Senator Lummis’ new BITCOIN Act allows US reserve to exceed 1M Bitcoin

12 Mars 2025 - 3:07AM

Cointelegraph

US Senator Cynthia Lummis’ newly reintroduced BITCOIN Act will

allow the government to potentially hold more than 1 million

Bitcoin as part of its newly established reserve.

The bill, first

introduced in July, directs the US government to

buy 200,000 Bitcoin (BTC) a year over five years for a

total acquisition of 1 million Bitcoin, which would be paid for by

diversifying existing funds within the Federal Reserve system and

the Treasury department.

However, the reintroduced

act, the Boosting Innovation, Technology, and Competitiveness

through Optimized Investment Nationwide (BITCOIN) Act of 2025,

opens the door for the US to acquire and hold in excess of 1

million BTC as long as it is acquired through lawful means other

than direct purchase, such as civil or criminal forfeitures, gifts

made to the US or transfers from federal agencies.

The extra Bitcoin can also come from US states that voluntarily

store their Bitcoin holdings in the strategic Bitcoin reserve,

though it’ll be stored in a segregated account.

“By transforming the president’s visionary executive action into

enduring law, we can ensure that our nation will harness the full

potential of digital innovation to address our national debt while

maintaining our competitive edge in the global economy,” said

Lummis, who announced the revamped bill during a March 11

conference hosted by The Bitcoin Policy Institute.

Lummis taps new bill co-sponsors

The BITCOIN Act also has a number of new co-sponsors, including

Republican Senators Jim Justice, Tommy Tuberville, Roger Marshall,

Marsha Blackburn and Bernie Moreno.

“I’m proud to join Senator Lummis on this common-sense bill to

create a strategic Bitcoin reserve and codify President Trump’s

executive order,” Justice said in a

statement.

“This bill represents America’s continued leadership in

financial innovation, bolsters both our economic security, and

gives us an opportunity to wrangle in our soaring national debt,”

he added.

Other changes

The bill also now sets a formal evaluation process for Bitcoin

forked assets and airdropped assets in the reserve.

Initially, the bill required all forked assets to be stored in

the reserve and couldn’t be sold or disposed of for five years

unless authorized by law.

Related: Texas

Senate passes Bitcoin reserve bill, New York targets memecoin rug

pulls: Law Decoded

The new bill now directs the Secretary after the mandatory

holding period to evaluate and retain the most valuable asset based

on market capitalization while retaining the “dominant

asset.”

Bitcoin has hard forked a number of times in the past to create

new cryptocurrencies, most notably Bitcoin Cash

(BCH), which forked on

Aug. 1, 2017, and Bitcoin Gold (BTG), which

forked on Oct. 24, 2017.

Lummis’ reintroduced bill comes just days after US President

Donald Trump signed an

executive order to create a “Strategic Bitcoin Reserve” and a

“Digital Asset Stockpile.”

The reserve and stockpile will initially use cryptocurrency

forfeited in government criminal and civil cases, but the reserve

won’t sell the stashed Bitcoin and will use “budget-neutral” ways

to increase its size, while tokens from the stockpile could be

sold.

Magazine: The

Sandbox’s Sebastien Borget cringes at the word ‘influencer’: X Hall

of Flame

...

Continue reading Senator Lummis’ new BITCOIN Act

allows US reserve to exceed 1M Bitcoin

The post

Senator Lummis’ new BITCOIN Act allows US reserve to

exceed 1M Bitcoin appeared first on

CoinTelegraph.

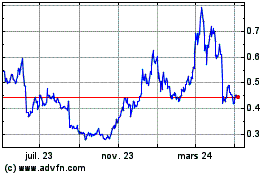

Sandbox (COIN:SANDUSD)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Sandbox (COIN:SANDUSD)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025