As filed with the Securities and Exchange Commission on September 25, 2024

| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

_______________________

POST-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-8

REGISTRATION STATEMENT NO. 333-274544

UNDER

THE SECURITIES ACT OF 1933

_______________________

Arm Holdings plc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

England and Wales

(State or other jurisdiction of incorporation or organization) | | Not Applicable

(I.R.S. Employer

Identification Number) |

110 Fulbourn Road Cambridge CB1 9NJ United Kingdom (Address of principal executive offices) | | |

Arm Holdings plc 2023 Omnibus Incentive Plan with Non-Employee Sub Plan and the France and Israel Sub-Plans The Arm Holdings plc RSU Award Plan with California and Israeli Sub-Plans The Arm Holdings plc All-Employee Plan 2019 with California and French Sub-Plans The Executive IPO Plan 2019 with California Sub-Plan The Arm Non-Executive Directors RSU Award Plan with California Sub-Plan Arm Holdings plc 2024 Employee Stock Purchase Plan

(Full title of plan) |

| | |

Arm, Inc.

120 Rose Orchard Way

San Jose, CA 95134

(Name and address of agent for service) |

+1 (408) 576-1500

(Telephone number, including area code, of agent for service) |

Copies to:

| | | | | | | | |

Spencer Collins

Chief Legal Officer

Arm Holdings plc

110 Fulbourn Road

Cambridge CB1 9NJ

United Kingdom

Tel: +44 (1223) 400 400 | | Phil Linnard

Slaughter and May

One Bunhill Row,

London EC1Y 8YY

United Kingdom

Tel: +44 (0)20 7600 1200 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒

Smaller reporting company ☐ Emerging growth company ☐

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐ |

EXPLANATORY NOTE

Arm Holdings plc (the “Company” or “Registrant”) previously filed a Registration Statement on Form S-8 (File No. 333-274544) with the U.S. Securities and Exchange Commission on September 15, 2023 (the “Prior Registration Statement”) with respect to 20,500,000 of the Registrant’s ordinary shares, par value $0.001 per share and American Depositary Shares representing ordinary shares (“ADSs”), issuable under the Company’s 2023 Omnibus Incentive Plan and the sub-plans thereto (the “Existing Plans”).

On September 11, 2024, at the Company’s Annual General Meeting, the Company’s shareholders approved the Company’s 2024 Employee Stock Purchase Plan (the “ESPP”), under which the Company may also issue shares from the share pool approved for the Existing Plans.

On September 12, 2024, the Company filed Post-Effective Amendment No. 1 to the Prior Registration Statement (“Post-Effective Amendment No. 1”) to amend the Prior Registration Statement to include the ESPP to the plans that may utilize the approved share pool. The Company is filing this Post Effective Amendment No. 2 to the Prior Registration Statement, as amended by Post-Effective Amendment No. 1 (“Post-Effective Amendment No. 2”) to correct the hyperlinks of certain Exhibits listed under Item 8 of Post-Effective Amendment No. 1 and to re-file Exhibit 5.1 and Exhibit 5.2 under Item 8 in html format.

For the avoidance of doubt, the Registrant did not register any additional shares pursuant to Post-Effective Amendment No. 1 and is not registering any additional shares pursuant to this Post-Effective Amendment No.2.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement in accordance with the provisions of Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”). The documents containing the information specified in Item 1 and Item 2 of Part I of Form S-8 will be delivered to the participants in the plan covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents previously filed with the SEC by the Company are incorporated by reference herein and shall be deemed to be part hereof:

(1) The Registrant’s latest annual report on Form 20-F filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for the fiscal year ended March 31, 2024, filed May 29, 2024; and

(2) The descriptions of the Registrant’s American Depositary Shares and Ordinary Shares contained in the Registrant’s registration statement on Form 8-A filed on September 12, 2023 (File No. 001-41800) under the Exchange Act, including any amendment or report filed for the purpose of updating such description.

All documents and reports filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act subsequent to the date hereof and prior to the filing of a post-effective amendment indicating that all securities offered herein have been sold or which deregisters all securities then remaining unsold, including any Reports of Foreign Private Issuers on Form 6-K submitted during such period (or portion thereof) that is identified in such form as being incorporated by reference into this Registration Statement, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of such documents and reports.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

To the extent permitted by the U.K. Companies Act 2006, the Registrant is empowered to indemnify its directors against any liability they incur by reason of their directorship. The Registrant maintains directors’ and officers’ insurance to insure such persons against certain liabilities. The Registrant has entered into a deed of indemnity with each of its directors and executive officers.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exhibit

Number | | Description of Exhibit | | Form | | File No. | | Exhibit | | Filing Date | | Filed Herewith |

| 4.1 | | | | 20-F | | 001-41800 | | 1.1 | | 05/29/2024 | | |

| 4.2 | | | | 20-F | | 001-41800 | | 2.1 | | 05/29/2024 | | |

| 4.3 | | | | 20-F | | 001-41800 | | 2.1 | | 05/29/2024 | | |

| 4.4 | | | | S-8 POS | | 333-274544 | | 4.4 | | 09/12/2024 | | |

| 4.5 | | | | S-8 | | 333-274544 | | 4.6 | | 09/15/2023 | | |

| 4.6 | | | | S-8 | | 333-274544 | | 4.7 | | 09/15/2023 | | |

| 4.7 | | | | S-8 | | 333-274544 | | 4.8 | | 09/15/2023 | | |

| 4.8 | | | | S-8 | | 333-274544 | | 4.9 | | 09/15/2023 | | |

| 4.9 | | | | S-8 POS | | 333-274544 | | 4.9 | | 09/12/2024 | | |

| 5.1 | | | | | | | | | | | | X |

| 5.2 | | | | | | | | | | | | X |

| 23.1 | | | | | | | | | | | | X |

| 23.2 | | | | | | | | | | | | X |

| 23.3 | | | | | | | | | | | | X |

Item 9. Undertakings.

(a)The Registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)to include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)to reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from

the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee Table” attached as Exhibit 107 to this Registration Statement; and

(iii)to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this Registration Statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b)The Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Cambridge, United Kingdom on September 25, 2024.

| | | | | |

| ARM HOLDINGS PLC |

|

| By: | /s/ Jason Child |

| Jason Child |

| Chief Financial Officer |

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Signature | Title | Date |

________/s/ Rene Haas________

Rene Haas |

Chief Executive Officer and Director

(Principal Executive Officer) | September 25, 2024 |

________/s/ Jason Child________

Jason Child |

Executive Vice President and Chief Financial Officer

(Principal Financial Officer) | September 25, 2024 |

________/s/ Laura Bartels________

Laura Bartels

|

Chief Accounting Officer

(Principal Accounting Officer) | September 25, 2024 |

___________________________

Masayoshi Son* |

Director and Chairman of the Board of Directors | September 25, 2024 |

___________________________

Ronald D. Fisher* |

Director | September 25, 2024 |

___________________________

Jeffrey A. Sine* |

Director | September 25, 2024 |

___________________________

Karen E. Dykstra* |

Director | September 25, 2024 |

___________________________

Young Sohn* |

Director | September 25, 2024 |

| | | | | | | | |

___________________________

Rosemary Schooler* |

Director | September 25, 2024 |

___________________________

Paul E. Jacobs, PhD* |

Director | September 25, 2024 |

*Signed by Jason Child according to the Power of Attorney in the Prior Registration Statement, as amended.

________*/s/ Jason Child________

Jason Child

Attorney in Fact

AUTHORIZED REPRESENTATIVE

Pursuant to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of Arm Holdings plc has signed this Registration Statement on September 25, 2024.

| | | | | |

| ARM, INC. |

|

| By: | /s/ Rene Haas |

| Name: | Rene Haas |

| Title: | Director |

|

|

| | | | | |

| 12 September 2024 |

| |

| |

Arm Holdings plc 110 Fulbourn Road Cambridge CB1 9NJ United Kingdom

| |

| Our reference |

| PRL/CXUS |

| Direct line |

| 020 7090 3961 |

Dear Sirs,

Arm Holdings plc Global Employee Stock Purchase Plan (the “ESPP”)

1.Introduction

We have acted as English legal advisers to Arm Holdings plc, a public limited company incorporated under the laws of England and Wales (the “Company”), and are giving this opinion in connection with the Company’s Post Effective Amendment No. 1 to the Prior Registration Statement on Form S-8 to which this opinion letter is attached as an exhibit (including the documents incorporated by reference therein, the “Registration Statement”) to be filed with the United States Securities and Exchange Commission (the “SEC”) on or around September 12, 2024. We have not been concerned with investigating or verifying the facts set out in the Registration Statement.

2.Documents and Searches

For the purposes of this opinion, we have examined copies of:

(a)the Registration Statement on Form S-8 previously filed with the SEC on September 15, 2023 (“Prior Registration Statement”) and the draft pdf copy of the Post Effective Amendment No. 1 to the Prior Registration Statement to be filed with the SEC on September 12, 2024;

(b)the rules of the ESPP (the “Rules”);

(c)the pdf executed copy of the written resolution passed by the Company’s Board of Directors on August 7, 2024 at which it was resolved, inter alia, to adopt the Rules (the “Board Resolution”);

(d)the pdf executed copy of the resolution proposed to shareholders of the Company on August 7, 2024 which resolves, inter alia, to approve the ESPP (the “Shareholder Resolution”);

(e)a pdf copy of the certificate of incorporation of the Company dated April 9, 2018 and a pdf copy of the certificate of incorporation on re-registration of the Company as a public company dated September 1, 2023; and

(f)the Articles of Association of the Company adopted on September 4, 2023 certified as true, complete and up-to-date by the deputy secretary of the Company.

In addition to examining the documents referred to above, we have carried out the following searches only:

(i)an online search at Companies House in England and Wales (“Companies House”) with respect to the Company, carried out at 9:30am (London time) on September 12, 2024 (the “Online Search”); and

(ii)a telephone enquiry at the Companies Court in London of the Central Registry of Winding-up Petitions in England and Wales with respect to the Company, carried out at 10:30am (London time) on September 12, 2024 (the “Telephone Enquiry”, together with the Online Search, the “Searches”).

3.Opinion

Based on and subject to the assumptions, the scope of opinion and the reservations mentioned below and to any matters not disclosed to us, we are of the opinion that:

(a)The Company is a public limited company duly incorporated under the laws of England and Wales and is a validly existing company.

(b)When the Shares are issued and delivered against full payment therefor as contemplated in the Registration Statement and in conformity with the Company’s Articles of Association and so as not to violate any applicable law, such Shares will have been validly issued and fully paid up and no further contributions in respect of such Shares will be required to be made to the Company by the holders thereof, by reason solely of their being such holders.

4.Assumptions

In giving this opinion we have assumed:

(a)that all copy (including electronic copy) or draft documents examined by us are complete and accurate as at today’s date and conform to the originals, that all signatures on the executed documents which, or copies of which, we have examined are genuine, and that the copy of the Articles of Association of the Company examined by us is complete, accurate and would, if issued today, comply, as respects the Articles of Association, with section 36 of the Companies Act 2006;

(b)that (i) the information disclosed by the Searches was then complete, up-to-date and accurate and has not since then been altered or added to and (ii) the Searches did not fail to disclose any information relevant for the purposes of this opinion;

(c)that (i) no proposal for a voluntary arrangement, and no moratorium has been obtained, in relation to the Company under Part I of the Insolvency Act 1986, (ii) the Company has not given any notice in relation to or passed any voluntary winding-up resolution, (iii) no application has been made or petition presented to a court, and no order has been made by a court, for the winding-up or administration of the Company, and no step has been taken to dissolve the Company, (iv) no liquidator, administrator, receiver, administrative receiver, trustee in bankruptcy or similar officer has been appointed in relation to the Company or any of its assets or revenues, and no notice has been given or filed in relation to the appointment of such an officer, and (v) no insolvency proceedings or analogous procedures have been commenced in any jurisdiction outside England and Wales in relation to the Company or any of its assets or revenues;

(d)that, insofar as any obligation under the ESPP is performed in, or is otherwise subject to, any jurisdiction other than England and Wales, its performance will not be illegal or ineffective by virtue of the law of that jurisdiction;

(e)that all acts, conditions or things required to be fulfilled, performed or effected in connection with the ESPP under the laws of any jurisdiction other than England and Wales have been duly fulfilled, performed and effected in accordance with the laws of each such jurisdiction;

(f)that the Rules which we have examined are in force, were validly adopted by the Company and have been and will be operated in accordance with their terms;

(g)that the draft copy of the Registration Statement which we have examined will become effective;

(h)that each of the Board Resolution and Shareholder Resolution is a true record of the resolutions passed by, respectively, the Company’s board of directors and the Company’s shareholders (as at their respective dates) and that the authorisations given and resolutions passed thereunder have not subsequently been rescinded or amended or superseded;

(i)that the directors of the Company have complied with their duties as directors in so far as relevant to this opinion letter;

(j)that, in respect of each issue of shares issued under the ESPP (the “Shares”), the Company will have sufficient authorised but unissued share capital and the directors of the Company will have been granted the necessary authority to allot and issue the relevant Shares;

(k)that a meeting of the board of directors of the Company or a duly authorised and constituted committee of the board of directors of the Company has been or will be duly convened and held, prior to the allotment and issue of the Shares, at which it was or will be resolved to allot and issue the Shares;

(l)that the Shares will, before allotment or issue, have been fully paid up in accordance with the Companies Act 2006;

(m)that the Shares are issued in accordance with the Rules;

(n)that the name of the relevant allottee and Shares allotted are duly entered in the register of members of the Company;

(o)that the Company has not made and will not make a payment out of capital in respect of the purchase of its own shares which would cause a liability to be incurred by its shareholders under the UK Insolvency Act 1986 (as amended);

(p)that none of the holders of the Company’s shares has received or will receive any dividends or distribution which constitute an unlawful distribution pursuant to common law or the Companies Act 2006; and

(q)that there is no actual or implied additional contractual relationship between the Company and the holders of the Shares, except for any contract of employment, the Company’s Articles of Association and the ESPP.

5.Scope of Opinion

This letter sets out our opinion on certain matters of the law of England and Wales as at today’s date. We have not made an investigation of, and do not express any opinion on, any other law. This letter is to be governed by and construed in accordance with English law.

6.Reservations

(a)This opinion is subject to any limitations arising from insolvency, liquidation, administration, moratorium, reorganisation and similar laws and procedures affecting the rights of creditors.

(b)Insofar as any obligation under the ESPP is to be performed in any jurisdiction other than England and Wales, an English court may have to have regard to the law of that jurisdiction in relation to the manner of performance and the steps to be taken in the event of defective performance.

(c)We express no opinion as to whether specific performance, injunctive relief or any other form of equitable remedy would be available in respect of any obligation of the Company under or in respect of the ESPP.

(d)The obligations of the Company and the remedies available to the Company or participants under or in respect of the ESPP will be subject to any law from time

to time in force relating to liquidation or administration or any other law or legal procedure affecting generally the enforcement of creditors’ rights.

(e)The Searches are not conclusive as to whether or not insolvency proceedings have been commenced in relation to the Company or any of its assets. For example, information required to be filed with the Registrar of Companies or the Central Registry of Winding-up Petitions is not in all cases required to be filed immediately (and may not be filed at all or on time); once filed, the information may not be made publicly available immediately (or at all); information filed with a District Registry or County Court may not, and in the case of administrations will not, become publicly available at the Central Registry; and the Searches may not reveal whether insolvency proceedings or analogous procedures have been commenced in jurisdictions outside England and Wales.

(f)We have not been responsible for verifying the accuracy of the information or the reasonableness of any statements of opinion contained in the Registration Statement, or that no material information has been omitted from it. In addition, we express no opinion as to whether the Registration Statement (or any part of it) contained or contains all the information required to be contained in it or whether the persons responsible for the Registration under relevant rules and regulations (including those of the SEC) have discharged their obligations thereunder.

(g)This opinion is subject to any limitations arising from United Nations, European Union or United Kingdom sanctions or other similar measures applicable to any relevant party or any transfers or payments made in connection with the ESPP.

7.Disclosure and Reliance

This opinion is addressed solely to you in connection with the filing of the Registration Statement and may not be relied upon by any other person or for any other purposes than those set out in this opinion.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required within section 7 of the Securities Act 1933, as amended or the rules and regulations of the SEC thereunder.

Yours faithfully

/s/ Slaughter and May

Slaughter and May

[Letterhead of Morrison & Foerster (UK) LLP]

Arm Holdings plc

110 Fulbourn Road

Cambridge

CB1 9NJ

United Kingdom

September 12, 2024

Ladies and Gentlemen:

Re: Arm Holdings plc – Registration Statement on Form S-8 – Exhibit 5.2

1.INTRODUCTION

1.1We have acted as English legal advisers to Arm Holdings plc, a public limited company incorporated under the laws of England and Wales (the “Company”), in connection with the Company’s registration statement on Form S-8 (File No. 333-274544) to which this opinion letter is attached as an exhibit (such registration statement, as amended by Post-Effective Amendment No.1 thereto and including the documents incorporated by reference therein, the “Registration Statement”) filed with the United States Securities and Exchange Commission (the “SEC”) pursuant to the United States Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated thereunder.

1.2Up to 63,100,144 ordinary shares of the Company each having a nominal value of £0.001 (the “Shares”), have been or will be allotted and issued pursuant to the Registration Statement (i) upon the vesting and settlement of outstanding awards granted under the Arm Holdings plc RSU Award Plan (including the California Sub-Plan and Israeli Sub-Plan), the Arm Holdings plc All-Employee Plan 2019 (including the California Sub-Plan and French Sub-Plans), the Executive IPO Plan 2019 (including the California Sub-Plan), the Arm Non-Executive Directors RSU Award Plan (including the California Sub-Plan) and the Arm Holdings plc 2023 Omnibus Incentive Plan (including the Non-Employee Sub-Plan, France Sub-Plan and Israel Sub-Plan) (the “2023 Omnibus Plan” and, together with the foregoing plans, the “Equity Incentive Plans”) adopted by the Company’s board of directors (the “Board” or the “Directors”) on August 24, 2023 and approved by the Company’s shareholders on August 25, 2023 and, in the case of the 2023 Omnibus Plan, amended by the Board on August 7, 2024 and (ii) upon the exercise of purchase rights under the Company’s 2024 Employee Stock Purchase Plan (the “2024 ESPP”) adopted by the Board on August 7, 2024 and approved by the Company’s shareholders on September 11, 2024.

1.3We are rendering this letter at the request of the Company in connection with the Registration Statement. We have taken instructions solely from the Company.

1.4Except as otherwise defined in this letter, capitalised terms used have the respective meanings given to them in the Registration Statement (as defined above) and headings are for ease of reference only and shall not affect interpretation.

1.5All references to legislation in this letter are to the legislation of England unless the contrary is indicated, and any reference to any provision of any legislation shall include any amendment, modification, re-enactment or extension thereof, as in force on the date of this letter.

2.DOCUMENTS

For the purpose of issuing this letter, we have reviewed the following documents only:

2.1the previously filed Registration Statement filed with the SEC on September 15, 2023;

2.2a draft pdf copy of Post-Effective Amendment No. 1 to the Registration Statement to be filed with the SEC on September 12, 2024;

2.3a pdf copy of each of the Equity Incentive Plans, including any amendments thereto;

2.4a pdf executed copy of the written resolutions passed by the Board on August 24, 2023 at which it was resolved, inter alia, to adopt the Equity Incentive Plans (the “Initial Board Resolutions”);

2.5a pdf executed copy of the written resolutions of the shareholders of the Company dated August 25, 2023, which resolved, inter alia, (i) to approve the Equity Incentive Plans, and (ii) to authorise the Directors for the purposes of section 551 of the Companies Act 2006, as amended (the “Companies Act”) to allot shares in the Company or grant rights to subscribe for or to convert any security into shares in the Company up to an aggregate nominal amount of £1,025,234 for a period ending on August 25, 2028 and to allot equity securities for cash pursuant to such authority as if section 561 of the Companies Act did not apply to the allotment (the “Shareholder Resolutions”);

2.6the draft minutes of the meeting of the Board held on August 7, 2024 at which it was resolved, inter alia, to amend the 2023 Omnibus Plan (together with the Initial Board Resolutions, the “Board Resolutions”);

2.7a pdf copy of the certificate of incorporation of the Company dated April 9, 2018 and a pdf copy of the certificate of incorporation on re-registration of the Company as a public company dated September 1, 2023; and

2.8a pdf copy of the articles of association of the Company adopted at an annual general meeting of the Company on September 4, 2023 (the “Articles”).

3.SEARCHES

In addition to examining the documents referred to in paragraph 2 (Documents), we have carried out the following searches only:

3.1an online search at Companies House in England and Wales (“Companies House”) with respect to the Company, carried out at 12:27 p.m. (London time) on September 12, 2024 (the “Online Search”); and

3.2an enquiry at the Companies Court in London of the Central Registry of Winding-up Petitions in England and Wales with respect to the Company, carried out at 11:29 a.m. (London time) on September 12, 2024 (the “Enquiry” and, together with the Online Search, the “Searches”).

4.OPINION

Subject to the assumptions set out in paragraph 5 (Assumptions), the scope of the opinion set out in paragraph 6 (Scope of Opinion) and the reservations set out in paragraph 7 (Reservations), and subject further to the following:

4.1the Registration Statement remaining effective under the Securities Act and no stop order suspending the effectiveness of the Registration Statement being issued under the Securities Act;

4.2the awards being validly granted in respect of the Shares under and in accordance with the rules of the Equity Incentive Plans, including the aggregate Shares issued under the 2023 Omnibus Plan and the 2024 ESPP not exceeding the Share Reserve (as defined in the 2023 Omnibus Plan and as increased or adjusted from time as set forth in the 2023 Omnibus Plan);

4.3the Directors, having validly resolved to allot and issue the Shares, or grant rights to subscribe for the Shares, at duly convened and quorate meeting of the Company or by way of duly passed written resolutions of the Board in compliance with all applicable laws and regulations and with such resolutions being in full force and effect and not having been rescinded or amended;

4.4the receipt in full of payment for the Shares in an amount of “cash consideration” (as defined in section 583(3) of the Companies Act) of not less than the aggregate nominal value or such amount as is required to be paid under the rules of the Equity Incentive Plans for such Shares, assuming in each case that the individual grants or awards under the Equity Incentive Plans are duly authorised by all necessary corporate action and duly granted or awarded and exercised in accordance with the requirements of applicable law, the Articles and the Equity Incentive Plans (and the agreements and awards duly adopted thereunder and in accordance therewith); and

4.5valid entries having been made in relation to the allotment and issue of the Shares in the books and registers of the Company,

it is our opinion that, as at today’s date, the Shares, if and when allotted and issued, registered in the name of the recipient in the register of members of the Company and delivered in accordance with the terms and conditions referred to in the Equity Incentive Plans and as described in the Registration Statement, will be duly and validly authorised and issued, fully paid or credited as fully paid (subject to the receipt of valid consideration by the Company for the issue thereof) and will not be subject to any call for payment of further capital.

5.ASSUMPTIONS

In giving the opinion in this letter, we have assumed (without making enquiry or investigation) that:

5.1all signatures, stamps and seals on all documents are genuine. All original documents are complete, authentic and up-to-date, and all documents submitted to us as a copy (whether by email or otherwise) are complete and accurate and conform to the original documents of which they are copies and that no amendments (whether oral, in writing or by conduct of the parties) have been made to any of the documents since they were examined by us;

5.2where a document has been examined by us in draft or specimen form, it will be or has been duly executed in the form of that draft or specimen;

5.3the Articles referred to in paragraph 2.6 of this letter will be in full force and effect, and no alteration has been made to the form of them, in each case prior to the relevant date of the granting of rights to subscribe for the Shares and/or the allotment and issue of the Shares (each such date, an “Allotment Date”);

5.4at the time of each allotment and issue of any Shares the Company shall have received in full “cash consideration” (as such term is defined in section 583(3) of the Companies Act) equal to the subscription price payable for such Shares whether by the participant, an employee benefit trust or otherwise and shall have entered the holder or holders thereof in the register of members of the Company showing that all such Shares shall have been fully paid up as to their nominal value and any premium thereon as at each Allotment Date;

5.5the Equity Incentive Plans have been validly adopted and remain in full force and effect, and no alteration has been made or will be made to the Equity Incentive Plans prior to any Allotment Date;

5.6in relation to any allotment and issue of any Shares by the Company pursuant to the Equity Incentive Plans, the recipient shall have become entitled to such Shares under the terms of the Equity Incentive Plans and such Shares, or rights over Shares, where applicable, will be fully vested each in accordance with the terms of the Equity Incentive Plans and such recipient has or will have complied with all other requirements of the Equity Incentive Plans in connection with the allotment and issue of such Shares;

5.7all awards have been made under the terms of the Equity Incentive Plans, that the terms of all awards have not materially deviated from the terms set out in the Equity Incentive Plans, and that any Shares will be allotted and issued in accordance with the terms set out in the Equity Incentive Plans and in accordance with the Articles and applicable laws;

5.8the Equity Incentive Plans (other than the Non-Executive Directors RSU Award Plan and the Non-Employee Sub-Plan of the 2023 Omnibus Plan) qualify as an “employees’ share scheme” as defined in section 1166 of the Companies Act;

5.9immediately prior to each Allotment Date, the Directors shall have sufficient authority and powers conferred upon them to allot and issue such Shares and grant such rights (as applicable) under section 551 of the Companies Act (unless such allotment and issue or grant is exempt under section 549(2) of the Companies Act) and under section 570 or section 571 of the Companies Act as if section 561 of the Companies Act did not apply to such allotment and issue or grant (unless such allotment and issue or grant is exempt from section 561 of the Companies Act pursuant to section 566 of the Companies Act) pursuant to the Shareholder Resolutions, or if the relevant authorities and powers under the Shareholder Resolutions have expired or been fully utilised the Company in general meeting having duly and validly resolved to grant such authorities and powers to the Directors, and the Directors shall not allot or issue (or purport to allot or issue) Shares and shall not grant rights (or purport to grant rights) to acquire Shares in breach of applicable law or in excess of such powers or in breach of any other limitation on their power to allot and issue Shares or grant rights to acquire Shares;

5.10no Shares shall be allotted or issued, or are or shall be committed to be allotted or issued, at a discount to their nominal value (whether in dollars or equivalent in any other currency);

5.11all documents, forms and notices which should have been delivered to Companies House in respect of the Company have been so delivered;

5.12the information revealed by the Searches is true, accurate, complete and up-to-date in all respects, and there is no information which should have been disclosed by the Searches that has not been disclosed for any reason and there has been no alteration in the status or condition of the Company since the date and time that the Searches were made and that the results of the Searches will remain complete and accurate as at each Allotment Date;

5.13in relation to the allotment and issue of the Shares, the Directors have acted and will act in the manner required by section 172 of the Companies Act and the Shares will be allotted and issued in good faith and on bona fide commercial terms and on arms’ length terms and for the purpose of carrying on the business of the Company and that there are reasonable grounds for believing that the allotment and issue of the Shares will promote the success of the Company for the benefit of its members as a whole;

5.14there has not been and will not be any bad faith, breach of trust, fraud, coercion, duress or undue influence on the part of any of the Directors in relation to any allotment and issue of Shares;

5.15the Board Resolutions were duly passed and have not subsequently been amended, rescinded or superseded and are in full force and effect; and each of the Directors having any interest in any of the matters had duly disclosed his interest therein and was entitled to vote on the resolutions therein; and the Directors have exercised their powers in good faith, for a proper purpose and in the best interests of the Company;

5.16a general meeting of the Company was duly convened and held on September 4, 2023 at which all constitutional, statutory and other formalities were duly observed, a

quorum of shareholders was present throughout and the Shareholder Resolutions were duly passed and not been revoked or varied and remain in full force and effect;

5.17the resolutions of the shareholders of the Company referred to in paragraph 5.9 were duly passed as resolutions of the Company, all constitutional, statutory and other formalities were observed and such resolutions will not have expired and will not be revoked or varied prior to each Allotment Date and will remain in full force and effect as at each Allotment Date;

5.18the Company has complied and will comply with all applicable anti-terrorism, anti-money laundering, sanctions and human rights laws and regulations and that each grant of rights to acquire Shares under the Equity Incentive Plans, as applicable, and that each allotment and issue of Shares pursuant to the Equity Incentive Plans, as applicable, will be consistent with all such laws and regulations;

5.19there has not been and will not be any bad faith, breach of trust, fraud, coercion, duress or undue influence on the part of any of the Directors in relation to any allotment and issue of Shares;

5.20no Shares or rights to subscribe for Shares have been or shall be offered to the public in the United Kingdom in breach of the Financial Services and Markets Act 2000 (“FSMA”), the EU Prospectus Regulation (Regulation (EU) 2017/1129) as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 or of any other United Kingdom laws or regulations concerning offers of securities to the public, and no communication has been or shall be made in relation to the Shares in breach of section 21 (Restrictions on financial promotion) of the FSMA or any other United Kingdom laws or regulations relating to offers or invitations to subscribe for, or to acquire rights to subscribe for or otherwise acquire, shares or other securities; and

5.21in issuing and allotting and granting rights to acquire Shares and administering the Equity Incentive Plans, the Company is not carrying on a regulated activity (within the meaning of section 19 (The general prohibition) of FSMA).

6.SCOPE OF OPINION

6.1The opinion given in this letter is limited to English law as it would be applied by English courts on the date of this letter.

6.2We express no opinion in this letter on the laws of any other jurisdiction. We have not investigated the laws of any country other than England and we assume that no foreign law affects the opinion stated in paragraph 4 (Opinion).

6.3We express no opinion as to any agreement, instrument or other document other than as specified in this letter. Without prejudice to the generality of the foregoing, we express no opinion regarding the 2024 ESPP and the allotment and issuance of Shares upon the exercise of purchase rights thereunder. For the purposes of giving the opinion in paragraph 4 (Opinion), we have only examined and relied on those documents set out in paragraph 2 (Documents) and made those searches and enquiries set out in paragraph 3 (Searches), respectively. We have made no further enquiries

concerning the Company or any other matter in connection with the giving of the opinion in paragraph 4 (Opinion).

6.4No opinion is expressed with respect to taxation in the United Kingdom or otherwise in this letter.

6.5We have not been responsible for investigating or verifying the accuracy of the facts or the reasonableness of any statement of opinion or intention, contained in or relevant to any document referred to in this letter, or that no material facts have been omitted therefrom.

6.6The opinion given in this letter is given on the basis of each of the assumptions set out in paragraph 5 (Assumptions) and is subject to each of the reservations set out in paragraph 7 (Reservations) to this letter. The opinion given in this letter is strictly limited to the matters stated in paragraph 4 (Opinion) and does not extend, and should not be read as extending, by implication or otherwise, to any other matters.

6.7This letter only applies to those facts and circumstances which exist as at today’s date and we assume no obligation or responsibility to update or supplement this letter to reflect any facts or circumstances which may subsequently come to our attention, any changes in laws which may occur after today, or to inform the addressee of any change in circumstances happening after the date of this letter which would alter the opinion given in this letter.

6.8We have not been responsible for investigation or verification of statements of fact (including statements as to foreign law) or to the reasonableness of any statements of opinion in the Registration Statement, or that no material facts have been omitted therefrom.

6.9This letter is given by Morrison & Foerster (UK) LLP and no partner or employee assumes any personal responsibility for it nor shall owe any duty of care in respect of it.

6.10This letter, the opinion given in it, and any non-contractual obligations arising out of or in connection with this letter and/or the opinion given in it, are governed by and shall be construed in accordance with English law as at the date of this letter. By accepting this letter you irrevocably agree and accept that the English courts shall have exclusive jurisdiction to hear and determine any dispute or claim arising out of or in connection with this letter or its formation, including without limitation, (i) the creation, effect or interpretation of, or the legal relationships established by, this letter, and (ii) any non-contractual obligations arising out of or in connection with this letter.

7.RESERVATIONS

7.1The Online Search described at paragraph 3.1 (Searches) is not capable of revealing conclusively whether or not:

(a)a winding-up order has been made or a resolution passed for the winding-up of a company;

(b)an administration order has been made; or

(c)a receiver, administrative receiver, administrator or liquidator has been appointed,

since notice of these matters may not be filed with the Registrar of Companies in England and Wales immediately and, when filed, may not be entered on the public database or recorded on the public microfiches of the relevant company immediately.

In addition, such a company search is not capable of revealing, prior to the making of the relevant order, whether or not a winding-up petition or a petition for an administration order has been presented.

7.2The Telephone Enquiry described at paragraph 3.2 (Searches) relates only to a compulsory winding-up and is not capable of revealing conclusively whether or not a winding-up petition in respect of a compulsory winding-up has been presented, since details of the petition may not have been entered on the records of the Central Registry of Winding-up Petitions in England and Wales immediately or, in the case of a petition presented to a County Court in England and Wales, may not have been notified to the Central Registry of Winding-up Petitions in England and Wales and entered on such records at all, and the response to an enquiry only relates to the period of approximately four years prior to the date when the enquiry was made. We have not made enquiries of any District Registry or County Court in England and Wales.

7.3The opinion set out in this letter is subject to: (i) any limitations arising from applicable laws relating to insolvency, bankruptcy, administration, reorganisation, liquidation, moratoria, schemes or analogous circumstances; and (ii) an English court exercising its discretion under section 426 of the Insolvency Act (co-operation between courts exercising jurisdiction in relation to insolvency) to assist the courts having the corresponding jurisdiction in any part of the United Kingdom or any relevant country or territory.

7.4We express no opinion as to matters of fact.

7.5We have made no enquiries of any individual connected with the Company.

7.6We express no opinion on the compliance of the Equity Incentive Plans, or the compliance of any award made under the Equity Incentive Plans, with the rules or regulations of the Nasdaq Global Select Market or the rules or regulations of any other securities exchange that are applicable to the Company.

7.7A certificate, documentation, notification, opinion or the like might be held by the English courts not to be conclusive if it can be shown to have an unreasonable or arbitrary basis or in the event of a manifest error.

7.8We express no opinion in relation to the legality, enforceability or validity of the Equity Incentive Plans or any award agreement entered into pursuant to the Equity Incentive Plans. In particular, but without prejudice to the generality of the foregoing, we have assumed that the Shares to be allotted under the Equity Incentive Plans, as applicable, or any such award agreement will be paid up in full (as to their nominal

value and any premium) in cash (within the meaning of section 583(1) of the Companies Act) and we express no opinion as to whether any consideration other than “cash consideration” (as such term is defined in section 583(3) of the Companies Act) which might be paid, or purport to be paid, for the Shares would result in such Shares being validly issued, fully paid and not subject to any call for payment of further capital.

7.9If (a) the Company or a person to whom the Shares are to be allotted and issued (a “Relevant Person”) is the target of economic or financial sanctions or other restrictive measures imposed in any jurisdiction (“Sanctions”) or is owned or controlled (directly or indirectly) by or is acting on behalf of or at the direction of or is otherwise connected with a person who is a target of Sanctions or (b) a Relevant Person is incorporated or resident in or operating from a country or territory that is a target of Sanctions or (c) the rights or obligations of a Relevant Person is otherwise affected by Sanctions, then the rights and obligations of such Relevant Person under the Equity Incentive Plans may be void and/or unenforceable.

7.10We express no opinion in this letter on the application or potential application of the National Security and Investment Act 2021 in relation to the Equity Incentive Plans or any transaction contemplated thereby.

8.DISCLOSURE AND RELIANCE

8.1This letter is addressed to you solely for your benefit in connection with the Registration Statement. We consent to the filing of this letter as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under section 7 of the Securities Act or the rules and regulations promulgated thereunder.

8.2This letter may not be relied upon by you for any other purpose, or furnished to, assigned to, quoted to, or relied upon by any other person, firm or other entity for any purpose, other than for the purpose set out in above in paragraph 8.1, without our prior written consent, which may be granted or withheld at our sole discretion.

Yours faithfully

/s/ Morrison & Foerster (UK) LLP

Morrison & Foerster (UK) LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (No. 333-274544) on Form S-8 of our report dated May 29, 2024, relating to the financial statements of Arm Holdings plc, appearing in the Annual Report on Form 20-F of Arm Holdings plc for the year ended March 31, 2024.

/s/ DELOITTE & TOUCHE LLP

San Jose, California

September 25, 2024

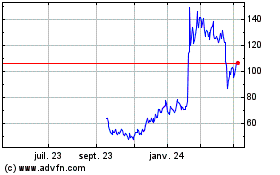

ARM (NASDAQ:ARM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

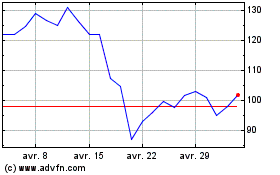

ARM (NASDAQ:ARM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024