SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant o

Filed by a Party other than the Registrant þ

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| o |

Definitive Additional Materials |

| þ |

Soliciting Material Under Rule 14a-12 |

BlackRock California Municipal Income Trust

(Name of Registrant as Specified In Its Charter)

Saba Capital Management, L.P.

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| þ |

No fee required. |

| |

|

| o |

Fee paid previously with preliminary materials. |

| o |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

From time to time, Saba Capital, Boaz R. Weinstein and their affiliates

may quote from, in whole or in part, Exhibits 1, 2 and 3. Boaz R. Weinstein posted the messages attached hereto as Exhibit 4 to his

X account.

Exhibit 1

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK |

SABA CAPITAL MASTER FUND, LTD.,

|

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

|

Civil Action No. |

Civ. |

| Plaintiff, |

|

|

| v. |

COMPLAINT |

|

BLACKROCK ESG CAPITAL ALLOCATION TRUST; R. GLENN HUBBARD, W. CARL KESTER, CYNTHIA L. EGAN, FRANK J. FABOZZI, LORENZO A. FLORES, STAYCE D. HARRIS, J. PHILLIP HOLLOMAN, CATHERINE A. LYNCH, ROBERT FAIRBAIRN, and JOHN M. PERLOWSKI, in their capacity as Trustees of the BlackRock ESG Capital Allocation Trust,

|

|

|

| Defendants. |

|

|

|

|

|

Plaintiff

Saba Capital Master Fund, Ltd. (“Saba”), for its Complaint against defendants BlackRock ESG Capital Allocation Trust (“ECAT”

or the “Trust”), R. Glenn Hubbard, W. Carl Kester, Cynthia L. Egan, Frank J. Fabozzi, Lorenzo A. Flores, Stayce D. Harris,

J. Phillip Holloman, Catherine A. Lynch, Robert Fairbairn, and John M. Perlowski, in their capacity as trustees of ECAT (the “Trustee

Defendants”) (collectively with ECAT, “Defendants”), states as follows:

NATURE OF THE ACTION

1. This

action arises from the Trustee Defendants’ brazen misuse of corporate machinery to entrench themselves as members of ECAT’s

Board of Trustees (the “Board”). Seeking to avoid the prospect of being replaced, ECAT’s Board adopted and maintained

a bylaw provision that strips away any realistic prospect for a shareholder to elect trustees other than the entrenched incumbents. The

Trustee Defendants’ illegal bylaw holds challenger candidates to a different standard than they hold themselves: In an uncontested

election in which the incumbents run for election unopposed, the bylaw requires that the incumbents garner only the vote of a plurality

of the shares voted in the election. By contrast, in a contested election, a candidate must win the votes of a majority

of all outstanding shares, which includes the shares represented by those who choose not to participate in the vote (“Entrenchment

Bylaw”).

2. The

Entrenchment Bylaw denies Saba—or, for that matter, any shareholder—any meaningful opportunity to mount a challenge to the

election of the Trustee Defendants. The Bylaw effectively guarantees that the election will “fail,” i.e., that no nominee

(neither Saba’s nominees nor the incumbent Trustee Defendants) will receive the votes needed under the Entrenchment Bylaw to be

elected. As a result, the Entrenchment Bylaw ensures that the Trustee Defendants will remain improperly in their seats as unelected “holdover”

trustees in perpetuity—that is, until resignation or death.

3. ECAT

has a recent, repeated history of failed elections, despite intense efforts to solicit votes. That history confirms that the voting standard

established by the Entrenchment Bylaw is realistically unattainable, preclusive of the shareholder franchise, and operates to entrench

the incumbent Trustee Defendants in their Board seats.

4. Saba

brings this suit to vindicate its shareholder rights under the Investment Company Act of 1940 (“ICA”), in advance of ECAT’s

July 2024 annual shareholder meeting in which seven incumbent Trustee Defendants will stand for election—none of whom has ever previously

been elected by a vote of ECAT’s shareholders. On February 15, 2024, Saba provided ECAT with notice of its intent to nominate candidates

to replace the seven Trustee Defendants up for election.

5. As

confirmed by ECAT’s failed 2023 elections, the application of the Entrenchment Bylaw’s voting standard has preordained the

results of the 2024 election as well: No candidate will be able to obtain the votes of a majority of all outstanding shares, and the seven

Trustee Defendants will retain their seats as holdovers. The Entrenchment Bylaw thus continues to frustrate Saba’s shareholder right,

and the right of all shareholders, to elect trustees without improper interference from the incumbent Trustee Defendants.

6. By

establishing a voting standard that deprives shareholders of any real, meaningful opportunity to elect Trustees, the Entrenchment Bylaw

violates the requirement of § 16 of the ICA that all directors be “elected to that office by the holders of the

outstanding voting securities of such company.” 15 U.S.C. § 80a-16(a) (emphasis added).

7. By

guaranteeing failed elections, and thereby keeping unelected incumbents (including incumbents who have never been elected by shareholders)

in their Board seats as holdovers, the Entrenchment Bylaw further contravenes § 16’s requirement that shareholders have a meaningful

opportunity to elect trustees annually. See id. (mandating that directors be elected at “an annual . . . meeting”

and that even classified boards be organized such that “the term of office of at least one class shall expire each year”).

8. Application

of the Entrenchment Bylaw to ECAT’s anticipated July 2024 election further violates § 16’s mandate that “at least

two-thirds of the directors then holding office shall have been elected to such office by the holders of the outstanding voting securities

of the company.” See id. (“vacancies occurring between [shareholder] meetings may be filled in any otherwise legal

manner if immediately after filling any such vacancy at least two-thirds of the directors then holding office shall have been elected

to such office by the holders of the outstanding voting securities of the company at such an annual or special meeting”).

ECAT’s seven unelected incumbent Trustees—i.e., 70% of the Board—will remain on the Board when yet another election

fails as a result of the Entrenchment Bylaw, in violation of § 16’s requirement that, even when some Board seats are filled

temporarily by means other than election, at least two-thirds of the Board must be elected by the shareholders.

9. The

Entrenchment Bylaw also violates the requirements of § 18(i) of the ICA that every share of issued stock be a “voting stock,”

which the statute defines as stock that “presently entitl[es] the owner or holder thereof to vote for the election of directors

of a company.” 15 U.S.C.

§§ 80a-18(i),

80a-2(a)(42). The preclusive voting standard imposed by the Entrenchment Bylaw effectively deprives any shareholder of the ability to

vote for the election of directors. Additionally, by giving disproportionate voting rights to the minority of shares cast in favor of

the incumbent Trustees, the Entrenchment Bylaw is contrary to § 18(i)’s requirement that every stock “have equal voting

rights with every other outstanding voting stock.” 15 U.S.C. § 80a-18(i).

10. The

Trustee Defendants’ efforts to entrench themselves in power run directly contrary to the ICA’s policies and purposes, including

its stated purpose of protecting shareholders from investment companies that (1) are “organized, operated, [or] managed . . . in

the interest of directors, officers, investment advisers, depositors, or other affiliated persons thereof” and (2) “issue

securities containing inequitable or discriminatory provisions, or fail to protect the preferences and privileges of the holders of their

outstanding securities.” 15 U.S.C. §§ 80a-1(b)(2), (3).

11. To

prevent the Trustee Defendants from continuing with their brazen assault on Saba’s shareholder franchise, Saba respectfully requests

that the Court declare that the Entrenchment Bylaw violates §§ 16 and 18(i) of the ICA and rescind the illegal Bylaw pursuant

to § 46(b) of the ICA.

PARTIES

12. Plaintiff

Saba is a Cayman Islands exempted company that, with other investment funds, are collectively the beneficial owners of 25.89% of ECAT.

13. Defendant

BlackRock ESG Capital Allocation Trust is a Maryland business trust, listed on the New York Stock Exchange under ticker symbol “ECAT,”

which conducts substantial business in New York.

14. Defendant

R. Glenn Hubbard is a citizen of New York, a current trustee of ECAT, and has been a trustee of a

complex of approximately 70 funds managed by BlackRock Investors, LLC (“BlackRock funds”) since

2007.

15. Defendant

W. Carl Kester is a citizen of Massachusetts, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2007.

16. Defendant

Cynthia L. Egan is a citizen of Florida, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2016.

17. Defendant

Frank J. Fabozzi is a citizen of Maryland, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2007.

18. Defendant

Lorenzo A. Flores is a citizen of California, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2021.

19. Defendant

Stayce D. Harris is a citizen of California, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2021.

20. Defendant

J. Phillip Holloman is a citizen of Ohio, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2021.

21. Defendant

Catherine A. Lynch is a citizen of Virginia, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2016.

22. Defendant

Robert Fairbairn is a citizen of New York, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2018.

23. Defendant

John M. Perlowski is a citizen of New Jersey, a current trustee of ECAT, and has been a trustee of the BlackRock funds since 2015.

JURISDICTION

AND VENUE

24. This

Court has jurisdiction over the subject matter of this action pursuant to Section 44 of the ICA, 15 U.S.C. § 80a-43, 28 U.S.C.A.

§ 1331, and 28 U.S.C. § 1391(b).

25. This

Court has personal jurisdiction over ECAT because it has sufficient minimum contacts within the District as to render the exercise of

jurisdiction over Defendants by this Court permissible under traditional notions of due process; 15 U.S.C. § 80a-43, including

because Defendants transact business in this District; and the law of the State of New York, including N.Y.

C.P.L.R. § 302, including by conducting continuous and systematic business in this District, by causing harm to Saba in this District,

and because this action arises out of events and transactions in this District.

26. Venue

is proper in this judicial district pursuant to 15 U.S.C. § 80a-43 and 28 U.S.C. §§

1391(b)-(c) because ECAT transacts business in this District, a substantial part of the events giving rise to the claim occurred in this

District, Saba has been harmed in this District, and the Defendants are subject to personal jurisdiction in this District.

27. Saba

recently brought suit against ECAT in this District, also asserting claims under the ICA to obtain rescission of another one of ECAT’s

unlawful bylaw provisions. In that case, this Court denied ECAT’s efforts to dismiss the case from this District pursuant to ECAT’s

forum selection clause, because that clause “categorically excludes claims ‘arising out of or in connection with the federal

securities laws.’” Saba Cap. Master Fund, Ltd. v. ClearBridge Energy Midstream Oppor. Fund Inc., No. 23-CV-5568 (JSR),

2023 WL 6279934, at *9 (S.D.N.Y. Sept. 26, 2023).

FACTUAL

ALLEGATIONS

ECAT’s

Underperforming Trustees and the Entrenchment Bylaw

28. ECAT

is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended.

29. ECAT

was first registered with the Securities and Exchange Commission (“SEC”) on or around May 28, 2021. ECAT filed subsequent

amended registration statements with the SEC.

30. All

ten of the current Trustee Defendants were appointed at the Trust’s inception to serve on the classified Board, which is divided

into three classes.

31. In

July 2022, in an uncontested election, one class of the Trustee Defendants (Frank J. Fabozzi, J. Phillip Holloman, and Robert Fairbairn),

were “elected” to their seats by a vote of a plurality of the shares voted.

32. In

August 2023, after multiple failed elections with insufficient votes to even reach quorum, a second class of the Trustee Defendants (Cynthia

L. Egan, Stayce D. Harris, Lorenzo A. Flores, and Catherine A. Lynch) continued in their seats as unelected holdovers.

33. The

remaining three Trustee Defendants (R. Glenn Hubbard, W. Carl Kester, and John M. Perlowski) have never stood for election by ECAT’s

shareholders and will be up for election for the first time in the upcoming July 2024 annual shareholder meeting.

34. ECAT

has a history of underperformance. It trades at a significant discount to its Net Asset Value (“NAV”)—i.e., shares

of ECAT are worth less than the combined value of the assets it owns. From January 1, 2022 to December 31, 2023, ECAT’s average

discount to NAV was 14.3%. The discount to NAV has been as large as 20% in 2023. ECAT’s perpetual discount level since its inception

indicates that the market does not have faith in its ability to add to shareholder value. The Board has also done little to address this

poor performance or to lessen ECAT’s discount to NAV.

35. Notwithstanding

its inability to add shareholder value, the Board has entrenched itself in office by maintaining the illegal Entrenchment Bylaw that has

stripped shareholders of a meaningful opportunity to elect new trustees who can effect change.

36. ECAT’s

Bylaws deprive Saba—or any shareholder—of any meaningful opportunity to elect Trustees. Section 11(b) of the Bylaws impose

a realistically unattainable standard only in elections in which shareholders actually exercise the franchise—i.e., vote

on competing trustee candidates—and not in elections where the incumbent trustees run unopposed.

37. Specifically,

Section 11(b), i.e., the Entrenchment Bylaw, states: “(i) with respect to the election of Directors, other than a Contested

Election, the affirmative vote of a plurality of the Shares represented in person or by proxy at any meeting at which a quorum is present

shall be the act of the shareholders with respect to such matter, (ii) with respect to a Contested Election, the affirmative vote

of a majority of the Shares outstanding and entitled to vote with respect to such matter at such meeting shall be the act of the

shareholders with respect to such matter” (emphasis added).

38. If

no candidate can garner the vote of a majority of the outstanding shares required to elect Trustees pursuant to the Entrenchment Bylaw,

then the incumbents keep their seats as “holdovers.”

39. Under

the Entrenchment Bylaw, all shares that are not voted in a contested election are effectively counted as a vote for the incumbent, and

shares that vote in favor of the incumbents enjoy disproportionate voting rights and more power to elect trustees than a majority of shares

cast in favor of challengers.

40. The

Entrenchment Bylaw ensures that the incumbent Trustees will improperly remain in their seats in perpetuity—that is, until resignation

or death—either as unelected “holdover” trustees after a failed contested election, or as trustees “elected”

by default in an uncontested election.

ECAT’s History

of Failed Elections Under the Entrenchment Bylaw

41. Four

Trustee Defendants (Cynthia L. Egan, Lorenzo A. Flores, Stayce D. Harris, and Catherine A. Lynch) were up for election in a July 10, 2023

annual meeting of ECAT’s shareholders. In advance of that election, Saba nominated four trustee candidates to replace these incumbents

up for election.

42. ECAT

and Saba engaged in intense proxy solicitation campaigns—including by mail and in the media—leading up to the July 10, 2023

shareholder meeting. Between May 5, 2023, when Saba filed its preliminary proxy statement with the

SEC, and July 10, 2023, the initially scheduled date of the shareholder meeting, Saba and ECAT filed nearly 30 proxy-related filings

with the SEC.

43. The

immense resources poured into proxy solicitation proved insufficient to turn out enough votes even to reach quorum to hold the scheduled

July 10, 2023 shareholder meeting, let alone for any candidate to achieve the 50%-of-outstanding-shares standard enshrined by the Entrenchment

Bylaw.

44. Without

enough votes for even a quorum, on July 11, 2023, ECAT adjourned the shareholder meeting to July 25, 2023.

45. Active

proxy solicitation efforts continued following the adjournment.

46. The

July 25, 2023 meeting, however, was once again adjourned to August 7, 2023 after ECAT failed to reach a quorum yet again.

47. When

ECAT failed to turn out enough votes to reach quorum for a third time, ECAT called off the 2023 election altogether and

the four Trustee Defendants up for election remained in their seats as unelected holdovers.

48. The

illegal, preclusive nature of the Entrenchment Bylaw is confirmed by the outcome of ECAT’s recent, repeated failed elections.

BlackRock’s Hypocrisy

about the Entrenchment Bylaw

49. ECAT

is managed by BlackRock Advisors, LLC, which is a subsidiary of BlackRock, Inc. (“BlackRock”).

50. BlackRock

is a self-proclaimed leader in corporate governance and periodically publishes the BlackRock Investment Stewardship Global Principles

(“BlackRock Principles”) and BlackRock Investment Stewardship Proxy Voting Guidelines for U.S. Securities (“BlackRock

Voting Guidelines”) with recommendations and guidelines on how investors should vote to protect their interests and promote “sound

corporate governance.”1

51. In

the BlackRock Principles, BlackRock notes that shareholders have “certain fundamental rights” and “should have the right

to: Elect, remove, and nominate directors.” It continues that “shareholder voting rights should be proportionate to economic

ownership—the principle of ‘one share, one vote’ helps to achieve this balance.”

52. The

BlackRock Principles further emphasize that “directors should stand for election on a regular basis, ideally annually. In our experience,

annual director elections allow shareholders to reaffirm their support for board members and/or hold them accountable for their decisions

in a timely manner.”

53. Meanwhile,

the BlackRock Voting Guidelines contain issue-specific proxy voting guidelines on “boards and directors” and “shareholder

protections,” including the following:

·

Classified Board of Directors/Staggered Terms: “Directors should be re-elected annually; classification of the board

generally limits shareholders’ rights to regularly evaluate a board’s performance and select directors.”

____________________

1 https://www.blackrock.com/corporate/literature/fact-sheet/blk-responsible-investment-engprinciples-global.pdf;

https://www.blackrock.com/corporate/literature/fact-sheet/blk-responsible-investment-guidelines-us.pdf.

·

Majority Vote Requirements: “Directors should generally be elected by a majority of the shares voted. We note that

majority voting may not be appropriate in all circumstances, for example, in the context of a contested election or those with concentrated

ownership

structures.”

·

Contested Director Elections and Special Situations: “We will evaluate the actions that the company has taken to limit

shareholders’ ability to exercise the right to nominate dissident director candidates, including those actions taken absent the

immediate threat of a contested situation. [BlackRock] may take voting action against directors where those actions are viewed as egregiously

infringing on shareholder rights.”

54. While

BlackRock espouses these principles when it is an investor or shareholder, it has different standards when it acts as fund manager. For

example, the ECAT Trustees serve staggered terms and stand for election only every three years—in blatant contradiction to its own

recommendation that directors stand for reelection annually. And—in direct contradiction to BlackRock’s recommendation that

directors be elected by a “majority of the shares voted”—the Entrenchment Bylaw imposes an unattainable

“majority of the shares outstanding” standard for challengers who dare try to unseat the incumbent Trustees.

FIRST CLAIM FOR RELIEF

(Rescission

Under the Investment Company Act)

55. Saba

repeats and realleges each of the allegations contained in paragraphs 1 through 54 above as if set forth in full herein.

56. The

ICA provides a private right of action for a party to a contract that violates the ICA to seek rescission of that violative contract.

Saba Cap. Cef Oppors. 1, Ltd. v. Nuveen Floating Rate Income Fund, 88 F.4th 103, 115 (2d Cir. 2023).

57. ECAT’s

Bylaws constitute a binding contract between Saba and ECAT.

58. The

Entrenchment Bylaw violates the ICA by establishing a standard that deprives shareholders of any meaningful opportunity to elect trustees,

and makes it realistically unattainable for challengers to unseat incumbent trustees, thereby allowing incumbents who are not elected

to that office to serve as trustees on ECAT’s Board. This standard contravenes the ICA’s mandate that “[n]o person shall

serve as a director of a registered investment company unless elected to that office by the holders of the outstanding voting securities

of such company,” and that directors stand for election annually or, at minimum, that “the term of office of at least one

class [of directors] shall expire each year.” 15 U.S.C. § 80a-16. Applying the standard at ECAT’s 2024 annual meeting,

at which seven unelected incumbent Trustee Defendants will be up for election, also violates the ICA’s mandate that “at least

two-thirds of the directors then holding office shall have been elected to such office by the holders of the outstanding voting securities

of the company.” Id.

59. The

Entrenchment Bylaw also violates the ICA’s mandate that all stock must “presently entitl[e] the owner or holder thereof to

vote for the election of directors of a company.” 15 U.S.C. §§ 80a-18(i), 80a-2(a)(42). The preclusive voting standard

imposed by the Entrenchment Bylaw effectively deprives any shareholder of the ability to

vote for the election of directors. And, by allowing incumbent trustees to retain their Board seats even after they receive fewer votes

than their challengers, the Entrenchment Bylaw effectively gives the votes cast in favor of incumbent trustees more voting rights and

power than votes cast for the challengers—in violation of § 18(i)’s requirement that all common shares “have equal

voting rights with every other outstanding voting stock.” 15 U.S.C. § 80a-18(i).

60. Absent

relief from the Court, Saba will be irreparably harmed by the Entrenchment Bylaw.

61. Saba

has no adequate remedy at law.

SECOND

CLAIM FOR RELIEF

(Declaratory

Judgment)

62. Saba

repeats and realleges each of the allegations contained in paragraphs 1 through 61 above as if set forth in full herein.

63. The

Entrenchment Bylaw prevents Saba from exercising its right as shareholder to elect trustees to the Board of ECAT annually, to hold shares

in a fund where at least two-thirds of the Board have been elected by the shareholders at an annual or special meeting, and to acquire

and vote stock in ECAT with the “equal voting rights” to which such shares are entitled.

64. By

adopting, maintaining, and implementing the Entrenchment Bylaw, Defendants have created a substantial and immediate controversy between

the parties, of sufficient immediacy and reality to warrant declaratory relief, as to whether doing so violates § 16 and § 80a-18(i).

65. Accordingly,

Saba seeks a declaratory judgment under 28 U.S.C. § 2201 et seq. to determine its rights and obligations, including whether the Entrenchment

Bylaw is illegal under 15 U.S.C. § 80a-16 and § 80a-18(i), and void pursuant to 15 U.S.C. § 80a-46(a).

REQUEST FOR RELIEF

WHEREFORE, Saba respectfully requests that this

Court enter a judgment in its favor as follows:

| a. | Declaring that the Entrenchment Bylaw violates the ICA, 15 U.S.C. §

80a-16 and § 80a-18(i); |

| b. | Rescinding the Entrenchment Bylaw, pursuant to 15 U.S.C. § 80a-46(b); |

| c. | Declaring the Entrenchment Bylaw void, pursuant to 15 U.S.C. § 80a-46(a); |

| d. | Preliminarily and permanently enjoining Defendants, their agents and representatives, and all other persons

acting in concert with them, from applying the Entrenchment Bylaw; and |

| e. | Such other and further relief as the Court may deem necessary and proper. |

DEMAND FOR JURY

TRIAL

Pursuant to Rule 38 of the Federal

Rules of Civil Procedure, Plaintiff hereby demands a trial by jury as to all issues so triable.

Dated: New York, New York

| March 6, 2024 |

Respectfully submitted, |

| |

|

| |

|

| |

/s/ Mark Musico |

| |

Mark P. Musico (SDNY No.: MM8001)

Jacob W. Buchdahl (SDNY No.: JB1902) |

| |

Y. Gloria Park (SDNY No.: GP0913)

SUSMAN GODFREY LLP |

| |

1301 Avenue of the Americas, 32nd Floor

New York, NY 10019 |

| |

Tel: 212-336-8330 |

| |

Fax: 212-336-8340 |

| |

mmusico@susmangodfrey.com

jbuchdahl@susmangodfrey.com

gpark@susmangodfrey.com |

| |

|

| |

Attorneys for Plaintiff |

CERTIFICATE OF SERVICE

I hereby certify

that on March 6, 2024, I caused the foregoing to be electronically filed with the Clerk of the Court using CM/ECF, which will send notification

of such filing to all registered participants.

/s/ Gloria Park

Gloria Park

Exhibit 2

U.S. District Court for the Southern District

of New York Rules That Certain Closed-End Funds, Including Funds Advised by BlackRock, Violated the Investment Company Act of 1940

BlackRock Illegally Stripped Votes at its

Closed-End Funds’ 2023 Annual Meetings

December 07, 2023 08:00 AM Eastern Standard Time

NEW YORK--(BUSINESS WIRE)--Saba

Capital Management, L.P. (“Saba” or “we”) today commented on the outcome of the lawsuit brought in the United

States District Court for the Southern District of New York (the “Court”) against 16 closed-end funds (the “Funds”)

including those managed by BlackRock, Inc. (“BlackRock”) and its Trustees (R. Glenn Hubbard, W. Carl Kester, Cynthia L. Egan,

Frank J. Fabozzi, Lorenzo A. Flores, Stayce D. Harris, J. Phillip Holloman, Catherine A. Lynch, Robert Fairbairn and John M. Perlowski).

Saba filed its lawsuit in the

Court on June 29, 2023 after the BlackRock trustees disclosed they would strip shareholders’ votes, in violation of the Investment

Company Act of 1940 (the “ICA”), at their 2023 Annual Meeting. Despite the Funds filing various motions to dismiss the lawsuit,

the Court ruled in favor of Saba, finding that the actions of the BlackRock Fund and its trustees violated federal law.

Boaz Weinstein, Founder and Chief Investment Officer of Saba, commented:

“By hook or by crook, BlackRock and its trustees were determined

to avoid being held accountable for the billions of dollars lost for investors. We are pleased to have brought this lawsuit for the benefit

of all investors in closed-end funds managed by BlackRock to put an end to the practice of robbing shareholders of their right to vote

all of their shares.

While ISS has previously highlighted BlackRock’s ‘abusive’

governance practices, this goes far beyond bad governance. By illegally stripping votes in an attempt to rig the election in their favor,

BlackRock trustees broke the law and deprived shareholders of their right to a fair and democratic election. BlackRock did this despite

the fact that two courts already made clear that stripping fund investors of their voting rights is illegal.”

Saba has previously brought and won lawsuits against Eaton

Vance and Nuveen regarding illegal vote stripping. Just last week, the U.S. Court of Appeals

for the Second Circuit upheld that certain Nuveen-advised closed-end funds also violated the ICA after

Saba sued Nuveen and the trustees in the Court.

The Court found the following funds adopted control share provisions

in violation of the ICA: BlackRock Municipal Income Fund (NYSE: MUI), BlackRock ESG Capital Allocation Term Trust (NYSE: ECAT), Adams

Diversified Equity Fund (NYSE: ADX), Adams Natural Resources Fund (NYSE: PEO), Tortoise Midstream Energy Fund (NYSE: NTG), Tortoise Energy

Independence Fund (NYSE: NDP), Tortoise Pipeline & Energy Fund (NYSE: TTP), Tortoise Energy Infrastructure Corp. (NYSE: TYG), Ecofin

Sustainable and Social Impact Term Fund (NYSE: TEAF), Royce Global Value Trust (NYSE: RGT) and FS Credit Opportunities Corp. (NYSE: FSCO).

Royce Global Value Trust is managed by Royce Investment Partners, an affiliate of Franklin Templeton.

***

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset management

firm that seeks to deliver superior risk-adjusted returns for a diverse group of clients. Founded in 2009 by Boaz Weinstein, Saba is a

pioneer of credit relative value strategies and capital structure arbitrage. Saba is headquartered in New York City. Learn more at www.sabacapital.com.

Contacts

Longacre Square Partners

Greg Marose / Kate Sylvester, 646-386-0091

gmarose@longacresquare.com / ksylvester@longacresquare.com

Exhibit 3

Leading Independent Proxy Advisory Firm

ISS Supports Saba Capital’s Case for Change at Three BlackRock Closed-End Funds

ISS Recommends ECAT Shareholders Vote FOR

the Election of Saba Nominee Ilya Gurevich on the GOLD Proxy Card and DO NOT VOTE on All Incumbent Directors

(Cynthia L. Egan, Lorenzo A. Flores, Stayce D. Harris and Catherine A. Lynch) on BlackRock’s WHITE Proxy Card

ISS Recommends BIGZ Shareholders Vote FOR

the Election of Saba Nominee Ilya Gurevich and Vote FOR All of Saba’s Shareholder Proposals on Corporate Governance

on the GOLD Proxy Card and DO NOT VOTE on All Incumbent Directors (Cynthia L. Egan, Lorenzo A. Flores, Stayce

D. Harris and Catherine A. Lynch) on BlackRock’s WHITE Proxy Card

ISS Recommends BFZ Shareholders WITHHOLD

on Incumbent Director R. Glenn Hubbard on BlackRock’s WHITE Proxy Card

July 03, 2023 09:15 AM Eastern Daylight Time

NEW YORK--(BUSINESS WIRE)--Saba Capital

Management, L.P. (“Saba” or “we”), a significant shareholder of the BlackRock ESG Capital Allocation Term Trust

(NYSE: ECAT) (“ECAT”), the BlackRock Innovation and Growth Term Trust (NYSE: BIGZ) (“BIGZ”) and the BlackRock

California Municipal Income Trust (NYSE: BFZ) (“BFZ”) (collectively, the “Funds”), today announced that Institutional

Shareholder Services Inc. (“ISS”) has supported its case for change at the aforementioned closed-end funds advised by BlackRock,

Inc. (“BlackRock”). In its reports, ISS made the following recommendations:

| · | ISS recommends ECAT shareholders vote FOR the election of Saba nominee Ilya Gurevich on

the GOLD proxy card and DO NOT VOTE on all incumbent directors (Cynthia L. Egan, Lorenzo A. Flores, Stayce

D. Harris and Catherine A. Lynch) on BlackRock’s WHITE proxy card at the 2023 Annual Meeting of Shareholders, which

is scheduled to be held on July 10, 2023. |

| · | ISS recommends BIGZ shareholders vote FOR the election of Mr. Gurevich and FOR all of

Saba’s shareholder proposals on corporate governance on the GOLD proxy card and DO NOT VOTE on all incumbent

directors (Ms. Egan, Mr. Flores, Ms. Harris and Ms. Lynch) on BlackRock’s WHITE proxy card at the 2023 Annual Meeting

of Shareholders, which is scheduled to be held on July 10, 2023. |

| · | ISS recommends that BFZ shareholders WITHHOLD support for long-time incumbent director

and board chair R. Glenn Hubbard on BlackRock’s WHITE proxy card – recognizing his responsibility for BFZ’s

corporate governance deficiencies – at the 2023 Annual Meeting of Shareholders, which is scheduled to be held on July 10, 2023. |

Paul Kazarian, Partner and Portfolio Manager of Saba, commented:

“ISS agrees that immediate boardroom change is required at ECAT,

BIGZ and BFZ. We are glad that ISS shares our concerns about the Funds’ corporate governance abuses that violate BlackRock’s

own Investment Stewardship Guidelines. As a self-proclaimed leader in corporate governance, it is hypocritical for BlackRock to disregard

the ESG standards that it has set as an investor and to which it purports to hold companies accountable.

Across each of these three funds, BlackRock’s hand-picked directors

have taken extreme steps to stifle the will of shareholders. They have (1) prohibited bylaw amendments by shareholders, (2) maintained

classified board structures, (3) required a majority of the outstanding vote in contested elections, and (4) failed to opt out of the

Delaware control share acquisition statute. BlackRock has also (5) flouted its own views on individuals who are ‘overboarded’ by keeping in place directors

who also serve as fiduciaries of dozens of other publicly listed companies.

We believe that the best path to address the Funds’ egregious and

long-term underperformance is through immediate boardroom change. On behalf of all ECAT, BIGZ and BFZ shareholders, Saba is committed

to improving corporate governance and closing the Funds’ discounts to NAV in order to enhance value for the benefit of all shareholders.

We will do everything in our power to achieve these goals.”

ISS Commentary on ECAT

In its full report on ECAT, ISS affirmed Saba’s case for boardroom

change and agreed with Saba’s concerns regarding the Fund’s corporate governance abuses and significant underperformance since

its IPO1:

| · | “Since its 2021 IPO through the advent of the dissident's campaign, the fund's total shareholder

return and discount to NAV have underperformed peers. In addition, the fund's corporate governance features several abusive practices.

In light of these factors, the dissident has made a case for significant change.” |

| · | “The fund's corporate governance structure includes numerous policies and practices that

do not align with the best interests of shareholders. For example, the board is classified, shareholders do not have the right

to amend the bylaws, and there is a worst-of-all-worlds vote standard for director elections […] The vote

standard for director elections is particularly egregious, as it can function as an entrenchment mechanism.” |

| · | “Ilya Gurevich has over 25 years of experience in financial services and is currently working

in this field […] Gurevich can credibly claim to understand the perspective of ECAT's retail shareholder base from his work as a

retirement planner. The board has not offered any substantive criticisms of his background or experience […] As such, a

vote for Gurevich is warranted on the dissident (GOLD) card.” |

ISS Commentary on BIGZ

In its full report on BIGZ, ISS affirmed Saba’s case for boardroom

change and agreed with Saba’s concerns regarding the Fund’s corporate governance abuses, operational deficiencies and discount

to NAV:

| · | “BIGZ completed its IPO in March 2021. Since then, share price has declined more than 60 percent,

erasing billions in market capitalization. TSR has been disappointing by any objective measure, and the discount to NAV is concerning.

At the same time, all distributions have derived from a return of capital, and operational woes have only been compounded by corporate

governance deficiencies.” |

| · | “In mid-2022, BIGZ began regularly trading at a 15-20 percent discount. Later in the year, valuation

deteriorated further, and BIGZ reached an all-time worst NAV discount of nearly 25 percent in December.” |

·

“BIGZ not only has a classified board, but there is an elevated probability of a failed vote

at this meeting due to the majority standard in contested director elections. These and other provisions disenfranchise shareholders

and entrench leadership.”

| · | “Ilya Gurevich has over 25 years of ongoing experience with financial services […] he can

credibly claim to understand the perspective of BIGZ's retail shareholder base, given that he has been an active retirement planner for

over a decade. Moreover, the board has not offered any substantive criticisms of his background or experience […] As such,

a vote for Ilya Gurevich is warranted.” |

ISS Commentary on BFZ

In its full report on BFZ, ISS affirmed Saba’s case for boardroom

change and agreed with Saba’s concerns regarding BIGZ’s corporate governance deficiencies, including the Fund’s classified

board structure and restrictive Delaware control share acquisition statute provision:

·

“The corporate governance structure at BFZ includes numerous policies and practices

that do not align with the best interests of shareholders. For example, the board is classified, the vote standard for director

elections is a plurality in all cases, and shareholders do not have the right to amend, repeal, or otherwise change the bylaws […]

although the board has engaged in proactive refreshment over the past several years, shareholder support in director elections

has remained abnormally low.”

| · | “As a Delaware statutory trust registered as a CEF, BFZ is subject to the control beneficial interest

acquisition provisions of the DE Statutory Trust Act, which is among the most restrictive control share acquisition statutes

in the nation.” |

| · | “Among the incumbent directors on ballot, Glenn Hubbard is most responsible for BFZ's

corporate governance deficiencies, as he has been a director for over 15 years, is the board chair, and is a member of the

governance and nominating committee. He is therefore a logical target for shareholders that are frustrated with the board’s management

of the Delaware control share acquisition statute at this meeting. […] As such, a WITHHOLD from Hubbard on the management

card is warranted.” |

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset management

firm that seeks to deliver superior risk-adjusted returns for a diverse group of clients. Founded in 2009 by Boaz Weinstein, Saba is a

pioneer of credit relative value strategies and capital structure arbitrage. Saba is headquartered in New York City. Learn more at www.sabacapital.com.

______________________________

1 Permission

to quote ISS was neither sought nor obtained.

Contacts

Longacre Square Partners

Greg Marose / Kate Sylvester, 646-386-0091

gmarose@longacresquare.com / ksylvester@longacresquare.com

Exhibit 4

"I’m curious if the @BlackRock board of

individuals with cherished reputations will want to risk being found to have violated federal law a second time. The ruling on their first

violation was made by Judge Rakoff in December 2023.

Saba Files Lawsuit Against BlackRock ESG Capital Allocation Term Trust

for Adopting an Illegal “Entrenchment Bylaw” that Strips Shareholders of the Opportunity to Elect New Directors Intends

to Hold BlackRock and Its Hand-Picked Board Members Accountable for Destroying Billions in Shareholder Value Names Incumbent Board

Members Cynthia Egan, Frank Fabozzi, Robert Fairbairn, Lorenzo Flores, Stayce Harris, R. Glenn Hubbard, J. Phillip Holloman, W. Carl Kester,

Catherine Lynch and John Perlowski as Defendants in the Lawsuit."

"Art, I’m not sure if you’re winding me up. @BlackRock

election rules poll: $ECAT has 102mm shares outstanding. In ‘23 shareholders voted to reelect the existing crew or to elect Saba

nominees. 48mm shares voted. How many did Saba need to win?

A: 24mm B: 51mm"

"Can someone cite a Democratic election where people who chose not

to vote still counted as a vote for the incumbent?"

"Poll 2: Should shareholders that don’t vote be counted as votes

for the @BlackRock board members? I can’t believe I’m even asking this question.

Yes No "

"Hence yesterday’s litigation. Shareholders of course

must have the right to elect a board and @BlackRock has taken that away through a vote standard that fully entrenches them. You can’t

make this stuff up. I’m only surprised that some sharp closed end fund investors here had no idea until our lawsuit."

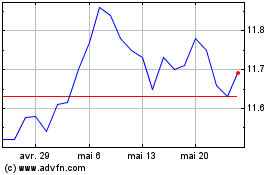

BlackRock California Mun... (NYSE:BFZ)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

BlackRock California Mun... (NYSE:BFZ)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024