TIDMGLIF

RNS Number : 2214U

GLI Finance Limited

01 April 2021

1 April 2021

GLI Finance Limited

(the "Group" or the Company")

Tender Offer for up to 25 per cent. of the issued ZDP Shares

and

Notice of Extraordinary General Meeting and posting of

circular

As part of the ZDP Share continuation proposals approved by the

Company's shareholders in November 2020, the Board stated that the

Company intended to make a cash tender offer for a proportion of

the Company's redeemable zero dividend preference shares ("ZDP

Shares"). The Board now proposes to implement the Tender Offer for

up to 25 per cent of the issued ZDP Shares (excluding ZDP Shares

held in treasury) (the "Tender Offer").

The making of the Tender Offer requires the approval of ordinary

shareholders at an extraordinary general meeting, to be held at the

Company's registered office, Block C, Hirzel Court, Hirzel Street,

St Peter Port, Guernsey GY1 2NL, Channel Islands on 22 April 2021

at 10.00 a.m. (the "Extraordinary General Meeting" or "EGM"). A

circular (the "Circular") will today be posted to holders of the

Company's ordinary shares of no par value ("Ordinary Shares") and

ZDP Shares (together the "Shareholders") providing details of the

Tender Offer, a notice of the EGM together with the required

resolutions, forms of proxy for the attention of ordinary

shareholders and tender forms for the attention of ZDP

shareholders. The Circular will shortly be available on the

Company's website at www.glifinance.com and Shareholders should

consider the full contents of the Circular in addition to the

summary information below.

Background to and reasons for the Tender Offer

The Company currently has two classes of Shares in issue:

Ordinary Shares and ZDP Shares. As at the date of this

announcement, the Company's issued share capital is 489,843,477

Ordinary Shares (of which 11,852,676 are held by a subsidiary of

the Company) and 20,791,418 ZDP Shares (of which 12,104,030 are

held in treasury).

The ZDP Shares are non-participating and non-voting (except in

certain limited circumstances) but carry the right to the repayment

of a Final Capital Entitlement on their maturity date of 5 December

2022, on which date the holders of ZDP Shares are entitled to

receive from the Company 164.64 pence for each ZDP Share that they

hold, which would represent a return on the issue price of the ZDP

Shares equivalent to 8 per cent. per annum (which increased from

5.5 per cent. per annum on 6 December 2019).

The Company has, in the past, utilised available cash funds to

buy back ZDP Shares with a view to reducing the quantum of the

Final Capital Entitlement. ZDP Shares bought back have previously

been held by the Company in treasury. Since the announcement of the

extension and other proposals on 17 November 2020, the Company has

bought back a further 95,000 ZDP Shares.

As at the date of this announcement, 8,687,388 ZDP Shares remain

in issue and are not held by the Company in treasury, equating to

an aggregate Final Capital Entitlement on 5 December 2022 of

approximately GBP14.30 million.

The Tender Offer is being made for up to 2,171,847 ZDP Shares,

being 25 per cent. of the issued ZDP Shares as at the date of this

announcement (excluding ZDP Shares held in treasury). Each ZDP

Shareholder (other than Restricted Shareholders and certain

Overseas Shareholders defined in the Circular) may elect to sell up

to 25 per cent. of their ZDP Shareholding.

The Tender Offer is being made at the Tender Price of 145.59

pence per ZDP Share. This is equal to the accrued capital

entitlement per ZDP Share as at 22 April 2021, the anticipated date

of completion of the Tender Offer, calculated in accordance with

the Articles. The aggregate Tender Price, assuming that the full

entitlement of ZDP Shares is tendered, will be approximately

GBP3.16 million.

The Tender Offer is being made for the benefit of both Ordinary

Shareholders, who will benefit from the reduced overall capital

entitlement of the ZDP Shares as a result of repurchasing 25 per

cent. of the ZDP Shares sooner than their maturity date; and ZDP

Shareholders, who may elect to realise some of their investment at

this time if they wish to do so.

ZDP Shareholders are not obliged to tender any of their ZDP

Shares and, if they do not wish to do so, they should not return a

Tender Form or TTE Instruction.

Ordinary Shareholders may not participate in the Tender

Offer.

The Board believes that this proposal is in the interests of all

Shareholders and the Company as a whole.

Details of the Tender Offer

Under the terms of the Tender Offer, ZDP Shareholders (other

than Restricted Shareholders and certain Overseas Shareholders)

will be entitled to tender up to their Tender Entitlement, being 25

per cent. of the ZDP Shares they hold as at the Record Date.

Tenders in excess of the Tender Entitlement will not be

satisfied.

Subject to the satisfaction of the Conditions relating to the

Tender Offer, the Company will purchase ZDP Shares validly tendered

under the Tender Offer at the Tender Price by way of an on-market

transaction on the main market of the London Stock Exchange. The

ZDP Shares which the Company acquires from tendering ZDP

Shareholders will be cancelled.

The proposed repurchase of ZDP Shares pursuant to the Tender

Offer would be categorised as a form of distribution under Guernsey

Companies Law. Before the repurchase may be undertaken, the Board

must be satisfied, on reasonable grounds, that the Company will

satisfy the solvency test as defined under the Guernsey Companies

Law immediately after the repurchase has been completed. The Board

will also need to consider if the financial position of the Company

is expected to, or has, changed materially between the time of the

authorisation of the repurchase and the actual time of the

repurchase. Currently, the Board is satisfied that the Company will

satisfy the solvency test. However, if the Board ceases to be

satisfied prior to completion of the Tender Offer that the Company

will satisfy the above-mentioned solvency test immediately after

the repurchase by the Company of the ZDP Shares from tendering ZDP

Shareholders, then the repurchase will no longer be deemed to be

authorised, and as a result, the Tender Offer will not proceed (or

be capable of becoming unconditional) and the ZDP Shares will not

be repurchased.

ZDP Shareholders should note that, once tendered, ZDP Shares may

not be sold, transferred, charged or otherwise disposed of other

than in accordance with the Tender Offer.

Shareholders who are in any doubt as to the contents of the

Circular or as to the action to be taken should immediately consult

their stockbroker, bank manager, solicitor, accountant or other

independent financial adviser authorised under FSMA.

The attention of ZDP Shareholders is drawn to Part 4 of the

Circular which sets out a general guide to certain aspects of

current UK and Guernsey taxation law and HMRC and Revenue Service

published practice. This information is a general guide and is not

exhaustive. Shareholders who are in any doubt as to their tax

position or who are subject to tax in a jurisdiction other than the

UK should consult an appropriate professional adviser.

This announcement is not a recommendation for ZDP Shareholders

to tender their ZDP Shares under the Tender Offer. Whether or not

ZDP Shareholders tender their ZDP Shares will depend on, amongst

other things, their view of the Company's prospects and their own

individual circumstances, including their tax position, on which

they should seek their own independent advice.

On 31 March 2021 the Company announced its audited results for

the year ended 31 December 2020. Shareholders may refer to that

announcement for the latest financial information on the Company

and the Board's present views on the Company's financial and

trading prospects.

Expected Timetable of Events

2021

Publication of the Circular and Tender 1 April

Offer opens

Latest time for receipt of Forms of Proxy 10.00 a.m. on 20 April

for the EGM

Latest time and date for receipt of Tender 10.00 a.m. on 20 April

Forms and submission of TTE Instructions

from Shareholders

Record Date and time for the Tender Offer 6.00 p.m. on 20 April

EGM 10.00 a.m. on 22 April

Publication of the results of the EGM and Following the EGM

the Tender Offer on 22 April

Completion of the Tender Offer Following the EGM

on 22 April

CREST settlement date: payments through 28 April

CREST made and CREST accounts settled

Balancing share certificates and cheques 28 April

despatched to certificated ZDP Shareholders

All of the times and dates in the expected timetable may be

extended or brought forward without further notice, at the

discretion of the Company. If any of the above times and/or dates

change materially, the revised time(s) and/or date(s) will be

notified to Shareholders by an announcement through a Regulatory

Information Service provider.

All references to time in this announcement are to UK time.

Capitalised terms used but not otherwise defined in the text of

this announcement are defined in the Circular.

For further information, please contact:

GLI Finance Limited

Andy Whelan

+44 (0)1534 708900

Liberum Capital (Nominated Adviser and Corporate Broker)

Chris Clarke

Edward Thomas

+44 (0) 20 3100 2190

Instinctif Partners (PR Advisor)

Tim Linacre/Lewis Hill

+44 (0)207 457 2020

LEI: 213800S2XOO3YSEGCA26

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSDLESFEFSEID

(END) Dow Jones Newswires

April 01, 2021 02:00 ET (06:00 GMT)

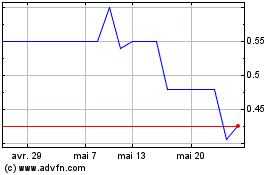

Sancus Lending (LSE:LEND)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Sancus Lending (LSE:LEND)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025