- Cemtrex Inc. (NASDAQ: CETX, CETXP), an

advanced security technology and industrial services company, today

issued a letter to shareholders from Chairman and CEO Saagar Govil.

To the Shareholders of Cemtrex, Inc.,

I wanted to provide you with a detailed update

on Cemtrex’s activities over the last several months. If you have

been following our progress closely then you will know that we have

made many changes to our organization with the hope that we will

generate attractive returns for all of you as we go forward. I also

wanted to take this opportunity to talk a little bit more in depth

about our Company in a way that might provide additional insight

into why management has made some of the decisions we have, and how

management views the current opportunities in our portfolio.

Over the last five years we have made a number

of different investments. Some have proven to be quite fruitful

while others, unfortunately, have not led to great results. We

cannot change the missteps we have taken, but we have certainly

learned from them and learned how to avoid them in the future.

While we remain bullish in the emerging opportunities that Cemtrex

invested in over the last five years, like Virtual Reality and

SmartDesk, it became readily apparent that we could not effectively

drive the best outcomes with these long-term investments due to the

enormous cash requirements and operating losses that would be

required to see these through. Private companies have certain

luxuries that public companies do not have when it comes to

building startups, particularly in rising interest rate

environments. As a result, we made the difficult but ultimately

correct decision to exit these businesses.

Looking ahead, we can confidently say that the

path we are on today is clearer than ever, with the highest

assurance of success that we have had since the Company’s

inception. But what does success mean? For us, a company over the

long term should be able to generate a higher return with its cash

than would be possible by investing it in the S&P 500 index.

Everything starts with this fundamental premise. Sadly, today there

are many public companies that do not meet this test, including

ours in recent years. Over the last ten years, despite making

several smart decisions, we made some unforced errors which

resulted in relinquishing any positive returns in our common stock

that could have been realized. However, despite these setbacks we

remain well poised for a positive turnaround on this front. Based

on the numerous changes over the last twenty four months and

restructuring of our business that we undertook in November of

2022, I am confident that we are on the right track to start

consistently driving above average returns. Let’s dive into why

that is the case:

With the restructuring completed Cemtrex owns

two great businesses: Vicon Industries, Inc. (“Vicon”) which

comprises our Security segment, and Advanced Industrial Services,

Inc. (“AIS”) which comprises our Industrial segment.

When we make an investment, we primarily look at

two measures of capital return efficiency. The first is with

respect to our investment. What is the cash-on-cash return of the

investment over its life compared to the S&P 500? Additionally,

we look at, on an annual basis, what is the Annual Net Income

against the starting FY Shareholder’s Equity in the business?

We acquired AIS during our FY 2016 for a total

purchase price of $7,500,000. Out of that purchase price, Cemtrex

contributed $1,000,000 of equity, which was paid in the form of

Cemtrex stock. The balance of the purchase price was financed

through debt. Looking at the Net Income of the business, excluding

the unusual benefits of COVID-19 relief programs like PPP that took

place in 2021, the cumulative return on that investment over the

eight years we have owned AIS has been $8,628,084 or 863%. When

that cumulative return is averaged over the 8 years ownership it

represents a 108% annual return on Cemtrex’s invested capital.

Furthermore, when we look at our second measure

for this business, the annual return on equity, we see additional

encouraging results. The annual return on beginning shareholder’s

equity for AIS, on average, over the last 8 years, again excluding

PPP benefits in 2021, has been approximately 35%. This important

measure encourages management to continue investing its equity into

this business to drive outsized returns. Additional factors that

make AIS an attractive business are: 1) approximately 70% of our

sales come from repeat customers we do business with; 2) attractive

30%+ gross margins that we see further opportunity to drive higher

as we grow the business; 3) the macro-economic factors in the U.S.

that are driving growth, including increased infrastructure

spending and reshoring of manufacturing.

For FY 2023, AIS produced strong results, with

sales reaching $25 million compared to $21.2 million for the prior

year, an increase of 18%. Additionally, operating income increased

from $.6 million in FY 2022 to $3.1 million in FY 2023,

representing a 400% increase in operating earnings for the

period.

Regarding our Security segment, let’s focus on

our investment in Vicon of which we own 95%. Cemtrex has invested

approximately $22.95 million of its own cash into Vicon, as debt

and equity, to date over the five years of ownership, including the

cost of acquiring the shares of the business as well as additional

investments made into the company to grow it. At the time our

initial investment was made the market cap of the company was

approximately $5.5 million. Today, with the company doing $34.7

million in annual revenue and three sequential quarters of

operating profit in FY 2023, we can conservatively estimate the

enterprise value of Vicon to be substantially higher than when we

made our investment and our return on equity, when annualized over

the 5 years of ownership, far exceeds the competing return on the

S&P 500.

In FY 2023, Vicon produced significantly better

results, with sales growing from $23.8 million in FY 2022 to $34.7

million in FY 2023, an increase of 46%. Gross Profit improved from

$8.5 million in FY 2022 to $15.6 million in FY 2023, an increase of

85%. The operating loss at Vicon was reduced from $6.1 million in

FY 2022 to $0.6 million in FY 2023, a reduction of 92%, and the

Company has had an operating profit three of the last four

quarters.

The exciting part is that we believe relative to

our current investment, limited additional capital, if any, will be

required on Cemtrex’s behalf to drive further growth at Vicon.

Based on the continued opportunity for growth, we believe that

Vicon has tremendous potential to increase its enterprise value

over the next five years that would maintain or exceed the annual

return on our capital. This will be accomplished primarily by

driving further topline growth, increasing operating profits, and

scaling Annual Recurring Revenue (“ARR”) products that we believe

can drive multiple expansion.

In our segment reporting we now carve out our

Corporate costs, essentially the costs to manage these portfolio

companies and the costs of being a public company, as a separate

segment so that it is easier for our shareholders to better

ascertain the underlying performance of the businesses we own. The

Corporate costs today reduce our operating income meaningfully, but

as we scale the business these costs will continue to remain at low

levels relative to our earnings.

As legendary investor Peter Lynch said, “Often,

there is no correlation between the success of a company’s

operations and the success of its stock over a few months or even a

few years. In the long term, there is a 100% correlation between

the success of a company and the success of its stock.” Our goal

going forward is to leverage our capital in a way to drive

excellent operating results and thus deliver exceptional returns on

our investments over time. We remain confident that as we stay on

this path the consistent results in the business will begin to be

reflected in our stock.

All the above certainly doesn’t summarize all

the accomplishments that have taken place within our Company this

past year. We have added a number of talented employees,

restructured some of our debt to give us greater flexibility for

growth, completed an important acquisition at AIS, and launched

several exciting products at Vicon that will set it on a path for

long term success for years to come. We feel, based on the results

above, that FY 2023 represents a key turning point for us, as we

have a renewed focus, clarity, and resolve to deliver exceptional

results going forward.

Sincerely,

Saagar GovilChairman and Chief Executive

Officer

About Cemtrex

Cemtrex Inc. (CETX) is a company that owns two

operating subsidiaries: Vicon Industries Inc and Advanced

Industrial Services Inc.

Vicon Industries, a subsidiary

of Cemtrex Inc., is a global leader in advanced security and

surveillance technology to safeguard businesses, schools,

municipalities, hospitals and cities. Since 1967, Vicon delivers

mission-critical security surveillance systems, specializing in

engineering complete security solutions that simplify deployment,

operation and ongoing maintenance. Vicon provides security

solutions for some of the largest municipalities and businesses in

the U.S. and around the world, offering a wide range of

cutting-edge and compliant security technologies, from AI-driven

video analytics to fully integrated access control solutions. For

more information visit www.vicon-security.com

AIS – Advanced Industrial

Services, a subsidiary of Cemtrex, Inc., is a premier

provider of industrial contracting services including

millwrighting, rigging, piping, electrical, welding. AIS Installs

high precision equipment in a wide variety of industrial markets

including automotive, printing & graphics, industrial

automation, packaging, and chemicals. AIS owns and operates a

modern fleet of custom designed specialty equipment to assure safe

and quick installation of your production equipment. Our talented

staff participates in recurring instructional training, provided to

ensure that the most current industry methods are being utilized to

provide an efficient and safe working environment. For more

information visit www.ais-york.com

For more information visit www.cemtrex.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements relating to the closing of

the offering, gross proceeds from the offering, our new product

offerings, expected use of proceeds, or any proposed fundraising

activities. These forward-looking statements are based on

management’s current expectations and are subject to certain risks

and uncertainties that could cause actual results to differ

materially from those set forth in or implied by such forward

looking statements. Statements made herein are as of the date of

this press release and should not be relied upon as of any

subsequent date. These risks and uncertainties are discussed under

the heading “Risk Factors” contained in our Form 10-K filed with

the Securities and Exchange Commission. All information in this

press release is as of the date of the release and we undertake no

duty to update this information unless required by law.

Investor Relations

Chris Tyson

Executive Vice President – MZ North America

Direct: 949-491-8235

CETX@mzgroup.us

www.mzgroup.us

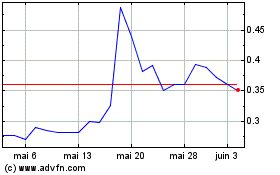

Cemtrex (NASDAQ:CETX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Cemtrex (NASDAQ:CETX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024