UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-38696

NIU TECHNOLOGIES

No.1 Building, No. 195 Huilongguan East Road,

Changping District, Beijing 102208

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

Exhibit 99.1—Press Release

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

By |

: |

/s/ Fion Zhou |

| |

Name |

: |

Fion Zhou |

| |

Title |

: |

Director and Chief Financial Officer |

Date: August 12, 2024

Exhibit 99.1

Niu Technologies

Announces Unaudited Second Quarter 2024 Financial Results

-- Second Quarter

Revenues of RMB 940.5 million, an increase of 13.5% year-over-year

-- Second Quarter

Net Loss of RMB 24.9 million, compared to Net Loss of RMB 1.9 million in the same period of last year

BEIJING, China,

August 12, 2024 – Niu Technologies (“NIU”, or “the Company”) (NASDAQ: NIU), the world’s leading provider

of smart urban mobility solutions, today announced its unaudited financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Financial Highlights

| · | Revenues

were RMB 940.5 million, an increase of 13.5% year-over-year |

| · | Gross

margin was 17.0%, compared with 23.1% in the second quarter of 2023 |

| · | Net

loss was RMB 24.9 million, compared with net loss of RMB 1.9 million in the second quarter

of 2023 |

| · | Adjusted

net loss (non-GAAP)1

was RMB 19.5 million, compared with adjusted net income of RMB 14.4 million

in the second quarter of 2023 |

Second Quarter 2024 Operating Highlights

| · | The

number of e-scooters sold was 256,162, up 20.8% year-over-year |

| · | The

number of e-scooters sold in China was 207,552, up 16.2% year-over-year |

| · | The

number of e-scooters sold in the international markets was 48,610, up 45.4% year-over-year |

| · | The

number of franchised stores in China was 3,124 as of June 30, 2024 |

| · | The

number of distributors of our international sales network was 54, covering 52 countries as

of June 30, 2024 |

Dr. Yan Li, Chief

Executive Officer of the Company, remarked, "The new products we introduced this year captured over 50% of our expanding domestic

sales volume in the first half of the year. Their unique design elements and superior performance have effectively appealed to our diverse

consumer demographics, validating our strategic approach to establish a prominent presence across all sectors of the vast Chinese market.”

Dr. Li continued,

"Strategic alliances with premier retail brands such as Best Buy are propelling NIU towards deeper market penetration in the US

market. Our premier partners not only elevate NIU’s brand recognition but also enable us to provide consumers with eco-friendly

transportation solutions that seamlessly match their lifestyles and values.”

1 Adjusted net income (loss) (non-GAAP) is defined as net

income (loss) excluding share-based compensation expenses

Second Quarter 2024 Financial Results

Revenues

were RMB 940.5 million, an increase of 13.5% year-over-year, mainly due to an increase in sales volume of 20.8%, partially offset by

a decrease in revenues per e-scooter of 6.1%. The following table shows the revenue breakdown and revenues per e-scooter in the periods

presented:

Revenues

(in RMB million) | |

2024

Q2 | | |

2023

Q2 | | |

% change

YoY | |

| E-scooter sales from China market | |

| 727.1 | | |

| 638.7 | | |

| +13.8 | % |

| E-scooter sales from international markets | |

| 130.4 | | |

| 114.7 | | |

| +13.7 | % |

| E-scooter sales, sub-total | |

| 857.5 | | |

| 753.4 | | |

| +13.8 | % |

| Accessories, spare parts and services | |

| 83.0 | | |

| 75.4 | | |

| +10.1 | % |

| Total | |

| 940.5 | | |

| 828.8 | | |

| +13.5 | % |

Revenues per e-scooter

(in RMB) | |

2024

Q2 | | |

2023

Q2 | | |

% change

YoY | |

| E-scooter sales from China market2 | |

| 3,503 | | |

| 3,577 | | |

| -2.1 | % |

| E-scooter sales from international markets2 | |

| 2,682 | | |

| 3,430 | | |

| -21.8 | % |

| E-scooter sales | |

| 3,347 | | |

| 3,554 | | |

| -5.8 | % |

| Accessories, spare parts and services3 | |

| 324 | | |

| 356 | | |

| -9.0 | % |

| Revenues per e-scooter | |

| 3,671 | | |

| 3,910 | | |

| -6.1 | % |

| § | E-scooter

sales revenues from China market were RMB 727.1 million, an increase of 13.8% year-over-year,

and represented 84.8% of total e-scooter revenues. The increase was mainly due to the increased

sales volume of e-scooter, partially offset by a decrease in revenues per e-scooter in China

market. |

| § | E-scooter

sales revenues from international markets were RMB 130.4 million, an increase of 13.7% year-over-year,

and represented 15.2% of total e-scooter revenues. The increase was mainly due to increased

sales of kick-scooters, partially offset by the decreased sales of electric motorcycles and

mopeds in international markets. |

| § | Accessories,

spare parts sales and services revenues were RMB 83.0 million, an increase of 10.1% year-over-year

and represented 8.8% of total revenues. The increase was mainly due to the increase of accessories

and spare parts sales in China market. |

| § | Revenues

per e-scooter was RMB 3,671, a decrease of 6.1% year-over-year, mainly due to higher proportion

and changes in product mix of kick-scooter in international markets. |

Cost of revenues

was RMB 780.8 million, an increase of 22.5% year-over-year, in line with the increase in revenues. The cost per e-scooter, defined

as cost of revenues divided by the number of e-scooters sold in a specific period, was RMB 3,048, an increase of 1.4% from RMB 3,006

in the second quarter of 2023. This increase was mainly due to a higher proportion of premium series sales and changes in product mix

of premium series in China market, partially offset by the lower freight cost in international sales.

2 Revenues per e-scooter on e-scooter

sales from China or international markets is defined as e-scooter sales revenues from China or international markets divided by the number

of e-scooters sold in China or international markets in a specific period

3 Revenues per e-scooter on accessories,

spare parts and services is defined as accessories, spare parts and services revenues divided by the total number of e-scooters sold

in a specific period

Gross margin

was 17.0%, compared with 23.1% in the same period of 2023. The decrease was mainly due to changes in product mix of e-scooter, particularly

an increased portion of premium series models with more competitive prices in China market, and a higher proportion of kick-scooters

sales in international markets.

Operating expenses

were RMB 191.8 million, a decrease of 3.5% year-over-year. Operating expenses as a percentage of revenues was 20.4%, compared with

24.0% in the second quarter of 2023.

| § | Selling

and marketing expenses were RMB 120.2 million (including RMB 1.3 million of share-based

compensation), an increase of 9.8% from RMB 109.5 million in the second quarter of 2023,

mainly due to increased promotions of RMB 7.6 million for online shopping festivals and RMB

3.4 million for other advertising and promotions, primarily in China market. Selling and

marketing expenses as a percentage of revenues was 12.8%, compared with 13.2% in the second

quarter of 2023. |

| § | Research

and development expenses were RMB 32.3 million (including RMB 1.8 million of share-based

compensation), a decrease of 21.9% from RMB 41.3 million in the second quarter of 2023, mainly

due to a decrease of RMB 8.7 million in share-based compensation and staff cost. Research

and development expenses as a percentage of revenues was 3.4%, compared with 5.0% in the

second quarter of 2023. |

| § | General

and administrative expenses were RMB 39.3 million (including RMB 2.1 million of share-based

compensation), a decrease of 18.0% from RMB 48.0 million in the second quarter of 2023, mainly

due to the decrease in allowance for doubtful accounts of RMB 23.7 million, partially offset

by the decrease in foreign exchange gain of RMB 18.7 million. General and administrative

expenses as a percentage of revenues was 4.2%, compared with 5.8% in the second quarter of

2023. |

Operating expenses

excluding share-based compensation were RMB 186.6 million, increased by 2.1% year-over-year, and represented 19.8% of revenues, compared

with 22.1% in the second quarter of 2023.

| § | Selling

and marketing expenses excluding share-based compensation were RMB 118.9 million, an

increase of 11.3% year-over-year, and represented 12.6% of revenues, compared with 12.9%

in the second quarter of 2023. |

| § | Research

and development expenses excluding share-based compensation were RMB 30.4 million, a

decrease of 6.5% year-over-year, and represented 3.2% of revenues, compared with 3.9% in

the second quarter of 2023. |

| § | General

and administrative expenses excluding share-based compensation were RMB 37.3 million,

a decrease of 14.2% year-over-year, and represented 4.0% of revenues, compared with 5.2%

in the second quarter of 2023. |

Share-based

compensation was RMB 5.4 million, compared with RMB 16.3 million in the same period of 2023.

Income tax expense

was RMB 1.0 million, compared with RMB 2.2 million in the same period of 2023.

Net loss was

RMB 24.9 million, compared with net loss of RMB 1.9 million in the second quarter of 2023. The net loss margin was 2.6%, compared with

net loss margin of 0.2% in the same period of 2023.

Adjusted net

loss (non-GAAP) was RMB 19.5 million, compared with an adjusted net income of RMB 14.4 million in the second quarter of 2023. The

adjusted net loss margin4 was 2.1%, compared with an adjusted

net income margin of 1.7% in the same period of 2023.

Basic and diluted net loss per ADS

were both RMB 0.31 (US$ 0.04).

Balance Sheet

As of June 30,

2024, the Company had cash and cash equivalents, term deposits and short-term investments of RMB 1,135.3 million in aggregate.

The Company had restricted cash of RMB 213.9 million and short-term bank borrowings of RMB 200.0 million.

Business Outlook

NIU expects revenues

of the third quarter 2024 to be in the range of RMB 1,298 million to RMB 1,483 million, representing a year-over-year increase of 40%

to 60%.

The above outlook

is based on information available as of the date of this press release and reflects the Company’s current and preliminary expectation

and is subject to change.

Conference Call

The Company will

host an earnings conference call on Monday, August 12, 2024 at 8:00 AM U.S. Eastern Time (8:00 PM Beijing/Hong Kong Time) to discuss

its second quarter financial and business results and provide a corporate update.

To join via phone,

participants need to register in advance of the conference call using the link provided below. Upon registration, participants will receive

dial-in numbers and a personal PIN, which will be used to join the conference call.

| Event: |

Niu Technologies Second Quarter 2024

Financial Results Conference Call |

| Registration Link: |

https://register.vevent.com/register/BI6c62f44d3ab44affb2ae1b8e392c65c7 |

A live and archived

webcast of the conference call will be available on the investor relations website at https://ir.niu.com/news-and-events/webcasts-and-presentations.

4 Adjusted net income (loss) margin

is defined as adjusted net income (loss) (non-GAAP) as a percentage of the revenues

About NIU

As the

world’s leading provider of smart urban mobility solutions, NIU designs, manufactures and sells high-performance electric

motorcycles, mopeds, bicycles, as well as kick-scooters and e-bikes. NIU has a diversified product portfolio that caters to the

various demands of our users and addresses different urban travel scenarios. Currently, NIU offers two model lineups, comprising a

number of different vehicle types. These include (i) the electric motorcycle, moped and bicycle series, including the NQi, MQi, UQi,

F series and others, and (ii) the micro-mobility series, including the kick-scooter series KQi and the e-bike series BQi. NIU has

adopted an omnichannel retail model, integrating the offline and online channels, to sell its products and provide services to

users.

For more information,

please visit www.niu.com.

Use of Non-GAAP Financial Measures

To supplement NIU’s

consolidated financial results presented in accordance with the accounting principles generally accepted in the United States of America

(“GAAP”), NIU uses the following non-GAAP financial measures: adjusted net income (loss) and adjusted net income (loss) margin.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial

information prepared and presented in accordance with GAAP. NIU believes that these non-GAAP financial measures provide meaningful supplemental

information regarding its performance and liquidity by excluding certain items that may not be indicative of its operating results. The

Company believes that both management and investors benefit from referring to these non-GAAP financial measures in assessing its performance

and when planning and forecasting future periods. These non-GAAP financial measures also facilitate management’s internal comparisons

to NIU’s historical performance. The Company believes these non-GAAP financial measures are useful to investors in allowing for

greater transparency with respect to supplemental information used by management in its financial and operational decision making. A

limitation of using these non-GAAP financial measures is that these non-GAAP measures exclude certain items that have been and will continue

to be for the foreseeable future a significant component in the Company’s results of operations. These non-GAAP financial measures

presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly

titled measures differently, limiting their usefulness as comparative measures to the Company’s data.

Adjusted net income

(loss) is defined as net income (loss) excluding share-based compensation expenses. Adjusted net income (loss) margin is defined as adjusted

net income (loss) as a percentage of the revenues.

For more information

on non-GAAP financial measures, please see the tables captioned “Reconciliation of GAAP and Non-GAAP Results”.

Exchange Rate

This announcement

contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the

readers. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB 7.2672 to US$ 1.00, the exchange rate

in effect as of June 28, 2024, as set forth in the H.10 Statistical release of the Board of Governors of the Federal Reserve System.

The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any

particular rate or at all.

Safe Harbor

Statement

This press

release contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “aims,” “future,”

“intends,” “plans,” “believes,” “estimates,” “likely to” and similar

statements. Among other things, the business outlook and quotations from management in this announcement, as well as NIU’s

strategic and operational plans, contain forward-looking statements. NIU may also make written or oral forward-looking statements in

its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and

other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are

not historical facts, including statements about NIU’s beliefs, plans and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: NIU’s

strategies; NIU’s future business development, financial condition and results of operations; NIU’s ability to maintain

and enhance its “NIU” brand; its ability to innovate and successfully launch new products and services; its ability to

maintain and expand its offline distribution network; its ability to satisfy the mandated safety standards relating to e-scooters;

its ability to secure supply of components and raw materials used in e-scooters; its ability to manufacture, launch and sell smart

e-scooters meeting customer expectations; its ability to grow collaboration with operation partners; its ability to control costs

associated with its operations; general economic and business conditions in China and globally; and assumptions underlying or

related to any of the foregoing. Further information regarding these and other risks is included in NIU’s filings with the

Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and NIU

does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Investor Relations Contact:

Niu Technologies

E-mail: ir@niu.com

NIU TECHNOLOGIES

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

As of | |

| | |

December 31, | | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 872,573,460 | | |

| 727,101,815 | | |

| 100,052,539 | |

| Term deposits | |

| 97,555,565 | | |

| 177,813,660 | | |

| 24,467,974 | |

| Restricted cash | |

| 107,666,733 | | |

| 213,949,000 | | |

| 29,440,362 | |

| Short-term investments | |

| - | | |

| 230,359,748 | | |

| 31,698,556 | |

| Accounts receivable, net | |

| 94,956,170 | | |

| 130,301,574 | | |

| 17,930,093 | |

| Inventories | |

| 392,790,141 | | |

| 603,908,397 | | |

| 83,100,561 | |

| Prepayments and other current assets | |

| 195,072,129 | | |

| 243,737,081 | | |

| 33,539,339 | |

| Total current assets | |

| 1,760,614,198 | | |

| 2,327,171,275 | | |

| 320,229,424 | |

| | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment, net | |

| 323,112,366 | | |

| 298,830,446 | | |

| 41,120,438 | |

| Intangible assets, net | |

| 1,306,401 | | |

| 1,175,039 | | |

| 161,691 | |

| Operating lease right-of-use assets | |

| 76,821,285 | | |

| 73,514,070 | | |

| 10,115,873 | |

| Deferred income tax assets | |

| 20,747,021 | | |

| 18,800,958 | | |

| 2,587,098 | |

| Other non-current assets | |

| 6,730,378 | | |

| 7,233,368 | | |

| 995,345 | |

| Total non-current assets | |

| 428,717,451 | | |

| 399,553,881 | | |

| 54,980,445 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 2,189,331,649 | | |

| 2,726,725,156 | | |

| 375,209,869 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Short-term bank borrowings | |

| 100,000,000 | | |

| 200,000,000 | | |

| 27,520,916 | |

| Notes payable | |

| 167,282,688 | | |

| 249,989,557 | | |

| 34,399,708 | |

| Accounts payable | |

| 575,724,288 | | |

| 919,265,231 | | |

| 126,495,106 | |

| Income taxes payable | |

| 1,357,913 | | |

| 1,055,191 | | |

| 145,199 | |

| Advances from customers | |

| 19,304,488 | | |

| 46,869,584 | | |

| 6,449,469 | |

| Deferred revenue-current | |

| 41,755,097 | | |

| 41,366,064 | | |

| 5,692,160 | |

| Accrued expenses and other current liabilities | |

| 165,511,396 | | |

| 213,447,871 | | |

| 29,371,405 | |

| Total current liabilities | |

| 1,070,935,870 | | |

| 1,671,993,498 | | |

| 230,073,963 | |

| | |

| | | |

| | | |

| | |

| Deferred revenue-non-current | |

| 13,168,111 | | |

| 13,967,386 | | |

| 1,921,976 | |

| Deferred income tax liabilities | |

| 2,362,494 | | |

| 2,857,184 | | |

| 393,162 | |

| Operating lease liabilities | |

| 280,421 | | |

| 70,701 | | |

| 9,729 | |

| Other non-current liabilities | |

| 8,968,519 | | |

| 9,529,060 | | |

| 1,311,242 | |

| Total non-current liabilities | |

| 24,779,545 | | |

| 26,424,331 | | |

| 3,636,109 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 1,095,715,415 | | |

| 1,698,417,829 | | |

| 233,710,072 | |

| | |

| | | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY: | |

| | | |

| | | |

| | |

| Class A ordinary shares | |

| 90,031 | | |

| 90,291 | | |

| 12,424 | |

| Class B ordinary shares | |

| 10,316 | | |

| 10,316 | | |

| 1,420 | |

| Additional paid-in capital | |

| 1,964,138,365 | | |

| 1,976,012,521 | | |

| 271,908,372 | |

| Accumulated other comprehensive loss | |

| (9,495,674 | ) | |

| (6,962,920 | ) | |

| (958,130 | ) |

| Accumulated deficit | |

| (861,126,804 | ) | |

| (940,842,881 | ) | |

| (129,464,289 | ) |

| Total shareholders’ equity | |

| 1,093,616,234 | | |

| 1,028,307,327 | | |

| 141,499,797 | |

| | |

| | | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

| 2,189,331,649 | | |

| 2,726,725,156 | | |

| 375,209,869 | |

NIU TECHNOLOGIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Revenues | |

| 828,811,204 | | |

| 940,485,316 | | |

| 129,415,086 | | |

| 1,246,047,222 | | |

| 1,445,219,891 | | |

| 198,868,875 | |

| Cost of revenues(a) | |

| (637,333,754 | ) | |

| (780,800,920 | ) | |

| (107,441,782 | ) | |

| (964,195,614 | ) | |

| (1,189,985,235 | ) | |

| (163,747,418 | ) |

| Gross profit | |

| 191,477,450 | | |

| 159,684,396 | | |

| 21,973,304 | | |

| 281,851,608 | | |

| 255,234,656 | | |

| 35,121,457 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling and marketing expenses(a) | |

| (109,541,946 | ) | |

| (120,227,190 | ) | |

| (16,543,812 | ) | |

| (181,902,025 | ) | |

| (225,560,363 | ) | |

| (31,038,139 | ) |

| Research and development expenses(a) | |

| (41,288,064 | ) | |

| (32,257,721 | ) | |

| (4,438,810 | ) | |

| (76,292,198 | ) | |

| (61,188,696 | ) | |

| (8,419,845 | ) |

| General and administrative expenses(a) | |

| (47,976,084 | ) | |

| (39,345,476 | ) | |

| (5,414,118 | ) | |

| (98,300,734 | ) | |

| (69,958,435 | ) | |

| (9,626,601 | ) |

| Total operating expenses | |

| (198,806,094 | ) | |

| (191,830,387 | ) | |

| (26,396,740 | ) | |

| (356,494,957 | ) | |

| (356,707,494 | ) | |

| (49,084,585 | ) |

| Government grants | |

| 528,120 | | |

| - | | |

| - | | |

| 826,973 | | |

| 3,756 | | |

| 517 | |

| Operating loss | |

| (6,800,524 | ) | |

| (32,145,991 | ) | |

| (4,423,436 | ) | |

| (73,816,376 | ) | |

| (101,469,082 | ) | |

| (13,962,611 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expenses | |

| (14,853 | ) | |

| (1,520,883 | ) | |

| (209,280 | ) | |

| (81,520 | ) | |

| (2,487,283 | ) | |

| (342,262 | ) |

| Interest income | |

| 7,150,433 | | |

| 8,762,650 | | |

| 1,205,781 | | |

| 15,262,816 | | |

| 18,017,361 | | |

| 2,479,271 | |

| Investment income | |

| - | | |

| 1,001,901 | | |

| 137,866 | | |

| 426,836 | | |

| 1,001,901 | | |

| 137,866 | |

| Loss before income taxes | |

| 335,056 | | |

| (23,902,323 | ) | |

| (3,289,069 | ) | |

| (58,208,244 | ) | |

| (84,937,103 | ) | |

| (11,687,736 | ) |

| Income tax (expense) benefit | |

| (2,240,676 | ) | |

| (1,016,141 | ) | |

| (139,826 | ) | |

| (4,035,500 | ) | |

| 5,221,026 | | |

| 718,437 | |

| Net loss | |

| (1,905,620 | ) | |

| (24,918,464 | ) | |

| (3,428,895 | ) | |

| (62,243,744 | ) | |

| (79,716,077 | ) | |

| (10,969,299 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment, net of nil income taxes | |

| 21,181,014 | | |

| 2,026,261 | | |

| 278,823 | | |

| 15,487,764 | | |

| 2,532,754 | | |

| 348,519 | |

| Unrealized gain on available-for-sale securities, net of reclassification | |

| - | | |

| - | | |

| - | | |

| (345,356 | ) | |

| - | | |

| - | |

| Comprehensive loss | |

| 19,275,394 | | |

| (22,892,203 | ) | |

| (3,150,072 | ) | |

| (47,101,336 | ) | |

| (77,183,323 | ) | |

| (10,620,780 | ) |

| Net loss per ordinary share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| (0.01 | ) | |

| (0.16 | ) | |

| (0.02 | ) | |

| (0.40 | ) | |

| (0.50 | ) | |

| (0.07 | ) |

| —Diluted | |

| (0.01 | ) | |

| (0.16 | ) | |

| (0.02 | ) | |

| (0.40 | ) | |

| (0.50 | ) | |

| (0.07 | ) |

| Net loss per ADS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| (0.02 | ) | |

| (0.31 | ) | |

| (0.04 | ) | |

| (0.80 | ) | |

| (1.01 | ) | |

| (0.14 | ) |

| —Diluted | |

| (0.02 | ) | |

| (0.31 | ) | |

| (0.04 | ) | |

| (0.80 | ) | |

| (1.01 | ) | |

| (0.14 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares and ordinary shares equivalents outstanding used in computing net loss per ordinary share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 156,834,747 | | |

| 158,541,994 | | |

| 158,541,994 | | |

| 156,303,739 | | |

| 158,127,845 | | |

| 158,127,845 | |

| —Diluted | |

| 156,834,747 | | |

| 158,541,994 | | |

| 158,541,994 | | |

| 156,303,739 | | |

| 158,127,845 | | |

| 158,127,845 | |

| Weighted average number of ADS outstanding used in computing net loss per ADS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| 78,417,374 | | |

| 79,270,997 | | |

| 79,270,997 | | |

| 78,151,870 | | |

| 79,063,923 | | |

| 79,063,923 | |

| —Diluted | |

| 78,417,374 | | |

| 79,270,997 | | |

| 79,270,997 | | |

| 78,151,870 | | |

| 79,063,923 | | |

| 79,063,923 | |

Note:

(a) Includes share-based compensation

expenses as follows:

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Cost of revenues | |

| 300,533 | | |

| 138,354 | | |

| 19,038 | | |

| 591,520 | | |

| 441,889 | | |

| 60,806 | |

| Selling and marketing expenses | |

| 2,705,325 | | |

| 1,328,704 | | |

| 182,836 | | |

| 5,833,402 | | |

| 3,338,816 | | |

| 459,436 | |

| Research and development expenses | |

| 8,734,735 | | |

| 1,831,979 | | |

| 252,089 | | |

| 15,105,360 | | |

| 3,273,257 | | |

| 450,415 | |

| General and administrative expenses | |

| 4,525,669 | | |

| 2,070,589 | | |

| 284,923 | | |

| 8,928,193 | | |

| 4,626,439 | | |

| 636,619 | |

| Total share-based compensation expenses | |

| 16,266,262 | | |

| 5,369,626 | | |

| 738,886 | | |

| 30,458,475 | | |

| 11,680,401 | | |

| 1,607,276 | |

NIU TECHNOLOGIES

RECONCILIATION

OF GAAP AND NON-GAAP RESULTS

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net loss | |

| (1,905,620 | ) | |

| (24,918,464 | ) | |

| (3,428,895 | ) | |

| (62,243,744 | ) | |

| (79,716,077 | ) | |

| (10,969,299 | ) |

| Add: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation expenses | |

| 16,266,262 | | |

| 5,369,626 | | |

| 738,886 | | |

| 30,458,475 | | |

| 11,680,401 | | |

| 1,607,276 | |

| Adjusted net income (loss) | |

| 14,360,642 | | |

| (19,548,838 | ) | |

| (2,690,009 | ) | |

| (31,785,269 | ) | |

| (68,035,676 | ) | |

| (9,362,023 | ) |

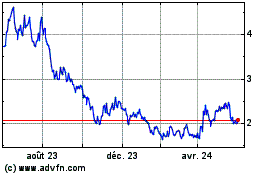

Niu Technologies (NASDAQ:NIU)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

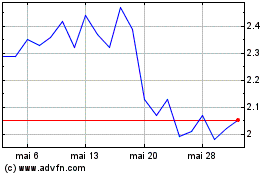

Niu Technologies (NASDAQ:NIU)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024