0000789570FALSE00007895702024-08-212024-08-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 21, 2024

MGM Resorts International

(Exact name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 001-10362 | 88-0215232 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

3600 Las Vegas Boulevard South, Las Vegas, Nevada 89109

(Address of principal executive offices – Zip Code)

Registrant’s Telephone Number, Including Area Code: (702) 693-7120

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock (Par Value $0.01) | | MGM | | New York Stock Exchange | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CRF § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CRF § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers of Security Holders.

(d) On August 21, 2024, the Board of Directors (the “Board”) of MGM Resorts International (the “Company”) increased the number of directors of the Company from eleven to twelve and appointed Keith Barr, as a member of the Board. Mr. Barr was also appointed to serve on the Audit Committee of the Board. Additional Board committee memberships will be determined at a later date.

There is no arrangement or understanding between Mr. Barr and any other persons pursuant to which he was selected to serve as a director of the Company. There are no related party transactions between the Company and Mr. Barr that would require disclosure under Item 404(a) of Regulation S-K. Mr. Barr will be entitled to receive the same cash and equity compensation as the other independent directors as described under “Director Compensation” in the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission (the “Commission”) on March 22, 2024 and incorporated herein by reference; provided that the annual retainer to be provided to Mr. Barr, as well as the other independent directors, was increased to $100,000 following the Company’s Annual Meeting on May 1, 2024. In connection with his appointment, Mr. Barr also received a pro-rated grant of restricted stock units with a target value of $161,250. The restricted stock units vest on the earlier of the first anniversary of the grant date and the date of the Company’s next annual meeting. The grant was made pursuant to the Form of Restricted Stock Unit Agreement for non-employee directors previously filed as Exhibit 10.4 to the Company’s Current Report on Form 8-K filed with the Commission on March 10, 2017 and incorporated herein by reference. On August 21, 2024, the Company issued a press release regarding the election of Mr. Barr, a copy of which is furnished as Exhibit 99.l to this Form 8-K.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| | |

99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | MGM Resorts International |

| | | |

| Date: August 21, 2024 | By: | /s/ Jessica Cunningham |

| | | Name: Jessica Cunningham |

| | | Title: Senior Vice President, Legal Counsel and Assistant Secretary |

MGM RESORTS WELCOMES GLOBAL HOSPITALITY LEADER KEITH BARR

TO BOARD OF DIRECTORS

LAS VEGAS (AUGUST 21, 2024) - MGM Resorts International (NYSE: MGM) (“MGM Resorts” or the “Company”) today appointed Keith Barr, former CEO of IHG Hotels & Resorts (IHG), to the Company’s Board of Directors. Barr becomes the 12th member of the board.

Barr is a globally recognized leader in the hospitality industry, with more than 30 years of experience. He served as the CEO of IHG Hotels & Resorts between 2017 and 2023 and as IHG’s Chief Commercial Officer between 2013 and 2017. In that time, Barr successfully drove innovation and internal changes that increased revenues, improved operational efficiency and built a more customer-centric culture at IHG.

“Keith’s tremendous career is a testament to his leadership skills and eye for innovation,” said Paul Salem, Chair of the MGM Resorts Board of Directors. “His experience in hotel operations, technology, sales and marketing will be an incredible asset as he offers valuable guidance to MGM Resorts.”

MGM Resorts CEO & President Bill Hornbuckle added: “We welcome Keith to our Board and are excited to tap into his deep knowledge and insights as we continue to focus on providing world-class experiences for our guests. Keith has spent decades driving innovation and growth in the hospitality industry, and his expertise in building a highly successful international business will be invaluable as we drive our own international growth strategy.”

Barr built his hospitality executive career with roles as CEO of Greater China, COO of Australia and New Zealand, and multiple roles in the Americas with IHG. He has served on the World Travel and Tourism Council, British American Business Council and WiHTL. Barr also contributes his time to multiple advisory leadership roles at Cornell University, his alma mater.

“It’s an honor to serve in this leadership role as MGM Resorts continues to lead in hospitality experiences throughout the entire world,” said Barr. “I’m looking forward to bringing my global hospitality expertise to the table as our leadership team continues to build MGM’s reputation worldwide as the premier gaming and entertainment company.”

###

ABOUT MGM RESORTS INTERNATIONAL

MGM Resorts International (NYSE: MGM) is an S&P 500® global entertainment company with national and international locations featuring best-in-class hotels and casinos, state-of-the-art meetings and conference spaces, incredible live and theatrical entertainment experiences, and an extensive array of restaurant, nightlife and retail offerings. MGM Resorts creates immersive, iconic experiences through its suite of Las Vegas-inspired brands. The MGM Resorts portfolio encompasses 31 unique hotel and gaming destinations globally, including some of the most recognizable resort brands in the industry. The Company's 50/50 venture, BetMGM, LLC, offers U.S. sports betting and online gaming through market-leading brands, including BetMGM and partypoker, and the Company’s subsidiary LeoVegas AB offers sports betting and online gaming through market-leading brands in several jurisdictions throughout

Europe. The Company is currently pursuing targeted expansion in Asia through the integrated resort opportunity in Japan. Through its “Focused on What Matters: Embracing Humanity and Protecting the Planet” philosophy, MGM Resorts commits to creating a more sustainable future, while striving to make a bigger difference in the lives of its employees, guests, and in the communities where it operates. The global employees of MGM Resorts are proud of their company for being recognized as one of FORTUNE® Magazine's World's Most Admired Companies®.

Forward Looking Statements:

Statements in this release that are not historical facts are forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, and involve risks and/or uncertainties, including those described in the Company's public filings with the Securities and Exchange Commission. Forward-looking statements can be identified by the use of forward-looking terminology such as "believes," "expects," "could," "may," "will," "should," "seeks," "likely," "intends," "plans," "pro forma," "projects," "estimates" or "anticipates" or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. The Company has based forward-looking statements on management's current expectations and assumptions and not on historical facts. Examples of these statements include, but are not limited to, the Company's expectations regarding the execution of its gaming and entertainment strategy. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise, and the Company may not be able to realize them. The Company does not guarantee that the transaction or other events described herein will happen as described (or that they will happen at all). These forward-looking statements involve a number of risks and uncertainties. Among the important factors that could cause actual results to differ materially from those indicated in such forward-looking statements include risks related to the economic and market conditions in the markets in which the Company operates and competition with other destination travel locations throughout the United States and the world, the design, timing and costs of expansion projects, risks relating to international operations, permits, licenses, financings, approvals and other contingencies in connection with growth in new or existing jurisdictions and additional risks and uncertainties described in the Company's Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports). In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise, except as required by law. If the Company updates one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those other forward-looking statements.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

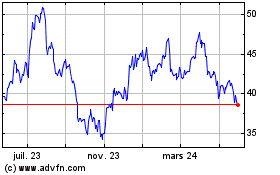

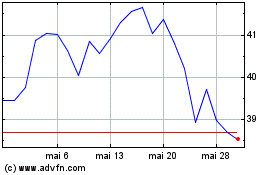

MGM Resorts (NYSE:MGM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

MGM Resorts (NYSE:MGM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024