Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

03 Décembre 2024 - 10:57PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: December 2024

Commission File No. 001-34184

SILVERCORP

METALS INC.

(Translation of registrant's name into English)

Suite 1750 – 1066 W. Hastings Street

Vancouver BC, Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form 40-F [ X ]

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: December 3, 2024 |

SILVERCORP METALS INC. |

| |

|

| |

/s/ Jonathan Hoyles |

| |

Jonathan Hoyles |

| |

General Counsel and Corporate Secretary |

EXHIBIT INDEX

3

Exhibit 99.1

FORM 51-102F3

MATERIAL CHANGE REPORT

|

|

| Item 1: |

Name and Address of Company |

Silvercorp Metals Inc. (“Silvercorp” or the “Company”)

Suite 1750 – 1066 West Hastings Street

Vancouver, British Columbia

V6E 3X1

|

|

| Item 2: |

Date of Material Change |

November 25, 2024

News releases were disseminated via Canada Newswire on November 19, November 21 and November 25, 2024. Copies of each were filed on the Company’s profile at www.sedarplus.ca. and EDGAR at www.sec.gov.

|

|

| Item 4: |

Summary of Material Change |

On November 19, 2024, the Company announced a private placement offering of US$130,000,000 aggregate principal amount of convertible senior notes due 2029 (the “Notes” and the “Offering”). The Offering included an option to purchase up to an additional US$20,000,000 aggregate principal amount of Notes, exercisable in whole or in part at any time until 20 days after the closing of the Offering.

On November 25, 2024, the Company announced the closing of US$150,000,000 aggregate principal amount of 4.75% convertible senior notes due 2029, which included the exercise in full of the option to purchase an additional US$20,000,000 aggregate principal amount of Notes.

|

|

| Item 5: |

Full Description of Material Change |

|

|

| Item 5.1 |

Full Description of Material Change |

The Company announced the commencement of the Offering on November 19, 2024 and pricing on November 21, 2024. Subsequently on November 25, 2024 the Company announced it had closed the Offering of US$150,000,000 aggregate principal amount Notes, which included the exercise in full of the option to purchase an additional US$20,000,000 aggregate principal amount of Notes.

The Company intends to use the net proceeds from the Offering for the construction of copper-gold mining projects outside of China, for the exploration and development of other projects and for working capital.

The Notes are senior unsecured obligations of the Company. The Notes will accrue interest payable semi-annually in arrears at a rate of 4.75% per annum and will mature on December 15, 2029, unless earlier repurchased, redeemed or converted. The initial conversion rate of the Notes is 216.0761 common shares of the Company (“Common Shares”) per $1,000 principal amount of Notes, or an initial conversion price of approximately US$4.63 (equivalent to approximately C$6.48) per Common Share. The initial conversion price of the Notes represents a premium of approximately 30% over the last reported sale price of the Company’s Common Shares on November 20, 2024, which was US$3.56 per share as reported on the NYSE American LLC.

The Notes were offered on a private placement basis and were not offered by way of a prospectus in Canada. The Notes and the distribution of Common Shares issuable upon conversion of the Notes have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws and may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and the rules promulgated thereunder and applicable state securities laws. The Notes were offered only to “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) and outside the United States to non-U.S. persons in compliance with Regulation S under the Securities Act. Offers and sales in Canada were made only pursuant to exemptions from the prospectus requirements of applicable Canadian provincial securities laws.

|

|

| Item 5.1 |

Disclosure for Restructuring Transactions |

Not applicable.

|

|

| Item 6: |

Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

|

|

| Item 7: |

Omitted Information |

Not applicable.

|

|

| Item 8: |

Executive Officer |

Lon Shaver, President (Tel: +1-604-669-9397)

December 3, 2024

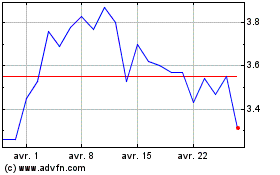

Silvercorp Metals (AMEX:SVM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Silvercorp Metals (AMEX:SVM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024