JBT Corporation (NYSE: JBT), a leading global technology

solutions provider to high-value segments of the food and beverage

industry, today announced that JBT’s voluntary takeover offer to

acquire all issued and outstanding shares of Marel hf. (ICL: Marel)

expired on December 20, 2024, at 12:00 PM GMT.

JBT has now satisfied all conditions to the offer, including the

minimum acceptance condition with at least 90 percent of all issued

and outstanding shares of Marel having been validly tendered in the

offer. Further information regarding the final result of the offer,

including the number of shares tendered, will be disclosed in JBT’s

upcoming 8-K filing. JBT will complete the offer in accordance with

its terms given the minimum acceptance conditions and other

required conditions have been met.

“Today marks the final major milestone in combining JBT and

Marel to form a leading food and beverage process company,” said

Brian Deck, President and Chief Executive Office of JBT. “We are

pleased with the outcome of the Marel shareholders’ tender

decisions and extend our appreciation to shareholders for

supporting the transaction. The compelling industrial logic of this

transaction is clear, and we are focused on delivering meaningful

value for the combined company’s customers, employees, and

shareholders.”

Settlement of Offer Consideration

The settlement of the transaction is expected to occur on

January 2, 2025. All Marel shareholders who validly tendered their

shares had the option to elect to receive either all cash, all JBT

common stock, or a combination of cash and JBT common stock in

respect of their Marel shares, subject to the proration

feature.

It is JBT’s intention to acquire all of the issued and

outstanding Marel shares not yet validly tendered and to apply for

the Marel shares to be delisted from Nasdaq Iceland hf. (Nasdaq

Iceland) and Euronext Amsterdam as soon as permitted and reasonably

practicable under applicable laws and regulations. As JBT’s

ownership in Marel will exceed 90 percent of all Marel shares after

settlement of the offer, JBT intends to redeem any Marel shares not

tendered in the offer by way of a compulsory purchase, pursuant to

Article 110 of the Icelandic Takeover Act no. 108/2007, as amended,

within three months of the settlement of the offer.

Corresponding Corporate Name and Stock Ticker Symbol

Change

In conjunction with the combination of JBT and Marel, JBT will

change its corporate name and stock ticker symbol to “JBT Marel

Corporation” and “JBTM,” respectively, which is expected to occur

on or about January 2, 2025. JBTM shares will remain listed on the

New York Stock Exchange (NYSE) with a secondary listing on Nasdaq

Iceland. JBT has secured an approval for secondary listing on

Nasdaq Iceland. Shares of JBTM are expected to commence trading on

both NYSE and Nasdaq Iceland on January 3, 2025.

Transaction Advisors

Goldman Sachs Co LLC is acting as JBT’s financial advisor and

Kirkland & Ellis LLP and LEX are serving as JBT’s legal

counsel. Arion banki hf. is acting as JBT’s lead manager for the

Icelandic offer and advising on the Icelandic listing, and ABN AMRO

Bank N.V. is acting as JBT’s Euronext Amsterdam Exchange agent.

About JBT Corporation

JBT Corporation (NYSE: JBT) is a leading global technology

solutions provider to high-value segments of the food &

beverage industry. JBT designs, produces and services sophisticated

products and systems for a broad range of end markets, generating

roughly one-half of its annual revenue from recurring parts,

service, rebuilds and leasing operations. JBT employs approximately

5,100 people worldwide and operates sales, service, manufacturing

and sourcing operations in more than 25 countries. For more

information, please visit www.jbtc.com.

Forward Looking

Statements

This release contains forward-looking statements as defined in

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are information of a non-historical

nature and are subject to risks and uncertainties that are beyond

JBT’s ability to control. These forward-looking statements include,

among others, statements relating to our business combination

transaction with Marel. The factors that could cause our actual

results to differ materially from expectations include, but are not

limited to, the following factors: the occurrence of any event,

change or other circumstances that could give rise to the

termination or abandonment of the voluntary takeover offer (the

“Offer”); the expected timing and likelihood of completion of the

proposed transaction with Marel; the risk that problems may arise

in successfully integrating the businesses of Marel and JBT, which

may result in the combined company not operating as effectively and

efficiently as expected; the risk that the combined company may be

unable to achieve cost-cutting synergies or that it may take longer

than expected to achieve those synergies; fluctuations in our

financial results; unanticipated delays or accelerations in our

sales cycles; deterioration of economic conditions, including

impacts from supply chain delays and reduced material or component

availability; inflationary pressures, including increases in

energy, raw material, freight and labor costs; disruptions in the

political, regulatory, economic and social conditions of the

countries in which we conduct business; changes to trade

regulation, quotas, duties or tariffs; fluctuations in currency

exchange rates; changes in food consumption patterns; impacts of

pandemic illnesses, food borne illnesses and diseases to various

agricultural products; weather conditions and natural disasters;

the impact of climate change and environmental protection

initiatives; acts of terrorism or war, including the ongoing

conflicts in Ukraine and the Middle East; termination or loss of

major customer contracts and risks associated with fixed-price

contracts, particularly during periods of high inflation; customer

sourcing initiatives; competition and innovation in our industries;

our ability to develop and introduce new or enhanced products and

services and keep pace with technological developments; difficulty

in developing, preserving and protecting our intellectual property

or defending claims of infringement; catastrophic loss at any of

our facilities and business continuity of our information systems;

cyber-security risks such as network intrusion or ransomware

schemes; loss of key management and other personnel; potential

liability arising out of the installation or use of our systems;

our ability to comply with U.S. and international laws governing

our operations and industries; increases in tax liabilities; work

stoppages; fluctuations in interest rates and returns on pension

assets; a systemic failure of the banking system in the United

States or globally impacting our customers’ financial condition and

their demand for our goods and services; availability of and access

to financial and other resource; the risk factors discussed in our

proxy statement/prospectus filed pursuant to Rule 424(b) under the

Securities Act of 1933, as amended (File No. 333-279438), on June

25, 2024, forming part of the Registration Statement on Form S-4,

initially filed by us on May 15, 2024 and declared effective on

June 25, 2024; and other factors described under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in JBT’s most recent Annual

Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) and in any subsequently filed Quarterly

Reports on Form 10-Q. JBT cautions shareholders and prospective

investors that actual results may differ materially from those

indicated by the forward-looking statements. JBT undertakes no

obligation to publicly update or revise any forward-looking

statements whether as a result of new information, future

developments, subsequent events or changes in circumstances or

otherwise.

Important Notices

This release is not intended to and does not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. In particular, this release is not an offer of

securities for sale in the United States, Iceland, the Netherlands

or Denmark.

Note to U.S. Shareholders

It is important that U.S. shareholders understand that the Offer

and any related offer documents are subject to disclosure and

takeover laws and regulations in Iceland and other European

jurisdictions, which may be different from those of the United

States. The Offer is made in compliance with the U.S. tender offer

rules, including Regulation 14E under the Securities Exchange Act

of 1934 as amended (the “Exchange Act”), and any exemption

available to JBT in respect of securities of foreign private

issuers provided by Rule 14d-1(d) under the Exchange Act.

Important Additional Information

No offer of JBT securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, or an exemption from registration, and

applicable European regulations, including the Icelandic Prospectus

Act no. 14/2020 and the Icelandic Takeover Act no. 108/2007 on

takeovers. In connection with the Offer, JBT filed with the SEC a

registration statement on Form S-4 (File No. 333-279438) (the

“Registration Statement”) that included a proxy

statement/prospectus (the “Proxy Statement/Prospectus”). The

Registration Statement was declared effective by the SEC on June

25, 2024. Additionally, JBT filed with the Financial Supervisory

Authority of the Central Bank of Iceland (the “FSA”) an offer

document and a prospectus, which have been approved by the FSA and

which have been published.

SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS,

THE PROSPECTUS, AND THE OFFER DOCUMENT, AS APPLICABLE, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC OR THE FSA CAREFULLY AND IN

THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

Shareholders may obtain a free copy of the Proxy

Statement/Prospectus, as well as other filings containing

information about JBT, without charge, at the SEC’s website at

www.sec.gov, and on JBT’s website at

https://ir.jbtc.com/overview/default.aspx. You may obtain a free

copy of the prospectus on the FSA’s website at www.fme.is and on

JBT’s website at https://www.jbtc.com/jbt-marel-offer-launch/ as

well as a free copy of the offer document.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219248571/en/

Investors & Media: Marlee Spangler (312) 861-5789

marlee.spangler@jbtc.com

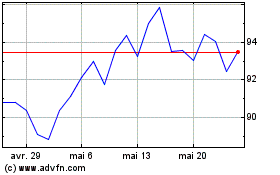

John Bean Technologies (NYSE:JBT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

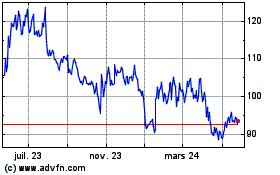

John Bean Technologies (NYSE:JBT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024