2023 full year results: Solid EBITDA recovery and deleveraging to

continue in 2024

- Full year adj. EBITDA [1] of €174M, up 67%, marking 6

consecutive quarters of improvement, supported by 10% LFL revenue

[1] growth and margin improvement of 3.5pp to reach 9.7%, with cost

transformation program delivering 5% operating savings for the 2nd

consecutive year;

- Strong cash flow generation, allowing for self-funded

55% capex increase to invest in the Group’s transformation, and

resulting in positive FCF after financing [2] of €9M;

- Basic EPS at €0.43 per share representing a significant

turnaround since 2020;

- Leverage nearly halved over the year from 6.4 times to

3.3 times;

- 2024 revenue [1] expected to grow by low single-digit

LFL, adj. EBITDA [1] margin to increase to 11%-12%, and FCF after

financing [2] to improve further, resulting in debt leverage

reduction to below 3.0 times by year end.

CEO quote

Gustavo Calvo Paz, Ontex’s CEO, said “We

accelerated our 3-year transformation plan over the past year and I

am very pleased with the excellent momentum achieved and the

encouraging results delivered in 2023. The solid level of activity,

and continued delivery on the cost transformation program, all

contributed to positive EPS and free cashflow for the first time in

several years. This marks a major milestone for the Group, and is a

huge credit to the Ontex team to deliver on our commitments. The

solid improvement in our financial performance and cashflow

generation allowed us to ramp up our investments for future growth,

innovation and further efficiency gains. Our momentum puts us well

on track to restoring value creation for all our stakeholders, whom

I would like to thank for their support as we continue our

journey.”

FY results

- Revenue [1] totaled €1,795 million, a 10% like-for-like

improvement, driven by a 9% price increase. The strategic

rebalancing of the portfolio led to double digit growth in selected

categories, while overall volumes remained stable. Including a 2%

adverse forex effect, revenue was up 7% year on year.

- Adjusted EBITDA [1] increased to €174 million, up 67%,

thanks to volume mix improvement of €5 million and the cost

transformation program delivering €72 million, which reduced the

operating cost base by 5% for a second consecutive year. The €156

million pricing nearly offset additional input costs, SG&A

inflation and the €43 million adverse forex impact. The adjusted

EBITDA margin rose to 9.7%, up 3.5pp. After deduction of €(71)

million depreciation and €(15) million restructuring costs, the

operating profit recovered to €88 million, compared to a loss of

€(69) million a year ago.

- Total Group revenue was €2,342 million, up 10% like for

like, including €547 million from the discontinued Emerging

Markets. These were up 11% like for like, excluding adverse forex

and adjusting for the Mexican business activities divested in May.

Strong pricing more than offset a slight volume and mix reduction.

Total Group adjusted EBITDA was €223 million, up 65% year on year.

Emerging Markets contributed €49 million, with a positive impact

from volume mix, strong pricing and operating efficiency gains more

than offsetting input cost and SG&A inflation.

- Profit for the year was €35 million, €27 million from

continuing operations and €8 million from discontinued operations.

Basic earnings per share thereby turned positive at €0.43.

- Free cash flow after financing [2] turned positive at €9

million, compared to €(115) million in 2022, with EBITDA growth

allowing to finance further investments in the Group’s

transformation, with capex of €96 million, up 55%, and €36 million

working capital increase over the year.

- Net financial debt reduced by 23% over the year to €665

million, including the net proceeds received from the divestment of

the Mexican activities. The adjusted EBITDA improvement drove the

leverage ratio down from 6.4 times at the start of the year to 3.3

times at the end.

Q4 results

- Revenue [1] was €446 million, stable like for

like. Prices came down slightly since the second quarter,

reflecting decreased raw material costs. Year on year, however,

prices were still up 3%. Although volumes, including mix effects,

were 3% down compared to a strong last quarter of 2022, growth in

selected categories continued. Overall revenue came in lower at 3%

on adverse forex.

- Adjusted EBITDA [1] was €47 million, up 16% year

on year and 7% quarter on quarter, driven by continued delivery on

the cost transformation program for €17 million. The €14 million

higher prices nearly compensated for adverse forex and cost

inflation. Raw materials price decreases had a positive impact of

€8 million, but were more than offset by the inflation of other

operating costs of €13 million and SG&A costs of €7 million.

Forex fluctuations had a €9 million adverse impact. The adjusted

EBITDA margin recovered to 10.4%, up 1.7pp year on year, and up

0.9pp quarter on quarter. After deduction of €(4) million

restructuring costs, and €(19) million depreciation, the operating

profit was €23 million.

- Total Group revenue was €545 million, stable like for

like versus 2022, and includes €99 million from the discontinued

Emerging Markets. These were up 2% like for like, as pricing more

than offset a slight volume and mix reduction. Total Group adjusted

EBITDA was €58 million, up 14% year on year, and stable quarter on

quarter. Emerging Markets contributed €12 million, up 8%, with a

positive impact from volume mix, pricing and operating efficiency.

Lower raw material costs more than offset further other operating

cost inflation.

Outlook

Based on solid delivery in 2023, as well as the

building blocks put in place to further support the Group’s

structural transformation, Ontex’s management is confident to

continue the Group’s profitability restoration in 2024 and

expects:

- Revenue [1] to grow by low single-digit like

for like, supported by strong double-digit growth in North

America, while managing prices in function of input costs and

market dynamics;

- Adjusted EBITDA margin [1] to improve to within a

range of 11% to 12%, based on continued delivery of the cost

transformation program;

- Further progress on divesting the remaining discontinued

operations of Emerging Markets activities, which meanwhile

are to contribute positively to adjusted EBITDA and free cash

flow;

- Free cash flow after financing [2] to improve further

above €9 million in 2023, while self-funding the accelerated Group

transformation through investments, which are anticipated to be in

excess of 6% of revenue in Core Markets;

- Leverage ratio to reduce further by year end to below

3.0 times the adjusted EBITDA of the last twelve months.

[1] Reported P&L figures, except for profit, represent

continuing operations, i.e. Core Markets, only. As from 2022,

Emerging Markets, are reported as discontinued operations,

following the strategic decision to divest these businesses.

[2] The free cash flow definition used, i.e. free cash

flow after financing, differs from the previous one, i.e. free cash

flow before financing. It encompasses free cash flow from the total

Group. The exact definition can be found further in the financial

notes to this document.

Unless otherwise indicated, all

comments in this document are on a year-on-year basis and for

revenue specifically on a like-for-like (LFL) basis (at constant

currencies and scope and excluding hyperinflation effects).

Definitions of Alternative Performance Measures (APMs) in this

document can be found further down in the financial notes to this

document.

Key full year & Q4 2023 figures

Business results

|

Business results |

Fourth Quarter |

Full Year |

|

in € million |

2023 |

2022 |

% |

% LFL |

2023 |

2022 |

% |

% LFL |

| Core Markets

(continuing operations) |

| Revenue |

446.0 |

459.8 |

-3% |

+0% |

1,794.7 |

1,672.2 |

+7% |

+10% |

|

Baby Care |

191.2 |

216.4 |

-12% |

-9% |

790.0 |

765.0 |

+3% |

+5% |

|

Adult Care |

191.5 |

176.3 |

+9% |

+13% |

736.4 |

653.6 |

+13% |

+16% |

|

Feminine Care |

57.3 |

59.7 |

-4% |

-3% |

241.3 |

222.0 |

+9% |

+9% |

| Adj. EBITDA |

46.5 |

40.3 |

+16% |

|

173.9 |

104.0 |

+67% |

|

|

Adj. EBITDA margin |

10.4% |

8.8% |

+1.7pp |

|

9.7% |

6.2% |

+3.5pp |

|

| Operating

profit/(loss) |

23.5 |

11.7 |

+101% |

|

88.3 |

(69.4) |

+227% |

|

| Emerging

Markets (discontinued operations) [1] |

|

Revenue |

98.7 |

214.8 |

-54% |

+2% |

546.8 |

792.3 |

-31% |

+11% |

| Adj. EBITDA |

11.8 |

11.0 |

+8% |

|

49.4 |

31.7 |

+56% |

|

|

Adj. EBITDA margin |

12.0% |

5.1% |

+6.9pp |

|

9.0% |

4.0% |

+5.0pp |

|

| Operating

profit/(loss) |

12.8 |

(42.3) |

+130% |

|

22.3 |

(90.9) |

+125% |

|

| Total Group

[1] |

|

Revenue |

544.7 |

674.6 |

-19% |

+0% |

2,341.5 |

2,464.5 |

-5% |

+10% |

| Adj. EBITDA |

58.3 |

51.2 |

+14% |

|

223.3 |

135.7 |

+65% |

|

|

Adj. EBITDA margin |

10.7% |

7.6% |

+3.1pp |

|

9.5% |

5.5% |

+4.0pp |

|

| Operating

profit/(loss) |

36.2 |

(30.6) |

+218% |

|

110.6 |

(160.3) |

+169% |

|

Financial results

|

Financial results |

|

|

|

|

|

Full Year |

|

in € million |

|

|

|

|

|

2023 |

2022 |

% |

|

| Profit/(loss) for the period

from continuing operations |

26.9 |

(148.7) |

+118% |

|

|

Profit/(loss) for the period from discontinued operations |

7.9 |

(121.6) |

+106% |

|

| Profit/(Loss) for the

period |

34.8 |

(270.3) |

+113% |

|

|

Basic EPS (in €) |

0.43 |

(3.34) |

+113% |

|

|

Capex |

(96.5) |

(62.4) |

-55% |

|

| Free cash flow after

financing |

9.1 |

(115.5) |

+108% |

|

| Net financial debt

[2] |

665.3 |

867.4 |

-23% |

|

|

Leverage ratio [2] |

3.3x |

6.4x |

-3.1x |

|

Core Markets (continuing operations) year on year

evolution

| Revenue |

|

|

|

2022 |

Vol/ |

Price |

2023 |

Forex |

2023 |

| in € million |

|

mix |

|

LFL |

|

|

| Fourth Quarter |

459.8 |

-13.6 |

+13.8 |

460.0 |

-14.1 |

446.0 |

| Full Year |

1,672.2 |

+5.4 |

+156.1 |

1,833.7 |

-39.0 |

1,794.7 |

|

Adj. EBITDA |

2022 |

Vol/ |

Raw |

Operating |

Operating |

SG&A/ |

Forex |

2023 |

| in € million |

|

mix/price |

materials |

costs |

savings |

Other |

|

|

| Fourth

Quarter |

|

40.3 |

+11.4 |

+7.5 |

-13.3 |

+16.8 |

-6.9 |

-9.3 |

46.5 |

| Full

Year |

|

104.0 |

+161.5 |

-66.7 |

-44.5 |

+72.3 |

-9.8 |

-42.9 |

173.9 |

[1] Emerging Markets and Total Group year-on-year

comparison is affected by the divestment of the Mexican business

activities as of May 2023. The LFL comparison is corrected for this

scope reduction.

[2] Balance sheet data are compared to start of the

period, i.e. December 2023 versus December 2022.

Full year 2023 business review of continuing

operations

Revenue of Core Markets

Revenue was €1,795 million, a 10%

like-for-like improvement, driven by price increases across all

categories. In a generally lower market, volumes were stable and

grew in selected categories, such as pants. In adult care revenue

growth was 16% like for like, with strong growth in the healthcare

channel. Baby care revenue grew 5% like for like and feminine care

9%, both on pricing. Including the adverse forex effect, revenue

was up 7%.

Volume and mix was overall

stable. In Europe, lower overall demand for baby care was offset by

retail brand share gains, owing to consumers shifting to better

value-for-money alternatives. In feminine care market share gains

by retailer brands led to growth, whereas the overall demand was

slightly down. Demand for adult care products continued to grow,

both for branded products and for retail brands. Ontex European

sales volumes were overall in line with the retail brand trends,

but outperformed in baby pants, and realized strong growth in the

healthcare channel. In North America demand for retail brands

decreased more than the overall market. Ontex sales volumes in

North America were in line with the market, as new contract gains

in the second half offset softer sales in the first half, which was

subject to some customer destocking.

Prices were up 9% on average, a

strong increase visible across categories and especially in the

healthcare channel, where the ramp-up in 2022 was slower. The

majority of the year-on-year price increase in 2023 is the effect

of the price roll-out in 2022 to mitigate the impact of the huge

increase in raw material and other input costs. In the first half

of 2023, prices still rose sequentially, but they started to

decrease slightly in the second half, reflecting decreasing raw

material prices. Combined over the last two years this represents

an overall increase of 18%.

Forex fluctuations had a

negative impact of 2%, linked to the devaluation of the Russian

ruble, the US and the Australian dollar, as well as the British

pound.

Adjusted EBITDA of Core Markets

Adjusted EBITDA increased to €174

million, up 67%, driven by volume mix improvement and consistent

solid delivery of the cost transformation program. Overall, pricing

nearly offset the additional input and SG&A cost inflation, and

the adverse forex impact. The adjusted EBITDA margin rose to 9.7%,

up 3.5pp.

While volume and mix had no significant

net impact on revenue, the growth in selected categories led to an

improvement of the product mix, resulting in a €5 million positive

impact.

The cost transformation program delivered

€72 million in gross savings, 30% more, maintaining a yearly

reduction rate of the operational cost base by some 5%, excluding

volume and cost price effects, for the second consecutive year.

Cost inflation weighed heavily on the

year-on-year comparison, with a negative impact of €67 million from

raw materials, mostly higher fluff prices and to a lesser extent

super-absorbent polymers. These fluff prices increased

significantly at the start of the year and only gradually came down

in the second half. Other operating costs were €44 million higher,

reflecting wage inflation as well as increased distribution, energy

and maintenance costs. Although the year-on-year increase slowed

down in the second half of the year, the operating cost base went

up by close to 8% versus 2022. SG&A costs were kept below 10%

of revenue, despite wage inflation.

Strong pricing contributed €156 million

year on year. Over the last two years pricing contributed €270

million. While this increase is substantial, it was not sufficient

to compensate the cumulative cost inflation incurred since the

start of the inflation wave in 2021.

Forex fluctuations had a €43 million net

negative impact. The currency depreciation impact on revenue was

exacerbated by a negative impact on costs, with a.o. the

appreciation of the Mexican peso affecting production costs in

North America. Although the US dollar depreciated versus last year,

which benefits the net cost exposure, the hedging over a longer

period of time led to a net negative impact.

Q4 2023 business review of continuing operations

Revenue of Core Markets

Revenue was €446 million, stable like for

like. While the year-on-year price increase reduced, in line with

lower input costs, it retained a positive impact, offsetting

slightly lower volumes. Baby care revenue was down 9% and feminine

care down 3% like for like, compared to a high comparable in 2022.

Adult care sales continued to grow strongly by 13% like for like,

both on volume and on price. Overall revenue came in lower at 3%

due to adverse forex.

Volume and mix impacted revenue

negatively by 3%, compared to a strong last quarter of 2022 when

promotional activities in Europe boosted baby care sales in

December, and phasing by certain customers in North America drove

orders for baby and feminine care up temporarily. This reduction

was partly offset by continued growth in selected product

categories and in adult healthcare channels.

Prices were up 3% on average versus last

year. While prices have been coming down slightly since the second

quarter, managed in function of sequentially decreasing raw

material costs, year on year they retained a positive impact.

Forex fluctuations continued to have a

negative impact, albeit less pronounced than in the third quarter,

mainly from the year-on-year weakening of the Russian ruble, the US

and the Australian dollar .

Adjusted EBITDA of Core Markets

Adjusted EBITDA of Core Markets was €47

million, up 16% year on year and 7% quarter on quarter, marking six

consecutive quarters of sequential growth. Continued delivery on

the cost transformation program more than compensated for the

slower volumes. Higher prices nearly offset cost inflation, which

still has a negative impact overall year on year. The adjusted

EBITDA margin thereby recovered to 10.4%, up 1.7pp year on year,

and up 0.9pp quarter on quarter. Forex fluctuations had a negative

impact.

Lower volumes were partly

offset by the mix improvement, leading to an overall €2 million

reduction.

The cost transformation program

contributed €17 million in gross savings, mostly in procurement,

thanks to the qualification of alternative sources.

Cost inflation continued to have a

negative impact overall. While the sequential raw material price

decrease resulted in a positive year-on-year impact for the first

time since 2021, with fluff prices still up, but more than offset

by a price reduction for other raw materials. Distribution and

maintenance costs as well as wages were still up year on year,

however. The total operating cost base went up by 2% versus the

fourth quarter of 2022. SG&A costs were up significantly as

result of wage inflation, some exceptional elements and cost

phasing affecting the last quarter of the year.

Forex fluctuations had a €9 million

negative net impact, with the weakening effect of foreign

currencies on revenue was exacerbated by transactional impacts.

Full year 2023 operational review

Operations

The cost transformation program delivered €91

million gross savings, of which €72 million in Core Markets

represent a 30% increase versus 2022. These initiatives allowed to

reduce raw materials and operating costs, prior to volume and

inflation effects, by 5.1%, in line with 4.9% in 2022. Besides the

optimization of the manufacturing footprint, continuous focus on

operational efficiencies led to a further reduction of the scrap

rate and Overall Equipment Efficiency (OEE) improvement. Service

levels also improved from the 2022 level.

Ontex continues to invest in its operations,

with €96 million for the Total Group for 2023, or 4.1% of revenue,

ramping up to 4.7% in the second half, and more than 5% for Core

Markets only. This is significantly above 2.5% in 2022 and

Ontex’s depreciation [1] to revenue ratio of some 3%.

The vast majority is invested in Core Markets, with about 70%

in operational efficiency improvement projects and in business

expansion. These investments included new production lines for

pants and adult care, adding capacity in North America and

improving the offer in Europe.

Innovation

Innovation represented some €19 million in

operational and capital expenditure in 2023, mostly in Core

Markets, with several new products developed or launched in the

year. All Ontex’s innovation is thoroughly tested with consumers,

to guarantee that new solutions offered to customers are comparable

to leading brand standards.

Building on the successful introduction of the

HappyFit™ baby pant platform, the Splashy® swim pants were rolled

out in baby care, and the DreamShield® back pocket for triple

leakage protection was developed. In Feminine care the newest

development is focused on liners, with the breathable, thin and

flexible ConfiDaily™. In tampons the SatinSense® cover for smoother

insertion and removal was launched. In the growing adult care

category, the new adult pants’ X-Core™ technology was rolled out in

light incontinence which combines higher performance and comfort

with affordability.

Sustainability [2]

Ontex further reduced its Scope 1 and Scope 2

emissions, by some 6% versus 2022. The 54% reduction compared to

the base year 2020 brings it closer to its Science-Based Target of

80% by 2030. Ontex commits to achieving carbon-neutrality 2030,

through energy savings, on-site renewable energy production,

purchasing energy from renewable sources and carbon offsets for the

remaining 20%. Ontex also aims to cut the emissions of its global

supply chain and introduced a Science-Based Target for Scope 3

emissions. About 5% reduction was achieved year on year by working

together with suppliers to create transparency on the carbon

intensity of raw materials. This brings Ontex back on track to

reduce emissions by 25% by 2030 versus 2020. Ontex's efforts have

been externally recognized, including recently with an A- score for

leadership in corporate transparency and performance on climate

change. Ontex received the score in early 2024 from the global

environmental non-profit organization Carbon Disclosure Project

(CDP).

Ontex takes the safety of its employees at

heart. In 2023 the frequency rate was 3.52 lost work day cases per

million worked hours, which is a 7% improvement versus 2022, and

35% compared to the base year 2020, by focusing on machine risk

reduction, behaviours and leadership awareness. Ontex strives to

reduce the number of accidents further down year after year to

eventually reach its ultimate ambition to a zero harm

workplace.

[1] Depreciation adjusted for depreciation of right-of-use

assets, as lease payments are not included in capex either.

[2] Preliminary unaudited figures for 2023

Full year 2023 financial review

P&L

Depreciation was stable at €(71) million,

reflecting continued investments offset by positive forex

effects.

EBITDA adjustments were made for €(15)

million. These adjust primarily for restructuring costs and a €(5)

million impairment related to the further optimization of the

European operations and business. This compares to EBITDA

adjustments made for €(103) million in 2022, when significant

impairments were taken on the Russian assets.

The net finance cost was €(45) million,

€6 million better than in 2022. The surge in interest rates only

had a smaller impact, as the majority of Ontex’s debt consists of

the fixed rate bond, and the overall indebtedness was reduced in

the second quarter. Currency effects had a positive impact.

The income tax was €(16) million,

compared to €(28) million a year ago. While the deducted effective

tax rate of 38% remains relatively high, it is impacted by the

geographical mix of earnings and conservative treatment for the

recognition of deferred tax assets in respect of certain

losses.

Discontinued operations contributed the

€8 million in profit for the year, compared to a €(122) million

loss a year ago, when significant impairments were taken. The

adjusted EBITDA from these activities was €49 million. The Mexican

business activities contributed for 4 months before being divested

in May. The remaining activities in Brazil and the Middle East

improved significantly through the year and versus 2022. A better

volume mix, strong pricing and operating efficiency gains more than

offset input cost and SG&A inflation. EBITDA adjustments were

made for €(27) million, mainly for an impairment of €(13) million

on the Middle Eastern assets and €(11) million costs related to the

divestment of the Mexican assets. Taxes were lower, at €(6)

million, as the scope reduced. Financial charges were €(9) million,

reflecting hyperinflation in Turkey, which impacted the total

profit contribution by €(8) million.

The profit for the year of the Total

Group was €35 million, compared to the €(270) million loss a year

before, when the profitability was lower and significant

impairments were taken in continuing and discontinued operations.

Basic earnings per share of the Total Group were €0.43, compared to

€(3.34) in 2022.

Cash flow

Capital expenditure was €(96) million,

representing 4.1% of the Total Group revenue, compared to 2.5% in

2022, with an acceleration in the second half of the year reaching

4.7%, accelerating investments in the North American business

expansion and the further implementation of the cost transformation

program.

Free cash flow after financing was €9

million, compared to €(115) million in 2022. Cash generation from

the strongly improved adjusted EBITDA allowed to fund the increased

capital expenditure, €(25) million lease payments, €(36) million

working capital needs and €(18) million cash-out for restructuring

and divestment-related cash costs. The sale of some obsolete assets

contributed €16 million. Cash taxes were €(21) million and the

financing cash-out totaled €(46) million, consisting mainly of the

net interest payments. Realized forex gains on financing activities

offset hedging costs as well as transaction costs related to the

renegotiated revolving credit facility.

Balance sheet

Working capital for the Total Group at

the end of the year was €164 million, a €13 million decrease versus

the end of 2022, largely linked to the exit of the Mexican

activities. Working capital needs in the remaining operations

increased. Receivables increased as a result of higher sales prices

and lower factoring activity. Factoring amounted to €164 million,

€28 million lower than at the year start, partly linked to the

divestment of the Mexican activities. Payables decreased with lower

raw material prices, as did inventories, but the latter was not

enough to compensate the working capital increase, partly as the

on-going effort to harmonize the supply chain temporarily limits

the implementation of working capital efficiencies.

Net financial debt of the Total Group was

€665 million at the end of the period, including lease liabilities

of €133 million. The decrease from €867 million at the start of the

year is entirely attributable to the divestment of the Mexican

business activities early May. Net proceeds of €200 million were

received from the acquirer, net of all transaction costs and

post-closing adjustments, as well as net of cash remaining in the

business. Deferred proceeds of €29 million, booked as non-current

receivables, are still due within the next five years.

The leverage ratio of the Total Group at

the end of the period was 3.3 times the adjusted EBITDA of the last

twelve months, which now excludes the Mexican business

contribution. The improvement compared to 6.4 times at the year

start, is based on the significant increase of the adjusted EBITDA,

and leaves sufficient headroom versus the maintenance covenants

applicable to the revolving credit facility.

The gross financial debt of the Total

Group reduced from €1,076 million to €834 million, following the

repayment of the €220 million term loan in the second quarter. The

gross debt excludes €168 million of cash and cash equivalents, and

consists of the €580 million bond at fixed 3.5% rate maturing in

July 2026, of €133 million of lease liabilities, and of €115

million drawn on the revolving credit facility. More information on

that facility, which was extended to December 2025, can be found in

the financial notes.

As from 2022, the Emerging Markets activities

are reported as assets held for sale. The net value of these

(assets minus related liabilities), came down from €412 million at

the year start to €160 million at the end of the period, reflecting

the Mexican business divestment and some smaller asset sales, as

well as an increase in the net cash position and asset value of the

remaining activities.

Disclaimer

This report may include forward-looking

statements. Forward-looking statements are statements regarding or

based upon our management’s current intentions, beliefs or

expectations relating to, among other things, Ontex’s future

results of operations, financial condition, liquidity, prospects,

growth, strategies or developments in the industry in which we

operate. By their nature, forward-looking statements are subject to

risks, uncertainties and assumptions that could cause actual

results or future events to differ materially from those expressed

or implied thereby. These risks, uncertainties and assumptions

could adversely affect the outcome and financial effects of the

plans and events described herein.

Forward-looking statements contained in this

report regarding trends or current activities should not be taken

as a report that such trends or activities will continue in the

future. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. You should not place undue reliance on

any such forward-looking statements, which speak only as of the

date of this report.

The information contained in this report is

subject to change without notice. No re-report or warranty, express

or implied, is made as to the fairness, accuracy, reasonableness or

completeness of the information contained herein and no reliance

should be placed on it.

In most of the tables of this report, amounts

are shown in € million for reasons of transparency. This may give

rise to rounding differences in the tables presented in the

report.

Corporate information

The above press release and related financial

information of Ontex Group NV for the twelve months ended December

31, 2023 was authorized for issue in accordance with a resolution

of the Board on February 7, 2024.

Audio webcast

Management will host an audio webcast for

investors and analysts on February 8, 2024 at 12:00 CET / 11:00 BT.

A copy of the presentation slides will be available on

ontex.com.

Click on the link below to attend the

presentation from your laptop, tablet or mobile device. Audio will

stream through your selected device, so be sure to have headphones

or your volume turned up.

https://channel.royalcast.com/landingpage/ontexgroup/20240208_1

A full replay of the presentation will be

available at the same link shortly after the conclusion of the live

presentation.

Financial calendar

- April 3,

2024

2023 annual report

- May 3,

2024

Q1 2024 results

- May 3,

2024

AGM

- July 31,

2024

Q2 & H1 2024 results

- October 24, 2024 Q3

2024 results

Enquiries

-

Investors

Geoffroy

Raskin

+32 53 33 37 30

investor.relations@ontexglobal.com

-

Media

Maarten

Verbanck

+32 53 33 36 20

corporate.communications@ontexglobal.com

About Ontex

Ontex is a leading international provider of

personal hygiene solutions, with expertise in baby care, feminine

care and adult care. Ontex’s innovative products are distributed in

around 100 countries through leading retailer brands, lifestyle

brands and Ontex brands. Employing some 7,500 people all over the

world, Ontex has a presence in 21 countries, with its headquarters

in Aalst, Belgium. Ontex is listed on Euronext Brussels and is part

of the Bel Mid®. To keep up with the latest news, visit ontex.com

or follow Ontex on LinkedIn, Facebook, Instagram and YouTube.

ONTEX GROUP

NV

Korte Keppestraat 21 – 9320 Erembodegem (Aalst) –

Belgium 0550.880.915 RPR Ghent – Division

Dendermonde

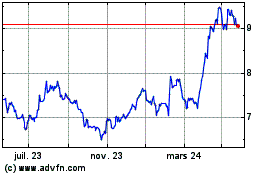

Ontex Group NV (EU:ONTEX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

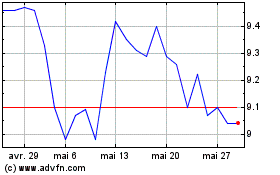

Ontex Group NV (EU:ONTEX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024