- H2 2024 revenue €12.0 million up 10.2% compared to H2 2023

- FY 2024 revenue €22.9 million up 3.3% compared to 2023

- Growing order backlog at €71.0 million, as of December 31,

2024

- eyonis™ Lung Cancer Screening (LCS) regulatory filings for FDA

510(k) clearance and CE marking in Q2, 2025

- eyonis™ LCS FDA 510(k) clearance expected in Q3, 2025 followed

by commercial launch in the USA

- EIB 2020 loan maturity extension combined with the new

financing agreement with Iris, and operational improvements in the

iCRO Business Unit organization, extend the Company’s cash runway

into Q4 2025

Regulatory News:

Median Technologies (FR0011049824, ALMDT, PEA/SME scheme

eligible), a leading developer of eyonis™, a suite of artificial

intelligence (AI) powered Software as a Medical Device (SaMD) for

early cancer diagnostics, and a globally leading provider of

AI-based image analyses and imaging services for oncology drug

developers, releases today its 2024 key financial indicators

(unaudited), and provides an outlook on the Company’s critical

milestones in 2025.

Fredrik Brag, Chief Executive Officer and Founder of Median

Technologies, commented: "We are delighted to report that the

second half of 2024 saw an acceleration of our iCRO1 business unit

revenue growth, +10.2% compared to revenues over the same period a

year before. We are now back to growth, after lower-than-expected

revenues in 2023 and H1 2024. Our new major iCRO agreements with

Top 3 and Top 10 pharma groups, the extension of our footprint in

South Korea and Japan and new Master Services Agreements with

global CROs in 2024 are driving continued order backlog growth in

2025. Thanks also to significant ongoing operational improvements

in the iCRO Business Unit organization, we anticipate iCRO will

improve its profitability in 2025 and contribute to the financing

of Median.

2025 is a truly pivotal year, expected to end with the

commercialization of our first AI-based Software as a Medical

Device, eyonis™ Lung Cancer Screening (LCS); we expect to file FDA

510(k) clearance and CE marking in Q2 2025, and obtain FDA

marketing authorization in Q3. This will be followed by immediate

commercialization in the U.S.

Lung cancer represents the number one cancer mortality

worldwide, because it is very often diagnosed at a late stage.

Early lung cancer diagnosis through screening procedures has

clearly been proven to save patients’ lives. We are confident that

eyonis™ LCS will deliver greater accuracy and efficiency to

increase early diagnosis and support radiologists in navigating

complex and often inconclusive imaging data, saving lives and

avoiding astronomical medical costs in the process. We believe

there is an ethical and economic imperative to roll out AI enabled

lung cancer screening to all those who can benefit."

eyonis™LCS

Software as a Medical Device: AI-driven innovation for Lung Cancer

Screening

2024 key achievements

Median reported in August that eyonis™ LCS, met all primary and

secondary endpoints with statistical significance in REALITY

(Clinicaltrials.gov identifier: NCT06576232), the first of the two

pivotal studies for Median’s fully owned Software as a Medical

Device eyonis™ LCS, providing an analytical validation.

A webinar on the REALITY data held in November 2024, featured

two globally leading U.S. pulmonologists discussing how eyonis™ LCS

will be used to help people at risk of lung cancer.

2025 strategic outlook and key milestones

The Company is on track to communicate the second eyonis™ LCS

pivotal study, RELIVE (Clinicaltrials.gov identifier: NCT06751576),

in the coming weeks. RELIVE is a Multi-Reader Multi-Case (MRMC)

trial that will offer clinical validation of eyonis™ LCS to

complement the analytical validation already achieved with REALITY.

The RELIVE study objective is to compare the ability of

radiologists to successfully diagnose lung cancer in patients with

or without the help of eyonis™ LCS.

Regulatory filings for U.S. FDA 510(k) clearance and for CE

marking, will be submitted in Q2 2025 for eyonis™ LCS. Marketing

authorizations are expected in Q3 2025 and Q1 2026, for U.S. and

EEA, respectively, assuming normal regulators’ review times.

Working in parallel, Median is in active discussions with

several leading U.S. AI diagnostic commercialization organizations

for eyonis™ LCS. The Company will review in due course its best

possible partnering options for the commercialization of eyonis™

LCS.

iCRO: AI-driven and central imaging

services for oncology drug development

2024 key financial indicators

Median’s 2024 revenue stemmed entirely from the iCRO Business

Unit, which provides imaging services to measure drug efficacy in

industry-sponsored oncology trials.

Q4 2024 revenue totaled €5.9 million, up 8.3%, vs €5.4 million

revenue generated over the same period in 2023.

H2 2024 saw 10.2% growth, with revenues totaling €12.0 million,

compared to €10.9 million revenues over the same period the prior

year.

2024 Full-Year revenue stood at €22.9 million, a 3.3% increase

compared to €22.2 million 2023 FY revenue.

Revenue growth acceleration over the second half of 2024

confirms the expected recovery of revenue.

On December 31, 2024, the order backlog2 stood at €71.0 million,

vs €68.2 million as of September 30, 2024, and vs €66.9 million as

of December 31, 2023.

2025 strategic outlook

Median Technologies’ iCRO Business Unit is currently the

preferred provider for two of the top three global pharma companies

in oncology, with the largest pipelines of oncology studies in the

world. In 2025, the Company will continue to deploy a 3-pillar

strategy to drive the iCRO business growth: becoming the preferred

imaging services provider for additional leading oncology groups;

strengthening partnerships with global CROs3; and geographical

expansion in new fast growing clinical trial markets, notably East

Asia.

Importantly, the iCRO Business Unit has launched this strategy,

thanks not only to its central imaging services but also Imaging

Lab, an entity of iCRO that provides biopharma companies with

advanced AI-based decision-making capabilities. Imaging Lab AI

image analysis capabilities are a powerful catalyst in the sales

process, differentiating and increasing the attractiveness of iCRO

services because it offers unique added value compared to peers in

the image processing space. Median aims in 2025 to establish new

master services agreements with flagship biopharmaceutical

companies, such as the one announced in August 2024.

Over the second half of 2024, the Company implemented

significant operational improvements to enhance the profitability

of the iCRO business. This effort will continue in 2025.

Cash and cash equivalents at €8.1m on

December 31, 2024

On December 31, 2024, cash and cash equivalents stood at €8.1

million, versus €19.5 million a year prior. Early 2024, the

Company’s cash position was strengthened with the receipt of €8.5

million from the release of the final tranche of the 2020 loan

granted by the European Investment Bank (EIB).

Cash position strengthened in January

2025, extending the Company’s cash runway from Q2 to Q4

2025

On January 24, 2025, the Company announced that the EIB had

agreed to extend the maturity of the 2020 loan granted to Median,

from April to October 2025. Median Technologies and the European

Investment Bank have also agreed on a new loan facility for up to

€37.5 million, with the release of tranches subject to certain

milestones. Description of the new financing project, which is

currently under appraisal is available on the EIB website. The

legal documentations for the 2025 loan and the 2020 loan maturity

extension are in process and expected to be finalized in Q1

2025.

On the same date, Median Technologies also announced that on

January 23, 2025, the Company signed a financing agreement with

Iris in the form of bonds redeemable in shares for a maximum amount

of €10 million, with an initial tranche of €4 million. The Company

will have the right to suspend and reactivate the drawdowns of the

tranches without penalty. The key terms and conditions of the

financing facility are as follows:

- A single tranche of 4,000 warrants,

subscribed by Iris Capital, each warrant entitling its holder to

subscribe to a bond redeemable in shares, - Iris Capital has

committed to subscribing over a 24-month period to 4,000 bonds upon

the exercise of the warrants in six tranches (the first for

€4,000,000, the second for €2,500,000, the third to fifth for

€1,000,000 each, and the sixth and final for €500,000), - Median

Technologies will have the right to suspend and reactivate the

drawdowns of the tranches without penalty, - The redemption price

of the bonds in new shares is equal to 95% of the lowest

volume-weighted average price over the twenty-five (25) trading

days immediately preceding the bond redemption date. By way of

exception, the parties may agree on a redemption price for the

Bonds in the event of a block sale of the shares resulting from the

redemption of the said Bonds by Iris Capital. - Furthermore, it is

specified that the redemption price of the bonds can in no case be

lower than (i) the minimum price set by the board of directors of

Median Technologies, namely 95% of the volume-weighted average

price of the trading day immediately preceding the bond redemption

date, (ii) the minimum price set by the combined general meeting of

the company's shareholders on June 19, 2024, namely the average

closing price of Median Technologies’ ordinary shares observed over

the twenty (20) trading sessions preceding the bond redemption

date, reduced by a discount of 20%, (iii) nor the nominal value of

the company’s shares.

The new financing agreement with Iris, the extension of the

EIB’s 2020 loan maturity from April to October 2025 combined with

the implementation of iCRO operational improvements extend the

Company’s cash runway into Q4, 2025. Successful completion of

milestones enabling drawdowns of the new 2025 EIB loan tranches

would extend the Company’s cash runway beyond Q4, 2025.

Next financial release on April 29, 2025, after

the market close: 2024 Financial Report

About Median Technologies: Pioneering innovative imaging

services and Software as a Medical Device, Median Technologies

harnesses cutting-edge AI to enhance the accuracy of early cancer

diagnoses and cancer treatments. Median's offerings include iCRO,

which provides medical image analysis and management in oncology

trials, and eyonis™, an AI/ML tech-based suite of software as a

medical device (SaMD). Median empowers biopharmaceutical entities

and clinicians to advance patient care and expedite the development

of novel therapies. The French-based company, with a presence in

the U.S. and China, trades on the Euronext Growth market (ISIN:

FR0011049824, ticker: ALMDT). Median is also eligible for the

French SME equity savings plan scheme (PEA-PME). For more

information, visit www.mediantechnologies.com.

Forward-Looking Statements

This press release contains forward-looking statements. These

statements are not historical facts. They include projections and

estimates as well as the assumptions on which these are based,

statements concerning projects, objectives, intentions, and

expectations with respect to future financial results, events,

operations, services, product development and potential, or future

performance.

These forward-looking statements can often be identified by the

words "expects," "anticipates," "believes," "intends," "estimates"

or "plans" and any other similar expressions. Although Median's

management believes that these forward-looking statements are

reasonable, investors are cautioned that forward-looking statements

are subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of Median

Technologies, including the risks set forth in the annual financial

report of the Company published on April 25, 2024, which is

available on the Company's website

(https://mediantechnologies.com/). The occurrence of all or parts

of such risks could cause actual results and events to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements.

All forward-looking statements in this press release are based

on information available to Median Technologies as of the date of

the press release. Median Technologies does not undertake to update

any forward-looking information or statements, subject to

applicable regulations, in particular Articles 223-1 et seq. of the

General Regulation of the French Autorité des Marchés

Financiers.

Disclaimer

The preliminary figures set forth above are based on

management’s initial review of the Company’s operations for the

period ending December 31st, 2024, and are subject to revision

based upon the finalization of the review conducted on the full

year financial statements by the Group's statutory auditors. Actual

results may differ materially from these preliminary figures as a

result of the completion of annual closing procedures, final

adjustments and other developments arising between now and the time

that the Company’s financial results are finalized, and such

changes could be material. In addition, these preliminary figures

are not a comprehensive statement of the Company’s financial

results for 2024, should not be viewed as a substitute for

financial statements prepared in accordance with generally accepted

accounting principles, and are not necessarily indicative of the

Company’s results for any future period.

1 iCRO: imaging Contract Research

Organization

2 The order backlog is the sum of orders

received but not yet fulfilled. An increase or decrease in the

order backlog corresponds to the order intake of the reporting

period, net of invoiced services, completed or cancelled contracts,

and currency impact for projects in foreign currency (re-evaluated

at the exchange rate on closing date). Orders are booked once the

customer confirms, in writing, its retention of the Company’s

services for a given project. The contract is usually signed a few

months after written confirmation.

3 CRO: Contract Research Organization

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130321829/en/

MEDIAN TECHNOLOGIES Emmanuelle Leygues VP, Corporate

Marketing & Financial Communications +33 6 10 93 58 88

emmanuelle.leygues@mediantechnologies.com

Investors Ghislaine Gasparetto SEITOSEI ACTIFIN

+33 6 21 10 49 24 ghislaine.gasparetto@seitosei-actifin.com

U.S. media & investors Chris Maggos COHESION

BUREAU +41 79 367 6254 chris.maggos@cohesionbureau.com

Press Caroline Carmagnol ALIZE RP +33 6 64 18 99

59 median@alize.com

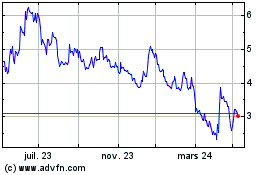

Median Technologies (EU:ALMDT)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

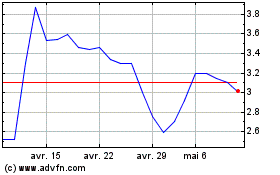

Median Technologies (EU:ALMDT)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025