Hudson Pacific and Macerich Complete $700 Million Sale of One Westside and Westside Two

03 Janvier 2024 - 8:46PM

Business Wire

Hudson Pacific Properties, Inc. (NYSE: HPP), a unique

provider of end-to-end real estate solutions for tech and media

tenants, and Macerich (NYSE: MAC), one of the nation’s

leading owners, operators and developers of major retail and

mixed-use properties in top markets, today announced the sale of

One Westside and Westside Two in Los Angeles to the Regents of the

University of California for $700 million before prorations and

closing costs. Hudson Pacific held a 75% interest and Macerich a

25% interest in the joint venture that owned the assets, which

total approximately 687,000 square feet.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240103440375/en/

“The opportunistic sale of One Westside and Westside Two

significantly bolsters our balance sheet and we now have no debt

maturities until year-end 2025,” said Victor Coleman, Chairman and

CEO of Hudson Pacific. “We transformed the former Westside Pavilion

mall into a multi-award winning, modern and flexible campus

environment that attracted not one, but two distinct large-scale,

high-quality end-users, a testament to our ability to create value

through development expertise, commitment to quality and strong

relationships.”

Macerich Chief Executive Officer Tom O’Hern noted that, “This

transaction is an excellent example of how Macerich consistently

makes the most of our opportunities to maximize value for our

stakeholders. Net proceeds enable us to further deleverage and

improve our liquidity profile, allowing us to more aggressively

advance Macerich’s successful densification-diversification

strategy, which adds new uses—from fitness, grocery and medical to

residential, hotel, office and more—to our high-quality portfolio

of Regional Town Centers in attractive U.S. markets.”

Hudson Pacific used net proceeds from the sale to repay amounts

outstanding on its unsecured revolving credit facility. This

transaction addresses the company’s debt maturities until December

2025, and further strengthens the company’s compliance with its

unsecured revolving credit facility covenants as recently amended.

Further, the company’s share of net debt to the company’s share of

undepreciated book value as of September 30, 2023 proforma for all

announced asset sales improved to 35% from 39%.

About Hudson Pacific Properties

Hudson Pacific Properties (NYSE: HPP) is a real estate

investment trust serving dynamic tech and media tenants in global

epicenters for these synergistic, converging and secular growth

industries. Hudson Pacific’s unique and high-barrier tech and media

focus leverages a full-service, end-to-end value creation platform

forged through deep strategic relationships and niche expertise

across identifying, acquiring, transforming and developing

properties into world-class amenitized, collaborative and

sustainable office and studio space. For more information visit

HudsonPacificProperties.com.

About Macerich

Macerich is a fully integrated, self-managed and

self-administered real estate investment trust (REIT). As a leading

owner, operator and developer of high-quality retail real estate in

densely populated and attractive U.S. markets, Macerich’s portfolio

is concentrated in California, the Pacific Northwest,

Phoenix/Scottsdale, and the Metro New York to Washington, D.C.

corridor. Developing and managing properties that serve as

community cornerstones, Macerich currently owns 47 million square

feet of real estate consisting primarily of interests in 44

regional town centers. Macerich is firmly dedicated to advancing

environmental goals, social good and sound corporate governance. A

recognized leader in sustainability, Macerich has achieved a #1

Global Real Estate Sustainability Benchmark (GRESB) ranking for the

North American retail sector for nine consecutive years

(2015-2023). For more information, please visit

www.Macerich.com.

Macerich uses, and intends to continue to use, its Investor

Relations website, which can be found at investing.macerich.com, as

a means of disclosing material nonpublic information and for

complying with its disclosure obligations under Regulation FD.

Additional information about Macerich can be found through social

media platforms such as LinkedIn. Reconciliations of non-GAAP

financial measures, including NOI and FFO, to the most directly

comparable GAAP measures are included in the earnings release and

supplemental filed on Form 8-K with the SEC, which are posted on

the Investor Relations website at investing.macerich.com.

Hudson Pacific Properties Forward-Looking Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as "may," "will," "should,"

"expects," "intends," "plans," "anticipates," "believes,"

"estimates," "predicts," or "potential" or the negative of these

words and phrases or similar words or phrases that are predictions

of or indicate future events, or trends and that do not relate

solely to historical matters. Forward-looking statements involve

known and unknown risks, uncertainties, assumptions and

contingencies, many of which are beyond the company's control,

which may cause actual results to differ significantly from those

expressed in any forward-looking statement. All forward-looking

statements reflect the company's good faith beliefs, assumptions

and expectations, but they are not guarantees of future

performance. Furthermore, the company disclaims any obligation to

publicly update or revise any forward-looking statement to reflect

changes in underlying assumptions or factors, of new information,

data or methods, future events or other changes. For a further

discussion of these and other factors that could cause the

company's future results to differ materially from any

forward-looking statements, see the section entitled "Risk Factors"

in the company's Annual Report on Form 10-K filed with the

Securities and Exchange Commission, or SEC, and other risks

described in documents subsequently filed by the company from time

to time with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240103440375/en/

Hudson Pacific Properties Investor Contact: Laura

Campbell (310) 622-1702 lcampbell@hudsonppi.com

Media Contact: Laura Murray (310) 622-1781

lmurray@hudsonppi.com

Macerich Karen Maurer (602) 953-6471

Karen.maurer@macerich.com

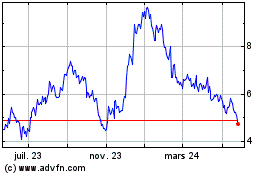

Hudson Pacific Properties (NYSE:HPP)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

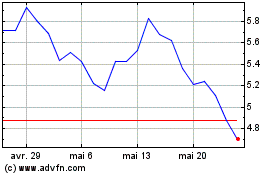

Hudson Pacific Properties (NYSE:HPP)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025