JD.com Announces Updates of Its Share Repurchase Program

18 Avril 2024 - 1:30PM

JD.com, Inc. (“JD.com” or the “Company”) (NASDAQ: JD and HKEX: 9618

(HKD counter) and 89618 (RMB counter)), a leading supply

chain-based technology and service provider, today announced that,

during the quarter ended March 31, 2024, the Company repurchased a

total of 87.5 million Class A ordinary shares (equivalent of 43.8

million ADSs) for a total of US$1.2 billion. All of these shares

were repurchased in the open markets from both NASDAQ and the Hong

Kong Stock Exchange pursuant to the Company’s share repurchase

programs publicly announced. The total number of shares repurchased

by the Company in the first quarter of 2024 amounted to

approximately 2.8% of its ordinary shares outstanding as of

December 31, 20231.

Pursuant to the Company’s previous share

repurchase program, expired on March 17, 2024, the Company has

repurchased a total of approximately US$2.1 billion as of March 17,

2024.

Pursuant to the Company’s new share repurchase

program, which is effective through March 18, 2027, the Company has

repurchased a total of approximately US$0.5 billion as of March 31,

2024. The remaining amount under the Company’s new share repurchase

program was US$2.5 billion as of March 31, 2024.

About JD.com, Inc.

JD.com is a leading supply chain-based

technology and service provider. The company’s cutting-edge retail

infrastructure seeks to enable consumers to buy whatever they want,

whenever and wherever they want it. The company has opened its

technology and infrastructure to partners, brands and other

sectors, as part of its Retail as a Service offering to help drive

productivity and innovation across a range of industries.

For investor and media inquiries, please

contact:

Investor Relations Sean Zhang +86 (10)

8912-6804IR@JD.com

Media Relations+86 (10)

8911-6155Press@JD.com

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates,” “confident” and

similar statements. JD.com may also make written or oral

forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in announcements

made on the website of the Stock Exchange of Hong Kong Limited, in

its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including statements about JD.com’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: JD.com’s growth strategies; its future

business development, results of operations and financial

condition; its ability to attract and retain new customers and to

increase revenues generated from repeat customers; its expectations

regarding demand for and market acceptance of its products and

services; trends and competition in China’s e-commerce market;

changes in its revenues and certain cost or expense items; the

expected growth of the Chinese e-commerce market; laws, regulations

and governmental policies relating to the industries in which

JD.com or its business partners operate; potential changes in laws,

regulations and governmental policies or changes in the

interpretation and implementation of laws, regulations and

governmental policies that could adversely affect the industries in

which JD.com or its business partners operate, including, among

others, initiatives to enhance supervision of companies listed on

an overseas exchange and tighten scrutiny over data privacy and

data security; risks associated with JD.com’s acquisitions,

investments and alliances, including fluctuation in the market

value of JD.com’s investment portfolio; natural disasters and

geopolitical events; change in tax rates and financial risks;

intensity of competition; and general market and economic

conditions in China and globally. Further information regarding

these and other risks is included in JD.com’s filings with the SEC

and the announcements on the website of the Stock Exchange of Hong

Kong Limited. All information provided herein is as of the date of

this announcement, and JD.com undertakes no obligation to update

any forward-looking statement, except as required under applicable

law.

________________________

1 The number of ordinary shares outstanding as of

December 31, 2023 was 3,137,663,915 shares, being 3,183,434,337

issued shares minus 45,770,422 treasury stock.

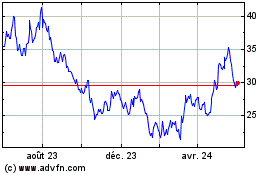

JD com (NASDAQ:JD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

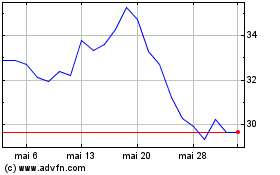

JD com (NASDAQ:JD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024