Alerus Financial Corporation (Nasdaq: ALRS), or the Company,

reported net income of $3.2 million for the fourth quarter of 2024,

or $0.13 per diluted common share, compared to net income of $5.2

million, or $0.26 per diluted common share, for the third quarter

of 2024, and net loss of $14.8 million, or ($0.73) per diluted

common share, for the fourth quarter of 2023.

CEO Comments

President and Chief Executive Officer Katie Lorenson said, “We

are pleased to end 2024 with a solid quarter on across-the-board

improvements to our performance metrics. The fourth quarter of 2024

was highlighted by the closing and conversion of HMN Financial,

Inc. (“HMNF”), the largest acquisition in our Company history, and

we welcome HMNF’s employees to the Alerus team. The combination of

HMNF and meaningful organic growth in our underlying core business,

drove an increase in earnings per share by a robust 41.9% versus

the prior quarter. Notably, the net interest margin expanded 97

basis points, while our adjusted efficiency ratio improved

significantly with a decrease to 69.0% from 77.7% in the third

quarter.

For the full year 2024, we achieved market share gains and

strong client base growth across all our business lines with our

noninterest income, which represents nearly half of our total

revenues. Noninterest income grew 19.4% quarter-over-quarter.

We enter 2025 with positive momentum and plan to continue making

long term investments to support and grow our diversified revenue

streams while continuing to prudently manage our expenses. While

our capital ratios declined in the fourth quarter due to the HMNF

acquisition, we remain above all well-capitalized thresholds and

expect to build capital in 2025. We bolstered our reserves with the

allowance for credit losses on loans to total loans moving up to

1.50%, while we continue to proactively identify and manage credit

normalization.

Looking ahead, we remain committed to driving sustainable growth

and delivering value to our shareholders. Our strategic focus on

organic growth, diversification, valuable fee income, and

maintaining strong asset quality will continue to guide our efforts

in 2025 and beyond.

I want to thank all our team members - both the new team from

HMNF and the long tenured legacy team - for your hard work,

dedication and invaluable contributions supporting our company, our

clients and our communities in 2024. Together, we will continue to

build on our successes and return Alerus to top tier financial

results.”

Fourth Quarter Highlights

- Adjusted earnings per common share (non-GAAP) of $0.44 in the

fourth quarter of 2024, an increase of 41.9% from $0.31 in the

third quarter of 2024.

- Completed the acquisition of HMN Financial, Inc. and its

subsidiary, Home Federal Savings Bank (together, “HMNF”) in the

fourth quarter of 2024, the 26th and largest acquisition in the

Company’s history.

- Total loans were $4.0 billion as of December 31, 2024, an

increase of $1.0 billion, or 31.7%, from September 30, 2024.

- Total deposits were $4.4 billion as of December 31, 2024, an

increase of $1.1 billion, or 31.7%, from September 30, 2024.

- Non-interest bearing deposits were $903.5 million as of

December 31, 2024, an increase of $245.9 million, or 37.4%, from

September 30, 2024.

- The loan to deposit ratio remained stable at 91.2% as of both

December 31, 2024 and September 30, 2024.

- Net interest income was $38.3 million in the fourth quarter of

2024, an increase of 69.8% from $22.5 million in the third quarter

of 2024.

- Net interest margin was 3.20% in the fourth quarter of 2024, an

increase of 97 basis points from 2.23% in the third quarter of

2024.

- Noninterest income was $33.9 million in the fourth quarter of

2024, which represented 46.9% of total revenues, an increase of

19.4% from $28.4 million in the third quarter of 2024.

- Adjusted pre-provision net revenue was $18.2 million in the

fourth quarter of 2024, an increase of 88.6% from $9.7 million in

the third quarter of 2024.

- Adjusted efficiency ratio (non-GAAP) was 69.0% in the fourth

quarter of 2024, improved from 77.7% in the third quarter of

2024.

- Allowance for credit losses on loans to total loans was 1.50%

as of December 31, 2024, an increase of 21 basis points from 1.29%

as of September 30, 2024.

- Adjusted return on average tangible common equity (non-GAAP)

was 14.7% in the fourth quarter of 2024, an increase from 9.0% in

the third quarter of 2024.

- Book value per common share was $19.68 as of December 31, 2024,

a 0.8% increase from $19.53 as of September 30, 2024.

Full Year 2024 Highlights

- Adjusted earnings per common share (non-GAAP) of $1.44 for the

year ended December 31, 2024, a decrease of 0.7% from $1.45 for the

year ended December 31, 2023.

- Total loans were $4.0 billion as of December 31, 2024, an

increase of $1.2 billion, or 44.7%, from December 31, 2023.

- Total deposits were $4.4 billion as of December 31, 2024, an

increase of $1.3 billion, or 41.4%, from December 31, 2023.

- Non-interest bearing deposits were $903.5 million as of

December 31, 2024, an increase of $175.4 million, or 24.1%, from

December 31, 2023.

- Net interest income was $107.0 million for the year ended

December 31, 2024, an increase of 21.9% from $87.8 million for the

year ended December 31, 2023.

- Net interest margin was 2.56% for the year ended December 31,

2024, an increase of 10 basis points from 2.46% for the year ended

December 31, 2023.

- Noninterest income was $114.9 million for the year ended

December 31, 2024, which represented 51.8% of total revenues, an

increase of 43.3% from $80.2 million for the year ended December

31, 2023.

- Total assets under administration/management at December 31,

2024 were $45.3 billion, an 11.3% increase from December 31,

2023.

- Adjusted pre-provision net revenue was $50.2 for the year ended

December 31, 2024, an increase of 24.3% from $40.4 million for the

year ended December 31, 2023.

- Adjusted efficiency ratio (non-GAAP) was 73.4% for the year

ended December 31, 2024, improved from 75.5% for the year ended

December 31, 2023.

- Allowance for credit losses on loans to total loans was 1.50%

as of December 31, 2024, an increase of 20 basis points from 1.30%

as of December 31, 2023.

- Book value per common share was $19.68 as of December 31, 2024,

a 5.2% increase from $18.71 as of December 31, 2023.

- Dividends paid per common share totaled $0.79 for the year

ended December 31, 2024, an increase of 5.3% from $0.75 for the

year ended December 31, 2023.

Selected Financial Data (unaudited)

As of and for the

Three months ended

Year ended

December 31,

September 30,

December 31,

December 31,

December 31,

(dollars and shares in thousands, except

per share data)

2024

2024

2023

2024

2023

Performance Ratios

Return on average total assets

0.24

%

0.48

%

(1.51

)%

0.47

%

0.31

%

Adjusted return on average total

assets(1)

0.83

%

0.57

%

0.52

%

0.68

%

0.77

%

Return on average common equity

2.68

%

5.52

%

(16.75

)%

5.30

%

3.26

%

Return on average tangible common

equity(1)

6.01

%

7.83

%

(18.85

)%

8.16

%

5.37

%

Adjusted return on average tangible common

equity(1)

14.65

%

9.04

%

8.38

%

11.15

%

11.30

%

Noninterest income as a % of revenue

46.94

%

55.72

%

3.54

%

51.78

%

47.74

%

Net interest margin (tax-equivalent)

3.20

%

2.23

%

2.37

%

2.56

%

2.46

%

Adjusted net interest margin

(tax-equivalent)(1)

2.81

%

2.35

%

2.31

%

2.53

%

2.42

%

Efficiency ratio(1)

73.36

%

80.29

%

165.40

%

75.93

%

85.85

%

Adjusted efficiency ratio(1)

68.97

%

77.71

%

78.18

%

73.44

%

75.50

%

Net charge-offs/(recoveries) to average

loans

0.13

%

0.04

%

(0.04

)%

0.13

%

(0.04

)%

Dividend payout ratio

153.85

%

76.92

%

(26.03

)%

80.61

%

129.31

%

Per Common Share

Earnings per common share - basic

$

0.13

$

0.26

$

(0.73

)

$

1.00

$

0.59

Earnings per common share - diluted

$

0.13

$

0.26

$

(0.73

)

$

0.98

$

0.58

Adjusted earnings per common share -

diluted (1)

$

0.44

$

0.31

$

0.26

$

1.44

$

1.45

Dividends declared per common share

$

0.20

$

0.20

$

0.19

$

0.79

$

0.75

Book value per common share

$

19.68

$

19.53

$

18.71

Tangible book value per common share

(1)

$

14.49

$

16.50

$

15.46

Average common shares outstanding -

basic

24,857

19,788

19,761

21,047

19,922

Average common shares outstanding -

diluted

25,144

20,075

19,996

21,321

20,143

Other Data

Retirement and benefit services assets

under administration/management

$

40,728,699

$

41,249,280

$

36,682,425

Wealth management assets under

administration/management

$

4,579,189

$

4,397,505

$

4,018,846

Mortgage originations

$

88,576

$

82,388

$

65,488

$

334,318

$

364,114

____________________

(1) Represents a non-GAAP financial

measure. See “Non-GAAP to GAAP Reconciliations and Calculation of

Non-GAAP Financial Measures.”

Results of Operations

Net Interest Income

Net interest income for the fourth quarter of 2024 was $38.3

million, a $15.7 million, or 69.8%, increase from the third quarter

of 2024. The increase was primarily due to increased interest

income on higher earning assets acquired in the HMNF transaction,

organic loan growth, and lower average rates paid on deposit

balances.

Net interest income increased $16.7 million, or 77.6%, from

$21.6 million for the fourth quarter of 2023. Interest income

increased $22.6 million, or 50.6%, from the fourth quarter of 2023,

primarily driven by higher earning assets acquired in the HMNF

transaction, strong organic loan growth at higher yields, and

purchase accounting accretion. The increase in interest income was

partially offset by a $5.9 million, or 25.4%, increase in interest

expense, driven by an increase in interest-bearing deposits from

the acquisition of HMNF and organic deposit growth.

Net interest margin (on a tax-equivalent basis) was 3.20% for

the fourth quarter of 2024, a 97 basis point increase from 2.23%

for the third quarter of 2024, and an 83 basis point increase from

2.37% for the fourth quarter of 2023. The increase in net interest

margin (on a tax-equivalent basis) was mainly attributable to

purchase accounting accretion, lower rates paid on deposits in the

fourth quarter, the unwinding of the Bank Term Funding Program

(“BTFP”) arbitrage trade late in the third quarter of 2024, and

organic loan and deposit growth.

Noninterest Income

Noninterest income for the fourth quarter of 2024 was $33.9

million, a $5.5 million increase from the third quarter of 2024.

The quarter over quarter increase was primarily driven by

improvement across all fee-based businesses. Mortgage banking

revenue increased $1.1 million, from $2.6 million in the third

quarter of 2024, primarily driven by higher mortgage originations

and higher margins on sold mortgages. Wealth revenue increased $0.3

million during the fourth quarter of 2024, a 4.9% increase from the

third quarter of 2024, primarily driven by the acquisition of HMNF.

Retirement and benefit services revenue increased $0.3 million in

the fourth quarter of 2024, a 2.1% increase from the third quarter

of 2024, primarily driven by nonmarket-based fees. Combined assets

under administration/management in wealth and retirement and

benefit services decreased 0.7% from September 30, 2024. The slight

decrease in combined assets under administration/management was

primarily due to stable equity and bond markets. Additionally,

other noninterest income increased $3.6 million during the fourth

quarter of 2024, a 144.9% increase from the third quarter of 2024,

primarily due to a gain on the sale of fixed assets related to the

sale of a Fargo, North Dakota office and increased swap fee income

generated from commercial loan originations.

Noninterest income for the fourth quarter of 2024 increased by

$33.1 million from the fourth quarter of 2023. The year over year

increase was primarily driven by the strategic balance sheet

repositioning transaction completed in the fourth quarter of 2023,

which resulted in a $24.6 million loss on the sale of investment

securities. Year over year, the fee-based businesses each showed

improvement. Mortgage banking revenue increased $2.4 million, from

$1.3 million in the fourth quarter of 2023, primarily driven by

higher mortgage originations and higher margins on sold mortgages.

Retirement and benefit services revenue increased $1.2 million, or

7.6%, from $15.3 million in the fourth quarter of 2023, primarily

driven by an increase in assets under administration/management of

11.0% during that same period. Wealth revenue increased $1.1

million, or 18.0%, in the fourth quarter of 2024, primarily driven

by an increase in assets under administration/management of 13.9%

during that same period. Other noninterest income increased $3.5

million, or 137.0%, in the fourth quarter of 2024 compared to the

fourth quarter of 2023, primarily due to a gain on the sale of

fixed assets related to the sale of a Fargo, North Dakota office

and increased swap fee income generated from commercial loan

originations.

Noninterest Expense

Noninterest expense for the fourth quarter of 2024 was $56.0

million, a $13.6 million, or 32.0%, increase from the third quarter

of 2024. The quarter over quarter increase was primarily driven by

the acquisition of HMNF and related expenses. Compensation expense

increased $5.6 million, or 26.6%, from the third quarter of 2024,

primarily driven by acquisition-related compensation expenses,

experienced talent acquisitions, and increased labor costs.

Professional fees and assessments increased $2.3 million, or 53.0%,

from the third quarter of 2024, primarily driven by increased

acquisition-related expenses of $1.6 million. Business services,

software and technology expense increased $2.1 million, or 42.1%,

from the third quarter of 2024, primarily driven by increased core

processing fees and equipment purchases in connection with the HMNF

acquisition. Intangible amortization expense was $2.8 million, a

$1.5 million increase from the third quarter of 2024, primarily

driven by amortization expense related to the $33.5 million core

deposit intangible recorded in connection with the HMNF

acquisition.

Noninterest expense for the fourth quarter of 2024 increased

$17.4 million, or 44.9%, from $38.7 million in the fourth quarter

of 2023. The increase was primarily driven by the acquisition of

HMNF and related expenses. Compensation expense increased $7.4

million, or 38.7%, in the fourth quarter of 2024, primarily due to

acquisition-related compensation expenses and increased labor

costs. Professional fees and assessments increased primarily due to

increased acquisition-related expenses of $3.3 million in

connection with the acquisition of HMNF and an increase in Federal

Deposit Insurance Corporation (“FDIC”) assessments. Employee taxes

and benefits expense increased $1.7 million, or 36.4%, primarily

due to increased expense related to the employee stock ownership

program (“ESOP”) and costs related to group insurance. Business

services, software and technology expense increased $1.2 million,

or 22.0%, in the fourth quarter of 2024, primarily driven by

increased core processing fees and equipment purchases in

connection with the HMNF acquisition. Intangible amortization

expense increased $1.5 million in the fourth quarter of 2024,

primarily driven by amortization expense related to the $33.5

million core deposit intangible recorded in connection with the

HMNF acquisition.

Financial Condition

Total assets were $5.3 billion as of December 31, 2024, an

increase of $1.4 billion, or 34.7%, from December 31, 2023. The

increase was primarily due to a $1.2 billion increase in loans, a

$101.3 million increase in available-for-sale investment

securities, a $40.8 million increase in goodwill, and a $26.7

million increase in other intangible assets, partially offset by a

decrease of $68.7 million in cash and cash equivalents and a

decrease of $23.9 million in held-to-maturity investment

securities. The increase in goodwill and other intangible assets

was related to the acquisition of HMNF.

Loans

Total loans were $4.0 billion as of December 31, 2024, an

increase of $1.2 billion, or 44.7%, from December 31, 2023. The

increase was primarily driven by a $938.0 million increase in

commercial loans and a $294.9 million increase in consumer

loans.

The following table presents the composition of our loan

portfolio as of the dates indicated:

December 31,

September 30,

June 30,

March 31,

December 31,

(dollars in thousands)

2024

2024

2024

2024

2023

Commercial

Commercial and industrial

$

666,727

$

606,245

$

591,779

$

575,259

$

562,180

Commercial real estate

Construction, land and development

294,677

173,629

161,751

125,966

124,034

Multifamily

363,123

275,377

242,041

260,609

245,103

Non-owner occupied

967,025

686,071

647,776

565,979

569,354

Owner occupied

371,418

296,366

283,356

285,211

271,623

Total commercial real estate

1,996,243

1,431,443

1,334,924

1,237,765

1,210,114

Agricultural

Land

61,299

45,821

41,410

41,149

40,832

Production

63,008

39,436

40,549

36,436

36,141

Total agricultural

124,307

85,257

81,959

77,585

76,973

Total commercial

2,787,277

2,122,945

2,008,662

1,890,609

1,849,267

Consumer

Residential real estate

First lien

921,019

690,451

686,286

703,726

697,900

Construction

33,547

11,808

22,573

18,425

28,979

HELOC

162,509

134,301

126,211

120,501

118,315

Junior lien

44,060

36,445

36,323

36,381

35,819

Total residential real estate

1,161,135

873,005

871,393

879,033

881,013

Other consumer

44,122

36,393

35,737

29,833

29,303

Total consumer

1,205,257

909,398

907,130

908,866

910,316

Total loans

$

3,992,534

$

3,032,343

$

2,915,792

$

2,799,475

$

2,759,583

Deposits

Total deposits were $4.4 billion as of December 31, 2024, an

increase of $1.3 billion, or 41.4%, from December 31, 2023.

Interest-bearing deposits increased $1.1 billion and

noninterest-bearing deposits increased $175.4 million, from

December 31, 2023. The increase in total deposits was due primarily

to the recent acquisition of HMNF, expanded and new commercial

deposit relationships, and synergistic deposit growth. Synergistic

deposits were $973.6 million as of December 31, 2024, an increase

of $122.0 million, or 14.3%, from December 31, 2023.

The following table presents the composition of the Company’s

deposit portfolio as of the dates indicated:

December 31,

September 30,

June 30,

March 31,

December 31,

(dollars in thousands)

2024

2024

2024

2024

2023

Noninterest-bearing demand

$

903,466

$

657,547

$

701,428

$

692,500

$

728,082

Interest-bearing

Interest-bearing demand

1,220,173

1,034,694

1,003,585

938,751

840,711

Savings accounts

165,882

75,675

79,747

82,727

82,485

Money market savings

1,381,924

1,067,187

1,022,470

1,114,262

1,032,771

Time deposits

706,965

488,447

491,345

456,729

411,562

Total interest-bearing

3,474,944

2,666,003

2,597,147

2,592,469

2,367,529

Total deposits

$

4,378,410

$

3,323,550

$

3,298,575

$

3,284,969

$

3,095,611

Asset Quality

Total nonperforming assets were $62.9 million as of December 31,

2024, an increase of $54.1 million from December 31, 2023. $25.0

million of the increase was due to one construction, land and

development loan moving to nonaccrual status in the second quarter

of 2024. During the third and fourth quarters of 2024, management

elected to make protective advances totaling $5.4 million in order

for construction to continue on the project. Management is actively

working with the borrower on strategies to complete construction,

preserve value, and support repayment of the loan. One large

residential real estate relationship and one CRE non-owner occupied

loan moving to nonaccrual status during the third quarter of 2024

also contributed $13.6 million to the increase. A further $1.5

million of the increase in the fourth quarter of 2024 was driven by

loans acquired from HMNF. Nonperforming assets included one loan

over 90 days past due and still on accrual. This loan was renewed

subsequent to year end.

As of December 31, 2024, the allowance for credit losses on

loans was $59.9 million, or 1.50% of total loans, compared to $35.8

million, or 1.30% of total loans, as of December 31, 2023.

The following table presents selected asset quality data as of

and for the periods indicated:

As of and for the three months

ended

December 31,

September 30,

June 30,

March 31,

December 31,

(dollars in thousands)

2024

2024

2024

2024

2023

Nonaccrual loans

$

54,433

$

48,026

$

27,618

$

7,345

$

8,596

Accruing loans 90+ days past due

8,453

—

—

—

139

Total nonperforming loans

62,886

48,026

27,618

7,345

8,735

OREO and repossessed assets

—

—

—

3

32

Total nonperforming assets

$

62,886

$

48,026

$

27,618

$

7,348

$

8,767

Net charge-offs/(recoveries)

1,258

316

2,522

58

(238

)

Net charge-offs/(recoveries) to average

loans

0.13

%

0.04

%

0.36

%

0.01

%

(0.04

)%

Nonperforming loans to total loans

1.58

%

1.58

%

0.95

%

0.26

%

0.32

%

Nonperforming assets to total assets

1.19

%

1.18

%

0.63

%

0.17

%

0.22

%

Allowance for credit losses on loans to

total loans

1.50

%

1.29

%

1.31

%

1.31

%

1.30

%

Allowance for credit losses on loans to

nonperforming loans

95

%

82

%

139

%

498

%

410

%

For the fourth quarter of 2024, the Company had net charge-offs

of $1.3 million, compared to net charge-offs of $0.3 million for

the third quarter of 2024 and net recoveries of $0.2 million for

the fourth quarter of 2023. The quarter-over-quarter increase in

net charge-offs was driven by a $0.6 million charge-off of one

residential real estate loan and a $0.4 million charge-off of one

commercial and industrial loan in the fourth quarter of 2024.

The Company recorded a provision for credit losses of $12.0

million for the fourth quarter of 2024, compared to a provision for

credit losses of $1.7 million for the third quarter of 2024 and a

provision for credit losses of $1.5 million for the fourth quarter

of 2023. The provision for credit losses for the fourth quarter of

2024 was primarily driven by a $7.8 million day one provision for

credit losses and unfunded commitment reserve related to the

acquisition of HMNF, as well as loan growth and an increase in

nonaccrual loans.

The unearned fair value adjustments on acquired loan portfolios

were $70.6 million and $5.2 million as of December 31, 2024 and

2023, respectively.

Capital

Total stockholders’ equity was $498.7 million as of December 31,

2024, an increase of $129.6 million from December 31, 2023. This

change was primarily driven by the issuance of stock in connection

with to the acquisition of HMNF. Tangible book value per common

share (non-GAAP) decreased to $14.49 as of December 31, 2024, from

$15.46 as of December 31, 2023. Tangible common equity to tangible

assets (non-GAAP) decreased to 7.15% as of December 31, 2024, from

7.94% as of December 31, 2023. Common equity tier 1 capital to risk

weighted assets decreased to 9.98% as of December 31, 2024, from

11.82% as of December 31, 2023.

The following table presents our capital ratios as of the dates

indicated:

December 31,

September 30,

December 31,

2024

2024

2023

Capital Ratios(1)

Alerus Financial Corporation

Consolidated

Common equity tier 1 capital to risk

weighted assets

9.98

%

11.12

%

11.82

%

Tier 1 capital to risk weighted assets

10.18

%

11.38

%

12.10

%

Total capital to risk weighted assets

12.55

%

14.04

%

14.76

%

Tier 1 capital to average assets

8.68

%

9.30

%

10.57

%

Tangible common equity / tangible assets

(2)

7.15

%

8.11

%

7.94

%

Alerus Financial, N.A.

Common equity tier 1 capital to risk

weighted assets

10.19

%

10.73

%

11.40

%

Tier 1 capital to risk weighted assets

10.19

%

10.73

%

11.40

%

Total capital to risk weighted assets

11.44

%

11.98

%

12.51

%

Tier 1 capital to average assets

8.66

%

8.90

%

9.92

%

____________________

(1)

Capital ratios for the current quarter are

to be considered preliminary until the Call Report for Alerus

Financial, N.A. is filed.

(2)

Represents a non-GAAP financial measure.

See “Non-GAAP to GAAP Reconciliations and Calculation of Non-GAAP

Financial Measures.”

Conference Call

The Company will host a conference call at 11:00 a.m. Central

Time on Wednesday, January 29, 2024, to discuss its financial

results. Attendees are encouraged to register ahead of time for the

call at investors.alerus.com. The call can also be accessed via

telephone at +1 (833) 470-1428, using access code 092113. A

recording of the call and transcript will be available on the

Company’s investor relations website at investors.alerus.com

following the call.

About Alerus Financial Corporation

Alerus Financial Corporation (Nasdaq: ALRS) is a commercial

wealth bank and national retirement services provider with

corporate offices in Grand Forks, North Dakota, and the

Minneapolis-St. Paul, Minnesota metropolitan area. Through its

subsidiary, Alerus Financial, National Association, Alerus provides

diversified and comprehensive financial solutions to business and

consumer clients, including banking, wealth services, and

retirement and benefit plans and services. Alerus provides clients

with a primary point of contact to help fully understand their

unique needs and delivery channel preferences. Clients are provided

with competitive products, valuable insight, and sound advice

supported by digital solutions designed to meet their needs.

Alerus operates 29 banking and commercial wealth offices, with

locations in Grand Forks and Fargo, North Dakota; the

Minneapolis-St. Paul, Minnesota metropolitan area; Rochester,

Minnesota; Southern Minnesota area; Marshalltown, Iowa; Pewaukee,

Wisconsin; and Phoenix and Scottsdale, Arizona. Alerus also

operates a commercial wealth office in La Crosse, Wisconsin. The

Alerus Retirement and Benefit business serves advisors, brokers,

employers, and plan participants across the United States.

Non-GAAP Financial Measures

Some of the financial measures included in this press release

are not measures of financial performance recognized by U.S.

Generally Accepted Accounting Principles, or GAAP. These non-GAAP

financial measures include the ratio of tangible common equity to

tangible assets, tangible book value per common share, return on

average tangible common equity, efficiency ratio, pre-provision net

revenue, adjusted noninterest income, adjusted noninterest expense,

adjusted pre-provision net revenue, adjusted efficiency ratio,

adjusted net income, adjusted return on average assets, adjusted

return on average tangible common equity, net interest margin

(tax-equivalent), adjusted net interest margin (tax-equivalent),

and adjusted earnings per common share - diluted. Management uses

these non-GAAP financial measures in its analysis of its

performance, and believes financial analysts and investors

frequently use these measures, and other similar measures, to

evaluate capital adequacy and financial performance.

Reconciliations of non-GAAP disclosures used in this press release

to the comparable GAAP measures are provided in the accompanying

tables. Management, banking regulators, many financial analysts and

other investors use these measures in conjunction with more

traditional bank capital ratios to compare the capital adequacy of

banking organizations with significant amounts of goodwill or other

intangible assets, which typically stem from the use of the

purchase accounting method of accounting for mergers and

acquisitions.

These non-GAAP financial measures should not be considered in

isolation or as a substitute for total stockholders’ equity, total

assets, book value per share, return on average assets, return on

average equity, or any other measure calculated in accordance with

GAAP. Moreover, the manner in which the Company calculates these

non-GAAP financial measures may differ from that of other companies

reporting measures with similar names.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include, without limitation, statements concerning

plans, estimates, calculations, forecasts and projections with

respect to the anticipated future performance of Alerus Financial

Corporation. These statements are often, but not always, identified

by words such as “may”, “might”, “should”, “could”, “predict”,

“potential”, “believe”, “expect”, “continue”, “will”, “anticipate”,

“seek”, “estimate”, “intend”, “plan”, “projection”, “would”,

“annualized”, “target” and “outlook”, or the negative version of

those words or other comparable words of a future or

forward-looking nature. Examples of forward-looking statements

include, among others, statements the Company makes regarding our

projected growth, anticipated future financial performance,

financial condition, credit quality, management’s long-term

performance goals, and the future plans and prospects of Alerus

Financial Corporation.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding our

business, future plans and strategies, projections, anticipated

events and trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ

materially from those indicated in forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in forward-looking statements include, among others, the following:

interest rate risk, including the effects of changes in interest

rates; effects on the U.S. economy resulting from the

implementation of policies proposed by the new presidential

administration, including tariffs, mass deportations, and tax

regulations; our ability to successfully manage credit risk,

including in the CRE portfolio, and maintain an adequate level of

allowance for credit losses; business and economic conditions

generally and in the financial services industry, nationally and

within our market areas, including the level and impact of

inflation rates and possible recession; the effects of recent

developments and events in the financial services industry,

including the large-scale deposit withdrawals over a short period

of time that resulted in several bank failures; our ability to

raise additional capital to implement our business plan; the

overall health of the local and national real estate market; credit

risks and risks from concentrations (by type of borrower,

geographic area, collateral, and industry) within our loan

portfolio; the concentration of large loans to certain borrowers

(including CRE loans); the level of nonperforming assets on our

balance sheet; our ability to implement our organic and acquisition

growth strategies, including the integration of HMNF which the

Company acquired in the fourth quarter of 2024; the commencement,

cost, and outcome of litigation and other legal proceedings and

regulatory actions against us or to which the Company may become

subject, including with respect to pending actions relating to the

Company’s previous ESOP fiduciary services commenced by government

or private parties; the impact of economic or market conditions on

our fee-based services; our ability to continue to grow our

retirement and benefit services business; our ability to continue

to originate a sufficient volume of residential mortgages; the

occurrence of fraudulent activity, breaches or failures of our or

our third-party vendors’ information security controls or

cybersecurity-related incidents, including as a result of

sophisticated attacks using artificial intelligence and similar

tools or as a result of insider fraud; interruptions involving our

information technology and telecommunications systems or

third-party servicers; potential losses incurred in connection with

mortgage loan repurchases; the composition of our executive

management team and our ability to attract and retain key

personnel; rapid and expensive technological change in the

financial services industry; increased competition in the financial

services industry, including from non-banks such as credit unions,

Fintech companies and digital asset service providers; our ability

to successfully manage liquidity risk, including our need to access

higher cost sources of funds such as fed funds purchased and

short-term borrowings; the concentration of large deposits from

certain clients, including those who have balances above current

FDIC insurance limits; the effectiveness of our risk management

framework; potential impairment to the goodwill the Company

recorded in connection with our past acquisitions, including the

acquisitions of Metro Phoenix Bank and HMNF; the extensive

regulatory framework that applies to us; the impact of recent and

future legislative and regulatory changes, including in response to

prior bank failures; new or revised accounting standards, as may be

adopted by state and federal regulatory agencies, the Financial

Accounting Standards Board, the Securities and Exchange Commission

(the “SEC”) or the Public Company Accounting Oversight Board;

fluctuations in the values of the securities held in our securities

portfolio, including as a result of changes in interest rates;

governmental monetary, trade and fiscal policies; risks related to

climate change and the negative impact it may have on our customers

and their businesses; severe weather and natural disasters, and

widespread disease or pandemics; acts of war or terrorism,

including ongoing conflicts in the Middle East and Russian invasion

of Ukraine, or other adverse external events; any material

weaknesses in our internal control over financial reporting;

changes to U.S. or state tax laws, regulations and governmental

policies concerning our general business, including changes in

interpretation or prioritization and changes in response to prior

bank failures; talent and labor shortages and employee turnover;

our success at managing the risks involved in the foregoing items;

and any other risks described in the “Risk Factors” sections of the

reports filed by Alerus Financial Corporation with the SEC.

Any forward-looking statement made by us in this press release

is based only on information currently available to us and speaks

only as of the date on which it is made. The Company undertakes no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

Alerus Financial Corporation and

Subsidiaries

Consolidated Balance Sheets

(dollars in thousands, except share and

per share data)

December 31,

December 31,

2024

2023

Assets

(Unaudited)

Cash and cash equivalents

$

61,239

$

129,893

Investment securities

Trading, at fair value

3,309

—

Available-for-sale, at fair value

588,053

486,736

Held-to-maturity, at amortized cost (with

an allowance for credit losses on investments of $131 and $213,

respectively)

275,585

299,515

Loans held for sale

16,518

11,497

Loans

3,992,534

2,759,583

Allowance for credit losses on loans

(59,929

)

(35,843

)

Net loans

3,932,605

2,723,740

Land, premises and equipment, net

39,780

17,940

Operating lease right-of-use assets

13,438

5,436

Accrued interest receivable

20,075

15,700

Bank-owned life insurance

36,033

33,236

Goodwill

87,564

46,783

Other intangible assets

43,882

17,158

Servicing rights

7,918

2,052

Deferred income taxes, net

48,766

34,595

Other assets

90,543

83,432

Total assets

$

5,265,308

$

3,907,713

Liabilities and Stockholders’

Equity

Deposits

Noninterest-bearing

$

903,466

$

728,082

Interest-bearing

3,474,944

2,367,529

Total deposits

4,378,410

3,095,611

Short-term borrowings

238,960

314,170

Long-term debt

59,069

58,956

Operating lease liabilities

18,991

5,751

Accrued expenses and other liabilities

71,179

64,098

Total liabilities

4,766,609

3,538,586

Stockholders’ equity

Preferred stock, $1 par value, 2,000,000

shares authorized: 0 issued and outstanding

—

—

Common stock, $1 par value, 30,000,000

shares authorized: 25,344,803 and 19,734,077 issued and

outstanding

25,345

19,734

Additional paid-in capital

269,708

150,343

Retained earnings

277,012

272,705

Accumulated other comprehensive loss

(73,366

)

(73,655

)

Total stockholders’ equity

498,699

369,127

Total liabilities and stockholders’

equity

$

5,265,308

$

3,907,713

Alerus Financial Corporation and

Subsidiaries

Consolidated Statements of

Income

(dollars and shares in thousands, except

per share data)

Three months ended

Year ended

December 31,

September 30,

December 31,

December 31,

December 31,

2024

2024

2023

2024

2023

Interest Income

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Loans, including fees

$

60,009

$

42,593

$

37,731

$

183,560

$

136,918

Investment securities

Taxable

5,737

4,596

6,040

19,745

24,262

Exempt from federal income taxes

166

169

182

679

740

Other

1,395

4,854

742

17,595

2,963

Total interest income

67,307

52,212

44,695

221,579

164,883

Interest Expense

Deposits

25,521

22,285

17,169

89,243

53,387

Short-term borrowings

2,837

6,706

5,292

22,584

20,976

Long-term debt

665

679

682

2,707

2,681

Total interest expense

29,023

29,670

23,143

114,534

77,044

Net interest income

38,284

22,542

21,552

107,045

87,839

Provision for credit losses

11,992

1,661

1,507

18,141

2,057

Net interest income after provision for

credit losses

26,292

20,881

20,045

88,904

85,782

Noninterest Income

Retirement and benefit services

16,488

16,144

15,317

64,365

65,294

Wealth management

7,010

6,684

5,940

26,171

21,855

Mortgage banking

3,673

2,573

1,279

10,469

8,411

Service charges on deposit accounts

644

488

341

1,976

1,280

Net gains (losses) on investment

securities

—

—

(24,643

)

—

(24,643

)

Other

6,059

2,474

2,557

11,950

8,032

Total noninterest income

33,874

28,363

791

114,931

80,229

Noninterest Expense

Compensation

26,657

21,058

19,214

87,311

76,290

Employee taxes and benefits

6,245

5,400

4,578

22,967

20,051

Occupancy and equipment expense

1,963

2,082

1,858

7,766

7,477

Business services, software and technology

expense

6,935

4,879

5,686

21,758

21,053

Intangible amortization expense

2,804

1,324

1,324

6,776

5,296

Professional fees and assessments

6,530

4,267

2,345

15,162

6,743

Marketing and business development

1,050

764

1,002

3,249

3,027

Supplies and postage

726

422

521

2,046

1,796

Travel

449

330

313

1,403

1,189

Mortgage and lending expenses

571

684

501

2,162

1,902

Other

2,093

1,237

1,312

5,641

5,333

Total noninterest expense

56,023

42,447

38,654

176,241

150,157

Income before income tax expense

4,143

6,797

(17,818

)

27,594

15,854

Income tax expense

921

1,590

(3,064

)

6,525

4,158

Net income

$

3,222

$

5,207

$

(14,754

)

$

21,069

$

11,696

Per Common Share Data

Earnings per common share

$

0.13

$

0.26

$

(0.73

)

$

1.00

$

0.59

Diluted earnings per common share

$

0.13

$

0.26

$

(0.73

)

$

0.98

$

0.58

Dividends declared per common share

$

0.20

$

0.20

$

0.19

$

0.79

$

0.75

Average common shares outstanding

24,857

19,788

19,761

21,047

19,922

Diluted average common shares

outstanding

25,144

20,075

19,996

21,321

20,143

Alerus Financial Corporation and

Subsidiaries

Non-GAAP to GAAP Reconciliations and

Calculation of Non-GAAP Financial Measures (unaudited)

(dollars and shares in thousands, except

per share data)

December 31,

September 30,

December 31,

2024

2024

2023

Tangible Common Equity to Tangible

Assets

Total common stockholders’ equity

$

498,699

$

386,486

$

369,127

Less: Goodwill

87,564

46,783

46,783

Less: Other intangible assets

43,882

13,186

17,158

Tangible common equity (a)

367,253

326,517

305,186

Total assets

5,265,308

4,084,640

3,907,713

Less: Goodwill

87,564

46,783

46,783

Less: Other intangible assets

43,882

13,186

17,158

Tangible assets (b)

5,133,862

4,024,671

3,843,772

Tangible common equity to tangible assets

(a)/(b)

7.15

%

8.11

%

7.94

%

Tangible Book Value Per Common

Share

Total common stockholders’ equity

$

498,699

$

386,486

$

369,127

Less: Goodwill

87,564

46,783

46,783

Less: Other intangible assets

43,882

13,186

17,158

Tangible common equity (c)

367,253

326,517

305,186

Total common shares issued and outstanding

(d)

25,345

19,790

19,734

Tangible book value per common share

(c)/(d)

$

14.49

$

16.50

$

15.46

Three months ended

Year ended

December 31,

September 30,

December 31,

December 31,

December 31,

2024

2024

2023

2024

2023

Return on Average Tangible Common

Equity

Net income

$

3,222

$

5,207

$

(14,754

)

$

21,069

$

11,696

Add: Intangible amortization expense (net

of tax)(1)

2,215

1,046

1,046

5,353

4,184

Net income, excluding intangible

amortization (e)

5,437

6,253

(13,708

)

26,422

15,880

Average total equity

478,128

375,229

349,382

397,747

358,268

Less: Average goodwill

84,414

46,783

46,783

56,242

46,959

Less: Average other intangible assets (net

of tax)(1)

34,107

10,933

14,067

17,534

15,624

Average tangible common equity (f)

359,607

317,513

288,532

323,971

295,685

Return on average tangible common equity

(e)/(f)

6.01

%

7.83

%

(18.85

)%

8.16

%

5.37

%

Efficiency Ratio

Noninterest expense

$

56,023

$

42,447

$

38,654

$

176,241

$

150,157

Less: Intangible amortization expense

2,804

1,324

1,324

6,776

5,296

Adjusted noninterest expense (g)

53,219

41,123

37,330

169,465

144,861

Net interest income

38,284

22,542

21,552

107,045

87,839

Noninterest income

33,874

28,363

791

114,931

80,229

Tax-equivalent adjustment

385

314

226

1,202

671

Total tax-equivalent revenue (h)

72,543

51,219

22,569

223,178

168,739

Efficiency ratio (g)/(h)

73.36

%

80.29

%

165.40

%

75.93

%

85.85

%

____________________

(1)

Items calculated after-tax utilizing a

marginal income tax rate of 21.0%.

Alerus Financial Corporation and

Subsidiaries

Non-GAAP to GAAP Reconciliations and

Calculation of Non-GAAP Financial Measures (unaudited)

(dollars and shares in thousands, except

per share data)

Three months ended

Year ended

December 31,

September 30,

December 31,

December 31,

December 31,

2024

2024

2023

2024

2023

Pre-Provision Net Revenue

Net interest income

$

38,284

$

22,542

$

21,552

$

107,045

$

87,839

Add: Noninterest income

33,874

28,363

791

114,931

80,229

Less: Noninterest expense

56,023

42,447

38,654

176,241

150,157

Pre-provision net revenue

$

16,135

$

8,458

$

(16,311

)

$

45,735

$

17,911

Adjusted Noninterest Income

Noninterest income

$

33,874

$

28,363

$

791

$

114,931

$

80,229

Less: Adjusted noninterest income

items

BOLI mortality proceeds (non-taxable)

—

—

—

—

1,196

Gain on sale of ESOP trustee business

—

—

—

—

2,775

Net gains (losses) on investment

securities

—

—

(24,643

)

—

(24,643

)

Net gain on sale of premises and

equipment

3,459

476

—

3,941

50

Total adjusted noninterest income items

(i)

3,459

476

(24,643

)

3,941

(20,622

)

Adjusted noninterest income (j)

$

30,415

$

27,887

$

25,434

$

110,990

$

100,851

Adjusted Noninterest Expense

Noninterest expense

$

56,023

$

42,447

$

38,654

$

176,241

$

150,157

Less: Adjusted noninterest expense

items

HMNF merger- and acquisition-related

expenses

3,295

1,661

—

5,546

—

Severance and signing bonus expense

2,276

31

422

2,901

1,897

Total adjusted noninterest expense items

(k)

5,571

1,692

422

8,447

1,897

Adjusted noninterest expense (l)

$

50,452

$

40,755

$

38,232

$

167,794

$

148,260

Adjusted Pre-Provision Net

Revenue

Net interest income

$

38,284

$

22,542

$

21,552

$

107,045

$

87,839

Add: Adjusted noninterest income (j)

30,415

27,887

25,434

110,990

100,851

Less: Adjusted noninterest expense (l)

50,452

40,755

38,232

167,794

148,260

Adjusted pre-provision net revenue

$

18,247

$

9,674

$

8,754

$

50,241

$

40,430

Adjusted Efficiency Ratio

Adjusted noninterest expense (l)

$

50,452

$

40,755

$

38,232

$

167,794

$

148,260

Less: Intangible amortization expense

2,804

1,324

1,324

6,776

5,296

Adjusted noninterest expense for

efficiency ratio (m)

47,648

39,431

36,908

161,018

142,964

Tax-equivalent revenue

Net interest income

38,284

22,542

21,552

107,045

87,839

Add: Adjusted noninterest income (j)

30,415

27,887

25,434

110,990

100,851

Add: Tax-equivalent adjustment

385

314

226

1,202

671

Total tax-equivalent revenue (n)

69,084

50,743

47,212

219,237

189,361

Adjusted efficiency ratio (m)/(n)

68.97

%

77.71

%

78.18

%

73.44

%

75.50

%

Adjusted Net Income

Net income

$

3,222

$

5,207

$

(14,754

)

$

21,069

$

11,696

Less: Adjusted noninterest income items

(net of tax)(1) (i)

2,733

376

(19,468

)

3,113

(16,040

)

Add: HMNF day one provision for credit

losses and unfunded commitments (net of tax)(1)

6,140

—

—

6,140

—

Add: Adjusted noninterest expense items

(net of tax)(1) (k)

4,401

1,337

333

6,673

1,499

Adjusted net income (o)

$

11,030

$

6,168

$

5,047

$

30,769

$

29,235

Adjusted Return on Average

Assets

Average total assets (p)

$

5,272,816

$

4,298,080

$

3,868,206

$

4,503,493

$

3,817,017

Adjusted return on average assets

(o)/(p)

0.83

%

0.57

%

0.52

%

0.68

%

0.77

%

Adjusted Return on Average Tangible

Common Equity

Adjusted net income (o)

$

11,030

$

6,168

$

5,047

$

30,769

$

29,235

Add: Intangible amortization expense (net

of tax)(1)

2,215

1,046

1,046

5,353

4,184

Adjusted net income, excluding intangible

amortization (q)

13,245

7,214

6,093

36,122

33,419

Average total equity

478,128

375,229

349,382

397,747

358,268

Less: Average goodwill

84,414

46,783

46,783

56,242

46,959

Less: Average other intangible assets (net

of tax)

34,107

10,933

14,067

17,534

15,624

Average tangible common equity (r)

359,607

317,513

288,532

323,971

295,685

Return on average tangible common equity

(q)/(r)

14.65

%

9.04

%

8.38

%

11.15

%

11.30

%

____________________

(1)

Items calculated after-tax utilizing a

marginal income tax rate of 21.0%.

Alerus Financial Corporation and

Subsidiaries

Non-GAAP to GAAP Reconciliations and

Calculation of Non-GAAP Financial Measures (unaudited)

(dollars and shares in thousands, except

per share data)

Three months ended

Year ended

December 31,

September 30,

December 31,

December 31,

December 31,

2024

2024

2023

2024

2023

Adjusted Net Interest Margin

(Tax-Equivalent)

Net interest income

$

38,284

$

22,542

$

21,552

$

107,045

$

87,839

Less: BTFP cash interest income

—

4,113

—

12,494

—

Add: BTFP interest expense

—

3,717

—

11,291

—

Less: Purchase accounting net

accretion

4,692

152

521

6,121

1,490

Net interest income excluding BTFP

impact

33,592

21,994

21,031

99,721

86,349

Add: Tax equivalent adjustment for loans

and securities

385

314

226

1,202

671

Adjusted net interest income (s)

$

33,977

$

22,308

$

21,257

$

100,923

$

87,020

Interest earning assets

4,808,230

4,077,716

3,645,184

4,221,832

3,592,476

Less: Average cash proceeds balance from

BTFP

—

303,043

—

231,366

—

Add: Change in unearned purchase

accounting discount

4,692

152

521

6,121

1,490

Adjusted interest earning assets (t)

$

4,812,922

$

3,774,825

$

3,645,705

$

3,996,587

$

3,593,966

Adjusted net interest margin

(tax-equivalent) (s)/(t)

2.81

%

2.35

%

2.31

%

2.53

%

2.42

%

Adjusted Earnings Per Common Share -

Diluted

Adjusted net income (o)

$

11,030

$

6,168

$

5,047

$

30,769

$

29,235

Less: Dividends and undistributed earnings

allocated to participating securities

(16

)

24

(247

)

79

(5

)

Net income available to common

stockholders (u)

11,046

6,144

5,294

30,690

29,240

Weighted-average common shares outstanding

for diluted earnings per share (v)

25,144

20,075

19,996

21,321

20,143

Adjusted earnings per common share -

diluted (u)/(v)

$

0.44

$

0.31

$

0.26

$

1.44

$

1.45

____________________

(1)

Items calculated after-tax utilizing a

marginal income tax rate of 21.0%.

Alerus Financial Corporation and

Subsidiaries

Analysis of Average Balances, Yields,

and Rates (unaudited)

(dollars in thousands)

Three months ended

Year ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Average

Average

Average

Average

Average

Average

Yield/

Average

Yield/

Average

Yield/

Average

Yield/

Average

Yield/

Balance

Rate

Balance

Rate

Balance

Rate

Balance

Rate

Balance

Rate

Interest Earning Assets

Interest-bearing deposits with banks

$

74,054

5.35

%

$

326,350

5.47

%

$

33,920

3.23

%

$

299,625

5.39

%

$

35,395

3.40

%

Investment securities(1)

883,116

2.68

749,062

2.55

921,555

2.70

791,111

2.60

983,545

2.56

Loans held for sale

15,409

5.60

15,795

3.20

11,421

6.01

14,180

5.90

13,217

5.46

Loans

Commercial and industrial

616,356

7.28

593,685

7.26

538,694

6.90

588,269

7.23

527,795

6.63

CRE − Construction, land and

development

250,869

6.33

184,611

5.68

117,765

8.12

172,700

6.77

99,315

7.66

CRE − Multifamily

351,804

6.50

242,558

5.62

227,453

5.48

272,125

5.87

185,262

5.25

CRE − Non-owner occupied

1,002,857

6.68

663,539

5.88

519,021

5.67

712,734

6.14

498,884

5.28

CRE − Owner occupied

293,169

6.56

289,963

5.41

266,274

5.18

286,540

5.71

256,690

5.07

Agricultural − Land

59,400

5.73

42,162

4.93

41,064

4.82

45,729

5.10

39,832

4.78

Agricultural − Production

58,999

7.36

40,964

6.84

34,480

6.64

43,361

6.89

30,663

6.48

RRE − First lien

904,414

4.50

689,382

3.98

691,152

3.95

747,874

4.17

673,118

3.80

RRE − Construction

31,722

9.74

16,792

3.86

32,958

4.97

22,832

6.58

33,508

4.98

RRE − HELOC

153,344

7.60

130,705

8.00

118,722

8.37

131,617

8.02

118,653

8.07

RRE − Junior lien

47,041

6.25

36,818

5.74

36,415

6.21

38,982

6.24

35,382

5.83

Other consumer

44,959

7.19

37,768

6.76

29,510

6.33

36,252

6.81

35,971

6.06

Total loans(1)

3,814,934

6.27

2,968,947

5.73

2,653,508

5.64

3,099,015

5.93

2,535,073

5.39

Federal Reserve/FHLB stock

20,717

7.66

17,562

8.25

24,780

7.48

17,901

8.12

25,246

6.98

Total interest earning assets

4,808,230

5.60

4,077,716

5.12

3,645,184

4.89

4,221,832

5.28

3,592,476

4.61

Noninterest earning assets

464,586

220,364

223,022

281,661

224,541

Total assets

$

5,272,816

$

4,298,080

$

3,868,206

$

4,503,493

$

3,817,017

Interest-Bearing Liabilities

Interest-bearing demand deposits

$

1,209,674

1.98

%

$

1,003,595

2.31

%

$

798,634

1.65

%

$

1,010,888

2.12

%

$

768,238

1.29

%

Money market and savings deposits

1,520,616

3.15

1,146,896

3.82

1,092,656

3.53

1,250,939

3.60

1,118,815

2.92

Time deposits

698,358

4.24

485,533

4.46

383,715

4.27

518,826

4.39

303,746

3.58

Fed funds purchased and BTFP

22,012

4.93

327,543

4.97

189,568

5.71

249,180

4.95

287,768

5.31

FHLB short-term advances

200,000

5.10

200,000

5.20

200,000

5.09

200,000

5.12

113,973

5.00

Long-term debt

59,055

4.48

59,027

4.58

58,943

4.59

59,013

4.59

58,900

4.55

Total interest-bearing liabilities

3,709,715

3.11

3,222,594

3.66

2,723,516

3.37

3,288,846

3.48

2,651,440

2.91

Noninterest-Bearing Liabilities and

Stockholders' Equity

Noninterest-bearing deposits

847,153

628,114

719,895

704,463

737,365

Other noninterest-bearing liabilities

237,820

72,143

75,413

112,437

69,944

Stockholders’ equity

478,128

375,229

349,382

397,747

358,268

Total liabilities and stockholders’

equity

$

5,272,816

$

4,298,080

$

3,868,206

$

4,503,493

$

3,817,017

Net interest rate spread

2.49

%

1.46

%

1.52

%

1.80

%

1.70

%

Net interest margin, tax-equivalent

(1)

3.20

%

2.23

%

2.37

%

2.56

%

2.46

%

____________________

(1)

Taxable-equivalent adjustment was

calculated utilizing a marginal income tax rate of 21.0%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128310319/en/

Alan A. Villalon, Chief Financial Officer 952.417.3733

(Office)

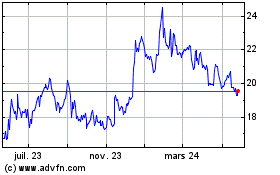

Alerus Financial (NASDAQ:ALRS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

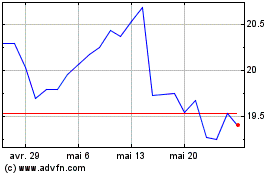

Alerus Financial (NASDAQ:ALRS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025