false000129894600012989462024-05-312024-05-310001298946us-gaap:CommonStockMember2024-05-312024-05-310001298946us-gaap:RedeemablePreferredStockMember2024-05-312024-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 31, 2024

DiamondRock Hospitality Company

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-32514 | | 20-1180098 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

2 Bethesda Metro Center, Suite 1400

Bethesda, MD 20814

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s telephone number, including area code): (240) 744-1150

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | DRH | | New York Stock Exchange |

| 8.250% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share | | DRH Pr A | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers

On May 31, 2024, DiamondRock Hospitality Company (the “Company”) entered into a retirement agreement with William J. Tennis (the “Retirement Agreement”) in connection with the previously announced retirement of Mr. Tennis as Executive Vice President, General Counsel and Corporate Secretary of the Company, effective as of June 30, 2024 (the “retirement date”).

The existing severance agreement between Mr. Tennis and the Company required that he enter into a release agreement with the Company as a condition of receiving certain post-retirement payments and equity terms. Pursuant to the Retirement Agreement, Mr. Tennis will continue in his role as Executive Vice President, General Counsel and Corporate Secretary of the Company through the retirement date and thereafter will provide consulting services to the Company from July 1, 2024 to December 31, 2024. Additionally, the Retirement Agreement provides for the following, among other matters:

•a pro-rata bonus for 2024 in the amount of $236,000, determined through the retirement date and calculated based on Mr. Tennis’ target bonus for the 2024 fiscal year;

•continued health insurance coverage for Mr. Tennis, his spouse and dependents until the earlier of December 31, 2024 or the end of his eligibility for continued coverage; and

•that the termination of his employment on the retirement date shall be characterized as a “retirement” under the terms of the severance agreement between Mr. Tennis and the Company.

In addition, Mr. Tennis’ outstanding equity awards will be treated as follows: (i) all restricted stock awards granted to Mr. Tennis in 2022 and 2024 that are subject to time-based vesting will vest immediately as of the retirement date; (ii) all performance stock units (“PSU”) awards granted to Mr. Tennis in 2022, 2023 and 2024 that are subject to performance-based vesting conditions will remain eligible to be earned, but Mr. Tennis will not receive any shares underlying the PSU awards until the end of the applicable performance period and the number of shares issued will equal the target amount for each PSU award; and (iii) all long-term incentive units in DiamondRock Hospitality Limited Partnership, the Company’s operating partnership, granted to Mr. Tennis in 2023 that are subject to time-based vesting will vest immediately as of the retirement date.

The foregoing payments and benefits are conditioned upon a customary release of claims in favor of the Company and compliance with the non-competition, non-solicitation, non-disclosure and non-disparagement covenants described in the Retirement Agreement.

This summary of the Retirement Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Retirement Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this report:

Exhibit No. Description

101.SCH Inline XBRL Taxonomy Extension Schema Document

101.CAL Inline XBRL Taxonomy Extension Calculation Linkbase Document

101.DEF Inline XBRL Taxonomy Extension Definition Linkbase Document

101.LAB Inline XBRL Taxonomy Extension Label Linkbase Document

101.PRE Inline XBRL Taxonomy Extension Presentation Linkbase Document

104 Cover Page Interactive Data File

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | DIAMONDROCK HOSPITALITY COMPANY |

| | | |

| Dated: June 3, 2024 | | | | By: | | /s/ Briony R. Quinn |

| | | | | | Briony R. Quinn |

| | | | | | Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 10.1

RETIREMENT AGREEMENT

This Retirement Agreement (the “Agreement”) is made by and between William J. Tennis (“you”) and DiamondRock Hospitality Company (“DiamondRock” or the “Company”), headquartered at 2 Bethesda Metro Center, Suite 1400, Bethesda, Maryland 20814. This Agreement includes the “general release” referenced in Section 3(a) of your Severance Agreement dated December 16, 2009 (as amended by that certain First Amendment to the Severance Agreement dated January 4, 2010 and a further amendment with an “Amendment Effective Date” of March 12, 2021) (together, the “Severance Agreement”).

In consideration of the mutual covenants contained herein and other good and valuable consideration the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows.

1.Continued Employment to Retirement Date. You shall remain employed with DiamondRock and shall continue to devote your reasonable best efforts to the performance of your responsibilities and any reasonably requested responsibilities to and including June 30, 2024 (the “Retirement Date”). During your continued employment, the Company shall continue your regular salary and benefit participation in all of the Company’s “employee benefit plans,” as defined at 29 U.S.C. § 1002(3), in which you participate. Effective as of the Retirement Date, you hereby resign from all offices, directorships, trusteeships, committee memberships and fiduciary capacities held with, or on behalf of, the Company and its affiliates or any benefit plans of the Company and its affiliates and shall take all actions reasonably requested by the Company to effectuate the foregoing. The Company agrees that the termination of your employment shall be characterized as a “Retirement” as defined in Section 2(h) of the Severance Agreement.

2.Accrued Salary and Benefits. Pursuant to Section 2(a) of the Severance Agreement, without limiting the foregoing, the Company shall pay you your “Accrued Salary” (as defined in the Severance Agreement) through the Retirement Date. The Company shall also reimburse you for any outstanding, reasonable business expenses that you have incurred on the Company’s behalf through the Retirement Date, after the Company’s timely receipt of appropriate documentation pursuant to the Company’s business expense reimbursement policy.

3.Consulting Services and Transitional Assistance. From July 1, 2024 to December 31, 2024 (the “Consulting Period”), you shall provide consulting services and transitional assistance to the extent reasonably requested by the Company; provided that the Company shall not require you to (x) provide any such services or assistance at times that would unreasonably interfere with personal commitments that you may have or (y) provide services that could be handled efficiently by in-house counsel or by outside counsel. During the Consulting Period, you shall have access to your Company Outlook Account to the same extent as you currently have such access.

4.Consideration. In exchange for your promises contained herein, if you timely sign and return this Agreement and do not thereafter revoke it as set forth herein, pursuant to Section 3(b) of the Severance Agreement, DiamondRock shall provide you with the following:

a.The Company shall pay you $236,000, less tax-related deductions and withholdings, which is a pro-rata bonus for fiscal year 2024 determined through the Retirement Date and calculated based on your target bonus for the 2024 fiscal year (the “Pro-Rata Bonus”). The Company shall pay you the Pro-Rata Bonus no later than sixty (60) days after the Retirement Date.

b.If you elect COBRA continuation coverage, the Company shall pay the full amount of premiums that it pays for you and your spouse and dependents as of the Retirement Date until the earlier of December 31, 2024 or the end of your eligibility under COBRA for continuation coverage for medical care (the period ending on the earlier of which is the “Severance Period”); provided that if any such insurance coverage shall become unavailable and/or the Company’s insurer refuses to continue coverage for you and your spouse and dependents during the Severance Period, the Company shall be required only to pay to you an amount which, after reduction for income and

employment taxes, is equal to the preexisting employer premiums for such insurance for the remainder of the Severance Period.

c.As of the Retirement Date, you shall become 100% vested in all of the “Base Shares” granted pursuant to the Restricted Stock Award Agreement between you and the Company with a Grant Date of February 27, 2022. Vesting of unvested “Stock Units” granted pursuant to the Performance Stock Unit Agreements between you and the Company with Grant Dates of Awards of February 22, 2022 and February 23, 2023 (together, the “PSU Agreements”) shall be governed by Section 4(d) of each such PSU Agreement. As of the Retirement Date, you shall become 100% vested in all of the “LTIP Units” granted pursuant to the LTIP Unit Award Agreement with a Grant Date of February 23, 2023. Except as otherwise provided in this Section 4(c), all of your Company restricted stock awards and LTIP unit awards shall continue to be subject to the terms of the applicable stock grant agreements, awards, and equity plans (collectively, the “Equity Agreements and Plans”); except that the forfeiture of unvested equity that is subject to vesting pursuant to this Agreement that would otherwise occur in the absence of this Agreement shall be suspended for sixty (60) days from the Retirement Date and shall occur only if this Agreement does not become effective.

d.The Company’s Executive Committee issued a memorandum to you dated February 29, 2024 and entitled “2024 Compensation” (the “2024 Compensation Memo”). The 2024 Compensation Memo attached forms of agreement entitled Restricted Stock Award Agreement (the “2024 RSA Agreement”) and Performance Stock Unit Agreement (the “2024 PSU Agreement” and, together with the 2024 RSA Agreement, the “2024 Equity Awards”). The Company shall complete the 2024 Equity Awards in accordance with the 2024 Compensation Memo and you shall execute the completed 2024 Equity Awards. As of the Retirement Date, you shall become 100% vested in all of the “Base Shares” granted pursuant to the 2024 RSA Agreement. Vesting of unvested “Stock Units” granted pursuant to the 2024 PSU Agreement shall be governed by Section 4(d) of the 2024 PSU Agreement.

e.Nothing in this Agreement shall be construed to require the Company to make any payments to compensate you for any adverse tax effect associated with any payments or benefits or for any deduction or withholding from any payment or benefit.

5.General Release of Claims. For yourself and your heirs, legal representatives, and assigns, you hereby release and forever discharge DiamondRock and its parent corporation and all of its affiliates, subsidiaries, divisions, successors, predecessors, successors-in-interest and assigns, and all of its and their past and present officers, directors, agents, shareholders, employees, insurers, successors, assigns, representatives, and attorneys (hereinafter, the “Released Parties”) from any and all claims charges, debts, demands, damages, liabilities or actions of any kind, whether known or unknown, anticipated or unanticipated, past or present, contingent or fixed, that you have or may have against any of the Released Parties that are based upon any acts or events that occurred on or before the date on which this Agreement is executed by you (together, “Claims”), including, but not limited to, Claims arising under federal, state, or local statutory or common law, such as Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e et seq., 42 U.S.C. §1981, the Americans with Disabilities Act, 42 U.S.C. §12101 et seq., the Age Discrimination in Employment Act, the Family and Medical Leave Act, Article 49B of the Maryland Code, the Maryland Equal Pay Act, Title 20 of the State Government Article of the Maryland Annotated Code, and the law of contract and tort. The Claims released by you include without limitation all wage Claims which have been or could have been asserted, or which are based upon or arise from the acts, practices, transactions, events, and/or facts underlying any wage Claim that was or could have been asserted. You agree not to accept damages of any nature, other equitable or legal remedies for your own benefit or attorney’s fees or costs from any of the Released Parties with respect to any Claim released by this Agreement. As a material inducement to the Company to enter into this Agreement, you represent that you have not assigned any Claim to any third party and that you have not filed or otherwise initiated any lawsuit with any court relating to any Claims being released by you under this Agreement. Notwithstanding the foregoing, nothing in this general release limits your rights under this Agreement, your rights under any “employee benefit plan” as defined at 29 U.S.C. §1002(3) or your right to continue group health plan coverage under the law known as COBRA.

6.No Consideration Absent Execution of this Agreement. You understand and agree that you would not be entitled to certain of the terms specified in Sections 4(a)-(d) of this Agreement, except for your execution of this Agreement and the fulfillment of the promises contained herein.

7.Continuing Obligations. You acknowledge that your obligations under the Severance Agreement shall continue in effect, including without limitation, your obligations under Sections 4 (Non-Disparagement), 5 (Non-Competition), 6 (Non-Solicitation of Employees), and 8(e) (Litigation and Regulatory Cooperation), the terms of which are hereby incorporated by reference as material terms of this Agreement.

8.Compensation Recovery Policy Acknowledgment. You acknowledge that you are a “Covered Person” for purposes of the Company’s Compensation Recovery Policy, adopted as of August 1, 2023 (the “Compensation Recovery Policy”). You agree that in the event of “Material Financial Restatement,” as defined in the Compensation Recovery Policy, and a demand by the Company for return of any “Erroneously Awarded Compensation,” as defined in the Compensation Recovery Policy, you shall promptly return any such Erroneously Awarded Compensation.

9.Affirmations. You affirm that you have been paid and/or have received all salary, bonuses, reimbursements, and/or benefits that have become due to you up to and including the date of your execution of this Agreement.

10.Confidentiality. You acknowledge that during your employment with DiamondRock, you had access to trade secrets and other confidential and/or proprietary information (“Confidential Information”). You agree that you will use your reasonable efforts and diligence to preserve, protect, and prevent the disclosure by you of such Confidential Information, and that you shall not intentionally, either directly or indirectly, use, misappropriate, disclose or aid any other person in disclosing such Confidential Information. You acknowledge that as used in this Agreement, “Confidential Information” includes, but is not limited to, all methods, processes, techniques, practices, trade secrets, personnel matters, financial data, operating results, plans, contractual relationships, projections for new business opportunities for new or developing business for the Company, to the extent that such information has been treated as confidential by the Company. “Confidential Information” also includes, but is not limited to, all notes, records, software, drawings, handbooks, manuals, policies, contracts, memoranda, sales files, or any other documents generated or compiled by any employee of DiamondRock, to the extent that such information has been treated as confidential by the Company. Such information is, and shall remain, the exclusive property of the Company. Notwithstanding the foregoing, Confidential Information shall not include any of the categories of information listed above which (i) is or becomes generally available to the public other than as a result of a disclosure by you or (ii) becomes known to you on a non-confidential basis from a source other than DiamondRock or (iii) is required to be disclosed by operation of law or valid subpoena. For the avoidance of doubt, pursuant to the federal Defend Trade Secrets Act of 2016, you shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (a) is made (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (b) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

11.DiamondRock Property. Prior to the Retirement Date, you shall make reasonable efforts to return to DiamondRock any and all property of DiamondRock in your possession and/or subject to your control. Such property includes, but is not limited to, DiamondRock keys, security cards, identification badges, credit cards, printers, fax machines, external media devices, and all documents, files or other written instruments (including copies) reflecting or containing Confidential Information, whether such material is in paper form or electronic or recorded format. Notwithstanding the foregoing, you may retain possession of any files and other property, including without limitation the laptop assigned to you (the “Laptop”), that you reasonably believe may be helpful to retain to assist you in providing services to the Company during the Consulting Period. In addition, at the end of the Consulting Period, the Company shall transfer ownership of the Laptop to you; provided that you first return the Laptop to the Company to ensure that all Company proprietary information has been removed from the Laptop. In addition, you shall ensure that all Company proprietary information is removed from your iPad. You acknowledge that the transfer of ownership of the Laptop to you may be considered to result in taxable income to you. If you

discover after the Retirement Date that you have not returned certain of such property, you shall promptly return it or destroy it; provided that you will not be responsible for returning documents in your possession that do not reflect or contain Confidential Information.

12.Protected Disclosures and Other Protected Actions. Nothing contained in this Agreement or the Severance Agreement limits your ability to file a charge or complaint with any federal, state or local governmental agency or commission (a “Government Agency”). In addition, nothing contained in this Agreement or the Severance Agreement limits your ability or that of any other person to communicate with any Government Agency or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including your ability or that of any other person to provide documents or other information to a Government Agency, without notice to the Company, nor does anything contained in this Agreement or the Severance Agreement apply to truthful testimony in litigation; provided that you may not share any communication or other information that is subject to the Company’s attorney-client privilege. If you file any charge or complaint with any Government Agency and if the Government Agency pursues any claim on your behalf, or if any other third party pursues any claim on your behalf, you waive any right to monetary or other individualized relief (either individually, or as part of any collective or class action); provided that nothing in this Agreement limits any right you may have to receive a whistleblower award or bounty for information provided to the Securities and Exchange Commission.

13.Nonadmission of Wrongdoing. The parties stipulate that this Agreement does not constitute an admission of liability, does not constitute any factual or legal precedent whatsoever, and may not be used as evidence in any subsequent proceeding of any kind, except in an action alleging a breach of this Agreement or the Severance Agreement.

14.Compliance with IRC Section 409A. This Agreement is intended to comply with Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and will be interpreted in a manner intended to comply with Section 409A of the Code. A termination of employment shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment of amounts or benefits upon or following a termination of employment unless such termination is also a “Separation from Service” within the meaning of Code Section 409A and, for purposes of any such provision of this Agreement, references to a “resignation,” “termination,” “termination of employment” or like terms shall mean Separation from Service. Notwithstanding anything herein to the contrary, (i) if at the time of your termination of employment with the Company you are a “specified employee” as defined in Section 409A of the Code (and any related regulations or other pronouncements thereunder) and the deferral of the commencement of any payments or benefits otherwise payable hereunder as a result of such termination of employment is necessary in order to prevent any accelerated or additional tax under Section 409A of the Code, then the Company will defer the commencement of the payment of any such payments or benefits hereunder (without any reduction in such payments or benefits ultimately paid or provided to you) until the date that is six months following your termination of employment with the Company (or the earliest date as is permitted under Section 409A of the Code) and (ii) if any other payments of money or other benefits due to you hereunder could cause the application of an accelerated or additional tax under Section 409A of the Code, such payments or other benefits shall be deferred if deferral will make such payment or other benefits compliant under Section 409A of the Code, or otherwise such payment or other benefits shall be restructured, to the extent possible, in a manner, determined by the Company, that does not cause such an accelerated or additional tax. To the extent any reimbursements or in-kind benefits due to you under this Agreement constitute “deferred compensation” under Code Section 409A, any such reimbursements or in-kind benefits shall be paid to you in a manner consistent with Treas. Reg. Section 1.409A-3(i)(1)(iv). Each payment made under this Agreement (including each installment payment) shall be designated as a “separate payment” within the meaning of Section 409A of the Code. The Company shall consult with you in good faith regarding the implementation of the provisions of this paragraph; provided that neither the Company nor any of its employees or representatives shall have any liability to you with respect thereto.

15.Remedies. Nothing in this Agreement shall be construed to limit any damages or remedies, including injunctive relief, to which such party may be entitled under applicable law based upon a breach of this Agreement or the Severance Agreement.

16.Entire Agreement. The Severance Agreement, this Agreement, and the Equity Agreements and Plans collectively constitute the entire agreement between the parties hereto with respect to the subject matter hereof and thereof and supersede all prior and contemporaneous oral and written agreements, understandings, and representations, if any; provided that you shall continue to be subject to post-employment obligations under the Company’s Insider Trading Procedures. There have been no representations or warranties made by any party other than the representations and warranties contained herein and therein.

17.Amendment. This Agreement may be amended, changed, or modified only upon a written agreement executed by both parties. No waiver of any provision of this Agreement will be valid unless in writing and signed by the party against whom such waiver is charged.

18.Final Agreement. The parties have made such investigation of the facts pertaining to this Agreement, and of all the matters pertaining thereto, as they deem necessary. This Agreement is intended to be and is final and binding, regardless of any claims of misrepresentation, concealment of fact, or mistake of law or fact.

19.Severability. If any term or provision of this Agreement is to any extent held invalid or unenforceable by a court of competent jurisdiction, the remainder of the Agreement shall not be affected thereby, and each of the terms and provisions of the Agreement shall be valid and enforced to the fullest extent permitted by law.

20.Governing Law. This Agreement shall be interpreted under the laws of Maryland without regard to conflict of laws provisions. You hereby irrevocably submit to and recognize the jurisdiction of Maryland’s state courts or if, appropriate, a federal court located in that state (which courts, for purposes of this Agreement, are the only courts of competent jurisdiction), over any suit, action or other proceeding arising out of, under or in connection with this Agreement or any subject addressed in this Agreement.

21.Acknowledgement of Understanding and Revocation Rights. You acknowledge that you have been given twenty-one (21) calendar days to consider this Agreement and that, with this Agreement, DiamondRock hereby advises you to consult with an attorney of your choice before signing this Agreement. You further acknowledge that DiamondRock is being induced to provide you payments, benefits, and other consideration under this Agreement by your promises, including the general release in Section 5 above. If you choose to accept the terms and conditions of this Agreement, you must sign and return the Agreement to Jeffrey J. Donnelly in hard copy or by PDF to jeff.donnelly@drhc.com within twenty-one (21) days. You understand that you have the right to revoke this Agreement after signing it by sending written notice of revocation to Mr. Donnelly at the address above, no later than seven (7) calendar days after you sign this Agreement. You acknowledge that this Agreement shall not be effective or enforceable until the 7‑day revocation period expires. This Agreement shall become effective on the first business day after the expiration of such 7-day revocation period (the “Effective Date”). The offer of severance pay, benefits, and other consideration set forth in this Agreement will expire when the 21‑day period ends, if this Agreement is not accepted and returned by you during that period.

22.Knowing and Voluntary Release. You agree that you are signing this Agreement voluntarily and of your own free will and not because of any threats or duress. You fully understand the meaning and intent of this Agreement, and have had an opportunity to discuss fully and review the terms of this Agreement with an attorney of your choice. You agree that you have carefully read this Agreement and understand its contents, freely and voluntarily assent to all terms and conditions contained in this Agreement, sign your name of your own free will, and intend to be legally bound by this Agreement’s terms.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Agreement on the dates stated below. You are advised to consult with an attorney before signing this Agreement. This is a legal document. Your signature will commit you to its terms. By signing below, you acknowledge that you have carefully read and fully understand all of the provisions of this Agreement and that you are knowingly and voluntarily entering into this Agreement.

Agreed to by Employee:

/s/ William J. Tennis ____________ May 31, 2024_____________

William J. Tennis Date

Agreed to by DiamondRock:

By: /s/ William W. McCarten ______ May 31, 2024_____________

William W. McCarten Date

Chairman of the Board of Directors

v3.24.1.1.u2

Document and Entity Information

|

May 31, 2024 |

| Entity Listings [Line Items] |

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-32514

|

| Document Period End Date |

May 31, 2024

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Entity Registrant Name |

DiamondRock Hospitality Co

|

| Entity Address, Address Line One |

2 Bethesda Metro Center, Suite 1400

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

240

|

| Local Phone Number |

744-1150

|

| Entity Central Index Key |

0001298946

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

20-1180098

|

| Common Stock, $0.01 par value |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

DRH

|

| Security Exchange Name |

NYSE

|

| 8.250% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

8.250% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

DRH Pr A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

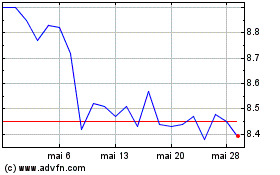

Diamondrock Hospitality (NYSE:DRH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Diamondrock Hospitality (NYSE:DRH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025