Medifast (NYSE: MED), the health and wellness company known for

its habit-based and coach-guided lifestyle solution,

OPTAVIA®, today reported results for the fourth quarter and

full year ended December 31, 2024.

Fourth Quarter 2024

- Revenue of $119.0 million, with revenue per active earning

coach of $4,391

- Independent active earning OPTAVIA coaches of

27,100

- Net income of $0.8 million (non-GAAP adjusted net income of

$1.1 million)

- Earnings per diluted share ("EPS") of $0.07 (non-GAAP adjusted

EPS of $0.10)

- Cash, Cash Equivalents, and Investment Securities of $162.3

million and no debt

Full Year 2024

- Revenue of $602.5 million

- Net income of $2.1 million (non-GAAP adjusted net income of

$20.2 million)

- EPS of $0.19 (non-GAAP adjusted EPS of $1.84)

“This past year was a pivotal year for Medifast, as we continued

to transform our business to meet the changing nature of a health

and wellness market that has been revolutionized by the rising

acceptance of GLP-1 medications,” said Dan Chard, Chairman &

CEO.

“Throughout the year, our team has shown resilience and

adaptability as we navigated evolving market dynamics, enabling

Medifast to remain positioned to be a leader in health and wellness

in a GLP-1 world. We're committed to offering solutions that meet

the diverse needs of our customers, whether they are focusing

solely on our habit-based approach to weight loss, using GLP-1

medications, or transitioning off them.”

Chard continued, “As we look ahead, our top priorities center on

reestablishing growth across all of our key metrics, including

driving coach productivity through accelerated customer

acquisition, and expanding the number of active earning coaches.

These efforts should allow us to broaden our reach, restore revenue

and profitability growth and deliver long-term value to all our

stakeholders.”

Fourth Quarter 2024 Results

Fourth quarter 2024 revenue decreased 37.7% to $119.0 million

from $191.0 million for the fourth quarter of 2023 primarily driven

by a decrease in the number of active earning OPTAVIA

coaches and lower coach productivity. The total number of active

earning OPTAVIA coaches decreased 34.1% to 27,100 compared

to 41,100 for the fourth quarter of 2023. The average revenue per

active earning OPTAVIA coach was $4,391, compared to $4,648

for the fourth quarter last year, a decline of 5.5% primarily

driven by continued pressure on customer acquisition.

Gross profit decreased 37.6% to $88.2 million from $141.4

million for the fourth quarter of 2023. The decrease in gross

profit was due to lower sales volumes. The company’s gross profit

as a percentage of revenue was 74.1% compared to 74.0% in the

fourth quarter of 2023.

Selling, general, and administrative expenses (“SG&A”)

decreased 34.1% to $87.5 million compared to $132.7 million for the

fourth quarter of 2023. The decrease in SG&A was primarily due

to a $27.4 million decrease in OPTAVIA coach compensation, a

$7.1 million decrease in employee compensation, a $5.8 million

decrease due to non-recurring costs incurred in the fourth quarter

of 2023 to establish the company's medically supported weight loss

initiative, which includes collaboration costs with LifeMD, and a

$3.0 million decrease in costs for coach-related events, partially

offset by $6.5 million of costs for company led marketing efforts.

As a percentage of revenue, SG&A increased 400 basis points

year-over-year to 73.5% of revenue, as compared to 69.5% for the

fourth quarter of 2023. The increase in SG&A as a percentage of

revenue was primarily due to 550 basis points of company led

marketing spend and 210 basis points of loss of leverage on fixed

costs, partially offset by a 300 basis point decrease due to

non-recurring costs incurred in the fourth quarter of 2023 to

establish the company's medically supported weight loss initiative,

as well as a 100 basis point decrease for costs related to

coach-related events. On a non-GAAP adjusted basis, which excludes

non-GAAP adjustments in the prior comparable period for IT and

supply chain optimization and the LifeMD collaboration costs,

SG&A decreased 30.1% to $87.5 million and non-GAAP adjusted

SG&A moved 800 basis points higher as a percentage of revenue

to 73.5%.

Income from operations decreased 91.8% to $0.7 million from $8.7

million in the prior year period. As a percentage of revenue,

income from operations was 0.6% for the fourth quarter of 2024

compared to 4.5% in the prior-year period due to the factors

described above impacting revenue and SG&A expenses. Non-GAAP

adjusted income from operations as a percentage of revenue was

0.6%, a decrease of 790 basis points from the year-ago period.

Other income decreased 49.7% to $0.6 million from $1.1 million

for the fourth quarter of 2023. The decrease in other income was

primarily due to unrealized losses on the investment in LifeMD

common stock. Non-GAAP other income, which excludes the quarter's

unrealized losses on LifeMD common stock investment, decreased

18.2% to $0.9 million primarily due to the write-off of unamortized

debt issuance costs.

The effective tax rate was 37.3% for the fourth quarter of 2024

compared to 38.4% in the prior-year period. The non-GAAP effective

tax rate was 34.6% as compared to 31.6% in the prior year

period.

In the fourth quarter of 2024, net income was $0.8 million, or

$0.07 per diluted share, based on approximately 11.0 million shares

of common stock outstanding. In the fourth quarter of 2023, net

income was $6.0 million, or $0.55 per diluted share, based on

approximately 10.9 million shares of common stock outstanding. In

the fourth quarter of 2024, non-GAAP adjusted net income was $1.1

million, or $0.10 per diluted share, compared to non-GAAP adjusted

net income of $11.9 million, or $1.09 per diluted share, in the

year-ago period.

Full Year Fiscal 2024 Results

For the fiscal year ended December 31, 2024, revenue decreased

43.8% to $602.5 million compared to revenue of $1.1 billion in

2023. Net income for 2024 was $2.1 million, or $0.19 per diluted

share, based on approximately 11.0 million shares outstanding. This

compares to 2023 net income of $99.4 million, or $9.10 per diluted

share, based on approximately 10.9 million shares outstanding. On a

non-GAAP adjusted basis, net income decreased 80.8% to $20.2

million and EPS decreased 80.9% to $1.84 per diluted share,

compared to the prior year period’s adjusted EPS of $9.64 per

diluted share.

Capital Allocation and Balance Sheet

The company’s balance sheet remains strong with cash, cash

equivalents, and investment securities of $162.3 million and no

interest-bearing debt as of December 31, 2024, compared to $150.0

million in cash and cash equivalents and no debt at December 31,

2023.

Outlook

The company expects first quarter 2025 revenue to be in the

range of $100 million to $120 million and first quarter 2025 EPS to

range from a loss of $0.50 per diluted share to $0.00 per diluted

share. The EPS range excludes any gains or losses from changes in

market price of the company's LifeMD common stock investment.

Conference Call Information

The conference call is scheduled for today, Tuesday, February

18, 2025 at 4:30 PM ET. The call will be broadcast live over the

Internet, hosted on the Investor Relations section of Medifast’s

website at www.MedifastInc.com or directly at

https://viavid.webcasts.com/starthere.jsp?ei=1705513&tp_key=7b87c842ba

and will be archived online and available through May 18, 2025. In

addition, listeners may dial (201) 389-0879 to join via telephone.

A telephonic playback will be available from February 18, 2025 at

8:30 PM ET through Tuesday, February 25, 2025 at 11:59 PM ET.

Participants can dial (412) 317-6671 and enter passcode 13751326 to

hear the playback.

About Medifast®:

Medifast (NYSE: MED) is the 40+ year old health and wellness

company known for its habit-based and coach-guided lifestyle

solution OPTAVIA®, which provides people with a simple yet

comprehensive approach to address obesity and support a healthy

lifestyle. OPTAVIA provides unparalleled coaching support

along with community, tailored nutrition and healthy habits, and

empowers people to master their weight loss journey through each

stage of life. Through the company's collaboration with national

virtual primary care provider LifeMD® (Nasdaq: LFMD) and its

affiliated medical group, customers now have access to GLP-1

medications where clinically appropriate. Medifast remains

committed to its mission of offering Lifelong Transformation,

Making a Healthy Lifestyle Second Nature™. Visit MedifastInc.com

and OPTAVIA.com for more information and follow @Medifast on

X and LinkedIn.

MED-F

Forward-Looking Statements

Please Note: This release contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements generally can be identified by use

of phrases or terminology such as “intend,” “anticipate,” “expect”

or other similar words or the negative of such terminology.

Similarly, descriptions of Medifast’s objectives, strategies,

plans, goals, outlook or targets contained herein are also

considered forward-looking statements. These statements are based

on the current expectations of the management of Medifast and are

subject to certain events, risks, uncertainties and other factors.

Some of these factors include, among others, Medifast's inability

to maintain and grow the network of independent OPTAVIA

coaches; industry competition and new weight loss products,

including weight loss medications such as GLP-1s, or services;

Medifast’s health or advertising related claims by OPTAVIA

customers; Medifast's inability to continue to develop new

products; effectiveness of Medifast's advertising and marketing

programs, including use of social media by OPTAVIA coaches;

the departure of one or more key personnel; Medifast's inability to

protect against online security risks and cyberattacks; risks

associated with Medifast's direct-to-consumer business model;

disruptions in Medifast's supply chain; product liability claims;

Medifast's planned growth into domestic markets including through

its collaboration with LifeMD, Inc.; adverse publicity associated

with Medifast's products; the impact of existing and future laws

and regulations on Medifast’s business; fluctuations of Medifast's

common stock market price; increases in litigation; actions of

activist investors; the consequences of other geopolitical events,

overall economic and market conditions and the resulting impact on

consumer sentiment and spending patterns; and Medifast's ability to

prevent or detect a failure of internal control over financial

reporting. Although Medifast believes that the expectations,

statements and assumptions reflected in these forward-looking

statements are reasonable, it cautions readers to always consider

all of the risk factors and any other cautionary statements

carefully in evaluating each forward-looking statement in this

release, as well as those set forth in its Annual Report on Form

10-K for the fiscal year ended December 31, 2024, and other filings

filed with the United States Securities and Exchange Commission,

including its quarterly reports on Form 10-Q and current reports on

Form 8-K. All of the forward-looking statements contained herein

speak only as of the date of this release.

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(U.S. dollars in thousands,

except per share amounts & dividend data)

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Revenue

$

119,003

$

191,015

$

602,463

$

1,072,054

Cost of sales

30,784

49,646

157,840

296,204

Gross profit

88,219

141,369

444,623

775,850

Selling, general, and administrative

87,510

132,693

441,745

649,448

Income from operations

709

8,676

2,878

126,402

Other income

Interest income

953

1,176

4,804

2,490

Other expense

(387

)

(50

)

(3,895

)

(95

)

566

1,126

909

2,395

Income before provision for income

taxes

1,275

9,802

3,787

128,797

Provision for income taxes

475

3,766

1,696

29,382

Net income

$

800

$

6,036

$

2,091

$

99,415

Earnings per share - basic

$

0.07

$

0.55

$

0.19

$

9.13

Earnings per share - diluted

$

0.07

$

0.55

$

0.19

$

9.10

Weighted average shares

outstanding

Basic

10,938

10,893

10,930

10,884

Diluted

10,983

10,935

10,963

10,921

Cash dividends declared per share

$

—

$

—

$

—

$

4.95

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(U.S. dollars in thousands,

except par value)

December 31, 2024

December 31, 2023

ASSETS

Current Assets

Cash and cash equivalents

$

90,928

$

94,440

Inventories, net

42,421

54,591

Investments

71,416

55,601

Income taxes, prepaid

—

8,727

Prepaid expenses and other current

assets

9,639

10,670

Total current assets

214,404

224,029

Property, plant and equipment - net of

accumulated depreciation

37,527

51,467

Right-of-use assets

11,155

15,645

Other assets

9,667

14,650

Deferred tax assets, net

11,460

4,117

TOTAL ASSETS

$

284,213

$

309,908

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current Liabilities

Accounts payable and accrued expenses

$

56,494

$

86,415

Income taxes payable

1,485

—

Current lease obligations

6,182

5,885

Total current liabilities

64,161

92,300

Lease obligations, net of current lease

obligations

9,943

16,127

Total liabilities

74,104

108,427

Commitments

Stockholders' Equity

Common stock, par value 0.001 per share:

20,000 shares authorized;

10,938 and 10,896 issued and

outstanding

at December 31, 2024 and December 31,

2023

11

11

Additional paid-in capital

33,136

26,573

Accumulated other comprehensive income

180

248

Retained earnings

176,782

174,649

Total stockholders' equity

210,109

201,481

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

284,213

$

309,908

Non-GAAP Financial Measures

In an effort to provide investors with additional information

regarding results, the company discloses various non-GAAP financial

measures in the quarterly earnings press release and other public

disclosures. The following GAAP financial measures have been

presented on an as adjusted basis: cost of sales, gross profit,

SG&A expenses, income from operations, other income, provision

for income taxes, net income, effective tax rate, and diluted

earnings per share. Each of these non-GAAP financial measures

excludes the impact of certain amounts as further identified below

that the company believes are not indicative of its core ongoing

operational performance. A reconciliation of each of these non-GAAP

financial measures to its most comparable GAAP financial measure is

included below. These non-GAAP financial measures are not intended

to replace GAAP financial measures.

These non-GAAP financial measures are used internally to

evaluate and manage the company's operations because the company

believes they provide useful supplemental information regarding the

company's on-going economic performance. The company has chosen to

provide this information to investors to enable them to perform

more meaningful comparisons of operating results and as a means to

emphasize the results of on-going operations.

The following tables reconcile the non-GAAP financial measures

included in this release:

Three months ended December

31, 2024

GAAP

Unrealized Loss on Investment

in LifeMD Common Stock

Non-GAAP

Cost of sales

$

30,784

$

—

$

30,784

Gross profit

88,219

—

88,219

Selling, general, and administrative

87,510

—

87,510

Income from operations

709

—

709

Other income

566

355

921

Provision for income taxes

475

89

564

Net income

800

266

1,066

Diluted earnings per share (1)

0.07

0.02

0.10

Three months ended December

31, 2023

GAAP

IT and Supply Chain

Optimization

LifeMD Collaboration

Costs

Non-GAAP

Cost of sales

$

49,646

$

—

$

—

$

49,646

Gross profit

141,369

—

—

141,369

Selling, general, and administrative

132,693

(2,555

)

(5,000

)

125,138

Income from operations

8,676

2,555

5,000

16,231

Other income

1,126

—

—

1,126

Provision for income taxes

3,766

583

1,141

5,490

Net income

6,036

1,972

3,859

11,867

Diluted earnings per share (1)

0.55

0.18

0.35

1.09

Year ended December 31,

2024

GAAP

Supply Chain Optimization and

Restructuring of External Manufacturing Agreements

Unrealized Loss on Investment

in LifeMD Common Stock

LifeMD Collaboration

Costs

Non-GAAP

Cost of sales

$

157,840

$

(2,579

)

$

—

$

—

$

155,261

Gross profit

444,623

2,579

—

—

447,202

Selling, general, and administrative

441,745

(12,502

)

—

(5,000

)

424,243

Income from operations

2,878

15,081

—

5,000

22,959

Other income

909

—

4,089

—

4,998

Provision for income taxes

1,696

3,770

1,022

1,250

7,738

Net income

2,091

11,311

3,067

3,750

20,219

Diluted earnings per share (1)

0.19

1.03

0.28

0.34

1.84

Year ended December 31,

2023

GAAP

IT and Supply Chain

Optimization

LifeMD Collaboration

Costs

Non-GAAP

Cost of sales

$

296,204

$

—

$

—

$

296,204

Gross profit

775,850

—

—

775,850

Selling, general, and administrative

649,448

(2,555

)

(5,000

)

641,893

Income from operations

126,402

2,555

5,000

133,957

Other income

2,395

—

—

2,395

Provision for income taxes

29,382

583

1,141

31,106

Net income

99,415

1,972

3,859

105,246

Diluted earnings per share (1)

9.10

0.18

0.35

9.64

(1) The weighted-average diluted shares outstanding used in the

calculation of these non-GAAP financial measures are the same as

the weighted-average shares outstanding used in the calculation of

the reported per share amounts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218029135/en/

Investor Contact: Medifast, Inc. Steven Zenker

InvestorRelations@medifastinc.com (443) 379-5256

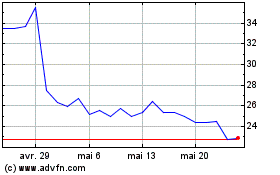

Medifast (NYSE:MED)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Medifast (NYSE:MED)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025