2024: A record-breaking performance

Paving the way for 2025-2028 strategic roadmap

_PRESS

RELEASE_

- 2024 standard sales of €7.1

billion (current sales of €8.5 billion), up

+8.7% on a reported basis and +5.1%

organically

- Acceleration in Electrification

businesses, up +13.0% organically in 2024, reflecting early-bird

investment and unabated focus on value-added solutions

- Q4 2024 standard sales of €1.9

billion, up +8.3% organically driven by all businesses

- A performance-driven

journey beyond 2024 objectives and “Winds of Change” 2021-2024

Capital Markets Day targets:

- All-time high

adjusted EBITDA of €804 million, up +21.0%

year-on-year, and adjusted EBITDA margin at

11.4%

- Outstanding Normalized free

cash flow at €454 million and 56% normalized cash

conversion

- Outperformance of ROCE in

Electrification businesses at 26.3%

- Record subsea-driven

PWR-Transmission adjusted backlog standing at

€7.4 billion

- Successful deployment of

the Electrification Pure Player strategy: Completion of

the La Triveneta Cavi acquisition, divestment of AmerCable

early 2025, and business separation of Lynxeo within the

Non-electrification business

- Net income at €283

million, up +27% versus 2023

- Strong balance

sheet: net debt at €681 million and 0.85x leverage

ratio

- Attractive return to

shareholders: proposed dividend for 2024 of €2.60 per

share, up +13%

- Initiation of 2025-2028

strategic roadmap “Sparking Electrification with Tech

solutions” with a new Executive Committee and structure to drive

the next chapter forward

- Full-year 2025 guidance

announced

- Adjusted EBITDA of between €770 and

850 million

- Free Cash Flow of between €225 and

325 million

~ ~ ~

Paris, February 19, 2025 –

Today, Nexans, a global leader in the design and manufacturing of

cable systems to power the world, published its financial

statements for the fiscal year 2024, as approved by the Board of

Directors at its meeting on February 18, 2025 chaired by Jean

Mouton. Commenting on the Group’s performance, Christopher Guérin,

Nexans’ Chief Executive Officer, said:

“In 2024, Nexans once again demonstrated its

ability to deliver profitable and sustainable performance in a

dynamic market environment. The Group set a new financial record,

underscoring the success of its structural transformation and

long-term strategic execution.

2024 also marks the successful completion of our 2021-2024

equity story “Winds of Change”, a period in which Nexans

fundamentally transformed into a pure player in electrification. As

we move to our next chapter up to 2028 “Sparking Electrification

with tech solutions”, we are building on this solid foundation with

a renewed ambition: to accelerate our growth, drive innovation, and

lead the energy transition with sustainable and high-value

solutions. Our commitment remains unchanged—creating long-term

value for all our stakeholders. “

2024 KEY FIGURES

|

(in millions of euros) |

2023 |

2024 |

|

Sales at current metal prices |

7,790 |

8,546 |

| Sales

at standard metal prices1 |

6,512 |

7,078 |

|

Reported growth |

-3.5% |

+8.7% |

|

Organic growth |

-0.9% |

+5.1% |

| Adj.

EBITDA |

665 |

804 |

|

Adj. EBITDA as a % of standard sales |

10.2% |

11.4% |

|

Specific operating items |

(53) |

(22) |

|

Depreciation and amortization |

(179) |

(217) |

|

Operating margin |

432 |

566 |

| Reorganization

costs |

(49) |

(62) |

| Other operating

items |

(9) |

10 |

|

Operating income |

374 |

513 |

| Net financial

income (loss) |

(83) |

(116) |

| Income

taxes |

(68) |

(115) |

|

Net income |

223 |

283 |

|

Net debt |

214 |

681 |

| Normalized free

cash-flow |

454 |

454 |

|

ROCE |

20.7% |

21.1% |

2024 BUSINESS PERFORMANCE

Sales at standard metal prices

reached €7,078 million in 2024, demonstrating strong organic growth

of +5.1% at constant scope and currency compared to 2023. Excluding

the Other activities segment, which is being strategically scaled

down, organic growth stood at +8.1%. The Electrification businesses

grew by +13.0% organically, driven largely by the PWR-Transmission

segment's strong growth thanks to capacity expansion at the Halden

plant in Norway. After a double digit organic growth in 2023, the

Non-electrification business proved resilient with a small organic

decline of -2.5%.

In the fourth quarter of 2024, Nexans achieved

remarkable organic growth of +8.3% compared to the fourth quarter

of 2023, and growth of +11.7% excluding the Other activities

segment driven by all business segments. Showcasing the strength of

its core business focus, the Electrification businesses

outperformed with +15.6% organic growth in the fourth quarter of

2024.

Net acquisitions/disposals had an impact on

standard sales of +€219 million reflecting i) the integration of La

Triveneta Cavi into the PWR-Connect segment from June 1, 2024, ii)

the acquisition of Reka Cables since April 2023 bolstering PWR-Grid

and PWR-Connect segments, and iii) the divestment of the Telecom

business since October 2023 in line with Nexans’ vision to become

an Electrification Pure Player.

In the fourth quarter of 2024, Nexans continued

to deliver on the implementation of its strategy to refocus its

activities. The Group announced the execution of an agreement to

sell AmerCable, a leading manufacturer of electrical power, control

and instrumentation cables for harsh environments, for an

enterprise value of US$280 million, which was completed on January

2, 2025. The Group also completed the business separation of its

specialty industrial cable operations formerly Nexans Industry

Solutions & Projects now named Lynxeo.

Adjusted EBITDA reached a

record high of €804 million in 2024, up by a solid +21.0% versus

€665 million in 2023. This strong performance underscored the

profitability enhancements across all business segments. The

adjusted EBITDA margin reached an all-time high of

11.4%, surpassing the previous year's strong performance of 10.2%.

This achievement illustrates the Group’s strategic focus on

operational excellence, selectivity and value-driven growth.

Electrification businesses achieved 12.9% adjusted EBITDA margin,

outperforming the 2023 achievement of a 12.5% margin.

In 2024, specific operating

items amounted to a negative €22 million. They included

€19 million related to share-based payment expenses, and €3

million related to additional costs on long-term projects impacted

by past reorganizations.

EBITDA including share-based

payment expenses - as per the 2021 Capital Markets Day definition

-amounted to €785 million in 2024, versus €652 million in 2023. The

Group’s EBITDA margin stood at 11.1% in 2024, in line with the

Group’s 2021 Capital markets day target of 10%-12%.

ROCE (including the 12-month

contribution of La Triveneta Cavi and AmerCable) pursued its strong

trajectory, reaching 21.1% for the Group, and 26.3% for the

Electrification businesses.

Operating margin totaled €566

million in 2024, representing 8.0% of sales at standard metal

prices (versus 6.6% in 2023).

The Group ended 2024 with operating

income of €513 million, compared with €374 million in

2023. The main changes were as follows:

-

Reorganization costs amounted to €62 million in

2024, compared with €49 million in 2023, partly due to the

transformation of the PWR-Transformation business and business

separation of Lynxeo.

- Other

operating items represented an income of €10 million in

2024, versus an expense of €9 million in 2023, of which:

- The core

exposure effect amounted to a positive €44 million in

2024, versus a negative €12 million in 2023, reflecting the

increase in copper prices over the year.

-

Acquisition-related costs of €22 million in 2024,

mainly related to the acquisition of La Triveneta Cavi. In

2023, acquisition-related costs of €10 million were mainly related

to the acquisition of Reka Cables in Finland.

The net financial expense

amounted to €116 million in 2024, compared with €83 million

during the same period last year. The increase primarily reflects

the successful issue of two bonds, a €575 million bond

maturing in 2029 and a €350 million bond maturing in 2030, as well

as negative foreign exchange impacts.

Income tax expense stood at

€115 million, up from €68 million in 2023. The tax rate

amounted to 29% of income before tax in 2024.

Net income amounted to a record

€283 million in 2024, versus €223 million in 2023, up

+26.6%, representing €6.39 per share.

CASH FLOW AND NET DEBT AT DECEMBER 31,

2024

Normalized free cash flow stood

at €454 million in 2024, reflecting the Group’s solid operating

performance. Calculated based on normalized free cash flow, the

adjusted EBITDA to cash conversion rate was

56%.

Cash from operations was a

strong €670 million in 2024, versus €511 million in 2023.

Change in working capital amounted to €178

million, versus €287 million in 2023 which was supported by the

positive impact of cash collection in the PWR-Transmission segment

and sustained efforts on inventory reduction. Thus, operating

working capital represented 0.5% of the Group’s annualized

full year sales at December 31, 2024 (0.3% at December 31, 2023),

well below its normative level of ≤6%. Normalized free cash flow

also included a negative reorganization cash impact of €72 million

in 2024, versus a negative €98 million in 2023.

Recurring capital expenditure

amounted to €257 million in 2024, representing 3.6% of Group’s

standard sales. Normalized free cash flow included financial

interest for €88 million, versus €73 million in 2023, and

other investing impacts for a positive €4 million, versus a

negative €16 million in 2023.

Free cash flow before M&A and equity

operations was €313 million in 2024, versus €234 million

in 2023, and included strategic capital

expenditure in the PWR-Transmission business for

€121 million, corresponding mainly to the ongoing investment

in a third cable-laying vessel, and to the finalization of the

expansion of the Halden plant in Norway. The other differing items

between Normalized free cash flow and Free cash flow before M&A

corresponded to normative project tax cash-out for €19 million (€28

million in 2023).

Net cash flow from M&A

amounted to a net outflow of €532 million in 2024, primarily

related to the acquisition of La Triveneta Cavi in June. In 2023,

this figure was a net outflow of €79 million related to the

acquisition of Reka Cables.

Equity operations represented a

net outflow of €164 million including the payment of the 2023

dividend of €2.30 per share for a total amount of €102 million, and

share buybacks for €33 million. There was a net outflow of €9

million related to unfavorable foreign exchange fluctuations and

new lease liabilities.

Net debt increased to €681

million at December 31, 2024, from €214 million at December 31,

2023, representing a 0.85x leverage ratio (net debt / adjusted

EBITDA) and 0.95x leverage ratio as per the covenant

definition2.

The Board of Directors resolved to propose to

the Annual General Meeting of May 15, 2025, a dividend

payment of €2.60 per share in respect of 2024, resulting

in a +13% increase versus the prior year, progressively increasing

the dividend as a mark of its confidence in the Group’s

prospects.

SUSTAINABILITY

As a leader in electrification, Nexans is

dedicated to shaping the future of its industry while prioritizing

sustainability and safety throughout its operations. The Group

unveiled its 2028 Environment, Social and Governance roadmap up to

2028 at its Capital Markets Day. Significant progress was achieved

in 2024:

-

Decarbonization initiatives yielding positive

results: 38% reduction in Scope 1 & 2 GHG emissions

(42% reduction target in 2028) and 40% reduction in Scope 3 GHG

emissions (30% reduction target in 2028);

- Circular

economy as a key strategic focus: copper recycled content

reached 21% in 2024 (25% target in 2028);

- Gender

diversity in graded positions at the core of human resources

strategy: 16% of women in senior management in 2024 (30%

target in 2028);

- Employee

engagement at the heart of Nexans’ performance: a

continuous Engagement Rate improvement since 2021, reaching 78% in

2024 (≥78% target in 2028);

- Ethical

business practices fully embraced: 100% completion rate of

compliance awareness training achieved in 2024.

Nexans’ environmental performance continued to

be recognized by leading non-financial rating agencies, positioning

the Group among the top performers in its industry. Nexans has

maintained a high CDP Climate rating of A- and, in its first year

of water-related scoring, achieved a strong B rating. Moreover, the

Group’s Ecovadis score was in the upper part of the Top 5% for

2024. These results underscore Nexans’ unwavering commitment to

sustainability as a core pillar of its strategy.

2024 PERFORMANCE BY SEGMENT

|

PWR-TRANSMISSION (18% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

2023 |

2024 |

Q4 2024 |

|

Sales at standard metal prices |

870 |

1,287 |

389 |

| Organic

growth |

+0.8% |

+50.3% |

+41.9% |

| Reported

growth |

-9.2% |

+47.9% |

+40.3% |

|

Adjusted EBITDA |

83 |

142 |

|

|

Adjusted EBITDA as a % of standard sales |

9.5% |

11.0% |

|

PWR-Transmission standard sales

came in at €1,287 million in 2024, up +50.3% organically compared

to 2023, boosted by the completion of the Halden, Norway, plant

capacity expansion at the beginning of the year, which doubled XLPE

technology capacities. In the fourth quarter of 2024, Nexans

achieved organic growth of +41.9% compared to the fourth quarter of

2023.

The segment’s adjusted

EBITDA reached €142 million in 2024, up

+72.3% compared to the same period last year. The adjusted EBITDA

margin showcased a significant increase to 11.0% in 2024, versus

9.5% in 2023. As expected, the margin upturn throughout the year

was supported notably by Revolution Wind successful installation

campaign, Inspection Maintenance and Repair (IMR) projects as well

as continued execution of the Great Sea Interconnector project.

Customer activity remained dynamic, and in line

with the Group’s risk-reward selectivity approach, the segment’s

adjusted backlog reached €7.4 billion at December

31, 2024, up +21.4% compared to December 31, 2023. The

strong order intake was notably fueled by a substantial contract

for the Gotland electricity connection project, an important

contract for East Anglia TWO offshore wind project in the southern

North Sea, and the LanWin 2 final award as part of the

frame-agreement with TenneT for around €1 billion. This record-high

adjusted backlog is more than 90% subsea-driven (subsea

interconnection and offshore wind projects) and provides multi-year

visibility with around 90% of the topline of the business secured

for the 2024-2028 period.

The robust visibility of manufacturing and

installation asset loads has been extended through 2030, with both

Charleston and Halden plants more than 90% loaded up to 2028.

Construction of Nexans’ third cable-laying vessel, Nexans Electra,

is on-track and will be completed in 2026. This state-of-the-art

vessel is a strategic asset that will significantly enhance

capacity to address the substantial growth in the business’

backlog. The Group also unveiled a strategic €90 million investment

at its facilities in France and Belgium to increase the production

of advanced 525kV onshore cables meeting the requirements of the

TenneT frame agreement.

| PWG-GRID

(18% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

2023 |

2024 |

Q4 2024 |

|

Sales at standard metal prices |

1,186 |

1,243 |

320 |

| Organic

growth |

+4.5% |

+3.1% |

+7.6% |

| Reported

growth |

+9.0% |

+4.8% |

+7.7% |

|

Adjusted EBITDA |

156 |

170 |

|

|

Adjusted EBITDA as a % of standard sales |

13.2% |

13.6% |

|

Standard sales in the PWR-Grid

segment rose organically by +3.1% compared with 2023 to

€1,243 million. Fourth quarter 2024, saw strong organic sales

growth of +7.6% compared to the same quarter last year. Europe

benefited from increased demand and the securing of new

frame-agreements. The Middle East and Africa region was boosted by

renewable energy projects. North America was stable with a good

second half, while South America encountered some project delays.

The Accessories business was a solid contributor throughout the

year.

Adjusted EBITDA rose by a sharp

+9.0% year-on-year to €170 million supported by selectivity on new

frame-agreements, operational excellence and the contribution of

the Reka Cables acquisition completed in April 2023. The

adjusted EBITDA margin reached an unprecedented

13.6% in 2024 compared with 13.2% in 2023, reflecting selective

growth and successful business transformation.

| PWR-CONNECT

(29% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

2023 |

2024 |

Q4 2024 |

|

Sales at standard metal prices |

1,679 |

2,073 |

551 |

| Organic

growth |

-6.3% |

+1.4% |

+4.2% |

| Reported

growth |

-8.6% |

+23.5% |

+40.2% |

|

Adjusted EBITDA |

229 |

283 |

|

|

Adjusted EBITDA as a % of standard sales |

13.6 % |

13.7% |

|

Standard sales in the

PWR-Connect segment amounted to €2,073 million in 2024, up +1.4%

organically. Europe suffered from lower demand in some residential

markets, despite sustained momentum in commercial and

infrastructure segments. Near East & Africa and South America

remained very strong while North America (Canada) rebounded in the

second half of the year. In fourth-quarter 2024, Nexans achieved

organic growth of +4.2% compared to fourth quarter 2023 and +0.5%

compared to the third quarter of 2024.

The 2024 figures reflect the contributions of La

Triveneta Cavi, starting from June 1, 2024, and Reka Cables, since

April 2023. These acquisitions are integral to Nexans'

Electrification strategy, expanding the Group’s capabilities and

reinforcing its market position in key regions.

Adjusted EBITDA reached €283

million in 2024, up +23.8% year-on-year. Adjusted EBITDA

margin was a robust 13.7%, thanks to structural

performance improvement initiatives, selectivity and value-added

solutions.

| NON-ELECTRIFICATION

(Industry & Solutions) (24% OF TOTAL STANDARD

SALES)

|

(in millions of euros) |

2023 |

2024 |

Q4 2024 |

|

Sales at standard metal prices |

1,750 |

1,701 |

406 |

| Organic

growth |

+13.7% |

-2.5% |

+2.1% |

| Reported

growth |

+12.3% |

-2.8% |

+1.9% |

|

Adjusted EBITDA |

185 |

207 |

|

|

Adjusted EBITDA as a % of standard sales |

10.6% |

12.2% |

|

In the Industry & Solutions segment,

standard sales for 2024 amounted to €1,701

million, reflecting a low organic decrease of -2.5% year-on-year,

while fourth-quarter 2024, up +2.1% compared to fourth-quarter

2023.

The performance reflects a slowdown in the

Automation market in Europe, which was partially offset by a stable

Shipbuilding, Rollingstock and Nuclear business. The Auto-harnesses

business was stable during the year.

Adjusted EBITDA for the segment

increased by +11.9% and reached €207 million, resulting in an

adjusted EBITDA margin of 12.2% in 2024, compared to 10.6% the

previous year. This improvement reflected a positive mix and

pricing effect resulting from the successful transformation of the

business.

| OTHER

ACTIVITIES (11% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

2023 |

2024 |

Q4 2024 |

|

Sales at standard metal prices |

1,026 |

774 |

186 |

| Organic

growth |

-17.9% |

-14.4% |

-14.9% |

| Reported

growth |

-21.2% |

-24.5% |

-17.3% |

|

Adjusted EBITDA |

13 |

2 |

|

The Other activities segment –

corresponding for the most part to copper wire sales and corporate

costs that cannot be allocated to other segments – reported

standard sales of €774 million in 2024. Standard

sales were down -14.4% organically year-on-year, mainly linked to

the Group’s strategy to reduce copper wire external sales through

tolling agreements in order to mitigate their dilutive effect.

The segment’s adjusted

EBITDA decreased to €2 million in 2024, versus

€13 million in 2023, reflecting notably temporary higher

corporate costs related to the business separation of Lynxeo.

2025 OUTLOOK In

2025, following the divestment of AmerCable in January 2025 and in

line with the new 2025-2028 strategic roadmap unveiled in November

2024, Nexans expects to achieve, excluding non-closed acquisitions

or divestments:

- Adjusted EBITDA of between €770 and

850 million

- Free Cash Flow of between €225 and

325 million

SIGNIFICANT EVENTS SINCE THE END OF

DECEMBER

January 2, 2025 – Nexans

announced the completion of the sale of AmerCable, a leading

manufacturer of electrical power, control and instrumentation

cables for harsh environments, to Mattr, for an enterprise value of

US$280 million.

The 2024 press release and presentation slides

are available in the Investor Relations Results section at Nexans -

Financial results.

A conference call is scheduled today at 9:00

a.m. CEST. Please find below the access details:

Webcast

https://channel.royalcast.com/landingpage/nexans/20250219_1/

Sell-side analysts wishing to participate to the

Q&A session at the end of the conference need to pre-register

to receive connection details (dial-in numbers and passcode) by

email.

~ ~ ~

FINANCIAL CALENDARApril 30,

2025:

Q1

2025 financial informationMay 15,

2025: Annual

General MeetingJuly 30, 2025:

Half-year

2025 earningsOctober 23, 2025:

Q3 2025 financial

information

About Nexans

For over a century, Nexans has played a crucial

role in the electrification of the planet and is committed to

electrifying the future. With approximately 28,500 people in 41

countries, the Group is paving the way to a new world of safe,

sustainable and decarbonized electricity that is accessible to

everyone. In 2024, Nexans generated €7.1 billion in standard sales.

The Group is a leader in the design and manufacturing of cable

systems and services across four main business areas:

PWR-Transmission, PWR-Grid, PWR-Connect and Industry &

Solutions. Nexans was the first company in its industry to create a

Foundation supporting sustainable initiatives, bringing access to

energy to disadvantaged communities worldwide. The Group is

recognized on the CDP Climate Change A List as a global leader on

climate action and has committed to Net-Zero emissions by 2050

aligned with the Science Based Targets initiative (SBTi).

Nexans. Electrify the Future.

Nexans is listed on Euronext Paris, compartment

A.For more information, please visit

www.nexans.com

Contacts

|

Investor relations |

Communication |

|

Audrey BourgeoisTel.: +33 (0)1 78 15 00

43audrey.bourgeois@nexans.com |

Mael Evin (Havas Paris)Tel.: +33 (0)6 44 12 14

91mael.evin@havas.com |

- Nexans_Full-year 2024 earnings Press release

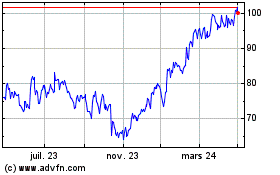

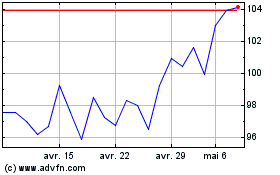

Nexans (EU:NEX)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Nexans (EU:NEX)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025