U.S. Dollar Rallies On Trump's Victory

06 Novembre 2024 - 1:21PM

RTTF2

The U.S. dollar was higher against its major counterparts in the

New York session on Wednesday, as Donald Trump's win in the

presidential election renewed optimism about economic growth

policies that could drive bond yields higher and boost

inflation.

Trump is projected to win far more than the 270 Electoral

College votes needed to secure his return to the White House after

claiming victory in several key swing states.

Trump is seen by the markets as better for corporations and is

likely to renew the tax cut package enacted during his first term,

which was due to expire at the end of 2025.

A Trump administration is also expected to scale back government

regulations and be less hostile to mergers and acquisitions.

However, Trump has also called for increased tariffs on China

and other countries, which could lead to renewed inflation

concerns.

The greenback advanced to more than a 4-month high of 1.0682

against the euro and more than a 3-month high of 0.8773 against the

franc, from its early lows of 1.0934 and 0.8620, respectively. The

next possible resistance for the currency is seen around 1.06

against the euro and 0.89 against the franc.

The greenback climbed to near a 3-month high of 1.2833 against

the pound and more than a 3-month high of 154.47 against the yen,

from its early 2-week lows of 1.3044 and 151.29, respectively. The

currency is poised to challenge resistance around 1.26 against the

pound and 156.00 against the yen.

The greenback rose to a 5-day high of 1.3959 against the loonie,

from an early low of 1.3823. Immediate resistance for the currency

is seen around the 1.40 level.

In contrast, the greenback eased to 0.6596 against the aussie,

from an early nearly 3-month high of 0.6512. This may be compared

to the previous session's 2-week low of 0.6642. If the currency

falls further, it is likely to test support around the 0.68

region.

The greenback retreated to 0.5975 against the kiwi, from an

early 3-month high of 0.5912. This may be compared to the Asian

session's 2-week low of 0.6021. The currency is likely to locate

support around the 0.62 level.

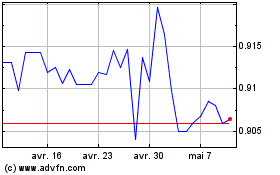

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Oct 2024 à Nov 2024

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Nov 2023 à Nov 2024