false

0001748790

0001748790

2024-11-19

2024-11-19

0001748790

amcr:OrdinarySharesParValue0.01PerShareMember

2024-11-19

2024-11-19

0001748790

amcr:Sec1.125GuaranteedSeniorNotesDue2027Member

2024-11-19

2024-11-19

0001748790

amcr:Sec5.450GuaranteedSeniorNotesDue2029Member

2024-11-19

2024-11-19

0001748790

amcr:Sec3.950GuaranteedSeniorNotesDue2032Member

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 19, 2024

AMCOR

PLC

(Exact

name of registrant as specified in its charter)

| Jersey |

001-38932 |

98-1455367 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 83 Tower Road North |

|

| Warmley, Bristol |

|

| United Kingdom |

BS30 8XP |

| (Address of principal executive offices) |

(Zip Code) |

+44 117 9753200

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

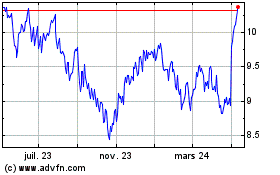

| Ordinary Shares, par value $0.01 per share |

|

AMCR |

|

The New York Stock Exchange |

| 1.125%

Guaranteed Senior Notes Due 2027 |

|

AUKF/27 |

|

The New York Stock Exchange |

| 5.450% Guaranteed Senior Notes Due 2029 |

|

AMCR/29 |

|

The New York Stock Exchange |

| 3.950% Guaranteed Senior Notes Due 2032 |

|

AMCR/32 |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into

a Material Definitive Agreement

Merger Agreement

On

November 19, 2024, Amcor plc, a Jersey public company (“Amcor”), Aurora Spirit, Inc., a Delaware corporation and wholly-owned

subsidiary of Amcor (“Merger Sub”), and Berry Global Group, Inc., a Delaware corporation (“Berry”), entered into

an Agreement and Plan of Merger (the “Merger Agreement”). The Merger Agreement provides for, among other things and subject

to the satisfaction or waiver of specified conditions set forth therein, the merger of Merger Sub with and into Berry (the “Merger”),

with Berry surviving the Merger as a wholly-owned subsidiary of Amcor.

The

board of directors of Amcor (the “Amcor Board”) and the board of directors of Berry (the “Berry Board”) have unanimously

approved the Merger Agreement and the transactions contemplated thereby.

Effect

on Capital Stock

Subject

to the terms and conditions set forth in the Merger Agreement, at the effective time of the Merger (the “Effective Time”),

each share of Berry common stock issued and outstanding (excluding shares held by Berry as treasury stock immediately prior to the Effective

Time) will be converted into the right to receive 7.25 fully paid and nonassessable Amcor ordinary shares (and, if applicable,

cash in lieu of fractional shares), less any applicable withholding taxes.

Governance

The

Merger Agreement provides that Amcor will take all necessary actions to cause, effective as of the Effective Time, the Amcor Board to

consist of 11 directors, of whom four such directors will be individuals serving on the Berry Board as of the date of the Merger Agreement,

and the remainder will be existing members of the Amcor Board as of immediately prior to the Effective Time.

The

Merger Agreement further provides that the chair of the Amcor Board immediately prior to the Effective Time will remain the chair of the

Amcor Board immediately subsequent to the Effective Time.

The

Merger Agreement further provides that Amcor will take all necessary actions to cause, effective as of the Effective Time, Stephen E.

Sterrett, the current chair of the Berry Board, to be named the deputy chair of the Amcor Board immediately subsequent to the Effective

Time.

The

Merger Agreement further provides that the chief executive officer of Amcor as of immediately prior to the Effective Time will remain

the chief executive officer of Amcor immediately subsequent to the Effective Time.

Treatment

of Equity Awards

Under

the terms of the Merger Agreement, each Berry restricted stock unit award (a “Berry RSU Award”) that is vested will be, as

of the Effective Time, cancelled and converted into the right to receive (i) the number of Amcor ordinary shares equal to the product,

rounded down to the nearest whole number of shares, of (a) the number of shares of Berry common stock subject to the Berry RSU Award immediately

prior to the Effective Time, and (b) 7.25, less applicable Tax withholding, and (ii) a cash amount equal to the Berry dividend equivalent

rights (“Berry DERs”) corresponding to the Berry RSU Award, less applicable tax withholding.

In

addition, each Berry RSU Award that is unvested will be, as of the Effective Time, cancelled and converted into (i) a time-based restricted

stock unit award of Amcor (an “Amcor RSU Award”), relating to a number of Amcor ordinary shares equal to the product, rounded

down to the nearest whole number of shares, of (a) the number of shares of Berry common stock subject to the Berry RSU Award, and (b)

7.25, and (ii) an amount in restricted cash equal to the amount that is accrued but unpaid with respect to the Berry DERs corresponding

to the Berry RSU Award. The resulting Amcor RSU Award and restricted cash payment will be subject to the same terms and conditions that

applied to the corresponding Berry RSU Award and Berry DER.

The

Merger Agreement also provides that each Berry performance stock unit award (a “Berry PSU Award”) will be, as of the Effective

Time, cancelled and converted into (i) an Amcor RSU Award, relating to a number of Amcor ordinary shares equal to the product, rounded

down to the nearest whole number of shares, of (a) the number of shares of Berry common stock subject to the Berry PSU Award (with such

number of shares of Berry common stock determined based upon actual performance), and (b) 7.25, and (ii) an amount in restricted cash

equal to the value of any Berry DERs corresponding to the Berry PSU Award. The resulting Amcor RSU Award and restricted cash payment will

be subject to the same terms and conditions (including service-based but excluding performance-based vesting conditions and cash settlement

features) that applied to the corresponding Beer PSU Award and Berry DER.

Under

the terms of the Merger Agreement, each Berry vested stock option (“Berry Vested Option”) award will be, as of the Effective

Time, cancelled and converted into the right to receive (i) that number of Amcor ordinary shares (rounded down to the nearest whole share

and less applicable tax withholding) equal to the quotient of (a) the product of (1) the excess, if any, of the merger consideration value

over the per share exercise price of the applicable Berry Vested Option award, multiplied by (2) the number of shares of Berry common

stock subject to the Berry Vested Option award, divided by (b) the Amcor closing share price and (ii) a cash amount equal to the amount

accrued but unpaid with respect to any Berry DERs that corresponded to the Berry Vested Option award. Any Berry Vested Option award with

an exercise price that is greater than the merger consideration value will be, upon the Effective Time, cancelled without consideration

other than any accrued but unpaid Berry DERs.

Further,

each Berry unvested stock option (“Berry Unvested Option”) award will, as of the Effective Time, be assumed and converted

into (i) an Amcor stock option (“Amcor Converted Option”) award (a) with respect to a number of Amcor ordinary shares (rounded

down to the nearest share) equal to the product of (1) the number of shares of Berry common stock subject to the corresponding Berry Unvested

Option award, multiplied by (2) 7.25, and (b) with an exercise price per Amcor ordinary share that is equal to the quotient of (x) the

exercise price per share of Berry common stock subject to the corresponding Berry Unvested Option award immediately prior to the Effective

Time, divided by (y) 7.25 (rounded up to the nearest cent) and (ii) an amount in restricted cash equal to the value of any Berry DERs

that are accrued and unpaid with respect to the Berry Unvested Option award. The resulting Amcor Converted Option and restricted cash

payment will be subject to the same terms and conditions (excluding the right to receive future dividend equivalents in excess of the

accrued, but unpaid, Berry DERs that applied to the corresponding Berry Unvested Option Award and Berry DER).

Representation

and Warranties; Certain Covenants

The

Merger Agreement includes customary representations, warranties and covenants of Amcor and Berry. Between the date of execution of the

Merger Agreement and the Effective Time, each of Amcor and Berry has agreed to use its reasonable best efforts to carry on its respective

businesses in all material respects in the ordinary course of business and to preserve substantially intact its business organization

and relationships with customers, suppliers and other third parties, and to comply with certain interim operating covenants.

In

addition, between the date of execution of the Merger Agreement and the Effective Time, each of Amcor and Berry has agreed not to, and

will cause its subsidiaries and its and their respective officers and directors not to, and will use its reasonable best efforts to cause

its and their respective other representatives not to, among other things, solicit, initiate or knowingly

encourage or take any other action to knowingly facilitate any third-party acquisition proposals, and has agreed to certain restrictions

on its and its subsidiaries’ and its and their representatives’ ability to respond to any such proposals, in each case, subject

to the terms and conditions of the Merger Agreement. Subject to certain qualifications, each of Amcor and Berry has agreed to use reasonable

best efforts to cause the Merger to be completed, including to obtain the required regulatory approvals for the transaction, and Amcor

has agreed, if required to resolve or eliminate any impediments or objections that may be asserted with respect to the Merger, to certain

commitments relating thereto.

Conditions

to the Merger

The

completion of the Merger is subject to certain conditions, including: (i) the adoption of the Merger Agreement by Berry’s stockholders,

(ii) the approval of the issuance of Amcor ordinary shares in the Merger (the “Share Issuance”) by Amcor’s shareholders,

(iii) the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as

amended, and the absence of any agreement with either the Federal Trade Commission or Antitrust Division of the Department of Justice

not to complete the Merger, (iv) the receipt of other required regulatory approvals, (v) the absence of any order or law that has the

effect of enjoining or otherwise prohibiting the completion of the Merger, (vi) the approval for listing of the Amcor ordinary shares

to be issued in connection with the Merger on the New York Stock Exchange and the effectiveness of a registration statement on Form S-4

with respect to such ordinary shares, (vii) subject to certain exceptions, the accuracy of the representations and warranties of the other

party, (viii) performance in all material respects by each party of its respective obligations under the Merger Agreement and (ix) the

absence of certain changes that have had, or would reasonably be expected to have, a material adverse effect with respect to each of Berry

and Amcor.

Termination

Rights and Fees

The

Merger Agreement also contains certain customary termination rights, whereby either party may terminate the Merger Agreement (i) by mutual

written consent, (ii) if the Merger has not been completed by November 19, 2025 (the “Outside Date”) (or, if the Outside Date

is automatically extended pursuant to the terms of the Merger Agreement, May 19, 2026), (iii) if the Berry Stockholder Approval (as defined

in the Merger Agreement) has not been obtained, (iv) if the Amcor Shareholder Resolution (as defined in the Merger Agreement) has not

been obtained and (v) if prior to the Effective Time a governmental entity of competent jurisdiction issues or enters any order

after the date of the Merger Agreement or any applicable law has been enacted that has the effect of permanently restraining, enjoining

or otherwise prohibiting the Merger (and, in the case of an order, has become final and non-appealable). In addition, (x) the Merger Agreement

may be terminated by Amcor (A) due to certain breaches by Berry of its representations, warranties and covenants contained in the Merger

Agreement, subject to certain cure rights, (B) if prior to the meeting of Berry’s stockholders the Berry Board changes its recommendation

in connection with the adoption of the Merger Agreement by Berry’s stockholders or (C) if prior to the meeting of Amcor’s

shareholders Amcor determines to enter into a superior proposal and (y) the Merger Agreement may be terminated by Berry (A) due to certain

breaches by Amcor of its representations, warranties and covenants contained in the Merger Agreement, subject to certain cure rights,

(B) if prior to the meeting of Amcor’s shareholders the Amcor Board changes its recommendation in connection with the approval of

the Share Issuance by Amcor’s shareholders or (C) if prior to the meeting of Berry’s stockholders Berry determines to enter

into a superior proposal.

Amcor

will be required to pay Berry a termination fee equal to $260 million in specified circumstances,

including if Amcor terminates the Merger Agreement to enter into a superior proposal or if Berry terminates the Merger Agreement following

a change of recommendation by the Amcor Board, in each case, subject to the terms and conditions of the Merger Agreement. Berry will be

required to pay Amcor a termination fee equal to $260 million in specified circumstances, including if Berry terminates the Merger Agreement

to enter into a superior proposal or if Amcor terminates the Merger Agreement following a change of recommendation by the Berry Board,

in each case, subject to the terms and conditions of the Merger Agreement.

The

representations, warranties and covenants set forth in the Merger Agreement have been made only for the purposes of the Merger Agreement

and solely for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties,

including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the

Merger Agreement instead of establishing these matters as facts, as well as by information contained in documents each party has filed

with the SEC as of a certain date set forth in the Merger Agreement, and may be subject to standards of materiality applicable to the

contracting parties that differ from those applicable to investors. In addition, such representations and warranties (1) will not survive

completion of the Merger and cannot be the basis for any claims under the Merger Agreement by the other party after termination of the

Merger Agreement, except as a result of a willful breach, and (2) were made only as of the dates specified in the Merger Agreement. Accordingly,

the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement

and not to provide investors with any other factual information regarding the parties or their respective businesses.

A copy of the Merger Agreement will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof

as Exhibit 2.1, and the foregoing description of the Merger Agreement and the Merger is qualified in its entirety by reference thereto.

Item 7.01. Regulation FD Disclosure

On

November 19, 2024, Amcor and Berry issued a joint press release announcing the entry into the Merger Agreement.

A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein. The press release also announced

that Amcor and Berry will be hosting a joint investor conference call and webcast at 8:00 a.m., Eastern Time, on November 19, 2024, to

discuss the transactions contemplated by the Merger Agreement. The presentation materials for the conference call and webcast are attached

hereto as Exhibit 99.2.

The

information contained in this Item 7.01, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of that section, nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended (the

“Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events

In

connection with, and concurrently with entry into, the Merger

Agreement, Amcor, as guarantor, and Amcor Flexibles North America, Inc. (“AFNA”), as borrower, entered into a debt commitment

letter dated November 19, 2024 (the “Debt Commitment Letter”), with Goldman Sachs Bank USA, UBS AG, Stamford Branch and UBS

Securities LLC (collectively, the “Banks”), pursuant to which the Banks have agreed to provide AFNA with an unsecured 364-day bridge

loan facility (the “Bridge Facility”) in an aggregate principal amount of $3.0 billion on the terms and subject to the

conditions set forth in the Debt Commitment Letter for the purposes of refinancing certain existing indebtedness of Berry (the “Specified

Berry Debt”). The Bridge Facility will be available to be drawn upon in the event that Amcor or one of its subsidiaries

has not prior to or concurrently with the consummation of the Merger received proceeds from one or more debt capital markets or loan facility

transactions sufficient to refinance the Specified Berry Debt. The obligations of

the Banks to provide the debt financing in accordance with the Debt Commitment Letter are subject to conditions customary for transactions

of this type.

Item 9.01. Financial Statements and Exhibits.

Important Information for Investors and Shareholders

This communication does not constitute an offer

to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus

or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

In

connection with the proposed transaction between Amcor plc (“Amcor”) and Berry Global Group, Inc. (“Berry”),

Amcor and Berry intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including, among

other filings, an Amcor registration statement on Form S-4 that will include a joint proxy statement of Amcor and Berry that also constitutes

a prospectus of Amcor with respect to Amcor’s ordinary shares to be issued in the proposed transaction, and a definitive joint

proxy statement/prospectus, which will be mailed to shareholders of Amcor and Berry (the “Joint Proxy Statement/Prospectus”).

Amcor and Berry may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for

the Joint Proxy Statement/Prospectus or any other document which Amcor or Berry may file with the SEC. INVESTORS AND SECURITY HOLDERS

OF AMCOR AND BERRY ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain

free copies of the registration statement and the Joint Proxy Statement/Prospectus (when available) and other documents filed with the

SEC by Amcor or Berry through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by

Amcor will be available free of charge on Amcor’s website at amcor.com under the tab “Investors” and under the heading

“Financial Information” and subheading “SEC Filings.” Copies of the documents filed with the SEC by Berry will

be available free of charge on Berry’s website at berryglobal.com under the tab “Investors” and under the heading “Financials”

and subheading “SEC Filings.”

Certain Information Regarding Participants

Amcor,

Berry, and their respective directors and executive officers may be considered participants in the solicitation of proxies from the shareholders

of Amcor and Berry in connection with the proposed transaction. Information about the directors and executive officers of Amcor is set

forth in its Annual Report on Form 10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024 and its proxy

statement for its 2024 annual meeting, which was filed with the SEC on September 24, 2024. Information about the directors and executive

officers of Berry is set forth in its Annual Report on Form 10-K for the year ended September 30, 2023, which was filed with the SEC on

November 17, 2023, its proxy statement for its 2024 annual meeting, which was filed with the SEC on January 4, 2024, and its Current Reports

on Form 8-K, which were filed with the SEC on February 12, 2024, April 11, 2024, September 6, 2024 and November 4, 2024. To the extent

holdings of Amcor’s or Berry’s securities by its directors or executive officers have changed since the amounts set forth

in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of

Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Amcor and Berry, including

a description of their direct or indirect interests, by security holdings or otherwise, and other information regarding the potential

participants in the proxy solicitations, which may be different than those of Amcor’s shareholders and Berry’s stockholders

generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding the

proposed transaction. You may obtain these documents (when they become available) free of charge through the website maintained by the

SEC at http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This

communication contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,”

“approximately,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “possible,”

“predict,” “project,” “target,” “seek,” “should,” “will,” or “would,”

the negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the

anticipated benefits of the proposed transaction, the impact of the proposed transaction on Amcor’s and Berry’s business and

future financial and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and

scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company

following the closing of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates,

assumptions and projections of the management of Amcor and Berry, and are qualified by the inherent risks and uncertainties surrounding

future expectations generally, all of which are subject to change. Actual results could differ materially from those currently anticipated

due to a number of risks and uncertainties, many of which are beyond Amcor’s and Berry’s control. None of Amcor, Berry or

any of their respective directors, executive officers, or advisors, provide any representation, assurance or guarantee that the occurrence

of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they

will have on the business, results of operations or financial condition of Amcor or Berry. Should any risks and uncertainties develop

into actual events, these developments could have a material adverse effect on Amcor’s and Berry’s businesses, the proposed

transaction and the ability to successfully complete the proposed transaction and realize its expected benefits. Risks and uncertainties

that could cause results to differ from expectations include, but are not limited to, the occurrence of any event, change or other circumstance

that could give rise to the termination of the merger agreement; the risk that the conditions to the completion of the proposed transaction

(including shareholder and regulatory approvals) are not satisfied in a timely manner or at all; the risks arising from the integration

of the Amcor and Berry businesses; the risk that the anticipated benefits of the proposed transaction may not be realized when expected

or at all; the risk of unexpected costs or expenses resulting from the proposed transaction; the risk of litigation related to the proposed

transaction; the risks related to disruption of management’s time from ongoing business operations as a result of the proposed transaction;

the risk that the proposed transaction may have an adverse effect on the ability of Amcor and Berry to retain key personnel and customers;

general economic, market and social developments and conditions; the evolving legal, regulatory and tax regimes under which Amcor and

Berry operate; potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed

transaction that could affect Amcor’s and/or Berry’s financial performance; and other risks and uncertainties identified

from time to time in Amcor’s and Berry’s respective filings with the SEC, including the Joint Proxy Statement/Prospectus to

be filed with the SEC in connection with the proposed transaction. While the list of risks presented here is, and the list of risks presented

in the Joint Proxy Statement/Prospectus will be, considered representative, no such list should be considered to be a complete statement

of all potential risks and uncertainties, and other risks may present significant additional obstacles to the realization of forward-looking

statements. Forward-looking statements included herein are made only as of the date hereof and neither Amcor nor Berry undertakes any

obligation to update any forward-looking statements, or any other information in this communication, as a result of new information, future

developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent. All forward-looking statements in

this communication are qualified in their entirety by this cautionary statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Date: November 19, 2024 |

| |

|

| |

AMCOR PLC |

| |

|

| |

/s/ Damien Clayton |

| |

Name: Damien Clayton |

| |

Title: Company Secretary |

Exhibit 99.1

AMCOR AND BERRY

TO COMBINE IN AN ALL-STOCK TRANSACTION,

CREATING A GLOBAL LEADER IN CONSUMER AND HEALTHCARE

PACKAGING SOLUTIONS

Combination of Complementary

Businesses Expands Product Offering and Capabilities to Support Higher Growth for Customers

Combined R&D

and Innovation Investment Accelerates Development of Sustainable Packaging Solutions and Delivers Greater Choice for Customers and Consumers

$650 Million Annual

Earnings Synergies Benefit

Over 35% Adjusted

Cash EPS Accretion

Companies to Host

Investor Conference Call Today at 8:00am U.S. Eastern Time

ZURICH, SWITZERLAND

and EVANSVILLE, INDIANA, Tues. – November 19, 2024 – Amcor plc (“Amcor”) (NYSE: AMCR; ASX: AMC) and Berry

Global Group, Inc. (“Berry”) (NYSE: BERY), today announced they have entered into a definitive merger agreement, pursuant

to which Amcor and Berry will combine in an all-stock transaction.

Berry shareholders

will receive a fixed exchange ratio of 7.25 Amcor shares for each Berry share held upon closing, resulting in Amcor and Berry shareholders

owning approximately 63% and 37% of the combined company, respectively. The transaction has received unanimous approval of the boards

of directors of both Amcor and Berry and values Berry’s common stock at $73.59 per share.

The combination

brings together two highly complementary businesses to create a global leader in consumer packaging solutions, with a broader flexible

film and converted film offering for customers, a scaled containers and closures business and a unique global healthcare portfolio. The

combined company will have unprecedented innovation capabilities and scale, and be uniquely positioned to accelerate growth, solve customers’

and consumers’ sustainability needs, unlock portfolio transformation and deliver significant value to both sets of shareholders.

Amcor CEO, Peter

Konieczny, said, “This combination delivers on our strategy to accelerate growth by putting the customer first, elevating the role

of sustainability and orienting the portfolio toward faster growing, higher margin categories. We will have a more complete and more

sustainable product offering, supported by stronger innovation capabilities, global scale and supply chain flexibility. We will help

global and local customers grow faster and operate more efficiently with a team of exceptional talent. As a result, this combination

also drives a step change in annual free cash flow, earnings growth and value creation for our shareholders. I, and the Amcor team, look

forward to joining with Berry to accelerate change and real impact for our customers and their consumers.”

Berry CEO, Kevin

Kwilinski, added, “Over the past year, Berry has undergone a significant transformation, completing the spin-off of our HHNF business,

enhancing our product mix and optimizing our portfolio. Our combination with Amcor is a logical next step in our company’s evolution,

and it is a testament to our entire team that we’re well positioned to build on this momentum and deliver even more value to our

shareholders. We expect to better serve customers through a comprehensive and innovative consumer packaging portfolio and a complementary

geographic coverage. Importantly Berry and Amcor have aligned philosophies focused on safety, employee experience, sustainability, innovation,

customer intimacy, and functional excellence. We will be better together, and I look forward to all we will achieve as a combined organization.”

Compelling Strategic Benefits:

| o | Stronger business,

strategically focused on high-growth, high-margin categories with greater capabilities and

a more complete product offering for customers |

| · | Creates

a global product offering in flexibles, containers and closures by combining Amcor’s

global flexibles and regional containers businesses with Berry’s regional flexibles

and global containers and closures businesses |

| · | Combines

two highly attractive and complementary global healthcare businesses |

| · | Strengthens

positions in high-growth, high-value categories, including Healthcare, Protein, Pet Food,

Liquids, Beauty & Personal Care, and Food Service |

| · | Brings

together complementary innovation capabilities and platforms, material science expertise

and specialized tooling, design and multi-component assembly capabilities |

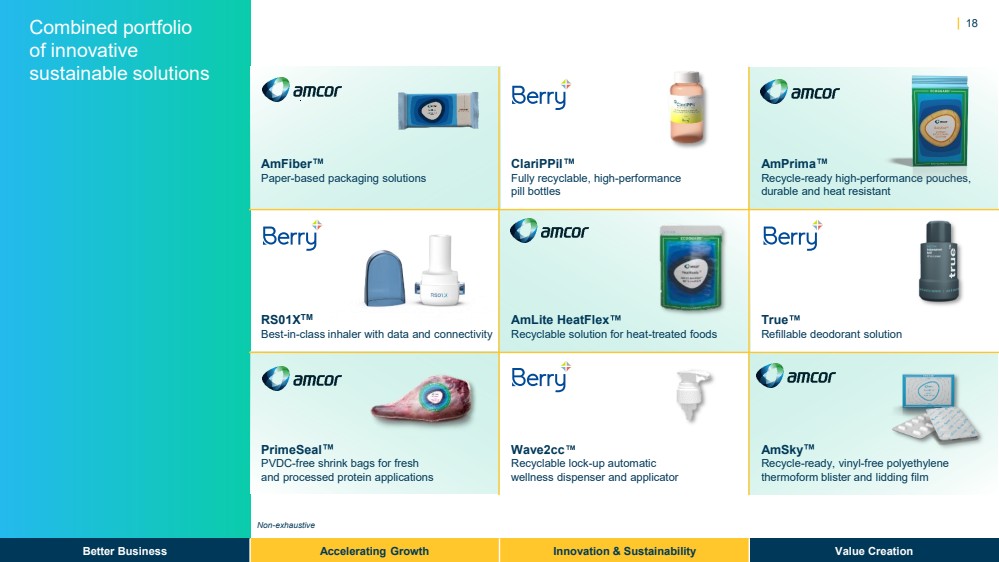

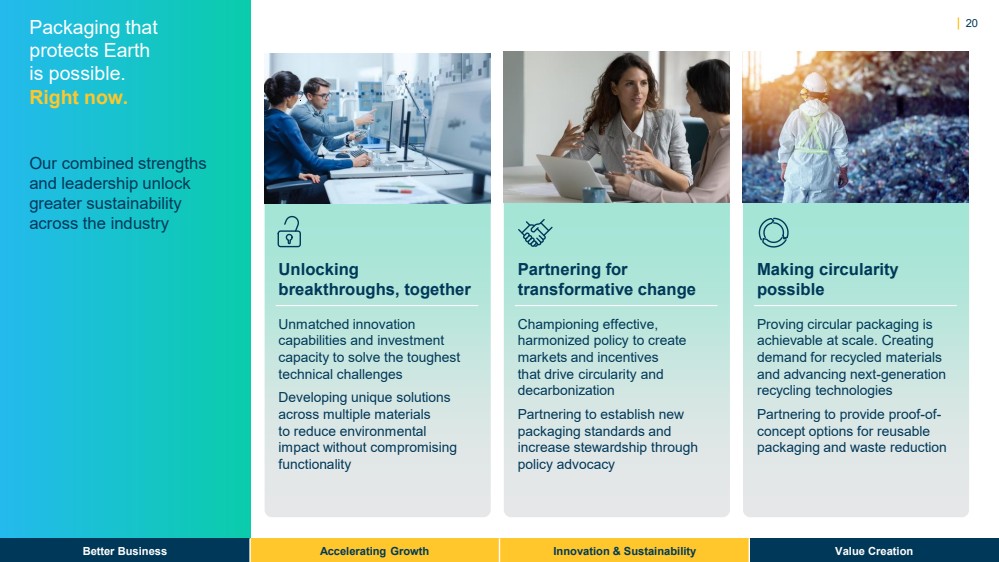

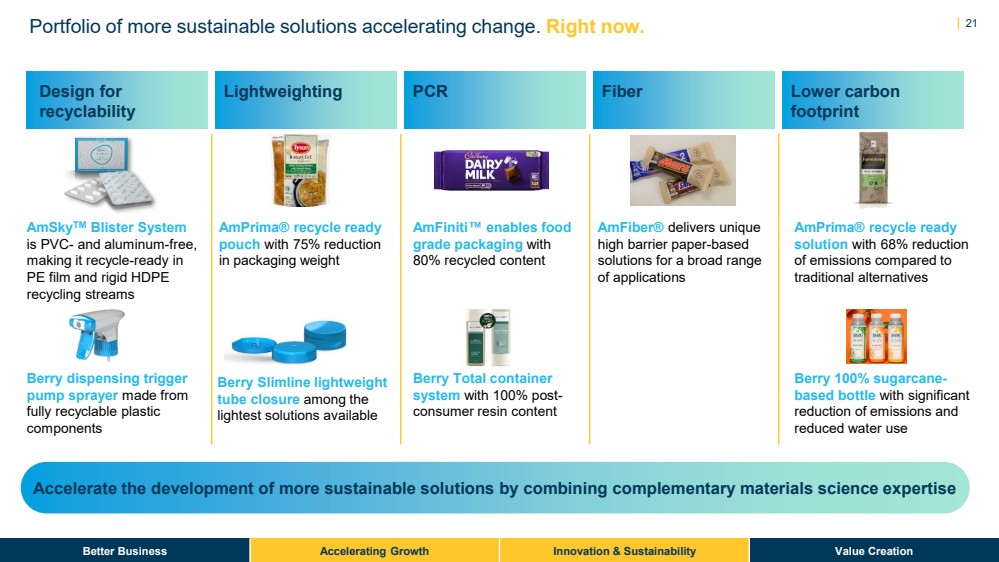

| o | Creates the

innovation partner of choice developing the most sustainable packaging solutions |

| · | Offers

customers a wider range of more sustainable solutions which drive circularity, increase use

of alternative materials and lower carbon footprint |

| · | Delivers

greater choice for customers and consumers with a portfolio of unique flexible, container

and closure solutions developed using a broader range of recycled materials, next generation

lightweighting technologies, reuse and recycle ready capabilities and differentiated high

barrier paper based formats |

| · | Establishes

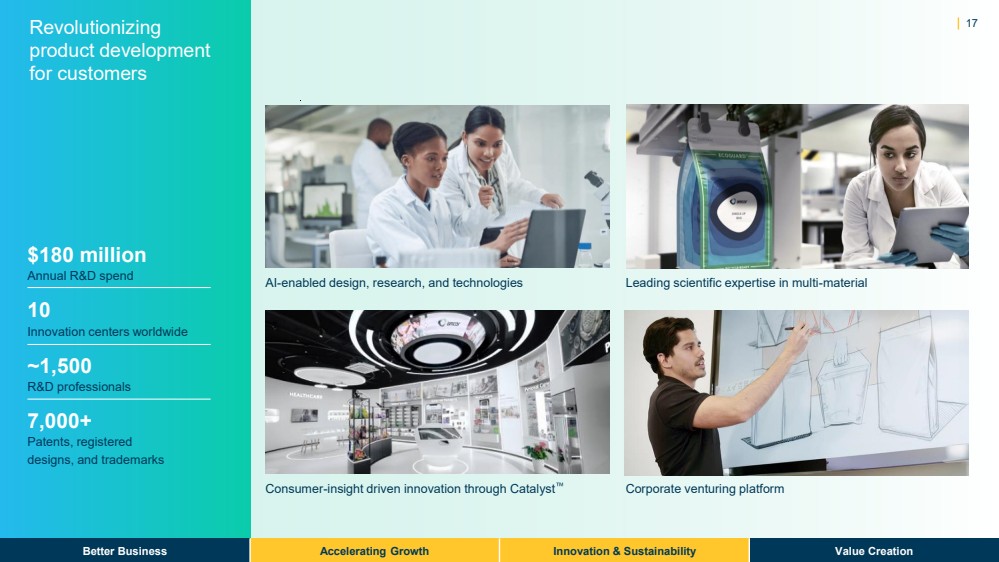

technology driven innovation leader with more capabilities and significantly higher capacity

to invest in solving technical challenges with combined R&D investment of $180 million

per annum, ~1,500 R&D professionals, 10 innovation centers worldwide and 7,000+ patents,

registered designs, and trademarks |

| · | Enhances

capabilities by leveraging corporate venturing partnerships to access new and groundbreaking

sustainability solutions (substrates, barrier, fiber and recycling), digital solutions and

disruptive ideas in adjacent businesses and technologies |

| o | Scale and

reach provide local expertise, global capabilities and supply chain resilience |

| · | Optimizes

footprint servicing customers in 140+ countries through ~400 production facilities, brings

global capabilities to local customers and provides local access and expertise to global

brands |

| · | Supports

customers in accessing broader growth opportunities and addressing specific regional needs

with a balanced geographic presence across continents including in high-growth emerging markets |

| · | Enhances

scale and reach that ensure supply chain resilience in a dynamic world and access to global

manufacturing best practices |

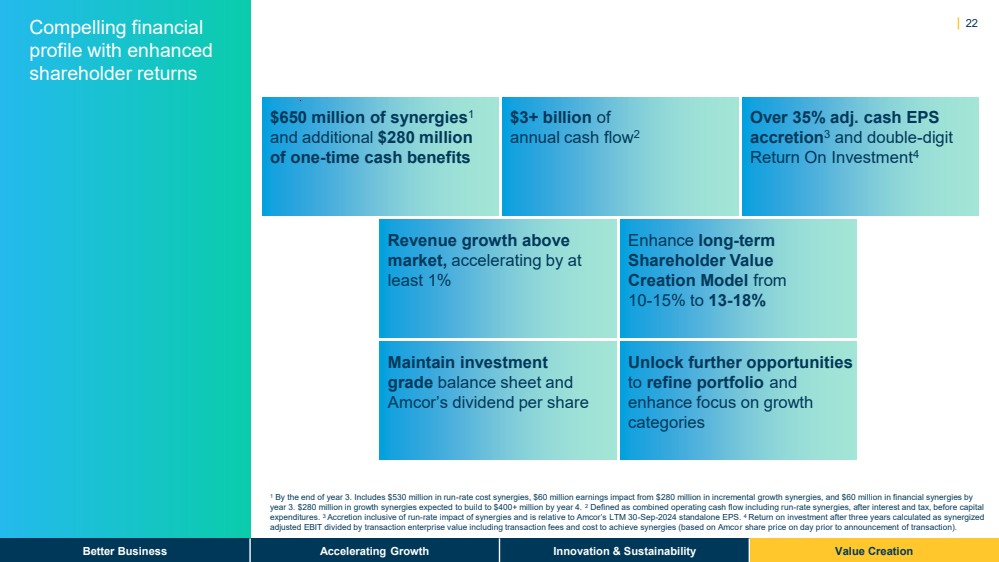

Compelling Financial Benefits:

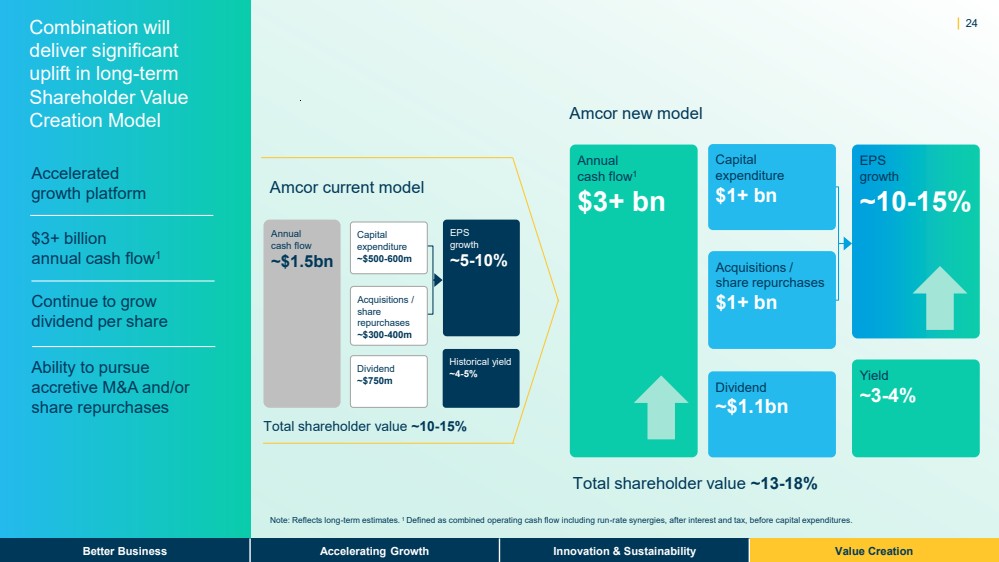

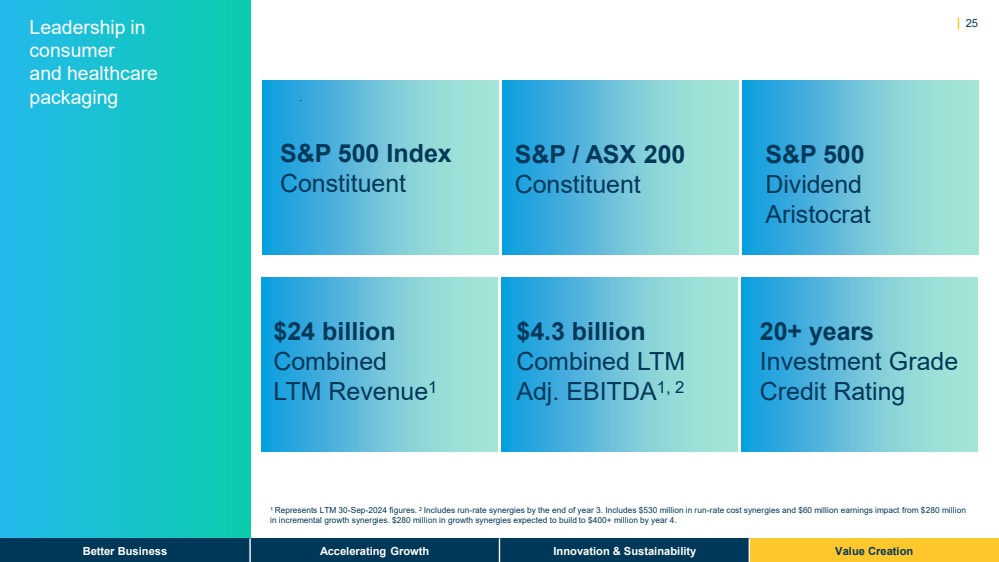

| o | Strong combined financial profile |

| · | Combined

revenues of $24 billion and adjusted EBITDA of $4.3 billion, including run-rate synergies |

| · | Combined

revenue growth above market, accelerating by at least 1% |

| · | Strong

combined annual cash flow1 of over $3 billion, providing significant capacity to fund organic reinvestment, a compelling

dividend, value accretive M&A and share repurchases |

| · | Expected

net leverage of 3.3x at close with path to de-lever below 3.0x within first full year |

| · | Commitment

to investment grade balance sheet and continued annual dividend growth from Amcor’s

current annualized base of $0.51 cents per share. Berry expects to maintain its current dividend

policy until the close of the transaction |

| · | Unlocks

further opportunities to refine portfolio, enhancing focus on high-growth, high-margin categories

and releasing capital to drive further growth |

1 Defined as combined operating cash flow including run-rate synergies, after interest

and tax, before capital expenditures.

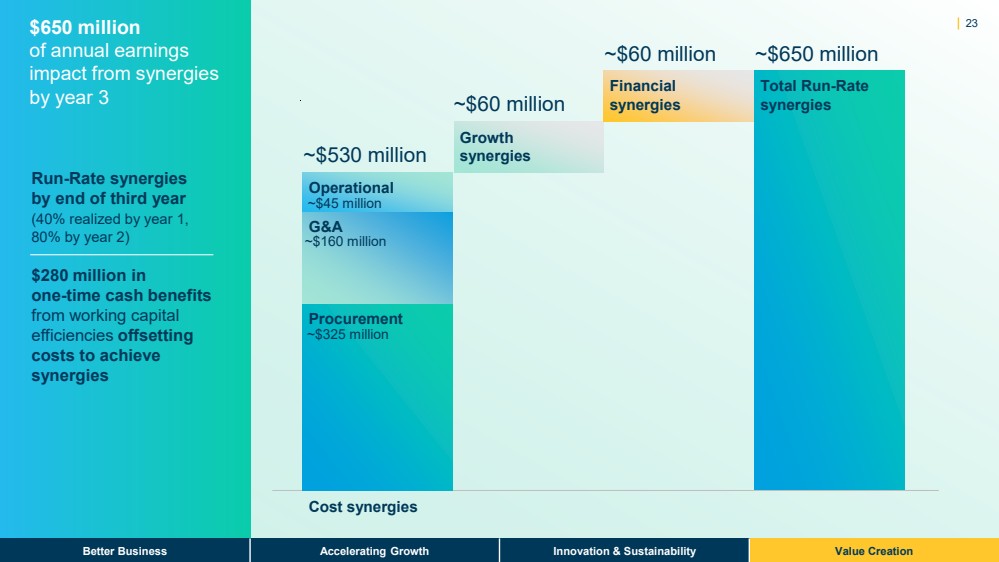

| o | $650 million

benefit from identified cost, growth and financial synergies by end of third year |

| · | $530

million annual run-rate pre-tax cost synergies |

| · | $60

million in annual run-rate financial savings |

| · | $60

million annual run-rate pre-tax earnings benefit from growth synergies, including from: |

| o | Increased

exposure to higher growth, higher value categories including Healthcare, Protein, Liquids,

Pet Food, Beauty & Personal Care and Food Service |

| o | Combined

innovation capabilities to better serve customers and unlock growth opportunities |

| o | Differentiated

commercial capabilities deployed across a broader platform |

| · | Additional

$280 million of one-time cash benefits from working capital efficiencies offsetting approximately

$280 million of expected pre-tax costs to achieve synergies |

| o | Significant value creation

for all shareholders |

| o | Over

35% adjusted cash EPS accretion and expected double-digit return on investment2 |

| o | Enhanced

long-term shareholder value creation through sustained higher expected earnings growth from

10-15% to 13-18% per annum |

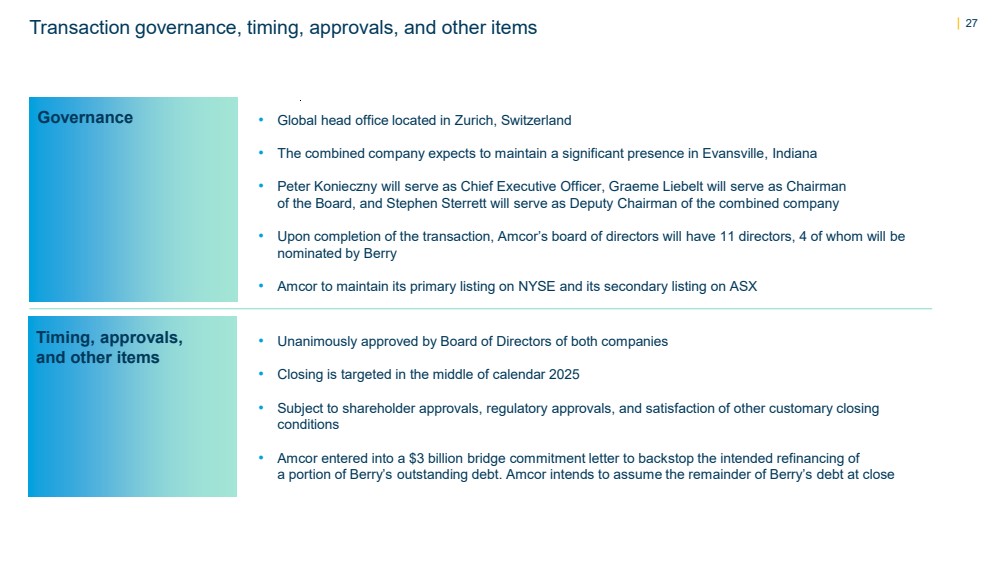

Timing and Approvals

The transaction

has been unanimously approved by the boards of directors of both Amcor and Berry. Closing is targeted in the middle of calendar year

2025. The closing of the transaction is subject to shareholder approvals, regulatory approvals, and satisfaction of other customary closing

conditions.

Board, Management, and Head Office

Peter Konieczny

will serve as Chief Executive Officer, Graeme Liebelt will serve as Chairman and Stephen Sterrett will serve as Deputy Chairman of the

combined company.

Amcor will maintain

its primary listing on the NYSE and its secondary listing on the ASX. The combined entity will be named Amcor plc.

Global Head Office

will remain in Zurich, Switzerland. The combined company expects to maintain a significant presence in Evansville, Indiana.

Upon completion

of the transaction, Amcor’s board of directors will expand to 11 directors, 4 of whom will be nominated by Berry.

2 Return

on investment after three years calculated as synergized adjusted EBIT divided by transaction enterprise value including transaction

fees and cost to achieve synergies (based on Amcor share price on day prior to announcement of transaction).

Conference Call

for Investment Community

Amcor and Berry

will host a joint investor conference call at 8.00am US Eastern Time on Tuesday 19 November 2024 / 12.00am Australian Eastern Time on

Wednesday 20 November 2024. For those wishing to participate in the call please use the following dial-in numbers:

USA:

800 715-9871 (toll-free) | 646 307-1963 (local)

Australia:

1800 519 630 (toll-free) | 02 9133 7103 (local)

United

Kingdom: 0800 358 0970 (toll-free) | 020 3433 3846 (local)

Hong

Kong: +852 3002 3410 (local)

Singapore:

+65 3159 5133 (local)

All

other countries: +1 646 307-1963 (this is not a toll-free number)

Conference

ID 3964921

Access

to the webcast and supporting materials will be available via the Investors section of each company’s website at amcor.com

and berryglobal.com. A webcast replay will be available at the conclusion of the call.

Berry will

separately release its fourth quarter and fiscal year 2024 earnings release before trading on the New York Stock Exchange begins today,

Tuesday, November 19, 2024. As a result of the transaction with Amcor, Berry will no longer host its previously planned quarterly conference

call at 10.00am US Eastern Time on Wednesday 20 November 2024 / 2.00am Australian Eastern Time on Thursday 21 November 2024. Berry will

post prepared remarks and a presentation regarding its fourth quarter and fiscal year 2024 earnings results on the Company’s website

at berryglobal.com.

Advisors

UBS Investment

Bank and Goldman Sachs & Co. LLC are acting as financial advisors to Amcor. Kirkland & Ellis LLP is acting as legal advisor to

Amcor.

Lazard and Wells

Fargo are acting as financial advisors to Berry. Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal advisor to Berry.

Amcor Investor Relations Contacts

Tracey Whitehead

Global Head of Investor Relations

T: +61 408 037 590

E: tracey.whitehead@amcor.com

Damien Bird

Vice President Investor Relations Asia

Pacific

T: +61 481 900 499

E: damien.bird@amcor.com

Damon Wright

Vice President Investor Relations North

America

T: +1 224 313 7141

E: damon.wright@amcor.com

Amcor Media Contacts

Australia

James Strong

Managing Director

Sodali & Co

T: +61 448 881 174

E: james.strong@sodali.com

Europe

Ernesto Duran

Head of Global Communications

T: +41 78 698 69 40

E: ernesto.duran@amcor.com

North America

Julie Liedtke

Director, Media Relations

T: +1 847 204 2319

E: julie.liedtke@amcor.com

Berry Investor Relations / Media

Contact

Dustin Stilwell

VP, Head of Investor Relations

T: +1 812 306 2964

E: ir@berryglobal.com

E: mediarelations@berryglobal.com

About Amcor

Amcor plc is a

global leader in developing and producing responsible packaging solutions across a variety of materials for food, beverage, pharmaceutical,

medical, home and personal-care, and other products. Amcor works with leading companies around the world to protect products, differentiate

brands, and improve supply chains. The Company offers a range of innovative, differentiating flexible and rigid packaging, specialty

cartons, closures and services. The company is focused on making packaging that is increasingly recyclable, reusable, lighter weight

and made using an increasing amount of recycled content. In fiscal year 2024, 41,000 Amcor people generated $13.6 billion in annual sales

from operations that span 212 locations in 40 countries. NYSE: AMCR; ASX: AMC

About Berry

Berry is a global

leader in innovative packaging solutions that we believe make life better for people and the planet. We do this every day by leveraging

our unmatched global capabilities, sustainability leadership, and deep innovation expertise to serve customers of all sizes around the

world. Harnessing the strength in our diversity and industry-leading talent of over 34,000 global employees across more than 200 locations,

we partner with customers to develop, design, and manufacture innovative products with an eye toward the circular economy. The challenges

we solve and the innovations we pioneer benefit our customers at every stage of their journey.

Important Information for Investors

and Shareholders

This communication

does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote

or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It

does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance with applicable

law.

In connection with

the proposed transaction between Amcor plc (“Amcor”) and Berry Global Group, Inc. (“Berry”), Amcor and Berry

intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including, among other filings,

an Amcor registration statement on Form S-4 that will include a joint proxy statement of Amcor and Berry that also constitutes a prospectus

of Amcor with respect to Amcor’s ordinary shares to be issued in the proposed transaction, and a definitive joint proxy statement/prospectus,

which will be mailed to shareholders of Amcor and Berry (the “Joint Proxy Statement/Prospectus”). Amcor and Berry may also

file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the Joint Proxy Statement/Prospectus

or any other document which Amcor or Berry may file with the SEC. INVESTORS AND SECURITY HOLDERS OF AMCOR AND BERRY ARE URGED TO READ

THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the registration statement

and the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Amcor or Berry through the website

maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Amcor will be available free of charge on

Amcor’s website at amcor.com under the tab “Investors” and under the heading “Financial Information” and

subheading “SEC Filings.” Copies of the documents filed with the SEC by Berry will be available free of charge on Berry’s

website at berryglobal.com under the tab “Investors” and under the heading “Financials” and subheading “SEC

Filings.”

Certain Information Regarding Participants

Amcor, Berry, and

their respective directors and executive officers may be considered participants in the solicitation of proxies from the shareholders

of Amcor and Berry in connection with the proposed transaction. Information about the directors and executive officers of Amcor is set

forth in its Annual Report on Form 10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024 and its proxy

statement for its 2024 annual meeting, which was filed with the SEC on September 24, 2024. Information about the directors and executive

officers of Berry is set forth in its Annual Report on Form 10-K for the year ended September 30, 2023, which was filed with the SEC

on November 17, 2023, its proxy statement for its 2024 annual meeting, which was filed with the SEC on January 4, 2024, and its Current

Reports on Form 8-K, which were filed with the SEC on February 12, 2024, April 11, 2024, September 6, 2024 and November 4, 2024. To the

extent holdings of Amcor’s or Berry’s securities by its directors or executive officers have changed since the amounts set

forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements

of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Amcor and Berry, including

a description of their direct or indirect interests, by security holdings or otherwise, and other information regarding the potential

participants in the proxy solicitations, which may be different than those of Amcor’s shareholders and Berry’s stockholders

generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding

the proposed transaction. You may obtain these documents (when they become available) free of charge through the website maintained by

the SEC at http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This communication

contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,”

“approximately,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “outlook,” “plan,” “potential,”

“possible,” “predict,” “project,” “target,” “seek,” “should,”

“will,” or “would,” the negative of these words, other terms of similar meaning or the use of future dates. Such

statements, including projections as to the anticipated benefits of the proposed transaction, the impact of the proposed transaction

on Amcor’s and Berry’s business and future financial and operating results and prospects, the amount and timing of synergies

from the proposed transaction, the terms and scope of the expected financing in connection with the proposed transaction, the aggregate

amount of indebtedness of the combined company following the closing of the proposed transaction and the closing date for the proposed

transaction, are based on the current estimates, assumptions and projections of the management of Amcor and Berry, and are qualified

by the inherent risks and uncertainties surrounding future expectations generally, all of which are subject to change. Actual results

could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Amcor’s

and Berry’s control. None of Amcor, Berry or any of their respective directors, executive officers, or advisors, provide any representation,

assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur,

or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Amcor or Berry.

Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on Amcor’s

and Berry’s businesses, the proposed transaction and the ability to successfully complete the proposed transaction and realize

its expected benefits. Risks and uncertainties that could cause results to differ from expectations include, but are not limited to,

the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the risk that

the conditions to the completion of the proposed transaction (including shareholder and regulatory approvals) are not satisfied in a

timely manner or at all; the risks arising from the integration of the Amcor and Berry businesses; the risk that the anticipated benefits

of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs or expenses resulting from the

proposed transaction; the risk of litigation related to the proposed transaction; the risks related to disruption of management’s

time from ongoing business operations as a result of the proposed transaction; the risk that the proposed transaction may have an adverse

effect on the ability of Amcor and Berry to retain key personnel and customers; general economic, market and social developments and

conditions; the evolving legal, regulatory and tax regimes under which Amcor and Berry operate; potential business uncertainty, including

changes to existing business relationships, during the pendency of the proposed transaction that could affect Amcor’s and/or Berry’s

financial performance; and other risks and uncertainties identified from time to time in Amcor’s and Berry’s respective filings

with the SEC, including the Joint Proxy Statement/Prospectus to be filed with the SEC in connection with the proposed transaction. While

the list of risks presented here is, and the list of risks presented in the Joint Proxy Statement/Prospectus will be, considered representative,

no such list should be considered to be a complete statement of all potential risks and uncertainties, and other risks may present significant

additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made only as of

the date hereof and neither Amcor nor Berry undertakes any obligation to update any forward-looking statements, or any other information

in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions

in them which become apparent. All forward-looking statements in this communication are qualified in their entirety by this cautionary

statement.

Note Regarding Use of Non-GAAP Financial

Measures

In addition to

the financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this communication

includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as EBIT, EBITDA, Adjusted EBITDA,

free cash flow and return on investment. These Non-GAAP Measures should not be used in isolation or as a substitute or alternative to

results determined in accordance with U.S. GAAP. In addition, Amcor's and Berry' definitions of these Non-GAAP Measures may not be comparable

to similarly titled non-GAAP financial measures reported by other companies. It should also be noted that projected financial information

for the combined businesses of Amcor and Berry is based on management’s estimates, assumptions and projections and has not been

prepared in conformance with the applicable accounting requirements of Regulation S-X relating to pro forma financial information, and

the required pro forma adjustments have not been applied and are not reflected therein. These measures are provided for illustrative

purposes, are based on an arithmetic sum of the relevant historical financial measures of Amcor and Berry and do not reflect pro forma

adjustments. None of this information should be considered in isolation from, or as a substitute for, the historical financial statements

of Amcor or Berry. Important risk factors could cause actual future results and other future events to differ materially from those currently

estimated by management, including, but not limited to, the risks that: a condition to the closing of the proposed transaction may not

be satisfied; a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject

to conditions that are not anticipated; Amcor is unable to achieve the synergies and value creation contemplated by the proposed transaction;

Amcor is unable to promptly and effectively integrate Berry’s businesses; management’s time and attention is diverted on

transaction related issues; disruption from the transaction makes it more difficult to maintain business, contractual and operational

relationships; the credit ratings of the combined company declines following the proposed transaction; legal proceedings are instituted

against Amcor, Berry or the combined company; Amcor, Berry or the combined company is unable to retain key personnel; and the announcement

or the consummation of the proposed transaction has a negative effect on the market price of the capital stock of Amcor and Berry or

on Amcor’s and Berry’s operating results.

Exhibit 99.2

| 1

Amcor and Berry

to combine

Investor presentation

November 19, 2024

Powerful transformation partner for

customers, consumers, and the Planet |

| Disclaimers

Important Information for Investors and Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or

approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus or

prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements of

Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

In connection with the proposed transaction between Amcor plc (“Amcor”) and Berry Global Group, Inc. (“Berry”), Amcor and Berry intend to file

relevant materials with the Securities and Exchange Commission (the “SEC”), including, among other filings, an Amcor registration statement on

Form S-4 that will include a joint proxy statement of Amcor and Berry that also constitutes a prospectus of Amcor with respect to Amcor’s ordinary

shares to be issued in the proposed transaction, and a definitive joint proxy statement/prospectus, which will be mailed to shareholders of Amcor

and Berry (the “Joint Proxy Statement/Prospectus”). Amcor and Berry may also file other documents with the SEC regarding the proposed

transaction. This document is not a substitute for the Joint Proxy Statement/Prospectus or any other document which Amcor or Berry may file with

the SEC. INVESTORS AND SECURITY HOLDERS OF AMCOR AND BERRY ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security

holders will be able to obtain free copies of the registration statement and the Joint Proxy Statement/Prospectus (when available) and other

documents filed with the SEC by Amcor or Berry through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed

with the SEC by Amcor will be available free of charge on Amcor’s website at amcor.com under the tab “Investors” and under the heading “Financial

Information” and subheading “SEC Filings.” Copies of the documents filed with the SEC by Berry will be available free of charge on Berry’s website

at berryglobal.com under the tab “Investors” and under the heading “Financials” and subheading “SEC Filings.”

Certain Information Regarding Participants

Amcor, Berry, and their respective directors and executive officers may be considered participants in the solicitation of proxies from the shareholders

of Amcor and Berry in connection with the proposed transaction. Information about the directors and executive officers of Amcor is set forth in its

Annual Report on Form 10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024 and its proxy statement for its

2024 annual meeting, which was filed with the SEC on September 24, 2024. Information about the directors and executive officers of Berry is set

forth in its Annual Report on Form 10-K for the year ended September 30, 2023, which was filed with the SEC on November 17, 2023, its proxy

statement for its 2024 annual meeting, which was filed with the SEC on January 4, 2024, and its Current Reports on Form 8-K, which were filed with

the SEC on February 12, 2024, April 11, 2024, September 6, 2024 and November 4, 2024. To the extent holdings of Amcor’s or Berry’s securities by

its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial

Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors

and executive officers of Amcor and Berry, including a description of their direct or indirect interests, by security holdings or otherwise, and other

information regarding the potential participants in the proxy solicitations, which may be different than those of Amcor’s shareholders and Berry’s

stockholders generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding the

proposed transaction. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at

http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act and

Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,” “believe,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “possible,” “predict,” “project,” “target,” “seek,”

“should,” “will,” or “would,” the negative of these words, other terms of similar meaning or the use of future dates. Such statements, including

projections as to the anticipated benefits of the proposed transaction, the impact of the proposed transaction on Amcor’s and Berry’s business and

future financial and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and scope of the

expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the

closing of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates, assumptions and

projections of the management of Amcor and Berry, and are qualified by the inherent risks and uncertainties surrounding future expectations

generally, all of which are subject to change. Actual results could differ materially from those currently anticipated due to a number of risks and

uncertainties, many of which are beyond Amcor’s and Berry’s control. None of Amcor, Berry or any of their respective directors, executive officers, or

advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking

statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of

Amcor or Berry. Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on Amcor’s

and Berry’s businesses, the proposed transaction and the ability to successfully complete the proposed transaction and realize its expected benefits.

Risks and uncertainties that could cause results to differ from expectations include, but are not limited to, the occurrence of any event, change or

other circumstance that could give rise to the termination of the merger agreement; the risk that the conditions to the completion of the proposed

transaction (including shareholder and regulatory approvals) are not satisfied in a timely manner or at all; the risks arising from the integration of the

Amcor and Berry businesses; the risk that the anticipated benefits of the proposed transaction may not be realized when expected or at all; the risk

of unexpected costs or expenses resulting from the proposed transaction; the risk of litigation related to the proposed transaction; the risks related to

disruption of management’s time from ongoing business operations as a result of the proposed transaction; the risk that the proposed transaction

may have an adverse effect on the ability of Amcor and Berry to retain key personnel and customers; general economic, market and social

developments and conditions; the evolving legal, regulatory and tax regimes under which Amcor and Berry operate; potential business uncertainty,

including changes to existing business relationships, during the pendency of the proposed transaction that could affect Amcor’s and/or Berry’s

financial performance; and other risks and uncertainties identified from time to time in Amcor’s and Berry’s respective filings with the SEC, including

the Joint Proxy Statement/Prospectus to be filed with the SEC in connection with the proposed transaction. While the list of risks presented here is,

and the list of risks presented in the Joint Proxy Statement/Prospectus will be, considered representative, no such list should be considered to be a

complete statement of all potential risks and uncertainties, and other risks may present significant additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made only as of the date hereof and neither Amcor nor Berry undertakes any

obligation to update any forward-looking statements, or any other information in this communication, as a result of new information, future

developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent. All forward-looking statements in this

communication are qualified in their entirety by this cautionary statement.

Note Regarding Use of Non-GAAP Financial Measures

In addition to the financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this communication

includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as EBIT, EBITDA, Adjusted EBITDA, free cash flow

and return on investment. These Non-GAAP Measures should not be used in isolation or as a substitute or alternative to results determined in

accordance with U.S. GAAP. In addition, Amcor’s and Berry’s definitions of these Non-GAAP Measures may not be comparable to similarly titled

non-GAAP financial measures reported by other companies.

It should also be noted that projected financial information for the combined businesses of Amcor and Berry is based on management’s estimates,

assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating to

pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. These measures are

provided for illustrative purposes, are based on an arithmetic sum of the relevant historical financial measures of Amcor and Berry and do not reflect

pro forma adjustments. None of this information should be considered in isolation from, or as a substitute for, the historical financial statements of

Amcor or Berry. Important risk factors could cause actual future results and other future events to differ materially from those currently estimated by

management, including, but not limited to, the risks that: a condition to the closing of the proposed transaction may not be satisfied; a regulatory

approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated;

Amcor is unable to achieve the synergies and value creation contemplated by the proposed transaction; Amcor is unable to promptly and effectively

integrate Berry’s businesses; management’s time and attention is diverted on transaction related issues; disruption from the transaction makes it

more difficult to maintain business, contractual and operational relationships; the credit ratings of the combined company declines following the

proposed transaction; legal proceedings are instituted against Amcor, Berry or the combined company; Amcor, Berry or the combined company is

unable to retain key personnel; and the announcement or the consummation of the proposed transaction has a negative effect on the market price of

the capital stock of Amcor and Berry or on Amcor’s and Berry’s operating results.

2 |

| 3 Today’s presenters

Peter Konieczny

Chief Executive Officer

Michael Casamento

Chief Financial Officer

Mark Miles

Chief Financial Officer

Kevin Kwilinski

Chief Executive Officer |

| A more sustainable and better future

is something our customers and our

partners are striving for.

So, we’re here to enable that future.

To anticipate their demands, to make

it possible.

We’re elevating brands, shaping

lives, and protecting Earth with every

solution.

4 |

| 5

We’re transforming the way the world

thinks about its packaging.

We’re accelerating our innovation and

pushing boundaries.

Not on the horizon, not tomorrow, but right now.

And that’s our new commitment: to act today

while we also work towards an ideal future.

5 |

| 6

It's not incremental change for us;

it's a fundamental shift in how we think and act.

We’re bringing unprecedented innovation

expertise and investment to solve the most

challenging technical problems we face.

We’re proving that circular packaging is

possible at scale and we’re driving demand

for recycled materials.

Join us as we accelerate towards a brighter,

more sustainable future, together, right now.

6 |

| 7 |

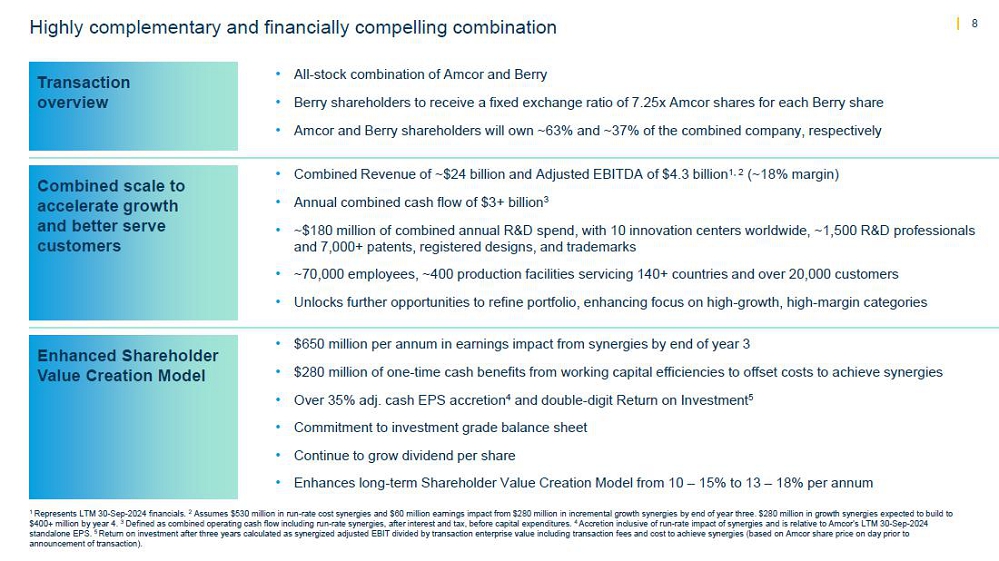

| Highly complementary and financially compelling combination 8

Transaction

overview

• All-stock combination of Amcor and Berry

• Berry shareholders to receive a fixed exchange ratio of 7.25x Amcor shares for each Berry share

• Amcor and Berry shareholders will own ~62% and ~38% of the combined company, respectively

Combined scale to

accelerate growth

and better serve

customers

• Combined Revenue of ~$24 billion and Adjusted EBITDA of $4.3 billion1, 2 (~18% margin)

• Annual combined cash flow of $3+ billion3

• ~$180 million of combined annual R&D spend, with 10 innovation centers worldwide, ~1,500 R&D professionals

and 7,000+ patents, registered designs, and trademarks

• ~70,000 employees, ~400 production facilities servicing 140+ countries and over 20,000 customers

• Unlocks further opportunities to refine portfolio, enhancing focus on high-growth, high-margin categories

Enhanced Shareholder

Value Creation Model

• $650 million per annum in earnings impact from synergies by end of year 3

• $280 million of one-time cash benefits from working capital efficiencies to offset costs to achieve synergies

• Over 35% adj. cash EPS accretion4 and double-digit Return on Investment5

• Commitment to investment grade balance sheet

• Continue to grow dividend per share

• Enhances long-term Shareholder Value Creation Model from 10 – 15% to 13 – 18% per annum

1 Represents LTM 30-Sep-2024 financials. 2 Assumes $530 million in run-rate cost synergies and $60 million earnings impact from $280 million in incremental growth synergies by end of year three. $280 million in growth synergies expected to build to

$400+ million by year 4. 3 Defined as combined operating cash flow including run-rate synergies, after interest and tax, before capital expenditures. 4 Accretion inclusive of run-rate impact of synergies and is relative to Amcor’s LTM 30-Sep-2024

standalone EPS. 5 Return on investment after three years calculated as synergized adjusted EBIT divided by transaction enterprise value including transaction fees and cost to achieve synergies (based on Amcor share price on day prior to

announcement of transaction).

Transaction

overview

Combined scale to

accelerate growth

and better serve

customers

Enhanced Shareholder

Value Creation Model |

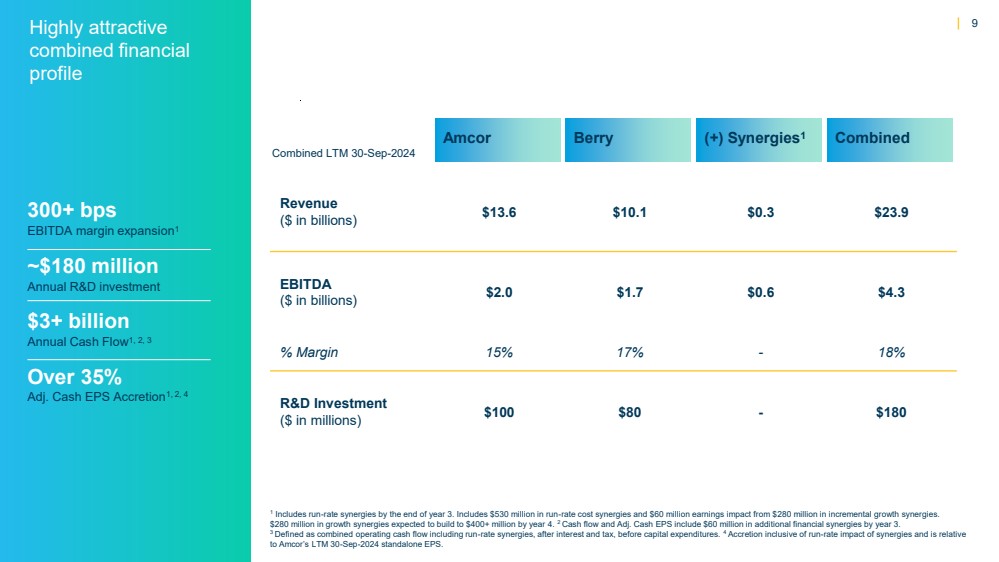

| Highly attractive 9

combined financial

profile

1

Includes run-rate synergies by the end of year 3. Includes $530 million in run-rate cost synergies and $60 million earnings impact from $280 million in incremental growth synergies.

$280 million in growth synergies expected to build to $400+ million by year 4. 2 Cash flow and Adj. Cash EPS include $60 million in additional financial synergies by year 3.

3 Defined as combined operating cash flow including run-rate synergies, after interest and tax, before capital expenditures. 4 Accretion inclusive of run-rate impact of synergies and is relative

to Amcor’s LTM 30-Sep-2024 standalone EPS.

300+ bps

EBITDA margin expansion1

~$180 million

Annual R&D investment

$3+ billion

Annual Cash Flow1, 2, 3

Over 35%

Adj. Cash EPS Accretion1, 2, 4

Amcor

Combined LTM 30-Sep-2024

Revenue

($ in billions) $13.6 $10.1 $0.3 $23.9

EBITDA

($ in billions) $2.0 $1.7 $0.6 $4.3

% Margin 15% 17% - 18%

R&D Investment

($ in millions) $100 $80 - $180

Berry (+) Synergies1 Combined |

| 10 Enhancing customer

value proposition

as a global leader in

packaging solutions

Better Business

with greater

capabilities,

broader scale,

and safer supply

chains

Accelerating

Growth with highly

complementary

portfolio and

innovation

platforms

Innovation and

Sustainability

investment

unlocks portfolio

transformation

Creating Value

that matters

1 2 3 4

Aligned with

Amcor strategy

Higher growth,

higher margin

Sustainability

focus

Highly attractive

economics |

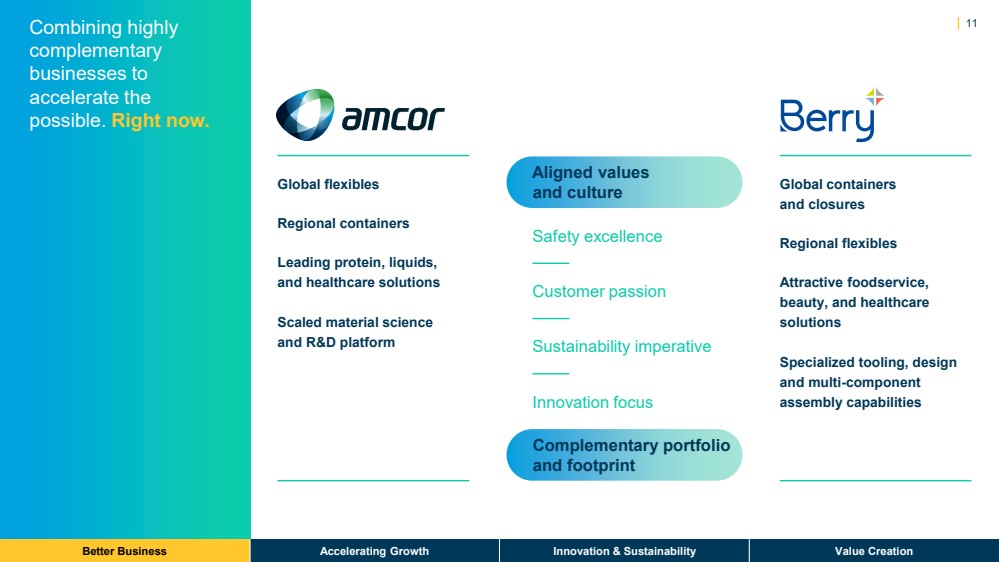

| Combining highly

complementary

businesses to

accelerate the

possible. Right now.

Global flexibles

Regional containers

Leading protein, liquids,

and healthcare solutions

Scaled material science

and R&D platform

Global containers

and closures

Regional flexibles

Attractive foodservice,

beauty, and healthcare

solutions

Specialized tooling, design

and multi-component

assembly capabilities

Aligned values

and culture

Complementary portfolio

and footprint

Safety excellence

Customer passion

Sustainability imperative

Innovation focus

Better Business Accelerating Growth Innovation & Sustainability Value Creation

11 |

| Complementary leadership serving customers in consumer and healthcare 12

Amcor Leadership Berry Leadership Strategic partner to

consumers’ most trusted brands

Highly differentiated and

complementary solutions

Better Business Accelerating Growth Innovation & Sustainability Value Creation

Global

Flexibles

Global

Healthcare

Flexibles

Global

Specialty

Cartons

Global

Consumer

Products

Global

Containers and

Closures

Global

Growing Healthcare

Devices |

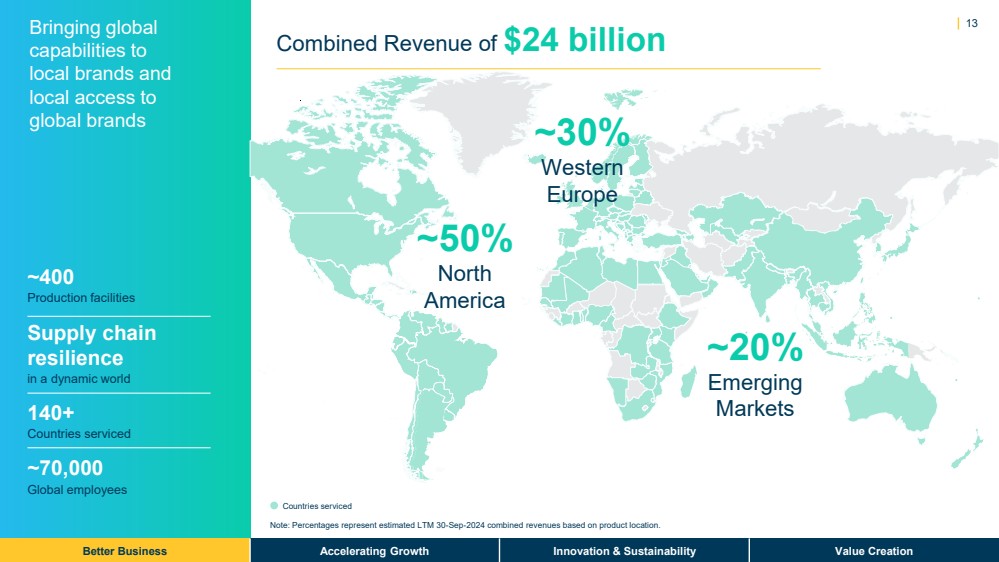

| 13 Bringing global

capabilities to

local brands and

local access to

global brands

Better Business Accelerating Growth Innovation & Sustainability Value Creation

Countries serviced

Note: Percentages represent estimated LTM 30-Sep-2024 combined revenues based on product location.

~400

Production facilities

Supply chain

resilience

in a dynamic world

140+

Countries serviced

~70,000

Global employees

Combined Revenue of $24 billion

~50%

North

America

~30%

Western

Europe

~20%

Emerging

Markets |

| Differentiated platform 14

for growth across

two strategically

attractive segments

Note: Percentages represent LTM 30-Sep-2024 combined revenues.

Better Business Accelerating Growth Innovation & Sustainability Value Creation

Flexibles

~60%

Containers and Closures

~40%

Complete packaging solutions

Multiple substrates expertise

Wide range of technologies