Refocused portfolio with ongoing

acquisitions acceleration, in line with the LEAP | 28 strategy;

2024 revenue outlook upgraded

Q3 2024 Key figures1

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241023040612/en/

Hinda Gharbi, CEO Bureau Veritas (Photo:

Business Wire)

› Revenue of EUR 1,547.9 million in the third quarter of 2024,

up 8.8% year-on-year and up 13.0% organically, › Strong organic

growth from all businesses compared to the third quarter of 2023:

with Industry at +23.8%, Certification at +17.7%, Marine &

Offshore at +13.2%, Buildings & Infrastructure at +9.3%,

Agri-Food & Commodities at +8.5% and Consumer Products Services

at +7.5%, › Positive scope effect of 0.5% in the third quarter of

2024, reflecting the accelerated pace of acquisitions with multiple

bolt-on deals (+1.1% contribution) realized net of disposals (-0.6%

contribution), › Negative currency impact of 4.7%, resulting from

the strength of the euro against most currencies.

Q3 2024 Highlights

› Active management of the portfolio in line with the LEAP | 28

strategy, › Consistent growth in every region (Americas, Middle

East, Africa, Asia-Pacific), outperforming respective underlying

markets, › Growth momentum maintained for sustainability services,

both for Transition services and Green Objects, › An acceleration

of the Group’s M&A programs with three transactions signed for

a total annualized revenue of c. EUR 40 million in line with the

LEAP | 28 portfolio strategy: the first one to expand leadership in

the B&I stronghold, the second and third ones to create new

strongholds in Renewables, and in Sustainability, › As the Group

optimizes value and impact of some of its businesses it has signed

an agreement to sell its Food testing business (EUR 133 million in

revenue in 2023) to Mérieux NutriSciences for an Enterprise Value

of EUR 360 million and net proceeds from disposals of around EUR

290 million. The deal is expected to be broadly neutral on EPS.

2024 Outlook upgraded

Based on the 9-month performance, leveraging a healthy and

growing sales pipeline and strong underlying market growth, Bureau

Veritas now expects to deliver for the full year 2024:

› 9 to 10% organic revenue growth (from “high single-digit”

previously); › Improvement in adjusted operating margin at constant

exchange rates; › Strong cash flow, with a cash conversion2 above

90%.

Hinda Gharbi, Chief Executive Officer, commented:

“We continued the execution of our LEAP |28 strategy in the

third quarter, and we are actively managing our portfolio. We have

completed three acquisitions, representing a total cumulative

annualized revenue of c. EUR 40 million for the transactions signed

this quarter, and of c. EUR 80 million for the total seven

acquisitions signed this year. We have also entered into an

agreement to sell our food testing business. The transaction

strengthens our balance sheet and gives us greater flexibility in

implementing our acquisition plans.

In Q3, we maintained a strong growth trajectory with an organic

growth of 13.0% driven by the entire portfolio. Year to date this

equates to an organic growth of 10.5%.

For the rest of the year and in light of our strong 9 months

growth, our robust backlog and our focused operational execution,

we are upgrading our 2024 revenue outlook for the second time this

year.”

Q3 2024 KEY FIGURES

GROWTH

IN EUR MILLION

Q3 2024

Q3 2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Marine & Offshore

122.7

110.0

+11.5%

+13.2%

-

(1.7)%

Agri-Food & Commodities

322.3

305.5

+5.5%

+8.5%

-

(3.0)%

Industry

336.0

309.0

+8.8%

+23.8%

(0.5)%

(14.5)%

Buildings &

Infrastructure

440.5

413.8

+6.4%

+9.3%

(1.9)%

(1.0)%

Certification

124.1

106.7

+16.3%

+17.7%

+2.2%

(3.6)%

Consumer Products Services

202.3

178.8

+13.2%

+7.5%

+7.6%

(1.9)%

Total Group revenue

1,547.9

1,423.8

+8.8%

+13.0%

+0.5%

(4.7)%

› Strong organic revenue growth across the full portfolio and

all geographies

Revenue in the third quarter of 2024 amounted to EUR 1,547.9

million, an 8.8% increase compared to Q3 2023. Organic growth

achieved a strong 13.0% which led to 10.5% on a 9-month basis.

Three businesses delivered very strong organic growth: Marine

& Offshore, up 13.2%, Industry, up 23.8%, and Certification, up

17.7%. Buildings & Infrastructure further recovered, up 9.3%

organically in the third quarter (after 4.3% in the first half)

while both Consumer Products Services and Agri Food &

Commodities grew high-single digits organically, both reflecting

improving market trends.

By geography, the Americas (28% of revenue, up 18.3%

organically) delivered strong growth led by a double-digit increase

in both Latin America and in the US. Europe (33% of revenue, up

7.5% organically) recorded robust growth, primarily led by high

activity levels in France and in Southern and Eastern European

countries. Business in Asia-Pacific (29% of revenue, up 10.4%

organically) benefited from robust growth in China, and

double-digit growth for Australia and India. Finally, activity was

also very strong in Africa and the Middle East (10% of revenue, up

23.4% organically), supported by Buildings & Infrastructure and

energy projects in the Middle East.

The scope effect was a positive 0.5%, reflecting bolt-on

acquisitions (contributing to +1.1%) realized in the past few

quarters and partly offset by the impact of small divestments

completed over the last twelve months (contributing to -0.6%).

Currency fluctuations had a negative impact of 4.7%, due to the

strength of the euro against most currencies.

› Solid financial position

By September 30th, 2024, net financial debt was higher than that

of June 30th, 2024, due to dividend payments in July 2024. The

Group had EUR 1.2 billion in available cash and cash equivalents,

and EUR 600 million in undrawn committed credit lines. The Group

has a solid financial structure with most of its debt maturities

beyond 2026 and 100% at fixed interest rates.

FOCUSED PORTFOLIO

In line with the LEAP | 28 strategy to focus its portfolio on

businesses with top leadership market position, the Group is

actively managing its portfolio, and it has activated a targeted

M&A program to attain its objectives:

› In Buildings & Infrastructure:

- In October 2024, Bureau Veritas announced the acquisition of

IDP Group, a leading independent provider of Building

Information Modeling (BIM), Project Management Assistance and

Digital Twin services for the public and private sector, with

strong positioning in decarbonization and other high-value

verticals. IDP realized revenues of c. EUR 30 million in 2023. This

acquisition will expand Bureau Veritas’ B&I services by

enhancing its global end-to-end operational capabilities,

leveraging innovative BIM expertise, consulting and Digital Twin

asset digitalization.

› In Renewables and Sustainability related

businesses:

- The Group acquired ArcVera Renewables in September 2024,

a specialized provider in finance-grade consulting and technical

services for wind, solar, and battery storage projects worldwide.

It generated revenues of c. EUR 6 million in 2023.

- In October 2024, Bureau Veritas also acquired Aligned

Incentives, a provider of Enterprise sustainability planning

platform and aggregator, enabling companies to measure their Scope

3 GHG emissions and compute life-cycle analysis at industrial

level. With tremendous potential for scaling up, Aligned Incentives

combines top-tier ESG advisory services, and an extensive database

supported by AI-Powered enterprise sustainability planning. It

generated revenues of EUR 3 million in 2023.

As it pursues its active portfolio management to optimize

value and impact of its portfolio the Group entered into an

agreement to sell its Food testing business (EUR 133 million in

revenue in 2023) to Mérieux NutriSciences for an Enterprise Value

of EUR 360 million and net proceeds from disposals of around EUR

290 million. This operation will slightly enhance the Group's

adjusted operating margin and is neutral on the attributable

adjusted net profit as of 2025. The transaction is expected to

close by the end of the fourth quarter of 2024 once customary

closing conditions have been met, including regulatory clearance in

certain geographies. The proceeds will help finance the accelerated

M&A plans of the LEAP I 28 strategy.

ANNUALIZED REVENUE

COUNTRY/

AREA

SIGNING/CLOSING DATE

FIELD OF EXPERTISE

Buildings &

Infrastructure

IDP Group

EUR 30m

Spain

October 2024

Building Information Modeling, Project

Management Assistance and Digital Twin services

Renewables /

Sustainability

ArcVera Renewables

EUR 6m

USA

September 2024

Finance-grade consulting and technical

services for wind, solar, and battery storage projects

Aligned Incentives

EUR 3m

USA

October 2024

Enterprise sustainability planning

platform & aggregator

Disposal

EUR 133m

15 countries

October 2024

Food testing business (34 laboratories

across 4 continents)

Year-to-date, the Group acquired or entered into agreements

for:

- The acquisition of seven companies, representing an annualized

cumulated revenue of c.EUR 80 million.

- The divestment of two companies, representing an annualized

cumulated revenue of c.EUR 165 million.

For more information, the press releases are available by

clicking here.

CORPORATE SOCIAL RESPONSIBILITY COMMITMENTS

› Corporate Social Responsibility (CSR) key

indicators

UNITED NATIONS’ SDGS

9M 2024

9M 2023

2028 TARGET

ENVIRONMENT / NATURAL CAPITAL

CO2 emissions (Scopes 1 & 2,

1,000 tons)3

#13

146

149

107

SOCIAL & HUMAN CAPITAL

Total Accident Rate (TAR)4

#3

0.24

0.24

0.23

Gender balance in senior

leadership (EC-II)5

#5

27.5%

27.5%

36%

Number of learning hours per

employee (per year)6

#8

26.4

22.9

40.0

GOVERNANCE

Proportion of employees trained

to the Code of Ethics

#16

98.6%

96.8%

99.0%

› Bureau Veritas received Gold Medal from EcoVadis

On October 11, 2024, Bureau Veritas was awarded the Gold Medal

from EcoVadis, (with a score of 77/100) recognizing its commitment

to Shaping a Better World. This distinction places Bureau Veritas

in the top 5% of companies rated by EcoVadis, and highlights its

efforts to uphold ethical labor practices, reduce environmental

impact, and promote transparency and responsibility in

business.

› Multiple recognitions by non-financial rating

agencies

Bureau Veritas ranks second among 184 companies in the S&P

Global Corporate Sustainability Assessment (CSA) for the

Professional Services Industry category - encompassing the TIC

sector - with a score of 84/100 for 2024. This achievement

illustrates the engagement of its 83,000 Trust Makers, at all

levels of the company, to advance its sustainability agenda.

MSCI has rated Bureau Veritas AA for its environmental, social

responsibility and governance (ESG) performance, the same level as

in 2023, with a score of 6.3. The Group has the best score in

Environment (10), improved its score in Social (6.3) and has a

score of 5.8 in Governance.

2024 OUTLOOK UPGRADED

Based on the 9-month performance, leveraging a healthy and

growing sales pipeline and strong underlying market growth, Bureau

Veritas now expects to deliver for the full year 2024:

› 9 to 10% organic revenue growth (from “high single-digit”

previously); › Improvement in adjusted operating margin at constant

exchange rates; › Strong cash flow, with a cash conversion7 above

90%.

Q3 2024 BUSINESS REVIEW

MARINE & OFFSHORE

IN EUR MILLION

2024

2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Q3 revenue

122.7

110.0

+11.5%

+13.2%

-

(1.7)%

9M revenue

374.0

338.6

+10.5%

+14.2%

-

(3.7)%

Marine & Offshore delivered a strong 13.2% organic growth in

the third quarter of 2024 (and 14.2% in the first 9 months), with

the following trends:

› A strong double-digit increase in New Construction (43%

of divisional revenue), in a dynamic construction market, led by

Asian countries, especially China. › Double-digit growth in Core

In-service activity (44% of divisional revenue), benefiting

from volume growth from increased classed vessels. As of September

30th, 2024, the fleet classed by Bureau Veritas included 11,913

ships, up 2.4% year on year and representing 152.3 million Gross

Register Tonnage (GRT). Retrofitting and upgrades to meet new

environmental regulations also contributed to growth. ›

Low-single-digit growth in Services (13% of divisional

revenue, including Offshore), with an upturn in orders in Offshore

activities.

The division maintains strong growth momentum as the maritime

industry decarbonizes, renews its fleet, invests in digitalization,

and improves its performance. The Group secured 10.8 million gross

tons year-to-date bringing the order book to 26.8 million gross

tons, up 24.2% compared to 21.6 million gross tons at end-September

2023. This is driven by dual fuel ships, LNG carriers, container

ships and specialized vessels.

Sustainability achievements

During the third quarter of 2024, Bureau Veritas contributed to

the development of low carbon emissions technologies and issued an

Approval in Principle (AiP) to French luxury cruises operator

Ponant for its new wind assisted propulsion sailing passenger

vessel.

AGRI-FOOD & COMMODITIES

IN EUR MILLION

2024

2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Q3 revenue

322.3

305.5

+5.5%

+8.5%

-

(3.0)%

9M revenue

936.2

917.1

+2.1%

+5.9%

-

(3.8)%

The Agri-Food & Commodities business recorded an 8.5%

organic revenue growth in the third quarter of 2024 (5.9% on a

nine-month basis).

The Oil & Petrochemicals segment (O&P, 31% of

divisional revenue) achieved a high-single digit organic revenue

growth in the third quarter of 2024 despite geopolitical challenges

and weather events in key markets. This good performance is due to

ongoing market share gains in some parts of Europe, a gradual

recovery of the North American operations and the ramp-up of

contracts following recent business development in the Middle East.

Non-trade activities such as Oil Condition Monitoring-related

services are also progressing well.

The Metals & Minerals business (M&M, 33% of

divisional revenue) accelerated its recovery in the third quarter,

posting a double-digit organic revenue growth in both Upstream

(more than two thirds of the segment revenue) and Trade activities.

With gold prices at record levels, activity grew in many locations

around the world, notably in Australia. The onsite laboratories

expansion, and the ramp up of operations in the Middle East also

contributed to the Upstream business good performance. Trade

activities benefited from robust international trade for copper and

other base metals.

In the third quarter of 2024, Agri-Food (22% of

divisional revenue) delivered a mid–single digit growth on an

organic basis. In the Agri sub-segment, Upstream activities

benefited from positive new developments with key players in Latin

America and Europe, achieving a high-single digit growth. The Trade

activities managed to deliver a mid-single digit organic growth in

a challenging competitive environment. The Food sub-segment

continued to grow mid-single digits organically in the third

quarter, from pricing and services diversification initiatives. In

line with the LEAP | 28 strategy, Bureau Veritas announced in

October that it has entered into an agreement to sell its food

testing business (EUR 133 million in revenue in 2023) to Mérieux

NutriSciences.

In the third quarter of 2024, Government services (14% of

the divisional revenue) recorded a low-single digit revenue growth

on an organic basis. The activity is particularly strong in some

Middle Eastern and African countries, especially in the

Verification of Conformity services. In Ivory Coast, the Group was

awarded a monitoring and inspection contract for the collection,

transport and disposal of household waste on behalf of the local

authorities.

Sustainability achievements

In the third quarter of 2024, Bureau Veritas continued to

leverage its expertise to support clients in transitioning towards

more sustainable and low-carbon practices through tailored

offerings. The Group secured an R&D contract with a Finnish oil

refining company to provide services for product and feedstock

quality optimization. It was also awarded a laboratory testing

services contract for a European leader in Sustainable Aviation

Fuel.

INDUSTRY

IN EUR MILLION

2024

2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Q3 revenue

336.0

309.0

+8.8%

+23.8%

(0.5)%

(14.5)%

9M revenue

960.0

927.3

+3.5%

+19.7%

(1.8)%

(14.4)%

With a 23.8% organic growth increase, the Industry business once

again delivered a strong and broad-based performance in the third

quarter of 2024, with all main segments growing double-digit.

Year-to-date, the Group recorded a 19.7% growth on an organic

basis, primarily driven by the energy sector which showed high

resilience despite increasing uncertainty globally.

By market, Power & Utilities (14% of divisional

revenue) recorded a high double-digit growth, with the Opex

activities performing well in some parts of the Middle East and of

Latin America, offsetting the impact of the exit from

low-profitable contracts. A good momentum was maintained in the

Capex shop inspection, and design review services for the nuclear

industry. Additionally, the renewable power generation activities

continued its high growth, with 2024 expected to be a record year

for solar, wind and hydrogen projects deployment. This is

particularly true in China and the US, with sustained high levels

of customers’ investments and the recent expansion of the Group’s

service offering to better address the market’s needs.

The Oil & Gas (31% of divisional revenue) activity

remained strong for both Capex and Opex services. Capex solutions

continued to benefit from the favorable investment cycle,

especially in the Middle East and in Australia. This quarter, the

Group secured a key contract to perform quality assurance and

quality control inspections on behalf of an offshore gas project in

Vietnam. Opex services’ growth was fueled by a series of full

inspections in major refineries.

Industry Products Certification (17% of divisional

revenue) performed well, especially in North America, China and

France driven by high demand for pressure vessel testing, welding

inspections, and raw materials testing.

Elsewhere, the Environmental Testing business (12% of

divisional revenue) grew mid-single digit organically, despite

macro conditions and high-interest rate environment delaying the

ramp-up of some remediation projects.

Sustainability achievements

In the third quarter of 2024, Bureau Veritas secured several

important contracts. This included a contract with a major energy

company for methane emissions measurement of, on the back of more

stringent regulatory requirements. The Group also conducted a

design review for an onshore liquefied hydrogen and membrane LNG

storage tank project in China, demonstrating its technical

expertise in emerging green energy infrastructure. Additionally,

Bureau Veritas was selected to provide certification services for

an offshore wind project in Poland, further solidifying its

position as a trusted partner for sustainable energy

initiatives.

BUILDINGS & INFRASTRUCTURE

IN EUR MILLION

2024

2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Q3 revenue

440.5

413.8

+6.4%

+9.3%

(1.9)%

(1.0)%

9M revenue

1,337.2

1,282.6

+4.3%

+5.9%

(0.6)%

(1.0)%

The Buildings & Infrastructure (B&I) business delivered

strong organic revenue growth of 9.3% in the third quarter of 2024,

representing a sequential improvement from the 4.3% organic

performance in the first half.

The growth was led by both the construction-related

activities and the building-in service

activity.

The Americas region (29% of divisional revenue) achieved

double-digit organic revenue growth, with a noticeable sequential

improvement in the United States. Leveraging its diversified

portfolio of activities, the US platform recorded strong

double-digit organic growth. The data center and mission-critical

business maintained significant double-digit organic expansion

globally, driven by a volume increase from growing demand fueled by

the AI computing needs, and from pricing initiatives. Both

regulatory-driven Opex services and Capex infrastructure projects

delivered strong growth. Compared to last year, the volume of real

estate transaction-related services picked up supported by

declining interest rates. Growth in Latin America, moderated as we

shift our portfolio in Brazil, with the exit of public contracts,

and a refocus on infrastructure projects.

Business in Europe (49% of divisional revenue) grew

high-single-digit organically. Italy was amongst the best

performers, benefiting from national infrastructure spending.

France had a strong quarter led by its Opex related activities,

benefiting from volume increases, productivity gains and positive

pricing. The Capex-related activities were slightly up,

outperforming the construction market thanks to their exposure to

infrastructure and public works (including the 2024 Paris Olympic

Games).

In the Asia Pacific region (17% of divisional revenue)

organic revenue grew at mid-single-digit. This was driven by strong

performance in South and Southeast Asian countries, as well as in

Australia. China's performance was broadly stable, supported by

activity in the energy-related construction sector while weak

public spending continued to constrain growth in transport

infrastructure.

Lastly, in the Middle East & Africa region (5% of

divisional revenue), Bureau Veritas maintained a strong

double-digit organic revenue growth. This was primarily driven by

the performance in Saudi Arabia, where the company supports

numerous large-scale, high-profile projects.

In October 2024, the Group acquired the IDP Group. This company

is a leading independent provider of Building Information Modeling,

Project Management Assistance and Digital Twin services for the

public and private sector in Spain. This acquisition will bring key

digital enablers that will enhance Bureau Veritas’s services and

operational capabilities in B&I.

Sustainability achievements

In the third quarter of 2024, Bureau Veritas was selected by

several California school districts to conduct facility

assessments, including energy audits and the development of Net

Zero Energy reduction plans. The Group was also awarded additional

inspections of electrical equipment for electric vehicle charging

stations in Italy.

CERTIFICATION

IN EUR MILLION

2024

2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Q3 revenue

124.1

106.7

+16.3%

+17.7%

+2.2%

(3.6)%

9M revenue

379.4

334.5

+13.4%

+16.5%

+0.7%

(3.8)%

Certification was among the strongest performing businesses

within the Group’s portfolio in the third quarter of 2024 with an

organic growth of 17.7%, a similar growth trend to the last two

quarters (9-month organic revenue growth of 16.5%). This was led by

strong volume increases, and robust price escalations across most

geographies. This performance reflects the high market growth rate

where comprehensive brand protection and sustainability commitments

fuel strong customer demand.

QHSE & Specialized Schemes solutions (55% of the

divisional revenue) posted double-digit growth in the third quarter

of the year, as it benefits from the reoccurrence of

recertifications for several schemes across different industries,

such as the automotive sector IATF. This activity is also supported

by the development of innovative solutions in response to

customers’ demand for customized and voluntary schemes.

Additionally, we continued to develop public outsourcing services

to address government and local authorities’ needs. In line with

the recent outsourced government contracts secured in France, the

Group was awarded a food second party audit and training services

in Madrid nursing homes in Spain.

Sustainability-related solutions & Digital (Cyber)

certification activities (24% of divisional revenue) also

recorded strong double-digit organic growth. This is mainly fueled

by high demand for verification of carbon and greenhouse gas

emissions, services around forestry-related topics and ESG related

supply chain audits ahead of upcoming tightening regulations. In

addition, cybersecurity certification and assurance services are

still benefiting from excellent market traction resulting in

double-digit growth in the third quarter.

Other solutions, including Training (21% of the

divisional revenue) delivered broadly stable revenue growth in the

third quarter of 2024.

Sustainability achievements

In the third quarter of 2024, Bureau Veritas continued to grow

sustainability reporting assurance services As an example, in

France, the Group helped a small and medium enterprise to evaluate

its CSR maturity, its double materiality analysis and to complete a

gap assessment ahead of CSRD reporting. The Group also completed

the audit of suppliers’ traceability and compliance with European

Deforestation regulations (or EUDR), for a leading producer of

natural rubber in Africa.

CONSUMER PRODUCTS SERVICES

IN EUR MILLION

2024

2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Q3 revenue

202.3

178.8

+13.2%

+7.5%

+7.6%

(1.9)%

9M revenue

582.8

527.9

+10.4%

+7.4%

+5.8%

(2.8)%

The Consumer Products Services division delivered a 7.5% organic

growth performance over the third quarter of 2024. In the first 9

months, the organic revenue increased by 7.4%.

By geography, Asia showed good organic growth led mainly by

China, Vietnam and Bangladesh.

The Softlines, Hardlines & Toys segment (accounting

for 46% of divisional revenue) delivered high-single-digit organic

growth in Q3 2024. This growth was driven by volumes recovery. The

growth was primarily led by China and Southeast Asian countries.

The Hardlines business was particularly strong, benefiting from a

global recovery, and an increase in Stock Keeping Units (SKUs).

Healthcare (including Beauty and Household) (8% of

divisional revenue) posted solid double-digit organic growth for Q3

2024. This was mainly driven by the performance in the USA as the

Group successfully scales the services of the acquisitions

completed in the last two years and benefited from a favorable

market.

Supply Chain & Sustainability services (14% of

divisional revenue) delivered a very good double-digit performance

from audits especially for CSR audits, and a global strong momentum

around social audits and green claim verification services.

Technology (32% of divisional revenue) recorded a

low-single-digit growth in Q3 2024, still affected by a global

decrease in demand for electronics, wireless products and new

mobility equipment (electrical vehicles, notably in China). It is a

sequential improvement after a negative H1, with continued good

trend in Electrical appliances testing.

Sustainability achievements

During the third quarter of 2024, Transition Services continued

to grow as the Group accompanied clients’ ESG transformation.

Services provided covered a wide range, including restricted

substances list testing program for an Austrian furniture chain,

and environmental emissions management services for one of the

largest clothing companies in China.

PRESENTATION

› Q3 2024 revenue will be presented on Wednesday, October 23,

2024, at 6:00 p.m. (Paris time) › A video conference will be

webcast live. Please connect to: Link to video conference › The

presentation slides will be available on:

https://group.bureauveritas.com/investors/financial-information/financial-results

› All supporting documents will be available on the website › Live

dial-in numbers:

- France: +33 (0)1 70 37 71 66 - UK: +44 (0)

33 0551 0200 - US: +1 786 697 3501 - International: +44 (0) 33 0551

0200 - Password: Bureau Veritas

2024 & 2025 FINANCIAL CALENDAR

› FY 2024 Results: February 25, 2025 (pre market) › Q1 2025

Revenue: April 24, 2025 (pre market) › Shareholder’s Meeting: June

19, 2025 › H1 2025 Results : July 25, 2025 (pre market) › Q3 2025

Revenue : October 23, 2025 (pre market)

ABOUT BUREAU VERITAS Bureau Veritas is a world leader in

inspection, certification, and laboratory testing services with a

powerful purpose: to shape a world of trust by ensuring responsible

progress. With a vision to be the preferred partner for customers’

excellence and sustainability, the company innovates to help them

navigate change. Created in 1828, Bureau Veritas’ 83,000 employees

deliver services in 140 countries. The company’s technical experts

support customers to address challenges in quality, health and

safety, environmental protection, and sustainability. Bureau

Veritas is listed on Euronext Paris and belongs to the CAC 40 ESG,

CAC Next 20, SBF 120 indices and is part of the CAC SBT 1.5° index.

Compartment A, ISIN code FR 0006174348, stock symbol: BVI. For more

information, visit www.bureauveritas.com, and follow us on LinkedIn

and X/Twitter.

Our information is certified with blockchain technology. Check

that this press release is genuine at www.wiztrust.com.

This press release (including the appendices) contains

forward-looking statements, which are based on current plans and

forecasts of Bureau Veritas’ management. Such forward-looking

statements are by their nature subject to a number of important

risk and uncertainty factors such as those described in the

Universal Registration Document (“Document d’enregistrement

universel”) filed by Bureau Veritas with the French Financial

Markets Authority (“AMF”) that could cause actual results to differ

from the plans, objectives and expectations expressed in such

forward-looking statements. These forward-looking statements speak

only as of the date on which they are made, and Bureau Veritas

undertakes no obligation to update or revise any of them, whether

as a result of new information, future events or otherwise,

according to applicable regulations.

APPENDIX 1: Q3 AND 9M 2024 REVENUE BY BUSINESS

IN EUR MILLION

Q3/9M 2024

Q3/9M 2023

CHANGE

ORGANIC

SCOPE

CURRENCY

Marine & Offshore

122.7

110.0

+11.5%

+13.2%

-

(1.7)%

Agri-Food & Commodities

322.3

305.5

+5.5%

+8.5%

-

(3.0)%

Industry

336.0

309.0

+8.8%

+23.8%

(0.5)%

(14.5)%

Buildings &

Infrastructure

440.5

413.8

+6.4%

+9.3%

(1.9)%

(1.0)%

Certification

124.1

106.7

+16.3%

+17.7%

+2.2%

(3.6)%

Consumer Products

202.3

178.8

+13.2%

+7.5%

+7.6%

(1.9)%

Total Q3 revenue

1,547.9

1,423.8

+8.8%

+13.0%

+0.5%

(4.7)%

Marine & Offshore

374.0

338.6

+10.5%

+14.2%

-

(3.7)%

Agri-Food & Commodities

936.2

917.1

+2.1%

+5.9%

-

(3.8)%

Industry

960.0

927.3

+3.5%

+19.7%

(1.8)%

(14.4)%

Buildings &

Infrastructure

1,337.2

1,282.6

+4.3%

+5.9%

(0.6)%

(1.0)%

Certification

379.4

334.5

+13.4%

+16.5%

+0.7%

(3.8)%

Consumer Products

582.8

527.9

+10.4%

+7.4%

+5.8%

(2.8)%

Total 9M revenue

4,569.6

4,328.0

+5.6%

+10.5%

+0.2%

(5.1)%

(a) Q3 and 9M 2023 figures by business have been restated

following a reclassification of activities impacting mainly the

Industry and Buildings & Infrastructure businesses (c. €2.6

million in 9M)

APPENDIX 2: 2024 REVENUE BY QUARTER

2024 REVENUE BY QUARTER

IN EUR MILLIONS

Q1

Q2

Q3

Marine & Offshore

122.1

129.2

122.7

Agri-Food & Commodities

297.3

316.6

322.3

Industry

295.6

328.4

336.0

Buildings &

Infrastructure

441.0

455.7

440.5

Certification

117.4

137.9

124.1

Consumer Products

166.1

214.4

202.3

Total revenue

1,439.5

1,582.2

1,547.9

APPENDIX 3: DEFINITION OF ALTERNATIVE PERFORMANCE INDICATORS

AND RECONCILIATION WITH IFRS

The management process used by Bureau Veritas is based on a

series of alternative performance indicators, as presented below.

These indicators were defined for the purposes of preparing the

Group’s budgets and internal and external reporting. Bureau Veritas

considers that these indicators provide additional useful

information to financial statement users, enabling them to better

understand the Group’s performance, especially its operating

performance. Some of these indicators represent benchmarks in the

testing, inspection and certification (“TIC”) business and are

commonly used and tracked by the financial community. These

alternative performance indicators should be seen as complementary

to IFRS-compliant indicators and the resulting changes.

GROWTH

Total revenue growth

The total revenue growth percentage measures changes in

consolidated revenue between the previous year and the current

year. Total revenue growth has three components:

- organic growth;

- impact of changes in the scope of consolidation (scope

effect);

- impact of changes in exchange rates (currency effect).

Organic growth

The Group internally monitors and publishes “organic” revenue

growth, which it considers to be more representative of the Group’s

operating performance in each of its business sectors.

The main measure used to manage and track consolidated revenue

growth is like-for-like, also known as organic growth. Determining

organic growth enables the Group to monitor trends in its business

excluding the impact of currency fluctuations, which are outside of

Bureau Veritas’ control, as well as scope effects, which concern

new businesses or businesses that no longer form part of the

business portfolio. Organic growth is used to monitor the Group’s

performance internally.

Bureau Veritas considers that organic growth provides management

and investors with a more comprehensive understanding of its

underlying operating performance and current business trends,

excluding the impact of acquisitions, divestments (outright

divestments as well as the unplanned suspension of operations – in

the event of international sanctions, for example) and changes in

exchange rates for businesses exposed to foreign exchange

volatility, which can mask underlying trends.

The Group also considers that separately presenting organic

revenue generated by its businesses provides management and

investors with useful information on trends in its industrial

businesses, and enables a more direct comparison with other

companies in its industry.

Organic revenue growth represents the percentage of revenue

growth, presented at Group level and for each business, based on a

constant scope of consolidation and exchange rates over comparable

periods:

- constant scope of consolidation: data are restated for the

impact of changes in the scope of consolidation over a 12‑month

period;

- constant exchange rates: data for the current year are restated

using exchange rates for the previous year.

Scope effect

To establish a meaningful comparison between reporting periods,

the impact of changes in the scope of consolidation is

determined:

- for acquisitions carried out in the current year: by deducting

from revenue for the current year revenue generated by the acquired

businesses in the current year;

- for acquisitions carried out in the previous year: by deducting

from revenue for the current year revenue generated by the acquired

businesses in the months in the previous year in which they were

not consolidated;

- for disposals and divestments carried out in the current year:

by deducting from revenue for the previous year revenue generated

by the disposed and divested businesses in the previous year in the

months of the current year in which they were not part of the

Group;

- for disposals and divestments carried out in the previous year:

by deducting from revenue for the previous year revenue generated

by the disposed and divested businesses in the previous year prior

to their disposal/divestment.

Currency effect

The currency effect is calculated by translating revenue for the

current year at the exchange rates for the previous year.

__________________________________ 1 Alternative performance

indicators are presented, defined and reconciled with IFRS in

appendix 2 of this press release. 2 (Net cash generated from

operating activities – lease payments + corporate tax)/adjusted

operating profit. 3 Greenhouse gas emissions from offices and

laboratories, tons of CO2 equivalent for net emissions

corresponding to Scopes 1 and 2 over a period of 12 consecutive

months (Q3 2023 to Q2 2024). 4 TAR: Total Accident Rate (number of

accidents with and without lost time x 200,000/number of hours

worked). 5 Proportion of women from the Executive Committee to Band

II (internal grade corresponding to a management or executive

management position) in the Group (number of women on a full-time

equivalent basis in a leadership position/total number of full-time

equivalents in leadership positions). 6 Indicator calculated over a

9-month period for 9M 2024 and 9M 2023, compared to a 12-month

period for 2028 target values. 7 (Net cash generated from operating

activities – lease payments + corporate tax)/adjusted operating

profit.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023040612/en/

ANALYST/INVESTOR CONTACTS

Laurent Brunelle +33 (0)1 55 24 76 09

laurent.brunelle@bureauveritas.com

Colin Verbrugghe +33 (0)1 55 24 77 80

colin.verbrugghe@bureauveritas.com

Karine Ansart karine.ansart@bureauveritas.com

MEDIA CONTACTS

Anette Rey +33 (0)6 69 79 84 88

anette.rey@bureauveritas.com

Martin Bovo +33 (0)6 14 46 79 94

martin.bovo@bureauveritas.com

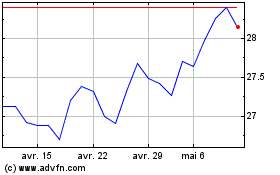

Bureau Veritas (EU:BVI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Bureau Veritas (EU:BVI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024