UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(RULE

14C-101)

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive

Information Statement |

American

Rebel Holdings, Inc.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

1) |

Title

of each class of securities to which transaction applies: |

| |

|

| |

|

|

| |

2) |

Aggregate

number of securities to which transaction applies: |

| |

|

| |

|

|

| |

3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

| |

|

|

| |

4) |

Proposed

maximum aggregate value of transaction: |

| |

|

| |

|

|

| |

5) |

Total

fee paid: |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

AMERICAN

REBEL HOLDINGS, INC.

5115

Maryland Way, Ste. 303

Brentwood,

Tennessee 37027

INFORMATION

STATEMENT IN LIEU OF ANNUAL MEETING OF STOCKHOLDERS

Dear

American Rebel Holdings, Inc. Stockholder:

The

purpose of this letter and the enclosed Information Statement is to inform you that stockholders holding shares of Series A Convertible

Preferred Stock (the “Series A Preferred”) and shares of Common Stock, representing in excess of a majority of the

outstanding shares of Common Stock of American Rebel Holdings, Inc. (“American Rebel”) have executed a written consent

dated January 10, 2025 (the “Written Consent”) in lieu of a special meeting to approve the private placement transactions

(the “Actions” or “Private Placements”) and issuance of the securities (the “Securities”),

each as defined and described in more detail in this Information Statement.

The

required consent of at least a majority of the votes allocated to our voting shares was given for each of the Private Placements.

The

General Corporation Law of the State of Nevada (the “NRS”), permit holders of a majority of the voting power to take

stockholder action by written consent. The written consent constitutes the consent of a majority of the total number of votes entitled

to vote on the foregoing actions and is sufficient under NRS 78.320 to approve the foregoing Actions. Accordingly, American Rebel is

not required to and will not hold a meeting of its stockholders to approve the Actions described herein. We encourage you to read the

attached Information Statement carefully for further information.

All

necessary corporate approvals required pursuant to the NRS and the Bylaws in connection with the matters referred to herein have been

obtained. This Information Statement is furnished solely for the purpose of informing the stockholders of the Company, in the manner

required under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), of this corporate action before

it takes effect.

The

accompanying Information Statement is being furnished to American Rebel stockholders for informational purposes only, pursuant to Section

14(c) of the Exchange Act and the rules and regulations prescribed thereunder. You are encouraged to carefully read the Information Statement

for further information regarding these actions. In accordance with the Exchange Act, the approval of the actions described herein will

be deemed effective at a date that is 20 calendar days after the date the Definitive Information Statement has been mailed to our stockholders.

This Information Statement is first being mailed to stockholders on or about ________ , 2025.

THIS

IS FOR YOUR INFORMATION ONLY. YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF A MEETING

OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

| |

Yours

truly, |

| |

|

| |

|

| |

Charles

A. Ross, Jr. |

| |

Chairman |

| Brentwood,

Tennessee |

|

| January

__, 2025 |

|

AMERICAN

REBEL HOLDINGS, INC.

5115

Maryland Way, Ste. 303

Brentwood,

Tennessee 37027

INFORMATION

STATEMENT

(Dated

_______, 2025)

NO

VOTE OR OTHER ACTION OF AMERICAN REBEL’S STOCKHOLDERS IS REQUIRED IN

CONNECTION WITH THIS INFORMATION STATEMENT.

AMERICAN

REBEL IS NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND AMERICAN REBEL A PROXY.

American

Rebel Holdings, Inc., a Nevada corporation (“American Rebel”) is furnishing this information statement (the “Information

Statement”) to its stockholders in full satisfaction of any notice requirements American Rebel may have under the Securities

and Exchange Act of 1934, as amended (the “Exchange Act”), and applicable Nevada law (the “NRS”).

No additional action will be undertaken by American Rebel with respect to the receipt of written consents, and no dissenters’ rights

with respect to the receipt of the written consents, and no dissenters’ rights under the NRS, are afforded to American Rebel’s

stockholders as a result of the adoption of the actions contemplated herein.

The

Information Statement is being mailed on or about ___________, 2025 to the holders of record at the close of business on January 21,

2025 (the “Record Date”), of the Common Stock of American Rebel in connection with actions approved by written consent

dated January 10, 2025 (the “Written Consent”) in lieu of a special meeting to approve the private placement transactions

(the “Actions” or “Private Placements”) and issuance of the securities (the “Securities”),

each as defined and described in more detail in this Information Statement.

American

Rebel is subject to the Nasdaq Listing Rules because its Common Stock is currently listed on The Nasdaq Capital Market (“Nasdaq”).

The issuance or potential issuance of shares of Common Stock in connection with the Private Placements implicates Nasdaq Listing Rule

5635, which requires prior stockholder approval in order to maintain our listing on Nasdaq. Nasdaq Listing Rule 5635(d) requires stockholder

approval prior to a transaction, other than a public offering, involving the sale, issuance or potential issuance by the issuer of common

stock (or securities convertible into or exercisable for common stock), which alone or together with sales by officers, directors or

substantial stockholders of the issuer, equals 20% or more of the common stock or 20% or more of the voting power outstanding before

the issuance at a price that is less than the lower of (i) the closing price immediately preceding the signing of the binding agreement;

or (ii) the average closing price of the common stock for the five trading days immediately preceding the signing of the binding agreement.

As of the signing date of each of the definitive documents to issue the Securities under the Private Placements, the Company could not

issue shares of Common Stock pursuant to the Private Placements in excess of the Rule 5635 limitations, unless the issuances of such

shares was approved by our stockholders.

The

approval of the Private Placements and issuance of the Securities for purposes of Nasdaq Listing Rule 5635 was taken by written consent

pursuant to NRS 78.320, which provides that any action that may be taken at any annual or special meeting of stockholders may be taken

without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall

be signed by the holders of outstanding capital stock having not less than the minimum number of votes that would be necessary to authorize

or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

The

American Rebel board of directors (the “Board”) adopted resolutions approving the Private Placements and issuance

of the Securities and recommended that the stockholders vote in favor of the Private Placements and issuance of the Securities. In connection

with the adoption of these resolutions, the Majority Stockholders also voted in favor and entered into a written consent approving the

Private Placements and issuance of the Securities.

Utilizing

the written consent of the holders of a majority in interest of our voting securities eliminates the costs involved in holding a special

meeting of stockholders.

Pursuant

to NRS 78.320, we are required to provide prompt notice of the taking of the corporate action without a meeting of stockholders to all

stockholders who did not consent in writing to such action. This Information Statement serves as this notice. This Information Statement

is being delivered to inform you of the corporate action described herein before it takes effect in accordance with Rule 14(c)-2 under

the Exchange Act.

No

appraisal rights are afforded to our stockholders under Nevada law in connection with the matters discussed in this Information Statement.

The

Board of Directors of the Company knows of no other matters other than that described in this Information Statement which have been recently

approved or considered by the holders of the Common Stock.

GENERAL

This

Information Statement is first being mailed to stockholders on or about _________, 2025, and the Actions described herein may not become

effective until at least 20 calendar days thereafter. The entire cost of furnishing this Information Statement will be borne by American

Rebel. American Rebel will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information

Statement to the beneficial owners of its Common Stock held of record by them and will reimburse such persons for their reasonable charges

and expenses in connection therewith.

The

corporate offices of American Rebel are located at 5115 Maryland Way, Ste. 303, Brentwood, Tennessee 37027 and American Rebel’s

telephone number is (833) 267-3235.

Except

as otherwise described herein, no director, executive officer, associate of any director or executive officer, or any other person has

any substantial interest, direct or indirect, by security holdings or otherwise, in the Actions, which is not shared by all other holders

of American Rebel’s Common Stock.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This

Information Statement may contain “forward-looking statements” made under the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about beliefs or expectations,

are forward-looking statements. These statements are based on plans, estimates, expectations and projections at the time the statements

are made, and readers should not place undue reliance on them. In some cases, readers can identify forward-looking statements by the

use of forward-looking terms such as “may,” “should,” “except,” “opportunity,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“target,” “goal,” or “continue,” or the negative of these terms or other comparable terms. Forward-looking

statements involve inherent risks and uncertainties and readers are cautioned that a number of important factors could cause actual results

to differ materially from those contained in any such forward-looking statements. Forward-looking statements herein speak only as of

the date each statement is made. Neither American Rebel nor any other person undertakes any obligation to update any of these statements

in light of new information or future events, except to the extent required by applicable law.

VOTE

REQUIRED AND INFORMATION ON VOTING STOCKHOLDERS

American

Rebel is not seeking consents, authorizations or proxies from you.

As

of the date of the Written Consent, American Rebel had 2,005,906 shares of Common Stock issued and outstanding and entitled to vote,

which for voting purposes are entitled to one vote per share. On January 10, 2025, the following consenting Voting Stockholders owning

a total of 3,107 shares of Common Stock and 124,812 shares of Series A Preferred, whereby each share is entitled to cast one thousand

(1,000) votes for each share held of the Series A Preferred on all matters presented to the stockholders of American Rebel for stockholder

vote, thereby allowing such Common Stock and Series A Preferred to cast votes totaling 124,815,107 shares of Common Stock, delivered

the executed Written Consent authorizing the Actions described herein. The consenting Voting Stockholders’ names, affiliation with

American Rebel and holdings are as follows:

| Name | |

Affiliation | |

Number of

Voting Shares | | |

% of Total

Voting Shares(4) | |

| Charles A. Ross, Jr. | |

Director, Chief Executive Officer, Treasurer | |

| 49,913,234 | (1) | |

| 39.36 | % |

| Doug Grau | |

President | |

| 50,000,913 | (2) | |

| 39.43 | % |

| Corey Lambrecht | |

Director, Chief Operating Officer | |

| 24,900,960 | (3) | |

| 19.63 | % |

| Total | |

| |

| 124,815,107 | | |

| 98.42 | % |

| (1) |

Includes

49,912 shares of Series A Preferred with equivalent of 49,912,000 shares of Common Stock voting power and 1,234 shares of Common

Stock beneficially owned by Mr. Ross. |

| |

|

| (2) |

Includes

50,000 shares of Series A Preferred with equivalent of 50,000,000 shares of Common Stock voting power and 913 shares of Common Stock

beneficially owned by Mr. Grau. |

| |

|

| (3) |

Includes

24,900 shares of Series A Preferred with equivalent of 24,900,000 shares of Common Stock voting power and 960 shares of Common Stock

beneficially owned by Mr. Lambrecht. |

| |

|

| (4) |

Percentage

is based upon 2,005,906 shares of Common Stock authorized and outstanding and adjusted by the 124,812,000 votes attributable to the

Series A Preferred, for a total of 126,817,906 total voting shares. Figures are rounded to the nearest hundredth of a percent. |

Pursuant

to American Rebel’s existing Bylaws and the NRS, the holders of the issued and outstanding shares of Common Stock, or Preferred

Stock voting rights, representing a majority of voting power may approve and authorize the Actions by written consent as if such Actions

were undertaken at a duly called and held meeting of stockholders. In order to significantly reduce the costs and management time involved

in soliciting and obtaining proxies to approve the Actions, and in order to effectuate the Actions as early as possible, the Board elected

to utilize, and did in fact obtain, the Written Consent of the Voting Stockholders. The Written Consent satisfies the stockholder approval

requirement for the Actions. Accordingly, under the NRS and the Bylaws, no other approval by the Board or stockholders of American Rebel

is required in order to approve the Actions.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information concerning the number of shares of American Rebel’s Common Stock owned beneficially

as of January 10, 2025, or exercisable within the next 60 days thereafter, by: (i) American Rebel’s directors; (ii) American Rebel’s

named executive officers; and (iii) each person or group known by American Rebel to beneficially own more than 5% of American Rebel’s

outstanding shares of Common Stock. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes

voting or investment power with respect to securities. Except as indicated by footnote, the persons named in the table below have sole

voting power and investment power with respect to all shares of Common Stock shown as beneficially owned by them.

| Name and Address of Beneficial Owner(1) | |

Amount and Nature of Beneficial Ownership | | |

Percentage of Common Stock Outstanding(2) | |

| Named Executive Officers: | |

| | |

| |

| Charles A. Ross, Jr., CEO, principal executive officer, Chairman, and treasurer(3) | |

| 9,957,234 | | |

| 83.23 | % |

| | |

| | | |

| | |

| Doug Grau, President, interim principal financial officer and interim principal accounting officer(4) | |

| 10,000,913 | | |

| 83.29 | % |

| | |

| | | |

| | |

| Corey Lambrecht, COO and Director(5) | |

| 9,325,960 | | |

| 82.30 | % |

| | |

| | | |

| | |

| Directors: | |

| | | |

| | |

| Larry Sinks, Director | |

| 0 | | |

| * | % |

| | |

| | | |

| | |

| Michael Dean Smith, Director | |

| 904 | | |

| 0.05 | % |

| | |

| | | |

| | |

| C. Stephen Cochennet, Director | |

| 245 | | |

| 0.0 1 | % |

| | |

| | | |

| | |

| Officers and Directors as a group (6 Persons) | |

| 29,285,256 | | |

| 93.61 | % |

*

Less than 0.01%.

| (1) |

Unless

otherwise noted above, the address of the persons and entities listed in the table is c/o American Rebel Holdings, Inc., 5115 Maryland

Way, Ste. 303, Brentwood, Tennessee 37027. |

| |

|

| (2) |

Percentage

is based upon 2,005,906 shares of Common Stock authorized and outstanding and adjusted as needed for derivative securities held by

such stockholders. Figures are rounded to the nearest hundredth of a percent. |

| |

|

| (3) |

Includes

19,912 shares of Series A Preferred Stock, which is currently convertible into 9,956,000 shares of Common Stock at the option of

the holder. Does not include an additional 30,000 shares of Series A Preferred stock, which are convertible, equally every year starting

on January 1, 2026 and for two additional years, into shares of Common Stock at a rate of 500 to 1. Further, each share of Series

A Preferred Stock is entitled to cast one thousand (1,000) votes for each share held of the Series A Preferred stock on all matters

presented to the stockholders of the Company for a vote. |

| |

|

| (4) |

Includes

20,000 shares of Series A Preferred Stock, which is currently convertible into 10,000,000 shares of Common Stock at the option of

the holder. Does not include an additional 30,000 shares of Series A Preferred stock, which are convertible, equally every year starting

on January 1, 2026 and for two additional years, into shares of Common Stock at a rate of 500 to 1. Further, each share of Series

A Preferred Stock is entitled to cast one thousand (1,000) votes for each share held of the Series A Preferred stock on all matters

presented to the stockholders of the Company for a vote. |

| |

|

| (5) |

Includes

18,650 shares of Series A Preferred Stock, which is currently convertible into 9,325,000 shares of Common Stock at the option of

the holder. Does not include an additional 6,250 shares of Series A Preferred stock, which are convertible, commencing on January

1, 2026, into shares of Common Stock at a rate of 500 to 1. Further, each share of Series A Preferred Stock is entitled to cast one

thousand (1,000) votes for each share held of the Series A Preferred stock on all matters presented to the stockholders of the Company

for a vote. |

ACTIONS

APPROVED BY CONSENTING MAJORITY STOCKHOLDERS

The

following actions have been approved by the written consent of the Majority Stockholders, whose votes represent approximately 98.42%

of the votes of our issued and outstanding capital stock entitled to vote on matters submitted to the stockholders:

APPROVAL

OF THE ISSUANCE OF COMMON STOCK IN ACCORDANCE WITH APPLICABLE NASDAQ LISTING RULES

Description

of the Private Placements

| Investor

Name |

|

Type

of Investment |

|

Investment

Date |

|

#

of Shares Issuable |

| 1800

Diagonal Lending LLC |

|

Promissory

Note |

|

March

21, 2024 |

|

615,706 |

| |

|

Promissory

Note |

|

May

28, 2024 |

|

186,208 |

| |

|

Bridge

Note |

|

August

8, 2024 |

|

236,247 |

| |

|

Promissory

Note |

|

October

4, 2024 |

|

238,467 |

| |

|

Promissory

Note |

|

November

6, 2024 |

|

267,668 |

| |

|

|

|

|

|

|

| Kingdom

Building, Inc. |

|

Consulting

Agreement (Preferred Stock) |

|

May

24, 2024 |

|

175,000 |

| |

|

Promissory

Note |

|

August

15, 2024 |

|

266,670 |

| |

|

OID

Note |

|

January

10, 2025 |

|

215,000 |

| |

|

|

|

|

|

|

| Coventry

Enterprises, LLC |

|

Promissory

Note |

|

September

4, 2024 |

|

466,667 |

| |

|

Preferred

Stock

Conversion |

|

September

4, 2024 |

|

33,000 |

| |

|

|

|

|

|

|

| Berke

Bakay |

|

Prefunded

Warrant |

|

October

23, 2024 |

|

284,530 |

| |

|

|

|

|

|

|

| Bakay

Capital Fund, LP |

|

OID

Note |

|

January

10, 2025 |

|

1,150,000 |

| |

|

|

|

|

|

|

| Alumni

Capital LP |

|

Promissory

Note |

|

October

30, 2024 |

|

840,000 |

| |

|

Warrant |

|

October

30, 2024 |

|

72,165 |

| |

|

|

|

|

|

|

| Osher

Capital Partners, LLC |

|

Purchase

and Exchange

Agreement |

|

November

11, 2024 |

|

2,000,000 |

| |

|

|

|

|

|

|

| Horberg

Enterprises LP |

|

OID

Note |

|

November

11, 2024 |

|

321,071 |

| |

|

OID

Note |

|

December

13, 2024 |

|

260,116 |

| |

|

|

|

|

|

|

| Silverback

Capital Corporation |

|

Settlement

Agreement

and

Stipulation |

|

December

26, 2024 |

|

3,000,000 |

1800

Diagonal Notes

On

March 21, 2024, the Company entered into a Securities Purchase Agreement with 1800 Diagonal Lending, LLC, an accredited investor

(“the Lender”), pursuant to which the Lender made a loan to the Company, evidenced by a promissory note in the principal

amount of $235,750 (the “Note”). A one-time interest charge of 15% ($35,362) and fees of $5,000 were applied on the issuance

date, resulting in net loan proceeds to us of $200,000. Accrued, unpaid interest and outstanding principal, subject to adjustment, is

required to be paid in seven payments; the first payment shall be in the amount of $162,667.20 and is due on June 30, 2024 with six (6)

subsequent payments each in the amount of $18,074.14 due on the 30th of each month thereafter (a total payback to the Lender

of $271,112.00). the Company has the right to prepay the Note within one hundred eighty days at a discount of 5%. Upon the occurrence

and during the continuation of any Event of Default, the Note shall become immediately due and payable and the Company will be obligated

to pay to the Lender, in full satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then outstanding principal

amount of the Note plus (x) accrued and unpaid interest on the unpaid principal amount of the Note to the date of payment plus (y) default

interest, if any, at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus (z) any amounts owed to the

Lender pursuant to the conversion rights referenced below. Only upon an occurrence of an event of default under the Note, the Lender

may convert the outstanding unpaid principal amount of the Note into restricted shares of common stock of the Company at a discount of

25% of the market price. The Lender agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock.

The Company agreed to reserve a number of shares of common stock equal to four times the number of shares of common stock which may be

issuable upon conversion of the Note at all times. The Company is currently in default in its obligations to 1800 Diagonal. The foregoing

descriptions of the Note and the Securities Purchase Agreement and of all of the parties’ rights and obligations under the Note

and the Securities Purchase Agreement are qualified in its entirety by reference to the Note and the Securities Purchase Agreement, copies

of which were filed as Exhibits 10.1 and 10.2, respectively to the Current Report on Form 8-K filed on March 22, 2024.

On

May 28, 2024, the Company entered into a Securities Purchase Agreement with 1800 Diagonal Lending, LLC, an accredited investor (“the

Lender”), pursuant to which the Lender made a loan to the Company, evidenced by a promissory note in the principal amount of $111,550

(the “Note”). An original issue discount of $14,550 and fees of $7,000 were applied on the issuance date, resulting in net

loan proceeds to the Company of $90,000. Accrued, unpaid interest and outstanding principal, subject to adjustment, is required to be

paid in nine payments in the amount of $13,881.78, with the first payment due on June 30, 2024, and remaining eight payments due on the

last day of each month thereafter (a total payback to the Lender of $124,936.00). Upon the occurrence and during the continuation of

any Event of Default, the Note shall become immediately due and payable and the Company will be obligated to pay to the Lender, in full

satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then outstanding principal amount of the Note plus

(x) accrued and unpaid interest on the unpaid principal amount of the Note to the date of payment plus (y) default interest, if any,

at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus (z) any amounts owed to the Lender pursuant to

the conversion rights referenced below. Only upon an occurrence of an event of default under the Note, the Lender may convert the outstanding

unpaid principal amount of the Note into restricted shares of common stock of the Company at a discount of 25% of the market price. The

Lender agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock. There are no warrants or

other derivatives attached to this Note. The Company agreed to reserve a number of shares of common stock equal to four times the number

of shares of common stock which may be issuable upon conversion of the Note at all times. The Company is currently in default in its

obligations to 1800 Diagonal. The foregoing descriptions of the Note and the Securities Purchase Agreement and of all of the parties’

rights and obligations under the Note and the Securities Purchase Agreement are qualified in its entirety by reference to the Note and

the Securities Purchase Agreement, copies of which are filed as Exhibits 10.1 and 10.2, respectively, to the Current Report on Form 8-K

filed on June 4, 2024.

On

August 8, 2024, the Company entered into a Securities Purchase Agreement with 1800 Diagonal Lending, LLC, an accredited investor

(“the Lender”), pursuant to which the Lender made a loan to the Company, evidenced by a promissory note in the principal

amount of $179,400 (the “Note”). An original issue discount of $23,400 and fees of $6,000 were applied on the issuance date,

resulting in net loan proceeds to the Company of $150,000. Accrued, unpaid interest and outstanding principal, subject to adjustment,

is required to be paid in five payments, with the first payment of $103,155 due on February 15, 2025, and remaining four payments of

$25,788.75 due on the fifteenth day of each month thereafter (a total payback to the Lender of $206,310.00). Upon the occurrence and

during the continuation of any Event of Default, the Note shall become immediately due and payable and the Company will be obligated

to pay to the Lender, in full satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then outstanding principal

amount of the Note plus (x) accrued and unpaid interest on the unpaid principal amount of the Note to the date of payment plus (y) default

interest, if any, at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus (z) any amounts owed to the

Lender pursuant to the conversion rights referenced below. Only upon an occurrence of an event of default under the Note, the Lender

may convert the outstanding unpaid principal amount of the Note into restricted shares of common stock of the Company at a discount of

25% of the market price. The Lender agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock.

There are no warrants or other derivatives attached to this Note. The Company agreed to reserve a number of shares of common stock equal

to four times the number of shares of common stock which may be issuable upon conversion of the Note at all times. The Company is currently

in default in its obligations to 1800 Diagonal. The foregoing descriptions of the Note and the Securities Purchase Agreement and of all

of the parties’ rights and obligations under the Note and the Securities Purchase Agreement are qualified in its entirety by reference

to the Note and the Securities Purchase Agreement, copies of which are filed as Exhibits 10.1 and 10.2 respectively to the Current Report

on Form 8-K filed on August 13, 2024.

On

October 4, 2024, the Company entered into a Securities Purchase Agreement with 1800 Diagonal Lending, LLC, an accredited investor

(“the Lender”), pursuant to which the Lender made a loan to the Company, evidenced by a promissory note in the principal

amount of $122,960 (the “Note”). An original issue discount of $16,960 and fees of $6,000 were applied on the issuance date,

resulting in net loan proceeds to the Company of $100,000. Accrued, unpaid interest and outstanding principal, subject to adjustment,

is required to be paid in nine payments of $15,574.89, with the first payment due on October 30, 2024, and remaining eight payments due

on the 30th day of each month thereafter (a total payback to the Lender of $140,174). Upon the occurrence and during the continuation

of any Event of Default, the Note shall become immediately due and payable and the Company will be obligated to pay to the Lender, in

full satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then outstanding principal amount of the Note

plus (x) accrued and unpaid interest on the unpaid principal amount of the Note to the date of payment plus (y) default interest, if

any, at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus (z) any amounts owed to the Lender pursuant

to the conversion rights referenced below. Only upon an occurrence of an event of default under the Note, the Lender may convert the

outstanding unpaid principal amount of the Note into restricted shares of common stock of the Company at a discount of 25% of the market

price. The Lender agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock. There are no

warrants or other derivatives attached to this Note. The Company agreed to reserve a number of shares of common stock equal to four times

the number of shares of common stock which may be issuable upon conversion of the Note at all times. The Company is currently in default

in its obligations to 1800 Diagonal. The foregoing descriptions of the Note and the Securities Purchase Agreement and of all of the parties’

rights and obligations under the Note and the Securities Purchase Agreement are qualified in its entirety by reference to the Note and

the Securities Purchase Agreement, copies of which are filed as Exhibits 10.1 and 10.2 respectively to this Current Report on Form 8-K

filed on October 8, 2024.

On

November 6, 2024, the Company entered into a Securities Purchase Agreement with 1800 Diagonal Lending, LLC, an accredited investor

(the “Lender”), pursuant to which the Lender made a loan to the Company, evidenced by a promissory note in the principal

amount of $122,960 (the “Note”). An original issue discount of $16,960 and fees of $6,000 were applied on the issuance date,

resulting in net loan proceeds to the Company of $100,000. Accrued, unpaid interest and outstanding principal, subject to adjustment,

is required to be paid in nine payments of $15,574.89, with the first payment due on December 15, 2024, and remaining eight payments

due on the 15th day of each month thereafter (a total payback to the Lender of $140,174). Upon the occurrence and during the continuation

of any Event of Default, the Note shall become immediately due and payable and the Company will be obligated to pay to the Lender, in

full satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then outstanding principal amount of the Note

plus (x) accrued and unpaid interest on the unpaid principal amount of the Note to the date of payment plus (y) default interest, if

any, at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus (z) any amounts owed to the Lender pursuant

to the conversion rights referenced below. Only upon an occurrence of an event of default under the Note, the Lender may convert the

outstanding unpaid principal amount of the Note into restricted shares of common stock of the Company at a discount of 25% of the market

price. The Lender agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock. There are no

warrants or other derivatives attached to this Note. The Company agreed to reserve a number of shares of common stock equal to four times

the number of shares of common stock which may be issuable upon conversion of the Note at all times. The Company is currently in default

in its obligations to 1800 Diagonal. The foregoing descriptions of the Note and the Securities Purchase Agreement and of all of the parties’

rights and obligations under the Note and the Securities Purchase Agreement are qualified in its entirety by reference to the Note and

the Securities Purchase Agreement, copies of which are filed as Exhibits 10.1 and 10.2 respectively to the Current Report on Form 8-K

filed on November 8, 2024.

Kingdom

Building, Inc.

On

May 15, 2024, the Company entered into a consulting agreement with Kingdom Building, Inc. (“KBI”), whereby KBI agreed

to provide certain strategic advisory services for the Company for a period of twelve months in exchange for 35,000 shares of Series

D Convertible Preferred Stock. Each share of Series D Convertible Preferred Stock is convertible into five shares of common stock.

On

Aust 15, 2024, the Company entered into a promissory note with KBI in the principal amount of $200,000, which matured on September

30, 2024. On October 1, 2024, the Company entered into a settlement agreement with KBI, whereby in settlement of (a) all principal and

interest amounts owed to KBI under the note, and (b) all claims by KBI for breaches by the Company of the note, the Company issued KBI

53,334 shares of Series D Convertible Preferred Stock. Each share of Series D Convertible Preferred Stock is convertible into five shares

of common stock.

On

January 10, 2025, the Company entered into a six-month promissory note with KBI in the principal amount $123,420. An original issue

discount of $23,420 was applied to the note on the issuance date and was paid through the issuance of 3,123 shares of the Company’s

Series D Convertible Preferred Stock to KBI, resulting in net loan proceeds to the Company of $100,000. Accrued, unpaid interest and

outstanding principal, subject to adjustment, is required to be paid on or before July 10, 2025 (a total payback to KBI of $107,500).

Upon the occurrence and during the continuation of any Event of Default, the note shall become immediately due and payable and the Company

will be obligated to pay to KBI, in full satisfaction of its obligations, an amount equal to 130% times the sum of (w) the then outstanding

principal amount of the note plus (x) accrued and unpaid interest on the unpaid principal amount of the note to the date of payment plus

(y) any amounts owed to KBI pursuant to the conversion rights referenced below. At any time after the issuance date of the note, KBI

may convert the outstanding unpaid principal amount of the note into restricted shares of Series D Convertible Preferred Stock of the

Company at $7.50 per share, or upon the sale of common stock below $1.50 per share, KBI has the ability to convert the outstanding amount

of the note into shares of common stock at the lowest price sold prior to the registration of the common stock. Each Lender agreed to

limit the amount of stock received to less than 4.99% of the total outstanding common stock. The Company granted KBI piggy-back registration

rights on the shares of common stock issuable upon conversion of the Series D Convertible Preferred Stock. The Company agreed to reserve

a number of shares of Series D Convertible Preferred Stock, and common stock issuable upon conversion thereof, equal to three times the

number of shares of Series D Convertible Preferred Stock, and common stock issuable upon conversion thereof, which may be issuable upon

conversion of the note at all times. The foregoing description of the KBI note and of all of the parties’ rights and obligations

under the note are qualified in their entirety by reference to the note, a copy of the KBI note was filed as Exhibit 10.3 to the Current

Report on Form 8-K filed on January 13, 2025.

Coventry

Enterprises

On

September 4, 2024, the Company entered into a securities purchase agreement with Coventry, pursuant to which Coventry made a second

loan to the Company, evidenced by a promissory note in the principal amount of $300,000. A one-time interest charge of 12% ($36,000)

was applied to the note upon issuance. Further, an original issue discount of $45,000, $75,436.02 was utilized to repay a June 14, 2024

note with Coventry, commissions to a broker dealer of $8,000, and fees of $10,000 were applied on the issuance date, resulting in net

loan proceeds to us of $161,563.98. Accrued, unpaid interest and outstanding principal, subject to adjustment, is required to be paid

in eight payments; the first payment shall be in the amount of $37,333.33 and was due on September 30, 2024 with seven (7) subsequent

payments each in the amount of $37,333.33 due on the last day of each month thereafter (a total payback to the Lender of $336,000.00).

In addition to the note, the Company and Coventry entered into a conversion agreement, whereby Coventry converted $49,500 of its June

14, 2024 note into 6,600 shares of the Company’s Series D Convertible Preferred Stock. Pursuant to the conversion agreement and

securities purchase agreement, the Company granted piggyback registration rights to Coventry on the shares of common stock underlying

the preferred shares and the shares of common stock potentially issuable upon default of the note. Upon the occurrence and during the

continuation of any Event of Default, the note shall become immediately due and payable and the Company will be obligated to pay to Coventry,

in full satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then outstanding principal amount of the note

plus (x) accrued and unpaid interest on the unpaid principal amount of the note to the date of payment plus (y) default interest, if

any, at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus (z) any amounts owed to Coventry pursuant

to the conversion rights referenced below. Only upon an occurrence of an event of default under the note, Coventry may convert the outstanding

unpaid principal amount of the note into restricted shares of common stock of the Company at a discount of 25% of the market price. Coventry

agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock. There are no warrants or other

derivatives attached to this note. The Company agreed to reserve a number of shares of common stock equal to four times the number of

shares of common stock which may be issuable upon conversion of the note at all times. The Company is currently in default in its obligations

to Coventry.The foregoing descriptions of the note, the securities purchase agreement, and conversion agreement and of all of the parties’

rights and obligations under the note, the securities purchase agreement and conversion agreement are qualified in its entirety by reference

to the note, the securities purchase agreement and conversion agreement, copies of which were filed as Exhibits 10.1, 10.2 and 10.3 respectively

to the Current Report on Form 8-K filed on September 9, 2024.

Berke

Bakay

On

October 23, 2024, the Company entered into an exchange and settlement agreement with Berke Bakay. On April 19, 2024, the Company

and Bakay had entered into a $500,000 revenue interest purchase agreement. Pursuant to the securities exchange agreement, AREB and Bakay

exchanged the revenue agreement and all rights and preferences thereunder for 57,000 shares of common stock, valued at $2.75 per share,

and a three-year pre-funded warrant to purchase 486,030 shares of common stock at $0.01 per share, valued at $2.74 per share. The securities

exchange agreement included representations, warranties and covenants by the Company and Bakay that are customary for a transaction of

this type. The foregoing description of the securities exchange agreement is not a complete description of all of the parties’

rights and obligations under the securities exchange agreement, and is qualified in its entirety by reference to the securities exchange

agreement, a copy of which was filed as Exhibit 10.1 to the Current Report on Form 8-K filed on October 30, 2024.

Bakay

Capital Fund

On

January 10, 2025, the Company entered into a six-month promissory note with Bakay Capital Fund, LP in the principal amount of $617,100.

An original issue discount of $117,100 was applied to the note on the issuance date and was paid through the issuance of 15,613 shares

of the Company’s Series D Convertible Preferred Stock, resulting in net loan proceeds to the Company of $500,000. Accrued, unpaid

interest and outstanding principal, subject to adjustment, is required to be paid on or before July 10, 2025 (a total payback of $537,500).

Upon the occurrence and during the continuation of any Event of Default, the note shall become immediately due and payable and the Company

will be obligated to pay to Bakay Capital, in full satisfaction of its obligations, an amount equal to 130% times the sum of (w) the

then outstanding principal amount of the note plus (x) accrued and unpaid interest on the unpaid principal amount of the note to the

date of payment plus (y) any amounts owed to Bakay Capital pursuant to the conversion rights referenced below. At any time after the

issuance date of the note, Bakay Capital may convert the outstanding unpaid principal amount of the note into restricted shares of Series

D Convertible Preferred Stock of the Company at $7.50 per share, or upon the sale of common stock below $1.50 per share, Bakay Capital

has the ability to convert the outstanding amount of the note into shares of common stock at the lowest price sold prior to the registration

of the common stock. Each Lender agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock.

The Company granted Bakay Capital piggy-back registration rights on the shares of common stock issuable upon conversion of the Series

D Convertible Preferred Stock. The Company agreed to reserve a number of shares of Series D Convertible Preferred Stock, and common stock

issuable upon conversion thereof, equal to three times the number of shares of Series D Convertible Preferred Stock, and common stock

issuable upon conversion thereof, which may be issuable upon conversion of the note at all times. The foregoing description of the Bakay

Capital note and of all of the parties’ rights and obligations under the note are qualified in their entirety by reference to the

note, a copy of the Bakay Capital note was filed as Exhibit 10.2 to the Current Report on Form 8-K filed on January 13, 2025.

Alumni

Capital

On

October 30, 2024, the Company entered into a securities purchase agreement with Alumni Capital LP (“Alumni”), pursuant

to which Alumni made a loan to the Company, evidenced by a promissory note in the principal amount of $420,000. An original issue discount

of $70,000 and commissions to a broker dealer of $28,000 were applied on the issuance date, resulting in net loan proceeds to the Company

of $322,000. Accrued, unpaid interest at the rate of 10% and outstanding principal, subject to adjustment, was required to be paid on

or before December 31, 2024. The Company also issued Alumni a five-year common stock purchase warrant to purchase up to 72,165 shares

of commons stock at $5.82 per share. Copies of the securities purchase agreement, note and warrant were attached as exhibits to the Form

8-K filed on November 1, 2024.

On

December 31, 2024, the Company and Alumni entered into an amendment to the securities purchase agreement whereby (i) the maturity

date of the note was extended to February 17, 2025, (ii) the principal amount of the note was increased by $21,000, and (iii) the exercise

price of the warrant was reduced to $3.50 per share. The foregoing description of the amendment and of all of the parties’ rights

and obligations under the amendment is qualified in its entirety by reference to the amendment, a copy of which is filed as Exhibit 10.2

to the Current Report on Form 8-K filed on January 3, 2025.

Osher

Capital Partners

On

November 11, 2024, the Company entered into a purchase and exchange agreement among Osher Capital Partners (“Osher”)

and Altbanq Lending LLC (“Altbanq”), pursuant to which Osher agreed to purchase from Altbanq a portion ($150,469.11) of a

promissory note dated March 27, 2024 in the original principal amount of $1,330,000 (the “Altbanq Note”), with a current

balance payable of $1,229,350 (the “Altbanq Note Balance”). Contemporaneously with assignment of the assigned note portion

to Osher, the Company exchanged the $150,469.11 of assigned note portion for 78,615 shares of the Company’s common stock as a 3(a)(9)

exchange. At any time during the ninety days after the initial closing, Osher may purchase additional portions of the Altbanq Note, at

one or more closing, by sending an additional closing notice in the amount set forth in the additional note notice and the Company will

exchange such additional portions for shares of its common stock as a 3(a)(9) exchange. The additional shares will be calculated by dividing

the relevant additional portion by 75% of the average of the three lowest bids for the Company’s common stock on its principal

trading market on the five trading days prior to the closing of the purchase of the additional portion. The purchase and exchange agreement

contains a beneficial ownership limitation of 4.99% of the number of the common shares outstanding immediately after giving effect to

the issuance of common shares issuable upon any closing of the purchase of an additional portion by Osher. No closing of the purchase

of any additional portion shall take effect nor shall Osher be able to purchase any additional portion to the extent that after giving

effect to such issuance after closing, the Purchaser Altbanq (together with its Affiliates, and any other Persons acting as a group together

with Osher or any of its Affiliates), would beneficially own in excess of the beneficial ownership limitation. The Company will not issue

shares of common stock in excess of 19.99% of the shares outstanding as of the date of the purchase and exchange agreement. In the event

the previous sentence restricts the Company’s ability to completely convert the Altbanq Note, the Company will seek stockholder

approval to allow the issuance shares of common stock in excess of 19.99% of the shares outstanding. For a period of ninety days after

the closing, Altbanq and Company shall not further amend the Altbanq Note nor allow any payments to be made on account of the Altbanq

Note. In the event there has been a material adverse event with the Company or tother reasonable cause, upon fifteen (15) days written

notice, Altbanq may accelerate the termination of this period. The foregoing descriptions of the purchase and exchange agreement and

of all of the parties’ rights and obligations under the purchase and exchange agreement are qualified in its entirety by reference

to the purchase and exchange agreement, a copy of which is filed as Exhibit 10.1 to the Current Report on Form 8-K filed on November

13, 2024.

Horberg

Enterprises

On

November 11, 2024, the Company entered into a twelve-month promissory note with Horberg Enterprises, LP (“Horberg”) in

the principal amount of $400,000. An original issue discount of $80,000 was applied on the issuance date and was paid through the issuance

of 26,756 shares of the Company’s common stock to Horberg, resulting in net loan proceeds to the Company of $320,000. Accrued,

unpaid interest and outstanding principal, subject to adjustment, is required to be paid in seven payments of $52,571.43, with the first

payment due on May 11, 2025, and remaining six payments due on the 11th day of each month thereafter (a total payback of $368,000.01).

Upon the occurrence and during the continuation of any Event of Default, the note shall become immediately due and payable and the Company

will be obligated to pay to Horberg, in full satisfaction of its obligations, an amount equal to 130% times the sum of (w) the then outstanding

principal amount of the note plus (x) accrued and unpaid interest on the unpaid principal amount of the note to the date of payment plus

(y) any amounts owed to Horberg pursuant to the conversion rights referenced below. At any time after 180 days from the issuance date

of the note, Horberg may convert the outstanding unpaid principal amount of the note into restricted shares of common stock of the Company

at the lesser of (i) $2.94 per share, or (ii) the average of the three (3) lowest VWAP’s in the preceding five (5) day trading

period to the conversion date. Horberg agreed to limit the amount of stock received to less than 4.99% of the total outstanding common

stock. There are no warrants or other derivatives attached to this note. The Company agreed to reserve a number of shares of common stock

equal to three times the number of shares of common stock which may be issuable upon conversion of the note at all times. The foregoing

descriptions of the note and of all of the parties’ rights and obligations under the note is qualified in its entirety by reference

to the note, a copy of which was filed as Exhibit 10.2 to the Current Report on Form 8-K filed on November 13, 2024.

On

December 13, 2024, the Company entered into a three-month promissory note Horberg in the principal amount of $213,715. An original

issue discount of $63,715 was applied on the issuance date and was paid through the issuance of 36,830 shares of the Company’s

common stock to Horberg, resulting in net loan proceeds to the Company of $150,000. Accrued, unpaid interest and outstanding principal,

subject to adjustment, is required to be paid in one lump sum payment of $155,625 on or before March 13, 2025. Upon the occurrence and

during the continuation of any Event of Default, the note shall become immediately due and payable and the Company will be obligated

to pay to Horberg, in full satisfaction of its obligations, an amount equal to 130% times the sum of (w) the then outstanding principal

amount of the note plus (x) accrued and unpaid interest on the unpaid principal amount of the note to the date of payment plus (y) any

amounts owed to Horberg pursuant to the conversion rights referenced below. At any time after the issuance date of the note, Horberg

may convert the outstanding unpaid principal amount of the note into restricted shares of common stock of the Company at the lesser of

(i) $1.73 per share, or (ii) the average of the three (3) lowest VWAP’s in the preceding five (5) day trading period to the conversion

date. Horberg agreed to limit the amount of stock received to less than 4.99% of the total outstanding common stock. There are no warrants

or other derivatives attached to this note. The Company agreed to reserve a number of shares of common stock equal to three times the

number of shares of common stock which may be issuable upon conversion of the note at all times. The foregoing description of the note

and of all of the parties’ rights and obligations under the note is qualified in its entirety by reference to the note, a copy

of which was filed as Exhibit 10.1 to the Current Report on Form 8-K filed on January 3, 2025.

Silverback

Capital Corporation

On

December 26, 2024, the Company entered into a Settlement Agreement and Stipulation (the “Settlement Agreement”) with

Silverback Capital Corporation (“SCC”) to settle outstanding claims owed to SCC. Pursuant to the Settlement Agreement, SCC

agreed to purchase certain outstanding payables between the Company and designated vendors of the Company totaling $1,843,595.18 (the

“Payables”) and will exchange such Payables for a settlement amount payable in shares of common stock of the Company (the

“Settlement Shares”). The Settlement Shares shall be priced at 75% of the average of the three lowest traded prices during

the five trading day period prior to a share request, which is subject to a floor price. In the event the Company’s market price

decreases to or below $1.00 per share, then either the Company or SCC may declare a default. SCC has agreed that it will not become the

beneficial owner of more than 4.99% of common stock of the Company at any point in time. Further, the Settlement Agreement provides that

Settlement Shares may not be issued to SCC if such issuance would exceed 19.9% of the outstanding common stock as of the date of the

Settlement Agreement, until such time as the Settlement Agreement is approved by the Company’s stockholders. The Settlement Agreement

and the issuance of the Settlement Shares was approved by the Circuit Court of the Twelfth Judicial Circuit Court for Manatee County,

Florida (the “Court”) on January 3, 2025 (Case No. 2024 CA 2116). The Court entered an Order confirming the fairness of the

terms and conditions of the Settlement Agreement and the issuance of the Settlement Shares. A copy of the Settlement Agreement was attached

as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2025. On January 13, 2025, SCC requested

the issuance of 70,000 shares of Common Stock to SCC, representing a payment of approximately $99,750. On January 15, 2025, SCC requested

the issuance of 103,500 shares of Common Stock to SCC, representing a payment of approximately $147,487.50.

Nasdaq

Listing Requirements and the Necessity of Stockholder Approval

American

Rebel is subject to the Nasdaq Listing Rules because its Common Stock is currently listed on Nasdaq. The issuance of shares of Common

Stock in connection with the Private Placements implicates Nasdaq Listing Rule 5635, which requires prior stockholder approval in order

to maintain listing on Nasdaq. Nasdaq Listing Rule 5635(d) requires stockholder approval prior to a transaction, other than a public

offering, involving the sale, issuance or potential issuance by the issuer of common stock (or securities convertible into or exercisable

for common stock), which alone or together with sales by officers, directors or substantial stockholders of the issuer, equals 20% or

more of the common stock or 20% or more of the voting power outstanding before the issuance at a price that is less than the lower of

(i) the closing price immediately preceding the signing of the binding agreement; or (ii) the average closing price of the common stock

for the five trading days immediately preceding the signing of the binding agreement.

The

issuance of shares of common stock in the Private Placements (including shares of common stock issuable upon conversion of the notes

set forth above or upon conversion of the shares of Series D Convertible Preferred Stock) could result in the issuance of shares of common

stock that represents more than 20% of our common stock or 20% of the voting power outstanding prior to the issuance of the respective

date of each Private Placement.

Based

on the table set forth above, the Company may issue a maximum of 10,628,515 shares of Common Stock pursuant to the Private Placements.

Action

by Written Consent of the Majority Stockholder

As

of January 10, 2025, the Majority Stockholders by written consent, in accordance with Nasdaq Listing Rule 5635(d), approved the Private

Placements and issuance of the Securities.

Our

Board is not soliciting your consent or your proxy in connection with this action and neither consents nor proxies are being requested

from stockholders.

The

actions taken by written consent of the Majority Stockholders will not become effective until the date that is 20 calendar days after

this Information Statement is first mailed to holders of our Common Stock as of the Record Date.

ABSENCE

OF DISSENTERS’ RIGHTS

No

dissenters’ or appraisal rights are available to our stockholders under the NRS in connection with the actions set forth in this

Information Statement.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION ABOUT THE COMPANY

The

Company is subject to the reporting requirements of the Exchange Act, and in accordance therewith files reports, proxy statements and

other information including annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K with the SEC. You can read the Company’s

SEC filings, including this information statement, over the Internet at the SEC’s website at www.sec.gov or the Company’s

website at www.americanrebel.com. The Company’s website and the information contained on, or that can be accessed through,

the website is not deemed to be incorporated by reference in, and is not considered part of, this information statement.

INFORMATION

INCORPORATED BY REFERENCE

We

“incorporate by reference” information into this Information Statement, which means that we disclose important information

to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be

part of this Information Statement, except for any information superseded by information contained expressly in this Information Statement,

and the information that we file later with the SEC will automatically supersede this information. You should not assume that (i) the

information in this Information Statement is current as of any date other than the date on the front page of this Information Statement

or (ii) any information we have incorporated by reference in this Information Statement is current as of any date other than the date

of the document incorporated by reference.

We

incorporate by reference the documents listed below and any documents filed by the Company with the SEC pursuant to Sections 13(a), 13(c),

14 or 15(d) of the Exchange Act (excluding any information furnished and not filed with the SEC pursuant to Item 2.02 or 7.01 on any

Current Report on Form 8-K, or corresponding information furnished under Item 9.01 or included as an exhibit), including all such documents

the Company may file with the SEC after the date on which this Information Statement was initially filed with the SEC:

| |

● |

our

Current Reports on Form 8-K, filed with the SEC on March 22, 2024, June 4, 2024, August 13, 2024, September 9, 2024, October 8, 2024,

October 30, 2024, November 1, 2024, November 8, 2024, November 13, 2024, January 3, 2025, and January 13, 2025. |

Upon

the written request of any record holder or beneficial owner of Common Stock entitled to notice hereunder, we will, without charge, provide

a copy of any documents we file with the SEC. Requests should be directed to 5115 Maryland Way, Ste. 303, Brentwood, Tennessee 37027,

Attention: Compliance Department.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

The

SEC has adopted rules that permit companies to deliver a single copy of an Information Statement to multiple stockholders sharing an

address unless a company has received contrary instructions from one or more of the stockholders at that address. This means that only

one copy of the Information Statement may have been sent to multiple stockholders in your household. If you would prefer to receive separate

copies of the Information Statement, either now or in the future, please contact us by mailing 5115 Maryland Way, Ste. 303, Brentwood,

Tennessee 37027, Attention: Compliance Department or calling American Rebel’s main telephone number at (833) 267-3235. In addition,

stockholders at a shared address who receive multiple copies of the Information Statement may request to receive a single copy of the

Information Statement and similar documents in the future in the same manner as described above.

CONCLUSION

As

a matter of regulatory compliance, the Company is sending you this Information Statement that describes the purpose and effect of the

actions adopted by the Majority Stockholders. Your consent to the approval of the actions is not required and is not being solicited

in connection herewith. This Information Statement is intended to provide the Company’s stockholders information required by the

rules and regulations of the Exchange Act.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE ATTACHED MATERIAL IS FOR INFORMATIONAL PURPOSES ONLY.

| |

By

Order of the Board of Directors: |

| |

|

| |

Yours

truly, |

| |

|

| |

/s/

Charles A. Ross, Jr. |

| |

Charles

A. Ross, Jr., Chairman |

| |

|

| Brentwood,

Tennessee |

|

| January

__, 2025 |

|

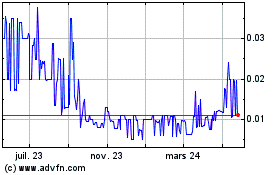

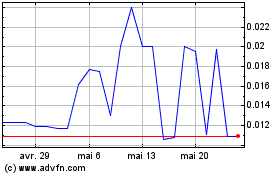

American Rebel (NASDAQ:AREBW)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

American Rebel (NASDAQ:AREBW)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025