Alcoa to receive $1.1 billion of proceeds in

Ma’aden shares and cash

Transaction simplifies Alcoa’s portfolio in

Saudi Arabia and provides greater financial flexibility

Alcoa (NYSE: AA, ASX: AAI) (“Alcoa” or the “Company”) announced

today that it has entered into a binding share purchase and

subscription agreement (the “Agreement”) with Saudi Arabian Mining

Company (“Ma’aden”), under which Alcoa will sell its full ownership

interest of 25.1% in the Ma’aden Joint Venture to Ma’aden for

approximately $1.1 billion. The transaction consideration comprises

approximately 86 million shares of Ma’aden (valued at $950 million

based on the volume-weighted average share price of Ma’aden for the

last 30 calendar days as of September 12, 2024) and $150 million in

cash.

The joint venture was created in 2009, as a fully integrated

mining complex in the Kingdom of Saudi Arabia, and today comprises

two entities: the Ma’aden Bauxite and Alumina Company (“MBAC”; the

bauxite mine and alumina refinery) and the Ma’aden Aluminium

Company (“MAC”; the aluminum smelter and casthouse). Alcoa

currently owns 25.1% of the joint venture and Ma’aden owns 74.9%.

The carrying value of Alcoa’s investment was $545 million as of

June 30, 2024.

Pursuant to the terms of the Agreement, Alcoa will hold its

Ma’aden shares for a minimum of three years, with one-third of the

shares becoming transferable after each of the third, fourth and

fifth anniversaries of closing of the transaction (the “holding

period”). During the holding period, Alcoa would be permitted to

hedge and borrow against its Ma’aden shares. Under certain

circumstances, such minimum holding period would be reduced. Pro

forma for the transaction, Alcoa would own approximately 2% of

Ma’aden’s current shares outstanding.

“We deeply value our partnership with Ma’aden. We are confident

that under the new arrangement, MBAC and MAC are well-positioned

for success,” said William F. Oplinger, Alcoa’s President and CEO.

“The transaction simplifies our portfolio, enhances visibility in

the value of our investment in Saudi Arabia and provides greater

financial flexibility for Alcoa, an important part of improving our

long-term competitiveness.”

“Since 2009, Alcoa has been a valued partner of Ma’aden, and our

aluminium business has benefited substantially from our strategic

partnership,” said Bob Wilt, Ma’aden’s CEO. “We look forward to

future opportunities to collaborate as we continue to build the

mining sector into the third pillar of the Saudi economy.”

The transaction is subject to regulatory approvals, approval by

Ma’aden’s shareholders and other customary closing conditions and

is expected to close in the first half of 2025.

In connection with the transaction, Citi is acting as Alcoa’s

exclusive financial advisor, and White & Case LLP is acting as

its legal counsel.

About Alcoa Corporation

Alcoa (NYSE: AA, ASX: AAI) is a global industry leader in

bauxite, alumina, and aluminum products with a vision to reinvent

the aluminum industry for a sustainable future. With a values-based

approach that encompasses integrity, operating excellence, care for

people and courageous leadership, our purpose is to Turn Raw

Potential into Real Progress. Since developing the process that

made aluminum an affordable and vital part of modern life, our

talented Alcoans have developed breakthrough innovations and best

practices that have led to greater efficiency, safety,

sustainability, and stronger communities wherever we operate.

Dissemination of Company Information

Alcoa intends to make future announcements regarding company

developments and financial performance through its website,

www.alcoa.com, as well as through press releases, filings

with the Securities and Exchange Commission, conference calls and

webcasts.

Cautionary Statement on Forward-Looking Statements

This press release contains statements that relate to future

events and expectations about Alcoa’s sale of its interest in the

Ma’aden joint venture, including but not limited to Alcoa’s

expectations relating to the completion and timing of the

transaction, and as such constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include those containing such

words as “aim,” “ambition,” “anticipates,” “believes,” “could,”

“develop,” “endeavors,” “estimates,” “expects,” “forecasts,”

“goal,” “intends,” “may,” “outlook,” “plans,” “potential,”

“projects,” “reach,” “seeks,” “sees,” “should,” “targets,” “will,”

“working,” “would,” or other words of similar meaning. All

statements by Alcoa that reflect expectations, assumptions or

projections about the future, other than statements of historical

fact, are forward-looking statements. Forward-looking statements

are not guarantees of future performance and are subject to known

and unknown risks, uncertainties, and changes in circumstances that

are difficult to predict. Although Alcoa believes that the

expectations reflected in any forward-looking statements are based

on reasonable assumptions, it can give no assurance that these

expectations will be attained, and it is possible that actual

results may differ materially from those indicated by these

forward-looking statements due to a variety of risks and

uncertainties. Additional information concerning factors that could

cause actual results to differ materially from those projected in

the forward-looking statements is contained in Alcoa’s filings with

the Securities and Exchange Commission. Alcoa disclaims any

obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise,

except as required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240915281567/en/

Investor Contact: Yolande Doctor Yolande.B.Doctor@Alcoa.com

Media Contact: Courtney Boone Courtney.Boone@Alcoa.com

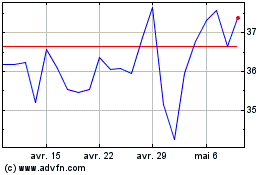

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

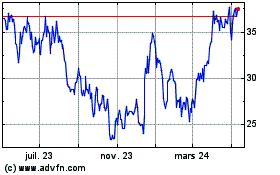

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024