TIDMNAVF TIDMAJG

RNS Number : 0039J

Nippon Active Value Fund PLC

11 August 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO ANY MEMBER STATE OF THE EUROPEAN

ECONOMIC AREA, THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, HONG

KONG, SINGAPORE OR THE REPUBLIC OF SOUTH AFRICA OR ANY JURISDICTION

FOR WHICH THE SAME COULD BE UNLAWFUL.

The information communicated in this announcement is deemed to

constitute inside information as stipulated under the UK Version of

Market Abuse Regulation (EU) No. 596/2014 (as incorporated into UK

Law by virtue of the European Union (Withdrawal) Act 2018, and as

subsequently amended ("MAR"). Upon the publication of this

announcement, this information is considered to be in the public

domain.

11 August 2023

Nippon Active Value Fund plc

LEI: 213800JOFEGZJYS21P75

Rollover from Atlantis Japan Growth Fund Limited

The Board of Nippon Active Value Fund plc (the "Company" or

"NAVF") is pleased to announce that heads of terms have been agreed

for a proposed rollover of the assets of Atlantis Japan Growth Fund

Limited ("AJGF") into the Company.

AJGF is an Investment Trust listed on the Official List of the

London Stock Exchange which was launched in 1996. It invests in

companies quoted on the Japanese Stock Exchange and has net assets

of GBP 80 m as at 31 July 2023. Following a review of AJGF's future

by its Board of Directors in light of its upcoming continuation

vote, AJGF has agreed terms to rollover its assets into the

Company.

The combination, if approved by each company's shareholders,

will be implemented through a scheme of reconstruction pursuant to

section 391(1)(b) of the Companies (Guernsey) Law, 2008, resulting

in the reconstruction and members' voluntary liquidation of AJGF.

This would result in the rollover of AJGF's assets into the Company

in exchange for the issue of new NAVF shares to AJGF shareholders

who elect to roll their investment into the enlarged fund. AJGF

shareholders will be offered the option of a cash exit for up to 25

per cent. of AJGF's shares in issue, providing AJGF shareholders

with the ability to realise part (or potentially all) of their

investment at a 2 per cent. discount to formula asset value ("FAV")

per share (the "Transaction").

The Transaction is in addition to the previously announced

proposed rollover of abrdn Japan Investment Trust plc assets into

the Company (the "AJIT Combination"). The Transaction is not

conditional upon the AJIT Combination successfully completing, and

the AJIT Combination is not conditional on the Transaction

completing.

New NAVF shares issued to AJGF's shareholders will be issued on

a FAV-to-FAV basis. FAVs will be calculated using the respective

net asset values of each company, adjusted for any dividends and

distributions declared by each party which have a record date prior

to the effective date of the rollover of AJGF's assets into

NAVF.

Following completion of the Transaction, it is expected that a

director from the Board of AJGF will join the Board of NAVF.

Rising Sun Management Limited ("RSM") (the Investment Adviser to

NAVF) has offered to pay for AJGF's costs to implement the

Transaction up to a cap of GBP800,000.

Benefits of the Transaction

Similarly to the AJIT Scheme, the Transaction would result in

the Company becoming larger with more shareholders and greater

assets and is expected to improve liquidity in the Company's shares

as well as spreading the fixed costs of the Company over a larger

pool of assets. The Company also expects an inflow of capital into

the NAVF portfolio which will enhance the Company's ability to

discover undervalued Japanese listed companies and enable active

engagement to deliver returns for shareholders.

Approvals

Implementation of the Transaction is subject to the approval,

inter alia, of the AJGF Shareholders as well as upon receiving

regulatory and tax approvals. NAVF intends to implement the

Transaction under the same prospectus to be issued by NAVF in

connection with the AJIT Combination. It is anticipated that NAVF

and AJGF will each publish a circular setting out details of the

Transaction in early September. As noted above, the Transaction is

not conditional on implementation of the AJIT Combination.

Joh. Berenberg, Gossler & Co KG, London Branch ("Berenberg")

has been appointed as Sponsor and Financial Adviser to the Company

in relation to the Transaction.

City Code

In accordance with customary practice for schemes of

reconstruction, The Panel on Takeover and Mergers has confirmed

that the City Code on Takeovers and Mergers is not expected to

apply to the combination of the Company and AJGF.

Update on AJIT Combination

Further to the announcement on 18 May 2023 regarding the AJIT

Combination the formal documentation for the implementation of the

combination of the AJIT and the Company is now well advanced and

the Board expects to announce its publication by early

September.

Rosemary Morgan, Chair of the Company commented:

"We are pleased to have reached agreement with AJGF's Board in

relation to the proposed combination. The proposed transaction will

offer AJGF shareholders the opportunity to continue to have

exposure to Japanese equities but now with the active management

approach which provides the potential to unlock greater value in

the Japanese market, whilst being part of a larger vehicle. We look

forward to the transaction progressing and welcoming the AJGF

shareholders to our company together with the AJIT shareholders,

subject to successful completion."

Enquiries

Berenberg

Gillian Martin / Dan Gee-Summons / Natasha Ninkov

Tel: +44 (0)20 3207 7800

Company Secretary

Sylvanus Cofie / Maria Matheou

Tel: +44 (0) 20 3327 9720

Important information relating to Sponsor and Financial

Adviser

Joh. Berenberg, Gossler & Co. KG, London Branch

("Berenberg") which is authorised and regulated by the German

Federal Financial Supervisory Authority and deemed authorised and

subject to limited regulation in the United Kingdom by the FCA, is

acting solely as sponsor and financial adviser to the Company and

for no one else in relation to the proposed transaction, and will

not be responsible to anyone other than the Company for providing

the protections afforded to the clients of Berenberg or for

providing advice in relation to the proposed transaction, the

contents of this document or any other matters described in this

announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed upon Berenberg by FSMA or the regulatory regime

established thereunder, Berenberg does not accept any

responsibility whatsoever or make any representation or warranty,

express or implied, concerning the contents of this announcement,

including as to its accuracy, completeness or verification, or for

any other statement made or purported to be made by it, or on its

behalf, in connection with the Company or the proposed transaction,

whether as to the past or future.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZZGMRRGDGFZM

(END) Dow Jones Newswires

August 11, 2023 02:00 ET (06:00 GMT)

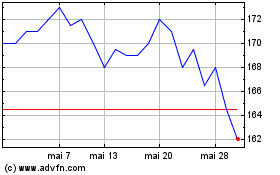

Nippon Active Value (LSE:NAVF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Nippon Active Value (LSE:NAVF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024