Murphy Oil Corporation (NYSE: MUR) (“Murphy” or the “Company”)

announced today the early tender results of its previously

announced series of tender offers (the “Tender Offers”) to purchase

for cash up to $600,000,000 aggregate principal amount (the

“Maximum Aggregate Cap”) of certain of its outstanding series of

senior notes listed in the table below (collectively, the “Notes”).

The Tender Offers are being made pursuant to the terms and

conditions set forth in the Offer to Purchase, dated September 19,

2024 (the “Offer to Purchase”). The Company refers investors to the

Offer to Purchase for the complete terms and conditions of the

Tender Offers.

As of 5:00 p.m., New York City time, on October 2, 2024 (such

date and time, the “Early Tender Date”), according to information

provided to Global Bondholder Services Corporation, the tender and

information agent for the Tender Offers, the aggregate principal

amount of each series of Notes listed in the table below has been

validly tendered and not validly withdrawn in each Tender Offer.

Withdrawal rights for the Notes expired at 5:00 p.m., New York City

time, on the Early Tender Date.

Title of Security

CUSIP Number

Principal Amount

Outstanding

Maximum SubCap(1)

Acceptance Priority

Level(2)

Principal Amount Tendered at

Early Tender Date

Percentage of Outstanding

Notes Tendered

Total Consideration(3)

(4)

Aggregate Principal Amount

Accepted for Purchase

Aggregate Purchase Price(3)

(4)

5.875% Senior Notes due 2027

626717 AM4 /

US626717AM42

$416,731,000

N/A

1

$258,380,000

62.00%

$1,012.50

$258,380,000

$261,609,750

7.050% Senior Notes due 2029

626717 AA0 /

US626717AA04

$179,708,000

$120,000,000

2

$62,105,000

34.56%

$1,077.50

$62,105,000

$66,918,137.5

6.375% Senior Notes due 2028

626717 AN2 /

US626717AN25

$348,744,000

N/A

3

$200,154,000

57.39%

$1,027.50

$200,154,000

$205,658,235

(1)

The maximum subcap applicable to the

7.050% Senior Notes due 2029 (the “2029 Notes”) of $120,000,000

(the “2029 Maximum SubCap”) represents the maximum aggregate

principal amount of the 2029 Notes that may be purchased in the

tender offer for the 2029 Notes.

(2)

Subject to the Maximum Aggregate Cap and

proration if applicable, the principal amount of Notes that is

purchased in each tender offer will be determined in accordance

with the applicable acceptance priority level (in numerical

priority order) specified in this column; provided that (i) we will

not accept 2029 Notes in an aggregate principal amount that exceeds

the 2029 Maximum SubCap and (ii) Notes validly tendered prior to or

at the Early Tender Date (as defined herein) will be accepted for

purchase in priority to other Notes validly tendered after the

Early Tender Date.

(3)

Does not include accrued and unpaid

interest on the Notes, which will also be payable as provided

herein.

(4)

Includes the Early Tender Premium (as

defined herein).

Subject to the satisfaction or waiver of the conditions to the

Tender Offers, the Company expects to accept for purchase all Notes

that were validly tendered at or prior to the Early Tender Date.

The Company expects to make payment for the accepted Notes on

October 7, 2024 (the “Early Settlement Date”). The Company intends

to fund the purchase of validly tendered and accepted Notes on the

Early Settlement Date with the net proceeds from the Debt Financing

(as defined herein) and available cash on hand.

The Tender Offers are conditioned upon, among other things, the

successful completion (in the sole determination of the Company) of

one or more debt financing transactions raising aggregate gross

proceeds of an amount at least equal to $600,000,000 (the “Debt

Financing” and such condition, the “Financing Condition”). The

Company expects to satisfy the Financing Condition with the closing

of its offering of new 6.000% Senior Notes due 2032, which is

expected to occur on the date hereof. However, no assurances can be

given that the Company will complete the Debt Financing.

The Tender Offers are scheduled to expire at 5:00 p.m., New York

City time, on October 18, 2024.

The consideration to be paid for the Notes validly tendered and

not validly withdrawn per $1,000 principal amount of such Notes

validly tendered and accepted for purchase pursuant to the

applicable Tender Offer is the amount set forth in the table above

under the heading “Total Consideration.” The amounts set forth in

the table above under “Total Consideration” include an early tender

premium of $50 per $1,000 principal amount of Notes accepted for

purchase (the “Early Tender Premium”). Each holder who validly

tendered and did not validly withdraw its Notes at or prior to the

Early Tender Date and whose Notes are accepted for purchase will be

entitled to receive the applicable “Total Consideration” set forth

in the table above under the heading “Total Consideration,” which

includes the Early Tender Premium. All holders of Notes accepted

for purchase will also receive accrued interest from, and

including, the most recent applicable interest payment date

preceding the Early Settlement Date to, but not including, the

Early Settlement Date, if and when such Notes are accepted for

payment.

INFORMATION RELATING TO THE TENDER OFFERS

The complete terms and conditions of the Tender Offers are set

forth in the Offer to Purchase. Investors with questions regarding

the terms and conditions of the Tender Offers may contact J.P.

Morgan Securities LLC at (866) 834-4666 (toll-free) or (212)

834-4818 (collect).

Global Bondholder Services Corporation is the tender and

information agent for the Tender Offers. Any questions regarding

procedures for tendering Notes or request for copies of the Offer

to Purchase should be directed to Global Bondholder Services

Corporation by any of the following means: by telephone at (855)

654-2014 (toll-free) or (212) 430-3774 (collect); by email at

contact@gbsc-usa.com; or by internet at the following web address:

https://www.gbsc-usa.com/MUR/.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders with respect to, the Notes. No offer,

solicitation, purchase or sale will be made in any jurisdiction in

which such an offer, solicitation or sale would be unlawful. The

Tender Offers are being made solely pursuant to the Offer to

Purchase made available to holders of the Notes. Further, nothing

contained herein shall constitute an offer to sell or a

solicitation of an offer to buy any debt securities that are the

subject of the Debt Financing. None of the Company or its

affiliates, their respective boards of directors, the dealer

managers, the tender and information agent or the trustee with

respect to any series of Notes is making any recommendation as to

whether or not holders should tender or refrain from tendering all

or any portion of their Notes in response to the tender offers.

Holders are urged to evaluate carefully all information in the

Offer to Purchase, consult their own investment and tax advisors

and make their own decisions whether to tender Notes in the Tender

Offers, and, if so, the principal amount of Notes to tender.

ABOUT MURPHY OIL CORPORATION

As an independent oil and natural gas exploration and production

company, Murphy Oil Corporation believes in providing energy that

empowers people by doing right always, staying with it and thinking

beyond possible. Murphy challenges the norm, taps into its strong

legacy and uses its foresight and financial discipline to deliver

inspired energy solutions. Murphy sees a future where it is an

industry leader who is positively impacting lives for the next 100

years and beyond. Additional information can be found on the

Company’s website at www.murphyoilcorp.com.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are generally identified through the

inclusion of words such as “aim”, “anticipate”, “believe”, “drive”,

“estimate”, “expect”, “expressed confidence”, “forecast”, “future”,

“goal”, “guidance”, “intend”, “may”, “objective”, “outlook”,

“plan”, “position”, “potential”, “project”, “seek”, “should”,

“strategy”, “target”, “will” or variations of such words and other

similar expressions. These statements, which express management’s

current views concerning future events, results and plans, are

subject to inherent risks, uncertainties and assumptions (many of

which are beyond our control) and are not guarantees of

performance. In particular, statements, express or implied,

concerning the Company’s future operating results or activities and

returns or the Company's ability and decisions to replace or

increase reserves, increase production, generate returns and rates

of return, replace or increase drilling locations, reduce or

otherwise control operating costs and expenditures, generate cash

flows, pay down or refinance indebtedness, achieve, reach or

otherwise meet initiatives, plans, goals, ambitions or targets with

respect to emissions, safety matters or other ESG

(environmental/social/governance) matters, make capital

expenditures or pay and/or increase dividends or make share

repurchases and other capital allocation decisions are

forward-looking statements. Factors that could cause one or more of

these future events, results or plans not to occur as implied by

any forward-looking statement, which consequently could cause

actual results or activities to differ materially from the

expectations expressed or implied by such forward-looking

statements, include, but are not limited to: macro conditions in

the oil and gas industry, including supply/demand levels, actions

taken by major oil exporters and the resulting impacts on commodity

prices; geopolitical concerns; increased volatility or

deterioration in the success rate of our exploration programs or in

our ability to maintain production rates and replace reserves;

reduced customer demand for our products due to environmental,

regulatory, technological or other reasons; adverse foreign

exchange movements; political and regulatory instability in the

markets where we do business; the impact on our operations or

market of health pandemics such as COVID-19 and related government

responses; other natural hazards impacting our operations or

markets; any other deterioration in our business, markets or

prospects; any failure to obtain necessary regulatory approvals;

any inability to service or refinance our outstanding debt or to

access debt markets at acceptable prices; adverse developments in

the U.S. or global capital markets, credit markets, banking system

or economies in general, including inflation; and our ability to

consummate the Tender Offers or the Debt Financing on the

anticipated terms, if at all. For further discussion of factors

that could cause one or more of these future events or results not

to occur as implied by any forward-looking statement, see “Risk

Factors” in our most recent Annual Report on Form 10-K filed with

the U.S. Securities and Exchange Commission (“SEC”) and any

subsequent Quarterly Report on Form 10-Q or Current Report on Form

8-K that we file, available from the SEC’s website. Murphy Oil

Corporation undertakes no duty to publicly update or revise any

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002655992/en/

Investor Contacts: InvestorRelations@murphyoilcorp.com

Kelly Whitley, 281-675-9107 Megan Larson, 281-675-9470 Beth Heller,

832-506-6831

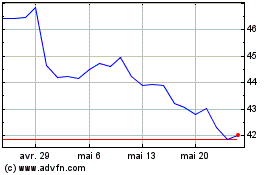

Murphy Oil (NYSE:MUR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Murphy Oil (NYSE:MUR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024