UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024.

Commission File Number 001-31722

New Gold Inc.

Suite 3320 - 181 Bay Street

Toronto, Ontario M5J 2T3

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

NEW GOLD INC. |

| |

|

|

| |

By: |

/s/ Sean Keating |

|

| Date: May 17, 2024 |

|

Sean Keating |

| |

|

Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL

FINANCING

(All dollar figures are in US dollars unless otherwise

indicated)

TORONTO, May 17, 2024 /CNW/ - New Gold Inc. ("New

Gold" or the "Company") (TSX: NGD) (NYSE American: NGD) is pleased to announce the closing of its "bought deal"

equity financing of 100,395,000 common shares, including 13,095,000 common shares issued upon the full exercise of the underwriters' over-allotment

option. At a price of $1.72 per common share, the Company raised aggregate gross proceeds of $172,679,400 pursuant to the offering. The

offering, announced on May 13, 2024, was conducted by a syndicate of underwriters led by CIBC Capital Markets and that included BMO Capital

Markets, RBC Capital Markets, Scotiabank, National Bank Financial Markets, TD Securities, BofA Securities, Canaccord Genuity, Laurentian

Bank Securities and Raymond James.

The Company intends to use the net proceeds of the

offering to fund a portion of the cash payment to complete the previously announced agreement relating to its strategic partnership with

Ontario Teachers' Pension Plan Board at the New Afton mine, whereby New Gold will increase its effective free cash flow interest in New

Afton to 80.1%.

About New Gold

New Gold is a Canadian-focused intermediate mining

company with a portfolio of two core producing assets in Canada, the Rainy River gold mine and the New Afton copper-gold mine. The Company

also holds other Canadian-focused investments. New Gold's vision is to build a leading diversified intermediate gold company based in

Canada that is committed to the environment and social responsibility.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release,

including any information relating to New Gold's future financial or operating performance are "forward-looking". All statements

in this news release, other than statements of historical fact, which address events, results, outcomes or developments that New Gold

expects to occur are "forward-looking statements". Forward-looking statements are statements that are not historical facts and

are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects", "is

expected", "budget", "scheduled", "targeted", "estimates", "forecasts", "intends",

"anticipates", "projects", "potential", "believes" or variations of such words and phrases or

statements that certain actions, events or results "may", "could", "would", "should", "might"

or "will be taken", "occur" or "be achieved" or the negative connotation of such terms. Forward-looking

statements in this news release include, among others, statements with respect to: the Company's ability to successfully complete the

New Afton transaction (the "Transaction") and the timing thereof, including receipt of all required regulatory approvals;

the proposed benefits of the Transaction to the Company's business, strategic objectives, financial condition, cash flows and results

of operations and to its shareholders being attained, including with respect to increased free cash flow; and the intended use of net

proceeds from the offering.

All forward-looking statements in this news release

are based on the opinions and estimates of management that, while considered reasonable as at the date of this news release in light of

management's experience and perception of current conditions and expected developments, are inherently subject to important risk factors

and uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking

statements are discussed in this news release, New Gold's latest annual management's discussion and analysis ("MD&A"), its

most recent annual information form and technical reports on the Rainy River Mine and New Afton Mine filed on the System for Electronic

Document Analysis and Retrieval ("SEDAR+") at www.sedarplus.ca and on the Securities and Exchange Commission's Electronic Data

Gathering, Analysis and Retrieval system ("EDGAR") at www.sec.gov. In addition to, and subject to, such assumptions discussed

in more detail elsewhere, the forward-looking statements in this news release are also subject to there being no significant disruptions

affecting New Gold's operations, including material disruptions to the Company's supply chain, workforce or otherwise.

Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual

results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking

statements. Such factors include, without limitation, the "Risk Factors" included in New Gold's most recent annual information

form, MD&A and other disclosure documents filed on and available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Forward

looking statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated

in such statements. All forward-looking statements contained in this news release are qualified by these cautionary statements. New Gold

expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information,

events or otherwise, except in accordance with applicable securities laws.

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-gold-completes-us173-million-bought-deal-financing-302148930.html

SOURCE New Gold Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/17/c0880.html

%CIK: 0000800166

For further information: Ankit Shah, Executive Vice President, Strategy

& Business Development, Direct: +1 (416) 324-6027, Email: ankit.shah@newgold.com; Brandon Throop, Director, Investor Relations, Direct:

+1 (647) 264-5027, Email: brandon.throop@newgold.com

CO: New Gold Inc.

CNW 08:59e 17-MAY-24

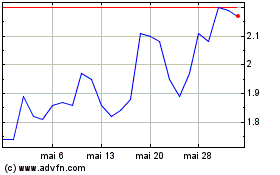

New Gold (AMEX:NGD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

New Gold (AMEX:NGD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024