Esker - On the Availability to the Public of the Offer Document Relating to the Tender Offer

25 Novembre 2024 - 4:00PM

Business Wire

This press release does not constitute an

offer to purchase securities or any form of solicitation and is not

intended to be distributed in jurisdictions where the proposed

Offer would not be authorized.

Translation for information purposes

only.

In case of discrepancy between the French

and English versions, the French version shall prevail.

PRESS RELEASE DATED 25 NOVEMBER 2024

ON THE AVAILABILITY TO THE PUBLIC OF THE

OFFER DOCUMENT RELATING TO THE TENDER OFFER

for the shares of the Company

initiated by

Boréal Bidco SAS

presented by

Presenting bank: Morgan Stanley

Presenting and guaranteeing bank: Societe

Generale

OFFER

PRICE: €262 per Esker SA share

DURATION

OF THE OFFER: 25 trading days

The timetable of the tender offer

(the “Offer”) will be set out by the Autorité des marchés

financiers (the “AMF”) in accordance with its General

Regulation.

This press release has been prepared by

Boréal Bidco SAS (the “Offeror”) and published pursuant to

Article 231-27, 1° and 2° of the AMF General Regulation.

Pursuant to Article L. 621-8 of the French

Monetary and Financial Code and Article 231-23 of its General

Regulation, the AMF has, in accordance with its compliance decision

dated 22 November 2024 of the Offer, affixed visa No. 24-495 to the

offer document prepared by the Offeror (the “Offer

Document”) relating to the Offer.

IMPORTANT NOTICE

In accordance with Articles L. 433-4 II of

the French Monetary and Financial Code and 232-4, 237-1 to 237-10

of the AMF General Regulation, Boréal Bidco SAS intends to file a

request with the AMF to carry out, within ten trading days from the

publication of the notice of result of the Offer, or, as the case

may be, in the event of a reopening of the Offer, within three

months from the closing of the Reopened Offer, a squeeze-out

procedure for Esker SA shares for a unitary indemnity equal to the

price of the Offer, i.e. €262 per Esker SA share, if the number of

Esker SA shares not tendered to the Offer by the minority

shareholders of Esker SA (other than the shares assimilated to

shares held by Boréal Bidco SAS or any person acting in concert

with the Offeror) does not represent, at the end of the Offer or,

as the case may be, the Reopened Offer, more than 10% of the

capital and voting rights of Esker SA.

The Offer is not being and will not be

made in any jurisdiction where it would not be permitted under

applicable law. The acceptance of the Offer by persons residing in

countries other than France and the United States of America may be

subject to specific obligations or restrictions imposed by legal or

regulatory provisions. Recipients of the Offer are solely

responsible for complying with such laws and, therefore, before

accepting the Offer, they are responsible for determining whether

such laws exist and are applicable, by relying on their own

advisors. For further information, see section 2.16 of the Offer

Document.

The Offer Document is available on the websites of the AMF

(www.amf-france.org), Esker SA

(www.esker.fr) and Bridgepoint

(www.bridgepoint.eu/shareholders/Sep-2024-microsite)

and may be obtained free of charge from:

Boréal Bidco SAS

21 avenue Kléber

75116 Paris

Morgan Stanley

61 rue de Monceau

75008 Paris

Société Générale

GLBA/IBD/ECM/SEG

75886 Paris Cedex 18

The Offer Document must be read in conjunction with all other

documents published in relation with the Offer. In accordance with

Article 231-28 of the AMF General Regulation, the information

relating to Boréal Bidco SAS’s legal, financial, accounting, and

other characteristics, which supplements the Offer Document

prepared by the Offeror, will be made available to the public no

later than the day before the Offer opens. A press release will be

issued to inform the public of how to have access to that

disclosure.

Prior to the opening of the Offer, the AMF and Euronext will

respectively publish a notice announcing the opening of the Offer

and the timetable and a notice announcing the terms and the

timetable of the Offer.

IMPORTANT DISCLAIMER

This press release has been prepared for

information purposes only. It does not constitute a public offer

(offre au public) and is not intended to be disseminated in the

jurisdictions in which the planned Offer is not authorized.

Dissemination of this press release, the Offer, and its acceptance

may subject to a specific regulation or restrictions in some

countries. The Offer is not addressed to persons directly or

indirectly subject to such restrictions, and may not be accepted in

any way from a country in which the Offer is subject to such

restrictions. Therefore, persons in possession of this press

release must inform themselves about and comply with any local

restrictions that may apply. The Offeror may not be held

responsible for any violation of such restrictions by anyone.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125899659/en/

Press: Lindsey Harrison Tel: (630) 730-1808 |

eskerpr@walkersands.com

Investor Relations: Emmanuel Olivier Tel: +33 (0)4 72 83

46 46 | emmanuel.olivier@esker.com

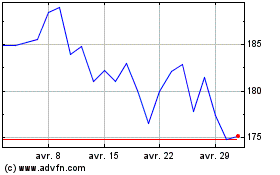

Esker (EU:ALESK)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Esker (EU:ALESK)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024