Altria Group, Inc. (NYSE: MO) today reports our 2024

second-quarter and first-half business results and narrows our

guidance for 2024 full-year adjusted diluted earnings per share

(EPS).

“Altria’s momentum continues to build as we pursue our Vision to

responsibly lead the transition of adult smokers to a smoke-free

future,” said Billy Gifford, Altria’s Chief Executive Officer. “In

the second quarter, our companies’ innovative smoke-free products

delivered strong share and volume performance, and we hit

meaningful milestones that we believe set us up for future success.

NJOY received the first and only marketing granted orders from the

FDA for menthol e-vapor products, and we submitted PMTA

applications to the FDA for next generation NJOY and on!

products.”

“Our traditional tobacco businesses also remained resilient,

despite a challenging operating environment. Our highly cash

generative businesses supported continued investments in our

innovative product efforts, and we returned significant value to

shareholders during the first half of the year, with more than $5.8

billion delivered to shareholders through share repurchases and

dividends.”

First-half adjusted diluted EPS declined by 1.6%, consistent

with our guidance expectations for growth to be weighted to the

second half of the year. We are narrowing our full-year 2024

guidance and now expect to deliver adjusted diluted EPS in a range

of $5.07 to $5.15. This range represents an adjusted diluted EPS

growth rate of 2.5% to 4.0% from a base of $4.95 in 2023.

Altria Headline Financials1

($ in millions, except per share data)

Q2 2024

Change vs. Q2

2023

First Half 2024

Change vs. First Half

2023

Net revenues

$6,209

(4.6)%

$11,785

(3.6)%

Revenues net of excise taxes

$5,277

(3.0)%

$9,994

(2.0)%

Reported tax rate

25.7%

1.1 pp

24.5%

(1.6) pp

Adjusted tax rate

24.3%

(0.4) pp

24.5%

(0.3) pp

Reported diluted EPS2

$2.21

85.7%

$3.41

56.4%

Adjusted diluted EPS2

$1.31

—%

$2.46

(1.6)%

1 “Adjusted” financial measures presented in this release

exclude the impact of special items. See “Basis of Presentation”

for more information and see the schedules to this press release

for reconciliations to corresponding GAAP measures.

2 “EPS” represents diluted earnings per share.

As previously announced, a conference call with the investment

community and news media will be webcast on July 31, 2024 at 9:00

a.m. Eastern Time. Access to the webcast is available at

www.altria.com/webcasts.

NJOY

Business Results

Second Quarter:

- NJOY consumables reported shipment volume increased 14.7%

sequentially to 12.5 million units.

- NJOY devices reported shipment volume increased 80.0%

sequentially to 1.8 million units.

- NJOY retail share in the U.S. multi-outlet and convenience

channel increased 1.3 share points sequentially to 5.5%.

First Half:

- NJOY consumables reported shipment volume was 23.4 million

units.

- NJOY devices reported shipment volume was 2.8 million

units.

- NJOY retail share in the U.S. multi-outlet and convenience

channel was 4.8%.

Smoke-free Product Portfolio Update

Marketing Granted Orders (MGOs)

- In June 2024, NJOY received marketing authorizations from the

FDA for four menthol e-vapor products, including NJOY ACE Pod

Menthol 2.4% and 5%, NJOY DAILY Menthol 4.5% and NJOY DAILY Extra

Menthol 6%. NJOY has the first and only menthol e-vapor products

authorized by the FDA.

- Under the terms of the agreement pursuant to which we acquired

NJOY (the Merger Agreement), we were obligated to make cash

payments totaling $250 million if the FDA issued MGOs for NJOY

menthol pod products. As a result, once the FDA issued MGOs for

NJOY menthol products in June 2024, we made these payments in July

2024. Additionally, we recorded a pre-tax charge of approximately

$140 million during the second quarter of 2024, related to a change

in the fair value of the contingent payments as part of the NJOY

acquisition.

Premarket Tobacco Product Application (PMTA)

Submissions

- NJOY submitted a supplemental PMTA to the FDA to commercialize

and market the NJOY ACE 2.0 device, which incorporates access

restriction technology designed to prevent underage use. In

addition, NJOY re-submitted PMTAs for blueberry and watermelon pod

products that work exclusively with the 2.0 device. Under the terms

of the Merger Agreement, upon the FDA issuance of MGOs with respect

to NJOY blueberry and watermelon pod products, we are obligated to

make cash payments totaling $250 million.

- Helix submitted PMTAs to the FDA for on! PLUS, an innovative

pouch product made using our proprietary “soft-feel” material. The

PMTAs were submitted for three varieties: tobacco, mint and

wintergreen, each in three different nicotine strength

options.

Cash Returns to Shareholders

Share Repurchase Program

- We completed our $2.4 billion accelerated share repurchase

program (ASR program), which was announced during the first quarter

of 2024. Under the ASR program, we repurchased 53.9 million shares

at an average price of $44.50.

- As of June 30, 2024, we had $990 million remaining under our

currently authorized $3.4 billion share repurchase program, which

we expect to complete by December 31, 2024. Share repurchases

depend on marketplace conditions and other factors, and the program

remains subject to the discretion of our Board of Directors

(Board).

Dividends

- We paid dividends of $1.7 billion and $3.4 billion in the

second quarter and first half, respectively. Future dividend

payments remain subject to the discretion of our Board.

Environmental, Social and Governance

Our Corporate Responsibility Focus Areas are: (i) reduce the

harm of tobacco products, (ii) prevent underage use, (iii) protect

the environment, (iv) drive responsibility through our value chain,

(v) support our people and communities and (vi) engage and lead

responsibly. Our corporate responsibility reports are available on

the Responsibility section of www.altria.com.

- We recently published the following materials that highlight

our responsibility efforts and initiatives:

- 2023 Reduce Harm of Tobacco Products Snapshot;

- 2023 Prevent Underage Use Snapshot;

- 2023 Support Our People & Communities Snapshot; and

- 2023 Engage & Lead Responsibly Report.

2024 Full-Year Guidance

We narrow our guidance for 2024 full-year adjusted diluted EPS

to be in a range of $5.07 to $5.15, representing a growth rate of

2.5% to 4.0% from a base of $4.95 in 2023. We expect 2024 adjusted

diluted EPS growth to be weighted to the second half of the year.

Our guidance includes the impact of two additional shipping days in

2024, both of which occur in the second half, and assumes limited

impact on combustible and e-vapor product volumes from enforcement

efforts in the illicit e-vapor market.

While our 2024 full-year adjusted diluted EPS guidance accounts

for a range of scenarios, the external environment remains dynamic.

We will continue to monitor conditions related to (i) the economy,

including the cumulative impact of inflation, (ii) adult tobacco

consumer (ATC) dynamics, including purchasing patterns and adoption

of smoke-free products, (iii) illicit e-vapor enforcement and (iv)

regulatory, litigation and legislative developments.

Our 2024 full-year adjusted diluted EPS guidance range includes

planned investments in support of our Vision, such as (i)

marketplace activities in support of our smoke-free products and

(ii) continued smoke-free product research, development and

regulatory preparation expenses.

We now expect our 2024 full-year adjusted effective tax rate to

be in a range of 24.0% to 25.0%.

Our full-year adjusted diluted EPS guidance range and full-year

forecast for our adjusted effective tax rate exclude the impact of

certain income and expense items that our management believes are

not part of underlying operations. These items may include, for

example, loss on early extinguishment of debt, restructuring

charges, asset impairment charges, acquisition, disposition and

integration-related items, equity investment-related special items,

certain income tax items, charges associated with tobacco and

health and certain other litigation items, and resolutions of

certain non-participating manufacturer (NPM) adjustment disputes

under the MSA (NPM Adjustment Items). See Table 1 below for the

income and expense items for the second quarter and first half of

2024.

Our management cannot estimate on a forward-looking basis the

impact of certain income and expense items, including those items

noted in the preceding paragraph, on our reported diluted EPS or

our effective tax rate because these items, which could be

significant, may be unusual or infrequent, are difficult to predict

and may be highly variable. As a result, we do not provide a

corresponding U.S. generally accepted accounting principles (GAAP)

measure for, or reconciliation to, our adjusted diluted EPS

guidance or our adjusted effective tax rate forecast.

ALTRIA GROUP, INC.

See “Basis of Presentation” below for an explanation of

financial measures and reporting segments discussed in this

release.

Financial Performance

Second Quarter

- Net revenues decreased 4.6% to $6.2 billion, primarily driven

by lower net revenues in the smokeable products segment, partially

offset by higher net revenues in the oral tobacco products segment.

Revenues net of excise taxes decreased 3.0% to $5.3 billion.

- Reported diluted EPS increased 85.7% to $2.21, primarily driven

by the gain on the sale of the IQOS Tobacco Heating System

commercialization rights, lower tobacco and health and certain

other litigation items and fewer shares outstanding, partially

offset by lower reported operating companies income (OCI), which

includes a non-cash impairment of the Skoal trademark, and a change

in the fair value of contingent payments associated with the

acquisition of NJOY.

- Adjusted diluted EPS was unchanged at $1.31, as lower adjusted

OCI was offset by fewer shares outstanding.

First Half

- Net revenues decreased 3.6% to $11.8 billion, driven by lower

net revenues in the smokeable products segment, partially offset by

higher net revenues in the oral tobacco products segment and the

all other category. Revenues net of excise taxes decreased 2.0% to

$10.0 billion.

- Reported diluted EPS increased 56.4% to $3.41, primarily driven

by the gain on the sale of the IQOS Tobacco Heating System

commercialization rights, 2023 charges related to our former

investment in JUUL Labs, Inc. (JUUL), lower tobacco and health and

certain other litigation items, fewer shares outstanding and the

partial sale of our investment in ABI and related favorable income

tax items. These items were partially offset by lower reported OCI,

which includes a non-cash impairment of the Skoal trademark, and a

change in the fair value of contingent payments associated with the

acquisition of NJOY.

- Adjusted diluted EPS decreased 1.6% to $2.46, primarily driven

by lower adjusted OCI, partially offset by fewer shares

outstanding.

Table 1 - Altria’s Adjusted

Results

Second Quarter

Six Months Ended June

30,

2024

2023

Change

2024

2023

Change

Reported diluted EPS

$

2.21

$

1.19

85.7

%

$

3.41

$

2.18

56.4

%

Acquisition and disposition-related

items

(1.09

)

—

(1.09

)

—

Asset impairment

0.15

—

0.15

—

Tobacco and health and certain other

litigation items

0.02

0.12

0.03

0.17

Loss on disposition of JUUL equity

securities

—

—

—

0.14

ABI-related special items

0.01

—

(0.02

)

(0.01

)

Cronos-related special items

—

—

0.01

0.02

Income tax items

0.01

—

(0.03

)

—

Adjusted diluted EPS

$

1.31

$

1.31

—

%

$

2.46

$

2.50

(1.6

)%

Note: For details of pre-tax, tax and after-tax amounts, see

Schedules 7 and 9.

Special Items

The EPS impact of the following special items is shown in Table

1 and Schedules 4 and 5.

Acquisition and Disposition-Related Items

In the second quarter and first half of 2024, we recorded

acquisition and disposition-related items of $2.6 billion (or $1.09

per share), primarily related to a pre-tax gain of $2.7 billion

upon the assignment of the IQOS Tobacco Heating System

commercialization rights to Philip Morris International Inc. in

April 2024, partially offset by a pre-tax charge related to a

change in the fair value of the contingent payments associated with

the acquisition of NJOY.

Asset Impairment

In the second quarter and first half of 2024, we recorded a

non-cash, pre-tax charge of $354 million (or $0.15 per share) for

an impairment of the Skoal trademark.

Tobacco and Health and Certain Other Litigation Items

In the second quarter and first half of 2024, we recorded

pre-tax charges of $44 million (or $0.02 per share) and $68 million

(or $0.03 per share), respectively, for tobacco and health and

certain other litigation items.

In the second quarter and first half of 2023, we recorded

pre-tax charges of $290 million (or $0.12 per share) and $401

million (or $0.17 per share), respectively, for tobacco and health

and certain other litigation items and related interest costs. The

charges in the second quarter of 2023 were primarily driven by our

settlement of JUUL-related litigation.

Loss on Disposition of JUUL Equity Securities

In the first half of 2023, we recorded a non-cash, pre-tax loss

of $250 million (or $0.14 per share) related to the disposition of

our former investment in JUUL. We recorded a corresponding

adjustment to the JUUL tax valuation allowance.

ABI-Related Special Items

In the first half of 2024, ABI-related special items included

net pre-tax income of $62 million (or $0.02 per share), primarily

related to our pre-tax gain on the partial sale of our investment

in ABI, partially offset by transaction costs.

The ABI-related special items include our respective share of

the amounts recorded by ABI and additional adjustments related to

(i) the conversion of ABI-related special items from international

financial reporting standards to GAAP and (ii) adjustments to our

investment required under the equity method of accounting.

Cronos-Related Special Items

In the first half of 2023, Cronos-related special items included

pre-tax losses of $30 million (or $0.02 per share), substantially

all of which related to our share of special items recorded by

Cronos. We recorded a corresponding adjustment to the Cronos tax

valuation allowance.

Income Tax Items

In the first half of 2024, we recorded income tax items of $52

million (or $0.03 per share), due primarily to an income tax

benefit from the partial release of a valuation allowance on

JUUL-related losses, partially offset by interest expense on tax

reserves recorded in prior years. The valuation allowance release

was due to the capital gain associated with the partial sale of our

investment in ABI.

SMOKEABLE PRODUCTS

Revenues and OCI

Second Quarter

- Net revenues decreased 5.6%, primarily driven by lower shipment

volume and higher promotional investments, partially offset by

higher pricing. Revenues net of excise taxes decreased 4.0%.

- Reported OCI decreased 1.4%, primarily driven by lower shipment

volume, higher promotional investments, higher per unit settlement

charges and higher manufacturing costs, partially offset by higher

pricing and lower selling, general and administrative (SG&A)

costs, which include lower tobacco and health and certain other

litigation items.

- Adjusted OCI decreased 2.0%, primarily driven by lower shipment

volume, higher promotional investments, higher per unit settlement

charges and higher manufacturing costs, partially offset by higher

pricing and lower SG&A costs. Adjusted OCI margins increased by

1.2 percentage points to 61.6%.

First Half

- Net revenues decreased 4.7%, primarily driven by lower shipment

volume and higher promotional investments, partially offset by

higher pricing. Revenues net of excise taxes decreased 3.2%.

- Reported OCI decreased 1.9%, primarily driven by lower shipment

volume, higher promotional investments, higher per unit settlement

charges and higher manufacturing costs, partially offset by higher

pricing and lower SG&A costs, which include lower tobacco and

health and certain other litigation items.

- Adjusted OCI decreased 2.3%, primarily driven by lower shipment

volume, higher promotional investments, higher per unit settlement

charges and higher manufacturing costs, partially offset by higher

pricing and lower SG&A costs. Adjusted OCI margins increased by

0.6 percentage points to 61.0%.

Table 2 - Smokeable Products: Revenues

and OCI ($ in millions)

Second Quarter

Six Months Ended June

30,

2024

2023

Change

2024

2023

Change

Net revenues

$

5,495

$

5,820

(5.6

)%

$

10,401

$

10,910

(4.7

)%

Excise taxes

(908

)

(1,041

)

(1,742

)

(1,969

)

Revenues net of excise taxes

$

4,587

$

4,779

(4.0

)%

$

8,659

$

8,941

(3.2

)%

Reported OCI

$

2,807

$

2,846

(1.4

)%

$

5,246

$

5,349

(1.9

)%

NPM Adjustment Items

—

—

(6

)

—

Tobacco and health and certain other

litigation items

20

40

38

52

Adjusted OCI

$

2,827

$

2,886

(2.0

)%

$

5,278

$

5,401

(2.3

)%

Reported OCI margins 1

61.2

%

59.6

%

1.6 pp

60.6

%

59.8

%

0.8 pp

Adjusted OCI margins 1

61.6

%

60.4

%

1.2 pp

61.0

%

60.4

%

0.6 pp

1 Reported and adjusted OCI margins are calculated as reported

and adjusted OCI, respectively, divided by revenues net of excise

taxes.

Shipment Volume

Second Quarter

- Smokeable products segment reported domestic cigarette shipment

volume decreased 13.0%, primarily driven by the industry’s decline

rate (impacted by macroeconomic pressures on ATC discretionary

income and the growth of illicit e-vapor products), trade inventory

movements and retail share losses.

- When adjusted for trade inventory movements, smokeable products

segment domestic cigarette shipment volume decreased by an

estimated 11%.

- When adjusted for trade inventory movements, total estimated

domestic cigarette industry volume decreased by an estimated

9.5%.

- Reported cigar shipment volume decreased 0.9%.

First Half

- Smokeable products segment reported domestic cigarette shipment

volume decreased 11.5%, primarily driven by the industry’s decline

rate (impacted by macroeconomic pressures on ATC discretionary

income and the growth of illicit e-vapor products), retail share

losses and trade inventory movements.

- When adjusted for trade inventory movements, smokeable products

segment domestic cigarette shipment volume decreased by an

estimated 10.5%.

- When adjusted for trade inventory movements and other factors,

total estimated domestic cigarette industry volume decreased by an

estimated 9%.

- Reported cigar shipment volume decreased 3.4%.

Table 3 - Smokeable Products: Reported

Shipment Volume (sticks in millions)

Second Quarter

Six Months Ended June

30,

2024

2023

Change

2024

2023

Change

Cigarettes:

Marlboro

16,316

18,506

(11.8

)%

31,289

34,902

(10.4

)%

Other premium

826

954

(13.4

)%

1,573

1,779

(11.6

)%

Discount

756

1,101

(31.3

)%

1,486

2,149

(30.9

)%

Total cigarettes

17,898

20,561

(13.0

)%

34,348

38,830

(11.5

)%

Cigars:

Black & Mild

460

465

(1.1

)%

877

908

(3.4

)%

Other

2

1

100.0

%

2

2

—

%

Total cigars

462

466

(0.9

)%

879

910

(3.4

)%

Total smokeable products

18,360

21,027

(12.7

)%

35,227

39,740

(11.4

)%

Note: Cigarettes volume includes units sold as well as

promotional units but excludes units sold for distribution to

Puerto Rico, U.S. Territories to overseas military and by Philip

Morris Duty Free Inc., none of which, individually or in the

aggregate, is material to our smokeable products segment.

Retail Share and Brand Activity

Second Quarter

- Marlboro retail share of the total cigarette category was

42.0%, a decrease of 0.1 share point versus the prior year and

unchanged sequentially. Additionally, Marlboro share of the premium

segment was 59.4%, an increase of 0.7 share points versus the prior

year and 0.1 share point sequentially.

- The cigarette industry discount retail share was 29.3%, an

increase of 1.0 share point versus the prior year and 0.2 share

points sequentially, primarily due to increased macroeconomic

pressures on ATC discretionary income.

First Half

- Marlboro retail share of the total cigarette category was

42.0%, a decrease of 0.1 share point. Additionally, Marlboro share

of the premium segment was 59.3%, an increase of 0.7 share

points.

- The cigarette industry discount retail share was 29.2%, an

increase of 0.9 share points, primarily due to increased

macroeconomic pressures on ATC discretionary income.

Table 4 - Smokeable Products:

Cigarettes Retail Share (percent)

Second Quarter

Six Months Ended June

30,

2024

2023

Percentage point

change

2024

2023

Percentage point

change

Cigarettes:

Marlboro

42.0

%

42.1

%

(0.1

)

42.0

%

42.1

%

(0.1

)

Other premium

2.2

2.3

(0.1

)

2.3

2.3

—

Discount

2.0

2.5

(0.5

)

2.0

2.6

(0.6

)

Total cigarettes

46.2

%

46.9

%

(0.7

)

46.3

%

47.0

%

(0.7

)

Note: Retail share results for cigarettes are based on data from

Circana, LLC (Circana) as well as MSAi. Circana maintains a blended

retail service that uses a sample of stores and certain wholesale

shipments to project market share and depict share trends. This

service tracks sales in the food, drug, mass merchandisers,

convenience, military, dollar store and club trade classes. For

other trade classes selling cigarettes, retail share is based on

shipments from wholesalers to retailers through the Store Tracking

Analytical Reporting System (STARS), as provided by MSAi. This

service is not designed to capture sales through other channels,

including the internet, direct mail and some illicitly

tax-advantaged outlets. It is the standard practice of retail

services to periodically refresh their retail scan services, which

could restate retail share results that were previously released in

these services.

ORAL TOBACCO PRODUCTS

Revenues and OCI

Second Quarter

- Net revenues increased 4.6%, primarily driven by higher pricing

and lower promotional investments, partially offset by a higher

percentage of on! shipment volume relative to MST versus the prior

year (mix change) and lower MST shipment volume. Revenues net of

excise taxes increased 5.5%.

- Reported OCI decreased 78.1%, primarily driven by a non-cash

impairment of the Skoal trademark, mix change, higher costs and

lower MST shipment volume, partially offset by higher pricing and

lower promotional investments.

- Adjusted OCI increased 1.8%, primarily driven by higher pricing

and lower promotional investments, partially offset by mix change,

higher costs and lower MST shipment volume. Adjusted OCI margins

decreased by 2.4 percentage points to 65.6%.

First Half

- Net revenues increased 4.1%, primarily driven by higher pricing

and lower promotional investments, partially offset by lower MST

shipment volume and mix change. Revenues net of excise taxes

increased 5.0%.

- Reported OCI decreased 38.1%, primarily driven by a non-cash

impairment of the Skoal trademark, lower MST shipment volume, mix

change and higher costs, partially offset by higher pricing and

lower promotional investments.

- Adjusted OCI increased 3.1%, primarily driven by higher pricing

and lower promotional investments, partially offset by lower MST

shipment volume, mix change and higher costs. Adjusted OCI margins

decreased by 1.2 percentage points to 67.5%.

Table 5 - Oral Tobacco Products:

Revenues and OCI ($ in millions)

Second Quarter

Six Months Ended June

30,

2024

2023

Change

2024

2023

Change

Net revenues

$

711

$

680

4.6

%

$

1,362

$

1,308

4.1

%

Excise taxes

(24

)

(29

)

(49

)

(57

)

Revenues net of excise taxes

$

687

$

651

5.5

%

$

1,313

$

1,251

5.0

%

Reported OCI

$

97

$

443

(78.1

)%

$

532

$

859

(38.1

)%

Asset impairment

354

—

354

—

Adjusted OCI

$

451

$

443

1.8

%

$

886

$

859

3.1

%

Reported OCI margins 1

14.1

%

68.0

%

(53.9) pp

40.5

%

68.7

%

(28.2) pp

Adjusted OCI margins 1

65.6

%

68.0

%

(2.4) pp

67.5

%

68.7

%

(1.2) pp

1 Reported and adjusted OCI margins are calculated as reported

and adjusted OCI, respectively, divided by revenues net of excise

taxes.

Shipment Volume

Second Quarter

- Oral tobacco products segment reported domestic shipment volume

decreased 1.8%, primarily driven by retail share losses, partially

offset by the industry’s growth rate, trade inventory movements and

other factors. When adjusted for trade inventory movements and

calendar differences, oral tobacco products segment shipment volume

decreased by an estimated 3%.

First Half

- Oral tobacco products segment reported domestic shipment volume

decreased 2.5%, primarily driven by retail share losses, partially

offset by the industry’s growth rate, calendar differences and

other factors. When adjusted for calendar differences and trade

inventory movements, oral tobacco products segment shipment volume

decreased by an estimated 3.5%.

- Total oral tobacco industry volume increased by an estimated 9%

for the six months ended June 30, 2024, primarily driven by growth

in oral nicotine pouches, partially offset by declines in MST

volumes.

Table 6 - Oral Tobacco Products:

Reported Shipment Volume (cans and packs in millions)

Second Quarter

Six Months Ended June

30,

2024

2023

Change

2024

2023

Change

Copenhagen

103.9

114.9

(9.6

)%

203.0

223.9

(9.3

)%

Skoal

37.5

42.6

(12.0

)%

74.2

82.9

(10.5

)%

on!

41.2

30.0

37.3

%

74.5

55.2

35.0

%

Other

18.1

16.9

7.1

%

33.6

33.0

1.8

%

Total oral tobacco products

200.7

204.4

(1.8

)%

385.3

395.0

(2.5

)%

Note: Volume includes cans and packs sold, as well as

promotional units, but excludes international volume, which is

currently not material to our oral tobacco products segment. New

types of oral tobacco products, as well as new packaging

configurations of existing oral tobacco products, may or may not be

equivalent to existing MST products on a can-for-can basis. To

calculate volumes of cans and packs shipped, one pack of snus or

one can of oral nicotine pouches, irrespective of the number of

pouches in the pack, is assumed to be equivalent to one can of

MST.

Retail Share and Brand Activity

Second Quarter

- Oral tobacco products segment retail share was 37.9%, as share

declines for MST products were primarily driven by oral nicotine

pouch segment share growth.

- Total U.S. oral tobacco category share for on! nicotine pouches

was 8.1%, an increase of 1.2 share points versus the prior year and

1.0 share point sequentially.

- The U.S. nicotine pouch category grew to 41.6% of the U.S. oral

tobacco category, an increase of 12.3 share points versus the prior

year. In addition, on!’s share of the nicotine pouch category was

19.4%, a decrease of 4.2 share points versus the prior year and an

increase of 1.8 share points sequentially.

First Half

- Oral tobacco products segment retail share was 37.9%, as share

declines for MST products were primarily driven by oral nicotine

pouch segment share growth.

- Total U.S. oral tobacco category share for on! nicotine pouches

was 7.6%, an increase of 0.9 share points versus the prior

year.

- The U.S. nicotine pouch category grew to 40.9% of the U.S. oral

tobacco category, an increase of 12.9 share points versus the prior

year. In addition, on!’s share of the nicotine pouch category was

18.5%, a decrease of 5.4 share points versus the prior year.

Table 7 - Oral Tobacco Products: Retail

Share (percent)

Second Quarter

Six Months Ended June

30,

2024

2023

Percentage point

change

2024

2023

Percentage point

change

Copenhagen

19.5

%

24.2

%

(4.7

)

19.8

%

24.7

%

(4.9

)

Skoal

7.7

9.6

(1.9

)

7.9

9.9

(2.0

)

on!

8.1

6.9

1.2

7.6

6.7

0.9

Other

2.6

3.0

(0.4

)

2.6

3.0

(0.4

)

Total oral tobacco products

37.9

%

43.7

%

(5.8

)

37.9

%

44.3

%

(6.4

)

Note: Our oral tobacco products segment’s retail share results

exclude international volume, which is currently not material to

our oral tobacco products segment. Retail share results for oral

tobacco products are based on data from Circana, a tracking service

that uses a sample of stores to project market share and depict

share trends. This service tracks sales in the food, drug, mass

merchandisers, convenience, military, dollar store and club trade

classes on the number of cans and packs sold. Oral tobacco products

are defined by Circana as domestic tobacco derived oral products,

in the form of MST, snus and oral nicotine pouches. New types of

oral tobacco products, as well as new packaging configurations of

existing oral tobacco products, may or may not be equivalent to

existing MST products on a can-for-can basis. For example, one pack

of snus or one can of oral nicotine pouches, irrespective of the

number of pouches in the pack, is assumed to be equivalent to one

can of MST. Because this service represents retail share

performance only in key trade channels, it should not be considered

a precise measurement of actual retail share. It is the standard

practice of retail services to periodically refresh their retail

scan services, which could restate retail share results that were

previously released in these services.

Altria’s Profile

We have a leading portfolio of tobacco products for U.S. tobacco

consumers age 21+. Our Vision is to responsibly lead the transition

of adult smokers to a smoke-free future (Vision). We are Moving

Beyond Smoking™, leading the way in moving adult smokers away from

cigarettes by taking action to transition millions to potentially

less harmful choices - believing it is a substantial opportunity

for adult tobacco consumers, our businesses and society.

Our wholly owned subsidiaries include leading manufacturers of

both combustible and smoke-free products. In combustibles, we own

Philip Morris USA Inc. (PM USA), the most profitable U.S. cigarette

manufacturer, and John Middleton Co. (Middleton), a leading U.S.

cigar manufacturer. Our smoke-free portfolio includes ownership of

U.S. Smokeless Tobacco Company LLC (USSTC), the leading global

moist smokeless tobacco (MST) manufacturer, Helix Innovations LLC

(Helix), a leading manufacturer of oral nicotine pouches, and NJOY,

LLC (NJOY), an e-vapor manufacturer with a commercialized product

portfolio fully covered by marketing granted orders from the U.S.

Food and Drug Administration (FDA).

Additionally, we have a majority-owned joint venture, Horizon

Innovations LLC (Horizon), for the U.S. marketing and

commercialization of heated tobacco stick products.

Our equity investments include Anheuser-Busch InBev SA/NV (ABI),

the world’s largest brewer, and Cronos Group Inc. (Cronos), a

leading Canadian cannabinoid company.

The brand portfolios of our operating companies include

Marlboro®, Black & Mild®, Copenhagen®, Skoal®, on!® and NJOY®.

Trademarks related to Altria referenced in this release are the

property of Altria or our subsidiaries or are used with

permission.

Learn more about Altria at www.altria.com and follow us on X

(formerly known as Twitter), Facebook and LinkedIn.

Basis of Presentation

We report our financial results in accordance with GAAP. Our

management reviews OCI, which is defined as operating income before

general corporate expenses and amortization of intangibles, to

evaluate the performance of, and allocate resources to, our

segments. Our management also reviews certain financial results,

including OCI, OCI margins and diluted EPS, on an adjusted basis,

which excludes certain income and expense items, including those

items noted under “2024 Full-Year Guidance.” Our management does

not view any of these special items to be part of our underlying

results as they may be highly variable, may be unusual or

infrequent, are difficult to predict and can distort underlying

business trends and results. Our management also reviews income tax

rates on an adjusted basis. Our adjusted effective tax rate may

exclude certain income tax items from our reported effective tax

rate. Our management believes that adjusted financial measures

provide useful additional insight into underlying business trends

and results, and provide a more meaningful comparison of

year-over-year results. Our management uses adjusted financial

measures for planning, forecasting and evaluating business and

financial performance, including allocating capital and other

resources and evaluating results relative to employee compensation

targets. These adjusted financial measures are not required by, or

calculated in accordance with, GAAP and may not be calculated the

same as similarly titled measures used by other companies. These

adjusted financial measures should thus be considered as

supplemental in nature and not considered in isolation or as a

substitute for the related financial information prepared in

accordance with GAAP. We provide reconciliations of historical

adjusted financial measures to corresponding GAAP measures in this

release.

We use the equity method of accounting for our investment in ABI

and Cronos and report our share of ABI’s and Cronos’s results using

a one-quarter lag because ABI’s and Cronos’s results are not

available in time for us to record them in the concurrent period.

The one-quarter reporting lag for ABI and Cronos does not affect

our cash flows. We accounted for our former investment in the

equity securities of JUUL at fair value.

Our reportable segments are (i) smokeable products, consisting

of combustible cigarettes and machine-made large cigars, and (ii)

oral tobacco products, consisting of MST, snus and oral nicotine

pouches. We have included results for NJOY, Horizon, Helix

International, and other business activities, substantially all of

which consist of research and development expense related to

certain new product platforms and technologies in “All Other.”

Comparisons are to the corresponding prior-year period unless

otherwise stated.

Forward-Looking and Cautionary Statements

This release contains projections of future results and other

forward-looking statements that are subject to a number of risks

and uncertainties and are made pursuant to the Safe Harbor

Provisions of the Private Securities Litigation Reform Act of

1995.

Important factors that may cause actual results to differ

materially from those contained in the forward-looking statements

included in this release are described in our publicly filed

reports, including our Annual Report on Form 10-K for the year

ended December 31, 2023. These factors include the following:

- our inability to anticipate and respond to changes in adult

tobacco consumer preferences and purchase behavior;

- our inability to compete effectively;

- the growth of the e-vapor category, including illegal

disposable e-vapor products, which contributes to reductions in

domestic cigarette consumption levels and shipment volume;

- the risks associated with illicit trade in tobacco products,

including counterfeit products, illegally imported products,

illegal disposable e-vapor products, illegal oral nicotine products

and products designed to avoid the regulatory framework for tobacco

products, such as products using nicotine analogues, each of which

contribute to reductions in the consumption levels and shipment

volumes of our businesses’ products;

- our failure to commercialize innovative products, including

tobacco products that may reduce health risks relative to other

tobacco products and appeal to adult tobacco consumers;

- changes, including in macroeconomic and geopolitical conditions

(including inflation), that result in shifts in adult tobacco

consumer disposable income and purchasing behavior, including

choosing lower-priced and discount brands or products, and

reductions in shipment volumes;

- unfavorable outcomes with respect to litigation proceedings or

any governmental investigations, including significant monetary and

non-monetary remedies and importation bans;

- the risks associated with significant federal, state and local

government actions, including FDA regulatory actions and inaction,

and various private sector actions;

- increases in tobacco product-related taxes;

- our failure to complete or manage successfully strategic

transactions, including our acquisition of NJOY and other

acquisitions, dispositions, joint ventures and investments in third

parties, or realize the anticipated benefits of such

transactions;

- significant changes in price, availability or quality of

tobacco, other raw materials or component parts, including as a

result of changes in macroeconomic, climate and geopolitical

conditions;

- our reliance on a few significant facilities and a small number

of key suppliers, distributors and distribution chain service

providers and the risks associated with an extended disruption at a

facility or in service by a supplier, distributor or distribution

chain service provider;

- the risk that we may be required to write down intangible

assets, including trademarks and goodwill, due to impairment;

- the risk that we could decide, or be required, to recall

products;

- the various risks related to health epidemics and pandemics and

the measures that international, federal, state and local

governments, agencies, law enforcement and health authorities

implement to address them;

- our inability to attract and retain a highly skilled and

diverse workforce due to the decreasing social acceptance of

tobacco usage, tobacco control actions and other factors;

- the risks associated with the various U.S. and foreign laws and

regulations to which we are subject due to our international

business operations;

- the risks concerning a challenge to our tax positions, an

increase in the income tax rate or other changes to federal or

state tax laws;

- the risks associated with legal and regulatory requirements

related to climate change and other environmental sustainability

matters;

- disruption and uncertainty in the credit and capital markets,

including risk of losing access to these markets;

- a downgrade or potential downgrade of our credit ratings;

- our inability to attract investors due to increasing investor

expectations of our performance relating to corporate

responsibility factors, including environmental, social and

governance matters;

- the failure of our, or our key service providers’ or key

suppliers’, information systems to function as intended, or

cyber-attacks or security breaches affecting us or our key service

providers or key suppliers;

- our failure, or the failure of our key service providers or key

suppliers, to comply with laws related to personal data protection,

privacy, artificial intelligence and information security;

- the risk that the expected benefits of our investment in ABI

may not materialize in the expected manner or timeframe or at all,

including due to macroeconomic and geopolitical conditions; foreign

currency exchange rates; ABI’s business results; ABI’s share price;

impairment losses on the value of our investment; our incurrence of

additional tax liabilities related to our investment in ABI; and

reductions in the number of directors that we can have appointed to

the ABI board of directors; and

- the risks associated with our investment in Cronos, including

legal, regulatory and reputational risks and the risk that the

expected benefits of the transaction may not materialize in the

expected timeframe or at all.

You should understand that it is not possible to predict or

identify all factors and risks. Consequently, you should not

consider the foregoing list complete. We do not undertake to update

any forward-looking statement that we may make from time to time

except as required by applicable law. All subsequent written and

oral forward-looking statements attributable to Altria or any

person acting on our behalf are expressly qualified in their

entirety by the cautionary statements referenced above.

Schedule 1

ALTRIA GROUP, INC.

and Subsidiaries

Consolidated Statements of

Earnings

For the Quarters Ended June

30,

(dollars in millions, except per

share data)

(Unaudited)

2024

2023

% Change

Net revenues

$

6,209

$

6,508

(4.6

)%

Cost of sales 1

1,602

1,681

Excise taxes on products 1

932

1,070

Gross profit

3,675

3,757

(2.2

)%

Marketing, administration and research

costs

528

472

Asset impairment

354

—

Operating companies income

2,793

3,285

(15.0

)%

Amortization of intangibles

37

27

General corporate expenses

223

353

Operating income

2,533

2,905

(12.8

)%

Interest and other debt expense, net

261

257

Net periodic benefit income, excluding

service cost

(25

)

(31

)

(Income) losses from investments in equity

securities 1

(119

)

(127

)

Gain on the sale of IQOS System

commercialization rights

(2,700

)

—

Earnings before income taxes

5,116

2,806

82.3

%

Provision for income taxes

1,313

689

Net earnings

$

3,803

$

2,117

79.6

%

Per share data:

Diluted earnings per share

$

2.21

$

1.19

85.7

%

Weighted-average diluted shares

outstanding

1,718

1,782

(3.6

)%

1 Cost of sales includes charges for

resolution expenses related to state settlement agreements and FDA

user fees. Supplemental information concerning those items, excise

taxes on products sold and (income) losses from investments in

equity securities is shown in Schedule 5.

Schedule 2

ALTRIA GROUP, INC.

and Subsidiaries

Selected Financial Data

For the Quarters Ended June

30,

(dollars in millions)

(Unaudited)

Net Revenues

Smokeable Products

Oral Tobacco Products

All Other

Total

2024

$

5,495

$

711

$

3

$

6,209

2023

5,820

680

8

6,508

% Change

(5.6

)%

4.6

%

(62.5

)%

(4.6

)%

Reconciliation:

For the quarter ended June 30,

2023

$

5,820

$

680

$

8

$

6,508

Operations

(325

)

31

(5

)

(299

)

For the quarter ended June 30,

2024

$

5,495

$

711

$

3

$

6,209

Operating Companies Income

(Loss)

Smokeable Products

Oral Tobacco Products

All Other

Total

2024

$

2,807

$

97

$

(111

)

$

2,793

2023

2,846

443

(4

)

3,285

% Change

(1.4

)%

(78.1

)%

(100%+)

(15.0

)%

Reconciliation:

For the quarter ended June 30,

2023

$

2,846

$

443

$

(4

)

$

3,285

Tobacco and health and certain other

litigation items - 2023

40

—

—

40

40

—

—

40

Asset impairment - 2024

—

(354

)

—

(354

)

Tobacco and health and certain other

litigation items - 2024

(20

)

—

—

(20

)

(20

)

(354

)

—

(374

)

Operations

(59

)

8

(107

)

(158

)

For the quarter ended June 30,

2024

$

2,807

$

97

$

(111

)

$

2,793

Schedule 3

ALTRIA GROUP, INC.

and Subsidiaries

Consolidated Statements of

Earnings

For the Six Months Ended June

30,

(dollars in millions, except per

share data)

(Unaudited)

2024

2023

% Change

Net revenues

$

11,785

$

12,227

(3.6

)%

Cost of sales 1

3,039

3,115

Excise taxes on products 1

1,791

2,026

Gross profit

6,955

7,086

(1.8

)%

Marketing, administration and research

costs

995

891

Asset impairment

354

—

Operating companies income

5,606

6,195

(9.5

)%

Amortization of intangibles

64

45

General corporate expenses

335

488

Operating income

5,207

5,662

(8.0

)%

Interest and other debt expense, net

515

486

Net periodic benefit income, excluding

service cost

(49

)

(62

)

(Income) losses from investments in equity

securities 1

(414

)

(47

)

Gain on the sale of IQOS System

commercialization rights

(2,700

)

—

Earnings before income taxes

7,855

5,285

48.6

%

Provision for income taxes

1,923

1,381

Net earnings

$

5,932

$

3,904

51.9

%

Per share data2:

Diluted earnings per share

$

3.41

$

2.18

56.4

%

Weighted-average diluted shares

outstanding

1,738

1,784

(2.6

)%

1 Cost of sales includes charges for

resolution expenses related to state settlement agreements and FDA

user fees. Supplemental information concerning those items, excise

taxes on products sold and (income) losses from investments in

equity securities is shown in Schedule 5.

2 Diluted earnings per share are computed

independently for each period. Accordingly, the sum of the

quarterly earnings per share amounts may not agree to the

year-to-date amounts.

Schedule 4

ALTRIA GROUP, INC.

and Subsidiaries

Selected Financial Data

For the Six Months Ended June

30,

(dollars in millions)

(Unaudited)

Net Revenues

Smokeable Products

Oral Tobacco Products

All Other

Total

2024

$

10,401

$

1,362

$

22

$

11,785

2023

10,910

1,308

9

12,227

% Change

(4.7

)%

4.1

%

100%+

(3.6

)%

Reconciliation:

For the six months ended June 30,

2023

$

10,910

$

1,308

$

9

$

12,227

Operations

(509

)

54

13

(442

)

For the six months ended June 30,

2024

$

10,401

$

1,362

$

22

$

11,785

Operating Companies Income

(Loss)

Smokeable Products

Oral Tobacco Products

All Other

Total

2024

$

5,246

$

532

$

(172

)

$

5,606

2023

5,349

859

(13

)

6,195

% Change

(1.9

)%

(38.1

)%

(100%+)

(9.5

)%

Reconciliation:

For the six months ended June 30,

2023

$

5,349

$

859

$

(13

)

$

6,195

Tobacco and health and certain other

litigation items - 2023

52

—

—

52

52

—

—

52

NPM Adjustment Items - 2024

6

—

—

6

Asset impairment - 2024

—

(354

)

—

(354

)

Tobacco and health and certain other

litigation items - 2024

(38

)

—

—

(38

)

(32

)

(354

)

—

(386

)

Operations

(123

)

27

(159

)

(255

)

For the six months ended June 30,

2024

$

5,246

$

532

$

(172

)

$

5,606

Schedule 5

ALTRIA GROUP, INC.

and Subsidiaries

Supplemental Financial Data

(dollars in millions)

(Unaudited)

For the Quarters Ended June

30,

For the Six Months

Ended June 30,

2024

2023

2024

2023

The segment detail of excise taxes on

products sold is as follows:

Smokeable products

$

908

$

1,041

$

1,742

$

1,969

Oral tobacco products

24

29

49

57

$

932

$

1,070

$

1,791

$

2,026

The segment detail of charges for

resolution expenses related to state settlement agreements included

in cost of sales is as follows:

Smokeable products

$

924

$

1,017

$

1,779

$

1,911

Oral tobacco products

2

—

5

3

$

926

$

1,017

$

1,784

$

1,914

The segment detail of FDA user fees

included in cost of sales is as follows:

Smokeable products

$

64

$

67

$

124

$

130

Oral tobacco products

1

1

2

2

$

65

$

68

$

126

$

132

The detail of (income) losses from

investments in equity securities is as follows:

ABI

$

(121

)

$

(135

)

$

(434

)

$

(340

)

Cronos

2

8

20

43

JUUL

—

—

—

250

$

(119

)

$

(127

)

$

(414

)

$

(47

)

Schedule 6

ALTRIA GROUP, INC.

and Subsidiaries

Net Earnings and Diluted Earnings

Per Share

For the Quarters Ended June

30,

(dollars in millions, except per

share data)

(Unaudited)

Net Earnings

Diluted EPS

2024 Net Earnings

$

3,803

$

2.21

2023 Net Earnings

$

2,117

$

1.19

% Change

79.6

%

85.7

%

Reconciliation:

2023 Net Earnings

$

2,117

$

1.19

2023 Acquisition and disposition-related

items

13

—

2023 Tobacco and health and certain other

litigation items

217

0.12

2023 ABI-related special items

(2

)

—

2023 Cronos-related special items

4

—

2023 Income tax items

(3

)

—

Subtotal 2023 special items

229

0.12

2024 Acquisition and disposition-related

items

1,882

1.09

2024 Asset impairment

(264

)

(0.15

)

2024 Tobacco and health and certain other

litigation items

(33

)

(0.02

)

2024 ABI-related special items

(19

)

(0.01

)

2024 Cronos-related special items

(2

)

—

2024 Income tax items

(19

)

(0.01

)

Subtotal 2024 special items

1,545

0.90

Fewer shares outstanding

—

0.05

Change in tax rate

11

—

Operations

(99

)

(0.05

)

2024 Net Earnings

$

3,803

$

2.21

Schedule 7

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and

non-GAAP Measures

For the Quarters Ended June

30,

(dollars in millions, except per

share data)

(Unaudited)

Earnings before Income

Taxes

Provision for Income

Taxes

Net Earnings

Diluted EPS

2024 Reported

$

5,116

$

1,313

$

3,803

$

2.21

Acquisition and disposition-related

items

(2,557

)

(675

)

(1,882

)

(1.09

)

Asset impairment

354

90

264

0.15

Tobacco and health and certain other

litigation items

44

11

33

0.02

ABI-related special items

24

5

19

0.01

Cronos-related special items

3

1

2

—

Income tax items

—

(19

)

19

0.01

2024 Adjusted for Special Items

$

2,984

$

726

$

2,258

$

1.31

2023 Reported

$

2,806

$

689

$

2,117

$

1.19

Acquisition and disposition-related

items

18

5

13

—

Tobacco and health and certain other

litigation items

290

73

217

0.12

ABI-related special items

(3

)

(1

)

(2

)

—

Cronos-related special items

4

—

4

—

Income tax items

—

3

(3

)

—

2023 Adjusted for Special Items

$

3,115

$

769

$

2,346

$

1.31

2024 Reported Net Earnings

$

3,803

$

2.21

2023 Reported Net Earnings

$

2,117

$

1.19

% Change

79.6

%

85.7

%

2024 Net Earnings Adjusted for Special

Items

$

2,258

$

1.31

2023 Net Earnings Adjusted for Special

Items

$

2,346

$

1.31

% Change

(3.8

)%

—

%

Schedule 8

ALTRIA GROUP, INC.

and Subsidiaries

Net Earnings and Diluted Earnings

Per Share

For the Six Months Ended June

30,

(dollars in millions, except per

share data)

(Unaudited)

Net Earnings

Diluted EPS1

2024 Net Earnings

$

5,932

$

3.41

2023 Net Earnings

$

3,904

$

2.18

% Change

51.9

%

56.4

%

Reconciliation:

2023 Net Earnings

$

3,904

$

2.18

2023 Acquisition and disposition-related

items

1

—

2023 Tobacco and health and certain other

litigation items

301

0.17

2023 Loss on disposition of JUUL equity

securities

250

0.14

2023 ABI-related special items

(22

)

(0.01

)

2023 Cronos-related special items

30

0.02

Subtotal 2023 special items

560

0.32

2024 NPM Adjustment Items

5

—

2024 Acquisition and disposition-related

items

1,882

1.09

2024 Asset impairment

(264

)

(0.15

)

2024 Tobacco and health and certain other

litigation items

(52

)

(0.03

)

2024 ABI-related special items

48

0.02

2024 Cronos-related special items

(19

)

(0.01

)

2024 Income tax items

52

0.03

Subtotal 2024 special items

1,652

0.95

Fewer shares outstanding

—

0.06

Change in tax rate

17

0.01

Operations

(201

)

(0.11

)

2024 Net Earnings

$

5,932

$

3.41

1 Diluted earnings per share are computed

independently for each period. Accordingly, the sum of the

quarterly earnings per share amounts may not agree to the

year-to-date amounts.

Schedule 9

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and

non-GAAP Measures

For the Six Months Ended June

30,

(dollars in millions, except per

share data)

(Unaudited)

Earnings before Income

Taxes

Provision for Income

Taxes

Net Earnings

Diluted EPS1

2024 Reported

$

7,855

$

1,923

$

5,932

$

3.41

NPM Adjustment Items

(6

)

(1

)

(5

)

—

Acquisition and disposition-related

items

(2,557

)

(675

)

(1,882

)

(1.09

)

Asset impairment

354

90

264

0.15

Tobacco and health and certain other

litigation items

68

16

52

0.03

ABI-related special items

(62

)

(14

)

(48

)

(0.02

)

Cronos-related special items

20

1

19

0.01

Income tax items

—

52

(52

)

(0.03

)

2024 Adjusted for Special Items

$

5,672

$

1,392

$

4,280

$

2.46

2023 Reported

$

5,285

$

1,381

$

3,904

$

2.18

Acquisition and disposition-related

items

1

—

1

—

Tobacco and health and certain other

litigation items

401

100

301

0.17

Loss on disposition of JUUL equity

securities

250

—

250

0.14

ABI-related special items

(28

)

(6

)

(22

)

(0.01

)

Cronos-related special items

30

—

30

0.02

2023 Adjusted for Special Items

$

5,939

$

1,475

$

4,464

$

2.50

2024 Reported Net Earnings

$

5,932

$

3.41

2023 Reported Net Earnings

$

3,904

$

2.18

% Change

51.9

%

56.4

%

2024 Net Earnings Adjusted for Special

Items

$

4,280

$

2.46

2023 Net Earnings Adjusted for Special

Items

$

4,464

$

2.50

% Change

(4.1

)%

(1.6

)%

1 Diluted earnings per share are computed

independently for each period. Accordingly, the sum of the

quarterly earnings per share amounts may not agree to the

year-to-date amounts.

Schedule 10

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and

non-GAAP Measures

For the Year Ended December 31,

2023

(dollars in millions, except per

share data)

(Unaudited)

Earnings before Income

Taxes

Provision for Income

Taxes

Net Earnings

Diluted EPS

2023 Reported

$

10,928

$

2,798

$

8,130

$

4.57

NPM Adjustment Items

(50

)

(12

)

(38

)

(0.02

)

Acquisition, disposition and

integration-related items

35

9

26

0.01

Tobacco and health and certain other

litigation items

430

107

323

0.18

Loss on disposition of JUUL equity

securities

250

—

250

0.14

ABI-related special items

89

19

70

0.03

Cronos-related special items

29

—

29

0.02

Income tax items

—

(32

)

32

0.02

2023 Adjusted for Special Items

$

11,711

$

2,889

$

8,822

$

4.95

Schedule 11

ALTRIA GROUP, INC.

and Subsidiaries

Condensed Consolidated Balance

Sheets

(dollars in millions)

(Unaudited)

June 30, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

1,799

$

3,686

Inventories

1,174

1,215

Other current assets

567

684

Property, plant and equipment, net

1,620

1,652

Goodwill and other intangible assets,

net

19,993

20,477

Investments in equity securities

8,335

10,011

Other long-term assets

899

845

Total assets

$

34,387

$

38,570

Liabilities and

Stockholders’ Equity (Deficit)

Current portion of long-term debt

$

1,553

$

1,121

Accrued settlement charges

1,320

2,563

Deferred gain from the sale of IQOS System

commercialization rights

—

2,700

Other current liabilities

4,909

4,935

Long-term debt

23,470

25,112

Deferred income taxes

3,281

2,799

Accrued pension costs

127

130

Accrued postretirement health care

costs

1,086

1,079

Other long-term liabilities

1,607

1,621

Total liabilities

37,353

42,060

Total stockholders’ equity (deficit)

attributable to Altria

(3,016

)

(3,540

)

Noncontrolling interest

50

50

Total liabilities and stockholders’

equity (deficit)

$

34,387

$

38,570

Total debt

$

25,023

$

26,233

Schedule 12

ALTRIA GROUP, INC.

and Subsidiaries

Supplemental Financial Data for

Special Items

For the Quarters Ended June

30,

(dollars in millions)

(Unaudited)

Marketing,

administration and research costs

Asset

impairment

General corporate

expenses

Interest and other debt

(income) expense, net

(Income) losses from

investments in equity securities

Gain on the sale of IQOS

System commercialization rights

2024 Special Items - (Income)

Expense

Acquisition and disposition-related

items

—

—

143

—

—

(2,700

)

Asset impairment

—

354

—

—

—

—

Tobacco and health and certain other

litigation items

20

—

24

—

—

—

ABI-related special items

—

—

—

—

24

—

Cronos-related special items

—

—

—

—

3

—

2023 Special Items - (Income)

Expense

Acquisition and disposition-related

items

—

—

41

(23

)

—

—

Tobacco and health and certain other

litigation items

40

—

240

10

—

—

ABI-related special items

—

—

—

—

(3

)

—

Cronos-related special items

—

—

—

—

4

—

Note: This schedule is intended to provide supplemental

financial data for certain income and expense items that management

believes are not part of underlying operations and their

presentation in Altria’s consolidated statements of earnings. This

schedule is not intended to provide, or reconcile, non-GAAP

financial measures.

Schedule 13

ALTRIA GROUP, INC.

and Subsidiaries

Supplemental Financial Data for

Special Items

For the Six Months Ended June

30,

(dollars in millions)

(Unaudited)

Cost of Sales

Marketing, administration and

research costs

Asset impairment

General corporate

expenses

Interest and other debt

(income) expense, net

(Income) losses from

investments in equity securities

Gain on the sale of IQOS

System commercialization rights

2024 Special Items - (Income)

Expense

NPM Adjustment Items

$

(6

)

$

—

$

—

$

—

$

—

$

—

$

—

Acquisition and disposition-related

items

—

—

—

143

—

(2,700

)

Asset impairment

—

—

354

—

—

—

—

Tobacco and health and certain other

litigation items

—

38

—

30

—

—

—

ABI-related special items

—

—

—

59

3

(124

)

—

Cronos-related special items

—

—

—

—

—

20

—

2023 Special Items - (Income)

Expense

Acquisition and disposition-related

items

—

—

—

44

(43

)

—

—

Tobacco and health and certain other

litigation items

—

52

—

338

11

—

—

Loss on disposition of JUUL equity

securities

—

—

—

—

—

250

—

ABI-related special items

—

—

—

—

—

(28

)

—

Cronos-related special items

—

—

—

—

—

30

—

Note: This schedule is intended to provide supplemental

financial data for certain income and expense items that management

believes are not part of underlying operations and their

presentation in our consolidated statements of earnings. This

schedule is not intended to provide, or reconcile, non-GAAP

financial measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730496966/en/

Altria Client Services Investor Relations 804-484-8222

Altria Client Services Media Relations 804-484-8897

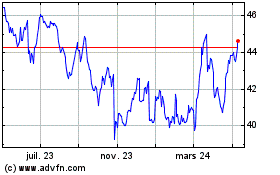

Altria (NYSE:MO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

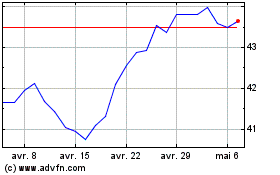

Altria (NYSE:MO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024