BlackRock’s Bitcoin ETF Reaches 2% Of Total BTC Supply Amid Record Inflows

01 Novembre 2024 - 7:30AM

NEWSBTC

On Wednesday, BlackRock, the world’s largest asset manager,

achieved a significant milestone in the Bitcoin ETF market,

recording the largest inflows since the inception of these

investment funds in January. Bitcoin ETF Demand Soars Ahead

Of US Presidential Election According to Bloomberg, approximately

$872 million flowed into BlackRock’s iShares Bitcoin Trust on

Wednesday, marking a daily record for the fund. This influx

highlights the strong demand for Bitcoin ETFs, with subscriptions

for this nine-month-old product ranking among the highest globally

for ETFs in 2024. As a result of the inflows, BlackRock’s

total holdings in Bitcoin now stand at 429,185 BTC, valued at

approximately $31.04 billion. This accounts for about 2.04% of

Bitcoin’s total supply, capped at 21 million coins. The recent

inflows are being attributed to a phenomenon dubbed the “Trump

trade,” as pro-crypto Republican nominee Donald Trump gains

momentum in betting markets ahead of the upcoming election day on

November 5. Related Reading: BNB Price Slips as Peers Climb:

Can It Regain Ground? Bitcoin is on the verge of reaching new

heights, fueled by a 13% rally in October. James Seyffart, an ETF

analyst at Bloomberg Intelligence, noted on Bloomberg Television

that the demand for these ETFs is palpable, suggesting that

investors are responding not only to Bitcoin’s upward momentum but

also to Trump’s favorable odds in the political arena. Trump has

made headlines with his pledge to turn the US into the “crypto

capital of the planet” and to create a strategic Bitcoin reserve

for the country to halve the US’s $35 trillion national debt.

In contrast, Democratic Vice President Kamala Harris, has pledged

to support a regulatory framework for the cryptocurrency industry

but has not provided further details on how her potential new

administration will address the community’s calls for a change in

leadership at the US Securities and Exchange Commission (SEC) and

its approach to digital assets. Price Predictions Surge Amid

bullish predictions for the leading crypto of the industry, market

expert Ali Martinez has shared compelling insights regarding

Bitcoin’s potential price trajectory for the months ahead. In

a recent post on social media platform X (formerly Twitter),

Martinez analyzed historical patterns, noting that Bitcoin has

typically peaked between the 1.618 and 2.272 Fibonacci retracement

levels during past bull cycles. If this trend continues,

Martinez predicts that Bitcoin could reach a price range between

$174,000 and $462,000 in the current cycle. Related Reading:

Analyst Says It’s ‘Time To Be Bullish On Ethereum’ As ETH Retests

$2,700 In addition to these price predictions, Martinez pointed to

another bullish indicator: a significant outflow of Bitcoin from

cryptocurrency exchanges. Over the past 48 hours, approximately

8,000 BTC, valued at around $576 million, have been withdrawn from

exchanges. This trend signifies a growing inclination among

investors to hold onto their Bitcoin rather than sell it, which can

create upward pressure on prices as BTC inches closer to its

all-time high level of $73,700 reached in March. At the time

of writing, BTC was trading at $71,640. This represents a

retracement of 1.2% over the past 24 hours. Featured image from

DALL-E, chart from TradingView.com

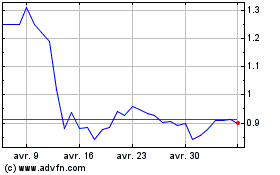

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025