Form 8-K - Current report

16 Septembre 2024 - 10:32PM

Edgar (US Regulatory)

0001099590FALSE2024-09-1200010995902024-09-122024-09-120001099590us-gaap:CommonStockMember2024-09-122024-09-120001099590meli:SustainabilityNotesDue2026Member2024-09-122024-09-120001099590meli:NoteDue2031Member2024-09-122024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event Reported): September 16, 2024 (September 12, 2024)

_________________________

MercadoLibre, Inc.

(Exact name of Registrant as specified in Charter)

Commission file number 001-33647

_________________________

| | | | | |

Delaware | 98-0212790 |

(State or other jurisdiction of incorporation ) | (I.R.S. Employer Identification Number) |

WTC Free Zone

Dr. Luis Bonavita 1294, Of. 1733, Tower II

Montevideo, Uruguay , 11300

(Address of registrant’s principal executive offices) (Zip Code)

(+598) 2-927-2770

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of Class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.001 par value per share | | MELI | | Nasdaq Global Select Market |

2.375% Sustainability Notes due 2026 | | MELI26 | | The Nasdaq Stock Market LLC |

3.125% Notes due 2031 | | MELI31 | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company oIf an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Board of Directors (the “Board”) of MercadoLibre, Inc. (the “Company”) is saddened to announce that Mr. Mario Vázquez, one of the directors of the Company, died on August 3, 2024. Mr. Vázquez had been a director since 2008 and served as Chairman of the Company’s Audit Committee and a member of the Company’s Compensation Committee and Nominating and Corporate Governance Committee. He made substantial contributions to the Company and will be deeply missed by all who have worked with him all these years at MercadoLibre, his family, friends and colleagues.

Due to Mr. Vázquez’s death, the Board currently consists of 8 members, of which 6 are independent, and the Audit Committee currently consists of 2 members. Under NASDAQ Listing Rule 5605, the Company is required to have a majority of its directors be independent. Additionally, the Audit Committee must consist of at least 3 directors, all of which must be independent, subject to a cure period for temporary vacancies.

On August 19, 2024, the Board appointed Mr. Richard Sanders, a current member of the Board, to the Compensation Committee and the Nominating and Corporate Governance Committee of the Board, filling the vacancies resulting from the passing of Mr. Vázquez.

On September 12, 2024, the Board, upon the recommendation of the Nominating and Corporate Governance Committee of the Board, unanimously approved the appointment of Mr. Stelleo Tolda as a Class I director of the Company, to serve from September 12, 2024 until the Company’s 2025 Annual Meeting of Stockholders and until his successor is duly elected and qualified or until his earlier death, resignation or removal. In addition, the Board, upon the recommendation of the Nominating and Corporate Governance Committee, appointed Mr. Tolda to the Audit Committee in reliance of NASDAQ Listing Rule 5605(c)(2)(B). The Board’s decision was based on its finding that the exceptional and limited circumstances contemplated by NASDAQ Listing Rule 5605(c)(2)(B) were present and justified the appointment of Mr. Tolda to the Audit Committee, and that appointing Mr. Tolda would be in the best interest of the Company and its shareholders. The Board’s determination was based, in part, on (i) the fact that the unanticipated vacancy would have otherwise left the Audit Committee with only two members, (ii) Mr. Tolda’s unique combination of expertise and education, including institutional knowledge and familiarity with the Company and the industries in which it operates and (iii) the belief by the Board that Mr. Tolda’s prior service as an officer of the Company will not compromise his ability to exercise independent judgment as a member of the Audit Committee.

Mr. Tolda, 56, most recently served as an advisor to the Company from April 2022 until September 12, 2024, providing strategic guidance and insight to the leadership team, pursuant to which Mr. Tolda was paid a gross fee of $10,000 per month. Other than the foregoing, there are no transactions involving the Company and Mr. Tolda that the Company would be required to report pursuant to Item 404(a) of Regulation S-K.

Prior to his role as an advisor, Mr. Tolda served as a senior vice president and as the Company’s country manager of Brazil from 1999 to 2009. In that role he guided the Company to its current position as the leading e-commerce marketplace in Brazil. Mr. Tolda was the Company’s Executive Vice President and Chief Operating Officer from April 2009 until August 2019. He then served as the Company’s Commerce President, from August 2020 to March 2022, where he focused on the transition of his role during Q1 of 2022. Before joining the Company, Mr. Tolda worked at Lehman Brothers Inc. in the United States in 1999, and at Banco Pactual and Banco Icatu in Brazil, from 1996 to 1997 and 1994 to 1996, respectively. He currently serves as a director of Diagnósticos da America S.A. (BVMF: DASA). From 2020 until 2023, he served as a director of Arco Educação (NASDAQ: ARCE). Mr. Tolda holds a master’s in business administration from Stanford University, a master’s degree and bachelor’s degree in mechanical engineering, also from Stanford University, and a certificate in financial accounting from Harvard Business School (Online).

There were no arrangements or understandings pursuant to which Mr. Tolda was elected as a director, and there are no related party transactions between the Company and Mr. Tolda reportable under Item 404(a) of Regulation S-K.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| MERCADOLIBRE, INC. |

| Registrant |

| | |

Date: September 16, 2024 | By: | /s/ Martín de los Santos |

| | Martín de los Santos |

| | Chief Financial Officer |

Cover

|

Sep. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 12, 2024

|

| Entity Registrant Name |

MercadoLibre, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33647

|

| Entity Tax Identification Number |

98-0212790

|

| Entity Address, Address Line One |

WTC Free Zone

|

| Entity Address, Address Line Two |

Dr. Luis Bonavita 1294

|

| Entity Address, Address Line Three |

Of. 1733, Tower II

|

| Entity Address, City or Town |

Montevideo

|

| Entity Address, Country |

UY

|

| Entity Address, Postal Zip Code |

11300

|

| Country Region |

598

|

| City Area Code |

2

|

| Local Phone Number |

927-2770

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001099590

|

| Amendment Flag |

false

|

| Document Fiscal Year Focus |

|

| Document Fiscal Period Focus |

|

| Common Stock, $0.001 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

MELI

|

| Security Exchange Name |

NASDAQ

|

| 2.375% Sustainability Notes due 2026 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.375% Sustainability Notes due 2026

|

| Trading Symbol |

MELI26

|

| Security Exchange Name |

NASDAQ

|

| 3.125% Notes due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.125% Notes due 2031

|

| Trading Symbol |

MELI31

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=meli_SustainabilityNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=meli_NoteDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

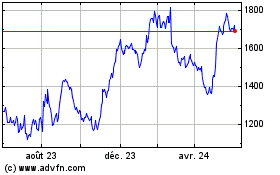

MercadoLibre (NASDAQ:MELI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

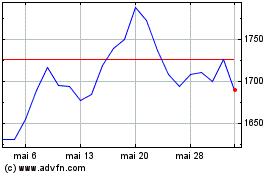

MercadoLibre (NASDAQ:MELI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024