UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Lamb Weston Holdings, Inc.

————————————————————————————————————————————————————

(Name of Registrant as Specified In Its Charter)

————————————————————————————————————————————————————

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

————————————————————————————————————————————————————

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

August 9, 2024

Fellow Shareholders,

Fiscal year 2024 was a difficult year for us at Lamb Weston, as our team faced a rapidly changing operating environment and soft global demand for fries. We also faced executional challenges that impacted our financial results. Our teams are focused on implementing the critical changes we are making to address these challenges, and importantly, these changes are driving our continued confidence in the long-term health of this business.

While we faced some challenges, we also took key actions to further drive our business forward in fiscal 2024, including:

•Integrating the acquisition of our former European joint venture;

•Starting up state-of-the-art processing facilities in Ulanqab, China and American Falls, Idaho;

•Strengthening our product portfolio by introducing innovative technologies to expand our total addressable market;

•Implementing pricing actions that offset multiple years of high input cost inflation;

•Upgrading our information technology infrastructure by cutting over key central systems in North America to a new enterprise resource planning (ERP) system; and

•Continuing to drive supply chain productivity savings across our global production network.

We’ve also made important investments in our people and in technology and infrastructure to drive efficiency in our manufacturing footprint.

While we remain confident in our long-term strategies to deliver sustainable, profitable growth, we anticipate an imbalance in supply and demand in the frozen potato category will continue to be a factor for fiscal year 2025, and we’re making operating adjustments in the near term to support improved execution, competitiveness and financial results.

Specifically, we’re focusing on growing volume by matching the right product at the right price to meet our customers’ needs and targeting specific investments in price and trade support to maintain our relationships and win new business. We are aggressively looking at opportunities to reduce costs by driving supply chain productivity and tightly managing operating expenses. We are also looking at key processes, identifying ways to simplify and make it easier for our customers to do business with Lamb Weston.

In 2025 we will celebrate the 75th anniversary of the founding of Lamb Weston. As we prepare for this important milestone, we are more focused than ever on operating in a way that sets the company up to serve our customers for another 75 years.

Thank you for being a Lamb Weston shareholder. I look forward to the future, and making progress against our long-term priorities, and our ambitious growth plans.

Sincerely,

Tom Werner

President and CEO

Forward-Looking Statements

This letter contains forward-looking statements within the meaning of the federal securities laws. Words such as “will,” “make,” “continue,” “remain,” “focus,” “implement,” “grow,” “drive,” “deliver,” “support,” “invest,” “target,” “anticipate,” “win,” “reduce,” “manage,” and variations of such words and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding our business and financial outlook and prospects; our plans, execution, investments, costs, volume growth, pricing and trade support and supply chain productivity; demand for our products; and our industry. These forward-looking statements are based on management’s current expectations and are subject to uncertainties and changes in circumstances. Readers of this letter should understand that these statements are not guarantees of performance or results. Many factors could affect these forward-looking statements and our actual financial results and cause them to vary materially from the expectations contained in the forward-looking statements. These risks and uncertainties include, among other things: the availability and prices of raw materials and other commodities; operational challenges; consumer preferences, including restaurant traffic in North America and our international markets, and an uncertain general economic environment, including inflationary pressures and recessionary concerns, any of which could adversely impact our business, financial condition or results of operations, including the demand and prices for our products; difficulties, disruptions or delays in implementing new technology, such as our new ERP system; levels of labor and people-related expenses; our ability to successfully execute our long-term value creation strategies; our ability to execute on large capital projects, including construction of new production lines or facilities; the competitive environment and related conditions in the markets in which we operate; political and economic conditions of the countries in which we conduct business and other factors related to our international operations; disruptions in the global economy caused by conflicts such as the war in Ukraine and conflicts in the Middle East and the possible related heightening of our other known risks; the ultimate outcome of litigation or any product recalls or withdrawals; changes in our relationships with our growers or significant customers; impacts on our business due to health pandemics or other contagious outbreaks, such as the COVID-19 pandemic, including impacts on demand for our products, increased costs, disruption of supply, other constraints in the availability of key commodities and other necessary services or restrictions imposed by public health authorities or governments; disruption of our access to export mechanisms; risks associated with integrating acquired businesses, including our former European joint venture; risks associated with other possible acquisitions; our debt levels; actions of governments and regulatory factors affecting our businesses; our ability to pay regular quarterly cash dividends and the amounts and timing of any future dividends; and other risks described in our reports filed from time to time with the Securities and Exchange Commission. We caution readers not to place undue reliance on any forward-looking statements included in this letter, which speak only as of the date of this letter. We undertake no responsibility for updating these statements, except as required by law.

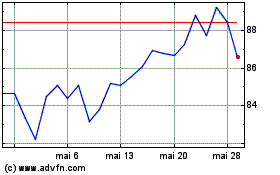

Lamb Weston (NYSE:LW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Lamb Weston (NYSE:LW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024