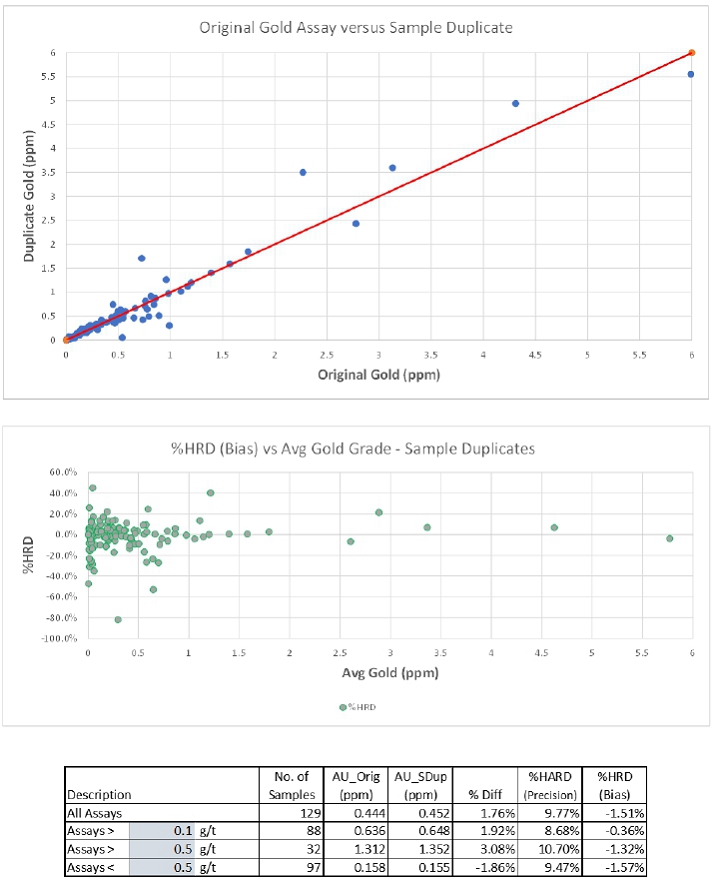

Original Gold Assay versus Sample Duplicate |

90 |

| Figure 10-1: |

Preliminary Cluster Analysis Interval Analytical KPI’s by Cluster |

97 |

| Figure 10-2: |

Richmond Hill Bottle Roll Test KPIs: Calculated Heads Au opt |

98 |

| Figure 10-3: |

Richmond Hill Bottle Roll Test KPIs: Calculated Heads Ag opt |

99 |

| Figure 10-4: |

Richmond Hill Bottle Roll Test KPIs: Ag:Au ratio |

99 |

| Figure 10-5: |

Richmond Hill Bottle Roll Test KPIs: Au Recovery Distribution |

100 |

| Figure 10-6: |

Richmond Hill Bottle Roll Test KPIs: Ag Recovery Distribution |

100 |

| M3-PN240322

3 February 2025

Revision 0 |

vii |

Richmond

Hill Project

Mineral

Resource Estimate

| Figure 10-7: |

Richmond Hill Column Test KPIs: Calculated Heads Au opt |

101 |

| Figure 10-8: |

Richmond Hill Column Test KPIs: Calculated Heads Ag opt |

102 |

| Figure 10-9: |

Richmond Hill Column Test KPIs: Ag:Au Ratio |

102 |

| Figure 10-10: |

Richmond Hill Column Test KPIs: Recovery % Au |

103 |

| Figure 10-11: |

Richmond Hill Column Test KPIs: Recovery % Ag |

103 |

| Figure 10-12: |

Rougher Flotation Flowsheet—BaseMet 2023, BL1244 |

105 |

| Figure 10-13: |

Rougher Mass vs. Gold Recovery—BaseMet 2023, BL1244 |

106 |

| Figure 10-14: |

Diagnostic Leach Test Flowsheet – BaseMet 2023, BL1244 |

107 |

| Figure 10-15: |

Gold Rougher Concentrate Recovery vs. Mass Recovery – BaseMet

2023, BL1346 |

108 |

| Figure 10-16: |

Gold Rougher Concentrate Recovery vs. Mass Recovery – BaseMet

2023, BL1346 |

109 |

| Figure 10-17: |

Gold Recovery vs. Sulfur Head Grade – BaseMet 2023, 1346 |

110 |

| Figure 10-18: |

Gold Recovery vs. Gold Head Grade – BaseMet 2023, BL1346 |

110 |

| Figure 10-19: |

Historical Richmond Hill Heap Leach KPI’s Au and Ag Recovery,

Recovered Ag:Au Ratio |

111 |

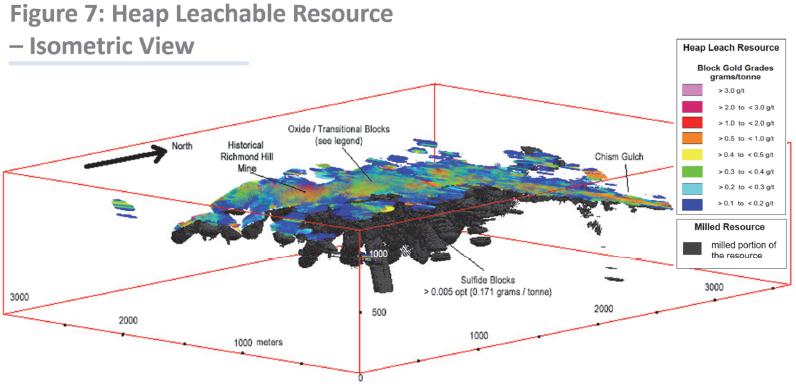

| Figure 11-1: |

Constraining Shell for Mineral Resource Estimate |

114 |

| Figure 11-2: |

Drillhole Locations by Company |

120 |

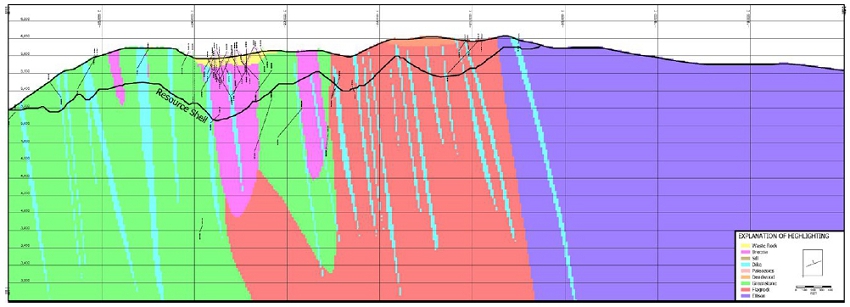

| Figure 11-3: |

Rock Types on the Resource Shell |

122 |

| Figure 11-4: |

Rock Types on Cross Section A-A’ |

123 |

| Figure 11-5: |

Rock Types on Section B-B’ |

124 |

| Figure 11-6: |

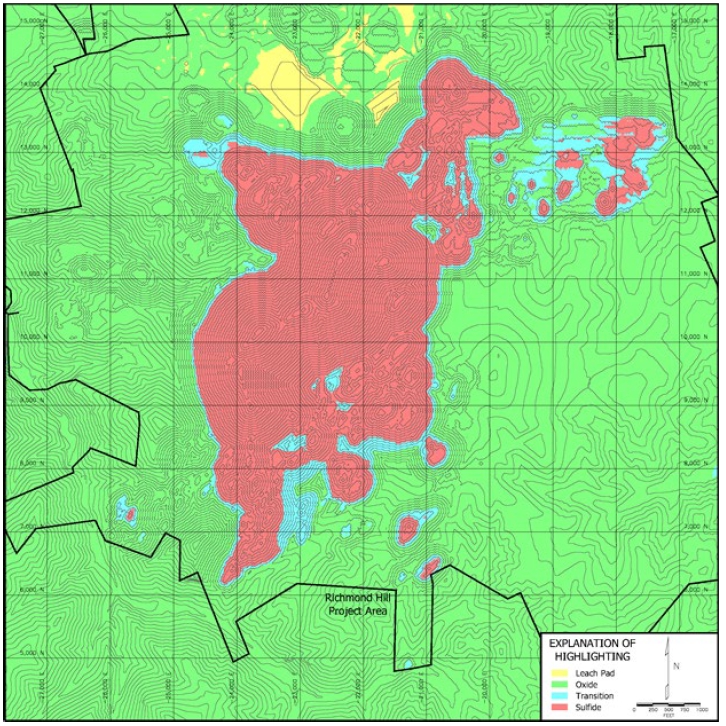

Oxidation Zones on the Resource Shell |

126 |

| Figure 11-7: |

Probability Plot of Gold by Rock Type – 10 ft. Composites (IMC,

2024) |

129 |

| Figure 11-8: |

Probability Plot of Silver by Rock Type – 10 ft. Composites (IMC,

2024) |

130 |

| Figure 11-9: |

Variogram for Tertiary Breccia – Azimuth 90°, Dip 85° |

132 |

| Figure 11-10: |

Variogram for Tertiary Breccia – Azimuth 22°, Dip -2° |

133 |

| Figure 11-11: |

Variogram for Precambrian Greenstone – Azimuth 292°, Dip

67° |

134 |

| Figure 11-12: |

Variogram for Precambrian Greenstone – Azimuth 202°, Dip

0° |

135 |

| Figure 11-13: |

Variogram for Precambrian Flagrock – Azimuth 45° - Dip 0° |

136 |

| Figure 11-14: |

Variogram for Precambrian Flagrock – Azimuth 135° –

Dip 45° |

137 |

| Figure 11-15: |

Variogram for Cambrian Deadwood – Azimuth 0° – Dip

12° |

138 |

| Figure 11-16: |

Variogram for Cambrian Deadwood – Azimuth 270° – Dip

0° |

139 |

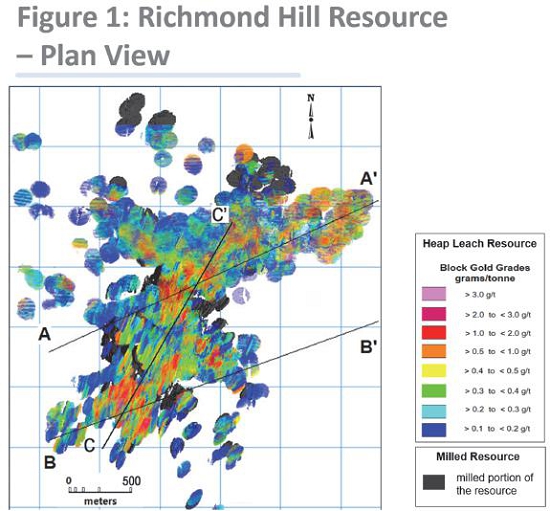

| Figure 11-17: |

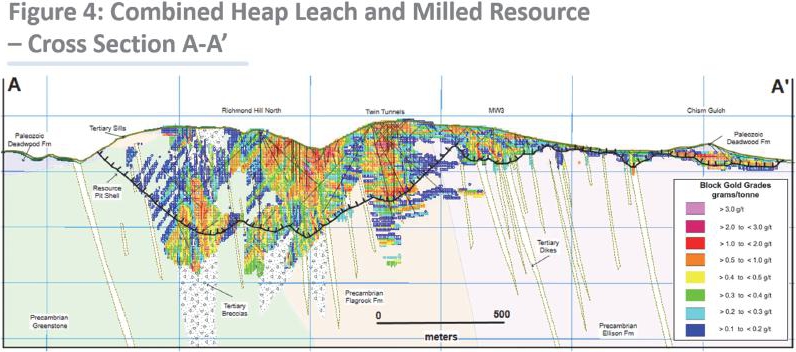

Gold Grade on Cross Section A-A’ (See Figure 11-2) |

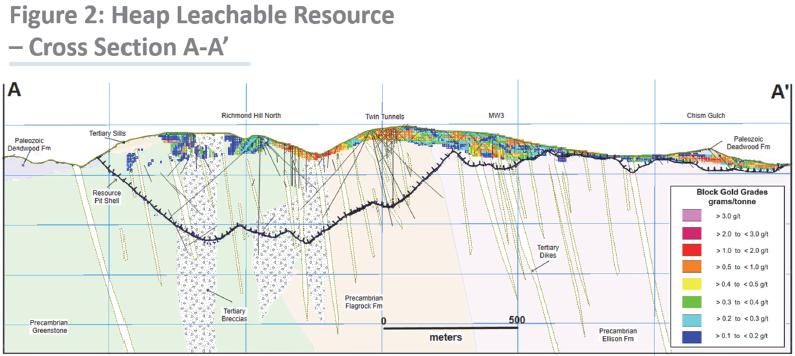

142 |

| Figure 11-18: |

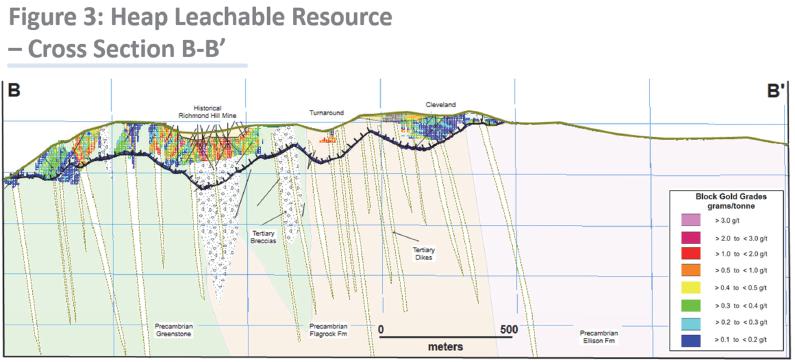

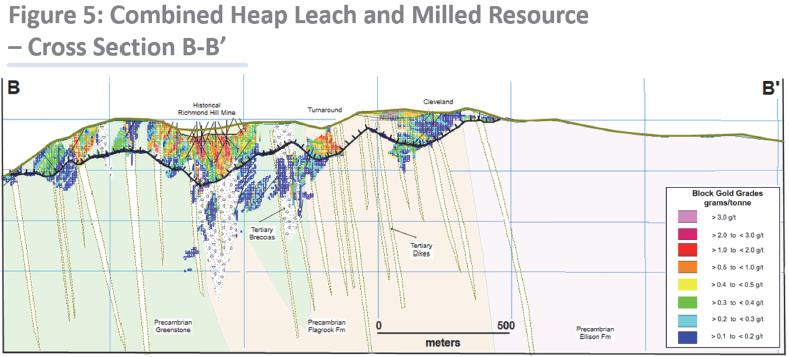

Gold Grades on Cross Section B-B’ (See Figure 11-2) |

143 |

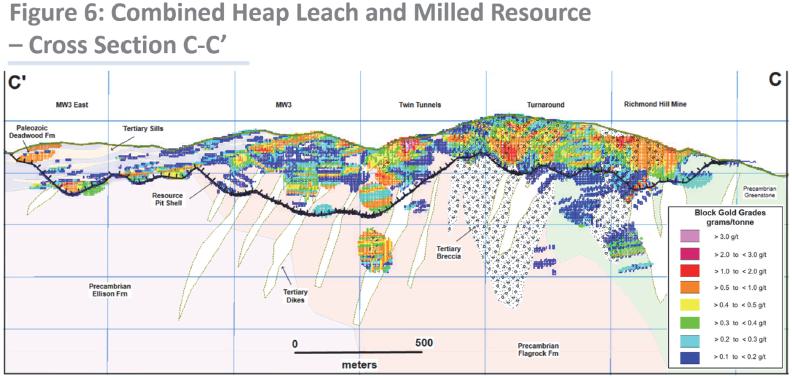

| Figure 11-19: |

Silver Grades on Cross Section A-A’ (See Figure 11-2) |

144 |

| Figure 11-20: |

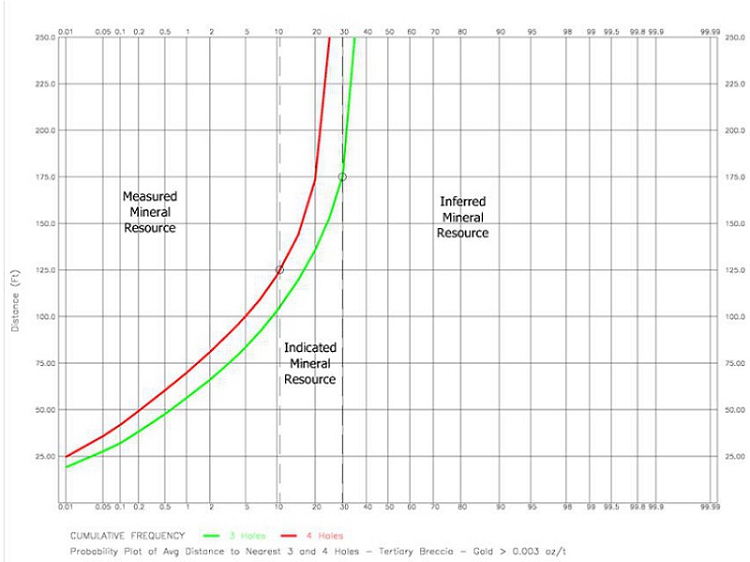

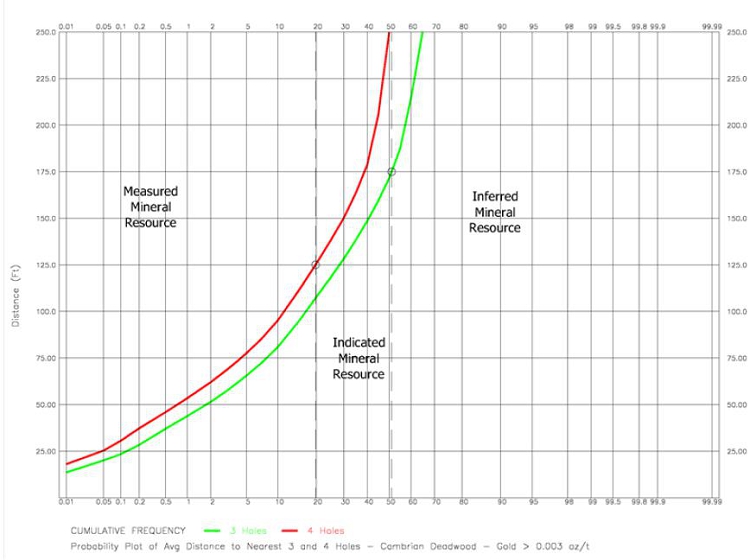

Probability Plot of Average Distance to Nearest 3 and 4 Holes – Tertiary Breccia |

146 |

| Figure 11-21: |

Probability Plot of Average Distance to Nearest 3 and 4 Holes –

Cambrian Deadwood |

147 |

| M3-PN240322

3 February 2025

Revision 0 |

viii |

Richmond

Hill Project

Mineral

Resource Estimate

| Figure 11-22: |

Resource Classification on Cross Section A-A’ |

148 |

| Figure 11-23: |

Resource Classification on Cross Section B-B’ |

149 |

| Figure 17-1: |

LAC’s Reclamation Liability Release Map (SDBME, 2016) |

167 |

| Figure 23-1: |

Recommended Richmond Hill 2024 Diamond Drill-Hole Locations |

178 |

| M3-PN240322

3 February 2025

Revision 0 |

ix |

Richmond

Hill Project

Mineral

Resource Estimate

List

of Tables

| TABLE |

DESCRIPTION |

PAGE |

| |

|

|

| Table 1-1: |

Mineral Resource Estimate |

3 |

| Table 1-2: |

Summary of Reconciliation Analysis for Contained Gold Ounces |

4 |

| Table 1-3: |

Budget for Recommended Work |

5 |

| Table 2-1: |

Qualified Persons Responsibilities |

9 |

| Table 3-1: |

Richmond Hill Gold Property Claims |

16 |

| Table 3-2: |

Richmond Hill Project Parcels with Holding Costs and Royalties |

24 |

| Table 3-3: |

Current Environmental Permits |

32 |

| Table 3-4: |

Potential Environmental Permits |

33 |

| Table 5-1: |

Summary of Richmond Hill’s Recent History |

40 |

| Table 7-1: |

Drilling by Company |

67 |

| Table 8-1: |

Groups of Drilling Programs at Richmond Hill Gold Project |

74 |

| Table 9-1: |

Comparison of Assay Certificates with Database for Dakota and Coeur

Drilling |

92 |

| Table 9-2: |

Comparison of Assay Certificates with Database for Legacy Drilling – Gold |

92 |

| Table 9-3: |

Comparison of Assay Certificates with Database for Legacy Drilling

– Silver |

93 |

| Table 10-1: |

Preliminary Geometallurgical Cluster Analysis Summary Table |

96 |

| Table 10-2: |

Historical Metallurgical Reports |

104 |

| Table 10-3: |

Master Composite Head Assays – BaseMet2023, BL1244 |

104 |

| Table 10-4: |

Rougher Flotation Results – BaseMet 2023, BL1244 |

105 |

| Table 10-5: |

Diagnostic Leach – BaseMet 2023, BL1244 |

107 |

| Table 10-6: |

Rougher Flotation Grind Series MC-TT-S – BaseMet 2023, BL1346 |

107 |

| Table 10-7: |

Rougher Flotation Results – BaseMet 2023, BL1346 |

109 |

| Table 10-8: |

Projected Precious Metal Recoveries |

111 |

| Table 11-1: |

Mineral Resource Estimate |

112 |

| Table 11-2: |

Mineral Resource at Various Prices – Leach Resources |

115 |

| Table 11-3: |

Mineral Resource at Various Prices – Mill Resources |

115 |

| Table 11-4: |

Economic Parameters for Mineral Resource Estimate |

117 |

| Table 11-5: |

Drilling by Company in Model Limits |

119 |

| Table 11-6: |

Model Rock Types |

121 |

| Table 11-7: |

Model Oxidation Zones |

125 |

| Table 11-8: |

Cap Grades and Number of Assays Capped |

127 |

| Table 11-9: |

Summary Statistics of Assays |

127 |

| M3-PN240322

3 February 2025

Revision 0 |

x |

Richmond

Hill Project

Mineral

Resource Estimate

| Table 11-10: |

Summary Statistics of 10 ft. Composites |

128 |

| Table 11-11: |

Estimation Parameters |

140 |

| Table 11-12: |

Specific Gravity Measurements |

150 |

| Table 11-13: |

Reconciliation of January 2025 and October 2023 Mineral Resources – Leach Resource |

154 |

| Table 11-14: |

Reconciliation of January 2025 and October 2023 Mineral Resources – Mill Resource |

156 |

| Table 11-15: |

Summary of Reconciliation Analysis for Contained Gold Ounces |

158 |

| Table 22-1: |

Mineral Resource |

173 |

| Table 23-1: |

Budget for Recommended Work |

176 |

| M3-PN240322

3 February 2025

Revision 0 |

xi |

Richmond Hill Project

Mineral

Resource Estimate

Dakota Gold Corp. (Dakota Gold) is a Delaware-incorporated

gold exploration and development company traded on the NYSE American with a head office in Lead, South Dakota. The company is focused

on revitalizing the Homestake District in South Dakota and has multiple gold mineral projects surrounding the historical Homestake mine,

including the Richmond Hill Gold Project (the Project), which is the subject of this Initial Assessment.

Dakota Gold contracted Independent Mining Consultants, Inc.

(IMC) of Tucson, Arizona to develop an updated mineral resource estimate and prepare an S-K 1300-compliant Initial Assessment and Technical

Report (the Report) for the Richmond Hill Gold Project. Mineral resources are reported using the definitions in Regulation S-K 1300,

17 CFR 229.1300. In this report, “resource” means “mineral resource” as defined therein.

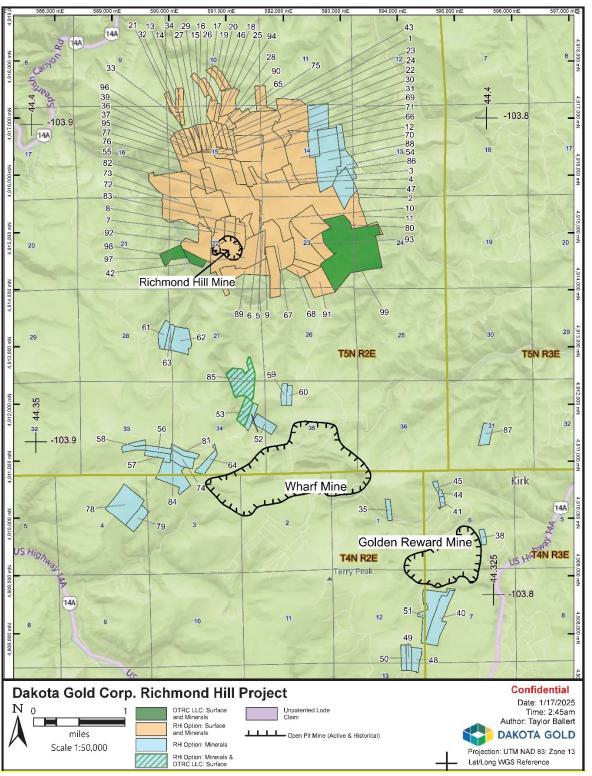

The Project property is comprised of more than

3000 acres of private surface and mineral rights (the Property). The Project includes the past-producing Richmond Hill mine and the historical

mines of the Carbonate District, as well as multiple prospective areas where gold has been drill-intersected.

The Project is in the western portion of Lawrence

County, South Dakota (Figure 2-1), approximately 4.5 miles northwest of Lead, South Dakota. The former Richmond Hill mine is approximately

44° 22’ 45” N latitude and 103° 51’ 30” W longitude.

In 2021, Dakota Territory Resources Corp, now

DTRC LLC, entered into a three-year option agreement (the Option) with Barrick subsidiaries Homestake Mining Company of California and

LAC Minerals (for convenience referred to collectively at times as Barrick) to acquire their interests in the Richmond Hill Project area.

In 2022, the Option was amended to extend the Option period until March 7, 2026. The Option was again amended in February 2025,

extending the option until December 31, 2028. Most parcels in the Option area include both surface and mineral rights, but in some

instances the Option only includes mineral rights, as discussed further in Section 3 of this Report. Under the Option, Dakota Gold

is obligated to file a 1% royalty against the Option properties upon exercise of the Option. Certain portions of the Project are subject

to additional royalties, as described further in Section 3 of this Report.

| 1.2 | Geology

and Mineralization |

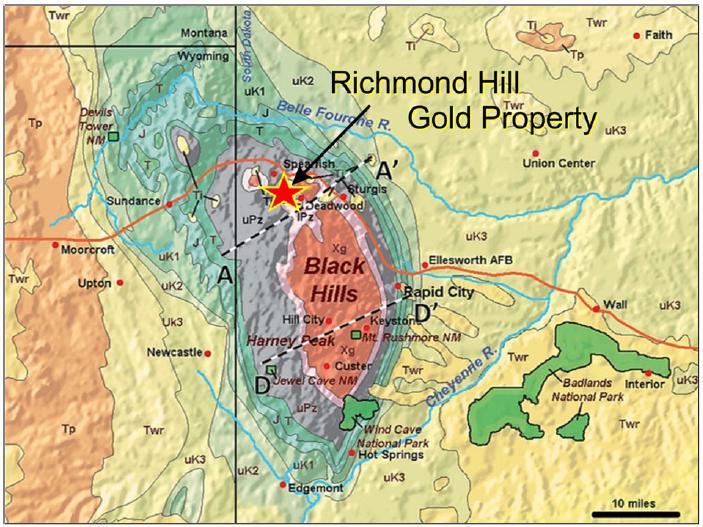

The Project is near the northwest end of the

Black Hills which is an oval-shaped north-northwest-striking mountain range approximately 45 miles by 90 miles in extent along the western

side of South Dakota and extending into Wyoming. The Black Hills is a domal uplift where erosion has exposed a window of Precambrian

igneous and metamorphic rocks flanked by a 6500 to 7000 feet deep sequence of Paleozoic to Mesozoic-aged sedimentary rocks dipping off

in all directions on the margin of the uplift, all subjected to intrusive activity in the Tertiary.

The Project is located on the northwestern portion

of the Lead dome, a subsidiary dome north of the main Black Hills uplift. The Lead dome developed in response to a major Tertiary intrusive

event that also led to development of the Tertiary-aged gold deposits. These Tertiary intrusive rocks have a wide range of compositions

and occur as stocks, sills, dikes, laccoliths, and breccia pipes. The Property forms a circular area approximately 2 miles in diameter.

Two major terranes underlie the claims. Precambrian

metamorphic rocks outcrop on the southern portions of the Property and consist of metamorphosed volcanic and sedimentary rocks. The western

portion of this terrane contains primarily extrusive metavolcanic rocks that appear to be mostly mafic in composition. The metasedimentary

rocks on the eastern side consist of phyllite, iron formations, and quartzites. Overlying the Precambrian rock on the north end of the

Property is a nearly complete Paleozoic section, which includes the Cambro-Ordovician Deadwood Formation; Ordovician to Mississippian

Englewood and the Whitewood and Winnipeg Formations; Mississippian Pahasapa Limestone; and the Pennsylvanian Minnelusa Formation. Tertiary

igneous rocks of varying composition have intruded extensively into both terranes.

| M3-PN240322

3 February 2025

Revision 0 |

1 |

Richmond

Hill Project

Mineral

Resource Estimate

Several gold–silver deposits and prospective

areas exist within the Project boundary. Within the Precambrian terrane, Tertiary-aged mineralization occurs within breccia pipes and

altered Precambrian rocks, with minor mineralization in the Tertiary intrusive rocks. Examples include the Richmond Hill deposit, Twin

Tunnels, Turnaround, Richmond Hill North, West Thumb, Huskie West, Cleveland, Calvin P, Cole Creek Heights, and Earle.

Within the Paleozoic terrane, mineralization

occurs in the Cambro-Ordovician Deadwood Formation along two primary horizons containing the most consistent mineralization. Examples

within the Deadwood Formation are Cole Creek in the upper portion and MW-3 Main, MW-3 East, and Chism Gulch in the lower portion. Localized

gold mineralization also occurs in the Pahasapa Limestone but is limited to narrow veins and structures in the old Carbonate Camp area.

| 1.3 | Exploration,

Development, and Operations |

Prior to Dakota Gold’s tenure, the Property

was drilled by at least 1,056 rotary, RC, and core holes testing multiple prospective areas within the claim boundary. Several of these

holes are excluded from the final database due to missing collar coordinates, downhole surveys, or other issues. Since optioning the

Property in 2021 to the effective date of this report, Dakota Gold has included an additional 148 diamond drill holes in this resource

estimate, representing 157,504 feet of core drilling. As of the date of this Report, the Project remains open in multiple directions

and Dakota Gold continues to conduct exploratory drilling of the Property.

Prior to entering into the Option agreement for

the Property, Dakota Gold also flew a high-resolution helicopter-borne magnetic and gamma-ray spectrometric survey over the Homestake

District. The survey covered an area of 962.4 km2 and included the Project area, with the objective of mapping Precambrian

lithologies and structure as well as Tertiary intrusive rocks and associated alteration in outcrop, subsurface, and beneath cover. The

results of this survey are not publicly available.

| 1.4 | Sample

Preparation, Analysis, Security, and Data Verification |

From 1984 to 1994, project drilling was completed

by St Joe, Bond Gold, and Homestake. Current industry QA/QC standards were not part of these programs. However, IMC has compared

historical drilling data against more recent data using current QA/QC protocols and found that the two populations of historical and

current data are similar with no evident errors or biases.

From 2019 to the present, current industry standards

for QA/QC have been followed. It is the opinion of the QP for this section that the Richmond Hill assay database of historical and current

data is adequate for the estimation of mineral resources and subsequent mineral reserves.

| 1.5 | Mineral

Processing and Metallurgy |

Historical oxide metallurgical testing was conducted

primarily at St. Joe’s Technical Center and on-site at the Richmond Hill Metallurgical Testing laboratory. Additional work was

conducted at Dawson Metallurgical Laboratories, Bondar-Clegg, Kappes Cassiday & Associates and Heinen Lindstrom and Associates.

This data was used to support the design and engineering of the production processing facility at Richmond Hill which operated from 1988

to 1993. Recent metallurgical testing focused on froth flotation of the transition and sulfide material was completed at Basement laboratories

in 2024.

The metallurgical testwork shows that Richmond

Hill oxide material is amenable to cyanide heap processing for the recovery of precious metals. Oxide heap leach recoveries are projected

at 89% and 30% for gold and silver respectively. The testwork also indicates that the Richmond Hill sulfide material is amenable to froth

flotation resulting in a precious metal rich sulfide concentrate. Precious metal recoveries via flotation are estimated at 85% for both

gold and silver. Testing of the transition material indicates it is possible to process this transition material via heap leaching or

flotation depending on the level of oxidation. Flotation of low sulfide transition material is estimated at 65% gold and 20% for silver.

Flotation of high sulfide transition material is estimated at 80% gold and 70% silver.

| M3-PN240322

3 February 2025

Revision 0 |

2 |

Richmond

Hill Project

Mineral

Resource Estimate

Additional metallurgical testwork is planned

to further define the metallurgical response and facilitate development of the Richmond Hill geometallurgical mode.

| 1.6 | Mineral

Resource Estimate |

The mineral resource estimate for Richmond Hill

includes mineral resources amenable to heap leaching and mineral resources amenable to milling. The mineral resource amenable to heap

leaching consists of the oxide and transition material types, and the mineral resource amenable to milling consists of the sulfide material.

Table 1-1 presents the mineral resource estimate. The measured and indicated mineral resource amenable to leaching amounts to 269.8 million

tons at 0.0135 oz/t gold and 0.141 oz/t silver for 3.65 million ounces of contained gold and 38.1 million ounces of contained silver.

Inferred mineral resource amenable to leaching is an additional 254.2 million tons at 0.0103 oz/t gold and 0.090 oz/t silver for 2.61

million ounces of contained gold and 22.8 million ounces of contained silver.

The measured and indicated mineral resource amenable

to milling amounts to 69.6 million tons at 0.0141 oz/t gold and 0.139 oz/t silver for 982,100 ounces of contained gold and 9.68 million

ounces of contained silver. Inferred mineral resource amenable to milling is an additional 202.2 million tons at 0.0121 oz/t gold and

0.145 oz/t silver for 2.45 million ounces of contained gold and 29.3 million ounces of contained silver.

The measured and indicated mineral resource for

leach and mill material amounts to 339.4 million tons at 0.0137 oz/t gold and 0.141 oz/t silver for 4.64 million ounces of contained

gold and 47.8 million ounces of contained silver. Inferred mineral resource for leach and mill material is an additional 456.4 million

tons at 0.0111 oz/t gold and 0.114 oz/t silver for 5.06 million ounces of contained gold and 52.1 million ounces of contained silver.

Table 1-1: Mineral Resource Estimate

| Resource Category | |

AuEq

COG (oz/t) | |

Ktons | |

AuEq (oz/t) | |

Gold (oz/t) | |

Silver (oz/t) | |

Gold (koz) | |

Silver (koz) | |

| Leach Resource: | |

| |

| |

| |

| |

| |

| |

| |

| Measured

Mineral Resource | |

| |

113,748 | |

0.0164 | |

0.0158 | |

0.160 | |

1,793.4 | |

18,208 | |

| Oxide | |

0.0026 | |

94,537 | |

0.0165 | |

0.0158 | |

0.167 | |

1,493.7 | |

15,788 | |

| Transition | |

0.0041 | |

19,211 | |

0.0161 | |

0.0156 | |

0.126 | |

299.7 | |

2,421 | |

| Indicated

Mineral Resource | |

| |

156,019 | |

0.0125 | |

0.0119 | |

0.128 | |

1,860.0 | |

19,884 | |

| Oxide | |

0.0026 | |

127,237 | |

0.0122 | |

0.0117 | |

0.128 | |

1,488.7 | |

16,286 | |

| Transition | |

0.0041 | |

28,783 | |

0.0134 | |

0.0129 | |

0.125 | |

371.3 | |

3,598 | |

| Meas/Indic

Mineral Resource | |

| |

269,768 | |

0.0141 | |

0.0135 | |

0.141 | |

3,653.3 | |

38,092 | |

| Oxide | |

0.0026 | |

221,774 | |

0.0140 | |

0.0134 | |

0.145 | |

2,982.4 | |

32,074 | |

| Transition | |

0.0041 | |

47,994 | |

0.0145 | |

0.0140 | |

0.125 | |

671.0 | |

6,018 | |

| Inferred

Mineral Resource | |

| |

254,186 | |

0.0106 | |

0.0103 | |

0.090 | |

2,613.4 | |

22,787 | |

| Oxide | |

0.0026 | |

211,994 | |

0.0101 | |

0.0098 | |

0.085 | |

2,077.5 | |

18,019 | |

| Transition | |

0.0041 | |

42,192 | |

0.0131 | |

0.0127 | |

0.113 | |

535.8 | |

4,768 | |

| Mill Resource (Sulfides): | |

| |

| |

| |

| |

| |

| |

| |

| Measured Mineral Resource | |

0.0050 | |

20,703 | |

0.0184 | |

0.0165 | |

0.151 | |

341.6 | |

3,126 | |

| Indicated Mineral Resource | |

0.0050 | |

48,893 | |

0.0147 | |

0.0131 | |

0.134 | |

640.5 | |

6,552 | |

| Meas/Indic Mineral Resource | |

0.0050 | |

69,596 | |

0.0158 | |

0.0141 | |

0.139 | |

982.1 | |

9,678 | |

| Inferred Mineral

Resource | |

0.0050 | |

202,221 | |

0.0139 | |

0.0121 | |

0.145 | |

2,446.9 | |

29,322 | |

| Leach and Mill Mineral Resource: | |

| |

| |

| |

| |

| |

| |

| |

| Measured Mineral Resource | |

| |

134,452 | |

0.0167 | |

0.0159 | |

0.159 | |

2,135.0 | |

21,334 | |

| Indicated Mineral Resource | |

| |

204,912 | |

0.0130 | |

0.0122 | |

0.129 | |

2,500.5 | |

26,436 | |

| Meas/Indic Mineral Resource | |

| |

339,364 | |

0.0145 | |

0.0137 | |

0.141 | |

4,635.4 | |

47,770 | |

| Inferred Mineral

Resource | |

| |

456,407 | |

0.0121 | |

0.0111 | |

0.114 | |

5,060.3 | |

52,109 | |

| M3-PN240322

3 February 2025

Revision 0 |

3 |

Richmond

Hill Project

Mineral

Resource Estimate

Notes:

1. The Mineral Resource estimate has an effective

date of 3 February 2025.

2. All figures are rounded to reflect the relative

accuracy of the estimate and therefore numbers may not appear to add precisely.

3. Mineral Resources that are not Mineral Reserves

do not have demonstrated economic viability.

4. Mineral Resources are based on prices of $2000/oz

gold and $25/oz silver.

5. Mineral Resources for leach material are based

on a gold equivalent cut-off of 0.0026 oz/t for oxide material and 0.0041 oz/t for transition material. Mineral Resources for mill material

are based on a gold equivalent cut-off of 0.0050 oz/t.

6. The gold equivalent value for each material

is as follows:

Oxide (Leach): Gold equivalent (oz/t) = gold

(oz/t) + 0.00418 x silver (oz/t), based on gold recovery of 89% and silver recovery of 30%.

Transition (Leach): Gold equivalent = gold (oz/t)

+ 0.00382 x silver (oz/t), based on gold recovery of 65% and silver recovery of 20%.

Sulfide (Mill): Gold equivalent = gold (oz/t)

+ 0.0127 x silver (oz/t), based on gold recovery of 85% and silver recovery of 85%.

7. The gold equivalent values account for metal

recoveries, treatment charges, refining costs, and refinery payable percentages.

8. Table 11-4 accompanies this Mineral Resource

statement and shows all relevant parameters for mineral resources.

9. Includes a preliminary estimated royalty rate

of 3.8% averaged across the Project property. The QP has determined that the resource is not sensitive to nominal changes in the royalty

rate but has recommended that this estimate be updated for the Project economic and cash flow analysis.

10. Mineral Resources are reported in relation

to a conceptual constraining pit shell to demonstrate reasonable prospects for economic extraction, as required by the definition of

Mineral Resource in S-K 1300; mineralization lying outside of the pit shell is excluded from the Mineral Resource.

11. The Mineral Resource estimate is also constrained

by the Richmond Hill Project Boundary. Only mineralization inside this boundary is included in the Mineral Resource Estimate, though

waste removal outside the boundary is allowed.

12. The Mineral Resources reported are contained

on mineral titles owned or controlled by Dakota Gold.

13. The Mineral Resources are reported in-situ

without any dilution or loss considerations, as a point of reference.

Table 1-2 presents a reconciliation of the January 2025

mineral resource estimate with the SK-1300 Initial Assessment published in April 2024 (analysis dated current as of October 5,

2023) estimate for mineral resources amenable to leaching. This includes the oxide and transition material. Notable changes include conversion

of hard grade estimation boundaries to soft boundaries based on additional data and analysis and updated domains for oxide, transition,

and sulfide materials. Updates to cut off grade, recovery rates, costs, gold price, and addition of silver also positively impacted the

model.

Table 1-2: Summary of Reconciliation Analysis

for Contained Gold Ounces

| | |

Oxide/Transition

(Leach) | |

Sulfide

(Mill) | |

All Mineral

Resource | |

| | |

Meas/Indic | |

Inferred | |

Meas/Indic | |

Inferred | |

Meas/Indic | |

Inferred | |

| Parameter | |

Au (koz) | |

Au (koz) | |

Au (koz) | |

Au (koz) | |

Au (koz) | |

Au (koz) | |

| Start - October 2023 Mineral Resource | |

859 | |

836 | |

469 | |

296 | |

1,328 | |

1,132 | |

| Due to Updated Oxide/Transition/Sulfide Domains | |

453 | |

461 | |

(302 | ) |

(197 | ) |

151 | |

264 | |

| Due to Internal versus Breakeven Cut-off Grade | |

35 | |

69 | |

10 | |

6 | |

45 | |

75 | |

| Due to Updated Recoveries | |

5 | |

37 | |

65 | |

138 | |

70 | |

175 | |

| Due to $2,000/oz Price | |

11 | |

47 | |

1.6 | |

5 | |

13 | |

53 | |

| Due to Dakota Gold Costs | |

51 | |

182 | |

(0.4 | ) |

(10 | ) |

51 | |

172 | |

| Due to Updated Resource Model (Note 1) | |

2,215 | |

910 | |

698 | |

1,855 | |

2,914 | |

2,765 | |

| Due to Silver (Note 2) | |

24 | |

72 | |

41 | |

353 | |

64 | |

425 | |

| Cumulative Change for All Parameters | |

2,794 | |

1,778 | |

513 | |

2,151 | |

3,307 | |

3,929 | |

| Final - January 2025 Mineral Resource | |

3,653 | |

2,613 | |

982 | |

2,447 | |

4,635 | |

5,060 | |

Note 1. Only gold used to develop resource shell.

Note 2. Silver economics allowed to contribute

to resource shell

| M3-PN240322

3 February 2025

Revision 0 |

4 |

Richmond

Hill Project

Mineral

Resource Estimate

In the 1980s and 1990s, considerable environmental

baseline information was collected to support historical mine permitting and to support reclamation and closure activities. This information,

along with new and additional or updated data, will be required to support future mine development and permitting efforts.

Dakota Gold collects select environmental baseline

information required to support planned exploration permitting and assist with reclamation of disturbed sites. Key environmental baseline

disciplines required to support exploration drilling permitting include: vegetation, wildlife, cultural, archaeology, and historical.

Dakota Gold will also be negotiating additional baseline requirements with South Dakota Department of Agriculture and Natural Resources

(SDDANR) as part of its permitting process for a new mine at Richmond Hill.

As part of LAC’s closure program at Richmond

Hill Mine, all material classified as acid generating was removed from the Spruce Gulch waste dump and placed in truck compacted lifts

back into the historical Richmond Hill mining area. Following placement of that material, the material was capped with clay to minimize

oxygen and water infiltration into the compacted potentially acid-generating material. LAC also used this method to remediate the ore

material on the heap leach pads, isolating the pads with a similar clay cap. The leach pad and backfilled historical Richmond Hill mining

area impoundment covers have met or exceeded original design specifications for limiting infiltration.

Any potentially impacted groundwater from the

former process area, pit impoundment, or Spruce Gulch waste dump facility is actively managed by two on-site water management and treatment

systems that have continued to operate throughout the post-closure period. Continued water treatment at these sites would be the responsibility

of Dakota Gold once the Option is exercised. The associated costs are subject to post-closure bonding, the obligation for which would

be assumed by Dakota Gold upon exercise of the Option.

| 1.8 | Conclusion

and Recommendations |

Under the assumptions presented in this Initial

Assessment Technical Report, and based on the available data, the Mineral Resource Estimates show reasonable prospects of economic extraction.

In addition, due to the nature of the Project and the ability to advance Richmond Hill towards production, the recommendation section

also outlines an estimate for a complete feasibility level work program. Of the feasibility level work outlined, certain areas of work

can be advanced concurrently with the recommended Initial Assessment with cash flow analysis, while others may be informed by the work.

The recommended program is for the company to

complete an economic and cash flow analysis.

The following are recommendations for the next

stages of work to advance the Project:

| · | Advance

the Project to an Initial Assessment that includes an economic analysis. |

| · | Additional

metallurgical testwork and process design. |

| · | Additional

drilling to infill the current mineral resource and test additional prospective areas. This

will also improve definition of geological domains and provide material for metallurgical

testing. |

| · | Advancement

of baseline environmental data collection to support initiation of Project permitting. |

| M3-PN240322

3 February 2025

Revision 0 |

5 |

Richmond

Hill Project

Mineral

Resource Estimate

Table 1-3 summarizes the budget cost for these

items.

Table 1-3: Budget for Recommended Work

| Item | |

2025 | | |

2026 | | |

Total | |

| 1. Program To Initial Assessment W/ Cash Flow

(IACF) | |

$ | 842,000 | | |

| - | | |

$ | 842,000 | |

| 2. Program For Feasibility Study (FS) Metallurgy and Environmental | |

$ | 2,700,000 | | |

$ | 3,000,000 | | |

$ | 5,700,000 | |

| - Metallurgy Program | |

$ | 500,000 | | |

$ | 400,000 | | |

$ | 900,000 | |

| - Monitoring Wells | |

$ | 600,000 | | |

| - | | |

$ | 600,000 | |

| - Environmental Geochemistry | |

$ | 120,000 | | |

$ | 300,000 | | |

$ | 420,000 | |

| - Environmental Samples/Analytics | |

$ | 840,000 | | |

$ | 1,000,000 | | |

$ | 1,840,000 | |

| - Environmental Studies/Modeling/Other | |

$ | 640,000 | | |

$ | 1,300,000 | | |

$ | 1,940,000 | |

| 3. Drilling Program | |

$ | 15,500,000 | | |

$ | 18,000,000 | | |

$ | 33,500,000 | |

| - Target Additional 500k oz For

Resource | |

$ | 9,000,000 | | |

$ | 2,000,000 | | |

$ | 11,000,000 | |

| - Target To Conversion of Resource

to Three Years Reserves | |

$ | 1,500,000 | | |

$ | 9,500,000 | | |

$ | 11,000,000 | |

| - Drilling

For Metallurgical Testing | |

$ | 5,000,000 | | |

$ | 6,500,000 | | |

$ | 11,500,000 | |

| Total | |

$ | 19,042,000 | | |

$ | 21,000,000 | | |

$ | 40,042,000 | |

It is anticipated that these items would be performed

over the next two years. Given the robust nature of the resource identified, Dakota Gold may choose to defer some portion of additional

exploration drilling.

| M3-PN240322

3 February 2025

Revision 0 |

6 |

Richmond

Hill Project

Mineral

Resource Estimate

Dakota Gold Corp. (Dakota Gold) is a Delaware-incorporated

company traded on the NYSE American and with a head office in Lead, South Dakota. Dakota Gold is focused on revitalizing the Homestake

District in South Dakota. Dakota Gold has multiple gold mineral projects surrounding the historical Homestake mine, including the Richmond

Hill Gold Project, which is the subject of this technical report summary. The Project hosts the former Richmond Hill gold mine that operated

from 1988 to 1993 as an open pit mine with heap leach facilities. The Project location is shown in Figure 2-1.

Dakota Gold contracted Independent Mining Consultants, Inc.

(IMC) of Tucson, Arizona to develop an updated mineral resource estimate and prepare an SK 1300-compliant Initial Assessment and Technical

Report for the Richmond Hill Gold Project (the Project). Mineral resources are reported using the definitions in Regulation S-K 1300,

17 CFR 229.1300. IMC’s scope of work was as follows:

| · | Validate

gold and silver assays in the database with original assay certificates for a representative

portion of the data. |

| · | Review

the quality assurance/quality control (QA/QC) programs and results for drilling database. |

| · | Review

geologic solids developed by Dakota Gold personnel and incorporate them into the resource

model. |

| · | Develop

gold and silver grade estimates and resource classification for the resource model. |

| · | Develop

an updated mineral resource for the Project. |

| · | Prepare

the updated Technical Report. |

Dakota Gold contracted Woods Process Services,

LLC (Woods) of Sparks, Nevada to perform the following scope of work for the Project:

| · | Review

existing metallurgical testing data and make estimates of process recoveries and processing

costs for the various mineral types. |

| · | Design

solids to define the various mineral types in the resource model. |

| · | Provide

recommendations on additional metallurgical testing. |

| · | Provide

sections for the updated Technical Report. |

| M3-PN240322

3 February 2025

Revision 0 |

7 |

Richmond

Hill Project

Mineral

Resource Estimate

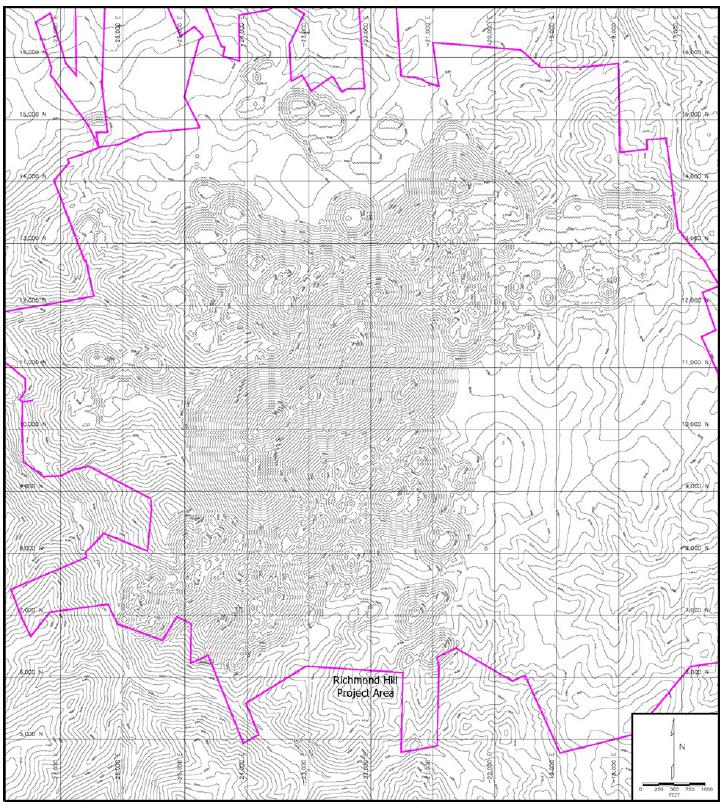

Figure 2-1: Property Location

| M3-PN240322

3 February 2025

Revision 0 |

8 |

Richmond

Hill Project

Mineral

Resource Estimate

Table 2-1 shows the Qualified Persons (QPs) for

this technical report and their respective areas of responsibility.

Table 2-1: Qualified Persons Responsibilities

| Qualified Person | |

Company | | |

Report Section(s) of

Responsibility |

| Michael G. Hester | |

IMC | | |

1 except 1.5,2-8,9.1,11-21,22 except

22.2, 23 except 23.2 and 23.6,24-26 |

| Jeffrey L. Woods | |

Woods | | |

1.5,9.2,10,22.2,23.2,23.6 |

Michael G. Hester visited the Property on January 16th

and 17th, 2025 to review site conditions and interview site personnel. This included the core logging, processing and

storage facilities.

Jeffrey L. Woods did not visit the site. There

is currently no on-site process-related infrastructure to examine.

Information in this Report is current as of February 3,

2025.

| 2.5 | Sources

of Information |

The main sources of information for this technical

report include:

| · | The

drillhole database compiled and maintained by Dakota Gold. |

| · | Various

geologic and ore type solids developed by Dakota Gold and Woods personnel. |

| · | The

report “S-K 1300 Initial Assessment and Technical Report Summary – Richmond Hill

Gold Project, South Dakota, U.S.A” dated April 30, 2024, by AKF Mining Services

Inc. |

| · | Reports

and documents cited in Sections 24 and 25 were used to support the preparation of this Report. |

| 2.6 | Previous

Technical Report Summaries |

The Registrant filed a technical report summary

on the Project, dated April 30, 2024, that included a maiden mineral resource estimate for the Project.

| 2.7 | Acronyms

and Abbreviations |

| $ | U.S. dollar |

| 3D | three-dimensional |

| AAS | atomic absorption spectroscopy |

| Ag | silver |

| AKF | AKF Mining Services Inc. |

| AOI | Area of Interest |

| ARD | acid-rock drainage |

| ARSD | Administrative Rules of South Dakota |

| Au | gold |

| Aueq | Gold equivalent |

| BC | Bondar-Clegg |

| B.C. | British Columbia |

| Barrick | Barrick Gold Corporation |

| M3-PN240322

3 February 2025

Revision 0 |

9 |

Richmond

Hill Project

Mineral

Resource Estimate

| BaseMet |

Base Metallurgical Laboratories |

| BLK |

blank |

| BMA |

bulk mineral analysis |

| BVMM |

Bureau Veritas Metals and Minerals |

| BWi |

Bond ball mill work index |

| CC |

Cole Creek |

| CDP |

crushed duplicate |

| CF |

Chism Flat |

| CG |

Chism Gulch |

| CN |

Cyanide |

| COd |

Cambro-Ordovician Deadwood Formation |

| COdcs |

Deadwood Formation basal conglomerate-sandstone |

| Core |

Central Crystalline Core |

| CP |

Calvin Point |

| CRM |

certified reference material |

| Cu |

copper |

| CUP |

Conditional Use Permit |

| CV |

Cleveland |

| Dakota Gold |

Dakota Gold Corp. |

| DO |

dissolved oxygen |

| DTRC |

Dakota Territory Resource Corp. |

| DUP |

duplicate |

| ERM |

Environmental Resources Management |

| EXNI |

Exploration Notice of Intent |

| Fe |

iron |

| Freeport |

Freeport Exploration Company |

| GRG |

gravity-recoverable gold |

| Homestake |

Homestake Mining Company of California |

| ICP-ES |

inductively coupled plasma-emission spectroscopy |

| ID2 |

inverse distance squared |

| IMC |

Independent Mining Consultants, Inc. |

| IP |

induced polarization |

| IRR |

internal rate of return |

| JV |

joint venture |

| Koz |

1000 troy ounces |

| K-Met |

K-Met Consultants Inc. |

| LAC |

LAC Minerals |

| LDL |

lower detection limit |

| Magee |

Magee Geophysical Surveys LLC |

| MC |

master composite |

| Mia |

coarse ore index |

| MRE |

mineral resource estimate |

| NaCN |

sodium cyanide |

| NPV |

net present value |

| NSR |

net smelter return |

| NWS |

National Weather Service |

| M3-PN240322

3 February 2025

Revision 0 |

10 |

Richmond

Hill Project

Mineral

Resource Estimate

| OK |

ordinary kriging |

| P80 |

80% passing |

| PAX |

potassium amyl xanthate |

| pC |

undivided Precambrian |

| PDP |

pulp duplicate |

| PEA |

preliminary economic assessment |

| Pef |

Precambrian Ellison |

| Pfl |

Precambrian Flagrock |

| Pgn |

Precambrian Greenstone |

| POX |

pressure oxidation |

| Property |

Richmond Hill Gold Project |

| QA/QC |

quality assurance and quality control |

| Q/C |

quality control |

| QP |

qualified person |

| RC |

reverse circulation |

| RH |

Richmond Hill |

| RHN |

Richmond Hill North |

| RO |

reverse osmosis |

| RQD |

rock quality designation |

| S |

sulfur |

| SAG |

semi-autogenous grinding |

| SCSE |

SAG circuit specific energy |

| SD |

standard deviation |

| SDBME |

South Dakota Board of Minerals & Environment |

| SDDANR |

South Dakota Department of Agriculture & Natural Resources |

| SDDENR |

South Dakota Department of Environment & Natural Resources |

| SDP |

sample duplicate |

| SMC |

SAG mill comminution |

| St. Joe |

St. Joe Gold Corporation |

| SURF |

Sanford Underground Research Facility |

| SWD |

surface water discharge |

| SWPPP |

Stormwater Pollution Prevention Plan |

| TA |

Turn Around |

| Tbx |

Tertiary hydrothermal breccia |

| Tbx RH |

Richmond Hill Tertiary hydrothermal breccia |

| Tbx RHN-NN |

Richmond Hill North No Name Tertiary hydrothermal breccia |

| Tdk |

Tertiary dike |

| Ti |

Tertiary intrusive |

| Tsl |

Tertiary sill |

| TT |

Twin Tunnels |

| U.S. |

United States of America |

| Viable |

Viable Resources Inc. |

| WOL |

whole ore leach |

| |

|

| Units of Measure |

|

| |

|

| μm |

micrometer (micron) |

| M3-PN240322

3 February 2025

Revision 0 |

11 |

Richmond

Hill Project

Mineral

Resource Estimate

| ° |

degrees azimuth |

| °F |

degrees Fahrenheit |

| % |

percent |

| $ |

United States dollar |

| ft |

foot |

| ft3/ton |

cubic feet per US ton |

| g |

gram |

| g/cm3 |

grams per cubic meters |

| g/mt |

grams per tonne |

| Ga |

giga-annum (billion years) |

| gal/min |

U.S. gallons per minute |

| h |

hour |

| kg |

kilogram |

| kg/t |

kilogram per tonne |

| km2 |

kilometer squared |

| kton |

1000 US tons |

| ktonne |

1000 metric tonnes |

| kV |

kilovolt |

| kW |

kilowatt |

| kWh/m3 |

kilowatt hours per cubic meter |

| kWh/t |

kilowatt hour per tonne |

| L |

liter |

| m3 |

cubic meter |

| m |

meter |

| Ma |

mega-annum (one million years) |

| mg |

milligram |

| mg/L |