Saint-Herblain (France), September 13, 2024 –

Valneva SE (Nasdaq: VALN; Euronext Paris: VLA)

(“Valneva” or the “Company”), a

specialty vaccine company, today announces the successful pricing

of its Private Placement (as defined below) for a final amount of

€61,180,000.

Peter Bühler, Valneva’s Chief Financial

Officer, commented, “We would like to thank our existing

shareholders for their continued support, as well as the new

healthcare specialist investors joining us through this raise. In

addition to supporting our current commercial and R&D

activities, this additional capital will give us greater

flexibility to invest in our future growth, including in the

Shigella vaccine program for which we recently acquired an

exclusive worldwide license”.

Context of the Offering

The Issuer intends to use the net proceeds of

the Private Placement primarily to fund the continuing development

of the Company’s clinical programs which include notably the Phase

3 pediatric and Phase 4 programs for the chikungunya vaccine as

well as the anticipated Phase 2 programs for the Shigella and Zika

vaccine candidates. A portion of the net proceeds will also be used

for the further commercialization of the Company’s existing

chikungunya vaccine, IXCHIQ®, to fund the acceleration of the

Company’s pre-clinical research and development activities and for

general corporate purposes. Valneva believes this new funding will

provide greater flexibility to invest in its future growth,

including in its Shigella vaccine program for which it recently

obtained an exclusive worldwide license.

The Company believes it will have sufficient

resources to finance its operational business, excluding debt

repayment, until potential milestone and commercial revenues from

its program against the Lyme disease enable the Company to operate

in a sustained profitable way.

Conclusion of the Lyme disease VALOR Phase trial

3 is still expected by the end of 2025, with the aim for Pfizer to

submit a Biologic License Application (BLA) to the Food and Drug

Administration and a Marketing Authorization Application (MAA) to

the European Medicine Agency in 2026, subject to positive data.

At the end of June 2024, the Company’s debt

amounted to $200 million. Reimbursements of the first $100 million

tranche will start in January 2026 and mature in the first quarter

of 2027. Reimbursements of the second $100 million tranche will

start in the first quarter of 2027 and mature in the fourth quarter

of 2028.

Terms of the Private

Placement

A total of 23,000,000 new ordinary shares (the

“Offer Shares”), each with a nominal value of

€0.15, have been issued at a price of €2.66 each, without

shareholders’ preferential subscription rights, (i) to a limited

number of institutional investors within the United States, or that

are U.S. persons (as defined in Regulation S (“Regulation

S”) of the Securities Act of 1933, as amended (the

“Securities Act”)) who have represented that they

are qualified institutional buyers (as defined in Rule 144A under

the Securities Act) in an offering exempt from registration under

Section 4(a)(2) of the Securities Act, and (ii) outside of the

United States to non-U.S. persons in an offering exempt from

registration under Regulation S, in the European Union (including

France) to qualified investors within the meaning of Article 2(e)

of Regulation 2017/1129 of the European Parliament and of the

Council of 14 June 2017, as amended (the

“Prospectus Regulation”) and

outside of the European Union (with the exception of the United

States, Australia and Japan), in each case for the benefit of

categories of investors defined by the 33rd resolution of the

Company’s combined ordinary and extraordinary general shareholders’

meeting of 26 June 2024 (“General

Meeting”) (the “Private

Placement”).

Dilution

The Offer Shares represent 16.5% of the

Company’s share capital on a non-diluted basis prior to the

completion of the Private Placement and 14.2% of the Company’s

share capital on a non-diluted basis following the Private

Placement. By way of illustration a shareholder holding 1% of the

share capital of the Company prior to the launch of the Private

Placement will now hold an interest of 0.86%.

Breakdown of the share capital before the

Private Placement

|

Shareholder |

Shares |

% Capital |

Voting Rights |

% of Voting Rights |

|

Groupe CDC |

13,539,703 |

9.72% |

22,159,181 |

14.21% |

| Pfizer Inc. |

9,554,395 |

6.86% |

9,549,761 |

6.13% |

| Groupe Grimaud La

Corbière |

6,744,702 |

4.84% |

12,949,533 |

8.31% |

| Polar

Capital |

5,423,702 |

3.89% |

5,423,702 |

3.48% |

| Free Float |

104,014,399 |

74.68% |

105,812,191 |

67.87% |

|

Total |

139,276,901 |

100.00% |

155,894,368 |

100.00% |

Breakdown of the share capital after the Private

Placement

|

Shareholder |

Shares |

% Capital |

Voting Rights |

% of Voting Rights |

| Groupe CDC |

14,089,703 |

8.68% |

22,709,181 |

12.69% |

| Pfizer Inc. |

9,554,395 |

5.89% |

9,549,761 |

5.34% |

| Polar

Capital |

8,123,702 |

5.01% |

8,123,702 |

4.54% |

| Groupe Grimaud La

Corbière |

6,744,702 |

4.16% |

12,949,533 |

7.24% |

| Braidwell LP |

5,400,000 |

3.33% |

5,400,000 |

3.02% |

| Free Float |

118,364,399 |

72.94% |

120,162,191 |

67.17% |

|

Total |

162,276,901 |

100.00% |

178,894,368 |

100.00% |

Admission to trading of the Offer

Shares

The settlement and delivery of the Offer Shares

to be issued in the Private Placement and their admission to

trading on the regulated market of Euronext Paris

(“Euronext Paris”) are expected on September 17,

2024. Other than being “restricted securities” in the United

States, the Offer Shares will be of the same category and fungible

with the existing ordinary shares, will be entitled to all rights

associated with the existing ordinary shares and will be admitted

to trading on Euronext Paris under the same ISIN as the existing

ordinary shares: ISIN FR0004056851.

Lock-Up Commitments

In connection with the Private Placement, the

Company, members of the management and of the Board of Directors

have signed a lock-up commitment pursuant to which they have each

agreed to a lock-up period of 90 days following the settlement and

delivery of the Private Placement, subject to certain customary

exceptions.

Financial Intermediaries

Jefferies GmbH and Bryan, Garnier & Co are

acting as Joint Global Coordinators and Joint Bookrunners in

connection with the Private Placement.

Risk Factors

Attention is drawn to the risk factors

associated with the Company and its activity presented in section

1.5 of the universal registration document registered with the

French Financial Market Authority (Autorité des Marchés Financiers)

(the “AMF”) on March 22, 2024 under number

D.24-0157 as updated in chapter I.5 of the Company’s interim

financial report for the first half of 2024 published and filed

with the AMF on August 13, 2024, which are available free of charge

on the Company’s website (https://valneva.com/investors). The

occurrence of all or part of these risks could have a negative

impact on the Company’s activity, financial situation, results,

development or outlook.

Additionally, investors are invited to consider

the following risks specific to this Private Placement: (i) the

market price of the Company’s shares may fluctuate and fall below

the subscription price of the Offer Shares, (ii) the volatility and

liquidity of the Company’s shares may fluctuate significantly,

(iii) sales of the Company’s shares may take place on the market

and have a negative impact on the market price of its shares,(iv)

the Company’s shareholders could suffer potentially significant

dilution resulting from any future capital increases required to

provide the Company with additional financing and (v) the Company

has broad discretion in the use of the net proceeds from the

Private Placement.

Prospectus

The Private Placement is not subject to a

prospectus requiring an approval from the AMF.

About Valneva

We are a specialty vaccine company that

develops, manufactures, and commercializes prophylactic vaccines

for infectious diseases addressing unmet medical needs. We take a

highly specialized and targeted approach, applying our deep

expertise across multiple vaccine modalities, focused on providing

either first-, best- or only-in-class vaccine solutions.

We have a strong track record, having advanced

multiple vaccines from early R&D to approvals, and currently

market three proprietary travel vaccines, including the world’s

first and only chikungunya vaccine, as well as certain third-party

vaccines.

Revenues from our growing commercial business

help fuel the continued advancement of our vaccine pipeline. This

includes the only Lyme disease vaccine candidate in advanced

clinical development, which is partnered with Pfizer, the world’s

most clinically advanced Shigella vaccine candidate, as well as

vaccine candidates against the Zika virus and other global public

health threats. More information is available

at www.valneva.com.

|

Valneva Investor and Media

Contacts Laetitia Bachelot-FontaineVP, Global

Communications and European Investor RelationsM +33 (0)6 4516

7099investors@valneva.com |

Joshua Drumm, Ph.D.VP, Global Investor Relations

M +001 917 815 4520joshua.drumm@valneva.com |

|

|

Forward-Looking Statements

This press release contains certain

forward-looking statements concerning the Private Placement,

including the anticipated use of proceeds from the Private

Placement, the anticipated dates of the pricing and closing of the

Private Placement, the admission of the Offer Shares to trading on

Euronext Paris and potential dilution to existing investors. In

addition, even if the actual results or development of Valneva are

consistent with the forward-looking statements contained in this

press release, those results or developments of Valneva may not be

indicative of future results. In some cases, you can identify

forward-looking statements by words such as "could," "should,"

"may," "expects," "anticipates," "believes," "intends,"

"estimates," "aims," "targets," or similar words. Such

forward-looking statements are based on assumptions that the

Company considers to be reasonable as of the date of this press

release and are subject to a number of known and unknown risks and

uncertainties and other factors that may cause actual results,

performance or achievements to be materially different from any

future results, performance or achievement expressed or implied by

these forward-looking statements. In particular, the expectations

of the Company could be affected by, among other things,

uncertainties involved in the development and manufacture of

vaccines, unexpected clinical trial results, unexpected regulatory

actions or delays, competition in general, currency fluctuations,

the impact of the global and European credit crisis, and the

ability to obtain or maintain patent or other proprietary

intellectual property protection, as well as the risks set forth in

section 1.5 of the universal registration document registered with

the French Financial Market Authority (Autorité des Marchés

Financiers) (the “AMF”) under number D.24-0157 on

March 22, 2024 (copies of which are available on the Company’s

website) as updated in chapter I.5 of the Company’s interim

financial report for the first half of 2024 published and filed

with the AMF on August 13, 2024 and the Company’s filings with the

SEC and to the development of economic conditions, financial

markets and the markets in which the Company operates. The

forward-looking statements contained in this press release are also

subject to risks not yet known to the Company or not currently

considered material by the Company. The occurrence of all or part

of such risks could cause actual results, financial conditions,

performance or achievements of the Company to be materially

different from such forward-looking statements. In light of these

risks and uncertainties, there can be no assurance that the

forward-looking statements made in this press release will in fact

be realized. These forward-looking statements are given only as of

the date of this press release and Valneva expressly declines any

obligation or commitment to publish updates or corrections of the

forward-looking statements included in this press release in order

to reflect any change affecting the forecasts or events, conditions

or circumstances on which these forward-looking statements are

based. Any information relating to past performance contained

herein is not a guarantee of future performance. Nothing herein

should be construed as an investment recommendation or as legal,

tax, investment or accounting advice.

Importance notice

This press release may not be published,

distributed or released in the United States, Australia, or Japan.

The release, publication or distribution of this press release in

certain jurisdictions may be restricted by laws or regulations.

Therefore, persons in such jurisdictions into which this press

release is released, published or distributed must inform

themselves about and comply with such laws or regulations. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

No communication and no information in respect

of the Private Placement may be distributed to the public in any

jurisdiction where a registration or approval is required. No steps

have been or will be taken in any jurisdiction where such steps

would be required. The issuance by the Company or the subscription

of the Offer Shares may be subject to legal and regulatory

restrictions in certain jurisdictions. The Company and its advisors

take no responsibility for any violation of any such restriction by

any person.

This press release is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of June 14, 2017, as amended

(the “Prospectus Regulation”) and of Regulation

(EU) 2017/1129 as it forms part of the United Kingdom domestic law

by virtue of the European Union (Withdrawal) Act 2018

(“EUWA”) (the “UK Prospectus

Regulation”).

This press release is not an offer to the public

other than to qualified investors, or an offer to subscribe or

designed to solicit interest for purposes of an offer to the public

other than to qualified investors in any jurisdiction, including

France.

European Economic Area

With respect to the member States of the

European Economic Area (each, a “Member State”),

no action has been undertaken or will be undertaken to make an

offer to the public of the securities requiring publication of a

prospectus in any relevant Member State, including France and

Germany. As a result, the securities may only be offered in

relevant Member States (i) to qualified investors, as defined by

the Prospectus Regulation; or (ii) in any other circumstances, not

requiring the Company to publish a prospectus as provided under

Article 3(2) of the Prospectus Regulation. These selling

restrictions with respect to Member States apply in addition to any

other selling restrictions which may be applicable in any Member

State.

United Kingdom

With respect to the United Kingdom, no action

has been undertaken or will be undertaken to make an offer to the

public of the securities referred to herein requiring a publication

of a prospectus. As a result, the securities may and will be

offered only (i) to qualified investors within the meaning of the

UK Prospectus Regulation, (ii) to fewer than 150 individuals or

legal entities (other than qualified investors as defined in the UK

Prospectus Regulation, or (iii) in accordance with the exemptions

set forth in Article 1 (4) of the UK Prospectus Regulation or under

any other circumstances which do not require the publication by

Valneva SE of a prospectus pursuant to Article 3 of the UK

Prospectus Regulation.

The distribution of this press release has not

been made, and has not been approved, by an “authorised person”

within the meaning of Article 21(1) of the Financial Services and

Markets Act 2000. As a consequence, this press release is only

being distributed to, and is only directed at, persons in the

United Kingdom that (i) are “investment professionals” falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended, the “Order”), (ii)

are persons falling within Article 49(2)(a) to (d) (“high net worth

companies, unincorporated associations, etc.”) of the Order, or

(iii) are persons to whom an invitation or inducement to engage in

investment activity (within the meaning of Article 21 of the

Financial Services and Markets Act 2000) in connection with the

issue or sale of any securities may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “Relevant Persons”).

Any investment or investment activity to which this document

relates is available only to Relevant Persons and will be engaged

in only with Relevant Persons. Any person who is not a Relevant

Person should not act or rely on this document or any of its

contents.

United States

This press release does not constitute or form

part of any offer of securities for sale or any solicitation to

purchase or to subscribe for securities or any solicitation of sale

of securities in the United States. The securities referred to

herein have not been and will not be registered under the

Securities Act or the law of any State or other jurisdiction of the

United States, and may not be offered, sold, pledged or otherwise

transferred, directly or indirectly, in the United States absent

registration under the Securities Act or pursuant to an exemption

from, or in a transaction not subject to, the registration

requirements of the Securities Act. Valneva SE does not intend to

register all or any portion of the securities in the United States

under the Securities Act or to conduct a public offering of the

securities in the United States. The Offer Shares are being offered

and sold (i) within the United States and to “U.S. persons” (as

defined in Regulation S) only on a private placement basis to a

limited number of institutional investors that are ”qualified

institutional buyers” as defined in Rule 144A of the Securities Act

and (ii) outside the United States in accordance with Regulation

S.

Australia and Japan

This announcement may not be published,

forwarded or distributed, directly or indirectly, in Australia or

Japan.

The distribution of this press release in

certain countries may constitute a breach of applicable law.

- 2024 09 13 Viognier-Pricing Press Release-EN-Final

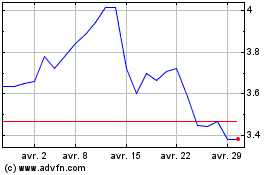

Valneva (EU:VLA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Valneva (EU:VLA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024