ABN AMRO reports net profit of EUR 759 million for Q3 2023

08 Novembre 2023 - 7:00AM

ABN AMRO reports net profit of EUR 759 million for Q3 2023

ABN AMRO reports net profit of EUR 759 million for Q3

2023

Q3 - Highlights of the quarter

- Strong result, with a net profit of EUR 759 million and

an ROE of 13.6%, supported by high other income and impairment

releases

- NII lower compared with Q2 due to deposit migration to

higher yielding products, a shift to other income, limited asset

margin pressure and lower results in trading

activities

- Business momentum remains good; our mortgage loan book

increased by EUR 0.4 billion and our corporate loan book by EUR 0.3

billion. Mortgage market share increased to 15%

- Costs remain under control; expected costs for 2023

lowered to between EUR 5.1 and EUR 5.2 billion

- Credit quality remains strong, with impairment releases

of EUR 21 million

- Solid capital position; fully-loaded Basel III CET1

ratio of 15.0% and Basel IV CET1 ratio of around 16%

- CEO’s term extended by four years, until

2028

Robert Swaak, CEO:

'In the third quarter, we once again delivered a strong

financial result with continued high net interest income (NII)

compared with last year, supported by high other income and

impairment releases. The Dutch economy is cooling down and

uncertainty about the economy and inflation remains, while I

continue to be concerned about the ongoing uncertainty in the

geopolitical environment. Slowing economic growth contrasts with

our strong business momentum. Demand for credit remains good and

both our mortgage and corporate loan books increased. Our market

share in mortgages increased to 15%, while house prices are rising

due to improved affordability.

Net profit in the third quarter was EUR 759 million and our

return on equity (ROE) was 13.6%. At EUR 1,533 million, NII was 20%

higher than last year. Compared with the previous quarter, NII was

affected by deposit migration to higher yielding products, a shift

to other income, limited asset margin pressure and lower results in

trading activities. Costs were higher than in Q2, mainly due to

regulatory levies. We now expect lower full-year costs for 2023,

between EUR 5.1 and EUR 5.2 billion, due to good cost control and a

delay in investments mainly given the tight labour market. While we

remain committed to cost discipline, we expect higher costs for

data capabilities, further digitalisation of processes and

Sustainable Finance Regulation in the coming year.

Credit quality remained strong in Q3 with impairment releases of

EUR 21 million. The releases were largely at Corporate Banking and

partly offset by an increase in the management overlay for

mortgages. The impact of the economic slowdown on our loan

portfolio so far has been limited, while buffers remain in place

against uncertainties in the economic outlook. Risk-weighted assets

increased by EUR 2.1 billion. This was mainly due to model updates

as part of our ongoing review of models, partly offset by business

developments. Our capital position remains strong, with a

fully-loaded Basel III CET1 ratio of 15.0% and a Basel IV CET1

ratio of around 16%. We will update our financial targets and our

capital framework at the Q4 results.

Higher interest rates have supported the profitability of banks

in the past few quarters, triggering public discussions about

savings rates. Strong, safe and profitable banks are important for

society as they support economic growth by financing companies and

investments, facilitate the payment system and help prevent

financial crime. We remain focused on fulfilling our role in

society, contributing to the real economy with safe and secure

banking and supporting our clients in the transition to a

sustainable economy. We recently established a Supervisory Board

Sustainability Committee responsible for supervising sustainability

aspects of our strategy and policies, including our climate

strategy. We are still making steady progress on the execution of

our climate strategy and will communicate new carbon reduction

targets for next sectors in our annual report published in March

2024.

We look forward to appointing Ferdinand Vaandrager as our Chief

Financial Officer and Ton van Nimwegen as our Chief Operations

Officer after the close of our extraordinary general meeting next

week. Tanja Cuppen, our Chief Risk Officer, has informed us that

she will not be available for a third term and will leave the bank

in April 2024.

I am pleased that the Dutch government’s stake in ABN AMRO is

now below 50%. We have made huge strides with the bank since 2010.

We are now a stable bank with a strong focus on clients’ interests,

laying a healthy foundation for further reduction of the State’s

shareholding. I am honoured by the trust the Supervisory Board has

placed in me and by the opportunity to lead this great bank for

another four years. I am proud of what we, together with all our

colleagues, have achieved for all our stakeholders. I would like to

thank our clients and our people foremost for their unwavering

commitment as we continue our journey as a personal bank in the

digital age.’

|

Key figures and indicators (in

EUR millions) |

Q3 2023 |

Q3 2022 |

Change |

Q2 2023 |

Change |

| Operating

income |

2,211 |

2,162 |

2% |

2,223 |

-1% |

|

Operating expenses |

1,228 |

1,254 |

-2% |

1,137 |

8% |

|

Operating result |

983 |

908 |

8% |

1,086 |

-9% |

| Impairment

charges on financial instruments |

-21 |

7 |

|

-69 |

69% |

|

Income tax expenses |

246 |

159 |

55% |

285 |

-14% |

|

Profit/(loss) for the period |

759 |

743 |

2% |

870 |

-13% |

| |

|

|

|

|

|

| Cost/income

ratio |

55.5% |

58.0% |

|

51.1% |

|

| Return on

average Equity |

13.6% |

13.9% |

|

16.2% |

|

| CET1

ratio |

15.0% |

15.2% |

|

14.9% |

|

| ABN AMRO

Press OfficeJarco de SwartSenior Press

Officerpressrelations@nl.abnamro.com+31 20 6288900 |

ABN AMRO

Investor RelationsAnnedien HeilbronInvestor Relations

investorrelations@nl.abnamro.com+31 20 6282282 |

This press release is published by ABN AMRO Bank N.V. and

contains inside information within the meaning of article 7 (1) to

(4) of Regulation (EU) No 596/2014 (Market Abuse Regulation)

- 20231108 ABN AMRO reports net profit of EUR 759 million for Q3

2023

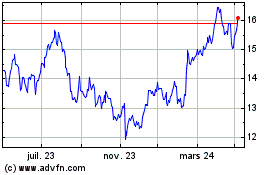

ABN AMRO Bank N.V (EU:ABN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

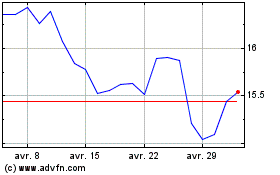

ABN AMRO Bank N.V (EU:ABN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025