UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of May 2024

Commission

File Number 001-40099

GOLD

ROYALTY CORP.

(Registrant’s

name)

1188

West Georgia Street, Suite 1830

Vancouver,

BC V6E 4A2

(604)

396-3066

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GOLD

ROYALTY CORP. |

| |

|

|

| Date:

May 28, 2024 |

By: |

/s/

Andrew Gubbels |

| |

Name: |

Andrew

Gubbels |

| |

Title: |

Chief

Financial Officer |

EXHIBIT

INDEX

Exhibit

99.1

Gold

Royalty Announces Agreement to Acquire Vares Copper Stream

Vancouver,

British Columbia – May 28, 2024 – Gold Royalty Corp. (“Gold Royalty” or the “Company”)

(NYSE American: GROY) is pleased to announce that it has entered into a binding purchase and sale agreement (the “PSA”)

with OMF Fund III (Cr) Ltd., an entity managed by Orion Mine Finance Management LP (“Orion”) to acquire a copper stream

(the “Stream”) on the Vares Silver Project (“Vares”), operated by a subsidiary of Adriatic Metals

plc (“Adriatic”) located in Bosnia and Herzegovina (the “Transaction”).

Under

the terms of the PSA, Gold Royalty will pay consideration to Orion of US$50 million to acquire the Stream at closing of the Transaction,

consisting of US$45 million payable in cash and US$5 million to be satisfied by the issuance of 2,906,977 Gold Royalty shares.

Transaction

Highlights:

| ● | Materially

accretive to Gold Royalty’s cash flow |

| |

○ |

The

Vares Stream applies to 100% of copper production from the mining area over the Rupice deposit. The Stream has associated ongoing

payments equal to 30% of the LME spot copper price, with the effective payable copper fixed at 24.5%. |

| |

○ |

First

concentrate production at Vares occurred in February 2024 with commercial production expected in the fourth quarter of 2024. |

| |

○ |

Adriatic

has provided production guidance of 240-300 kt of ore mined from Vares with copper grades of 0.5-0.6% in 2024. Adriatic forecasts

750-850 kt and 800-900 kt of ore mined in 2025 and 2026 respectively at grades of 0.5-0.7% Cu. |

| |

○ |

Gold

Royalty expects to potentially further benefit from copper prices currently near all time highs. |

| ● | High-quality

asset with exploration and expansion upside |

| |

○ |

Adriatic’s

most recent guidance is targeting a mine life of 18 years with an attractive operating cost profile. |

| |

○ |

Mine

plan is built upon the high-grade polymetallic Rupice deposit with copper expected to comprise only 2% of the life of mine revenue. |

| |

○ |

Studies

are underway to increase annual production rates to 1 million tonnes of ore per year by 2026. |

| |

○ |

Adriatic

has stated that the project remains open for further exploration within the existing Vares concessions. |

| ● | Aligning

with a strong and proven operating team |

| |

○ |

Adriatic’s

operating team is highly experienced. |

| |

○ |

Recent

initiatives have improved productivity levels and advanced development supporting Adriatic’s disclosed guidance of commercial

production in the fourth quarter of 2024. |

David

Garofalo, Chairman and CEO of Gold Royalty, commented: “With this acquisition we are adding another high-quality, long-life asset

to our portfolio which we expect will meaningfully increase our revenue and cash flow on a per share basis. Vares not only provides significant

near-term cash flow, but also provides potential upside through exploration and mine expansion. We welcome Orion as a strategic shareholder

and look forward to further enhancing our relationship with a leading private equity firm with an exceptional track record in the global

mining sector. Finally, while the Gold Royalty portfolio is still predominantly precious metals focussed, the Company expects to benefit

from record copper prices through the additional copper exposure that comes with the Vares Stream.”

Overview

of the Vares Silver Project

The

Vares Silver Project consists of 41 km2 of concession area, which is centered around the town of Vares. The town is located

in the Vares municipality in Bosnia and Herzegovina and is a 50-minute drive from Sarajevo, the capital of Bosnia and Herzegovina. The

Vares Operation is one of the largest investments in Bosnia and Herzegovina, bringing significant economic and social benefits to the

country. The Stream applies to certain areas of Vares, including the Rupice area of the project. All mineral reserves and resources within

the current Vares mine plan are from the Rupice deposit and are subject to the Stream (refer to Table 2 and Table 3).

Vares

is a polymetallic project with the majority of expected production to be silver and zinc, in addition to smaller components of lead,

gold, copper, and antimony. Current development and near-term production are expected from the Rupice underground mine.

The

Vares Processing Plant has a nominal capacity of 800,000 tonnes per annum, and applies three-stage crushing, grinding, flotation and

filtration to produce two saleable concentrates: silver-lead and zinc concentrates are expected to be transported via rail to the Port

of Ploče for shipment to smelters. The silver-lead concentrate contains payable silver, lead, zinc, copper and gold. The zinc

concentrate contains payable zinc, silver, and gold. Both the Rupice Mine and Vares Processing Plant have been designed and constructed

using the latest technology from the leading manufacturers in the industry, whilst adhering to the highest levels of health and safety.

On

January 24, 2024, Adriatic announced its maiden production guidance for 2024, 2025 and 2026 following an updated reserve announcement

in December 2023. The guidance is based on successful extension and exploration drilling, mine optimization work and advancing higher

grade development at Rupice and Rupice Northwest. Such guidance consisted of the 2024 ramp-up and future life of mine averages:

Table

1 – Adriatic Production Guidance for the Vares Silver Project

| |

|

2024 |

|

2025 |

|

2026 |

|

2027-2040

(average) |

| Ore

Mined (kt) |

|

240-300 |

|

750-850 |

|

800-900 |

|

800-900 |

| Zinc

(%) |

|

4.5-5.9 |

|

5.8-7.8 |

|

6.1-8.1 |

|

4.6-6.1 |

| Silver

(g/t) |

|

261-348 |

|

259-345 |

|

211-281 |

|

160-214 |

| Lead

(%) |

|

3.2-4.2 |

|

3.6-4.9 |

|

3.5-4.7 |

|

2.9-3.9 |

| Copper

(%) |

|

0.5-0.6 |

|

0.5-0.7 |

|

0.5-0.7 |

|

0.4-0.5 |

| Gold

(g/t) |

|

2.1-2.8 |

|

2.4-3.2 |

|

2.1-2.8 |

|

1.2-1.6 |

Table

2 – Rupice Deposit Mineral Reserves (as announced on December 20, 2023)

| Classification |

|

Tonnes

(Mt) |

|

Grades |

|

Contained Metal |

|

Ag

(g/t) |

|

Zn

(%) |

|

Pb

(%) |

|

Au

(g/t) |

|

Cu

(%) |

|

Sb

(%) |

|

Ag

(Moz) |

|

Zn

(kt) |

|

Pb

(kt) |

|

Au

(koz) |

|

Cu

(kt) |

|

Sb

(kt) |

| Proved |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

| Probable |

|

13.8 |

|

187 |

|

5.2 |

|

3.3 |

|

1.4 |

|

0.5 |

|

0.2 |

|

83 |

|

723 |

|

457 |

|

640 |

|

64 |

|

24 |

Mineral

Reserves Notes:

| ● |

The

Mineral Reserve has been prepared by Adriatic reported in accordance with the requirements of ASX Listing Rule 5.8 and the JORC Code

and is not a current mineral resource estimate prepared under SK-1300. |

| ● |

For

the mineral reserves, metal prices of US$23.00/oz Ag, US$2,450/t Zn, US$2,280/t Pb, US$8,335/t Cu, US$1,912/oz Au and US$11,525/t

Sb were used. |

| ● |

A

mining cost of US$35/t was used for the cost model, all other costs remained as per the previous definitive feasibility study disclosed

by Adriatic; |

| ● |

As

there was no measured mineral resource, no proven ore reserves were estimated. |

| ● |

During

the stope optimization process, a maximum of 5% inferred material is allowed to be included in individual stope shapes; |

| ● |

Overall,

less than 1% of the Ore Reserve is in the inferred category; |

| ● |

Any

inferred material was given a zero grade; |

| ● |

No

stoping had taken place at the cut-off date of this report and while development stockpiling has commenced, volumes are not sufficient

for any reasonable grade reconciliation to commence; |

| ● |

The

estimated reserves were reported on a 100% basis; and |

| ● |

A

cut-off is applied using a net smelter return of US$68/t ore. |

Table

3 – Rupice Deposit Mineral Resource Estimate (as announced on July 27, 2023)

| Classification |

|

Tonnes

(Mt) |

|

Grades |

|

Contained

Metal |

Ag

(g/t) |

|

Zn

(%) |

|

Pb

(%) |

|

Au

(g/t) |

|

Cu

(%) |

|

Sb

(%) |

|

BaSO4

(%) |

|

Ag

(Moz) |

|

Zn

(kt) |

|

Pb

(kt) |

|

Au

(koz) |

|

Cu

(kt) |

|

Sb

(kt) |

|

BaSO4

(kt) |

| Indicated |

|

18.3 |

|

168 |

|

4.6 |

|

2.9 |

|

1.3 |

|

0.4 |

|

0.2 |

|

30 |

|

98.6 |

|

844 |

|

535 |

|

74 |

|

81 |

|

36 |

|

5,426 |

| Inferred |

|

2.8 |

|

75 |

|

2.4 |

|

1.6 |

|

0.5 |

|

0.2 |

|

0.1 |

|

13 |

|

6.8 |

|

69 |

|

46 |

|

47 |

|

7 |

|

4 |

|

353 |

Mineral

Resource Estimate Notes:

| ● |

The

Mineral Resource Estimate has been prepared by Adriatic reported in accordance with the requirements of ASX Listing Rule 5.8 and

the JORC Code and is not a current mineral resource estimate prepared under SK-1300. |

| ● |

A

cut-off grade of 50 g/t silver equivalent was applied. |

| ● |

Silver

equivalent (AgEq) –was calculated using conversion factors of 31.1 for Zn, 24.88 for Pb, 80.0 for Au, 1.87 for BaSO4, 80.87

for Cu, 80.87 for Sb, and recoveries of 90% for all elements. Metal prices used were US$2,500/t for Zn, US$2,000/t for Pb, US$150/t

for BaSO4, US$2,000/oz for Au, US$25/oz for Ag, US$6,500/t for Sb and US$6,500 for Cu. |

| ● |

The

applied formula was: AgEq = Ag(g/t) x 90% + 31.1 x Zn(%) x 90% + 24.88 x Pb(%) * 90% + 1.87 x BaSO4% x 90% + 80 x Au(g/t) x 90% +

80.87 x Sb(%) x 90% + 80.87 x Cu(%) x 90% |

| ● |

Adriatic

disclosed that it was the opinion that all elements and products included in the metal equivalent formula have a reasonable potential

to be recovered and sold. |

| ● |

Metallurgical

recoveries of 90% have been applied in the metal equivalent formula based on recent and ongoing test work results. |

| ● |

A

bulk density (BD) was calculated for each model cell based on its domain, using regression formulas. For the Main zone: BD = 2.66612

+ BaSO4 x 0.01832 + Pb x 0.03655 - Zn x 0.02206 + Cu x 0.09279 for the barite high-grade domain, BD = 2.72748 + BaSO4 x 0.02116 +

Pb * 0.04472 + Zn x 0.01643 - Cu x 0.08299 for the barite low-grade domain; and for the NW zone: BD = 2.92581 + BaSO4 x 0.01509 +

Pb x 0.04377 - Zn x 0.02123 + Cu x 0.10089 for the barite high-grade domain, BD = 2.74383 + BaSO4 x 0.01731 + Pb x 0.04573 + Zn x

0.02023 - Cu x 0.06041 for the barite low-grade-domain (the barite domains were interpreted using 30% BaSO4 cut-off). |

| ● |

Rows

and columns may not add up due to rounding. |

For

further information regarding the Vares Project and the above estimates and guidance, please refer to Adriatic’s company announcements

dated January 24, 2024, December 20, 2023, July 27, 2023, August 19, 2021, available under its profile at www.sedarplus.ca.

Transaction

Funding

The

Company expects to fund the acquisition by means of its announced equity offering and borrowings under its revolving credit facility.

Gold Royalty has entered into an amendment to its credit agreement with the Bank of Montreal and the National Bank of Canada to

expand its existing secured revolving credit facility by US$5 million in connection with the Transaction. As amended, the expanded credit

facility will consist of a US$30 million secured revolving credit facility with an accordion feature providing for an additional

US$5 million of availability subject to certain conditions. Such amendment is subject to, among other things, closing of the Transaction

and the satisfaction of customary conditions.

About

Gold Royalty Corp.

Gold

Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission

is to invest in high-quality, sustainable, and responsible mining operations to build a diversified portfolio of precious metals royalty

and streaming interests that generate superior long-term returns for our shareholders. Gold Royalty’s diversified portfolio currently

consists primarily of net smelter return royalties on gold properties located in the Americas.

Gold

Royalty Corp. Contact

Peter

Behncke

Director,

Corporate Development & Investor Relations

Telephone:

(833) 396-3066

Email:

info@goldroyalty.com

Qualified

Person

Alastair

Still, P.Geo., Director of Technical Services of the Company, is a “qualified person” as such term is defined under Canadian

National Instrument 43-101 (“NI 43-101”) and has reviewed and approved the technical information disclosed in this

news release.

Notice

to Investors

Except

where otherwise stated, the disclosure in this press release relating to the Vares Project has been derived from the disclosures of Adriatic

identified herein and other public information disclosed by it. Such information has not been independently verified by the Company.

Specifically, Gold Royalty has limited, if any, access to the property subject to the royalty. Although Gold Royalty does not have any

knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate.

Unless

otherwise indicated, the technical and scientific disclosure contained or referenced in this news release, including any references to

mineral resources or mineral reserves, was prepared by the Adriatic under the 2012 Edition of the Australasian Code for Reporting of

Exploration Results, which differs from the requirements under NI 43-101 and those of the U.S. Securities and Exchange Commission, including

under subpart 1300 of Regulation S-K under the Securities Exchange Act of 1934 (“SK 1300”). Accordingly, the scientific and

technical information contained or referenced in this news release may not be comparable to similar information prepared by entities

under NI 43-101 or SK 1300.

In

addition, the disclosure herein includes information regarding resource and reserve estimates and other exploration information prepared

and disclosed by Adriatic, which has been included by the Company pursuant to Item 1304 of SK1300 as such information was prepared and

disclosed by Adriatic prior to the Company’s acquisition of an interest in Vareš. The Company is not treating such information

as a current estimate of mineral resources or mineral reserves under SK1300 and notes that a qualified person of the Company has not

done sufficient work to classify the estimate as such under SK1300.

Forward-Looking

Statements

Certain

of the information contained in this news release constitutes “forward-looking information” and “forward-looking statements”

within the meaning of applicable Canadian and U.S. securities laws (collectively, “forward-looking statements”), including

but not limited to statements regarding the Company’s expected acquisition of the Stream and the anticipated benefits of the Transaction,

the disclosed expectations, plans, strategies and expectations disclosed by the operator of the Vares Project, including its production

guidance and expected production milestones for the project, the proposed amendments to the Company’s revolving credit facility

and the completion of the announced equity offering. Such statements can be generally identified by the use of terms such as “may”,

“will”, “expect”, “intend”, “believe”, “plans”, “anticipate”

or similar terms. Forward-looking statements are based upon certain assumptions and other important factors, including that the conditions

to the Offering and the SPA will be satisfied in a timely manner, the amendments to the Company’s revolving credit facility will

be completed as expected, the announced equity offering of the Company will be completed as contemplated and that the operator of the

Vares Project will achieve its disclosed expected timelines and milestones at the project, future growth and acquisitions and the parties’

ability to identify and complete investment opportunities. Forward-looking statements are subject to a number of risks, uncertainties

and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking

statements including, among others, including the possibility that the Transaction does not close when expected, or at all, because conditions

to closing are not satisfied on a timely basis, possibility that the announced equity offering does not close when expected, or at all,

because conditions to closing are not satisfied on a timely basis, or at all, any inability to amend the Company’s revolving credit

facility as expected, volatility in the price of gold or copper, risks related to the operator of the Vares Project, including operational

risks associated with mine development and operation, risks related to exploration, development, permitting, infrastructure, operating

or technical difficulties of such project, the influence of macroeconomic developments and other factors set forth in the Company’s

Annual Report on Form 20-F for the year ended December 31, 2023 and its other publicly filed documents under its profiles at www.sedarplus.ca

and www.sec.gov. Although the Company has attempted to identify important factors that could cause actual results to differ materially

from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated

or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

Exhibit

99.2

Gold

Royalty Announces US$30 Million Bought Deal Financing

BASE

SHELF PROSPECTUS AND PRELIMINARY PROSPECTUS SUPPLEMENT ACCESSIBLE

AND FINAL PROSPECTUS SUPPLEMENT TO BE ACCESSIBLE WITHIN TWO BUSINESS DAYS

ON SEDAR+

Vancouver,

British Columbia – May 28, 2024 – Gold Royalty Corp. (“Gold Royalty” or the “Company”)

(NYSE American: GROY) is pleased to announce that it has entered into an agreement with National Bank Financial Inc. and BMO Capital

Markets Corp., as joint book-runners, on behalf of a syndicate of underwriters (collectively, the “Underwriters”),

pursuant to which the Underwriters have agreed to purchase, on a bought deal basis, 17,442,000 units of the Company (the “Units”)

at a price of US$1.72 per Unit (the “Offering Price”), for aggregate gross proceeds of approximately US$30

million (the “Offering”).

Each

Unit will consist of one common share of the Company (each a “Common Share”) and one common share purchase warrant

(each a “Warrant”). Each Warrant will be exercisable to acquire one Common Share of the Company for a period of thirty-six

months at an exercise price of US$2.25. Subject to receipt of the necessary approvals, the Common Shares as well as the Common

Shares issuable upon exercise of the Warrants will be listed on the NYSE American. The Company has agreed to use commercially reasonable

efforts to list the Warrants on the NYSE American following closing of the Offering.

The

Company has granted the Underwriters an over-allotment option, exercisable in whole or in part at any time at the Offering Price up to

30 days after closing of the Offering, to purchase up to an additional 15% of the number of Units issued pursuant to the Offering, for

additional gross proceeds to the Company of up to approximately US$4.5 million, to acquire Units, Common Shares and/or Warrants

(or any combination thereof).

The

Company intends to use the net proceeds of the Offering to fund a portion of the consideration for its acquisition (the “Acquisition”)

of a copper stream (the “Stream”) in respect of the Vareš Silver Project, operated by a subsidiary of Adriatic

Metals plc and located in Bosnia and Herzegovina pursuant to a purchase and sale agreement (the “PSA”) between

the Company and OMF Fund III (Cr) Ltd., an entity managed by Orion Mine Finance Management LP (“Orion”). Under the

terms of the PSA, Gold Royalty will pay US$50 million to acquire the Stream from Orion at the closing of the Acquisition, comprised of

US$45 million payable in cash and US$5 million to be satisfied by the issuance of 2,906,977 Gold Royalty shares.

Closing

of the Offering is expected to occur on or about May 31, 2024 (the “Closing Date”), subject to customary

closing conditions, including the receipt of all necessary approvals of the NYSE American in accordance with its applicable listing

requirements. The closing of the Offering is not conditional upon the completion of the Acquisition. In the event that the Acquisition

is not completed, the Company may reallocate the net proceeds from the Offering for general corporate purposes, including to fund other

acquisitions or repay outstanding indebtedness.

The

Offering will be made in each of the provinces and territories of Canada, other than Quebec and Nunavut, by way of a prospectus supplement

to the Company’s Canadian short form base shelf prospectus dated July 15, 2022. The Company has also filed with the U.S. Securities

and Exchange Commission (the “SEC”) a registration statement on Form F-3 (File No. 333-265581), containing a shelf

prospectus dated July 6, 2022, which was declared effective by the SEC on July 15, 2022. The securities in the Offering are being

offered only by means of a prospectus, including a prospectus supplement, forming a part of the registration statement. A preliminary

prospectus supplement and accompanying prospectus relating to, and describing the terms of, the Offering has been filed with the SEC. as well as a preliminary prospectus supplement to the shelf prospectus contained in the registration statement, in respect of the Offering.

The Offering may also be made on a private placement basis in other international jurisdictions in reliance on applicable private placement

exemptions. Before investing, prospective investors should read the Canadian base shelf prospectus and the prospectus supplement thereto,

or the registration statement, including the U.S. base prospectus therein, and the prospectus supplement thereto, as applicable, including,

in each case, the documents attached thereto or incorporated by reference therein, for more complete information about the Company and

the Offering.

These

documents may be accessed for free on the System for Electronic Document Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca

and on the SEC’s Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) at www.sec.gov. An electronic

or paper copy of the base shelf prospectus, the preliminary prospectus supplement and the final prospectus supplement (when filed) as

well as any amendment to the documents may be obtained in Canada, without charge, from National Bank Financial Inc. by phone at (416)

869-6534 or by email at NBF-Syndication@bnc.ca or from BMO Nesbitt Burns Inc. by phone at 905-791-3151 Ext 4312 or by email at torbramwarehouse@datagroup.ca

and in the United States by contacting National Bank of Canada Financial Inc. by phone at (416) 869-6534 or by email at NBF-Syndication@bnc.ca

or BMO Capital Markets Corp. by phone at 800-414-3627 or by email at bmoprospectus@bmo.com, by providing the contact with an email address

or address, as applicable.

It

is expected that delivery of the Units will be made against payment therefor on or about the Closing Date, which will be three business

days following the date of the prospectus supplement (this settlement cycle being referred to as "T+3"). Under Rule 15c6-1

of the Securities Exchange Act of 1934, as amended, trades in the secondary market are generally required to settle in one business day

(this settlement cycle being referred to as “T+1”), unless the parties to any such trade expressly agree otherwise. Accordingly,

purchasers who wish to trade their Common Shares, Warrants or Common Shares underlying the Warrants issuable upon exercise thereof prior

to the Closing Date will be required, by virtue of the fact that the Units will not settle in T+1, to specify an alternate settlement

cycle at the time of any such trade to prevent a failed settlement. Purchasers of Units who wish to trade their Common Shares, Warrants

or Common Shares underlying the Warrants issuable upon exercise thereof prior to the Closing Date should consult their own advisors.

Furthermore, the Company has agreed to use commercially reasonable efforts to list the Warrants on the NYSE American. Listing will be

subject to fulfilling all listing requirements of the NYSE American. As a result, the Warrants will not be immediately tradeable over

the facilities of the NYSE American on the Closing Date.

This

news release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities

in any province, state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification

under the securities laws of any such province, state or jurisdiction.

About

Gold Royalty Corp.

Gold

Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission

is to invest in high-quality, sustainable, and responsible mining operations to build a diversified portfolio of precious metals royalty

and streaming interests that generate superior long-term returns for our shareholders. Gold Royalty’s diversified portfolio currently

consists primarily of net smelter return royalties on gold properties located in the Americas.

Gold

Royalty Corp. Contact

Peter

Behncke

Director,

Corporate Development & Investor Relations

Telephone:

(833) 396-3066

Email:

info@goldroyalty.com

Forward-Looking

Statements:

Certain

of the information contained in this news release constitutes “forward-looking information” and “forward-looking statements”

within the meaning of applicable Canadian and U.S. securities laws (collectively, “forward-looking statements”), including

but not limited to statements regarding the Company’s acquisition of the Stream, the size and timing of the Offering, the completion

of the Offering, the satisfaction of customary closing conditions related to the Offering, the use of proceeds of the Offering, and

the listing of the Common Shares and Warrants on the NYSE American. Such statements can be generally identified by the use of terms such

as “may”, “will”, “expect”, “intend”, “believe”, “plans”, “anticipate”

or similar terms. Forward-looking statements are based upon certain assumptions and other important factors, including that the conditions

to the Offering and the Acquisition will be satisfied, and all requisite regulatory approvals for the Offering will be obtained, in a

timely manner. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual

results to be materially different from those expressed or implied by such forward-looking statements including, among others, the possibility

that the Offering does not close when expected, or at all, because conditions to closing are not satisfied on a timely basis, or at all,

the possibility that the Acquisition does not close when expected, or at all, because conditions to closing are not satisfied on a timely

basis, or at all, and other factors set forth in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023,

its registration statement, prospectuses and prospectus supplements relating to the Offering and its other publicly filed documents,

available under its profiles at www.sedarplus.ca and www.sec.gov. Although the Company has attempted to identify important factors that

could cause actual results to differ materially from those contained in forward-looking statements, prospectuses and prospectus supplement,

there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements

will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements,

except in accordance with applicable securities laws.

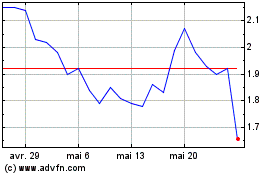

Gold Royalty (AMEX:GROY)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Gold Royalty (AMEX:GROY)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025