Ontex reaches important milestone in reshaping its portfolio with binding agreement to sell its Brazilian business to Softys

30 Septembre 2024 - 11:00PM

UK Regulatory

Ontex reaches important milestone in reshaping its portfolio with

binding agreement to sell its Brazilian business to Softys

Aalst, Belgium, September 30,

2024 – Ontex Group NV (Euronext: Ontex), a leading

international developer and producer of personal care products,

announces that it has entered into a binding agreement to sell its

Brazilian business activities to Softys S.A. for an enterprise

value of BRL 671 million (or approximately €110 million*). Softys

is a personal hygiene company with operations across Latin America,

that also acquired Ontex’s Mexican business activities in 2023. It

is a wholly owned subsidiary of Empresas CMPC S.A., which is

headquartered in Chile.

Gustavo Calvo Paz, Ontex’s CEO, said: “This

divestment represents another major milestone towards Ontex’s

ambitioned portfolio, focusing on retail brands and healthcare in

Europe and North America. Moreover, the proceeds from the sale will

further reduce our indebtedness, putting us in an even stronger

position to execute our transformation. I am convinced that Softys,

with its 40 years of experience in the personal hygiene market in

Latin America, is well placed to take the business forward,

benefiting from the talent and expertise of our teams, as they also

did with our Mexican business.”

The transaction includes Ontex’s business in

Brazil and its manufacturing facility in Senador Canedo in the

State of Goiás. The business develops, manufactures, commercializes

and distributes diapers and pants for the baby care market under

the PomPom, Cremer, Sapeka and Turma da Mônica brands, as well as

for the adult care market under the Bigfral brand. It has

approximately 1,400 employees and contributed revenue of €97

million and adjusted EBITDA of €13 million to the Group in the

first half of 2024.

Subject to customary balance sheet adjustments,

the net proceeds of the transaction, after deduction of tax-related

payments and transaction fees, are expected to be approximately €82

million*, of which up to €18 million* will be held in escrow. The

transaction will generate a net gain on disposal of approximately

€39 million* and trigger the recognition of a non-cash accounting

loss of approximately €(140) million* related to the accumulated

currency translation reserves.

Ontex and Softys aim to close the transaction,

which is subject to customary conditions, including merger

clearance from the Brazilian antitrust authority, during the first

half of 2025.

[*] All amounts in € are based on the

current BRL/EUR exchange rate, and can therefore change by the time

of finalization of the transaction.

Enquiries

- Investors Geoffroy

Raskin

+32 53 33 37 30

investor.relations@ontexglobal.com

-

Media

Maarten

Verbanck +32

53 33 36 20

corporate.communications@ontexglobal.com

About Ontex

Ontex is a leading international developer and producer of care

products and solutions for retailers and healthcare, with expertise

in baby care, feminine care and adult care. Ontex’s innovative

products are distributed in around 100 countries through retailers

and healthcare providers. Employing some 7,500 people, Ontex has a

presence in 14 countries, with its headquarters in Aalst, Belgium.

Ontex is listed on Euronext Brussels and is part of the Bel Mid®.

To keep up with the latest news, visit ontex.com or follow Ontex on

LinkedIn, Facebook, Instagram and YouTube.

- 241001_BrazilDivestment_EN

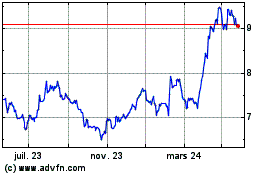

Ontex Group NV (EU:ONTEX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

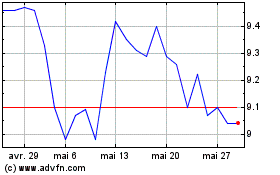

Ontex Group NV (EU:ONTEX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025