Alliance HealthCare Services, Inc. (NASDAQ: AIQ) (the “Company,”

“Alliance,” “we” or “our”), a leading national provider of

outsourced radiology, oncology and interventional services,

announced today that it has signed a definitive merger agreement

with Tahoe Investment Group Co., Ltd. (“Tahoe”), formerly known as

Fujian Thai Hot Investment Co., Ltd., THAIHOT Investment Company

Limited (“THAIHOT”), THAIHOT Investment Company US Limited and

Alliance HealthCare Services Merger Sub Limited (each an indirect

wholly owned subsidiary of Tahoe, and, together with Tahoe, the

“Tahoe Group”), pursuant to which the Tahoe Group will acquire all

of the outstanding common stock of Alliance that is not

beneficially owned by the Tahoe Group or owned by Alliance as

treasury stock, for US $13.25 per share in cash, or a total payment

of approximately US $75 million to equity holders of Alliance other

than the Tahoe Group.

The US $13.25 per share price represents a premium of 67% over

the Company’s closing trading price on December 9, 2016, the last

trading day prior to Tahoe’s initial proposal was publicly

disclosed, and a premium of 38% over the US $9.60 purchase price

per share initially offered by Tahoe.

As previously disclosed on March 29, 2016, Tahoe, through

THAIHOT, completed the purchase of a majority interest in Alliance

and THAIHOT currently owns approximately 51% of the outstanding

common stock of Alliance.

The Company’s Board of Directors, acting on the unanimous

recommendation of the special committee formed by the Board of

Directors (the “Special Committee”), approved the merger agreement

and the transactions contemplated by the merger agreement and

resolved to recommend that the Company’s stockholders adopt the

merger agreement and the transactions contemplated by the merger

agreement. The Special Committee, which is comprised solely of

independent and disinterested directors of the Company who are

unaffiliated with the Tahoe Group or management of the Company,

exclusively negotiated the terms of the merger agreement with the

Tahoe Group, with the assistance of its independent financial and

legal advisors.

Neil Dimick, Chairman of the Special Committee, said, “We are

confident that we have negotiated a fair price and that this merger

is in the best interest of our minority stockholders. The price of

US $13.25 is a 67% premium over the last trading day prior to the

offer and a 38% premium over the initial offer by Tahoe in

December.”

“We continue to be supportive of Alliance’s strategy in the

United States and China,” says Qisen Huang, Chairman and Founder of

Tahoe. Huang continued, “Healthcare has been a major focus for

Tahoe in the last two years and we expect to continue to expand our

healthcare business lines globally to benefit the health of those

we serve.”

“I am pleased to see that the Special Committee and Tahoe have

finished their work and have come to an agreement enabling the

Company to move forward,” says Tom Tomlinson, CEO of Alliance

HealthCare Services. Tomlinson continued, “Tahoe has been a very

supportive majority stockholder and we look forward to continued

collaboration as we use our position as an industry leader in

outsourced medical services to increase the quality of care

delivered in the United States as well as expand healthcare

services in China.”

Upon closing of the merger, Alliance will become an indirect

wholly owned subsidiary of Tahoe. Alliance is expected to remain

headquartered in Southern California. Alliance’s executive

management team is expected to remain in place. All of Alliance’s

divisions within the United States are expected to continue

unaffected.

The merger is subject to approval by Alliance’s stockholders,

including a non-waivable condition requiring approval by the

holders of a majority of the outstanding shares of Alliance common

stock that are not beneficially owned by the members of the Tahoe

Group or certain senior executive officers of the Company, as well

as certain other customary closing conditions. The merger is not

subject to a financing condition. The Company will call a meeting

of stockholders for the purpose of voting on the adoption of the

merger agreement in due course. If completed, the merger will

result in the Company becoming a privately held company and

Alliance’s common stock would no longer be listed on NASDAQ.

Lazard is serving as sole financial advisor to the Special

Committee, O’Melveny & Myers LLP is serving as legal counsel to

the Special Committee, and Richards, Layton & Finger P.A. is

serving as Delaware legal counsel to the Special Committee. Latham

& Watkins LLP is serving as legal counsel to the Company.

Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal

counsel to the Tahoe Group.

About Tahoe

Tahoe is an investment holding company based in Fuzhou,

China, holding a diversified portfolio of assets in various

industries including real estate development, securities,

hospitality, biomedicine and healthcare. Tahoe was founded in 1996

and as of September 30, 2016, the total assets of Tahoe Investment

Group Co. Ltd exceeded US $18.9 billion. Tahoe’s diversified

portfolio includes controlling ownership in Thai Hot Group,

one of the leading real-estate developers in China listed

on the Shenzhen Stock Exchange (SZSE:000732). Tahoe is

also the third largest shareholder of the Shanghai Stock

Exchange listed Dongxing Securities (SHSE:601198).

Tahoe expanded its business landscape to include biomedicine and

healthcare industry by acquiring a large-scale pharmaceutical

company. In early 2015, Tahoe made healthcare and medical services

one of its top priorities, including radiology and oncology, and it

intends to expand healthcare services in

mainland China to an underserved healthcare marketplace.

Qisen Huang is the Founder and Chairman of Tahoe.

About Alliance HealthCare Services

Alliance HealthCare Services (NASDAQ: AIQ) is a leading national

provider of outsourced medical services including radiology,

oncology and interventional. We partner with healthcare providers

and hospitals to provide a full continuum of services from mobile

to fixed-site to comprehensive service line management and joint

venture partnerships. We also operate freestanding clinics and

Ambulatory Surgical Centers that are not owned by hospitals or

providers.

As of December 31, 2016, Alliance operated 625 diagnostic

radiology and radiation therapy systems, including 113 fixed-site

radiology centers across the country, and 33 radiation therapy

centers and SRS facilities. With a strategy of partnering with

hospitals, health systems and physician practices, Alliance

provides quality clinical services for over 1,100 hospitals and

other healthcare partners in 46 states, where approximately 2,450

Alliance Team Members are committed to providing exceptional

patient care and exceeding customer expectations. For more

information, visit www.alliancehealthcareservices-us.com.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of the proposed acquisition of Alliance by the Tahoe Group

and their respective affiliates. In connection with the proposed

merger, Alliance will file with the SEC and furnish to Alliance’s

stockholders a proxy statement and other relevant documents. This

filing does not constitute a solicitation of any vote or approval.

BEFORE MAKING ANY VOTING DECISION, ALLIANCE’S STOCKHOLDERS ARE

URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES

AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN

CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN

THE PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED MERGER.

Investors will be able to obtain a free copy of the proxy

statement, when available, and other relevant documents filed by

Alliance with the SEC at the SEC’s website at www.sec.gov. In

addition, investors may obtain a free copy of the proxy statement,

when available, and other relevant documents from Alliance’s

website at www.alliancehealthcareservices-us.com/proxy or by

directing a request to Alliance HealthCare Services, Inc., Attn:

Rhonda Longmore-Grund, CFO, 100 Bayview Circle, Suite 400, Newport

Beach, California 92660 or calling 949.242.5300.

Participants in the Solicitation

Alliance and its directors, executive officers and certain other

members of management and employees of Alliance may be deemed to be

“participants” in the solicitation of proxies from the stockholders

of Alliance in connection with the proposed Merger. Information

regarding the interests of the persons who may, under the rules of

the SEC, be considered participants in the solicitation of the

stockholders of Alliance in connection with the proposed Merger,

which may be different than those of Alliance’s stockholders

generally, will be set forth in the proxy statement and the other

relevant documents to be filed with the SEC. Stockholders can find

information about Alliance and its directors and executive officers

and their ownership of Alliance’s Common Stock in Alliance’s

definitive proxy statement for its most recent annual meeting of

stockholders, filed with the SEC on April 29, 2016, and additional

information about the ownership of Alliance’s Common Stock by

Alliance’s directors and executive officers is included in their

Forms 3, 4 and 5 filed with the SEC.

Forward-Looking Statements

This communication contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 that involve a number of risks and uncertainties. This

communication contains forward-looking statements related to

Alliance, the Tahoe Group and the proposed acquisition of Alliance

by the Tahoe Group and their respective affiliates. Actual results

and events in future periods may differ materially from those

expressed or implied by these forward-looking statements because of

a number of risks, uncertainties and other factors. All statements

other than statements of historical fact, including statements

containing the words “aim,” “anticipate,” “are confident,”

“estimate,” “expect,” “will be,” “will continue,” “will likely

result,” “project,” “intend,” “plan,” “believe” and other words and

terms of similar meaning, or the negative of these terms, are

statements that could be deemed forward-looking statements. Risks,

uncertainties and other factors include, but are not limited to:

(i) the occurrence of any event, change or other circumstances that

could give rise to the termination of the merger agreement; (ii)

the inability to complete the proposed merger due to the failure to

obtain stockholder approval for the proposed merger or the failure

to satisfy other conditions to completion of the proposed merger;

(iii) the failure of the proposed merger to close for any other

reason; (iv) risks related to disruption of management’s attention

from Alliance’s ongoing business operations due to the transaction;

(v) the outcome of any legal proceedings, regulatory proceedings or

enforcement matters that may be instituted against Alliance and

others relating to the merger agreement; (vi) the risk that the

pendency of the proposed merger disrupts current plans and

operations and the potential difficulties in employee retention as

a result of the pendency of the proposed merger; (vii) the effect

of the announcement of the proposed merger on Alliance’s

relationships with its customers, operating results and business

generally; and (viii) the amount of the costs, fees, expenses and

charges related to the proposed merger. Consider these factors

carefully in evaluating the forward-looking statements. Additional

factors that may cause results to differ materially from those

described in the forward-looking statements are set forth in

Alliance’s Annual Report on Form 10–K for the fiscal year ended

December 31, 2016, filed with the SEC on March 10, 2017, under the

heading “Item 1A. Risk Factors,” and in subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The

forward-looking statements represent Alliance’s views as of the

date on which such statements were made and Alliance undertakes no

obligation to publicly update such forward-looking statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170411005546/en/

Alliance HealthCare Services, Inc.Rhonda Longmore-Grund,

949-242-5300Executive Vice PresidentChief Financial Officer

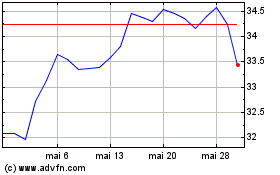

Global X Funds Global X ... (NASDAQ:AIQ)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Global X Funds Global X ... (NASDAQ:AIQ)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025