Caesars Entertainment, Inc. (NASDAQ: CZR) (“Caesars,” “CZR,”

“CEI” or “the Company”) today reported operating results for the

second quarter ended June 30, 2024.

Second Quarter 2024 and Recent Highlights:

- GAAP net revenues of $2.8 billion versus $2.9 billion for the

comparable prior-year period.

- GAAP net loss of $122 million compared to net income of $920

million for the comparable prior-year period, with the decrease

primarily driven by a release of $940 million of valuation

allowance against deferred tax assets associated with our REIT

leases in the prior year.

- Same-store Adjusted EBITDA of $1.0 billion versus $1.0 billion

for the comparable prior-year period.

- Caesars Digital Adjusted EBITDA of $40 million versus $11

million for the comparable prior-year period.

Tom Reeg, Chief Executive Officer of Caesars Entertainment,

Inc., commented, “On a consolidated basis, the Company generated $1

billion of Adjusted EBITDA. Our operating results reflect year over

year growth in Adjusted EBITDA in our Las Vegas segment driven by

record same store revenues, hotel occupancy and Average Daily Rate

(ADR). Our Caesars Digital segment posted a new second-quarter

Adjusted EBITDA record, driven by strong revenue growth and solid

flow through. Regional segment results reflect competition in new

markets partially offset by our temporary facility in Danville,

Virginia and our property in Columbus, Nebraska. We remain

optimistic for the balance of 2024 driven by strong operating

trends in our Las Vegas and Caesars Digital segments and the

expected openings of the permanent facility in Danville coupled

with our $430 million capital investment in our newly rebranded

Caesars New Orleans property.”

Second Quarter 2024 Financial Results Summary and Segment

Information

After adjusting for the effects of our completed divestiture,

the following tables present adjustments to net revenues, net

income (loss) and Adjusted EBITDA as reported, in order to reflect

a same-store basis:

Net Revenues

Three Months Ended June

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

1,101

$

1,128

$

(47

)

$

1,081

1.9

%

Regional

1,385

1,461

—

1,461

(5.2

)%

Caesars Digital

276

216

—

216

27.8

%

Managed and Branded

70

72

—

72

(2.8

)%

Corporate and Other

(2

)

2

—

2

*

Caesars

$

2,830

$

2,879

$

(47

)

$

2,832

(0.1

)%

Net Revenues

Six Months Ended June

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

2,129

$

2,259

$

(101

)

$

2,158

(1.3

)%

Regional

2,750

2,850

—

2,850

(3.5

)%

Caesars Digital

558

454

—

454

22.9

%

Managed and Branded

138

141

—

141

(2.1

)%

Corporate and Other

(3

)

5

—

5

*

Caesars

$

5,572

$

5,709

$

(101

)

$

5,608

(0.6

)%

Net Income (Loss)

Three Months Ended June

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

272

$

261

$

(5

)

$

256

6.3

%

Regional

(51

)

124

—

124

*

Caesars Digital

4

(22

)

—

(22

)

*

Managed and Branded

17

19

—

19

(10.5

)%

Corporate and Other

(364

)

538

—

538

*

Caesars

$

(122

)

$

920

$

(5

)

$

915

*

Net Income (Loss)

Six Months Ended June

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

470

$

554

$

(15

)

$

539

(12.8

)%

Regional

(10

)

199

—

199

*

Caesars Digital

(30

)

(54

)

—

(54

)

44.4

%

Managed and Branded

35

38

—

38

(7.9

)%

Corporate and Other

(745

)

47

—

47

*

Caesars

$

(280

)

$

784

$

(15

)

$

769

*

Adjusted EBITDA (b)

Three Months Ended June

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

514

$

512

$

(4

)

$

508

1.2

%

Regional

469

508

—

508

(7.7

)%

Caesars Digital

40

11

—

11

*

Managed and Branded

17

19

—

19

(10.5

)%

Corporate and Other

(40

)

(43

)

—

(43

)

7.0

%

Caesars

$

1,000

$

1,007

$

(4

)

$

1,003

(0.3

)%

Adjusted EBITDA (b)

Six Months Ended June

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

954

$

1,045

$

(15

)

$

1,030

(7.4

)%

Regional

902

956

—

956

(5.6

)%

Caesars Digital

45

7

—

7

*

Managed and Branded

35

38

—

38

(7.9

)%

Corporate and Other

(83

)

(81

)

—

(81

)

(2.5

)%

Caesars

$

1,853

$

1,965

$

(15

)

$

1,950

(5.0

)%

____________________

*

Not meaningful

(a)

Adjustment for pre-disposition results of

operations reflecting the subtraction of results of operations for

Rio All-Suite & Casino prior to divestiture at the end of the

third quarter of 2023. Such figures are based on unaudited internal

financial statements and have not been reviewed by the Company’s

auditors for the periods presented. The additional financial

information is included to enable the comparison of current results

with results of prior periods.

(b)

Adjusted EBITDA is not a GAAP measurement

and is presented solely as a supplemental disclosure because the

Company believes it is a widely used measure of operating

performance in the gaming industry. See “Reconciliation of GAAP

Measures to Non-GAAP Measures” below for a definition of Adjusted

EBITDA and a quantitative reconciliation of Adjusted EBITDA to net

income (loss), which the Company believes is the most comparable

financial measure calculated in accordance with GAAP.

Balance Sheet and Liquidity

As of June 30, 2024, Caesars had $12.4 billion in aggregate

principal amount of debt outstanding. Total cash and cash

equivalents were $830 million, excluding restricted cash of $129

million.

(In

millions)

June 30, 2024

December 31, 2023

Cash and cash equivalents

$

830

$

1,005

Bank debt and loans

$

6,075

$

3,193

Notes

6,311

9,199

Other long-term debt

44

47

Total outstanding indebtedness

$

12,430

$

12,439

Net debt

$

11,600

$

11,434

As of June 30, 2024, our cash on hand and borrowing capacity was

as follows:

(In

millions)

June 30, 2024

Cash and cash equivalents

$

830

Revolver capacity (a)

2,235

Revolver capacity committed to letters of

credit

(68

)

Available revolver capacity committed as

regulatory requirement

(46

)

Total (b)

$

2,951

___________________

(a)

Revolver capacity includes $2.25 billion

under the CEI Revolving Credit Facility, maturing in January 2028

(subject to a springing maturity in the event certain other

long-term debt of Caesars is not extended or repaid), and $25

million under the Caesars Virginia Revolving Credit Facility,

maturing on April 26, 2029, less $40 million reserved for specific

purposes.

(b)

Excludes approximately $280 million of

additional borrowing available under the Caesars Virginia Delayed

Draw Term Loan.

“Our debt reduction plan continued in the second quarter, with

Term Loan B repayments of over $100 million. We continue to

forecast 2024 full year capital expenditures of $800 million,

excluding our Danville project which is funded within the joint

venture,” said Bret Yunker, Chief Financial Officer.

Reconciliation of GAAP Measures to Non-GAAP Measures

Adjusted EBITDA (described below), a non-GAAP financial measure,

has been presented as a supplemental disclosure because it is a

widely used measure of performance and basis for valuation of

companies in our industry and we believe that this non-GAAP

supplemental information will be helpful in understanding our

ongoing operating results. Management has historically used

Adjusted EBITDA when evaluating operating performance because we

believe that the inclusion or exclusion of certain recurring and

non-recurring items is necessary to provide a full understanding of

our core operating results and as a means to evaluate

period-to-period results. Adjusted EBITDA represents net income

(loss) before interest income and interest expense, net of interest

capitalized, (benefit) provision for income taxes, depreciation and

amortization, stock-based compensation expense, (gain) loss on

extinguishment of debt, impairment charges, other (income) loss,

net income (loss) attributable to noncontrolling interests,

transaction costs associated with our acquisitions, developments

and divestitures, and non-cash changes in equity method

investments. Adjusted EBITDA also excludes the expense associated

with certain of our leases as these transactions were accounted for

as financing obligations and the associated expense is included in

interest expense. Adjusted EBITDA is not a measure of performance

or liquidity calculated in accordance with accounting principles

generally accepted in the United States (“GAAP”). Adjusted EBITDA

is unaudited and should not be considered an alternative to, or

more meaningful than, net income (loss) as an indicator of our

operating performance. Uses of cash flows that are not reflected in

Adjusted EBITDA include capital expenditures, interest payments,

income taxes, debt principal repayments, and payments under our

leases with affiliates of GLPI and VICI Properties, Inc., which can

be significant. As a result, Adjusted EBITDA should not be

considered as a measure of our liquidity. Other companies that

provide EBITDA information may calculate Adjusted EBITDA

differently than we do. The definition of Adjusted EBITDA may not

be the same as the definitions used in any of our debt

agreements.

Conference Call Information

The Company will host a conference call to discuss its results

on July 30, 2024 at 2:30 p.m. Pacific Time, 5:30 p.m. Eastern Time.

Participants may register for the call approximately 15 minutes

before the call start time by visiting the following website at

https://register.vevent.com/register/BI373390002b464f40a43cc986aa34eb52.

Once registered, participants will receive an email with the

dial-in number and unique PIN number to access the live event. The

call will also be accessible on the Investor Relations section of

Caesars’ website at https://investor.caesars.com.

About Caesars Entertainment, Inc.

Caesars Entertainment, Inc. (NASDAQ: CZR) is the largest

casino-entertainment company in the US and one of the world’s most

diversified casino-entertainment providers. Since its beginning in

Reno, NV, in 1937, Caesars Entertainment, Inc. has grown through

development of new resorts, expansions and acquisitions. Caesars

Entertainment, Inc.’s resorts operate primarily under the Caesars®,

Harrah’s®, Horseshoe®, and Eldorado® brand names. Caesars

Entertainment, Inc. offers diversified gaming, entertainment and

hospitality amenities, one-of-a-kind destinations, and a full suite

of mobile and online gaming and sports betting experiences. All

tied to its industry-leading Caesars Rewards loyalty program, the

company focuses on building value with its guests through a unique

combination of impeccable service, operational excellence and

technology leadership. Caesars is committed to its employees,

suppliers, communities and the environment through its PEOPLE

PLANET PLAY framework. To review our latest CSR report, please

visit www.caesars.com/corporate-social-responsibility/csr-reports.

Know When To Stop Before You Start.® Gambling Problem? Call

1-800-522-4700. For more information, please visit

www.caesars.com/corporate.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include statements regarding

our strategies, objectives and plans for future development or

acquisitions of properties or operations, as well as expectations,

future operating results and other information that is not

historical information. When used in this press release, the terms

or phrases such as “anticipates,” “believes,” “projects,” “plans,”

“intends,” “expects,” “might,” “may,” “estimates,” “could,”

“should,” “would,” “will likely continue,” and variations of such

words or similar expressions are intended to identify

forward-looking statements. Although our expectations, beliefs and

projections are expressed in good faith and with what we believe is

a reasonable basis, there can be no assurance that these

expectations, beliefs and projections will be realized. There are a

number of risks and uncertainties that could cause our actual

results to differ materially from those expressed in the

forward-looking statements which are included elsewhere in this

press release. These risks and uncertainties include, but are not

limited to: (a) the impact on our business, financial results and

liquidity of economic trends, inflation, public health emergencies,

terrorist attacks and other acts of war or hostility, work

stoppages and other labor problems, or other economic and market

conditions, including reductions in discretionary consumer spending

as a result of downturns in the economy and other factors outside

our control; (b) the impact of future cybersecurity breaches on our

business, financial conditions and results of operations; (c) our

ability to successfully operate our digital betting and iGaming

platform and expand its user base; (d) risks associated with our

leverage and our ability to reduce our leverage; (e) the effects of

competition, including new competition in certain of our markets,

on our business and results of operations; and (f) additional

factors discussed in the sections entitled “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the Company’s most recent Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q as filed with the

Securities and Exchange Commission. Other unknown or unpredictable

factors may also cause actual results to differ materially from

those projected by the forward-looking statements.

In light of these and other risks, uncertainties and

assumptions, the forward-looking events discussed in this press

release might not occur. These forward-looking statements speak

only as of the date of this press release, even if subsequently

made available on our website or otherwise, and we do not intend to

update publicly any forward-looking statement to reflect events or

circumstances that occur after the date on which the statement is

made, except as may be required by law.

CAESARS ENTERTAINMENT,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(UNAUDITED)

Three Months Ended

June 30,

Six Months Ended

June 30,

(In millions,

except per share data)

2024

2023

2024

2023

NET REVENUES:

Casino

$

1,557

$

1,584

$

3,092

$

3,169

Food and beverage

435

435

857

862

Hotel

514

525

1,007

1,028

Other

324

335

616

650

Net revenues

2,830

2,879

5,572

5,709

OPERATING EXPENSES:

Casino

817

817

1,669

1,645

Food and beverage

266

258

529

509

Hotel

139

143

276

280

Other

100

111

194

218

General and administrative

465

499

965

1,008

Corporate

80

86

158

165

Impairment charges

118

—

118

—

Depreciation and amortization

326

323

653

623

Transaction and other costs, net

13

33

19

49

Total operating expenses

2,324

2,270

4,581

4,497

Operating income

506

609

991

1,212

OTHER EXPENSE:

Interest expense, net

(594

)

(586

)

(1,184

)

(1,180

)

Loss on extinguishment of debt

(3

)

—

(51

)

(197

)

Other income (loss)

(1

)

3

25

6

Total other expense

(598

)

(583

)

(1,210

)

(1,371

)

Income (loss) from continuing operations

before income taxes

(92

)

26

(219

)

(159

)

Benefit (provision) for income taxes

(10

)

902

(25

)

951

Income (loss) from continuing operations,

net of income taxes

(102

)

928

(244

)

792

Net income (loss)

(102

)

928

(244

)

792

Net income attributable to noncontrolling

interests

(20

)

(8

)

(36

)

(8

)

Net income (loss) attributable to

Caesars

$

(122

)

$

920

$

(280

)

$

784

Net income (loss) per share - basic and

diluted:

Basic income (loss) per share

$

(0.56

)

$

4.27

$

(1.29

)

$

3.65

Diluted income (loss) per share

$

(0.56

)

$

4.26

$

(1.29

)

$

3.63

Weighted average basic shares

outstanding

216

215

216

215

Weighted average diluted shares

outstanding

216

216

216

216

CAESARS ENTERTAINMENT,

INC.

RECONCILIATION OF NET INCOME

(LOSS) ATTRIBUTABLE TO CAESARS TO ADJUSTED EBITDA

(UNAUDITED)

Three Months Ended

June 30,

Six Months Ended

June 30,

(In

millions)

2024

2023

2024

2023

Net income (loss) attributable to

Caesars

$

(122

)

$

920

$

(280

)

$

784

Net income attributable to noncontrolling

interests

20

8

36

8

(Benefit) provision for income taxes

(a)

10

(902

)

25

(951

)

Other (income) loss (b)

1

(3

)

(25

)

(6

)

Loss on extinguishment of debt

3

—

51

197

Interest expense, net

594

586

1,184

1,180

Impairment charges (c)

118

—

118

—

Depreciation and amortization

326

323

653

623

Transaction costs and other, net (d)

26

46

42

74

Stock-based compensation expense

24

29

49

56

Adjusted EBITDA

$

1,000

$

1,007

$

1,853

$

1,965

Pre-disposition Adjusted EBITDA (e)

—

(4

)

—

(15

)

Same-Store Adjusted EBITDA

$

1,000

$

1,003

$

1,853

$

1,950

____________________

(a)

Benefit for income taxes during the three

and six months ended June 30, 2023 includes the release of $940

million of valuation allowance against deferred tax assets.

(b)

Other (income) loss for the six months

ended June 30, 2024 primarily represents a change in estimate of

our disputed claims liability.

(c)

Impairment charges for the three and six

months ended June 30, 2024 includes impairment within our Regional

segment as a result of a decrease in projected future cash flows at

certain properties primarily due to localized competition.

(d)

Transaction costs and other, net primarily

includes costs related to non-cash losses on the write down and

disposal of assets, professional services for transaction and

integration costs, various contract exit or termination costs,

pre-opening costs in connection with our temporary facility

openings, and non-cash changes in equity method investments.

(e)

Adjustment for pre-disposition results of

operations reflecting the subtraction of results of operations for

Rio All-Suite Hotel & Casino prior to divestiture at the end of

the third quarter of 2023. Such figures are based on unaudited

internal financial statements and have not been reviewed by the

Company’s auditors for the periods presented. The additional

financial information is included to enable the comparison of

current results with results of prior periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730809834/en/

Investor Relations: Brian Agnew, bagnew@caesars.com; Charise

Crumbley, ccrumbley@caesars.com, 800-318-0047

Media Relations: Kate Whiteley, kwhiteley@caesars.com

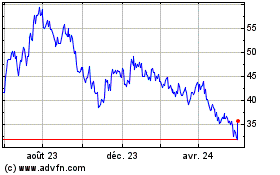

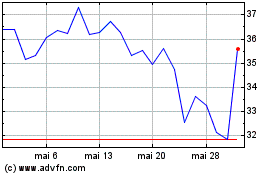

Caesars Entertainment (NASDAQ:CZR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Caesars Entertainment (NASDAQ:CZR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025