TIDMALSP

RNS Number : 9981N

Ace Liberty & Stone PLC

30 September 2019

Ace Liberty and Stone plc

("Ace" or "the Company")

FINAL RESULTS FOR THE YEARED 30 APRIL 2019

Strong Growth in Revenue, Profit, and Portfolio Value

Ace Liberty and Stone Plc (NEX: ALSP), the active property

investment company capitalising on commercial property investment

opportunities across the UK, is delighted to announce its Final

Results for the year ended 30 April 2019.

Financial Highlights:

-- Revenue for the year grew to GBP5,072,435 (2018: GBP3,515,088) a 44.3% increase

-- Property assets have increased to GBP88.3 million (2018: GBP58.2 million) a 51.7% increase

-- Comprehensive Income grew to GBP814,562 (2018: GBP361,295) a 125.5% increase

-- Profit after taxation increased to GBP765,717 (2018: GBP361,296) a 111.94% increase

-- Dividend payments for the year were double that of the previous year at 2.5p per share

-- Dividends paid in three installments resulting in earlier receipt by shareholders

-- Basic Earnings per share 1.97p (2018: 0.91p) and diluted

earnings per share 1.15p (2018: 0.61p) increased by 116.5% and

88.5% respectively

Operational Highlights:

-- Ace has substantially strengthened its portfolio with the

acquisition of eight properties for a combined total of

GBP32,952,499:

o Tweedale House, Oldham and Brocol House Wigan; Princes Court,

Leicester; Mecca Bingo Hall in Chesterfield; Frances House in

Northampton; Black Horse Street in Bolton; Nolan House in

Warrington; and James Cook House in Middlesbrough

-- The portfolio was also rebalanced with the sale of the

Doncaster car park; as well as most of the remaining residential

assets in Barnsley and Stoke on Trent

-- Since the year end further residential properties were sold

in Barnsley and the sale of Hillcrest House in Leeds was also

agreed

-- Ace also sold Hume House for GBP3,900,000, representing an

overall 307% return on our investment over the purchase price of

GBP1,670,000 in 2014; and Bridge House in Dudley was sold with

deferred completion

-- These transactions show Ace's proactive investment and

trading strategy in action, finding multi-use and attractive

locations with strong rental agreements and established tenants

-- Banking relationships were improved with new banking

facilities of GBP20 million agreed with Coutts & Co in addition

to the existing facility with long term supporter Lloyds Bank

-- Shareholder support has also been forthcoming with:

o GBP1.2 million of the 5% Convertible Loan Note converted into

Ordinary shares

o GBP3.2 million loan agreed; and

o GBP10 million Convertible Loan Note renewal agreed

Ismail Ghandour, Chief Executive Officer, commented:

"We are currently in a very strong position, with a healthy

balance sheet, good cashflow and excellent banking relationships in

place. Ace will now look to use this financial and operational

platform to explore opportunities that present themselves as a

result of the current economic and political turmoil.

"Our strategy remains unchanged and we will choose our

properties very carefully, making sure they fit our investment

criteria; fully let; with national or local government or triple-A

commercial tenants; and most leases covering the next nine plus

years. We are more convinced than ever that there are many more

profitable opportunities in smaller, thriving towns outside of the

capital and believe we can continue our growth no matter what the

eventual outcome of Brexit brings."

-ends-

For further information, please contact:

Ace Liberty & Stone Plc

Ivan Minter, Financial Director Tel: +44 (0) 20 7201 8340

http://acelibertyandstone.com

Alfred Henry Corporate Finance Ltd,

NEX Exchange Corporate Adviser

Jon Isaacs / Nick Michaels Tel: +44 (0) 20 3772 0021

www.alfredhenry.com

Belvedere Communications

John West /Llew Angus Tel: +44 (0) 20 3687 2756

www.belvederepr.com

SP Angel Corporate Finance LLP

Broker

Abigail Wayne / Rob Rees Tel: +44 (0)20 3470 0470

www.spangel.co.uk

ACF Equity Research

Christopher Nicholson / Amalia Barnoschi Tel: +44 (0) 20 7558 8974

www.acfequityresearch.com

Chairman's Statement

It is my great pleasure once again to recommend an Annual Report

which shows remarkable progress.

The Company has purchased properties in Oldham, Wigan,

Leicester, Chesterfield, Northampton, Bolton, Middlesbrough and

Warrington during the year under review, spending GBP32,952,499 on

these properties. This has the effect of lifting the total passing

rent of the portfolio to GBP6,477,438. Photographs of these

properties are shown on the inside front and back cover of the

annual report. During the year the Doncaster car park was sold as

were most of the remaining residential properties in our Barnsley

and Stoke on Trent portfolios. The sale of Bridge House, Dudley was

agreed with deferred completion. Since the year end, we have

completed the sale of the residential properties in Barnsley and

arranged the sale Hillcrest House, Leeds. The proceeds of these

sales will be used for further purchases.

I again commend to you the KPIs published on pages 6 and 7 of

the annual report. This is information used by management to run

the business and we believe it is beneficial for shareholders and

potential investors to be able to share it. In the last five years,

the portfolio has grown from some GBP24million to GBP88million with

the income proportionately increasing from GBP2.2million to

GBP6.5million the graph of this performance forms the basis of the

Report's front cover design. We also take pride in the quality of

the portfolio. The Weighted Average Unexpired Lease to Break

measurement (WAULB) has been consistently close to nine years for

the past three years and, elsewhere in the Report, we disclose that

59 per cent of the Group income is from National and Local

Government tenants. These statistics show our stability outperforms

many in our industry and confirm the very secure base from which to

approach the future.

We also show the underlying portfolio strength in terms of cash-

and profit- earning with the management reports which show the

growth of gross contribution from the portfolio over the past five

years from GBP724,243 to GBP3,547,530. Over the same period

recurring overheads have grown only from GBP365,439 to GBP872,735,

demonstrating sound corporate management on behalf of our

shareholders.

I commented last year on the effect of IFRS on our published

reports. In our view the KPIs published will give a more focused

report on the essence of the business.

The Company continues to benefit from sound banking

relationships. In addition to the valued facility from Lloyds Bank

Plc, we have added a new facility from Coutts & Co which

reached approximately GBP20million at the year end. This support

enables us to engage with confidence with potential vendors.

Shareholders, too, have been supportive. The holders of almost

GBP1.2million of the 5% CLN have converted into Ordinary Shares and

over GBP800,000 have exercised their warrants, contributing new

equity capital to the enterprise. In addition, we have successfully

arranged the issue of a GBP3.2million loan, also to shareholders,

accompanied by warrants exercisable at 95p. The holder of the

GBP10million CLN has agreed to renew this instrument.

Finally, I am delighted to report the continued increase in the

Company's dividend payments. The payment in respect of the year

ended 2019 was double that of the previous year, at 2.5p per share,

and was paid in three instalments instead of annually, resulting in

earlier receipt by shareholders.

None of us can foresee what awaits us in the future and, in

these troubled times, it would be rash of me to make any forecasts.

I can simply say that the Company is very soundly placed and the

Board will be ready to meet any opportunities which occur in the

next twelve months.

Dr Tony Ghorayeb

Chairman

Date: 25 September 2019

Consolidated Statement of Comprehensive Income for the year

ended 30 April 2019

2019 2018

GBP GBP

Revenue 5,072,435 3,515,088

Gain / (loss) on disposal of investment

property 284,138 (40,758)

Administrative expenses (1,827,857) (1,042,612)

Fair value gain on investment property 1,247,371 250,000

Fair value losses on assets held for

sale (320,079) (250,000)

Finance cost (3,354,830) (2,219,199)

Finance income 5,511 1,622

Share based payment charge (347,726) -

Profit before taxation 758,963 214,141

Taxation 6,754 147,154

------------ --------------

Profit after taxation 765,717 361,295

Other comprehensive income 48,845 -

Total comprehensive income for the

period 814,562 361,295

============ ==============

Attributable to:

Owners of the parent 814,562 361,295

============ ==============

Earnings per share on continuing activities Pence Pence

Basic earnings per share attributable

to equity owners of the parent 2 1.97 0.91

Diluted earnings per share attributable

to equity owners of the parent 2 1.15 0.61

Consolidated Statement of Financial position at 30 April

2019

2019 2018

ASSETS GBP GBP

Non-current assets

Investment property 79,538,096 50,487,866

79,538,096 50,487,866

----------- -----------

Current assets

Assets held for sale 8,784,921 7,734,000

Trade and other receivables 510,490 934,479

Cash and cash equivalents 1,956,742 5,180,225

----------- -----------

11,252,153 13,848,704

----------- -----------

TOTAL ASSETS 90,790,249 64,336,570

=========== ===========

EQUITY AND LIABILITIES

Current liabilities

Liabilities relating to

assets held for sale 1,440,125 2,587,141

Trade and other payables 4,833,381 1,239,869

Taxation 96,681 162,098

Borrowings 15,921,701 690,000

----------- -----------

22,291,888 4,679,108

----------- -----------

Non-current liabilities

Borrowings 47,212,143 40,003,625

Deferred tax 116,188 214,502

----------- -----------

47,328,331 40,218,127

----------- -----------

Share capital 10,608,342 10,065,887

Share premium 9,099,025 7,643,310

Share option reserve 826,906 479,180

Other reserve 341,603 579,548

Treasury shares (480,620) (480,620)

Retained earnings 774,774 1,152,030

----------- -----------

Total equity 21,170,030 19,439,335

----------- -----------

TOTAL EQUITY AND LIABILITIES 90,790,249 64,336,570

----------- -----------

Consolidated Cash Flow Statement for the year ended 30 April

2019

2019 2018

GBP GBP

Profit before tax 758,963 214,141

Cash flow from operating

activities

Adjustments for:

Finance income (5,511) (1,622)

Finance costs 3,354,830 2,219,199

Gain on disposal of

investment property (284,138) 40,758

Fair value adjustment (927,292) -

Decrease / (Increase)

in receivables 423,989 (756,313)

Increase in payables 1,558,525 476,019

Tax paid (156,977) (337,186)

Interest paid (1,448,846) (1,520,350)

Other finance costs (356,562) -

paid

Share based payment 347,726 -

charge

Net cash generated by operating activities 3,264,707 334,646 334,646

------------- -------------

Cash flows from investing

activities

Interest received (5,511) 1,622

Purchase of investment

properties (32,952,499) (20,784,558)

Sale of investment properties 4,063,138 1,501,242

Net cash used by investing

activities (28,894,872) (19,281,694)

------------- -------------

Cash flows from financing

activities

Share issue, net of issue

costs - 85,300

Long term loans advanced 23,415,375 26,673,688

Long term loans repaid (690,000) (3,593,404)

Short term loans advanced 1,440,125 1,000,000

Short term loans repaid (665,705) -

Equity dividend paid (1,093,113) (389,121)

Net cash generated by financing

activities 22,406,682 23,776,463

------------- -------------

Net (decrease) / increase in cash

and cash equivalents (3,223,483) 4,829,415

------------- -------------

Cash and cash equivalents at the beginning

of the period 5,180,225 350,810

Cash and cash equivalents at the end

of the period 1,956,742 5,180,225

============= =============

NOTES TO PRELIMINARY RESULTS FOR THE PERIODED 30 APRIL 2018

1. The financial information set out above does not constitute

statutory accounts for the purpose of Section 434 of the Companies

Act 2006. The financial information has been extracted from the

statutory accounts of Ace Liberty & Stone Plc and is presented

using the same accounting policies, which have not yet been filed

with the Registrar of companies, but on which the auditors gave an

unqualified report on 25(th) September 2019.

The preliminary announcement of the results for the year ended

30 April 2019 was approved by the board of directors on 25(th)

September 2019.

2. Earnings per Share

The calculations of earnings per share are based on the following

earnings and numbers of shares.

GBP GBP

Profit for the period attributable

to equity owners 814,562 361,295

-------------- -------------

No. of No. of

shares shares

of 25p of 25p

Weighted average number of shares

For basic earnings per share 41,245,673 39,837,319

Dilutive effect of share options 29,837,805 18,942,245

-------------- -------------

For diluted earnings per share 71,083,478 58,779,564

============== =============

Earnings per share pence pence

Basic 1.97 0.91

Diluted 1.15 0.61

GBP GBP

Dividends declared during the

year - per share of 25p 0.0291 0.01

Dividends declared during the

year - total 1,196,786 389,121

There were no dividends declared and approved prior to the end of

the year for inclusion in the Financial Statements. However, a dividend

of GBP356,994 was approved after the year end, being equal to 0.84p

per share.

- ends -

The Directors accept responsibility for this announcement.

Notes to Editors

Ace Liberty & Stone Plc is a property investment company

with a diverse portfolio of properties located across the UK,

currently including Leeds, Sunderland, Plymouth, Dudley, Gateshead,

Barnstaple, and London. The Company locates commercial and

residential properties which have the potential for an increase in

value through creative asset management activity, such as change of

tenancy, change of use or new lease negotiation. Ace has maintained

a track record of generating strong profits at disposal of

properties and achieving better-than average returns on capital.

With strong support from shareholders and mortgage lenders, the

Company is currently seeking further investment opportunities in

the UK to create value for existing and new investors.

Ace is run by a board with extensive property experience, an

excellent network of contacts and relevant professional

qualifications. This sector expertise has allowed the Board to

identify opportunities and act promptly to secure investments.

For more information on the Company please visit

www.acelibertyandstone.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NEXSESFEWFUSEDU

(END) Dow Jones Newswires

September 30, 2019 02:03 ET (06:03 GMT)

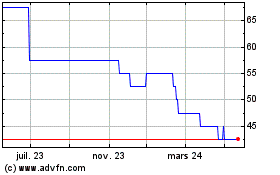

Ace Liberty & Stone (AQSE:ALSP)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

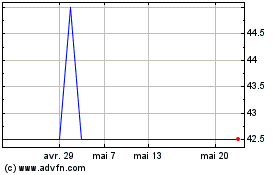

Ace Liberty & Stone (AQSE:ALSP)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025