First Trust Advisors L.P. Announces Distributions for Exchange-Traded Funds

21 Juin 2010 - 11:04PM

Business Wire

First Trust Advisors L.P. (“FTA”) announces the declaration of

the regular quarterly and semi-annual distributions for 36 of 43

exchange-traded funds advised by FTA.

The following dates apply to today’s distribution

declarations: Expected Ex-Dividend Date June 22, 2010

Record Date June 24, 2010 Payable Date June 30, 2010

Per Share

Ticker

Exchange

Fund Name

Frequency

Amount

First Trust Exchange-Traded

Fund

FDM NYSE Arca First Trust Dow Jones Select MicroCap IndexSM Fund

Semi-Annually $ 0.02680 FDL NYSE Arca First Trust Morningstar®

Dividend LeadersSM Index Fund Quarterly $ 0.16560 FPX NYSE Arca

First Trust US IPO Index Fund Semi-Annually $ 0.07020 FDV NYSE Arca

First Trust Strategic Value Index Fund Semi-Annually $ 0.19720 FVI

NYSE Arca First Trust Value Line® Equity Allocation Index Fund

Semi-Annually $ 0.14860 FVD NYSE Arca First Trust Value Line®

Dividend Index Fund Quarterly $ 0.10390 FRI NYSE Arca First Trust

S&P REIT Index Fund Semi-Annually $ 0.10000 FIW NYSE Arca First

Trust ISE Water Index Fund Semi-Annually $ 0.09450 FCG NYSE Arca

First Trust ISE-Revere Natural Gas Index Fund Semi-Annually $

0.04460 FNI NYSE Arca First Trust ISE Chindia Index Fund

Semi-Annually $ 0.11900 QQEW NASDAQ First Trust NASDAQ-100 Equal

Weighted IndexSM Fund Semi-Annually $ 0.04000 QTEC NASDAQ

First Trust NASDAQ-100-Technology

Sector IndexSM Fund

Semi-Annually $ 0.02140 QQXT NASDAQ First Trust NASDAQ-100

Ex-Technology Sector IndexSM Fund Semi-Annually $ 0.04510 QABA

NASDAQ First Trust NASDAQ® ABA Community Bank Index Fund

Semi-Annually $ 0.14290

First Trust Exchange-Traded

Fund II

FDD NYSE Arca First Trust Dow Jones STOXX® European Select Dividend

Index Fund Quarterly $ 0.29660 FFR NYSE Arca First Trust FTSE

EPRA/NAREIT Developed Markets Real Estate Index Fund Semi-Annually

$ 0.37730 FGD NYSE Arca First Trust Dow Jones Global Select

Dividend Index Fund Quarterly $ 0.34340 FAN NYSE Arca First Trust

ISE Global Wind Energy Index Fund Semi-Annually $ 0.09240 FLM NYSE

Arca First Trust ISE Global Engineering and Construction Index Fund

Semi-Annually $ 0.44400 GRID NASDAQ

First Trust NASDAQ® Clean Edge®

Smart Grid Infrastructure Index Fund

Semi-Annually $ 0.10760 BICK NASDAQ First Trust BICK Index Fund

Semi-Annually $ 0.07740 CU NASDAQ First Trust ISE Global Copper

Index Fund Semi-Annually $ 0.05820 PLTM NASDAQ First Trust ISE

Global Platinum Index Fund Semi-Annually $ 0.07570

First Trust Exchange-Traded

AlphaDEX® Fund

FEX NYSE Arca First Trust Large Cap Core AlphaDEX® Fund

Semi-Annually $ 0.10250 FNX NYSE Arca First Trust Mid Cap Core

AlphaDEX® Fund Semi-Annually $ 0.06650 FYX NYSE Arca First Trust

Small Cap Core AlphaDEX® Fund Semi-Annually $ 0.03850 FTA NYSE Arca

First Trust Large Cap Value Opportunities AlphaDEX® Fund

Semi-Annually $ 0.17670 FTC NYSE Arca First Trust Large Cap Growth

Opportunities AlphaDEX® Fund Semi-Annually $ 0.04140 FAB NYSE Arca

First Trust Multi Cap Value AlphaDEX® Fund Semi-Annually $ 0.15900

FXD NYSE Arca First Trust Consumer Discretionary AlphaDEX® Fund

Semi-Annually $ 0.03600 FXG NYSE Arca First Trust Consumer Staples

AlphaDEX® Fund Semi-Annually $ 0.09240 FXN NYSE Arca First Trust

Energy AlphaDEX® Fund Semi-Annually $ 0.03330 FXO NYSE Arca First

Trust Financials AlphaDEX® Fund Semi-Annually $ 0.06900 FXR NYSE

Arca First Trust Industrials/Producer Durables AlphaDEX® Fund

Semi-Annually $ 0.04870 FXZ NYSE Arca First Trust Materials

AlphaDEX® Fund Semi-Annually $ 0.08220 FXU NYSE Arca First Trust

Utilities AlphaDEX® Fund Semi-Annually $ 0.23310

First Trust Advisors L.P., the Funds’ investment advisor, along

with its affiliate First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management, financial advisory services, and municipal and

corporate investment banking, with collective assets under

management or supervision of approximately $29 billion as of May

31, 2010 through closed-end funds, unit investment trusts, mutual

funds, separate managed accounts and exchange-traded funds.

You should consider the investment objectives, risks, charges

and expenses of a Fund before investing. Prospectuses for the Funds

contain this and other important information and are available free

of charge by calling toll-free at 1-800-621-1675 or visiting

www.ftportfolios.com. A prospectus should be read

carefully before investing.

Past performance is no assurance of future results. Principal

Risk Factors: A Fund’s shares will change in value, and you could

lose money by investing in a Fund. An investment in a Fund involves

risk similar to those of investing in any fund of equity securities

traded on exchanges. A Fund seeks investment results that

correspond generally to the price and yield of an index. You should

anticipate that the value of a Fund’s shares will decline, more or

less, in correlation with any decline in the value of the index. A

Fund’s return may not match the return of the index. Unlike the

Fund, the indices do not actually hold a portfolio of securities

and therefore do not incur the expenses incurred by the Fund. A

Fund may invest in small capitalization and mid capitalization

companies. Such companies may experience greater price volatility

than larger, more established companies. The risks of investing in

each Fund are spelled out in its prospectus, shareholder report,

and other regulatory filings.

Investors buying or selling Fund shares on the secondary market

may incur brokerage commissions. Investors who sell Fund shares may

receive less than the share’s net asset value. Unlike shares of

open-end mutual funds, investors are generally not able to purchase

Fund shares directly from the Fund and individual shares are not

redeemable. However, specified large blocks of shares called

“creation units” can be purchased from, or redeemed to, the

Fund.

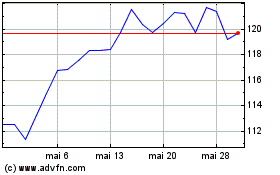

First Trust NASDAQ Clean... (NASDAQ:GRID)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

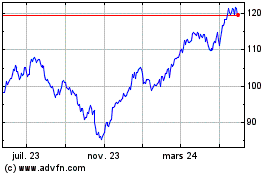

First Trust NASDAQ Clean... (NASDAQ:GRID)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024