Latest research in Jackson’s Security in

Retirement Series exposes critical gaps in retirement healthcare

planning amid rising costs of care and increased life

expectancy

Nearly two-thirds of pre-retired investors

surveyed are underestimating their expected healthcare expenses in

retirement

Only 27% of investors surveyed believe they

will require long-term care — yet 70% of individuals turning 65 are

likely to need this type of care

Jackson National Life Insurance Company® (Jackson®), the main

operating subsidiary of Jackson Financial Inc.1 (NYSE: JXN), today

released key findings on how retirees and financial professionals

perceive healthcare risk and the associated impacts on retirement

income planning, including costs of healthcare and long-term care.

The study is the third installment of Jackson’s Security in

Retirement Series, conducted in partnership with the Center for

Retirement Research at Boston College, and follows the initial

longevity risk and inflation risk studies released over the past 15

months. The multi-phased research initiative aims to provide

useful, actionable, research-based insights on a variety of

potential threats to financial security in retirement.

Jackson’s research reveals a notable gap between individuals’

perceptions of healthcare and long-term care costs and their

overall financial preparedness, underscoring the need for better

retirement planning. The findings reveal critical risks once

retired, particularly in light of rising healthcare expenses,

longer lifespans and the increasing prevalence of chronic

conditions, all of which highlight a growing need for proactive

planning to achieve a secure retirement.

Key findings from the research include:

- Healthcare costs are grossly underestimated. Nearly

two-thirds of pre-retired investors surveyed are underestimating

their prospective healthcare expenses in retirement, anticipating

health care expenses at least $1,220 below the $8,600 annual

estimate and possibly increasing their healthcare risk.2

Additionally, only 27% of investors surveyed believe they will

require long-term care at some point in their lives, however, 70%

of individuals turning 65 each year are likely to need this type of

care at some point in their lives.3 This is particularly notable,

as Jackson’s recent longevity risk study found the vast majority of

investors inaccurately predict their life expectancy, increasing

retirement income planning risk.

- Rising costs and advancements in technology increase

financial burden. Advances in medical technology and treatments

are expected to increase healthcare costs significantly over the

next decade. The price of medical care including services,

insurance, drugs and equipment has increased by over 120% since

2000,4 leaving many retirees at risk of draining their savings.

These findings align with insights from Jackson’s 2024 inflation

risk study, which examined how pre-retired households struggle to

adapt to rising costs of essential expenses, including healthcare,

in the face of inflation.

- Investors are considering asset spend-down to qualify for

Medicaid. More than 60% of investors surveyed said they plan to

or may consider spending down their assets to qualify for Medicaid

as a long-term care funding solution but may be underprepared for

the dramatic life changes that would come with spending down their

assets.

- Concerns over long-term care costs are amplified among

financial professionals surveyed. Two in five financial

professionals are concerned that clients will be unable to afford

acceptable care, with 56% citing this as a major risk for

retirees.

- Personal experience drives better preparedness.

Respondents who have seen family members require long-term care are

nearly twice as likely to believe they will need similar care. This

group is also more proactive in exploring costs, adjusting

retirement timelines and planning for assisted living

expenses.

- Women face unique challenges. Women leading household

financial decisions express higher concern about healthcare risks

but are less likely to anticipate requiring long-term care despite

longer life expectancies. Many report lower income and asset

levels, yet they are three times more likely than men to be

caregivers for family members.

“Retirement should be a time for security and stability,

however, our research shows many households may be unprepared for

the realities of the healthcare challenges and expenses they will

face,” said Glen Franklin, Assistant Vice President of Research,

RIA and Lead Generation Strategy for Jackson National Life

Distributors LLC (JNLD), the marketing and distribution business of

Jackson. “Our research is particularly timely given potential

policy shifts resulting from the election outcome, as proposals

addressing healthcare reform and federal funding for long-term care

programs could significantly impact retirees’ healthcare costs and

savings strategies. This further underscores the importance of

working with financial professionals to prepare for an evolving

landscape and proactively address healthcare risks in investors’

retirement plans."

“These new survey data should be a wakeup call for policymakers,

financial professionals and older Americans themselves,” said

Andrew Eschtruth, Director of the Center for Retirement Research at

Boston College. “We are particularly concerned that too many people

nearing or in retirement don’t have a good grasp of their potential

healthcare needs and out-of-pocket costs, which could narrow their

options when it comes time to pay the bills.”

The research, fielded between July 12-August 2, 2024, included

online surveys of more than 400 financial professionals and 500

investors with at least $100,000 in financial assets between the

ages of 48 and 78 years. Respondents were required to participate

in, or lead, household financial decision-making.

Jackson’s ongoing work with the Center for Retirement Research

at Boston College aims to help retirement investors and financial

professionals better navigate financial challenges and mitigate

risks to retirement income planning. Part one of Jackson’s Security

in Retirement Series focused on longevity risk, or the risk of

outliving income when faced with the possibility of living longer

than expected, and part two of the Series focused on inflation

risk. Future studies will explore and analyze a selection of other

critical risks impacting Americans’ security in retirement, such as

market dynamics and policy risk related to government programs.

To access details and up-to-date findings relative to this

research as well as other proprietary research materials developed

by Jackson on topics that impact the saving and spending habits of

Americans, visit www.jackson.com/researchcenter.

ABOUT JACKSON

Jackson® (NYSE: JXN) is committed to helping clarify the

complexity of retirement planning—for financial professionals and

their clients. Through our range of annuity products, financial

know-how, history of award-winning service* and streamlined

experiences, we strive to reduce the confusion that complicates

retirement planning. We take a balanced, long-term approach to

responsibly serving all our stakeholders, including customers,

shareholders, distribution partners, employees, regulators and

community partners. We believe by providing clarity for all today,

we can help drive better outcomes for tomorrow. For more

information, visit www.jackson.com.

*SQM (Service Quality Measurement Group) Call Center Awards

Program for 2004 and 2006-2023. (Criteria used for Call Center

World Class FCR Certification is 80% or higher of customers getting

their contact resolved on the first call to the call center (FCR)

for 3 consecutive months or more.)

Jackson® is the marketing name for Jackson Financial Inc.,

Jackson National Life Insurance Company® (Home Office: Lansing,

Michigan) and Jackson National Life Insurance Company of New York®

(Home Office: Purchase, New York).

Jackson, its distributors, and their respective

representatives do not provide tax, accounting, or legal advice.

Any tax statements contained herein were not intended or written to

be used and cannot be used for the purpose of avoiding U.S.

federal, state, or local tax penalties. Tax laws are complicated

and subject to change. Tax results may depend on each taxpayer’s

individual set of facts and circumstances. You should rely on your

own independent advisors as to any tax, accounting, or legal

statements made herein.

This material should be considered educational in nature and

does not take into account your particular investment objectives,

financial situations, or needs, and is not intended as a

recommendation, offer, or solicitation for the purchase or sale of

any product, security, or investment strategy.

Annuities are issued by Jackson National Life Insurance Company

(Home Office: Lansing, Michigan) and in New York by Jackson

National Life Insurance Company of New York (Home Office: Purchase,

New York). Variable annuities are distributed by Jackson National

Life Distributors LLC, member FINRA. May not be available in all

states, and state variations may apply. These products have

limitations and restrictions. Discuss them with your financial

professional or contact the Company for more information.

Jackson® is committed to ensuring more Americans in or nearing

retirement can benefit from greater clarity and confidence in their

financial futures. To better support this important goal, we have

partnered with leading academic experts at the Center for

Retirement Research at Boston College to launch the Jackson

Security in Retirement Series. This multiphase research effort will

take a comprehensive look at a range of potential threats to

financial security with the goal of helping financial professionals

and retirement savers more effectively identify and manage them.

Jackson is not affiliated with the Center for Retirement Research

at Boston College.

Firm and state variations may apply. Additionally, products

may not be available in all states.

*Guarantees are subject to the claims-paying ability of the

issuing insurance company.

1 Jackson Financial Inc. is a U.S. holding company and the

direct parent of Jackson Holdings LLC (JHLLC). The wholly-owned

direct and indirect subsidiaries of JHLLC include Jackson National

Life Insurance Company, Brooke Life Insurance Company, PPM America,

Inc. and Jackson National Asset Management, LLC.

2 This is based on a subset of 114 pre-retired investors

surveyed and excludes those who indicated they were unable to

provide an estimate of annual household health care expenses.

3 Christine Benz, Morningstar, “100 Must-Know Statistics about

Long-Term Care: 2023 Edition,” March 29, 2023.

4 Shameek Rakshit, et al., Peterson-KFF Health System Tracker,

“How does medical inflation compare to inflation in the rest of the

economy?” August 2, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122854732/en/

Media Contact: Patrick Rich Patrick.Rich@Jackson.com

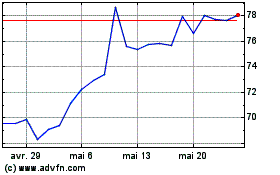

Jackson Financial (NYSE:JXN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Jackson Financial (NYSE:JXN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025