Production Near the High-End of Quarterly

Guidance

Declares Fixed-plus-Variable Dividend to be

Paid in June

Civitas Resources, Inc. (NYSE: CIVI) (the "Company" or

"Civitas") today announced its first quarter 2023 financial and

operating results. A conference call to discuss the results is

planned for 8:00 a.m. MT (10:00 a.m. ET), May 4, 2023. Dial-in

details can be found in this release. In addition, supplemental

slides have been posted to the Company’s website,

www.civitasresources.com.

First Quarter 2023 Highlights

- Average daily sales volumes of 159.4 thousand barrels of oil

equivalent per day ("MBoe/d"), near the high-end of Company

quarterly guidance of 155-160 MBoe/d

- Total capital expenditures of $236.9 million

- GAAP net income of $202.5 million and Adjusted EBITDAX(1) of

$443.4 million

- Net cash provided by operating activities of $538.8 million and

free cash flow(1) of $186.5 million

- Fixed-plus-variable dividend, to be paid in June, of $2.12 per

share, essentially flat with first quarter's dividend of $2.15 per

share

- Total liquidity was $1.5 billion as of March 31, 2023, which

consisted of $556.1 million of cash plus funds available under the

Company's credit facility

(1) Non-GAAP financial measure; see attached reconciliation

schedules at the end of this release.

Combined Base and Variable Dividend to be Paid in

June

The Company's board of directors approved a dividend of $2.12

per share, payable on June 29, 2023 to shareholders of record as of

June 15, 2023. The total reflects the combination of a quarterly

base dividend of $0.50 per share and a quarterly variable dividend

of $1.62 per share. Additional details regarding the calculation of

the variable dividend can be found in the Company's new investor

presentation located on its website.

Civitas CEO Chris Doyle said, “Civitas reported outstanding

results again this quarter. Through ongoing capital discipline and

a focus on generating cash, our production and cash flow exceeded

expectations and our capital investments were slightly lower than

expected. Our business plan is a proven value creator and is

focused on four pillars: generating significant free cash flow,

maintaining a premier balance sheet, returning cash to

shareholders, and leading on ESG. We are delivering today across

all of these categories and our shareholder return framework is

differentiated with continued high payouts to our owners.”

First Quarter 2023 Financial and Operating Results

During the first quarter of 2023, the Company reported average

daily sales of 159.4 MBoe/d, of which 45% was crude oil, 31% was

natural gas, and 24% was natural gas liquids. The table below

provides sales volumes, product mix, and average sales prices for

the first quarter of 2023 and 2022.

Three Months Ended March

31,

2023

2022

% Change

Avg. Daily Sales Volumes:

Crude oil (Bbls/d)

71,791

68,039

6

%

Natural gas (Mcf/d)

298,957

297,627

—

%

Natural gas liquids (Bbls/d)

37,812

41,363

(9

)%

Crude oil equivalent (Boe/d)

159,429

159,007

—

%

Product Mix

Crude oil

45

%

43

%

Natural gas

31

%

31

%

Natural gas liquids

24

%

26

%

Average Sales Prices (before

derivatives):

Crude oil (per Bbl)

$

71.21

$

89.65

(21

)%

Natural gas (per Mcf)

$

3.82

$

4.20

(9

)%

Natural gas liquids (per Bbl)

$

27.06

$

41.68

(35

)%

Crude oil equivalent (per Boe)

$

45.64

$

57.06

(20

)%

Capital expenditures during the quarter were $236.9 million,

which included $12.4 million of land and midstream investments. The

Company drilled 28 gross (21.3 net) operated wells, completed 33

gross (29.2 net) operated wells, and turned to sales 49 gross (42.6

net) operated wells during the first quarter.

Net crude oil, natural gas, and natural gas liquids revenue in

the first quarter of 2023 was $656.0 million, compared to $814.3

million in the fourth quarter of 2022. The decrease was primarily

related to 10% and 33% lower crude oil and natural gas realized

prices, respectively. Crude oil accounted for approximately 70% of

total revenue for the quarter. Differentials for the Company's

crude oil production, relative to WTI, averaged approximately

negative $4.72 per barrel in the quarter.

Lease operating expense for the first quarter of 2023, on a unit

basis, increased to $3.19 per Boe from $3.02 per Boe in the fourth

quarter of 2022.

The Company's general and administrative expenses for the first

quarter were $36.9 million, which included $7.4 million in non-cash

stock-based compensation as well as $4.4 million of advisory

services and cash severance costs. On a per unit basis, the

Company's general and administrative expenses decreased 2%

sequentially from $2.62 per Boe in the fourth quarter of 2022 to

$2.57 per Boe in the first quarter of 2023.

2023 Outlook

Full-year 2023 guidance is shown below.

2023 Guidance

Low

High

D&C Capital Expenditures ($MM)

$725

$825

Land, Midstream & Other Capital

Expenditures ($MM)

$75

$85

Total Production (MBoe/d)

160

170

Oil Production (MBbl/d)

72

77

% Liquids

68%

70%

Realized Oil Price ($/Bbl relative to

WTI)

$(4.00)

$(5.00)

Lease Operating Expenses ($/Boe)

$2.90

$3.20

Gathering, Transportation and Processing

Expenses ($/Boe)

$4.50

$5.00

Midstream Operating Expenses ($/Boe)

$0.60

$0.70

Cash G&A Expenses ($MM)

$90

$100

Production Taxes (% of revenue)

8%

9%

Cash Income Taxes ($MM)(1)

$75

$125

(1) Assuming $80.00/Bbl WTI and

$3.50/MMBtu Henry Hub commodity prices

Note: Guidance is forward-looking information that is subject to

considerable change and numerous risks and uncertainties, many of

which are beyond the Company’s control. See “Forward-Looking

Statements” below.

Conference Call Information

The Company plans to host a conference call to discuss first

quarter results at 8:00 a.m. MT (10:00 a.m. ET) on May 4, 2023. A

live webcast and replay will be available on the Investor Relations

section of the Company’s website at www.civitasresources.com.

Dial-in information for the conference call is included below.

Type

Phone Number

Passcode

Live participant

888-510-2535

4872770

Replay

800-770-2030

4872770

About Civitas Resources, Inc.

Civitas Resources, Inc. is Colorado’s first carbon neutral oil

and gas producer and is focused on developing and producing crude

oil, natural gas, and natural gas liquids in Colorado’s

Denver-Julesburg Basin. The Company is committed to pursuing

compelling economic returns and cash flow while delivering

best-in-class cost leadership and capital efficiency. Civitas is

dedicated to safety, environmental responsibility, and implementing

industry leading practices to create a positive local impact. For

more information about Civitas, please visit

www.civitasresources.com.

Forward-Looking Statements and Cautionary Statements

Certain statements in this press release concerning future

opportunities for Civitas, future financial performance and

condition, guidance, and any other statements regarding Civitas’

future expectations, beliefs, plans, objectives, financial

conditions, assumptions, or future events or performance that are

not historical facts are “forward-looking” statements based on

assumptions currently believed to be valid. Forward-looking

statements are all statements other than statements of historical

facts. The words “anticipate,” “believe,” “ensure,” “expect,” “if,”

“intend,” “estimate,” “probable,” “project,” “forecasts,”

“predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,”

“potential,” “may,” “might,” “anticipate,” “likely,” “plan,”

“positioned,” “strategy,” and similar expressions or other words of

similar meaning, and the negatives thereof, are intended to

identify forward-looking statements. The forward-looking statements

are intended to be subject to the safe harbor provided by Section

27A of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995.

These forward-looking statements involve significant risks and

uncertainties that could cause actual results to differ materially

from those anticipated, including, but not limited to, the ultimate

timing, outcome and results of integrating the legacy operations of

Civitas; changes in capital markets and the ability of Civitas to

finance operations in the manner expected; the effects of commodity

prices; the risks of oil and gas activities; and the fact that

operating costs and business disruption may be greater than

expected. Additionally, risks and uncertainties that could cause

actual results to differ materially from those anticipated also

include: declines or volatility in the prices we receive for our

oil, natural gas, and natural gas liquids; general economic

conditions, whether internationally, nationally, or in the regional

and local market areas in which we do business, including any

future economic downturn, the impact of continued or further

increased inflation, disruption in the financial markets, and the

availability of credit on acceptable terms; the effects of

disruption of our operations or excess supply of oil and natural

gas due to world health events, including the COVID-19 pandemic and

the actions by certain oil and natural gas producing countries,

including Russia; the continuing effects of the COVID-19 pandemic,

including any recurrence or the worsening thereof; the ability of

our customers to meet their obligations to us; our access to

capital on acceptable terms; our ability to generate sufficient

cash flow from operations, borrowings, or other sources to enable

us to fully develop our undeveloped acreage positions; our ability

to continue to pay dividends at their current levels or at all; the

presence or recoverability of estimated oil and natural gas

reserves and the actual future sales volume rates and associated

costs; uncertainties associated with estimates of proved oil and

gas reserves; the possibility that the industry may be subject to

future local, state, and federal regulatory or legislative actions

(including additional taxes and changes in environmental regulation

and regulations addressing climate change); environmental risks;

seasonal weather conditions; lease stipulations; drilling and

operating risks, including the risks associated with the employment

of horizontal drilling and completion techniques; our ability to

acquire adequate supplies of water for drilling and completion

operations; availability of oilfield equipment, services, and

personnel; exploration and development risks; operational

interruption of centralized oil and natural gas processing

facilities; competition in the oil and natural gas industry;

management’s ability to execute our plans to meet our goals; our

ability to attract and retain key members of our senior management

and key technical employees; our ability to maintain effective

internal controls; access to adequate gathering systems and

pipeline take-away capacity; our ability to secure adequate

processing capacity for natural gas we produce, to secure adequate

transportation for oil, natural gas, and natural gas liquids we

produce, and to sell the oil, natural gas, and natural gas liquids

at market prices; costs and other risks associated with perfecting

title for mineral rights in some of our properties; political

conditions in or affecting other producing countries, including

conflicts in or relating to the Middle East, South America, and

Russia (including the current events involving Russia and Ukraine),

and other sustained military campaigns or acts of terrorism or

sabotage; and other economic, competitive, governmental,

legislative, regulatory, geopolitical, and technological factors

that may negatively impact our businesses, operations, or pricing.

Expectations regarding business outlook, including changes in

revenue, pricing, capital expenditures, cash flow generation,

strategies for our operations, oil and natural gas market

conditions, legal, economic, and regulatory conditions, and

environmental matters are only forecasts regarding these

matters.

Additional information concerning other risk factors is also

contained in Civitas’ most recently filed Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and other Securities and Exchange Commission filings. Civitas

undertakes no duty to publicly update these statements except as

required by law.

Schedule 1:

Condensed Consolidated Statements of Operations

(in thousands, except for per share

amounts, unaudited)

Three Months Ended March

31,

2023

2022

Operating net revenues:

Oil and natural gas sales

$

656,022

$

817,810

Operating expenses:

Lease operating expense

45,838

36,019

Midstream operating expense

10,061

5,712

Gathering, transportation, and

processing

67,352

50,403

Severance and ad valorem taxes

52,362

63,304

Exploration

571

528

Depreciation, depletion, and

amortization

201,303

184,860

Abandonment and impairment of unproved

properties

—

17,975

Unused commitments

391

776

Bad debt recovery

(253

)

—

Merger transaction costs

482

20,534

General and administrative expense,

including $7,380 and $8,090, respectively, of stock-based

compensation

36,858

35,720

Total operating expenses

414,965

415,831

Other income (expense):

Derivative gain (loss)

25,160

(295,493

)

Interest expense

(7,449

)

(9,066

)

Gain (loss) on property transactions,

net

(241

)

16,797

Other income

9,023

783

Total other income (expense)

26,493

(286,979

)

Income from operations before income

taxes

267,550

115,000

Income tax expense

(65,089

)

(23,361

)

Net income

$

202,461

$

91,639

Net income per common share:

Basic

$

2.48

$

1.08

Diluted

$

2.46

$

1.07

Weighted-average common shares

outstanding:

Basic

81,719

84,840

Diluted

82,430

85,326

Schedule 2:

Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited)

Three Months Ended March

31,

2023

2022

Cash flows from operating activities:

Net income

$

202,461

$

91,639

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion, and

amortization

201,303

184,860

Deferred income tax expense

45,953

23,361

Abandonment and impairment of unproved

properties

—

17,975

Stock-based compensation

7,380

8,090

Amortization of deferred financing

costs

1,150

1,078

Derivative (gain) loss

(25,160

)

295,493

Derivative cash settlement loss

(10,550

)

(166,578

)

(Gain) loss on property transactions,

net

241

(16,797

)

Other

(8

)

68

Changes in current assets and

liabilities:

Accounts receivable, net

140,744

11,906

Prepaid expenses and other assets

17,528

(2,398

)

Accounts payable and accrued

liabilities

(35,646

)

88,975

Settlement of asset retirement

obligations

(6,547

)

(5,131

)

Net cash provided by operating

activities

538,849

532,541

Cash flows from investing activities:

Acquisition of oil and natural gas

properties

(30,824

)

(300,087

)

Cash acquired

—

44,310

Proceeds from sale of oil and natural gas

properties

5,700

—

Exploration and development of oil and

natural gas properties

(250,389

)

(260,667

)

Additions to other property and

equipment

(630

)

(68

)

Other

536

212

Net cash used in investing activities

(275,607

)

(516,300

)

Cash flows from financing activities:

Dividends paid

(173,376

)

(103,596

)

Common stock repurchased and retired

(300,107

)

—

Proceeds from exercise of stock

options

440

178

Payment of employee tax withholdings in

exchange for the return of common stock

(2,118

)

(12,928

)

Net cash used in financing activities

(475,161

)

(116,346

)

Net change in cash, cash equivalents, and

restricted cash

(211,919

)

(100,105

)

Cash, cash equivalents, and restricted

cash:

Beginning of period(1)

768,134

254,556

End of period(1)

$

556,215

$

154,451

(1) Includes $0.1 million of restricted

cash and consists of funds for road maintenance and repairs that is

presented in other noncurrent assets within the accompanying

unaudited condensed consolidated balance sheets.

Schedule 3:

Condensed Consolidated Balance Sheets

(in thousands, unaudited)

March 31, 2023

December 31, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

556,113

$

768,032

Accounts receivable, net:

Oil and natural gas sales

222,448

343,500

Joint interest and other

115,717

135,816

Derivative assets

3,319

2,490

Prepaid income taxes

7,711

29,604

Prepaid expenses and other

50,933

48,988

Total current assets

956,241

1,328,430

Property and equipment (successful efforts

method):

Proved properties

7,130,302

6,774,635

Less: accumulated depreciation, depletion,

and amortization

(1,408,790

)

(1,214,484

)

Total proved properties, net

5,721,512

5,560,151

Unproved properties

585,791

593,971

Wells in progress

322,106

407,351

Other property and equipment, net of

accumulated depreciation of $7,935 in 2023 and $7,329 in 2022

49,655

49,632

Total property and equipment, net

6,679,064

6,611,105

Long-term derivative assets

2,463

794

Right-of-use assets

31,589

24,125

Other noncurrent assets

5,691

6,945

Total assets

$

7,675,048

$

7,971,399

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable and accrued expenses

$

263,429

$

295,297

Production taxes payable

222,077

258,932

Oil and natural gas revenue distribution

payable

506,640

538,343

Derivative liability

22,878

46,334

Asset retirement obligations

25,557

25,557

Lease liability

17,450

13,464

Total current liabilities

1,058,031

1,177,927

Long-term liabilities:

Senior notes

393,693

393,293

Ad valorem taxes

470,180

412,650

Derivative liability

7,442

17,199

Deferred income tax liabilities

365,573

319,618

Asset retirement obligations

263,586

265,469

Lease liability

14,794

11,324

Total liabilities

2,573,299

2,597,480

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $.01 par value,

25,000,000 shares authorized, none outstanding

—

—

Common stock, $.01 par value, 225,000,000

shares authorized, 80,297,548 and 85,120,287 issued and outstanding

as of March 31, 2023 and December 31, 2022, respectively

4,869

4,918

Additional paid-in capital

3,973,587

4,211,197

Retained earnings

1,123,293

1,157,804

Total stockholders’ equity

5,101,749

5,373,919

Total liabilities and stockholders’

equity

$

7,675,048

$

7,971,399

Schedule 4: Adjusted

EBITDAX

(in thousands, unaudited)

Adjusted EBITDAX represents earnings

before interest, income taxes, depreciation, depletion, and

amortization, exploration expense, and other non-cash and

non-recurring charges. Adjusted EBITDAX excludes certain items that

we believe affect the comparability of operating results and can

exclude items that are generally non-recurring in nature or whose

timing and/or amount cannot be reasonably estimated. Adjusted

EBITDAX is a non-GAAP measure that we present because we believe it

provides useful additional information to investors and analysts,

as a performance measure, for analysis of our ability to internally

generate funds for exploration, development, acquisitions, and to

service debt. We are also subject to financial covenants under our

Credit Facility based on adjusted EBITDAX ratios. In addition,

adjusted EBITDAX is widely used by professional research analysts

and others in the valuation, comparison, and investment

recommendations of companies in the oil and natural gas exploration

and production industry. Adjusted EBITDAX should not be considered

in isolation or as a substitute for net income, net cash provided

by operating activities, or other profitability or liquidity

measures prepared under GAAP. Because adjusted EBITDAX excludes

some, but not all items that affect net income and may vary among

companies, the adjusted EBITDAX amounts presented may not be

comparable to similar metrics of other companies.

The following table presents a

reconciliation of the GAAP financial measure of net income to the

non-GAAP financial measure of adjusted EBITDAX.

Three Months Ended March

31,

2023

2022

Net income

$

202,461

$

91,639

Exploration

571

528

Depreciation, depletion, and

amortization

201,303

184,860

Abandonment and impairment of unproved

properties

—

17,975

Stock-based compensation(1)

7,380

8,090

Non-recurring general and administrative

expense(1)

—

2,886

Merger transaction costs

482

20,534

Unused commitments

391

776

(Gain) loss on property transactions,

net

241

(16,797

)

Interest expense

7,449

9,066

Interest income(2)

(6,218

)

—

Derivative (gain) loss

(25,160

)

295,493

Derivative cash settlements loss

(10,550

)

(166,578

)

Income tax expense

65,089

23,361

Adjusted EBITDAX

$

443,439

$

471,833

(1) Included as a portion of general and

administrative expense in the condensed consolidated statements of

operations.

(2) Included as a portion of other income

in the condensed consolidated statements of operations.

Schedule 5: Free

Cash Flow

(in thousands, unaudited)

Free cash flow is a supplemental non-GAAP

financial measure that is calculated as net cash provided by

operating activities before changes in current assets and

liabilities and less exploration and development of oil and natural

gas properties, changes in working capital related to capital

expenditures, and purchases of carbon offsets. We believe that free

cash flow provides additional information that may be useful to

investors in evaluating our ability to generate cash from our

existing oil and natural gas assets to fund future exploration and

development activities and to return cash to shareholders. Free

cash flow is a supplemental measure of liquidity and should not be

viewed as a substitute for cash flows from operations because it

excludes certain required cash expenditures.

The following table presents a

reconciliation of the GAAP financial measure of net cash provided

by operating activities to the non-GAAP financial measure of free

cash flow:

Three Months Ended March

31,

2023

2022

Net cash provided by operating

activities

$

538,849

$

532,541

Add back: changes in current assets and

liabilities

(116,079

)

(93,352

)

Cash flow from operations before changes

in operating assets and liabilities

422,770

439,189

Less: exploration and development of oil

and natural gas properties

(250,389

)

(260,667

)

Less: changes in working capital related

to capital expenditures

14,099

28,015

Free cash flow

$

186,480

$

206,537

Schedule 6: Per unit

cash margins

(unaudited)

Three Months Ended March

31,

2023

2022

Percent Change

Crude oil equivalent sales volumes

(MBoe)

14,349

14,311

—

%

Realized price (before

derivatives)

$

45.64

$

57.06

(20

)%

Per unit costs ($/Boe)

Lease operating expense

$

3.19

$

2.52

27

%

Midstream operating expense

$

0.70

$

0.40

75

%

Gathering, transportation, and

processing

$

4.69

$

3.52

33

%

Severance and ad valorem taxes

$

3.65

$

4.42

(17

)%

General and administrative expense

$

2.57

$

2.50

3

%

Stock-based compensation

$

(0.51

)

$

(0.57

)

(11

)%

Interest expense

$

0.52

$

0.63

(17

)%

Total cash costs

$

14.81

$

13.42

10

%

Cash margin (before derivatives)

$

30.83

$

43.64

(29

)%

Derivative cash settlements

$

(0.74

)

$

(11.64

)

(94

)%

Cash margin (after derivatives)

$

30.09

$

32.00

(6

)%

Non-cash items

Depreciation, depletion, and

amortization

$

14.03

$

12.92

9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230503005869/en/

Investor Relations: John Wren, ir@civiresources.com

Media: Rich Coolidge, info@civiresources.com

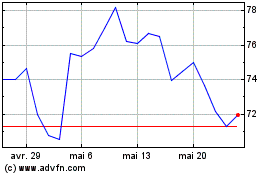

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025