As filed with the Securities and Exchange Commission on August 17, 2023.

Registration No. 333-273541

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-10

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

NEW PACIFIC METALS CORP.

(Exact name of Registrant as specified in its

charter)

| British Columbia, Canada |

|

1040 |

|

Not Applicable |

(Province or other Jurisdiction of

Incorporation or Organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer Identification

Number, if applicable) |

Suite 1750 - 1066 West Hastings Street, Vancouver,

British Columbia V6E 3X1

(604) 663-1368

(Address and telephone number of Registrant’s

principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204, Newark, DE

19711, (302)-738-6680

(Name, address (including zip code) and telephone

number (including area code) of agent for service in the United States)

Copies to:

|

Jalen Yuan

New Pacific Metals Corp.

Suite 1750 - 1066 West Hastings Street

Vancouver, British Columbia

Canada V6E 3X1

(604) 663-1368 |

|

Christopher L. Doerksen

Dorsey & Whitney LLP

Columbia Center

701 Fifth Avenue, Suite 6100

Seattle, Washington 98104

(206) 903-8800 |

Approximate date of commencement of proposed

sale of the securities to the public:

As soon as practicable after this Registration

Statement becomes effective

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It

is proposed that this filing shall become effective (check appropriate box below):

| A. |

☐ |

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

| B. |

☒ |

at some future date (check the appropriate box below) |

| |

1. |

☐ |

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

| |

2. |

☐ |

pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| |

3. |

☒ |

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| |

4. |

☐ |

after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check

the following box. ☒

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective

as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting pursuant to Section 8(a) of the Act,

may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES

OR PURCHASERS

Information contained herein is subject

to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and

Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement

becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any

sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state.

Information has been incorporated by reference

in this short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the General Counsel

and Corporate Secretary of New Pacific Metals Inc. at 1750-1066 West Hastings Street, Vancouver, British Columbia, Canada V6E 3X1 and

are also available electronically at www.sedarplus.ca.

No securities regulatory authority has expressed

an opinion about these securities and it is an offence to claim otherwise.

SHORT FORM BASE SHELF PROSPECTUS

| New Issue and Secondary Offering |

August 16, 2023 |

NEW PACIFIC METALS CORP.

US$200,000,000

Common Shares

Preferred Shares

Debt Securities

Warrants

Units

Subscription Receipts

This short form base shelf prospectus

(the “Prospectus”) relates to the offer and sale by New Pacific Metals Corp. (“New Pacific” or

the “Company”) from time to time of common shares (the “Common Shares”), preferred shares (“Preferred

Shares”), debt securities (“Debt Securities”), warrants to purchase other Securities (as defined herein)

(the “Warrants”), units (the “Units”) comprised of one or more of any of the other Securities or

any combination of such Securities and subscription receipts (the “Subscription Receipts”) (all of the foregoing,

collectively, the “Securities”) or any combination thereof in one or more series or issuances up to an aggregate total

offering price of US$200 million (or the equivalent thereof in Canadian dollars or any other currencies) during the 25-month period that

this Prospectus, including any amendments thereto, remains effective. The Securities may be offered separately or together, in amounts,

at prices and on terms to be determined based on market conditions at the time of sale and set forth in an accompanying shelf prospectus

supplement (each, a “Prospectus Supplement”). In addition, the Securities may be offered and issued in consideration

for the acquisition of other businesses, assets or securities by the Company or one of its subsidiaries. The consideration for any such

acquisition may consist of the Securities separately, a combination of Securities or any combination of, among other things, Securities,

cash and assumption of liabilities. One or more securityholders (each, a “Selling Securityholder”) of the Company

may also offer and sell Securities under this Prospectus. See “Selling Securityholders”.

New Pacific is permitted, under a multi-jurisdictional

disclosure system adopted by the securities regulatory authorities in Canada and the United States, to prepare this Prospectus in accordance

with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different

from those of the United States. The financial statements incorporated by reference herein have been prepared in accordance with International

Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and thus may not be comparable

to financial statements of United States companies.

The enforcement by investors of civil liabilities

under the United States federal securities laws may be affected adversely by the fact that the Company is governed by the laws of British

Columbia, Canada, that some or all of its officers and directors are residents of a foreign country, that some or all of the experts

named in this Prospectus are, and the underwriters, dealers or agents named in any Prospectus Supplement may be, residents of a foreign

country, and that all or a substantial portion of the assets of the Company and said persons may be located outside of the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE OR CANADIAN SECURITIES COMMISSION

OR REGULATORY AUTHORITY NOR HAS THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Prospective investors should be aware that

the acquisition of the Securities may have tax consequences in Canada and the United States. Such consequences for investors who are

resident in, or citizens of, the United States may not be described fully herein or in any applicable Prospectus Supplement. Prospective

investors should read the tax discussion contained in the applicable Prospectus Supplement, if any, with respect to a particular offering

of Securities.

The specific terms of the Securities with respect

to a particular offering will be set out in the applicable Prospectus Supplement, including, where applicable: (i) in the case of Common

Shares, the number of Common Shares offered, the offering price (in the event the offering is a fixed price distribution) or the manner

of determining the offering price (in the event the offering is a non-fixed price distribution), whether the Common Shares are being

offered for cash, and any other terms specific to the Common Shares; (ii) in the case of Preferred Shares, the designation of the particular

class or series of Preferred Shares, as applicable, the number of Preferred Shares offered, the offering price or manner of determining

the offering price, whether the Preferred Shares are being offered for cash, the dividend rate, if any, any terms for redemption or retraction,

any exchange or conversion terms, and any other terms specific to the Preferred Shares, (iii) in the case of Debt Securities, the aggregate

principal amount and ranking of Debt Securities being offered, the issue and delivery date, the maturity date, the offering price or

manner of determining the offering price, the interest provisions, the currency or currency unit for which the Debt Securities may be

purchased, the authorized denominations, the covenants, the events of default, any terms for redemption or retraction, any exchange or

conversion rights attached to the Debt Securities, the form of Debt Securities, whether the Debt Securities will be secured by any of

the Company’s assets or guaranteed by any other person, and any other terms specific to the Debt Securities; (iv) in the case of

Warrants, the offering price or manner of determining the offering price, whether the Warrants are being offered for cash, the designation,

the number and the terms of the Common Shares, Preferred Shares or other securities purchasable upon exercise of the Warrants, any procedures

that will result in the adjustment of these numbers, the exercise price, the dates and periods of exercise, and any other specific terms;

(v) in the case of Units, the number of Units being offered, the offering price and the number and terms of the Securities comprising

the Units; and (vi) in the case of Subscription Receipts, the number of Subscription Receipts being offered, the offering price or manner

of determining the offering price, whether the Subscription Receipts are being offered for cash, the terms, conditions and procedures

for the conversion of the Subscription Receipts into other Securities, the designation, number and terms of such other Securities, and

any other terms specific to the Subscription Receipts. See “Plan of Distribution”. A Prospectus Supplement relating

to a particular offering of Securities may include terms pertaining to the Securities being offered thereunder that are not within the

terms and parameters described in this Prospectus. Where required by statute, regulation or policy, and where Securities are offered

in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to such Securities will be included

in the Prospectus Supplement describing such Securities.

All applicable shelf information permitted under

applicable laws to be omitted from this Prospectus that has been omitted will be contained in one or more Prospectus Supplements that

will be delivered to purchasers together with this Prospectus, except in cases where an exemption from such delivery is available. Each

Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date

of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

Prospective investors should read this Prospectus and any applicable Prospectus Supplement carefully before investing in any Securities

issued pursuant to this Prospectus.

The Company and the Selling Securityholder(s)

may offer and sell Securities to, or through, underwriters, dealers or agents and may also offer and sell certain Securities directly

to other purchasers or through agents pursuant to exemptions under applicable securities laws. See “Plan of Distribution”.

The Prospectus Supplement relating to each issue of Securities offered pursuant to this Prospectus will set forth the names of any underwriters,

dealers or agents involved in the offering and sale of such Securities and will set forth the terms of the offering of such Securities,

the method of distribution of such Securities including, to the extent applicable, the proceeds to the Company or the Selling Securityholder(s),

if any, and any fees, discounts or any other compensation payable to underwriters, dealers or agents and any other material terms of

the plan of distribution.

No underwriter has been involved in the preparation

of this Prospectus or performed any review of the contents of this Prospectus.

This Prospectus may qualify one or more “at-the-market distributions” (as defined in National Instrument 44-102 -

Shelf Distributions (“NI 44-102”)). The Securities may be sold from time to time

in one or more transactions at a fixed price or prices or at non-fixed prices including sales in transactions that are deemed to be at-the-market

distributions. If offered

on a non-fixed price basis, the Securities may be offered at market prices prevailing at the time of sale, at prices determined by reference

to the prevailing price of a specified Security in a specified market or at prices to be negotiated with purchasers, in which case the

compensation payable to an underwriter, dealer or agent in connection with any such sale will be decreased by the amount, if any, by

which the aggregate price paid for Securities by the purchasers is less than the gross proceeds paid by the underwriter, dealer or agent

to the Company. The price at which the Securities will be offered and sold may vary from purchaser to purchaser and during the period

of distribution.

This Prospectus does not qualify for issuance

Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to

one or more underlying interests including, for example, an equity or debt security, a statistical measure of economic or financial performance

including, but not limited to, any currency, consumer price or mortgage index, or the price or value of one or more commodities, indices

or other items, or any other item or formula, or any combination or basket of the foregoing items. For greater certainty, this Prospectus

may qualify for issuance Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or

in part, by reference to published rates of a central banking authority or one or more financial institutions, such as a prime rate or

bankers’ acceptance rate, or to recognized market benchmark interest rates such as EURIBOR (or any replacement or successor thereto)

or a U.S. Federal funds rate.

In connection with any offering of Securities,

except as otherwise set out in a Prospectus Supplement relating to a particular offering of Securities, the underwriters, dealers or

agents may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a level above

that which might otherwise prevail in the open market. Such transactions may be commenced, interrupted or discontinued at any time. However,

no underwriter of an “at-the-market distribution”, as defined in NI 44-102, and no person or company acting jointly or in

concert with such an underwriter, may, in connection with such a distribution, enter into any transaction that is intended to stabilize

or maintain the market price of the Securities or Securities of the same class as the Securities distributed under this Prospectus and

Prospectus Supplement, including selling an aggregate number or principal amount of Securities that would result in an underwriter creating

an over-allocation position in the Securities. A purchaser who acquires Securities forming part of the underwriters’, dealers’

or agents’ over-allotment position acquires those Securities under this Prospectus and the Prospectus Supplement relating to the

particular offering of Securities, regardless of whether the over-allotment position is ultimately filled through the exercise of the

over-allotment option or secondary market purchases. See “Plan of Distribution”.

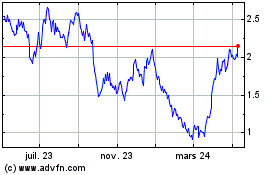

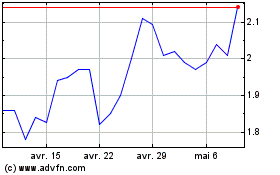

The outstanding

Common Shares are listed and posted for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “NUAG”

and are listed on the NYSE American (the “NYSE American”) under the symbol “NEWP”. On August 15, 2023, the

last trading day prior to the date of this Prospectus, the closing price of the Common Shares on the TSX was C$2.94 on the NYSE American was US$2.13.

Unless otherwise specified in the applicable

Prospectus Supplement, Preferred Shares, Debt Securities, Warrants, Units or Subscription Receipts will not be listed on any securities

exchange. Consequently, unless otherwise specified in the applicable Prospectus Supplement, there is no market through which the Preferred

Shares, Debt Securities, Warrants, Units or Subscription Receipts may be sold and purchasers may not be able to resell any such Securities

purchased under this Prospectus. This may affect the pricing of the Preferred Shares, Debt Securities, Warrants, Units or Subscription

Receipts in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities and the extent

of issuer regulation. See “Risk Factors”.

This Prospectus constitutes a public offering

of these Securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to

sell such Securities.

Investing in the Securities involves significant

risks. Prospective purchasers of the Securities should carefully consider the risk factors described under the heading “Risk

Factors” and elsewhere in this Prospectus, in documents incorporated by reference in this Prospectus and in the applicable

Prospectus Supplement with respect to a particular offering of Securities.

All dollar amounts in this Prospectus are

in United States dollars, unless otherwise indicated. See “Currency Presentation and Exchange Rate Information”.

The Company’s head office is located at

Suite 1750 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1, and its registered office is located at Suite

1750 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1.

Readers should rely only on the information contained

or incorporated by reference in this Prospectus and any applicable Prospectus Supplement. The Company has not authorized anyone to provide

readers with different information. The Company is not making an offer to sell or seeking an offer to buy the Securities in any jurisdiction

where the offer or sale is not permitted. Readers should not assume that the information contained in this Prospectus and any applicable

Prospectus Supplement is accurate as of any date other than the date of such documents, regardless of the time of delivery of this Prospectus

and any applicable Prospectus Supplement or of any sale of the Securities. Information contained on the Company’s website should

not be deemed to be a part of this Prospectus or incorporated by reference herein and should not be relied upon by prospective investors

for the purpose of determining whether to invest in the Securities.

Market data and certain industry forecasts used

in this Prospectus or any applicable Prospectus Supplement and the documents incorporated by reference herein were obtained from market

research, publicly available information and industry publications. The Company believes that these sources are generally reliable, but

the accuracy and completeness of the information is not guaranteed. The Company has not independently verified this information and does

not make any representation as to the accuracy of this information.

References to “New Pacific” and “the

Company” include direct and indirect subsidiaries of New Pacific, where applicable.

TABLE OF CONTENTS

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING INFORMATION

Certain statements and information contained

in this Prospectus and the documents incorporated by reference herein, that are not current or historic factual statements, constitute

“forward-looking information” or “forward-looking statements” (collectively, “forward-looking information”)

within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian provincial securities

laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”,

“is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”,

“assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”,

“objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that

certain actions, events or results “may”, “could”, “would”, “might” or “will”

be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact

and may be forward-looking statements or information. Such statements include, but are not limited to: statements regarding anticipated

exploration, drilling, development, construction, and other activities or achievements of the Company; inferred, indicated or measured

mineral resources or mineral reserves on the Company’s projects; the results of the PEA (as defined below) and other technical

reports; timing of receipt of permits and regulatory approvals; estimates of the Company’s revenues and capital expenditures; the

acquisition of other businesses, assets or securities; the growth of Company’s mineral resources through acquisitions and exploration;

future securities offerings; plan of distribution; terms of the Securities; use of proceeds; capital expenditures; success of exploration

activities; government regulation of mining operations; environmental risks; and other forecasts and predictions with respect to the

Company and its properties.

Forward-looking statements or information are

subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ

from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic

and social impact of COVID-19; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization,

general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of

interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental

risks, operations and political conditions, the regulatory environment in Bolivia and Canada, risks associated with community relations

and corporate social responsibility, and other factors described under the heading “Risk Factors” in this Prospectus, the

Annual Information Form (as defined below) and the other documents incorporated by reference into this Prospectus. This list is not exhaustive

of the factors that may affect any of the Company’s forward-looking statements or information.

The forward-looking statements are necessarily

based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this Prospectus or the

date of the document incorporated by reference, as applicable, that, while considered reasonable by management, are inherently subject

to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations

and options include, but are not limited to, those related to the Company’s ability to carry on current and future operations,

including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing,

extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies

and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the stabilization of the political

climate in Bolivia; the Company’s ability to obtain and maintain social license at its mineral properties; the availability and

cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals

or permits, including the ratification and approval of the Mining Production Contract with COMIBOL (as defined below) by the Plurinational

Legislative Assembly of Bolivia; the ability of the Company’s Bolivian partner to convert the exploration licenses at the Carangas

Project to AMCs (as defined below); the ability to meet current and future obligations; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated

with the mining industry.

Although the forward-looking statements contained

in this Prospectus and the documents incorporated by reference herein are based upon what management believes are reasonable assumptions,

there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements

in this Prospectus and the documents incorporated by reference herein are qualified by these cautionary statements. The forward-looking

statements contained in this Prospectus and in each of the documents incorporated by reference herein are made as of the date of such

document and, accordingly, is subject to change after such date. Accordingly, readers should not place undue reliance on such statements.

Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to

update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required

by law.

CAUTIONARY NOTE

REGARDING RESULTS OF PRELIMINARY ECONOMIC ASSESSMENT

The results of the independent preliminary economic

assessment (the “PEA”) contained in the Silver Sand Technical Report (as defined below) are preliminary in nature

and are intended to provide an initial assessment of the Silver Sand Project’s economic potential and development options. The

PEA mine schedule and economic assessment includes numerous assumptions and is based on both indicated and inferred mineral resources.

Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable

them to be categorized as mineral reserves, and there is no certainty that the project economic assessments described herein will be

achieved or that the PEA results will be realized. The estimate of mineral resources may be materially affected by geology, environmental,

permitting, legal, title, socio-political, marketing or other relevant issues. Mineral resources are not mineral reserves and do not

have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the inferred

mineral resources to be considered in future advanced studies. AMC Consultants (as defined below) (mineral resource, mining, infrastructure

and financial analysis) was contracted to conduct the PEA in cooperation with Halyard Inc. (metallurgy and processing), and NewFields

Canada Mining & Environment ULC (tailings, water and waste management). The qualified persons (as defined in NI 43-101 (as defined

below)) for the PEA for the purposes of NI 43-101 are Mr. John Morton Shannon, P.Geo, General Manager and Principal Geologist at AMC Consultants,

Mr. Wayne Rogers, P.Eng, and Mr. Mo Molavi, P.Eng, both Principal Mining Engineers

with AMC Consultants, Mr. Andrew Holloway P.Eng, Process Director with Halyard Inc., and Mr. Leon Botham P.Eng., Principal Engineer with

NewFields Canada Mining & Environment ULC, in addition to Ms. Dinara Nussipakynova, P.Geo., Principal Geologist with AMC Consultants,

who estimated the mineral resources (collectively, the “Silver Sand Technical Report Authors”). All qualified persons

for the PEA have reviewed the disclosure of the PEA herein. The PEA is based on the MRE, which was reported on November 28, 2022. The

effective date of the MRE is October 31 2022. The cut-off applied for reporting the pit-constrained mineral resources is 30 g/t silver.

Assumptions made to derive a cut-off grade included mining costs, processing costs and recoveries and were obtained from comparable industry

situations. The model is depleted for historical mining activities. Mineral resources are constrained by optimized pit shells at a silver

price of US$22.50 per ounce, silver metallurgical recovery of 91%, silver payability of 99%, open pit mining cost of US$2.6/t, processing

cost of US$16/t, G&A cost of US$2/t, and slope angle of 44-47 degrees. Key assumptions used for pit optimization for the PEA mining

pit include silver price of US$22.50 per ounce, silver metallurgical recovery of 91%, silver payability of 99%, open pit mining cost

of US$2.6/t, incremental mining cost of US$0.04/t (per 10 m bench), processing cost of US$16/t, tailing storage facility operating cost

of US$0.7/t, G&A cost of US$2/t, royalty of 6.00%, mining recovery of 92%, dilution of 8%, and cut-off grade of 30 g/t silver.

CAUTIONARY NOTE

TO UNITED STATES INVESTORS REGARDING

PRESENTATION OF MINERAL RESOURCE ESTIMATES

This Prospectus, including the documents incorporated

by reference herein, has been prepared in accordance with the securities laws in effect in Canada which differ from the requirements

of United States securities laws. The technical and scientific information contained herein has been prepared in accordance with National

Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”), which differs from the standards

adopted by the SEC.

Accordingly, the technical and scientific information

contained herein, including any estimates of mineral reserves and mineral resources, may not be comparable to similar information disclosed

by U.S. companies subject to the reporting and disclosure requirements of the SEC.

FINANCIAL INFORMATION

Unless otherwise indicated, all financial information

included and incorporated by reference in this Prospectus is determined using IFRS, which differs from United States generally accepted

accounting principles.

CURRENCY PRESENTATION

AND EXCHANGE RATE INFORMATION

The financial statements of the Company incorporated

by reference in this Prospectus are reported in United States dollars. In this Prospectus, all dollar amounts referenced, unless otherwise

indicated, are expressed in United States dollars and are referred to as “$” or “US$”. Canadian dollars are referred

to as “C$”. The high, low and closing exchange rates for Canadian dollars in terms of the United States dollar for each of

the indicated periods, as quoted by the Bank of Canada, were as follows:

| | |

Period ended

June 30 | | |

Year ended December 31 (C$) | |

| | |

2023 | | |

2022 | | |

2021 | | |

2020 | |

| High | |

| 1.3807 | | |

| 1.3856 | | |

| 1.2942 | | |

| 1.4496 | |

| Low | |

| 1.3151 | | |

| 1.2451 | | |

| 1.2040 | | |

| 1.2718 | |

| Closing | |

| 1.3240 | | |

| 1.3544 | | |

| 1.2678 | | |

| 1.2732 | |

On August 15, 2023,

the last business day prior to the date of this Prospectus, the exchange rate for Canadian dollars in terms of the United States dollar,

as quoted by the Bank of Canada, was US$1.00 = C$1.3482.

DOCUMENTS INCORPORATED

BY REFERENCE

Information

has been incorporated by reference in this Prospectus from documents filed with the securities commissions or similar authorities in

each of the provinces of Canada (the “Qualifying Provinces”). Copies of the documents incorporated herein by reference

may be obtained on request without charge from the General Counsel and Corporate Secretary of the Company at its head office at Suite

1750 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1, telephone (604) 633-1368, and are also available electronically

through SEDAR+ at www.sedarplus.ca or at www.sec.gov/edgar.shtml (“EDGAR”). The

filings of the Company through SEDAR+ and EDGAR are not incorporated by reference in this Prospectus except as specifically set out herein.

As of the date hereof, the following documents,

filed by the Company with the securities commissions or similar authorities in each of the Qualifying Provinces, and filed with, or furnished

to, the SEC, are specifically incorporated by reference into, and form an integral part of, this Prospectus provided that such documents

are not incorporated by reference to the extent that their contents are modified or superseded by a statement contained in this Prospectus

or a Prospectus Supplement or in any other subsequently filed document that is also incorporated by reference in the Prospectus or a

Prospectus Supplement, as further described below:

| (a) | the annual information form of the Company for the year ended

June 30, 2022 dated as at September 28, 2022 (the “Annual Information Form”); |

| (b) | the audited consolidated financial statements of the Company

as of and for the years ended June 30, 2022 and 2021, together with the notes thereto and the report of independent registered public

accounting firm thereon; |

| (c) | the management’s discussion and analysis of the Company

for the year ended June 30, 2022 (the “Annual MD&A”); |

| (d) | the unaudited condensed consolidated interim financial statements

of the Company for the three and nine months ended March 31, 2023 and 2022, together with the notes thereto (the “Interim Financial

Statements”); |

| (e) | the management’s discussion and analysis of the Company

for the three and nine months ended March 31, 2023 (the “Interim MD&A”); |

| (f) | the management information circular dated October 24, 2022

in respect of the annual general meeting of New Pacific shareholders held on December 2, 2022; |

| (g) | the material change report dated February 17, 2023 with respect

to the Company filing the Silver Sand Technical Report; |

| (h) | the material change report dated December 6, 2022 with respect

to the appointment of Peter Megaw and Dickson Hall to the board of directors of the Company (the “Board”); and |

| (i) | the material change report dated December 2, 2022 with respect

to the Company filing the Carangas Technical Report (as defined below). |

Any document of the type referred to in section

11.1 of Form 44-101F1 of National Instrument 44-101 - Short Form Prospectus Distributions filed by the Company with the securities

commissions or similar regulatory authorities in the applicable provinces of Canada after the date of this Prospectus and prior to the

termination of any offering of securities hereunder shall be deemed to be incorporated by reference in this Prospectus. In addition,

to the extent that any document or information incorporated by reference into this Prospectus is included in any report filed with or

furnished by the Company to the SEC pursuant to the United States Securities Exchange Act of 1934, as amended (the “Exchange

Act”), after the date of this Prospectus, that document or information shall be deemed to be incorporated by reference as an

exhibit to the Registration Statement (as defined below) of which this Prospectus forms a part (in the case of Form 6-K and Form 8-K,

only if and to the extent set forth therein). The Company may also incorporate other information filed with or furnished to the SEC under

the Exchange Act, provided that information included in any report on Form 6-K or Form 8-K shall be so deemed to be incorporated by reference

only if and to the extent expressly provided in such Form 6-K or Form 8-K.

Any statement contained in this Prospectus

or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for purposes

of this Prospectus, to the extent that a statement contained herein or in any other subsequently filed document that also is, or is deemed

to be, incorporated by reference herein modifies, replaces or supersedes such statement. Any statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute a part of this Prospectus; rather only such statement as modified or

superseded shall be considered to constitute part of this Prospectus. The modifying or superseding statement need not state that it has

modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The

making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement,

when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required

to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

A Prospectus Supplement containing the specific

terms of an offering of Securities will be delivered to purchasers of such Securities together with this Prospectus to the extent required

under applicable securities laws except in cases where an exemption from such delivery has been obtained and will be deemed to be incorporated

by reference into this Prospectus as of the date of such Prospectus Supplement, but only for the purposes of the offering of Securities

covered by that Prospectus Supplement.

Upon a new annual information form and related

annual audited consolidated financial statements and management’s discussion and analysis being filed by the Company with, and

where required, accepted by, the applicable securities regulatory authorities during the term of this Prospectus: (i) the previous annual

information form, the previous annual audited consolidated financial statements, and related management’s discussion and analysis;

(ii) all interim financial statements and related management’s discussion and analysis, all material change reports and all business

acquisition reports filed by the Company prior to the commencement of the Company’s financial year in respect of which the new

annual information form is filed; and (iii) any business acquisition report for acquisitions completed since the beginning of the financial

year in respect of which the new annual information form is filed (unless such report is incorporated by reference into the current annual

information form or less than nine months of the acquired business or related businesses operations are incorporated into the Company’s

current annual audited consolidated financial statements) shall be deemed no longer to be incorporated by reference into this Prospectus

for purposes of future offers and sales of Securities hereunder. Upon interim consolidated financial statements and the accompanying

management’s discussion and analysis being filed by the Company with the applicable securities regulatory authorities during the

period that this Prospectus is effective, the previous interim consolidated financial statements and the accompanying management’s

discussion and analysis filed shall no longer be deemed to be incorporated into this

Prospectus for purposes of future offers and sales

of Securities under this Prospectus. In addition, upon a new management information circular for the annual meeting of shareholders being

filed by the Company with the applicable securities regulatory authorities during the period that this Prospectus is effective, the previous

management information circular filed in respect of the prior annual meeting of shareholders shall no longer be deemed to be incorporated

into this Prospectus for purposes of future offers and sales of Securities under this Prospectus. In addition, certain marketing materials

(as that term is defined in applicable Canadian securities legislation) may be used in connection with a distribution of Securities under

this Prospectus and the applicable Prospectus Supplement(s). Any “template version” of “marketing materials”

(as those terms are defined in applicable Canadian securities legislation) pertaining to a distribution of Securities, and filed by the

Company after the date of the Prospectus Supplement for the distribution and before termination of the distribution of such Securities,

will be deemed to be incorporated by reference into that Prospectus Supplement for the purposes of the distribution of Securities to

which the Prospectus Supplement pertains.

The Company has not provided or otherwise authorized

any other person to provide investors with information other than as contained or incorporated by reference in this Prospectus or any

Prospectus Supplement. If an investor is provided with different or inconsistent information, he or she should not rely on it.

DOCUMENTS FILED

AS PART OF THE REGISTRATION STATEMENT

The following documents have been, or will be,

filed with the SEC as part of the Registration Statement (as defined below) of which this Prospectus forms a part: (1) the documents

listed under “Documents Incorporated by Reference”; (2) the consent of Deloitte LLP; (3) powers of attorney from certain

of the Company’s directors and officers; (4) the consents of the qualified persons referred to in this Prospectus or the documents

incorporated by reference herein; and (5) a copy of the form of indenture for Debt Securities. A copy of the form of any applicable warrant

agreement, subscription receipt agreement or statement of eligibility of trustee on Form T-1, as applicable, will be filed by post-effective

amendment or by incorporation by reference to documents filed or furnished with the SEC under the Exchange Act.

AVAILABLE INFORMATION

The Company is subject to the information reporting

requirements of the Exchange Act and applicable Canadian requirements and, in accordance therewith, files reports and other information

with the SEC and with securities regulatory authorities in Canada. Under the multi-jurisdictional disclosure system adopted by the United

States and Canada, such reports and other information may generally be prepared in accordance with the disclosure requirements of Canada,

which requirements are different from those of the United States. As a foreign private issuer, the Company is exempt from the rules under

the Exchange Act prescribing the furnishing and content of proxy statements, and the Company’s officers, directors and principal

shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. Prospective

investors may read and download any public document that the Company has filed with the securities commission or similar regulatory authority

in each of the provinces of Canada on SEDAR+ at www.sedarplus.ca. The reports and other information filed and furnished by the Company

with the SEC can be inspected on the SEC’s website at www.sec.gov.

The Company has filed with the SEC a registration

statement on Form F-10 (the “Registration Statement”) under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”), with respect to the Securities. This Prospectus, which forms part of the Registration Statement,

does not contain all of the information set forth in the Registration Statement, certain parts of which are contained in the exhibits

to the Registration Statement as permitted by the rules and regulations of the SEC. See “Documents Filed as Part of the Registration

Statement”. For further information with respect to the Company and the Securities, reference is made to the Registration Statement

and the exhibits thereto. Statements contained in or incorporated by reference into this Prospectus about the contents of any contract,

agreement or other document are not necessarily complete and, in each instance, reference is made to the copy of the document filed as

an exhibit to the Registration Statement for a complete description of the matter involved. Each such statement is qualified in its entirety

by such reference. Each time the Company sells Securities under the Registration Statement, it will provide a Prospectus Supplement that

will contain specific information about the terms of that offering. The Prospectus Supplement may also add, update or change information

contained in this Prospectus.

SUMMARY DESCRIPTION

OF BUSINESS

The

Company is a Canadian mining issuer engaged in exploring and developing mineral properties in Bolivia. The Company’s precious metal

projects include the flagship Silver Sand project (the “Silver Sand Project”)

in Potosí Department, Bolivia; the Carangas project (the “Carangas Project”)

in the Oruro Department, Bolivia; and the Silverstrike project (the “Silverstrike Project”)

in La Paz Department, Bolivia. With experienced management and sufficient technical and financial resources, management believes the

Company is well positioned to create shareholder value through exploration and resource development.

The disclosure in this Prospectus and the documents

incorporated by reference herein of a scientific or technical nature for the Silver Sand Project is supported by the PEA and technical

report prepared in accordance with NI 43-101 titled “Technical Report – Silver Sand Deposit Preliminary Economic Assessment”

dated February 16, 2023 and with an effective date of November 30, 2022 (the “Silver Sand Technical Report”) and prepared

by certain qualified persons associated with AMC Mining Consultants (Canada) Ltd (“AMC Consultants”). The Silver Sand

Technical Report is available under the Company’s profile at www.sedarplus.ca. The Silver Sand Technical Report supersedes and

replaces all prior technical reports in respect of the Silver Sand Project.

The disclosure in this Prospectus and the documents

incorporated by reference herein of a scientific or technical nature for the Carangas Project is supported by the technical report prepared

in accordance with NI 43-101 titled “Carangas Project Technical Report” dated August 20, 2022 and with an effective date

of June 16, 2022 (the “Carangas Technical Report”) and prepared by Mr. Donald Birak, AusIMM Fellow. The Carangas Technical

Report is available under the Company’s profile at www.sedarplus.ca.

Further information regarding the business of

the Company, its operations and its mineral properties, including the Silver Sand Project, the Carangas Project, and the Silverstrike

Project can be found in the Annual Information Form and the documents incorporated by reference into this Prospectus. See “Documents

Incorporated by Reference”.

The corporate chart of the Company as of the

date hereof including the Company’s subsidiaries, together with the jurisdiction of incorporation of each subsidiary and the percentage

of voting securities beneficially owned, controlled or directed, directly or indirectly, is set out below.

Recent

Developments

On

February 16, 2023, the Company announced filing of the Silver Sand Technical Report, with an effective date of November 30, 2022. The

Silver Sand Technical Report was prepared in accordance with NI 43-101 by certain qualified persons associated with AMC Consultants.

Following the PEA results, the Company is working to advance the Silver Sand Project in 2023 by 1) completing a pre-feasibility study,

and 2) working towards obtaining an “environmental license”, that is the “Environmental Impact Statement (DIA)”

issued by the Ministry of Environmental and Water of Bolivia.

From

July 2021 to July 2023, the Company commenced multiple-staged drill programs totaling 81,200 metres (“m”)

in 189 drill holes at its Carangas Project. These drill results confirmed a broad silver-lead-zinc polymetallic mineralization starting

near surface in an area of up to 1,000 m long by 800 m wide by 200 m deep with a wide and thick zone of gold mineralization below it.

In early 2023, The Company engaged consulting firm RPMGlobal Canada Limited (“RPMGlobal”)

for technical services regarding a NI 43-101 mineral resource estimate report for the

Carangas Project. The qualified person from RPMGlobal

completed his site visit at the end of March 2023. The resource estimation is expected to be completed in the third quarter of 2023.

On

November 22, 2022, the Company filed the Carangas Technical Report.

From

June to October, 2022, the Company completed an initial discovery drill program totaling 3,200 m in 10 drill holes at its Silverstrike

Project. In 2023, the Company decided to pause the exploration activities at the Silverstrike Project in order to focus on programs for

Silver Sand Project and Carangas Project.

On

December 5, 2022, the Company announced the appointment of Dr. Peter Megaw and Mr. Dickson Hall to the Board. Two of the former directors,

Mr. Jack Austin and Mr. David Kong did not stand for re-election as directors.

On January 26, 2023, the Company announced the

appointment of Mr. Andrew Williams to the position of President.

MINERAL PROPERTIES

SILVER

SAND PROJECT

Current

Technical Report

The current technical report for the Silver Sand

Project is the Silver Sand Technical Report. The Silver Sand Technical Report supersedes all prior technical reports relating to the

Silver Sand Property. The qualified persons for the Silver Sand Technical Report are the Silver Sand Technical Report Authors. The Silver

Sand Technical Report was prepared in accordance with the requirements of NI 43-101 for filing on SEDAR+.

The disclosure set out below regarding the Silver

Sand Project is based on, without material modification or revision, the disclosure in the Silver Sand Technical Report unless otherwise

indicated. The Silver Sand Technical Report is available for review under the Company’s SEDAR+ profile at www.sedarplus.ca. The

Silver Sand Technical Report contains more detailed information and qualifications than are set out below and readers are encouraged

to review the Silver Sand Technical Report. This summary is subject to all of the assumptions, information and qualifications set forth

therein.

The Silver Sand Technical Report provides an

updated mineral resource estimate and provides the results of a preliminary economic assessment on the Silver Sand Project. The Company,

through its wholly-owned subsidiaries, acquired exploration and mining rights over an aggregate area of approximately 60 square kilometres

(km2) covering the Silver Sand deposit and its surrounding areas. The Silver Sand area has been intermittently mined for silver

from narrow high-grade mineralized veins in the Cretaceous sandstone since early to mid-1500s.

Property

Description, Location and Access

The Silver Sand Project is situated in the Colavi

District of Potosí Department in southwestern Bolivia, 33 kilometres (km) north-east of Potosí city, the department

capital. The approximate geographic center of the Silver Sand Project is 19°22’ 4.97” S latitude and 65°31’

22.93” W longitude at an elevation of 4,072 m above sea level.

Exploration and mining rights in Bolivia are

granted by the Ministry of Mines and Metallurgy through the Jurisdictional Mining Administrative Authority (“AJAM”).

Under Mining and Metallurgy Law No. 535 (the “2014 Mining Law”), as modified by the Law No. 845 (the “2016

Mining Law”, together with the 2014 Mining Law, the “New Mining Laws”), tenure is granted as either an Administrative

Mining Contract (“AMC”) or an exploration license. Tenure held under previous legislation was converted to Temporary

Special Authorizations (“ATEs”), formerly known as “mining concessions”, under the New Mining Laws. These

ATEs are required to be consolidated to new 25-hectare sized cuadriculas (concessions) and converted to AMCs. AMCs created by conversion

recognize existing rights of exploration and / or exploitation and development, including treatment, foundry refining, and / or trading.

AMCs have a fixed term of 30 years and can be

extended for a further 30 years if certain conditions are met. Each contract requires ongoing work and the submission of plans to AJAM.

Exploration licenses are valid for a maximum

of five years and provide the holder with the first right of refusal for an AMC.

In specific areas, mineral tenure is owned by

the Bolivian state mining corporation, Corporación Minera de Bolivia (“COMIBOL”). In these areas development

and production agreements can be obtained by entering into a Mining Production Contract (“MPC”) with COMIBOL.

Depending on the nature and scope of the activities

to be conducted, the operator may need specific licenses or dispensations from the environmental authorities under the Ministry of Environment

and Water or the Departmental Governorships. This applies to projects that may require consultation with a population that could be affected

by the Silver Sand Project.

100%

Owned New Pacific Tenure

The Silver Sand Project originally comprised

17 ATEs, now converted to a consolidated AMC covering an area of 3.1656 km2. These ATEs were acquired by New Pacific in its

original purchase of the interests of Alcira, now New Pacific’s wholly owned subsidiary. They are valid for 30 years and can be

extended for an additional 30 years.

In accordance with the 2014 and 2016 Mining Laws,

New Pacific (through Alcira) submitted all required documents for the consolidation and conversion of the original 17 ATEs, which comprise

the core of the Silver Sand Project, to Cuadriculas and AMC, to AJAM. Conversion was initially approved by AJAM in February 2018. On

6 January 2020, Alcira signed an AMC with AJAM pursuant to which the 17 ATEs were consolidated into one concession named as Arena De

Plata (Silver Sand) with an area of 3.1656 km2. This AMC is registered with the mining register with mining registration number

1-05-1500055-0001-21, notary process completed and registration published in the mining gazette on 15 July 2021.

In addition, New Pacific acquired 100% interest

in three continuous concessions originally consisting of ATEs called Jisas, Jardan and El Bronce from third party private entities. The

Jisas and Jardan concessions have been consolidated into an AMC named as Jisasjardan with an area of 1.75 km2. This AMC is

registered by AJAM with registration number 1-05-1500410-0094-22. The El Bronce concession has been consolidated into an AMC named

Bronce with an area of 0.5 km2. This AMC is registered by AJAM with registration number 1-05-1501194-0093-22. These two AMCs

have been notarized and registration published in the mining gazette on 12 February 2023.

The total area of AMCs under full control of

the Company is 5.42 km2 after the consolidation and conversion. Table 1 summarizes the Silver Sand Project mineral tenure.

Table 1 Mineral Tenure controlled

by New Pacific

National registry | |

Name | |

Concession type | |

Size of in km2 | | |

Titleholder | |

Duration | |

| 1-05-1500055-0001-21 | |

Arena De Plata | |

AMC | |

| 3.17 | | |

Empresa Minera Alcira S.A. | |

| 30

years from February 14, 2020 | |

| 1-05-1500410-0094-22 | |

Jisasjardan | |

AMC | |

| 1.75 | | |

Empresa Jisas – Jardan SRL | |

| 30 years from December 4, 2020 | |

| 1-05-1501194-0093-22 | |

Bronce | |

AMC | |

| 0.5 | | |

Empresa El Cateador SRL | |

| 30 years from January 15, 2021 | |

| Totals | |

| |

| |

| 5.42 | | |

| |

| | |

Mining production contract

The Company, through Alcira, entered into an

MPC with COMIBOL on January 11, 2019. An updated MPC was entered with COMIBOL on January 19, 2022. The updated MPC covers 12 ATEs and

196 cuadriculas for a total area of about 55 km2 surrounding the Silver Sand Project core area. The MPC must be ratified by

the Congress of Bolivia (“Congress”) to be valid and enforceable.

Once the MPC has been ratified by Congress, the

MPC with COMIBOL will be valid for 15 years which may be automatically renewed for an additional 15 year term and potentially, subject

to submission of an acceptable work plan, for an additional 15 year term for a total of 45 years. According to the terms of the MPC,

the Company will pay COMIBOL a 6% gross sales value if the mineral concessions covered by the MPC are commercially exploited at a future

date.

Environmental permits

The Company has successfully obtained environmental

permits from local authorities to conduct mineral exploration and drilling activities in the mineral concessions fully owned by the Company

and the MPC areas owned by COMIBOL. There are no known significant factors or risks that might affect access or title, or the right or

ability to perform work on the Silver Sand Project, including permitting and environmental liabilities to which the Silver Sand Project

is subject.

Land holding costs

AJAM employs a special tax unit (“STU”),

that is indexed to the “Unidad de Fomento a la Vivienda”, to calculate the annual fee which mineral concession holders have

to pay to the government. Depending on the type and size of mineral concessions, the number of STUs varies between 375 and 692 STUs per

cuadricula. In 2019, each STU was equivalent to two Bolivianos. Note that the STU may change slightly year by year.

Table 2 below provides details of fees paid to

the government from 2019 to 2022. In the years 2019 to 2021, fees were paid based on the 17 ATEs. Starting from year 2022, fees are paid

based on the consolidated concession of AMCs. For the concessions covered by the MPC with COMIBOL, fees are paid only for 7 ATEs in the year

2019. The Company does not have to pay any fees to the government for the remaining ATEs owned by COMIBOL and covered by the MPC as they

are nationalized concessions. The fees were paid for year 2019 only as COMIBOL did not provide account information to make payments for

years 2020, 2021, and 2022. For the 196 Cuadriculas, according to the terms of MPC, the Company will have to pay the annual fees to

the government when COMIBOL is granted mineral concessions by AJAM. In addition, the Company will pay COMIBOL a management fee of $10,000

per month for all the concessions covered by the MPC upon ratification.

Table 2 Fees paid to government from

2019 to 2022

Concessions | |

Title holder | |

2019 | | |

2020 | | |

2021 | | |

2022 | |

| 17 ATEs | |

Empresa Minera Alcira S.A. | |

| 11,644 | | |

| 11,869 | | |

| 12,093 | | |

| | |

| Arena de Plata | |

Empresa Minera Alcira S.A. | |

| | | |

| | | |

| | | |

| 6,140 | |

| Bronce | |

Empresa El Cateador SRL | |

| 222 | | |

| 226 | | |

| 230 | | |

| 233 | |

| Jisas | |

Empresa Jisas – Jardan SRL | |

| 4,620 | | |

| 4,710 | | |

| 4,800 | | |

| 4,850 | |

| Jardan | |

Empresa Jisas – Jardan SRL | |

| 1,848 | | |

| 1,884 | | |

| 1,920 | | |

| 1,940 | |

| 7 ATEs of MPC | |

COMIBOL | |

| 3,215 | | |

| | | |

| | | |

| | |

| | |

Total BOB | |

| 21,549 | | |

| 18,689 | | |

| 19,043 | | |

| 13,163 | |

| | |

Equivalent to US$ | |

| 3,096 | | |

| 2,685 | | |

| 2,736 | | |

| 1,891 | |

Surface rights

As per the 2014 Mining Law, holders of mining

rights may obtain surface rights through administrative agreements entered into with AJAM. In addition, surface rights may be obtained

on third-party contract areas and by neighbouring properties by the following means: (i) agreement between parties; (ii) payment of compensation;

and (iii) compliance with the regulations and procedures for authorization. Once surface rights are obtained, holders of mining rights

may build treatment plants, dams and tailings, infrastructure and other infrastructure necessary to carry out mining activities. The

Company has not yet obtained surface land rights.

Royalties and encumbrances

For the MPC, if commercial production commences,

the Company will pay COMIBOL a 6% gross sales value of all minerals produced from the MPC areas.

AMCs are subject to the following royalties and

duties:

(i) Mining royalty: The royalty is applicable

to all mining actors and applies to the exploitation, concentration and/or commercialization of mineral and metals non-renewable resources

at the time of their internal sale or export pursuant to the 2014 Mining Laws. The royalty is established according to the status of

the mineral (raw, refined, etc.), on whether the mineral will be exported, and international mineral prices. The royalty applicable to

silver pre-concentrates, concentrates, complexes, precipitates, bullion or molten bar and refined ingot is as shown in Table 3.

Table 3 Royalty

applicable to silver in the AMC

| Official silver price per troy ounce (US$) | |

Aliquot (%) | |

| Greater than $8.00 | |

| 6 | |

| From $4.00 to $8.00 | |

| 0.75 * official silver price | |

| Less than $4.00 | |

| 3 | |

(ii) Mining Patent: Is a requirement

for the mining operator to continue holding mining rights over the mining area. Patents are calculated according to the size of the area

under the exploration license or contract, as set out in the 2014 Mining Law. Failure to pay for the patents will trigger the loss of

the underlying exploration or mining rights.

History

Mining activity has been carried out on the Silver

Sand Project and adjacent areas by various operators intermittently since the early 16th century. Historical mining activities on the

Silver Sand Project mainly targeted high-grade vein structures and records of historical mine production are not available.

Despite the long history of mining on the Silver

Sand Project and its adjacent areas, there has been little modern systematic exploration work recorded prior to 2009. In 2009 modern

exploration on the Silver Sand Project commenced when Ningde Jungie Mining Industry Co. Ltd. (NJ Mining) purchased Alcira, owner of the

Silver Sand

Project from Empresa Minera Tirex Ltda, a private Bolivia mining company. New Pacific acquired Alcira from NJ Mining, in

mid-2017.

NJ Mining carried out a comprehensive exploration

program across the Silver Sand Project. Exploration work comprised geological mapping, surface and underground sampling, trenching, and

the drilling of eight diamond drillholes for 2,334 metres (m).

There are no known historical estimates of mineral

resources or mineral reserves at the Silver Sand Project, and there has been no documented production from the Silver Sand Project.

Geological Setting,

Mineralization and Deposit Types

The Silver Sand Project is located in the south

section of the polymetallic tin belt in the Eastern Cordillera of the Central Andes, Bolivia. The oldest rocks observed within the Silver

Sand Project comprise Ordovician to Silurian marine, clastic sediments which have been intensely folded and faulted.

Bedrock in the Silver Sand Project area mainly

consists of weakly deformed Cretaceous continental sandstone, siltstone, and mudstone and the strongly deformed Paleozoic marine sedimentary

rocks. The Cretaceous sedimentary sequence forms an open syncline which plunges gently NNW and is bounded to the SW and NE by NW trending

faults.

The Cretaceous sedimentary sequence within the

Silver Sand Project is divided into the lower La Puerta Formation and the upper Tarapaya Formation. The La Puerta Formation consists

of sandstones and unconformably overlies the highly folded Paleozoic marine sedimentary rocks. The Tarapaya Formation conformably overlies

the La Puerta sandstones in the central part of the Silver Sand Project and comprises siltstones and mudstones intercalated with minor

sandstone. Both the Cretaceous and Paleozoic sedimentary sequences are intruded by numerous small Miocene subvolcanic dacitic porphyry

intrusions.

The Silver Sand Project exhibits a variety of

geometries and morphology of the mineralized bodies which are controlled and hosted by local structures of tectonic transfer nature.

Some are evident in outcrops, but the best examples are observed in drill cores and in underground workings. Mineralized structures usually

appear as steps-overs developed between two neighbouring fault / vein segments that exhibit an echelon arrangement and may or may not

be connected by lower-ranking faults / vein. These types of structures are of fractal type, which implies that they repeat their geometry,

regardless of the observation scale, in arrangements of sigmoid (jogs), echelon, subparallel stepped, relay, horsetails, and extensional

nets (swarms).

A total of eleven mineralized prospects have

been identified across the Silver Sand Project to date. These include the Silver Sand deposit and the El Fuerte, San Antonio, Aullagas,

Snake Hole, Mascota, Esperanza, North Plain, Jisas, Jardan, El Bronce, occurrences. Silver Sand, Snake Hole, Jisas, and El Bronce have

been tested by drilling. Another nine prospects were defined by rock chip and grab sampling of ancient and recent artisanal mine workings

and dumps. Exploration results from surface outcrops and underground workings defined a silver mineralized belt 7.5 km long and 2 km

wide. At the Silver Sand deposit mineralization has been traced for more than 2,000 m along strike, to a maximum width of about 680 m

and a dip extension of more than 250 m.

Four mineralization styles have been recognized

in the Silver Sand Project, and these in order of importance are: (1) sandstone-hosted silver mineralization, (2) porphyritic dacitic-hosted

silver mineralization, (3) diatream breccia-hosted silver mineralization, and (4) manto-type tin and base metal mineralization.

The mineralization in the Silver Sand Project

comprises silver-containing sulphosalts and sulphides occurring within sheeted veins, stockworks, veinlets, breccia infill and disseminated

within host rocks. The most common silver-bearing minerals include freibergite [(Ag,Cu,Fe)12(Sb,As)4S13], miargyrite [AgSbS2], polybasite

[(Ag,Cu)6(Sb,As)2S7] [Ag9CuS4], bournonite [PbCuSbS3] (some lattices of copper may be replaced by silver), andorite [PbAgSb3S6], and

boulangerite [Pb5Sb4S11] (some lattices of lead may be replaced by silver). Most silver mineralization is hosted in La Puerta sandstone

units with minor amounts in porphyritic dacite diatreme breccia.

The Silver Sand Project is an epithermal silver

deposit. Silver mineralization is hosted by faults, fractures, fissures, and crackle breccia zones in the Cretaceous La Puerta (brittle)

sandstone and porphyritic dacitic dikes, laccolith, and stocks. In the mineralized sandstone, open spaces are filled with silver-containing

sulphosalts and sulphides in forms of sheeted veins, stockworks, and veinlets, as well as breccia fillings and minor disseminations.

Most silver mineralization in the Silver Sand Project is structurally controlled with secondary rheological controls. The intensity of

mineralization is dependent on the frequency of various mineralized vein structures developed in the brittle host rocks.

Silver and base metal mineralization in the Silver

Sand Project was formed during the regional uplifting and erosion process associated with the Tertiary orogenic events in the Eastern

Cordillera. The genetic model of silver and tin mineralization in the Silver Sand Project is a magmatic-hydrothermal system related to

a deep-seated magmatic centre.

Exploration

Since October 2017, New Pacific has carried out

an extensive property-scale reconnaissance investigation program by surface and underground sampling of the mineralization outcrops and

the accessible ancient underground mine workings across the Silver Sand Project.

A total of 1,046 rock chip samples were collected

from 35 separate outcrops by New Pacific. Continuous chip samples were collected at 1.5 m intervals along lines roughly perpendicular

to the strike direction of the mineralization zones. Sample lines covered a total length of 2,863 m. Most of the sampled outcrops are

located above or near old mine workings.

New Pacific has also mapped and sampled 65 historical

mine workings comprising 5,780 m of underground tunnels. A total of 1,171 continuous chip samples have been collected at 1 – 2

m intervals along walls of available tunnels that cut across the mineralized zones.

Mine dumps from historical mining activities

are scattered across a significant portion of the Silver Sand Project. New Pacific has collected a total of 1,408 grab samples from historical

mine dumps. The majority of samples collected were remnants of high-grade narrow veins extracted from underground mining activity. Of

the 1,408 samples collected from historical mine dumps to date, 439 samples (31%) returned assay results between 30 and 3,290 grams per

tonne (g/t) Ag with an average grade of 194 g/t Ag.

Assay results of underground chip samples and

surface mine dump grab samples show that silver mineralization widely occurs in the wall rocks of the previously mined-out high-grade

veins in the abandoned ancient underground mining works.

Drilling

From October 2017 to July 2022, New Pacific conducted

intensive diamond drilling programs on the Silver Sand Project totalling 139,920 m in 564 drillholes. A total of 523 HQ diamond holes

for a total metreage of 128,074 m was drilled over the Silver Sand core area to define the mineralization. After drilling specific exploration

targets, holes were drilled on a 50 m x 50 m grid to delineate the spatial extensions of the major mineralized zones. This was followed

up by drilling on a nominal 25 x 25 m grid, infilling defined areas of mineralization. Drilling was halted during 2020 and part 2021

due to COVID-19 protocols and recommenced later in 2021.

All holes were drilled from the surface. Drillholes

were drilled up to 545 m deep at inclinations between -45° and -80° towards azimuths of 060° (~NE) and 220° (~SW) to

intercept the principal trend of mineralized vein structures perpendicularly.

The drilling programs have covered an area of

approximately 1,600 m long in the north-south direction and 800 m wide in the east-west direction and have defined silver mineralization

at the Silver Sand deposit over an oblique strike length of 2 km, a collective width of 650 m and to a depth of 250 m below surface.

Drill coring was completed using conventional

HQ (64 millimetre (mm) diameter) equipment and 3 m drill rods. Drill collars are surveyed using a Real-Time Kinematic differential global

positioning system (GPS), and downhole deviation surveys are completed by the drilling contractor using a REFLEX EZ-SHOT and SPT GyroMaster

downhole survey tools. Drillholes are surveyed at a depth of approximately 20 m, and on approximately 30 m intervals as drilling progresses.

Upon completion of each drillhole a concrete monument is constructed with the hole details inscribed.

Core is collected by New Pacific personnel and

drill core containing visible mineralization is wrapped in paper to minimize disturbance during transport. Logging is both carried out

at the rig where a quick log is completed, and after transportation to the Company’s Betanzos core processing facility, which is

located approximately 1.5 hours, by road, from the Silver Sand Project. Currently data is directly collected or loaded into MX Deposit a

database software from Sequent.

In addition to drilling in the Silver Sand core

area, drilling was carried out at Snake Hole (32 drillholes for 7,457 m) and at the northern prospects, (9 drillholes for 4,298 m). These

holes were more exploratory in nature but the same procedures as the grid drilling in the core area were employed.

Core recovery from the drill programs varies

between 0% (voids and overburden) and 100%, averaging 97%. More than 92% of core intervals have a core recovery of greater than 95%.

Sampling, Analysis and Data Verification

New Pacific has developed and implemented good

standard procedures for sample preparation, analytical, and security protocols.

New Pacific manages all aspects of sampling from

the collection of samples, to sample delivery to the laboratory. All samples are stored and processed at the Betanzos facility. This

facility is surrounded by a brick wall, has a locked gate, and is monitored by video surveillance and security guards 24 hours a day,

seven days a week. Within the facility, there are separate and locked areas for core logging, sampling, and storage.

Samples are transported on a weekly basis by

New Pacific personnel from the Betanzos facility to the ALS laboratories (ALS) in Oruro, Bolivia for sample preparation, and then shipped

to ALS in Lima, Peru for geochemical analysis. ALS Oruro and ALS Lima are part of ALS Global – an independent commercial laboratory

specializing in analytical geochemistry services, all of which are accredited. in accordance with ISO/IES 17025:2017, and are independent

of New Pacific.

All core, chip, and grab samples are prepared

using the following procedures: (1) crush to 70% less than 2 mm; (2) riffle split off 250 g; and (3) pulverize split to better than 85%

passing a 75-micron sieve.

Sample analysis in 2017 and 2018 comprised an

aqua regia digest followed by Inductively Coupled Plasma (ICP) Atomic Emission Spectroscopy (AES) analysis of Ag, Pb, and Zn (ALS code

OG46). Assay results greater than 1,500 g/t Ag were sent for fire assay and gravimetric finish analysis. In 2019 New Pacific changed

its analysis protocol to include systematic multielement analysis for an initial 51 element ICP mass spectroscopy (MS) analysis. Over-limit

samples were handled differently for different elements and protocols were further amended for the 2021-2022 drilling.

Drill programs have included quality assurance

and quality control monitoring programs which have incorporated the insertion of certified reference materials (CRMs), blanks, and duplicates

into the sample streams, and umpire (check) assays at a separate laboratory at different times.

Four different CRMs have been used throughout

the Silver Sand Project history. A total of 4,495 CRMs were submitted between October 2017 and July 2022 representing an average overall