Community Health Systems, Inc. (the “Company”) (NYSE: CYH)

announced today the early tender results of the previously

announced cash tender offer (the “Tender Offer”) by its wholly

owned subsidiary, CHS/Community Health Systems, Inc. (the

“Issuer”), to purchase up to $985 million aggregate principal

amount (the “Tender Cap”) of the Issuer’s outstanding 8.000% Senior

Secured Notes due 2026 (the “2026 Notes”), on the terms and subject

to the conditions set forth in the Offer to Purchase Statement,

dated December 11, 2023, as amended (the “Offer to Purchase”).

According to Global Bondholder Services Corporation, the

depositary and information agent for the Tender Offer, as of 5:00

p.m., New York City time, on December 22, 2023 (the “Early Tender

Deadline”), $1,946,236,000 aggregate principal amount of the

outstanding 2026 Notes were validly tendered and not validly

withdrawn. As the aggregate principal amount of the 2026 Notes

validly tendered and not validly withdrawn at or prior to the Early

Tender Deadline exceeded the Tender Cap, the Company will accept

such 2026 Notes for purchase on a prorated basis.

The table below identifies the aggregate principal amount of

2026 Notes validly tendered (and not validly withdrawn) as of the

Early Tender Deadline, the aggregate principal amount of 2026 Notes

that will remain outstanding on the Early Payment Date (as defined

below) and the approximate proration factor.

CUSIP No.(1)

Title of Security

Aggregate Principal Amount

Outstanding(2)

Aggregate Principal Amount

Tendered as of the Early Tender Deadline

Aggregate Principal

Amount to be Accepted for Purchase

Aggregate Principal Amount

Remaining Outstanding

Approximate Proration

Factor

12543D BC3

U17127 AL2

8.000% Senior Secured Notes due

2026

$2,100,809,000

$1,946,236,000

$985,000,000

$1,115,809,000

50.6%

(1) CUSIPs are provided for the

convenience of holders. No representation is made as to the

correctness or accuracy of such numbers.

(2) Aggregate principal amount outstanding

for the 2026 Notes as of December 11, 2023.

The withdrawal deadline for the Tender Offer was 5:00 p.m., New

York City time, on December 22, 2023, and has not been extended.

Accordingly, previously tendered 2026 Notes may not be withdrawn,

subject to applicable law.

The settlement date for 2026 Notes validly tendered as of the

Early Tender Deadline and accepted for purchase is expected to

occur on December 28, 2023 (the “Early Payment Date”). On the Early

Payment Date, the Company will pay the total consideration of

$1,000 per $1,000 principal amount of 2026 Notes accepted for

purchase plus accrued and unpaid interest from and including the

interest payment date immediately preceding the Early Payment Date

to, but not including, the Early Payment Date.

The Issuer will accept for purchase the 2026 Notes validly

tendered and not validly withdrawn as of the Early Tender Deadline

on a prorated basis, in accordance with the Offer to Purchase. 2026

Notes not accepted for purchase as a result of proration will be

rejected from the Tender Offer and will be returned to tendering

holders at the Issuer’s expense promptly following the earlier of

the Expiration Time (as defined below) or the date on which the

Tender Offer is terminated, in accordance with the Offer to

Purchase.

The Tender Offer is scheduled to expire at 5:00 p.m., New York

City time, on January 10, 2024 (the “Expiration Time”), unless

extended or earlier terminated by the Issuer. However, because the

aggregate principal amount of the 2026 Notes validly tendered and

not validly withdrawn as of the Early Tender Deadline exceeds the

Tender Cap, the Issuer does not expect to accept for purchase any

2026 Notes tendered after the Early Tender Deadline.

The Tender Offer is subject to the satisfaction or waiver of

certain conditions as described in the Offer to Purchase. The

complete terms and conditions of the Tender Offer are set forth in

the Offer to Purchase and remain unchanged.

The Issuer has retained Citigroup Global Markets Inc. to act as

dealer manager in connection with the Tender Offer. Questions about

the Tender Offer may be directed to Citigroup Global Markets Inc.

at (800) 558-3745 (toll free) or (212) 723-6106 (collect). Copies

of the Tender Offer documents and other related documents may be

obtained from Global Bondholder Services Corporation, the

depositary and information agent for the Tender Offer, at (855)

654-2015 (toll free) or (212) 430-3774 (collect), or by email at

contact@gbsc-usa.com.

This press release shall not constitute an offer to buy or sell,

or the solicitation of any offer to buy or sell, any securities.

Any offer or solicitation with respect to the Tender Offer will be

made only by means of the Offer to Purchase, and the information in

this press release is qualified by reference to the Offer to

Purchase. The Tender Offer is not being made to holders of 2026

Notes in any jurisdiction in which the making or acceptance thereof

would not be in compliance with the securities, blue sky or other

laws of such jurisdiction. In addition, nothing contained herein

constitutes a notice of redemption of the 2026 Notes. Holders must

make their own decision as to whether to tender any of their 2026

Notes, and, if so, the principal amount of 2026 Notes to

tender.

Forward-Looking Statements

This press release may include information that could constitute

forward-looking statements. These statements involve risk and

uncertainties. The Company undertakes no obligation to revise or

update any forward-looking statements, or to make any other

forward-looking statements, whether as a result of new information,

future events or otherwise, except as otherwise required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231226414126/en/

Investor Contacts: Kevin J. Hammons, 615-465-7000

President and Chief Financial Officer or Anton Hie, 615-465-7012

Vice President – Investor Relations

Media Contact: Tomi Galin, 615-628-6607 Executive Vice

President, Corporate Communications, Marketing and Public

Affairs

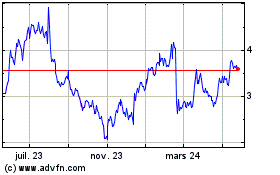

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

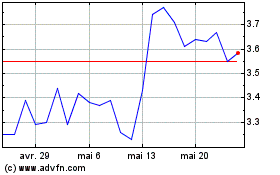

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025