MetLife Poll Finds Growing Percentage of Plan Sponsors with De-Risking Goals Looking to Completely Divest Their Company’s Pension Liabilities in the Near Future

08 Octobre 2024 - 2:55PM

Business Wire

As LIMRA reports a 14% increase in pension risk transfer (PRT)

deals for the first half of 2024 compared to 20231, MetLife’s 2024

Pension Risk Transfer Poll finds the percentage of companies with

de-risking goals who plan to completely divest their defined

benefit (DB) pension plan liabilities has increased to 93%, up from

89% in the 2023 Poll. About half, 52%, plan to divest two to five

years from now, with an average of 3.8 years.

“As the Poll and other market data indicates, the pension risk

transfer market continues its bullish growth and will likely

continue to remain strong in the near future,” says Elizabeth

Walsh, vice president, U.S. Pensions, MetLife. “As a market leader

focused on service, MetLife has seen this activity firsthand,

including several transactions with the same clients as they

continue to derisk in tranches, focusing on specific participant

populations.”

The driving force between the continued interest in de-risking

remains the current macroeconomic environment. In fact, 47% of plan

sponsors say that rising interest rates are the top catalyst,

followed by rising inflation, 45%, and increased market volatility,

44%.

Preparing to Act

According to the Poll, 93% of plan sponsors say their company is

weighing its pension plan’s value against the cost of the benefit.

And, plan sponsors are preparing to take action to reduce their DB

plans’ pension risks, with many taking steps in the last two years

that are typically precursors to pension risk transfer. These steps

include improving their plan’s data quality (56%), increasing plan

contributions (52%), having more involvement from their C-suite

executives in DB plan management (29%), offering a lump sum

distribution “window” to terminated-vested participants (23%) and

adopting a liability driven investing (LDI) strategy to minimize

risks that could affect the plan’s funded status (20%).

“It is encouraging to see improving data quality as a top action

item,” says Walsh. “Through our implementation experience, we have

seen the benefit of clean participant data, which leads to a

smoother transfer of the administration to the insurer, and

ultimately, a better participant experience.”

As an additional indicator of plan sponsor’s interest in pension

de-risking, the Poll found 85% of plan sponsors are having, or

already had, discussions with their plan advisors/consultants about

a pension risk transfer.

Exploring De-Risking Strategies

When it comes to the type of pension risk transfer activity plan

sponsors report they will most likely use to achieve their

de-risking goals, 66% say they will use an annuity buyout,

including an annuity buyout on its own or a combination of lump sum

and an annuity buyout. This is up significantly from the 46% who

said they would choose this activity in MetLife’s inaugural Pension

Risk Transfer Poll in 2015.

The Poll also found that over two-thirds of plan sponsors, 68%,

will secure a group annuity for a retiree lift-out, transferring

the liabilities related to some or all of a plan’s retiree

population. According to the Poll, more than half of plan sponsors

who say they will use an annuity buyout, 54%, report they would

likely secure a single annuity buyout transaction, while 46% would

use a series of annuity buyout transactions.

“The current macro environment has led to favorable annuity

pricing, creating a sense of urgency for plan sponsors to act

sooner rather than later when choosing to pursue a transaction,”

says Walsh. “As the Poll shows, some plan sponsors may be

positioned to act quickly since they’ve started the path to

de-risking by taking some critical preparatory steps and are

keeping an eye on the market.”

When it comes to the timing of potential transactions, the Poll

found that 90% of plan sponsors have been closely tracking

estimated market pricing for annuity buyouts. In fact, 38% are

watching very closely. Eighty-two percent would be concerned about

missing a window of opportunity to secure an annuity buyout with

competitive rates.

To address this concern, MetLife recently launched its Pension

Risk Transfer Estimator Tool, which helps plan sponsors estimate

the cost of transferring certain pension liabilities to an

insurance provider.

About the Study

MetLife’s 2024 Pension Risk Transfer Poll was fielded between

July 16 and July 31, 2024. MetLife commissioned MMR Research

Associates, Inc. to conduct the online survey. Survey responses

were received from 250 DB plan sponsors with $100 million or more

in plan assets who have de-risking goals. The Poll results reflect

companies with average DB plan assets of $1.3 billion, and an

average funded status of 94%. To read the full report, visit

http://metlife.com/2024prtpoll.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Asia, Latin America, Europe and the

Middle East. For more information, visit www.metlife.com.

1

https://www.limra.com/en/newsroom/news-releases/2024/limra-u.s.-pension-risk-transfer-sales-jump-14-in-first-half-of-2024/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008020350/en/

MetLife: Judi Mahaney jmahaney@metlife.com 646-238-4655

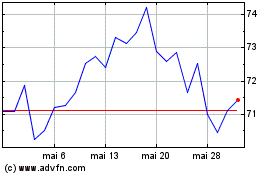

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025