TRX Gold Corporation (TSX:TNX) (NYSE American:TRX) (the “Company”

or “TRX Gold”) today reported its results for the second quarter of

2023 (“Q2 2023”) for the three months ended February 28, 2023.

Financial results will be available on the Company’s website on

April 14, 2023.

Key highlights for Q2 2023

include:

- Newly

expanded mill running smoothly: Q2 2023 represents the

first full quarter of gold production from the newly expanded

1,000+ tonne per day (“tpd”) processing plant at Buckreef Gold,

following commercial production declaration in November 2022. The

Buckreef Gold team continues to prove that the project can be grown

in a phased manner, thanks to an efficient local work force and

strong reliable supply chain which has enabled the Company to

minimize costs and deliver milestones on time and on budget.

- Gold

production growth on target: Buckreef Gold recorded its

highest quarterly production to date of 5,636 ounces of gold and

sold 5,505 ounces of gold, resulting in positive operating cash

flow for the Company of $4.8 million. Year to date, Buckreef Gold

poured and sold 11,030 and 11,258 ounces of gold, respectively,

both half-year production records, resulting in positive operating

cash flow of $11.4 million. At mid-year, the Company is on track to

meet its annual gold production guidance for fiscal 2023 of 20,000

to 25,000 ounces of gold, at total average cash costs1 of $750 -

$850 per ounce.

- A

high-margin gold operation: In Q2 2023, the Company

recognized revenue of $10.1 million, cost of sales of $5.2 million,

gross profit of $4.9 million, gross profit margin of 49% and

Adjusted EBITDA1 of $4.3 million. Year to date, the Company

recognized revenue of $19.8 million, cost of sales of $9.6 million,

gross profit of $10.2 million, gross profit margin of 52% and

Adjusted EBITDA1 of $8.7 million.

-

Reinvesting cash flow to drive value accretion:

During Q2 2023, investments continued to be made in the

infrastructure and development of the Buckreef Gold project,

including construction of a significantly expanded tailings storage

facility to accommodate a larger production profile, road

realignment around the Special Mining License which will enable

full life of mine access to the Main Zone, the purchase of four new

gensets to replace existing rental units, as well as development

drilling as part of a program which focused on infill and

exploration drilling at Buckreef Main, Anfield and Eastern

Porphyry.

- A third

mill expansion is on track: Subsequent to quarter-end, the

Company used cash flow from operations to order an additional 1,000

tonne tpd ball mill for the Buckreef project as part of the

short-term objective of increasing Buckreef Gold’s current average

annual throughput by 75-100%. Construction of the expanded milling

circuit is expected to start in fiscal 2023 and potentially benefit

production in late calendar 2023.

-

Exploration drilling continues: In Q2 2023,

Buckreef Gold drilled 13 holes representing 1,411 meters at

Buckreef Gold, including exploration drilling at Eastern Porphyry

and sterilization drilling at Buckreef Gold’s ROM pad. Assay

results from the two programs have been received and are being

analyzed with results expected in the next few weeks.

- A keen

eye on the bigger prize: Buckreef Gold has commenced the

long-lead items for de-risking the larger mine development project.

Advancements include work on geotechnical characterization to

determine the ultimate pit slopes of the 2-kilometre-long open pit,

the variability metallurgical study for the next 5-7 years of

production, as well as the identification of potential locations

for the larger processing plant, potential dry stack tailings

facility, waste rock piles and other associated

infrastructure.

- Working

safely: The Company achieved zero lost time injuries (LTI)

as well as having no reportable environmental or community related

incidents during the quarter.

TRX Gold’s CEO, Stephen Mullowney comments: “We

are happy to deliver another solid quarter of financial results.

Buckreef Gold’s newly expanded mill is operating well and

generating cash flow which has allowed us to reinvest in the

project to drive long-term value. Our growth plans are on track as

we work on yet another expansion with the goal of increasing near

term gold production, while our geological team of experts is hard

at work advancing many projects aimed at developing Buckreef Gold

into a much larger and significant gold producer. A little over 24

months ago we hit “reset” at the Buckreef Gold project and since

then we have seen the project develop quickly with significant

growth potential ahead.”

Figure 1. The Buckreef Gold open pit extending

into the horizon.

Q2 2023 Webcast Details

When: Wednesday, April 19 at 11:00 AM ESTWebcast

URL: Click here or copy paste into web browserA replay will be made

available for 30 days following the call on the Company’s

website.

Qualified Person

Mr. Andrew Mark Cheatle, P.Geo., MBA, ARSM, is

the Company’s Qualified Person under National Instrument 43-101

“Standards of Disclosure for Mineral Projects” (“NI 43-101”) and

has reviewed and assumes responsibility for the scientific and

technical content in this press release.

Non-IFRS Performance

Measures

The company has included certain non-IFRS

measures in this news release. The following non-IFRS measures

should be read in conjunction with the Company’s unaudited interim

consolidated financial statements for the three months ended

February 28, 2023, as well as the Company’s audited consolidated

financial statements included in the Company's Annual Report on

Form 40-F and Annual Information Form for the year ended August 31,

2022. The financial statements and related notes of TRX Gold have

been prepared in accordance with International Financial Reporting

Standards (“IFRS”). Additional information has been filed

electronically on SEDAR and is available online under the Company’s

profile at www.sedar.com and on our website at www.TRXGold.com.

Cash costs per ounce of gold

sold

Cash cost per ounce of gold sold is a non-IFRS

performance measure and does not constitute a measure recognized by

IFRS and does not have a standardized meaning defined by IFRS. Cash

cost per ounce may not be comparable to information in other gold

producers’ reports and filings. As the Company uses this measure to

monitor the performance of our gold mining operations and its

ability to generate positive cash flow, beginning in Q1 2023, total

cash costs per ounce of gold sold starts with cost of sales related

to gold production and removes depreciation.

Adjusted EBITDA

Adjusted EBITDA is a non-IFRS performance

measure and does not constitute a measure recognized by IFRS and

does not have a standardized meaning defined by IFRS. Adjusted

EBITDA may not be comparable to information in other gold

producers’ reports and filings. Adjusted EBITDA is presented as a

supplemental measure of the Company’s performance and ability to

service its obligations. Adjusted EBITDA is frequently used by

securities analysts, investors and other interested parties in the

evaluation of companies in the industry, many of which present

Adjusted EBITDA when reporting their results. Issuers present

Adjusted EBITDA because investors, analysts and rating agencies

consider it useful in measuring the ability of those issuers to

meet their obligations. Adjusted EBITDA represents net income

(loss) before interest, income taxes, and depreciation and also

eliminates the impact of a number of items that are not considered

indicative of ongoing operating performance.

Certain items of expense are added, and certain

items of income are deducted from net income that are not likely to

recur or are not indicative of the Company’s underlying operating

results for the reporting periods presented or for future operating

performance and consist of:

- Unrealized gain/loss on derivative warrant liabilities;

- Accretion related to the provision for reclamation; and

- Share-based compensation expense; and

- Tax adjustments related to a prior period tax assessment

(2012-2020).

The following table provides a reconciliation of

net income (loss) and comprehensive income (loss) to Adjusted

EBITDA per the financial statements for the three and six months

ended February 28, 2023.

|

|

Three Months Ended |

Three Months Ended |

Six Months Ended |

Six Months Ended |

|

|

February 28, 2023 |

February 28, 2022 |

February 28, 2023 |

February 28, 2022 |

|

Net (loss) income and comprehensive (loss) income per financial

statements |

(50 |

) |

(1,002 |

) |

5,110 |

|

(3,160 |

) |

| Add: |

|

|

|

|

|

Depreciation |

294 |

|

125 |

|

487 |

|

125 |

|

| Interest

and other expenses |

856 |

|

341 |

|

1,041 |

|

380 |

|

| Income

tax expense |

1,178 |

|

151 |

|

2,664 |

|

151 |

|

| Change in

fair value of derivative warrant liabilities |

965 |

|

145 |

|

(2,400 |

) |

(63 |

) |

|

Share-based payment expense |

645 |

|

533 |

|

1,398 |

|

1,513 |

|

|

Adjusted EBITDA |

3,888 |

|

293 |

|

8,300 |

|

(1,054 |

) |

The Company has included “cash costs per ounce

of gold sold” and “Adjusted EBITDA” as non-IFRS performance

measures throughout this news release as TRX Gold believes that

these generally accepted industry performance measures provide a

useful indication of the Company’s operational performance. The

Company believes that certain investors use this information to

evaluate the Company’s performance and ability to generate cash

flow. Accordingly, they are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS.

About TRX Gold Corporation

TRX Gold is rapidly advancing the Buckreef Gold

Project. Anchored by a Mineral Resource published in May 2020, the

project currently hosts an NI 43-101 Measured and Indicated Mineral

Resource of 35.88 MT at 1.77 g/t gold containing 2,036,280 ounces

of gold and an Inferred Mineral Resource of 17.8 MT at 1.11 g/t

gold for 635,540 ounces of gold. The leadership team is focused on

creating both near-term and long-term shareholder value by

increasing gold production to generate positive cash flow. The

positive cash flow will be utilized for exploratory drilling with

the goal of increasing the current gold Resource base and advancing

the Sulphide Ore Project which represents 90% of current gold

Resources. TRX Gold’s actions are led by the highest ESG standards,

evidenced by the relationships and programs that the Company has

developed during its nearly two decades of presence in Geita

Region, Tanzania.

For investor or shareholder inquiries,

please contact:

Investors Christina Lalli Vice

President, Investor RelationsTRX Gold Corporation+1-438-399-8665

c.lalli@TRXgold.comwww.TRXgold.com

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TRX Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to continued operating

cash flow, expansion of its process plant, estimation of mineral

resources, ability to develop value creating activities,

recoveries, subsequent project testing, success, scope and

viability of mining operations, the timing and amount of estimated

future production, and capital expenditure.

Although TRX Gold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TRX Gold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that TRX Gold files with the SEC and the various Canadian

securities authorities. You can review and obtain copies of these

filings from the SEC's website at http://www.sec.gov/edgar.shtml

and the Company’s profile on the System for Electronic Document

Analysis and Retrieval (“SEDAR”) at www.sedar.com.

The information contained in this press release

is as of the date of the press release and TRX Gold assumes no duty

to update such information.

The TSX and NYSE America have not reviewed and

do not accept responsibility for the adequacy or accuracy of the

contents of this press release, which has been prepared by the

management of TRX Gold.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/fecf6865-9e1f-4eaf-8d45-19604f1fd8c3

1 Refer to “Non-IFRS Performance Measures” section.

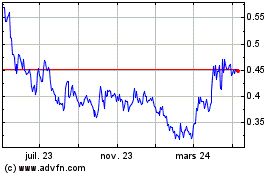

TRX Gold (AMEX:TRX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

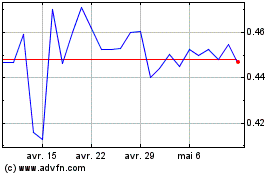

TRX Gold (AMEX:TRX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024