Gray Television Makes Significant Progress on Debt Reduction and Replenishes Authorization for Additional Debt Reduction

20 Novembre 2024 - 10:46PM

Gray Television, Inc. (“Gray,” “Gray Media,” the “Company,” “we,”

“us” or “our”) (NYSE: GTN) has completed a series of transactions

that collectively reduced the Company’s principal amount of debt

outstanding by $278 million since October 1, 2024, bringing the

Company’s total principal debt reduction to $519 million since

January 1, 2024. Accordingly, our Board of Directors today

has authorized an increase in our previously announced debt

repurchase authorization, replenishing the authorization to a total

of $250 million of available liquidity to repurchase our

outstanding indebtedness. We anticipate that the meaningful

reduction in our outstanding debt this year will result in a

significant reduction of cash interest expense going forward.

Through various recently completed transactions since November

8, 2024, we have used approximately $204 million of cash on hand to

repurchase and retire approximately $239 million of principal

amount of debt consisting of:

(a) $5 million of

outstanding principal of Term Loan D due December 1, 2028, (b) $143

million of outstanding principal of 2027 Notes,(c) $10 million of

outstanding principal of 2030 Notes, and(d) $81 million of

outstanding principal of 2031 Notes.

As a result of these transactions, the Company currently has

outstanding debt in the following principal amounts:

|

|

|

|

|

|

|

|

|

Principal Amount Outstanding($ in millions) |

December 31, 2023Actual |

|

September 30, 2024Actual |

|

November 20, 2024Actual |

|

|

Revolving Credit Facility due 12/31/2027 ($680 million

commitment) |

|

|

- |

|

- |

|

|

2021 Term Loan due 12/1/2028 (S + 300) |

|

|

$1,439 |

|

$1,395 |

|

|

2024 Term Loan due 6/4/2029 (S + 525) |

|

|

499 |

|

499 |

|

|

10.5% Senior Secured Notes due 7/15/2029 |

|

|

1,250 |

|

1,250 |

|

|

Total outstanding principal secured by a first

lien |

$2,660 |

|

$3,188 |

|

$3,144 |

|

|

5.875% Senior Unsecured Notes due 7/15/2026 |

|

|

10 |

|

10 |

|

|

7.000% Senior Unsecured Notes due 5/15/2027 |

|

|

671 |

|

528 |

|

|

4.750% Senior Unsecured Notes due 10/15/2030 |

|

|

800 |

|

790 |

|

|

5.375% Senior Unsecured Notes due 11/15/2031 |

|

|

1,300 |

|

1,219 |

|

|

Total outstanding principal, including current

portion |

$6,210 |

|

$5,969 |

|

$5,691 |

|

|

|

The extent of future repurchases, including the amount and

timing of any repurchases, will depend on general market

conditions, regulatory requirements, alternative investment

opportunities and other considerations. This repurchase

program supersedes any previous repurchase authorization, does not

require us to repurchase a minimum amount of debt, and it may be

modified, suspended or terminated at any time without prior

notice.

Forward-Looking Statements:

This press release contains certain forward-looking statements

that are based largely on Gray’s current expectations and reflect

various estimates and assumptions by Gray. These statements

are statements other than those of historical fact and may be

identified by words such as “estimates,” “expect,” “anticipate,”

“will,” “implied,” “intend,” “assume” and similar expressions.

Forward-looking statements are subject to certain risks, trends and

uncertainties that could cause actual results and achievements to

differ materially from those expressed in such forward-looking

statements. Such risks, trends and uncertainties, which in some

instances are beyond Gray’s control, include Gray’s ability to

complete its debt repurchasing efforts on the terms and within the

timeframe currently contemplated, the reduction of cash interest

expenses, and other future events. Gray is subject to additional

risks and uncertainties described in Gray’s quarterly and annual

reports filed with the Securities and Exchange Commission from time

to time, including in the “Risk Factors,” and management’s

discussion and analysis of financial condition and results of

operations sections contained therein, which reports are made

publicly available via its website, www.gray.tv. Any

forward-looking statements in this communication should be

evaluated in light of these important risk factors. This

press release reflects management’s views as of the date hereof.

Except to the extent required by applicable law, Gray undertakes no

obligation to update or revise any information contained in this

communication beyond the date hereof, whether as a result of new

information, future events or otherwise.

About Gray:

Gray Media, or Gray, is a multimedia company headquartered in

Atlanta, Georgia, formally known as Gray Television, Inc. The

company is the nation’s largest owner of top-rated local television

stations and digital assets serving 113 television markets that

collectively reach approximately 36 percent of US television

households. The portfolio includes 77 markets with the top-rated

television station and 100 markets with the first and/or second

highest rated television station, as well as the largest Telemundo

Affiliate group with 43 markets totaling nearly 1.5 million

Hispanic TV Households. The company also owns Gray Digital Media, a

full-service digital agency offering national and local clients

digital marketing strategies with the most advanced digital

products and services. Gray’s additional media properties include

video production companies Raycom Sports, Tupelo Media Group, and

PowerNation Studios, and studio production facilities Assembly

Atlanta and Third Rail Studios. Gray owns a majority interest in

Swirl Films. For more information, please visit

www.graymedia.com.

Gray Contacts:

Jeff Gignac, Executive Vice President and Chief

Financial Officer, 404-504-9828Kevin P. Latek,

Executive Vice President, Chief Legal and Development Officer,

404-266-8333

#

# #

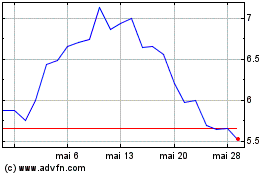

Gray Television (NYSE:GTN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Gray Television (NYSE:GTN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024