Key Facts

- New survey reveals significant shift in relationship between

younger generations and traditional financial institutions as trust

in financial advice from social media grows.

- According to the survey, social media has become the primary

source of financial advice for younger generations, which can

promote unrealistic comparisons and financial insecurity.

FIS® (NYSE: FIS), a global leader in financial technology, today

announced the findings of a comprehensive U.S. consumer research

study examining the shifting landscape of generational

relationships with financial institutions. The study highlights the

increasing challenges traditional banks face in competing to be the

voice of authority on personal finances amid rapid technological

advancements and economic uncertainty.

Hashim Toussaint, GM of Digital and Open Banking at FIS,

commented on the findings, stating, "This research highlights a

pivotal moment for the financial services industry. As younger

generations increasingly turn to digital platforms for financial

advice, traditional banks must evolve to meet their changing

expectations. By offering personalized, data-driven solutions, we

can bridge the trust gap and support consumers in making informed

financial decisions, bringing greater harmony to their financial

lives."

Social media takes over as the main driver of financial

advice for younger generations

The research shows that social media has become the primary

source of financial advice for younger generations. For instance,

40% of Gen Z and 36% of Millennials surveyed report that they are

learning about finance from social media platforms, whereas less

than 25% of this cohort are being educated by their financial

institution.

Yet, dependence on social media has its drawbacks. Financial

advice on these platforms tends to be fragmented and can result in

unrealistic comparisons and disjointed financial decisions, which

can heighten financial anxiety among consumers. Just over half of

Americans surveyed feel they are not making or saving enough money

compared to others they see on social media, with two-thirds of Gen

Z feeling this way.

Hashim Toussaint of FIS notes, "As reliance on social media for

financial guidance grows, a profound challenge for banks emerges as

they compete with the immediate gratification offered by

influencers. Banks must lean into their role as trusted financial

advisors, unlocking the financial wisdom for customers to put their

money to work, so they can take a step back from the daily

doomscrolling and have greater confidence in their ability to

achieve their future goals.”

Rising financial anxiety across generations due to fragmented

advice and economic uncertainty

Across all generations, financial anxiety is on the rise,

exacerbated by the constant access to fragmented financial advice

on social media. The study found that 68% of surveyed Gen Z and

Millennials, and 63% of surveyed Gen X, strongly agree that money

is a major emotional stressor. Additionally, nearly half (47%) of

the Gen Z and Millennials surveyed check their personal

checking/savings accounts daily compared to just 30% of Boomers

surveyed.

A particularly striking finding from the study is that 41% of

surveyed Americans believe they could only invest money if they

experienced a financial windfall like winning the lottery, and 55%

are worried they will never be able to retire. This pervasive

financial anxiety suggests that many US consumers may feel their

current financial strategies are insufficient for achieving

long-term goals like homeownership or substantial investment.

Two-thirds of Gen Z consumers surveyed do not feel they make

enough money compared to their peers, and 59% of Gen Z respondents

think about their money on a daily basis compared to only 36% of

Boomer respondents. As consumers struggle to keep their finances in

harmony, this anxiety may intensify, leading to behaviors such as

doomscrolling, which further deepens their financial fears and

uncertainties.

Consumers are vaulting their funds at rest instead of putting

their money to work

The study reveals that younger generations are primarily keeping

their money in checking accounts and digital wallets. Specifically,

33% of Gen Z and 42% of Millennials reporting holding their funds

in checking accounts, while digital wallets are reportedly used by

18% of Gen Z and 11% of Millennials. Additionally, many in younger

generations are keeping money in accounts that are not FDIC

insured, which can pose significant risks to their financial

security.

The trend of keeping most funds in checking accounts suggests

that younger generations are not maximizing growth and optimization

opportunities. However, Gen Z consumers have reported opening more

financial accounts in the past year than any other generation

surveyed, which suggests that while they are putting their money at

work by investing, they are actively engaging with their

finances.

Banks can bridge generational trust gap by keeping pace with

new entrants and delivering exceptional customer

experiences

Amid these challenges lies a significant opportunity for banks

to drive exceptional customer experiences and earn the trust of

younger, tech-savvy consumers. Over 80% of Americans surveyed

remain loyal to their long-time financial institutions, however,

just over half would consider switching for a better offer.

Notably, Millennials switched banks five times more than Boomers in

the past year.

To attract younger customers, banks should create innovative

tools and services that empower consumers to stay organized, inform

them about their choices, and support them in achieving their

financial goals. Offering tailored and easily accessible financial

solutions will help attract and retain the next generation of

customers.

Methodology

FIS’ survey was conducted by Savanta in July 2024. The research

explores the attitudes and behaviors of US Consumers across

financial wisdom, data privacy and perception and the impact of

social media on how different generations view their financial

wellbeing, as well as the opportunity for banks to evolve in these

areas.

The US data is based on a representative sample of 2,992 adult

consumers across the US, spanning Generation Z (18-27), Millennials

(28-43), Generation X (44-59) and Baby Boomers (60+).

About FIS

FIS is a financial technology company providing solutions to

financial institutions, businesses, and developers. We unlock

financial technology to the world across the money lifecycle

underpinning the world’s financial system. Our people are dedicated

to advancing the way the world pays, banks and invests, by helping

our clients to confidently run, grow, and protect their businesses.

Our expertise comes from decades of experience helping financial

institutions and businesses of all sizes adapt to meet the needs of

their customers by harnessing where reliability meets innovation in

financial technology. Headquartered in Jacksonville, Florida, FIS

is a member of the Fortune 500® and the Standard & Poor’s 500®

Index. To learn more, visit FISglobal.com. Follow FIS on LinkedIn,

Facebook and X.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016941016/en/

Kim Snider, 904.438.6278 Senior Vice President FIS Global

Marketing and Communications kim.snider@fisglobal.com

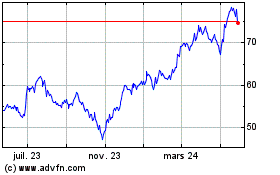

Fidelity National Inform... (NYSE:FIS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

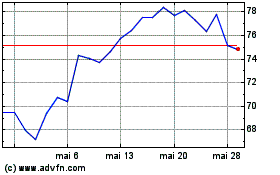

Fidelity National Inform... (NYSE:FIS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024