Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

28 Octobre 2024 - 9:13PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER

PURSUANT

TO RULE 13a-16 OR 15b-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of October, 2024

IRSA

Inversiones y Representaciones Sociedad Anonima

(Exact name of Registrant as specified in its charter)

IRSA

Investments and Representations Inc.

(Translation of registrant´s name into English)

Republic

of Argentina

(Jurisdiction of incorporation or organization)

Carlos

Della Paolera 261 9th Floor

(C1001ADA)

Buenos

Aires, Argentina

(Address of principal

executive offices)

Form 20-F ⌧ Form

40-F ☐

Indicate by

check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ☐ No

x

IRSA

INVERSIONES Y REPRESENTACIONES SOCIEDAD ANONIMA

(THE

“COMPANY”)

REPORT

ON FORM 6-K

Attached is an

English translation of the letter dated October 28, 2024, filed by

the Company with the Bolsa de Comercio de Buenos Aires and the

Comisión Nacional de Valores.

Buenos Aires,

October 28, 2024 – IRSA Inversiones y Representaciones S.A.

(NYSE:IRS;BYMA:IRSA), informs that in accordance

with the resolution of the Ordinary and Extraordinary General

Shareholders’ Meeting dated October 28, 2024 and the Board of

Directors meeting, due to the delegations made by the

Shareholders’ Meeting, a cash dividend of ARS 90,000,000,000,

charged to the year ended on June 30, 2024, equivalent to

1,261.1712782686%

of the stock capital with collection right represented by a total

of 713,622,341 shares with a nominal value ARS 10, will be made

available to the shareholders as of November 5, 2024, or on the

subsequent date resulting from the application of the regulations

in the jurisdictions where the Company's shares are listed

(“Date of Provision”).

The

amount per ordinary share (VN ARS 10) will be

ARS 126.11712782686

and the

amount per each Global Depositary Share (GDS) wil be ARS

1,261.1712782686,

payable to all shareholders that have such quality as of November

1, 2024, according to the registry held by Caja de Valores

S.A.

Payment

will be made through Caja de Valores S.A., at its address located

at 25 de Mayo 362, City of Buenos Aires, from 10 am to 3

pm.

GDS

holders will receive the amounts corresponding to the dividend

through The Bank of New York Mellon, depositary of said

certificates as of the date resulting from the application of the

regulations in force in the jurisdiction where the Company's GDSs

are listed.

It is

made known that the distribution of dividends is subject to the 7%

withholding tax established in section 97 of the Income Tax Law

(Decree 824/2019 and modifications).

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized, in the city of

Buenos Aires, Argentina.

|

|

IRSA Inversiones y Representaciones Sociedad

Anónima

|

|

|

|

|

|

|

|

October 28, 2024

|

By:

|

/s/ Saúl

Zang

|

|

|

|

|

Saúl

Zang

|

|

|

|

|

Responsible for the

Relationship with the Markets

|

|

|

|

|

|

|

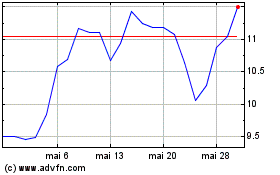

IRSA Inversiones and Rep... (NYSE:IRS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

IRSA Inversiones and Rep... (NYSE:IRS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024