LECTRA: First nine months of 2024: revenues and EBITDA continued to

grow, despite the degraded environment

First nine months of 2024: revenues and EBITDA continued

to grow, despite the degraded environment

- Revenues: 394.2 million euros

(+10%)*

- EBITDA before non-recurring items:

68.5 million euros (+16%)*

*At actual exchange rates

|

|

|

|

|

In millions of euros |

July 1 – September 30 |

January 1 – September 30 |

|

|

2024(1) |

2023 |

2024(1) |

2023 |

|

Revenues |

131.9 |

118.7 |

394.2 |

358.3 |

|

Change at actual exchange rates (in %) |

11% |

|

10% |

|

|

EBITDA before non-recurring items(2) |

26.2 |

23.9 |

68.5 |

59.2 |

|

Change at actual exchange rates (in %) |

10% |

|

16% |

|

EBITDA margin before non-recurring items

(in % of revenues) |

19.9% |

20.1% |

17.4% |

16.5% |

|

Income from operations before non-recurring items

(2) |

15.7 |

16.4 |

37.3 |

36.7 |

|

Change at actual exchange rates (in %) |

-5% |

|

2% |

|

|

Net income(3) |

10.1 |

11.0 |

21.2 |

24.9 |

|

Free cash flow before non-recurring items

(2) |

21.6 |

15.5 |

49.9 |

32.1 |

|

|

|

|

|

|

(1) The 2024 amounts include Launchmetrics since

January 23, 2024

(2) The definition for performance indicators

appears in the September 30, 2024 Financial Report

(3) In 2023, net income included the impact of

non-recurring income of 2.6 million euros

Paris, October 30, 2024. Today,

Lectra’s Board of Directors, chaired by Daniel Harari, reviewed the

consolidated financial statements for the third quarter and the

first nine months of 2024, which have not been reviewed by the

Statutory Auditors. To facilitate the analysis of the Group's

results in its new scope, the accounts of Lectra excluding

Launchmetrics (the "Lectra 2023 scope") and those of Launchmetrics

are analyzed separately.

The detailed 2024 vs 2023 comparisons are based

on actual exchange rates, except for the Lectra 2023 scope stated

on a like-for-like basis.

- Q3

2024

The macroeconomic and geopolitical environment

experienced further degradation in the third quarter but with

heterogeneous situations across different geographical markets and

market sectors.

This situation resulted in a cautious position

on the part of the Group's customers in their investment decisions,

resulting in a negative effect, particularly on orders for new

systems.

However, driven by both the integration of

Launchmetrics and the improvement in the Group’s fundamentals

–growth in recurring revenues, higher gross profit, growth in

EBITDA before non-recurring items and near-coverage of all fixed

costs through recurring activity– Q3 2024 revenues (131.9 million

euros) and EBITDA before non-recurring items (26.2 million euros)

increased significantly (by 11% and 10%, respectively). The EBITDA

margin before non-recurring items stood at 19.9%.

Lectra 2023 scope

Orders for perpetual software licenses,

equipment and accompanying software, and non-recurring services

(32.2 million euros) were stable compared to Q3 2023.

The annual value of new subscriptions for

software came to 2.6 million euros, up 17% compared to Q3 2023.

Q3 2024 revenues came to 120.8 million euros, up

3% compared Q3 2023. EBITDA before non-recurring items was 23.5

million euros and EBITDA margin before non-recurring items stood at

19.5% (-0.5 percentage point).

- FIRST NINE

MONTHS OF 2024

Revenues for the first nine months of 2024 were

394.2 million euros, up 10%, with the following breakdown: 111.3

million euros in revenus from new systems (28% of total revenues,

down 5%) and 282.9 million euros in recurring revenues (72% of

total revenues, up 18%), including 56.4 million euros in SaaS

revenue (14% of total revenues, multiplied by 2.6)

Gross profit came to 281.6 million euros, up 13%

compared to the first nine months of 2023, and the gross profit

margin came to 71.4%, up 1.7 percentage points.

EBITDA before non-recurring items totalled 68.5

million euros, up 16%, and the EBITDA margin before non-recurring

items rose to 17.4%, up 0.9 percentage point.

Consolidated income from operations before

non-recurring items amounted to 37.3 million euros, up 2%. This

included a 16.8 million euros charge for amortization of intangible

assets arising from acquisitions made since 2021, including 7.4

million euros for Launchmetrics.

Considering this amortization, the increase in

financial expenses and an income tax charge of 10.0 million

euros, net income totalled 21.2 million euros. Net income for

the first nine months of 2023 (24.9 million euros) included

the impact of a non-recurring income of 2.6 million euros in

Q3 2023.

Free cash flow before non-recurring items came

to 49.9 million euros, up sharply from 32.1 million euros

in the first nine months of 2023.

As of September 30, 2024, the Group has a

particularly robust balance sheet, with consolidated shareholders'

equity of 332.7 million euros, a negative working capital

requirement of 8.7 million euros and net financial debt of

41.0 million euros after payment of the first tranche of the

acquisition of Launchmetrics, i.e., 77.0 million euros.

Lectra 2023 scope

In the first nine months of 2024, orders for

perpetual software licenses, equipment and accompanying software,

and non-recurring services (106.3 million euros) were stable

compared to the same period in 2023. The annual value of new

software subscription orders came to 8.0 million euros, up 4%

compared to the first nine months of 2023.

Revenues amounted to 364.0 million euros, up 2% compared to the

first nine months of 2023.

EBITDA before non-recurring items was 63.2

million euros, up 8%, and the EBITDA margin before non-recurring

items came to 17.4%, up 1.0 percentage point compared to 2023.

- BUSINESS

TRENDS AND OUTLOOK

In its financial report on the fourth quarter

and full year 2023, published on February 14, 2024, Lectra

reiterated its long-term vision, as well as the objectives of its

2023-2025 strategic roadmap and its ambitions for 2025: revenues of

600 million euros, of which 400 million euros in recurring

revenues, including 90 million euros in SaaS revenues, and an

EBITDA margin before non-recurring items exceeding 20%.

The Group also stated that while the substantial

improvement in the fundamentals of the Group's business model in

2023 would have a positive impact on 2024 results, persistent

macroeconomic and geopolitical uncertainties could continue to

weigh on investment decisions by its customers.

On February 14, the Group reported its

objectives for 2024, before including the Launchmetrics acquisition

(i.e., for the Lectra 2023 scope): to achieve revenues in the range

of 480 to 530 million euros (+2% to +12%) and EBITDA before

non-recurring items in the range of 85 to 107 million euros (+10%

to +40%).

The Group also reported that Launchmetrics

revenues (for the consolidation period from January 23 to December

31, 2024) were projected to be in the range of 42 to 46 million

euros, with an EBITDA margin before non-recurring items of more

than 15%.

These scenarios were prepared based on the

closing exchange rates on December 29, 2023, and particularly

$1.10/€1.

Given the results for the first nine months of

2024, full year revenues and EBITDA before non-recurring items are

expected to reach the lower end of the indicated ranges.

The 2024 Annual Financial Report, as well as the Management

Discussion and Analysis of Financial Conditions and Results of

Operations and the financial statements for the first nine months

of 2024 are available on lectra.com. Q3 and the first nine months

of 2024 earnings will be published on October 30, 2024.

About

Lectra

A major player in

the fashion, automotive and furniture markets, Lectra contributes

to the development of Industry 4.0 with boldness and passion, fully

integrating Corporate Social Responsibility (CSR) into its global

strategy.The Group offers industrial intelligence solutions -

software, cutting equipment, data analysis solutions and associated

services - that facilitate the digital transformation of the

companies it serves. In doing so, Lectra helps its customers push

boundaries and unlock their potential. The Group is proud to state

that its 3,000 employees are driven by three core values: being

open-minded thinkers, trusted partners and passionate

innovators. Founded in 1973, Lectra reported revenues of 478

million euros in 2023. The company is listed on Euronext, where it

is included in the following indices: CAC All Shares, CAC

Technology, EN Tech Leaders and ENT PEA-PME 150. For more

information, visit lectra.com.

Lectra – World Headquarters: 16–18, rue Chalgrin • 75016 Paris •

France

Tel. +33 (0)1 53 64 42 00 – www.lectra.com

A French Société Anonyme with capital of €37,832,965 • RCS Paris B

300 702 305

- Lectra_Press_Release_Q3_9M 2024 vdef

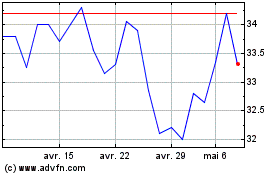

Lectra (EU:LSS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

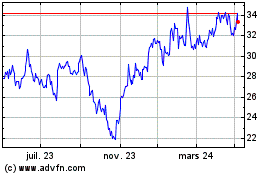

Lectra (EU:LSS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024